Abstract

With two bidders, one strong and one weak, the introduction of at least some degree of anonymous “pay-your-bid” in the payment rule of the second-price auction behoves any risk-neutral seller who, while possibly efficiency minded, cares about revenues. This can be achieved by adding to the winner’s payment a uniform proportion of his own bid, as in Güth and van Damme’s auction, or by having bidders receive a uniform proportion of the losing bid, as in Goeree and Offerman’s Amsterdam auction, or even by selling uniform toeholds to the bidders prior to the auction. We demonstrate one-to-one relations between the equilibria of these auctions and of first-price auctions. By assuming a power relation between the bidders’ value cumulative or decumulative functions, we obtain explicit expressions for the first-order effects of the pay-your-bid rule.

Similar content being viewed by others

Notes

It does maximize expected revenues if the common value distribution is “regular”. See Myerson (1981).

For example, the empirical studies of Branman and Froeb (2000), Krasnokutskaya (2011), and Athey et al. (2011) are consistent with such heterogeneous bidders. Among initially homogeneous bidders, efficient collusion or mergers give rise to effective bidders with “power-related” value cumulative distributions functions, that is, fixed powers of the same cumulative function. Many important references on the implementation of efficient collusion can be found in Marshall and Marx (2012). See also the contribution by Biran and Forges (2011). The effects of efficient mergers have been simulated in Dalkir et al. (2000), Tschantz et al. (2000), and Branman and Froeb (2000). Pesendorfer (2000) and Baldwin et al. (1997) have detected efficient collusion in actual auctions. Power-related cumulative distributions follow from natural axioms in Waehrer and Perry (2003) and Piccione and Tan (1996).

If discrimination among bidders is impossible, for example because illegal, even more complexity may be necessary. For example, an obvious nondiscriminatory optimal mechanism would: 1. ask the bidders to reveal their identities (their value distributions) and their common knowledge (the set of the value distributions of all bidders); 2. cancel the sale if their answers are inconsistent; and 3. otherwise, implement the optimal discriminatory mechanism through a direct mechanism. For the implementation of the optimal mechanism through a particular class of anonymous sealed-bid auctions, see Deb and Pai (2014).

Nevertheless, Lebrun (2012) shows that, in a restricted n-bidder model and in the general 2-bidder model, the standard English auction if followed by resale implements the mechanism that is optimal among all mechanisms selling with certainty. Wilson (1987) advocates the study of the possible interim efficiency, of which optimality is a special case, of simple and familiar trading rules “over a wide class of environments”.

I owe this observation to Brent Hickman.

Although they do not coin a name for their auction, Güth and Damme (1986) refer to its payment rule as the “\(\lambda \)-pricing rule” where \(\lambda \) is our \(1-k\).

Some of our results extend to binding reserve prices. See Extensions in Sect. 2.

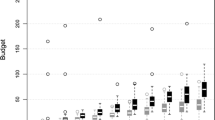

The premiums in these experiments are 30 %. Interestingly, the average revenues from the “first-price AA”, where the last stage is a first-price auction with premium, are 60.1.

We use the same notation for a probability distribution and its cumulative distribution function.

This assumption is also equivalent to the requirement that the “local \(\rho \)-concavity” of \(F_{1}\) be bounded from above (for other applications of local \(\rho \)-concavity to auction theory, see, for example, Mares and Swinkels 2011). From the log-concavity of \(F_{1}\) over \(\left( c,c+\varepsilon \right) \), we have \( \varepsilon _{1}\le 1\) over this interval and we could then replace our assumption that \(\varepsilon _{1}\) be bounded from below by the assumption that it be bounded.

Indeed, it implies likelihood-ratio dominance. For these stochastic orders, see, for example, Appendix B in Krishna (2009).

All our results about the 2-k-PA would remain unchanged with any finite reserve price not larger than \(c\).

As we indicate in Appendix 1, the proof of the differentiability can be found in the online supplements.

That is, unique up to the inessential indeterminacy when the value is \(c\) (see 1. in Theorem 1 (i)).

To go through, this argument then requires a full interval as value support. Indeed, our results do not hold for general discrete distributions, for example. See Footnote 18.

As already mentioned in the previous footnote, our results depend on an interval value support. For Maskin and Riley (1985)s discrete two-value case, we mention in Example 2 below, the strong bidder’s equilibrium strategy in the 2-k-PA does not tend towards truth-bidding as \(k\) approaches zero. Rather, his bid distribution when his value is high becomes concentrated at the high and low values. At the limit, the total auction revenues are equal to the smaller revenues from the FPA. Notice though that, from our results, there exist small revenue-improving \(k\)’s for any given approximation of this discrete case by smooth power-related value distributions with a common interval support.

This formula gives \(\frac{\hbox {d}}{\hbox {d}k}\ln ER\left( 0\right) =0.3214\) when \(e_{1}=1\) and \(e_{2}=4\). As the numerical estimations in Marshall et al. (1994) imply \(\ln ER\left( 1\right) -\ln ER\left( 0\right) =0.0803\), the relative rate of increase \(\frac{\hbox {d}}{\hbox {d}k}\ln ER\left( k\right) \) must obviously decrease at some \(k\)’s between 0 and 1. This is also the case for \(e_{1}=2\) and \(e_{2}=3\), where \(\ln ER\left( 1\right) -\ln ER\left( 0\right) =0.0071\) while \(\frac{\hbox {d}}{\hbox {d}k}\ln ER\left( 0\right) =0.0238\).

See, for example, Lebrun (1996).

As there are two bidders, the auction proceeds directly to the “second-stage” where \(c\) is the “bottom price”, in the terminology of Hu et al. (2011).

Or we may assume that they become infinitely risk-averse above a certain high bid threshold.

If unboundedly large bids were allowed, multiple equilibria would exist (as they would exist in the FPA if there was no lower bound on the allowable bids). See also Footnotes 14 and 27.

A bidder is not allowed to bid if he refuses to buy his share. When only one bidder bids, the auction price is the reserve price \(c\). Not buying one’s share is then weakly dominated.

Again, \(F_{2}\) likelihood-ratio dominates \(F_{1}\) and, in particular, we have \(\rho _{2}\ge \rho _{1}\).

If the premium is paid only to the loser, submitting a bid strictly smaller than the value divided by \(1+k\) is weakly dominated. The equilibrium \( \left( \widehat{\beta }_{1}\left( .;k\right) ,\widehat{\beta }_{2}\left( .;k\right) \right) \) of this variant of the AA for the value distributions \( F_{1},F_{2}\) is related to the equilibrium \(\left( \widetilde{\beta } _{1}\left( .;k\right) ,\widetilde{\beta }_{2}\left( .;k\right) \right) \) of the AA, the way we have defined it (following Goeree and Offerman 2004), for the value distributions \(\widetilde{F}_{1},\widetilde{F}_{2}\) over \( \left[ c/\left( 1+k\right) ,d/\left( 1+k\right) \right] \) such that \( \widetilde{F}_{1}\left( x\right) =1-\left( 1-F_{1}\left( \left( 1+k\right) x\right) \right) ^{1/1+k}\), for all \(x\in \left[ c/\left( 1+k,d/\left( 1+k\right) \right) \right] \), \(i=1,2\). The relation between the equilibria is as follows: \(\widehat{\beta }_{i}\left( x;k\right) =\widetilde{\beta } _{i}\left( x/\left( 1+k\right) ;k\right) \), for all \(x\) in \(\left[ c,d\right] \) and \(i=1,2\). In particular, either bidder with value \(d\) bids \(d/\left( 1+k\right) \) in this variant of the AA.

