Abstract

We study a common-value bilateral bargaining model with equity offer. In particular, we consider a model in which players bargain over an equity share of a common-value stochastic pie (i.i.d. over time) and players receive private signals on the size of the pie each period. Efficient agreement is a stochastic rule: Delay is efficient if the expected size of today’s pie is small and the discount factor is high. Hence, information aggregation is crucial for efficiency. We derive the conditions under which an equilibrium that attains the efficient agreement exists. The key idea is that the proposer makes an offer in such a way that the responder will use her signal if the responder’s signal is crucial for an efficient agreement.

Similar content being viewed by others

Notes

In the auction literature, DeMarzo et al. (2005) study auctions with contingent payments in which payment can take forms other than cash, including equity. Examples of such auctions include an oil lease auction, where the government sells a certain percentage of the oil revenue from an oil field if successfully explored. See Skrzypacz (2013) for a survey of the auction literature on contingent payment.

See, e.g., Lerner (1994) for the importance of information aggregation in the syndication of VCs. He reports that experienced VCs only syndicate with other VCs with similar experience in the first-round (i.e., new) investment due to the importance of private signals.

Our environment differs from that of Myerson and Satterthwaite (1983) with respect to studying a bilateral trade with independent private values: Our model can be interpreted as bargaining between a buyer and a seller with (perfectly) correlated values. Evans (1989),Vincent (1989), and Deneckere and Liang (2006) study bargaining with correlated values, assuming that the size of the pie is persistent, the incomplete information is one sided, and only the uninformed party makes offers.

The i.i.d. assumption helps us focus on the issue of information aggregation across players while avoiding complexity due to the intertemporal transmission of information.

The model can also be interpreted as bargaining between a randomly matched buyer and seller. Both the buyer and the seller have only a noisy signal about the size of the surplus from the trade and will be rematched with another player if they cannot agree. The size of the pie is i.i.d. for each matching, and the players have different information about the true size of the surplus. They will benefit from information aggregation because they will gain if they trade when the surplus is large (and wait for another random match if the surplus is small).

The i.i.d. assumption implies the irrelevance of history for efficient agreement. We assume transferable utility and thus the terms of agreement for players are also irrelevant for efficiency. Note that the efficient agreement schedule is based on the information profile at the interim stage but not on the unknown, true size of the pie. An actual efficient agreement could end up with a low social value ex post.

If the share upon agreement is expected to be around half, both parties have incentive to act according to the efficient agreement schedule; note first that their continuation payoff is equal due to the random-proposer setup. Thus by making the share around half, their payoffs upon agreement increase proportionally to that of the social surplus. Therefore efficiency and individual interests align for a “ fair” share.

For example, debt contracts need to specify maturity, which may not be easy to set, since it is uncertain when the return will materialize. In general, writing contingent payments involves transaction costs to find and agree to these sorts of contrat terms. Equity contracts, however, are immune to maturity.

See, e.g., Evans (1989), Vincent (1989), Spier (1992), Deneckere and Liang (2006), and Fuchs and Skrzypacz (2013). These papers study bargaining with correlated values, assuming that the size of the pie is persistent, the incomplete information is one-sided, and the uninformed party makes offers so that the game is a screening game. Our paper differs from these papers in that we allow two-sided asymmetric information, and signaling is considered. On the other hand, the size of the pie is i.i.d. over time in this paper, and dynamic screening is not considered.

The argument is similar to that of Proposition 4 in Eraslan et al. (2014) in which efficient equilibrium is obtained when players in a common value bankruptcy bargaining environment decide how to split the surplus first, then deicide what to do with the firm.

In “Appendix 3: Discussion of off-path beliefs,” we discuss plausibility of pessimistic belief system for the efficient equilibria. In fact, whenever an equilibrium exists that delivers High or Medium Delay, there also exists an equilibrium delivering the agreement schedule that satisfies the D1 criterion of Banks and Sobel (1987).

In Rubinstein bargaining, the first-mover advantage arises since the proposer can make an offer to which the responder is indifferent between accepting and rejecting.

Offer \(\alpha (h)\) need not be exactly 1/2. To be more precise, \(\alpha (h)\in [\mu ,1-\mu ]\), where \(\mu =\max \left\{ 1-\frac{\delta W(\delta ,q,L,H)}{E[x]},\frac{\delta W(\delta ,q,L,H)}{E[x|h,h]}\right\} < \frac{1}{2}\). The bounds are derived from the proposer’s nonmimicry incentive condition and the responder’s incentive condition for High Delay Schedule, which are

$$\begin{aligned} (1-\alpha )E[x|h,h]&\ge \delta W(\delta ,q,L,H)\ge (1-\alpha )E[x],\text { and } \\ \alpha E[x|h,h]&\ge \delta W(\delta ,q,L,H)\ge \alpha E[x]. \end{aligned}$$Given \(E[x|h,h]\ge 2\delta W(\delta ,q,L,H)\ge E[x],\) these are equivalent to

$$\begin{aligned} \max \left\{ 1-\frac{\delta W(\delta ,q,L,H)}{E[x]},\frac{\delta W(\delta ,q,L,H)}{E[x|h,h]}\right\} \le \frac{1}{2}\le \min \left\{ 1-\frac{\delta W(\delta ,q,L,H)}{E[x|h,h]},\frac{\delta W(\delta ,q,L,H)}{E[x]}\right\} . \end{aligned}$$which can be written as

$$\begin{aligned} \mu \le \alpha \le 1-\mu . \end{aligned}$$See footnote 20.