Here, the proof of the “terminal” condition \(\beta _{i}\left( d;k\right) =d\), \(i=1,2\), in the AA is similar to the proof of the “initial” condition \( \widetilde{\beta }_{i}\left( c;k\right) =c\), \(i=1,2\), in a FPA where the finite reserve price is not larger and possibly strictly smaller than \(c\). If the condition at \(d\) was not satisfied in the AA, a bidder who would win for sure for some value \(v<d\) (from our assumption that bids must not exceed \(B\), such a bidder would exist) would increase his payoff by decreasing his bid to a bid \(b^{\prime }>v\) that would lose with strictly positive probability.

This is similar to the observation in Bulow et al. (1999, p. 442).

This is consistent with the following intuition. If bidder \(i\) with value \( v\) and bid \(b\) faced bidder \(j\) who bid “close” to his value, bidder \(i\)s expected payoff would be close to \(\int _{c}^{b-\Delta }\left( v-w-\Delta \right) dF_{j}\left( w\right) +\left( v-b\right) \left( F_{j}\left( b\right) -F_{j}\left( b-\Delta \right) \right) \), where \(\Delta \) is the price increment. The FOC would then be \(\alpha _{i}\left( b;\Delta \right) =b+\left( F_{j}\left( b\right) -F_{j}\left( b-\Delta \right) \right) /f_{j}\left( b\right) \), a strong bidder would shade his bid more, and higher revenues would ensue for small \(\Delta \)s. Here, the effect on revenues would actually be of the second-order in \(\Delta \) and the effect on surplus of a higher order. Whether this heuristic argument can be made rigorous is left for future work.

Of course, it could also follow from the literature (for example, Reny 1999) on the existence of a Nash equilibrium in discontinuous games.

\(\beta _{i}\left( \alpha _{i}\left( b;k\right) ;k\right) =b\) only when \(b\le \eta \left( k\right) \). Otherwise, \(\beta _{i}\left( \alpha _{i}\left( b;k\right) ;k\right) \le b\).

It is somewhat interesting that we proved a statement about the solution to a differential system and boundary conditions using only equilibrium properties.

The full formal argument rules out the existence of a sequence \(\left( s_{t};k_{t}\right) \rightarrow \left( s;0\right) \), where \(s\in K\), such that \(\lim _{t\rightarrow +\infty }\Phi ^{\prime }\left( s_{t};k_{t}\right) \) exists in the weak sense (that is, can be infinite) and is different from \(l\) . See the online supplements.

Because of the discontinuity of the derivative of \(\Psi \left( .;k\right) \) at \(\ln F_{1}\left( x\left( k\right) \right) \), we express statement (ii) below in terms of the inverse function \(\Psi ^{-1}\left( .;k\right) \). As it can be easily verified by appealing to (i), (ii) is equivalent to the uniform convergence over any interval \(\left[ \underline{u},\ln F_{1}\left( x\left( k\right) \right) \right] \) of \(\Psi \left( .;k\right) \) and its derivative towards \(\Lambda \) and its derivative, that is, to the following statement: (ii)’ \(\max _{u\in \left[ \underline{u},\ln F_{1}\left( x\left( k\right) \right) \right] }\max \left( \left| \Psi ^{\prime }\left( u;k\right) -l\right| ,\left| \Psi \left( u;k\right) -lu\right| \right) \) tends towards zero with \(k\), for all finite \(\underline{u}<0\).

Our assumption that \(\varepsilon _{1}\) be bounded enters the proof of (v).

As we already observed, \(\varphi ^{\prime }\left( d;k\right) =\frac{1}{l}\), for all \(k\). Consequently, \(\varphi ^{\prime }\left( v;k\right) \) is discontinuous at \(\left( d;0\right) \) if \(l>1\).

References

Athey, S., Levin, J., Seira, E.: Comparing open and sealed bid auctions: evidence from timber auctions. Quart. J. Econ. 126, 207–257 (2011)

Baldwin, L.H., Marshall, R.C., Richard, J.-F.: Bidder collusion at forest service timber sales. J. Polit. Econ. 105, 657–699 (1997)

Besley, T., Suzumura, K.: Taxation and welfare in an oligopoly with strategic commitment. Int. Econ. Rev. 33, 413–431 (1992)

Biran, O., Forges, F.: Core-stable rings in auctions with independent private values. Games Econ. Behav. 73, 52–64 (2011)

Blume, A., Heidhues, P.: All equilibria of the Vickrey auction. J. Econ. Theory 114, 170–177 (2004)

Bochove, C. van, Boerner, L., Quint, D.: Anglo-Dutch Premium Auctions in Eighteenth-Century Amsterdam. Discussion paper, University of Wisconsin-Madison (2013)

Branman, L., Froeb, L.M.: Mergers, cartels, set-asides, and bidding preferences in asymmetric oral auctions. Rev. Econ. Stat. 82, 283–290 (2000)

Brunner, C., Hu, A., Oechssler, J.: Premium auctions and risk preferences: an experimental study. Games Econ. Behav. 87, 467–484 (2014)

Bulow, J., Huang, M., Klemperer, P.: Toeholds and takeovers. J. Polit. Econ. 107, 427–454 (1999)

Cheng, H.: Ranking sealed high-bid and open asymmetric auctions. J. Math. Econ. 42, 471–498 (2006)

Cramton, P., Gibbons, R., Klemperer, P.: Dissolving a partnership efficiently. Econometrica 55, 615–632 (1987)

Dalkir, S., Logan, J.W., Masson, R.T.: Mergers in symmetric and asymmetric noncooperative auction markets: the effects on prices and efficiency. Int. J. Ind. Organ. 18, 383–413 (2000)

Deb, R., Pai, M.M.: Symmetric Auctions. Discussion Paper, University of Toronto (2014)

de Frutos, M.A.: Asymmetric price–benefit auctions. Games Econ. Behav. 33, 48–71 (2000)

Goeree, J.K., Offerman, T.: The Amsterdam auction. Econometrica 72, 281–294 (2004)

Güth, W., van Damme, E.: A comparison of pricing rules for auctions and fair division games. Soc. Choice Welf. 3, 177–198 (1986)

Hickman, B.: On the pricing rule in electronic auctions. Int. J. Ind. Organ. 28, 423–433 (2010)

Hu, A., Offerman, T., Zou, L.: Premium auctions and risk preferences. J. Econ. Theory 146, 2420–2439 (2011)

Kaplan, T.R., Zamir, S.: Asymmetric first-price auctions with uniform distributions: analytical solutions to the general case. Econ. Theor. 50(2), 269–302 (2012)

Kirkegaard, R., Overgaard, P.B.: Pre-auction offers in asymmetric first-price and second-price auctions. Games Econ. Behav. 63, 145–165 (2008)

Kirkegaard, R.: A mechanism design approach to ranking asymmetric auctions. Econometrica 80(5), 2349–2364 (2012)

Klemperer, P.D.: What really matters in auction design. J. Econ. Perspect. 16, 169–189 (2002)

Krasnokutskaya, E.: Identification and estimation of auction models with unobserved heterogeneity. Rev. Econ. Stud. 78, 293–327 (2011)

Krishna, V.: Auction Theory. Academic Press, San Diego (2009)

Lebrun, B.: Revenue Comparison between the First and Second Price Auctions in a Class of Asymmetric Examples. Université Laval, Mimeo (1996)

Lebrun, B.: First-Price Auctions in the Asymmetric N Bidder Case. Discussion paper, Université Laval (1997)