This \(\alpha ^{*}\) is in [1 / 2, 1). First, \(\alpha ^{*}=1-\delta W/E[x]\ge 1/2\) because \(E[x]\ge 2\delta W\) by the efficiency requirement for the case of Medium Delay Schedule. We also have \(\alpha ^{*}<1,\) because \(W>0\) and \(E[x]>0.\)

For \(\alpha >\alpha (h),\) the best response given \(s_{r}\) and the belief is

$$\begin{aligned}&\text {to reject for }s_{r}=h,\ell ,\quad \text {if } (1-\alpha )E[x|\ell ,h]<\delta W, \\&\left\{ \begin{array}{ll} \text {to accept} &{} \text {for }s_{r}=h, \\ \text {to reject} &{} \text {for }s_{r}=\ell , \end{array} \right. \text {if }(1-\alpha )E[x|\ell ,h]\ge \delta W>(1-\alpha )E[x|\ell ,\ell ], \end{aligned}$$Note that for \(\alpha >\alpha ^{*},\) \((1-\alpha )E[x|\ell ,h]<\delta W\) by the definition of \(\alpha ^{*}.\) Therefore, \(\sigma (\alpha ,s_{r})\) is optimal for \(\alpha >\alpha (\ell ).\) To show that \(\sigma (\alpha ,s_{r})\) is optimal for \(\alpha \in (\alpha (h),\alpha (\ell )],\) we need \( \delta W>(1-\alpha (h))E[x|\ell ,\ell ].\) For \(\alpha \le \alpha (h),\) the best response is to accept for \(s_{r}=h,\ell ,\) if \(\delta W\le (1-\alpha (h))E[x|h,\ell ],\) which holds since \(\alpha (h)<\alpha ^{*}.\) This shows that \(\sigma (\alpha ,s_{r})\) is optimal for \(\alpha \le \alpha (h).\)

The case where \(2\delta W(\delta ,q,L,H)=E[x]\) (where High Delay and Medium Delay are equally efficient) is excluded since the on-schedule ICs indeed imply \(\alpha (h)=\alpha (\ell )=1/2,\) which contradicts signaling (\(\alpha (h)\not =\alpha (\ell )\)).

In this footnote, we show that adopting alternative belief systems other than the pessimistic belief defined above cannot improve the attainability of efficient equilibria.

Suppose that for some belief that is different from the pessimistic one, there is an efficient equilibrium. Since an equilibrium is separating, we must have either (i) \(\alpha (h)<\alpha (\ell )\) or (ii) \(\alpha (h)>\alpha (\ell ).\)

First, consider the case of (i). The argument in “ Proposer’s Off-Path Incentive Conditions” shows that all the off-path incentive conditions hold, even if we replace the belief with the pessimistic one. Hence, the attainability of an efficient equilibrium does not extend.

Second, consider the case of (ii). Lemma 4 shows that we can find \(\tilde{\alpha }(h)<\alpha ^{*}\) such that \(\tilde{\alpha }(h)\) and \(\alpha (\ell )=\alpha ^{*}\) satisfy both (IC\(_{h\ell }\)) and (IC\(_{\ell h}).\) With the pessimistic belief we use for \(\tilde{\alpha }(h)\) and \(\alpha (\ell )=\alpha ^{*},\) all of the off-path incentive conditions hold, and hence we can find another efficient equilibrium with the pessimistic belief. Hence the attainability of an efficient equilibrium does not extend.

Suppose that the conditions for Medium Delay to be efficient hold with strict inequalities; i.e., \(E[x]>2\delta W>E[x|\ell ,\ell ].\) Then

$$\begin{aligned} \frac{1}{2}E[x|h]&=\frac{1}{2}\Pr (h|h)E[x|h,h]+\frac{1}{2}\Pr (\ell |h)E[x]>\frac{1}{2}\Pr (h|h)E[x|h,h]+\Pr (\ell |h)\delta W, \\ \frac{1}{2}E[x|\ell ]&=\frac{1}{2}\Pr (h|\ell )E[x]+\frac{1}{2}\Pr (\ell |\ell )E[x|\ell ,\ell ]<\frac{1}{2}\Pr (h|\ell )E[x]+\Pr (\ell |\ell )\delta W, \end{aligned}$$Now suppose \(\alpha (h)\) and \(\alpha (\ell ),\) \(\alpha (h)\not =\alpha (\ell ),\) are very close to 1/2. We can see from the above inequalities that the nonmimicry conditions are satisfied. Note that by the definition of \(\alpha ^{*},\) share \(\alpha (\ell )(=\alpha ^{*})\) is close to 1/2 only when \(E[x]\approx 2\delta W.\)

Suppose that it is efficient to agree if and only if both players receive h signal as in High Delay Schedule. By bundling m and \(\ell \) signals together, we can construct an equilibrium analogous to the High Delay efficient equilibrium with two signals studied in the text. The continuation value, the threshold discount factor, and the incentive conditions are defined accordingly, by replacing E[x] with E[x|h, m].

Note that our discussion is conditional on the equilibrium we focus on, i.e., the efficient equilibrium. This is because the players are less likely to play an inefficient equilibrium if an efficient equilibrium is attainable given the fact that the players can engage in preplay cheap talk of a very general form.

It is straightforward to show that \(\delta W{\ge } A(q,L,H)\) is equivalent to \( \delta {\ge } \frac{2A(q,L,H)}{E[x]-\Pr (\ell ,\ell )(E[x|\ell ,\ell ]{-}2A(q,L,H))}.\)

These are the incentive conditions on the equilibrium paths. The argument to verify the off-path incentive conditions is analogous to the one in Sect. 3.1.1.

References

Ausubel, L.M., Cramton, P., Deneckere, R.J.: Bargaining with incomplete information. In: Aumann, R.J., Hart, S. (eds.) Handbook of Game Theory, vol. 3, pp. 1897–1945. Elsevier Science Publishers B.V, Greenwich (2002)

Ausubel, L.M., Deneckere, R.J.: A direct mechanism characterization of sequential bargaining with one-sided incomplete information. J. Econ. Theory 48, 18–46 (1989)

Banks, J.S., Sobel, J.: Equilibrium selection in signaling games. Econometrica 55, 647–662 (1987)

Bond, P., Eraslan, H.: Strategic voting over strategic proposals. Rev. Econ. Stud. 77, 459–490 (2010)

Brooks, R., Landeo, C., Spier, K.: Trigger happy or gun shy? Dissolving common-value partnerships with Texas shootouts. Rand. J. Econ. 41, 649–673 (2010)

Chatterjee, K., Samuelson, L.: Bargaining with two-sided incomplete information: an infinite horizon model with alternating offers. Rev. Econ. Stud. 54, 175–192 (1987)

Cramton, P.: Bargaining with incomplete information: an infinite-horizon model with two-sided uncertainty. Rev. Econ. Stud. 51, 579–593 (1984)

Cramton, P.: Strategic delay in bargaining with two-sided uncertainty. Rev. Econ. Stud. 59, 205–225 (1992)

Damiano, E., Li, H., Suen, W.: Delay in strategic information aggregation. Mimeo. (2010)

DeMarzo, P.M., Kremer, I., Skrzypacz, A.: Bidding with securities: auctions and security design. Am. Econ. Rev. 95, 936–959 (2005)

Deneckere, R.J., Liang, M.Y.: Bargaining with interdependent values. Econometrica 74, 1309–1364 (2006)

Eraslan, H., Merlo, A.: Majority rule in a stochastic model of bargaining. J. Econ. Theory 103, 31–48 (2002)

Eraslan, H., Mylovanov, T., Yilmaz, B.: Deliberation and security design in bankruptcy. Mimeo (2014)

Evans, R.: Sequential bargaining with correlated values. Rev. Econ. Stud. 56, 499–510 (1989)

Feddersen, T.J., Pesendorfer, W.: The swing voter’s curse. Am. Econ. Rev. 86, 404–424 (1996)

Fuchs, W., Skrzypacz, A.: Bridging the gap: bargaining with interdependent values. J. Econ. Theory 148, 1226–1236 (2013)

Fudenberg, D., Tirole, J.: Sequential bargaining with incomplete information. Rev. Econ. Stud. 50, 221–247 (1983)

Fudenberg, D., Tirole, J.: Game Theory. MIT Press, Cambridge (1991)

Hanazono, M., Watanabe, Y.: Merger negotiation and merger performance. Mimeo (2016)

Herings, J.J., Predtetchinski, A.: Procedural fairness and redistributive proportional tax. Econ. Theory 59, 333–354 (2015)

Herings, J.J., Predtetchinski, A.: Bargaining under monotonicity constraints. Econ. Theory 62, 221–243 (2016)

Kennan, J., Wilson, R.: Bargaining with private information. J. Econ. Lit. 31, 45–104 (1993)

Lerner, J.: The syndication of venture capital investments. Fin. Manag. 23, 16–27 (1994)

Merlo, A., Tang, X.: Identification of stochastic sequential bargaining models. Econometrica 80, 1563–1604 (2012)

Merlo, A., Wilson, C.: Stochastic model of sequential bargaining with complete information. Econometrica 63, 371–399 (1995)

Merlo, A., Wilson, C.: Efficient delays in a stochastic model of bargaining. Econ. Theory 11, 39–55 (1998)

Myerson, R.B., Satterthwaite, M.A.: Efficient mechanisms for bilateral trading. J. Econ. Theory 29, 265–281 (1983)

Reinganum, J.F., Wilde, L.L.: Settlement, litigation, and the allocation of litigation costs. Rand. J. Econ. 17, 557–566 (1986)

Schweinzer, P.: Sequential bargaining with common values: The case of bilateral incomplete information. Mimeo (2010b)

Schweinzer, P.: Sequential bargaining with common values. J. Math. Econ. 46, 109–121 (2010a)

Schweizer, U.: Litigation and settlement under two-sided icomplete information. Rev. Econ. Stud. 56, 163–177 (1989)

Skrzypacz, A.: Auctions with contingent payments – an overview. Int J Ind Organ. 31, 666–675 (2013)

Spier, K.: The dynamics of pretrial negotiation. Rev. Econ. Stud. 59, 93–108 (1992)

Vincent, D.R.: Bargaining with common values. J. Econ. Theory 48, 47–62 (1989)

Acknowledgments

We thank the Editor-in-charge and an anonymous referee for the detailed comments that greatly improve the exposition of the paper. We also thank H ülya Eraslan, Shinsuke Kambe, Antonio Merlo, Chun-Hui Miao, and Akira Okada for helpful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors acknowledge the financial support for this research from Murata Science Foundation, Zengin Foundation for Studies on Economics and Finance, and JSPS Kakenhi Grant No. 25245031.