Lebrun, B.: First price auctions in the asymmetric N bidder case. Int. Econ. Rev. 40, 125–142 (1999)

Lebrun, B.: Continuity of the first price auction Nash correspondence. Econ. Theor. 20, 435–453 (2002)

Lebrun, B.: Uniqueness of the equilibrium in first-price auctions. Games Econ. Behav. 55, 131–151 (2006)

Lebrun, B.: Optimality and the English and second-price auctions with resale. Games Econ. Behav. 75, 731–751 (2012)

Lebrun, B.: Revenue-Superior Variants of the Second-Price Auctions. Discussion paper, York University (2014)

Lizzeri, A., Persico, N.: Uniqueness and existence of equilibrium in auctions with a reserve price. Games Econ. Behav. 30, 83–114 (2000)

Mares, V., Swinkels, J.M.: Near-optimality of the second price mechanisms in a class of asymmetric auctions. Games Econ. Behav. 72, 218–241 (2011)

Marshall, R.C., Marx, L.M.: The Economics of Collusion. MIT Press, Cambridge (2012)

Marshall, R.C., Meurer, M.J., Richard, J.-F., Stromquist, W.: Numerical analysis of asymmetric first price auctions. Games Econ. Behav. 7, 193–220 (1994)

Maskin, E.S., Riley, J.G.: Optimal auctions with risk averse buyers. Econometrica 52, 1473–1518 (1984)

Maskin, E.S., Riley, J.G.: Auction theory with private values. Am. Econ. Rev. 75, 150–155 (1985)

Maskin, E.S., Riley, J.G.: Asymmetric auctions. Rev. Econ. Stud. 67, 413–438 (2000)

Milgrom, P.R.: Putting Auction Theory to Work. Cambridge University Press, Cambridge (2004)

Monderer, D., Tennenholtz, M.: K-price auctions. Games Econ. Behav. 31, 220–244 (2000)

Monderer, D., Tennenholtz, M.: K-price auctions: revenue inequalities, utility equivalence, and competition in auction design. Econ. Theor. 24, 255–270 (2004)

Myerson, R.B.: Optimal auction design. Math. Oper. Res. 6, 58–73 (1981)

Okuno-Fujiwara, M., Suzumura, K.: Symmetric Cournot oligopoly and economic welfare: a synthesis. Econ. Theor. 3, 43–59 (1993)

Pesendorfer, M.: A study of collusion in first-price auctions. Rev. Econ. Stud. 67, 381–411 (2000)

Piccione, M., Tan, G.: Cost-reducing investment, optimal procurement and implementation by auctions. Int. Econ. Rev. 37, 663–685 (1996)

Reny, P.J.: On the existence of pure and mixed strategy Nash equilibria in discontinuous games. Econometrica 67, 1029–1056 (1999)

Seade, J.: On the effects of entry. Econometrica 48, 479–489 (1980)

Suzumura, K., Kiyono, K.: Entry barriers and economic welfare. Rev. Econ. Stud. 54, 157–167 (1987)

Tschantz, S., Crooke, P., Froeb, L.: Mergers in sealed versus oral auctions. Int. J. Econ. Bus. 7, 201–212 (2000)

Waehrer, K., Perry, M.K.: The effects of mergers in open-auction markets. RAND J. Econ. 34, 287–304 (2003)

Wasser, C.: Bilateral k+1-price auctions with asymmetric shares and values. Games Econ. Behav. 82, 350–368 (2013)

Wilson, R.: Game-theoretic analyses of trading processes. In: Bewley, T.F. (ed.) Advances in Economic Theory: Fifth World Congress, pp. 33–70. Cambridge University Press, Cambridge (1987)

Author information

Authors and Affiliations

Corresponding author

Additional information

I am grateful to Brent Hickman for helpful comments and in particular for suggesting the example of the bid increment in electronic auctions. I also thank a referee and the participants to conferences and seminars where I presented this paper. Financial support was provided by the Social Sciences and Humanities Research Council of Canada.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1

1.1 Proof of Theorem 1

Proof of (i): The proof of the necessity of the characterization (i) proceeds along similar lines as the proof in Lebrun (1997, 1999) of the characterization in Theorem 1 in Lebrun (1999) of the equilibria of the FPA. We relegate it to the online supplements.

It is weakly dominated to submit a bid strictly above one’s value. It is unprofitable to submit a bid strictly below \(c\) when one’s value is strictly above \(c\) or to submit a bid strictly above the common maximum bid \(\eta \left( k\right) \). The sufficiency of the system (1) of FOCs then follows from the strict monotonicity of the strategies and the nonnegativity of the cross second-order partial derivative, equal to \(\frac{\hbox {d}}{\hbox {d}b}F_{j}\left( \alpha _{j}\left( b\right) \right) \), of any bidder \(i\)’s payoff with respect to his own bid \(b\) in \(\left( r,\eta \left( k\right) \right) \) and own value.

Proof of (ii): From Theorem 1 in Lebrun (1999), the differential system and boundary conditions in (i) are the same as those that characterize the equilibria of the FPA where the value distributions are \( F_{1}^{1/k},...,F_{n}^{1/k}\) and (ii) follows. \(\square \)

1.2 Proof of Corollary 1

Proof of (i): The existence follows from Theorem 1 (ii) above and Lebrun (1999) (or other papers on the FPA, such as Lebrun 1997 or Maskin and Riley 2000).Footnote 30 Strict log-concavity of \(F_{i}\) and strict log-concavity of \(F_{i}^{1/k}\) are equivalent. Uniqueness then follows from Lebrun (2006).

Proof of (ii): The formula is a direct consequence of Theorem 1 (ii) above and the envelope theorem or Myerson (1981).

Proof of (iii): From \(F_{2}^{1/k}=F_{1}^{l/k}\), \(F_{2}^{1/k}\) reverse-hazard-rate dominates \(F_{1}^{1/k}\). From Corollary 3 (ii) in Lebrun (1999), we then have \(\beta _{1}\left( .;k\right) \ge \beta _{2}\left( .;k\right) \) or, equivalently, \(\alpha _{2}\left( .;k\right) \ge \alpha _{1}\left( .;k\right) \). The equations (1) then immediately imply \( \frac{\hbox {d}}{\hbox {d}b}\ln F_{2}\alpha _{2}\left( b;k\right) \ge \frac{\hbox {d}}{\hbox {d}b}\ln F_{1}\alpha _{1}\left( b;k\right) \) and (iii.1) is proved.

Assume \(l>1\). If there existed \(b\) in \(\left( r,\eta \left( k\right) \right) \) such that \(\alpha _{1}\left( b;k\right) =\alpha _{2}\left( b;k\right) \), we would have from (1) \(l\alpha _{2}^{\prime }\left( b;k\right) \rho _{1}\left( \alpha _{2}\left( b;k\right) \right) =\frac{\hbox {d}}{\hbox {d}b} \ln F_{2}\left( \alpha _{2}\left( b;k\right) \right) =\frac{\hbox {d}}{\hbox {d}b}\ln F_{1}\left( \alpha _{1}\left( b;k\right) \right) =\alpha _{1}^{\prime }\left( b;k\right) \rho _{1}\left( \alpha _{1}\left( b;k\right) \right) \). Consequently, we would have \(\alpha _{2}^{\prime }\left( b;k\right) <\alpha _{1}^{\prime }\left( b;k\right) \) and \(\alpha _{2}\left( .;k\right) \) would be strictly larger than \(\alpha _{1}\left( .;k\right) \) to the right of \(b\), which would contradict (iii.1). No such \(b\) then exists and we have proved (iii.2). \(\square \)

Lemma 1

Uniform upper bound on the rate of convergence of the weak bidder’s strategy:

Proof

From Corollary 1 (iii), we have for \(w\le v\):

Consequently, from Corollary 1 (ii) we find:

from which it follows:

where the equality is from Lemma 2 (i) below.