Appendices

Appendix 1: Proofs

1.1 A1.1 Proof of Lemma 2

Define, from the associated ICs,

That is, \(\alpha _{1}\) is the lowest \(\alpha (h)\) satisfying (IC\(_{h\ell }\)) and \(\alpha _{2}\) is the highest \(\alpha (h)\) satisfying (IC\(_{\ell h}\)). To assure that there is \(\alpha (h)\in [\alpha _{1},\alpha _{2}]\), we need \(\alpha _{1}\le \alpha _{2}\). The condition \(\alpha _{1}\le \alpha _{2}\) can be rewritten as

Define the RHS of the last inequality as A(q, L, H). Since \(\delta W\) is increasing in \(\delta ,\) \(\delta W\ge A(q,L,H)\) defines a lower bound of \( \delta \) for which \(\alpha _{1}\le \alpha _{2}\) holds.Footnote 24

Simplifying the numerator of A(q, L, H) yields

whereas simplifying the denominator of A(q, L, H) yields

Hence

It is easy to see that A(q, L, H) is increasing in q.

Recall that E[x] is constant and \(E[x|\ell ,\ell ]\) is decreasing in q, and that \(E[x|\ell ,\ell ]=E[x]\) for \(q=1/2.\) We can also see that

and

This shows that \(E[x]>2A(q,L,H)\) for all q, and there is a threshold \( \tilde{q}\in (0,1)\) such that \(E[x|\ell ,\ell ]>2A(q,L,H)\) for \(q<\tilde{q}\) and \(E[x|\ell ,\ell ]<2A(q,L,H)\) for \(q>\tilde{q}.\)

1.2 A1.2 Proof of Lemma 3

Consider \(\alpha (h)\) satisfying (IC\(_{h\ell }\)) and (IC\(_{\ell h}\)). We first show that if \(E[x]>2\delta W,\) we can take \(\alpha (h)\) to be smaller than \(\alpha (\ell ).\) It suffices to show that \(\alpha _{1}\) in Lemma 2 is smaller than \(\alpha (\ell ).\) Indeed

Next we show that we can take \(\alpha (h)\) such that \((1-\alpha (h))E[x|\ell ,\ell ]<\delta W\Leftrightarrow \alpha _{2}>1-\delta W/E[x|\ell ,\ell ].\) We verify this inequality by establishing \(\alpha _{2}\ge 1-\delta W/E[x|\ell ] \) \((>1-\delta W/E[x|\ell ,\ell ]).\) Indeed

1.3 A1.3 Proof of Lemma 4

Step 1 If an efficient equilibrium with \(\alpha (h)>\alpha (\ell )\) exists, then \(\alpha (h)=\alpha ^{*}\) i.e., \((1-\alpha (h))E[x]=\delta W.\)

Proof Since the responder with \(\ell \) signal must accept \(\alpha (h)\) in efficient equilibrium, \((1-\alpha (h))E[x]\ge \delta W.\) Suppose \((1-\alpha (h))E[x]>\delta W\) and consider \(\alpha \in (\alpha (h),\alpha ^{*}].\) Note that \((1-\alpha )E[x]>\delta W\) so that (i) if the responder believes the proposer has h signal, she accepts even if her signal is \(\ell ,\) and (ii) if the responder believes the proposer has \(\ell \) signal, she accepts if and only if her signal is h. In other words, the responder’s reaction to \(\alpha \) is the same as when \(\alpha (h)\) is offered (case (i)) or when \(\alpha (\ell )\) is offered (case (ii)). This implies that either the proposer with h signal or the one with \(\ell \) signal has an incentive to deviate to offer \(\alpha ,\) contradicting to equilibrium. Hence, \((1-\alpha (h))E[x]=\delta W.\)

Step 2 If an efficient equilibrium with \(\alpha (h)>\alpha (\ell )\) exists, then there is some \(\alpha ^{h\prime }<\alpha ^{*}\) such that

In other words, the nonmimicry conditions for an efficient equilibrium hold.

Proof If an efficient equilibrium with \(\alpha (h)=\alpha ^{*}>\alpha (\ell )\) exists, we have the following nonmimicry conditions

Since \(\alpha ^{*}>\alpha (\ell ),\) the latter inequality implies

Note also that \(\alpha ^{*}=1-\delta W/E[x]>1/2,\) since \(E[x]>2\delta W.\) This implies

We then have the following inequalities:

Now we substitute the \(\alpha ^{*}\) in the left-hand sides of the inequalities with \(\alpha ^{h\prime }\). Since the inequalities are strict, slightly lowering \(\alpha ^{h\prime }\) does not change the inequalities. The resulting inequalities are indeed the nonmimicry conditions to be verified.