That the upper bound is uniform over \(\left[ c,d\right] \), that is,

is a consequence of Lemma 2 (ii) (here, we use our assumption of bounded elasticity \(\varepsilon _{1}\)). We have proved the statement about \(\beta _{1}\left( v;k\right) \).

Let \(\varepsilon \) and \(\gamma \) be arbitrary strictly positive numbers. From (12), there exists \(k^{\prime }>0\) such that for all \(0<k<k^{\prime }\) we have:

for all \(v\) in \(\left[ c,d\right] \). Applying the inequality above to \( v=\alpha _{1}\left( b;k\right) \), for all \(b\) in \(\left[ c,d\right] \), we find:Footnote 31

As \(\rho _{1}^{-1}\left( v\right) =F_{1}\left( v\right) /f_{1}\left( v\right) \) is bounded (it tends towards zero when \(v\) tends towards \(c\)), we obtain that \(\alpha _{1}\left( b;k\right) \) tends towards \(b\) uniformly over \(\left[ c,d\right] \) when \(k\) tends towards zero and the statement about \( \alpha _{1}\left( b;k\right) \) then follows from (13). \(\square \)

Lemma 2

Technical lemma: Let \(G\) be a continuous function over \(\left[ c,d\right] \) that is continuously differentiable and strictly positive over \(\left( c,d\right] \) with a strictly positive derivative \(g\) over this semi-open interval. Then:

-

(i)

For all \(v\) in \(\left( c,d\right] \), we have:

$$\begin{aligned} \lim _{l\rightarrow +\infty }l\int _{c}^{v}\left( \frac{G\left( w\right) }{ G\left( v\right) }\right) ^{l}\hbox {d}w=\frac{G\left( v\right) }{g\left( v\right) }. \end{aligned}$$ -

(ii)

For all \(v\) in \(\left( c,d\right] \), we have:

$$\begin{aligned} \lim _{l\rightarrow +\infty }\int _{c}^{v}\left( \frac{G\left( w\right) }{ G\left( v\right) }\right) ^{l}\hbox {d}w=0, \end{aligned}$$and the convergence is uniform in \(v\) over \( \left( c,d\right] \) if \(G\) is log-concave over an interval \(\left[ c,c+\eta \right] \), with \(\eta >0\), \(G\left( c\right) =0\), \(g\) is continuously differentiable over \(\left( c,d\right] \) and its elasticity \(\varepsilon \) with respect to \(G\) is bounded from below over \( \left[ c,d\right] \).

Proof

See the online supplements. \(\square \)

1.3 Proof of Theorem 2

From Lemma 1 above, \(\beta _{1}\left( v;k\right) \) and \(\alpha _{1}\left( v;k\right) \) are continuous in \(k\) uniformly with respect to \(v\) in \(\left[ c,d\right] \). The joint continuity at all such points follows.

We next prove the statement about \(\beta _{2}\) and \(\alpha _{2}\). For all \(v>c\), \(\beta _{2}\left( v;k\right) \) must be optimal for bidder \(2\) with value \(v\) and in particular better than the bid \(v\). After integration by parts, his expected payoff \(\left( 1-k\right) \int _{c}^{v}\left( v-b\right) dF_{1}\left( \alpha _{1}\left( b\right) \right) \) if he submits \(v\) is:

and if he submits \(\beta _{2}\left( v;k\right) \):

Consequently, we must have:

and then:

Let \(\left( v_{l},k_{l}\right) _{l\ge 1}\) be a sequence tending towards \(\left( v,0\right) \) with \(v\) in \(\left( c,d\right] \) and such that \( k_{l}>0\), for all \(l\). Suppose \(\beta _{2}\left( v_{l};k_{l}\right) \) does not tend towards \(v\). Extracting a subsequence if necessary, we may assume that it tends towards \(b^{\prime }\ne v\). As \(\beta _{2}\left( v_{l};k_{l}\right) \le v_{l}\), we must have \(b^{\prime }<v\). From (14) applied to \(\left( v_{l},k_{l}\right) \), we have:

Making \(l\) tends towards \(+\infty \) and using the joint continuity of \( \alpha _{1}\left( b;k\right) \), we find:

which is impossible. We have proved that \(\beta _{2}\left( v;k\right) \) is continuous at \(\left( v;0\right) \) jointly in \(\left( v;k\right) \), for all \( v>c\). The inequalities \(c\le \beta _{2}\left( v;k\right) \le v\) imply that \(\beta _{2}\left( v;k\right) \) tends towards \(c\) if \(\left( v;k\right) \) tends towards \(\left( c;0\right) \), and we also obtain the continuity at \( \left( c;0\right) \).

Proving the continuity of \(\alpha _{2}\) from the result we have already established is straightforward.

At this point, the joint continuity of \(\varphi \) at all \(\left( v;k\right) \) is immediate.Footnote 32 \(\square \)

Appendix 2

From (1), the rates of change with respect to \(k\) of the direct and inverse bidding functions are related to the derivatives of these functions with respect to value and bid. Although from Theorem 2, \(\varphi \left( .;k\right) \) approaches the identity function, the value of its derivative does not approach one everywhere. Indeed, dividing the second equation in (1) by the first, we find:

which combined with power relation and the condition (3), implies:

Thus, when the values are differently distributed, \(\varphi ^{\prime }\left( d;k\right) \) stays away from one.

To acquire information about the behaviour of the derivative of \(\varphi \), we differentiate (15) and, after rearranging, we find:

where the functions \(\gamma _{1},\gamma _{2}\) are defined as follows:

for all \(v\) in \(\left( c,d\right] \) and \(i,j=1,2\), \(i\ne j\). Thus, \(\gamma _{i}\left( .;k\right) \) would be bidder \(i\)’s inverse bidding function if bidder \(j\) bid truthfully. The following properties of these functions are simple to prove.

Lemma 3

There exist \(\zeta ,\mu >0\) such that \(\gamma _{1}\left( .;.\right) \), \(\gamma _{2}\left( .;.\right) \) can be continuously extended to \(\left[ c,d+\mu \right) \times \left( -\zeta ,\zeta \right) \) in such a way that, for \(i\ne j\):

-

(i)

\(\gamma _{i}\left( c;k\right) =c\), for all \( k\) in \(\left( -\zeta ,\zeta \right) \);

-

(ii)

Over \(\left( c,d+\mu \right) \times \left( -\zeta ,\zeta \right) \): \(\gamma _{i}\left( .;.\right) \) is continuously differentiable; the derivative \(\gamma _{i}^{\prime }\left( .;.\right) \) with respect to \(b\) is strictly positive and bounded away from zero; \(\frac{\partial }{\partial k}\gamma _{i}\left( .;.\right) \) is strictly positive and bounded from above; and \( \gamma _{i}\left( d+\mu ;k\right) >d\), for all \(k\) in \( \left( -\zeta ,\zeta \right) \).

-

(iii)

Over \(\left( c,d\right] \times \left( -\zeta .\zeta \right) \): \(\frac{\partial }{\partial k}\gamma _{i}^{-1}\left( .;.\right) \) is strictly negative, bounded from below, and equal to \(-\left( \gamma _{i}^{\prime }\left( \gamma _{i}^{-1}\left( v;k\right) ;k\right) \rho _{j}\left( \gamma _{i}^{-1}\left( v;k\right) \right) \right) ^{-1}\).