Appendix 2: Equilibrium for no delay schedule

Suppose that the discount factor is such that No Delay Schedule is efficient. To attain this outcome in equilibrium, the proposer’s offer must be accepted regardless of his own and the responder’s signals. The proposer’s offer must be pooling, since otherwise he has an incentive to always make the more favorable claim of the possible offers. Let \(\alpha ^{p}\ \)be the proposer’s pooling offer. The responder with \(\ell \) signal accepts \(\alpha ^{p}\) if

Among such shares, the best one for the proposer is the highest offer. As we will see in the following, the main problem in constructing an efficient equilibrium is to deter the proposer from making an off-path offer. Note that the higher the on-path pooling offer, the weaker the proposer’s incentive to make an off-path offer. We thus focus on an equilibrium with the highest offer in order to weaken the condition to attain an efficient equilibrium:

We consider the following pessimistic off-path belief:

Unlike the previous cases, the responder’s on-path belief depends on her own signal due to the correlation of the signals. It is important to set zero belief for higher \(\alpha \) to deter the proposer’s deviation; as before, the responder needs to change her acceptance behavior for higher \(\alpha .\) Note, however, that \((1-\alpha ^{p})E[x]>(1-\alpha ^{p})E[x|\ell ]=\delta W,\) so that the responder with h signal is willing to accept an \(\alpha \) slightly higher than \(\alpha ^{p}\) even though the belief is pessimistic. Accordingly, the responder’s optimal reaction to offer \(\alpha \) is to accept always for \(\alpha \le \alpha ^{p},\) to accept if the responder’s signal is h for \(\alpha \in (\alpha ^{p},\alpha ^{**}]\) where \( \left( 1-\alpha ^{**}\right) E[x]=\delta W,\) and to reject always for \(\alpha >\alpha ^{**}\) (note that \(\alpha ^{**}=1-\delta /2\) since \(W=E[x]/2).\)

Therefore, if an efficient equilibrium exists, it should take the following form:

-

The proposer’s offer strategy is \(\alpha (h)=\alpha (\ell )=\alpha ^{p}.\)

-

The responder’s strategy is

$$\begin{aligned} \text {for }\alpha&>\alpha ^{*},\ \sigma (\alpha ,s_{r})=\text {reject for }s_{r}=h,\ell , \\ \text {for }\alpha&\in (\alpha ^{p},\alpha ^{**}],\, \sigma (\alpha ,s_{r})=\left\{ \begin{array}{ll} \text {accept} &{} \text {for }s_{r}=h, \\ \text {reject} &{} \text {for }s_{r}=\ell , \end{array} \right. \\ \text {for }\alpha&\le \alpha ^{p},\quad \sigma (\alpha ,s_{r})=\text {accept for }s_{r}=h,\ell . \end{aligned}$$ -

The belief is the above pessimistic belief system.

1.1 A2.1 Proposer’s off-path incentive condition

Since the responder’s reaction is constant over each of the intervals, \( [0,\alpha ^{p}],(\alpha ^{p},\alpha ^{**}],\) and \((\alpha ^{**},1],\) the offers other than \(\alpha ^{p},\alpha ^{**},\) and 1 are (weakly) dominated. In addition, due to the fact that

offer \(\alpha =1\) is also dominated by \(\alpha ^{p}.\)

To deter deviation to \(\alpha ^{**}\), the following conditions must hold:

The second constraint, (IC\(_{\ell }\)), is indeed equivalent to the condition under which No Delay Schedule is efficient:

On the other hand, the first condition, (IC\(_{h}\)), does not always hold even when No Delay Schedule is efficient. The following technical lemma gives the requirement for (IC\(_{h}\)):

Lemma 5

(IC\(_{h}\)) holds iff Condition B is satisfied, i.e., \(\delta W\le B(q,L,H),\) where

with the following properties:

-

1.

\(2B(1,L,H)=0,\) and \(2B(1/2,L,H)=E[x]=\left. E[x|\ell ,\ell ]\right| _{q=1/2}\)

-

2.

If \(L>0,\) then there is a \(\tilde{q}\) such that \(2B(q,L,H)>E[x|\ell ,\ell ]\) for \(q\in (1/2,\tilde{q}),\) and \(2B(q,L,H)<E[x|\ell ,\ell ]\) for \(q> \tilde{q}.\)

-

3.

If \(L=0,\) \(2B(q,L,H)\ge E[x|\ell ,\ell ]\) for all q (equality holds for \(q=1/2\), 1).

Proof

Rearranging (IC\(_{h}\)), we have

Define

It is easy to see

By definition,

Note that the denominator is positive for all q. The numerator is

The fraction in the last line is positive for \(q>1/2.\) If \(q=1/2,\) the expression in the square bracket is

The expression also can be rewritten as

Since \(((1-q)H^{2}+qL^{2})\) and \(q(1-q)\) are decreasing for \(q\in (1/2,1),\) the expression is monotone decreasing in q and goes to \(-HL.\) Therefore, as long as \(L>0,\) there is \(\tilde{q}\in (1/2,1)\) such that \( 2B(q,L,H)<E[x|\ell ,\ell ]\) iff \(q>\tilde{q}.\) \(\square \)

The condition \(\delta W\le B(q,L,H)\) and the properties of B(q, L, H) provide information about when No Delay Schedule is efficient but (IC\(_{h}\)) fails (see also Fig. 5 below). If \(L=0,\) it never fails since \(2B(q,L,H)\ge E[x|\ell ,\ell ]\ge 2\delta W\) always holds under No Delay Schedule being efficient. However, if \(L>0,\) there is a \( \tilde{q}\) such that \(q>\tilde{q}\Rightarrow 2B(q,L,H)<E[x|\ell ,\ell ]\); hence, \(2B(q,L,H)<2\delta W\le E[x|\ell ,\ell ]\) can arise.