Proof

See the online supplements.

The sign of the expression (16) does not depend directly on \(b\): \(\ln F_{2}\left( \varphi \left( v;k\right) \right) \) is concave or convex with respect to \(\ln F_{1}\left( v\right) \) depending on whether \(\gamma _{1}\left( \varphi \left( v;k\right) ;k\right) \) is smaller or larger than \( \gamma _{2}\left( v;k\right) \). We are lead to consider the functions \( \gamma _{1}^{-1}\left( \gamma _{2}\left( .;k\right) ;k\right) ,\varphi \left( .;k\right) \), and the identity function in the space of logarithms of cumulative probabilities. We denote the new functions \(\Psi \left( .;k\right) ,\Phi \left( .;k\right) \), and \(\Lambda \) and define them formally below. The linearity of \(\Lambda \) follows immediately from power relation.

Definitions

Let \(k\) be in \(\left( 0,\zeta \right) \), where \(\zeta >0\) is as in Lemma 3 above. Let \(\Psi \left( .;k\right) ,\Phi \left( .;k\right) \), and \(\Lambda \) be the following functions:

-

(i)

$$\begin{aligned} \Psi \left( u;k\right) =\ln F_{2}\left( \gamma _{1}^{-1}\left( \gamma _{2}\left( F_{1}^{-1}\left( \exp u\right) ;k\right) ;k\right) \right) , \end{aligned}$$

for all \(u<\ln F_{1}\left( x\left( k\right) \right) \), where \(x\left( k\right) \in \left( c,d\right] \) is defined as follows:

$$\begin{aligned} x\left( k\right) =\gamma _{2}^{-1}\left( \gamma _{1}\left( d;k\right) ;k\right) ; \end{aligned}$$and

$$\begin{aligned} \Psi \left( u;k\right) =0, \end{aligned}$$for all \(u\) in \(\left[ \ln F_{1}\left( x\left( k\right) \right) ,0\right] \);

-

(ii)

$$\begin{aligned} \Phi \left( u;k\right) =\ln F_{2}\left( \varphi \left( F_{1}^{-1}\left( \exp u\right) ;k\right) \right) , \end{aligned}$$

for all \(u\le 0\);

-

(iii)

$$\begin{aligned} \Lambda \left( u\right) =lu, \end{aligned}$$

for all \(u\le 0\).

As \(\rho _{2}=l\rho _{1}\), we have \(\gamma _{2}\left( .;k\right) \ge \) \( \gamma _{1}\left( .;k\right) \) and \(x\left( k\right) \) in (i) above is well defined. All functions above are continuous. The function \(\Psi \left( .;k\right) \) is strictly increasing over \(\left( -\infty ,\ln F_{1}\left( x\left( k\right) \right) \right) \) and equal to zero over \(\left[ \ln F_{1}\left( x\left( k\right) \right) ,0\right] \). The function \(\Phi \left( .;k\right) \) strictly increases from \(-\infty \) to zero.

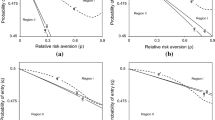

Figure 3 displays a possible configuration of the graphs of these functions. From Corollary 1 (iii), \(\Phi \left( .;k\right) \) is at least equal to \( \Lambda \), and strictly above it over the interior of its definition domain if \(l>1\). Because \(\Psi \left( .;k\right) \) reaches zero already at \(\ln F_{1}\left( x\left( k\right) \right) \) and \(\Phi \left( .;k\right) \) only at zero, \(\Psi \left( .;k\right) \) is above \(\Phi \left( .;k\right) \) in the neighbourhood of the origin. If \(l>1\), \(\gamma _{2}\left( .;k\right) >\gamma _{1}\left( .;k\right) \) and \(\Psi \left( .;k\right) \) is strictly above \(\Lambda \). As we already inferred from (16), the position of \( \Phi \left( .;k\right) \) relative to \(\Psi \left( .;k\right) \) determines the direction of its concavity. Thus, Lemma 4 below holds true.

Lemma 4

If \(l>1\):

-

(i)

\(\Psi \left( u;k\right) >\Lambda \left( u\right) \) , for all \(u\le 0\);

-

(ii)

\(\Psi \left( u;k\right) >\Phi \left( u;k\right) \) , for all \(u\) in \(\left( \ln F_{1}\left( x\left( k\right) \right) ,0\right) \).

-

(iii)

\(\Phi \left( u;k\right) >\Lambda \left( u\right) \) , for all \(u<0\);

-

(iv)

\(\Phi ^{\prime \prime }\left( u;k\right) >\) (\( < \); \(=\)) \(0\) if and only if \(\Phi \left( u;k\right) >\) (\(<\); \(=\)) \(\Psi \left( u;k\right) \) , for all \(u<0\).

From the explicit expression in the definition of \(\Psi \left( .;k\right) \), it is simple to prove that it and its derivative tend towards \(\Lambda \) and its derivative. From its definition and Theorem 2, \(\Phi \left( .;k\right) \) tends towards \(\Lambda \). The downward-pointing arrows in Figure 3 above represent these convergences.

From Lemma 4, we formally prove in the online supplements that the derivative of \(\Phi \left( .;k\right) \) converges towards the derivative of \( \Lambda \) compactly over \(\left( -\infty ,0\right) \), that is, uniformly over every compact subinterval \(K\) of \(\left( -\infty ,0\right) \). The main ideas of the proof are as follows. From the convergence of \(\Psi \left( .;k\right) \) and its derivative, there exists \(k^{\prime }\) such \( \Psi ^{\prime }\left( .;k\right) \) is close to \(l\) over \(K\) and smaller or only possibly slightly larger than \(l\) over \(\left[ \min K,0\right] \), for all \(0<k<k^{\prime }\). If, at some pointFootnote 33 \(s\) in \(K\) and for small \(k\), the derivative of \(\Phi \left( .;k\right) \) was further above \(l\) than \(\Psi ^{\prime }\left( .;k\right) \) is over \(\left[ \min K,0\right] \), \(\Phi \left( .;k\right) \) could not at the same time tend towards \(\Lambda \), remain above it, and be strictly increasing. For example, if \(\Phi ^{\prime }\left( .;k\right) \) at a point \(s\) was further above \(l\) than \( \Psi ^{\prime }\left( .;k\right) \) is over \(\left[ \min K,0\right] \) and if \( \Phi \left( s;k\right) \) was not smaller than \(\Psi \left( s;k\right) \), \( \Phi \left( .;k\right) \) would be convex at \(s\) (from Lemma 4 (iv)), its derivative would even be higher and \(\Phi \left( .;k\right) \) would hence never meet \(\Psi \left( .;k\right) \) to the right of \(s\). As depicted in Fig. 4, \(\Phi \left( .;k\right) \) would then be equal to zero to the left of \(\ln F_{1}\left( x\left( k\right) \right) \); something which is impossible as \(\Phi \left( u;k\right) \) vanishes only at \(u=0\).

If \(\Phi ^{\prime }\left( .;k\right) \) at a point \(s\) was again further above \(l\) than \(\Psi ^{\prime }\left( .;k\right) \) is over \(\left[ \min K,0 \right] \), but if \(\Phi \left( s;k\right) \) was now less than or equal to \( \Psi \left( s;k\right) \), \(\Phi \left( .;k\right) \) would be concave at \(s\) (from Lemma 4 (iv)), its derivative would be higher and hence \(\Phi \left( .;k\right) \) would never meet \(\Psi \left( .;k\right) \) and would remain concave to the left of \(s\). However, as the derivative of \(\Lambda \) is the constant \(l\), a derivative of \(\Phi \left( .;k\right) \) uniformly bounded away from \(l\) to the left of \(s\) is incompatible with \(\Phi \left( .;k\right) \) tending everywhere towards \(\Lambda \). For an illustration of this case, see Fig. 5. Ruling out \(\Phi ^{\prime }\left( .;k\right) \) further below \(l\) than \(\Psi ^{\prime }\left( .;k\right) \) is over \(K\) proceeds along similar lines.

We have Lemma 5 below.Footnote 34

Lemma 5

If the function spaces below are endowed with the compact-open topology (the topology of uniform convergence over every compact subset), we have:

-

(i)

\(\lim _{k\rightarrow 0}x\left( k\right) =d\);

-

(ii)

\(\Psi ^{-1}\left( .;k\right) \) tends towards \(\Lambda ^{-1}\) in \(C^{1}\left( \mathbb {R}_{-},\mathbb {R}\right) \);

-

(iii)

\(\ \Phi \left( .;k\right) \) tends towards \(\Lambda \) in \(C^{1}\left( \left( -\infty ,0\right) ,\mathbb {R}\right) \);

-

(iv)

\(\overline{\lim }_{\left( s;k\right) \rightarrow \left( 0;0\right) }\Phi ^{\prime }\left( s;k\right) \le l\);

-

(v)

\(\overline{\lim }_{\left( s;k\right) \rightarrow \left( -\infty ;0\right) }\Psi ^{\prime }\left( s;k\right) , \overline{\lim }_{\left( s;k\right) \rightarrow \left( -\infty ;0\right) }\Phi ^{\prime }\left( s;k\right) \le l\). .

Proof

See the online supplements.Footnote 35 \(\square \)

Thanks to Lemma 5, we can prove that, away from the extremities of the value interval, the slope of \(\varphi \left( .;k\right) \) tends towards one. We list this and other useful consequences from Lemma 5 about the limits of derivatives in Theorem 6 below.

Theorem 6

Convergence of the derivatives with respect to value or bid in the 2-k-PA: Extend the derivatives \(\beta _{i}^{\prime }\left( .;k\right) \), \(\alpha _{i}^{\prime }\left( .;k\right) ,\varphi ^{\prime }\left( .;k\right) \) to \(k=0\) as follows:

for all \(v\) in \(\left( c,d\right) \) and all \( i=1,2\). Then:Footnote 36

-

(i)

\(\beta _{i}^{\prime }\left( v;k\right) ,\alpha _{i}^{\prime }\left( v;k\right) ,\varphi ^{\prime }\left( v;k\right) \) are continuous jointly in both variables at \( \left( v;0\right) \), for all \(v\) in \(\left( c,d\right) \);

-

(ii)

\(\overline{\lim }_{\left( v;k\right) \rightarrow \left( d;0\right) }\varphi ^{\prime }\left( v;k\right) \le 1\);

-

(iii)

\(\overline{\lim }_{\left( v;k\right) \rightarrow \left( c;0\right) }\frac{\hbox {d}\ln F_{2}\left( \varphi \left( v;k\right) \right) }{\hbox {d}\ln F_{1}\left( v\right) }\le l\).

Proof of (i):

-

(a)

For all \(u\) in \(\left( -\infty ,0\right) \), the first equality below follows from Lemma 5 (iii):

$$\begin{aligned} l&= \lim _{\left( s,k\right) \rightarrow \left( u,0\right) }\Phi ^{\prime }\left( s;k\right) \\&= \lim _{\left( s,k\right) \rightarrow \left( u,0\right) }\frac{lf\left( \varphi \left( F^{-1}\left( \exp s\right) ;k\right) \right) }{F\left( \varphi \left( F^{-1}\left( \exp s\right) ;k\right) \right) }\frac{\exp s}{ f\left( F^{-1}\left( \exp s\right) \right) }\varphi ^{\prime }\left( F^{-1}\left( \exp s\right) ;k\right) \\&= l\lim _{\left( s,k\right) \rightarrow \left( u,0\right) }\varphi ^{\prime }\left( F^{-1}\left( \exp s\right) ;k\right) . \end{aligned}$$The second equality follows from the definition of \(\Phi \) and the third from the joint continuity, according to Theorem 2, of \(\varphi \left( v;k\right) \). Consequently, \(\lim _{\left( s,k\right) \rightarrow \left( u,0\right) }\varphi ^{\prime }\left( F^{-1}\left( \exp s\right) ;k\right) \), or equivalently \(\lim _{\left( v,k\right) \rightarrow \left( w,0\right) }\varphi ^{\prime }\left( v;k\right) \), where \(w\!=\!F^{-1}\left( \exp u\right) \!\in \! \left( c,d\right) \), exists and is equal to \(1\).

-

(b)

Let \(v\) be in \(\left( c,d\right) \) . From Corollary 1 (ii), we have \(\beta _{1}\left( u;k\right) =u-\int _{c}^{u}\left( \frac{ F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\hbox {d}w\), for all \(u\) in \(\left( c,d\right) \). Differentiating this equation, we find:

$$\begin{aligned} \beta _{1}^{\prime }\left( u;k\right)&= \frac{1}{k}\int _{c}^{u}\left( \frac{ F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\hbox {d}w\frac{f_{2}\left( \varphi \left( u;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\varphi ^{\prime }\left( u;k\right) \nonumber \\&= \frac{1}{k}\int _{c}^{e}\left( \frac{F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\hbox {d}w \frac{f_{2}\left( \varphi \left( u;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\varphi ^{\prime }\left( u;k\right) \nonumber \\&+\,\int _{e}^{u}\frac{F_{2}\left( \varphi \left( w;k\right) \right) }{\varphi ^{\prime }\left( w;k\right) f_{2}\left( \varphi \left( w;k\right) \right) } d\left( \frac{F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k} \nonumber \\&\cdot \,\frac{f_{2}\left( \varphi \left( u;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\varphi ^{\prime }\left( u;k\right) , \end{aligned}$$(17)where \(e\) is a fixed number strictly between \(c\) and \(v\). The first term in the RHS of the last equality above tends towards zero if \(\left( u;k\right) \) tends towards \(\left( v;0\right) \). In fact, we have:

$$\begin{aligned} 0&\le \frac{1}{k}\int _{c}^{e}\left( \frac{F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\hbox {d}w\frac{f_{2}\left( \varphi \left( u;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\varphi ^{\prime }\left( u;k\right) \\&\le \frac{1}{k}\left( \frac{F_{2}\left( \varphi \left( e;k\right) \right) }{ F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\frac{ f_{2}\left( \varphi \left( u;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\varphi ^{\prime }\left( u;k\right) , \end{aligned}$$and, from Theorem 2 and what we have just proved in (a) above, \(\varphi \left( u;k\right) \) and \(\varphi ^{\prime }\left( u;k\right) \) are jointly continuous in \(\left( u;k\right) \) at \(\left( v;0\right) \).