The properties of B(q, L, H) imply that (IC\(_{h}\)) would be harder to hold as \(\delta \) becomes higher, and the threshold of \(\delta \) decreases as q increases. Intuitively, if the signal accuracy is very high, the proposer with h signal would expect that it is very likely that the responder has the same signal and accepts the most profitable deviation offer \(\alpha ^{**}>\alpha .\) To deter such deviation, the difference between \( \alpha ^{**}-\alpha ^{p}=\delta (E[x]/E[x|\ell ]-1)/2\) must be small enough. This is why \(\delta \) needs to be small (this also makes forgoing till the next period more costly, which contributes to (IC\(_{h}\)) being satisfied). Moreover, the lemma confirms that if q is above a certain level, the threshold of \(\delta \) is below the level for which No Delay Schedule is efficient. This immediately implies that a fully efficient equilibrium for No Delay Schedule fails to exist if the signal accuracy is relatively high and if the discount factor is not too low.

Proposition 2

(Part 3, Restatement) Suppose \(\delta \in [0,\underline{\delta }(q,L/H)]\) (No Delay Schedule is efficient). The strategy profile and the belief system defined above compose an efficient equilibrium if and only if Condition B holds, i.e., \(\delta W\le B(q,L,H)\).

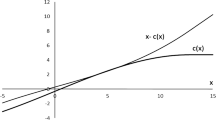

We plot the diagram for \(L/H=.6,\) in which \(\delta W\le B(q,L,H)\) holds in the area below the dotted (red) curve (Condition B in Figure 5). An efficient No Delay equilibrium does not exist in the region below the dashed (blue) curve and above the dotted (red) curve. Therefore, efficiency is not always attainable. As the discount factor decreases and/or the signal accuracy increases, the benefit to the proposer with a high signal of using signal-responsive offers becomes larger. Hence, the deviation temptation from a pooling offer is too high to sustain the efficient pooling equilibrium.

Consider the perfect information case, \(q=1,\) in which efficiency is obtained by separating offers conditional on the signals. Notice that this efficient equilibrium cannot be achieved in the limit of efficient equilibria as \(q\rightarrow 1.\) Instead, a sequence of separating equilibria can be made arbitrarily close to the efficient equilibrium by the approximate efficiency result in the following.

Comparative Statics for No Delay Schedule

For an efficient equilibrium under No Delay Schedule, we only consider how the proposer’s offer \(\alpha ^{p}\) is affected by signal accuracy (q) and the relative size of the pie (L / H). We do not consider the effect on time to agreement because the players always agree immediately in an efficient equilibrium under No Delay Schedule (remember that the discount factor was too low so the players prefer to agree immediately under No Delay Schedule). The equilibrium offer \(\alpha ^{p}\) is determined by \((1-\alpha ^{p})E[x|\ell ]=\delta W\), which can be rewritten as

Hence, the equilibrium offer \(\alpha ^{p}\) is decreasing in q and increasing in L / H. Continuation value W increases in the size of L given H, and is constant in q, whereas the expected pie size, \( E[x|\ell ],\) is increasing in the size of L given H, and decreasing in q. This shows why \(\alpha ^{p}\) is decreasing in q. The intuition for \( \alpha ^{p}\) increasing in L / H is analogous to that for Medium Delay Schedule.

Approximate Efficiency of No Delay Schedule

For the case of approximate efficiency in No Delay Schedule, consider a separating equilibrium in which the proposer offers \(\alpha (h)>\alpha (\ell )\), and the responder accepts \(\alpha (h)\) if she receives h signal and always accepts \(\alpha (\ell )\). The ex ante value from this agreement schedule is

The responder’s incentive conditions are

Again we assume the pessimistic belief for off-path offers.

The proposer’s off-path incentive condition implies \((1-\alpha (\ell ))E[x|\ell ,\ell ]\le \delta V_{s};\) otherwise the proposer can deviate to offer \(\alpha ^{\prime },\)which is slightly higher than \(\alpha (\ell )\) but still acceptable. Hence,

We consider the case in which the responder receives no rent, i.e.,

Consider the nonmimicry conditions:

The first IC is redundant for a sufficiently large q, since \(q\rightarrow 1 \) implies

The second one can be rewritten as

An argument analogous to approximate efficiency for Medium Delay Schedule shows that as q goes to 1, an approximately efficient equilibrium exists.