We may consider \(\left( \frac{F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\) in the second term as a probability distribution over the couples \(\left( w;t\right) \) that is the product of two distributions: the distribution over \(\left[ e,u\right] \) whose cumulative function is \(\left( \frac{F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\) and hence that has a mass point at \(e\); and the degenerate distribution at \(k\). That is, the second term is \( \mathop {\displaystyle \iint }\limits _{\left( e,u\right] \times \left[ 0,1\right] }\frac{F_{2}\left( \varphi \left( w;t\right) \right) }{\varphi ^{\prime }\left( w;t\right) f_{2}\left( \varphi \left( w;t\right) \right) }d\left( \left( \frac{ F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k}\times \delta _{\left\{ k\right\} }\left( t\right) \right) \). As \(\left( u;k\right) \) tends towards \(\left( v;0\right) \), this product distribution tends weakly towards the distribution concentrated at \(\left( v;0\right) \). From Theorem 2 and (a) above, the integrand is a continuous function of \(\left( u;t\right) \). Consequently, we have:

$$\begin{aligned}&\lim _{\left( u;k\right) \rightarrow \left( v;0\right) }\int _{e}^{u}\frac{ F_{2}\left( \varphi \left( w;k\right) \right) }{\varphi ^{\prime }\left( w;k\right) f_{2}\left( \varphi \left( w;k\right) \right) }d\left( \frac{ F_{2}\left( \varphi \left( w;k\right) \right) }{F_{2}\left( \varphi \left( u;k\right) \right) }\right) ^{1/k} \\&\quad =\frac{F_{2}\left( v\right) }{f_{2}\left( v\right) }. \end{aligned}$$(17) then implies \(\lim _{\left( u;k\right) \rightarrow \left( v;0\right) }\beta _{1}^{\prime }\left( u;k\right) =1\), for all \(v\) in \(\left( c,d\right) \).

-

(c)

Let \(b\) be in \(\left( c,d\right) \). For all \(k\) and all \( \widetilde{b}\) such that \(c<\widetilde{b}<\beta \left( d;k\right) =\eta \left( k\right) \), we obviously have \(\alpha _{1}^{\prime }\left( \widetilde{ b};k\right) =1/\beta _{1}^{\prime }\left( \alpha _{1}\left( \widetilde{b} ;k\right) ;k\right) .\) (b) above then implies \(\lim _{\left( \widetilde{b} ;k\right) \rightarrow \left( b;0\right) }\alpha _{1}^{\prime }\left( \widetilde{b};k\right) =1\). From the identity \(\alpha _{2}\left( \widetilde{b};k\right) =\varphi \left( \alpha _{1}\left( \widetilde{b} ;k\right) ;k\right) \), we have \(\alpha _{2}^{\prime }\left( \widetilde{b} ;k\right) =\varphi ^{\prime }\left( \alpha _{1}\left( \widetilde{b};k\right) ;k\right) \alpha _{1}^{\prime }\left( \widetilde{b};k\right) \) and consequently \(\lim _{\left( \widetilde{b};k\right) \rightarrow \left( b;0\right) }\alpha _{2}^{\prime }\left( \widetilde{b};k\right) =1\). Finally, from \(\beta _{2}^{\prime }\left( u;k\right) =1/\alpha _{2}^{\prime }\left( \beta _{2}\left( u;k\right) ;k\right) \), for all \(u\) in \(\left( c,d\right) \) and \(k\), we have \(\lim _{\left( u;k\right) \rightarrow \left( v;0\right) }\beta _{2}^{\prime }\left( u;k\right) =1\), for all \(v\) in \( \left( c,d\right) \).

Proof of (ii): The proof of (ii) from Lemma 5 (iv) is similar to (a) in the proof of (i) above.

Proof of (iii): Proceeding again as in (a) in the proof of (i) above, (iii) is an immediate consequence of Lemma 5 (v). \(\square \)

Proof of Theorem 3 (i): Let \(v\) be in \(\left( c,d\right) \). From (1), we have \(\left( \alpha _{i}\left( b;k\right) -b\right) /k=F_{j}\left( \alpha _{j}\left( b;k\right) \right) /\left( f_{j}\left( \alpha _{j}\left( b;k\right) \right) \alpha _{j}^{\prime }\left( b;k\right) \right) \), for all \(b\) close enough to \(v\) and all \(k\) small enough. Letting \(\left( b;k\right) \) tend towards \(\left( v;0\right) \) and using Theorem 6 (i) and Theorem 2, we find the statement in (i) about \(\alpha _{i} \).

We have \(\left( u-\beta _{i}\left( u;k\right) \right) /k=\left( \alpha _{i}\left( \beta _{i}\left( u;k\right) ;k\right) -\beta _{i}\left( u;k\right) \right) /k\), for all \(u\) close enough to \(v\) and \(k\) small enough. The statement in (i) about \(\beta _{i}\) then follows from the statement about \(\alpha _{i}\) and from Theorem 2.

From (15), we have:

Letting \(\left( u;k\right) \) tend towards \(\left( v;0\right) \) and using the statement about \(\beta _{1}\) and Theorem 6 (i) and Theorem 2, we obtain the statement in (i) about \(\varphi \). \(\square \)

Lemma 6

Uniform upper bound on the rate of convergence of \(\mathbf {\varphi }\): \(\overline{\lim }_{k\rightarrow 0}\max _{u\in \left[ c,d\right] }\left( \frac{\varphi \left( u;k\right) -u}{k}-\left( l-1\right) \rho _{1}\left( u\right) ^{-1}\right) \le 0\).

Proof

Let \(\gamma \) and \(\varepsilon \) be arbitrary strictly positive numbers. From (18) and (19), Theorem 3 (i), which we have just proved, Lemma 1, and Theorem 6 (i, ii, iii), there exists \(k^{\prime }>0\) such that for all \(0<k<k^{\prime }\) and \(u\) in \(\left[ c,d\right] \), we have:

where \(M\) is the maximum of \(F_{1}/f_{1}\). Consequently, \(\overline{\lim } _{k\rightarrow 0}\sup _{u\in \left[ c,d\right] }\left( \frac{\varphi \left( u;k\right) -u}{k}-\right. \left. \left( l-1\right) \frac{F_{1}\left( u\right) }{f_{1}\left( u\right) }\right) \) \(\le \varepsilon \left( M+l-1+\varepsilon \right) \) and the lemma follows by making \(\varepsilon \) tend towards zero. \(\square \)

Proof of Theorem 3 (ii): From Corollary 1 (iii), bidder 1 bids more aggressively and the differences \(\Delta ER\left( k\right) \) and \( \Delta ES\left( k\right) \) between the expected revenues and total surpluses from the 2-k-PA and the SPA are as follows:

The rate of change of the expected revenues can then be written as:

where:

which is continuous over \(\left[ c,d\right] ^{2}\). Let \(K\) be the maximum of \(\left| \Delta \left( v_{1},v_{2}\right) \right| \) over this square. From Lemma 6 above, there exists \(k^{\prime }>0\) such that, for all \(0<k<k^{\prime }\) and all \(u\) in \(\left( c,d\right) \), we have: \(0\le \left( \varphi \left( u;k\right) -u\right) /k\le 1+\left( l-1\right) F_{1}\left( u\right) /f_{1}\left( u\right) \). As \(F_{1}\left( u\right) /f_{1}\left( u\right) \) is bounded, there exists \(L\) such that \(0\le \left( \varphi \left( u;k\right) -u\right) /k\le L\), for all \(u\) in \(\left[ c,d \right] \) and \(0<k<k^{\prime }\). For all \(0<k<k^{\prime }\), we then have:

for all \(v_{1}\) in \(\left[ c,d\right] \), and the integrand in the RHS of (20) is bounded.