Appendix 3: Discussion of off-path beliefs

We examine whether the off-path beliefs of the above equilibria are reasonable in line with the D1 criterion of Banks and Sobel (1987). Two remarks are noted. First, the game is not a standard signaling game in which each player can move only once. However, the information in our model is not persistent, so we can still apply the refinement argument within a period (at least for a stationary equilibrium). Second, we are dealing with two-sided incomplete information with correlation. We need to consider a belief system conditional on the responder’s type. To incorporate correlation, we adopt the following “ two-stage” beliefs.

Let \(\beta (\alpha )\) denote the belief that the proposer has h signal given offer \(\alpha \) ignoring the responder’s signal (think of it as an outsider’s belief). Suppose \(\alpha \) is offered with some probability. By Bayes’ rule

For example, with a pooling offer \(\alpha ,\) i.e., \(\Pr (\alpha |h)=\Pr (\alpha |\ell )=1,\) we have \(\beta (\alpha )=.5.\) With a separating offer \( \alpha (h),\alpha (\ell ),\) i.e., \(\Pr (\alpha (h)|h)=\Pr (\alpha (\ell )|\ell )=1,\ \)we have \(\beta (\alpha (h))=1\) and \(\beta (\alpha (\ell ))=0.\) Note that

Responder’s belief \(\beta (\alpha ,s_{r})\) can be induced by \(\beta (\alpha )\):

This is consistent with the on-path belief of pooling, \(\beta (\alpha ,h)=q^{2}+(1-q)^{2}.\) We apply the above formulas for off-path beliefs given an arbitrary \(\beta (\alpha ).\) For notational simplicity, we denote \(\beta \) for \(\beta (\alpha ),\) \(\beta ^{h}=\beta (\alpha ,h),\) and \(\beta ^{\ell }=\beta (\alpha ,\ell )\). Straightforward algebra shows that \(\beta ^{h}\ge \beta ^{\ell }\) for all \(\beta \in [0,1],\) where equality holds at \( \beta =0,1.\) There are three possible best responses by the responder given \( \alpha \), \(\beta \) and W: (i) if

the responder always accepts, (ii) if

only the responder with h signal accepts, and (iii) if

the responder always rejects.

Now we examine the plausibility of pessimistic belief. A version of D1 criterion for our model can be stated as follows (see Fudenberg and Tirole 1991, p.452): fix an equilibrium and off-path offer \(\alpha .\) Suppose that for each \(\beta \in [0,1]\) such that the proposer with h signal (\(\ell \)) is weakly better off by offering \(\alpha \) than the equilibrium offer, \(\alpha (h)\) (\( \alpha (\ell )\)), the proposer with \(\ell \) signal ( h ) is always strictly better off by offering \(\alpha \) than by offering the equilibrium offer, \(\alpha (\ell )\) (\(\alpha (h)\)). Suppose, in addition, that there is \(\beta ^{\prime }\) for which only the proposer with \(\ell \) signal ( h) is strictly better off, then the belief after observing \(\alpha \) should be \( \beta =0 \ \)(\(\beta =1\)). An equilibrium passes the D1 test if all the off-path beliefs satisfy this criterion.

Efficient equilibrium for high patience (high delay schedule). First, note that in addition to the equilibrium discussed in Sect. 3.1.1., there are other equilibria: the strategy profile and the belief system are the same as in the equilibrium in Sect. 3.1.1 except for \(\alpha (h)\). We can show that if \(\alpha (h)\) satisfies

the associated strategy profile and the belief system compose an equilibrium (note that these conditions hold for \(\alpha (h)=1/2)\).Footnote 25

We show that for the highest \(\alpha \) satisfying the above conditions, the associated equilibrium with such \(\alpha \) passes the D1 test. The highest \(\alpha \) satisfies either \( (1-\alpha )E[x|h,h]=\delta W\) or \(\alpha E[x]=\delta W.\) Consider the case where \((1-\alpha )E[x|h,h]=\delta W\) and \(\alpha E[x]<\delta W.\) The proposer obtains all the rent from the efficient agreement, and therefore the proposer with h signal cannot be better off by any offer given that the responder receives at least the reservation payoff. This implies that any belief system passes the D1 test.

Consider the case where \(\alpha E[x]=\delta W\) and \((1-\alpha )E[x|h,h]>\delta W.\) For offer \(\alpha ^{\prime }\) such that \((1-\alpha ^{\prime })E[x|h,h]<\delta W,\) the responder rejects the offer for any belief; hence the D1 test does not impose any restriction on the belief for such offer.

Consider offer \(\alpha ^{\prime }>\alpha \) for which \((1-\alpha ^{\prime })E[x|h,h]\ge \delta W\). Note that \(\alpha ^{\prime }>\alpha \) implies \( \delta W\ge (1-\alpha ^{\prime })E[x].\) If \(\beta \) is high enough, the responder with h signal would accept \(\alpha ^{\prime },\) and hence the proposer with h signal will be strictly better off. However, with such a belief, the proposer with \(\ell \) signal would always be better off than the equilibrium payoff, since \(\alpha ^{\prime }E[x]>\alpha E[x]=\delta W.\) Hence, \(\beta =0\) is consistent with the D1 test.

Consider offer \(\alpha ^{\prime }<\alpha .\) For such \(\alpha ^{\prime },\) the payoff of the proposer with \(\ell \) signal would be \(\alpha ^{\prime }E[x|\ell ]<\alpha ^{\prime }E[x]<\alpha E[x]=\delta W\) if the responder always accepts, and \(\alpha ^{\prime }\Pr (h|\ell )E[x]+\Pr (\ell |\ell )\delta W<\delta W\). This shows that the proposer with \(\ell \) signal is always worse off. Thus \(\beta =1\) for offer \(\alpha ^{\prime }<\alpha \) is consistent with the D1 test.

Efficient equilibrium for medium patience (medium delay schedule). We show that the equilibrium passes the D1 test iff (IC \( _{\ell h}\)) is binding.

Consider offer \(\alpha ^{\prime }(<\alpha (h))\) for which the equilibrium belief is \(\beta =1\) and the responder always accepts. With any belief, the proposer is never better off by offering \(\alpha ^{\prime };\) if the belief is so high that the responder always accepts, this is the same action as in the equilibrium and the off-path ICs imply that offering \( \alpha ^{\prime }\) is never profitable. If the belief is such that only the responder with h signal accepts, this offer is dominated by offering \( \alpha (\ell ),\) and therefore the proposer is never better off. This shows \( \beta =1\) for \(\alpha ^{\prime }<\alpha \) is consistent with the D1 test.

Consider offer \(\alpha ^{\prime }>\alpha (\ell ).\) If \((1-\alpha ^{\prime })E[x|h,h]<\delta W,\)the responder never accepts the offer, regardless of the beliefs; hence, any beliefs are consistent with the D1 test. Now suppose \((1-\alpha ^{\prime })E[x|h,h]\ge \delta W.\) If \(\beta \) is sufficiently high, the responder with h signal accepts it; hence, the proposer with \( \ell \) signal strictly prefers such \(\alpha ^{\prime }\) to \(\alpha (\ell )\), whereas the proposer with h signal may not. Therefore, \(\beta =0\) for \( \alpha ^{\prime }\) is consistent with the D1 test.

Consider offer \(\alpha ^{\prime }\) such that \(\alpha (h)<\alpha ^{\prime }<\alpha (\ell ).\) Since \((1-\alpha (\ell ))E[x]=\delta W,\) we have \( (1-\alpha ^{\prime })E[x]>\delta W,\) implying that the responder always accepts \(\alpha ^{\prime }\) if \(\beta \) is sufficiently high. Consider an equilibrium for which (IC\(_{\ell h})\) binds (it is easy to see that such an equilibrium exists if there is an \(\alpha (h)\) satisfying both (IC\(_{h\ell }\) ) and (IC\(_{\ell h}\))), namely

Given this condition, the proposer regardless of the signal is strictly better off by offering \(\alpha ^{\prime }\) if offer \(\alpha ^{\prime }\) is always accepted, while he is worse off if offer \(\alpha ^{\prime }\) is not always accepted (by the off-path incentive conditions). Hence, \(\beta =0\) for \(\alpha ^{\prime }\) is consistent with the D1 test. On the other hand, for an equilibrium with (IC\(_{\ell h})\) being slack, there is an \(\alpha ^{\prime \prime }\) close to \(\alpha (h)\) such that the proposer with h signal is better off by offering \(\alpha ^{\prime \prime }\) if offer \(\alpha ^{\prime \prime }\) is always accepted, while the proposer with \(\ell \) signal is not, implying that \(\beta =1\) for offer \(\alpha ^{\prime \prime }\) under the D1 criterion. Hence the equilibrium in which (IC\(_{\ell h}\)) binds only survives the D1 test.

Efficient equilibrium for low patience (no delay schedule). Indeed, some (but not all) efficient equilibrium fail to pass the D1 test. If off-path offer \(\alpha ^{\prime }>\alpha \) is always accepted, the proposer wishes to deviate regardless of its signal. Consider the case where \(\alpha ^{\prime }>\alpha \) is accepted only by the responder with h signal . We check whether the proposer with h signal is better off by offering \( \alpha ^{\prime }\) than with the equilibrium offer.

Consider offer \(\alpha ^{\prime }\) for which \((1-\alpha ^{\prime })E[x|h,h]=\delta W.\) Note that a higher offer than \(\alpha ^{\prime }\) is always rejected. If \(\beta =1,\) the proposer with h signal is better off by offering \(\alpha ^{\prime }\) than with the equilibrium offer \(\alpha \) iff (recalling that \(\alpha =1-\delta W/E[x|\ell ]\))

If this does not hold, \(\beta =0\) for \(\alpha ^{\prime }\) is consistent with the D1 test.

Recall (IC\(_{h}\)) for this equilibrium:

Since \(-1/E[x]<-1/E[x|h],\) the above two inequalities are both satisfied in some parameter region; hence, there is some region in which the associated efficient equilibrium fails to pass the D1 test. Note also that if q is close to 1, the proposer with \(\ell \) signal is nearly certain that the responder receives \(\ell \) signal, so offer \(\alpha ^{\prime }\) will be rejected even if \(\beta =1.\) Hence, the proposer with \(\ell \) signal is worse off by offering \(\alpha ^{\prime }\) rather than by \(\alpha \) (we could proceed to the tedious details for this argument).

Rights and permissions

About this article

Cite this article

Hanazono, M., Watanabe, Y. Equity bargaining with common value. Econ Theory 65, 251–292 (2018). https://doi.org/10.1007/s00199-016-1004-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-1004-1