From the previous paragraph, if we can find the almost everywhere pointwise limit of the integrand of (20), we will be entitled to apply the Lebesgue dominated convergence theorem. Let \(v_{1}\) be in \(\left( c,d\right) \). The integrand of (20) at \(v_{1}\) can be rewritten as:

Let \(\varepsilon \) be an arbitrary strictly positive number. By continuity of \(\Delta \left( v_{1},v_{2}\right) \) over \(\left[ c,d\right] ^{2}\), there exists \(\xi >0\) such that \(\left| \Delta \left( v_{1},v_{2}\right) -\Delta \left( v_{1},v_{1}\right) \right| <\varepsilon \) for all \(v_{2}\) such that \(\left| v_{1}-v_{2}\right| <\xi \). From Theorem 2, there exists \(k^{\prime \prime }\), which we may assume smaller than \(k^{\prime }\), such that, for all \(0<k<k^{\prime \prime }\), we have \(\varphi \left( v_{1};k\right) -v_{1}<\xi \). We then obtain:

for all \(0<k<k^{\prime \prime }\). As \(\varepsilon \) was arbitrary, we have proved

From Theorem 3 (i), we also have \(\lim _{k\rightarrow 0}\frac{\varphi \left( v_{1};k\right) -v_{1}}{k}=\frac{l-1}{l}\frac{F_{1}\left( v_{1}\right) }{ f_{1}\left( v_{1}\right) }\) and we have proved:

From the Lebesgue theorem of dominated convergence, \(\frac{d_{r}}{dk} ER\left( 0\right) =\lim _{k\rightarrow _{>}0}\frac{\Delta ER\left( k\right) }{ k}\) exists and (4) holds true. That \(\frac{d_{r}}{dk}ES\left( 0\right) \) exists and satisfies (5) can be proved similarly. If \(F_{1},F_{2}\) are different, we have \(l>1\) and \(\sigma _{2}<\sigma _{1}\) over \(\left( c,d\right) \). The strict positivity of \(\frac{d_{r}}{dk}ER\left( 0\right) \) follows from (4). \(\square \)

Appendix 3

1.1 Proof of Theorem 5

Proof of (i): It follows directly from Theorem 3 (i) and the previous theorem. For example, from Theorem 3 (i), we have \(\lim _{\left( \widetilde{b};k\right) \rightarrow \left( \widetilde{v};0\right) }\frac{ \widetilde{\alpha }_{i}\left( \widetilde{b};k\right) -\widetilde{b}}{k}= \widetilde{\rho }_{j}\left( \widetilde{v}\right) ^{-1}\). However, through the change of variables \(\widetilde{b}=c+d-b\), \(\widetilde{v}=c+d-v\), we have \(\widetilde{\alpha }_{i}\left( \widetilde{b};k\right) -\widetilde{b} =b-\alpha _{i}\left( b\right) \), \(\widetilde{\rho }_{j}\left( \widetilde{v} \right) =\frac{\widetilde{f}_{j}\left( \widetilde{v}\right) }{\widetilde{F} _{j}\left( \widetilde{v}\right) }=\frac{f_{j}\left( v\right) }{1-F_{j}\left( v\right) }=\sigma _{j}\left( v\right) \) and the result follows. The second inequality is proved similarly.

From Theorem 3 (i), we have \(\lim _{\left( \widetilde{u},k\right) \rightarrow \left( \widetilde{v},0\right) }\frac{\widetilde{\varphi }\left( \widetilde{u} ;k\right) -\widetilde{u}}{k}=\frac{l-1}{l}\widetilde{\rho }_{2}\left( \widetilde{v}\right) ^{-1}\), where \(\widetilde{\varphi }=\widetilde{\alpha } _{1}\widetilde{\beta }_{2}\) (as bidder 2 is the weak bidder for the transformed distributions). Compounding this equality with the joint continuity of \(\widetilde{\varphi }^{-1}\left( \widetilde{u};k\right) \), from Theorem 2, we find \(\lim _{\left( \widetilde{u},k\right) \rightarrow \left( \widetilde{v},0\right) }\frac{\widetilde{u}-\widetilde{\varphi } ^{-1}\left( \widetilde{u};k\right) }{k}=\frac{l-1}{l}\widetilde{\rho } _{2}\left( \widetilde{v}\right) ^{-1}\). The last statement of (i) then follows by changing the variables as above.

Proof of (ii):

-

(a)

From Lemma 6, we have

\(\overline{\lim }_{k\rightarrow 0}\max _{\widetilde{u}\in \left[ c,d\right] }\left( \frac{\widetilde{u}-\widetilde{\varphi }^{-1}\left( \widetilde{u};k\right) }{k}-\left( l-1\right) \widetilde{\rho }_{2}\left( \widetilde{\varphi }^{-1}\left( \widetilde{u};k\right) \right) ^{-1}\right) \le 0\), with \(\widetilde{\varphi }=\widetilde{\alpha }_{1}\widetilde{\beta } _{2}\), and, from the joint continuity of \(\widetilde{\varphi }^{-1}\left( \widetilde{u};k\right) \), we then have

\(\overline{\lim }_{k\rightarrow 0}\max _{\widetilde{u}\in \left[ c,d\right] }\left( \frac{\widetilde{u}-\widetilde{\varphi }^{-1}\left( \widetilde{u} ;k\right) }{k}-\left( l-1\right) \widetilde{\rho }_{2}\left( \widetilde{u} \right) ^{-1}\right) \le 0\). Changing the variables, we obtain \(\overline{ \lim }_{k\rightarrow 0}\max _{u\in \left[ c,d\right] }\left( \frac{\varphi \left( u;k\right) -u}{k}-l\left( l-1\right) \sigma _{1}\left( u\right) ^{-1}\right) \le 0\).

-

(b)

As the expected payoff of either bidder with value \(c\) is the premium \(k\left( \theta \left( k\right) -c\right) \) he receives, the differences \(\Delta ER^{A}\left( k\right) \) and \(\Delta ES^{A}\left( k\right) \) between the expected revenues and total surpluses from the AA and the SPA are as follows:

$$\begin{aligned} \Delta ER^{A}\left( k\right)&= \int _{c}^{d}\int _{v_{1}}^{\varphi \left( v_{1};k\right) }\left( \omega _{1}\left( v_{1}\right) \!-\!\omega _{2}\left( v_{2}\right) \right) dF_{2}\left( v_{2}\right) dF_{1}\left( v_{1}\right) \!-\!2k\left( \theta \left( k\right) \!-\!c\right) , \\ \Delta ES^{A}\left( k\right)&= \int _{c}^{d}\int _{v_{1}}^{\varphi \left( v_{1};k\right) }\left( v_{1}-v_{2}\right) dF_{2}\left( v_{2}\right) dF_{1}\left( v_{1}\right) . \end{aligned}$$The rate of change of the expected revenues can then be written as:

$$\begin{aligned} \frac{\Delta ER^{A}\left( k\right) }{k}=\int _{c}^{d}\frac{1}{k} \int _{v_{1}}^{\varphi \left( v_{1};k\right) }\Delta \left( v_{1},v_{2}\right) \hbox {d}v_{2}\hbox {d}v_{1}-2\left( \theta \left( k\right) -c\right) , \end{aligned}$$where \(\Delta \left( v_{1},v_{2}\right) \) is defined as in the proof of Theorem 3. From Theorem 2, \(\theta \left( k\right) =c+d-\widetilde{\beta } _{i}\left( d;k\right) \) tends towards \(c\) as \(k\) tends towards zero. The rest of the proof proceeds as the proof of Theorem 3 and appeals to (i) and (a) above. \(\square \)

Rights and permissions

About this article

Cite this article

Lebrun, B. Revenue-superior variants of the second-price auction. Econ Theory 59, 245–275 (2015). https://doi.org/10.1007/s00199-014-0853-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-014-0853-8

Keywords

- Second-price auction

- First-price auction

- English auction

- 2-k-price auction

- Amsterdam auction

- Bidder heterogeneity