Abstract

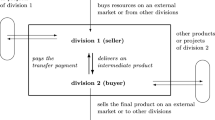

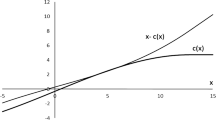

Suppose that a firm has several owners and that the future is uncertain in the sense that one out of many different states of nature will realize tomorrow. An owner’s time preference and risk attitude will determine the importance he places on payoffs in the different states. It is a well-known problem in the literature that under incomplete asset markets, a conflict about the firm’s objective function tends to arise among its owners. In this paper, we take a new approach to this problem, which is based on non-cooperative bargaining. The owners of the firm play a bargaining game in order to choose the firm’s production plan and a scheme of transfers which are payable before the uncertainty about the future state of nature is resolved. We analyze the resulting firm decision in the limit of subgame-perfect equilibria in stationary strategies. Given the distribution of bargaining power, we obtain a unique prediction for a production plan and a transfer scheme. When markets are complete, the production plan chosen corresponds to the profit-maximizing production plan as in the Arrow–Debreu model. Contrary to that model, owners typically do use transfers to redistribute profits. When markets are incomplete, the production plan chosen is almost always different from the one in a transfer-free Drèze (pseudo-)equilibrium and again owners use transfers to redistribute profits. Nevertheless, our results do support the Drèze criterion as the appropriate objective function of the firm.

Similar content being viewed by others

Notes

A more detailed discussion on the Grossman-Hart criterion and other reasons for its inconsistency can be found in Dierker and Dierker (2011).

A typical interpretation of \(\mu \) is that it reflects the bargaining power of the owners. We do not place further restrictions on its distribution. In particular, bargaining power may but need not be determined by the shares of ownership. The model can accommodate the case where, for example, everybody has equal bargaining power, but also the case where the bargaining power does increase with the share of ownership. Bargaining power may therefore capture strengths such as bargaining skill which are not derived from the firm’s ownership structure. Alternatively, one can interpret the bargaining model literally, in which case \( \mu \) simply determines the bargaining protocol that is used in reaching a decision. A much more general class of bargaining protocols is studied in Britz et al. (2010) and is shown to lead to the same results as the simple bargaining protocol used in this paper.

Since \(X\) is bounded from above, there is for each \(i\in \mathcal {I}\) a vector \(\bar{x}^{i}\in \mathbb R ^{S+1}_{++}\) such that for all \( x \in X, \) \(x^{i}\le \bar{x}^{i}. \) Fix a state \(s\in \mathcal {S}\). By Assumption 2.2 (3), it holds that \(u^{i}(x^{i}_{s},\bar{x}^{i}_{s})\) goes to negative infinity when \(x^{i}_{s}\) approaches zero. By the continuity of the utility function, there is \(b^{i}_{s}\) such that \(u^{i}(x^{i}_{s},\bar{x}^{i}_{-s})<v^{0i}\) when \(x^{i}_{s}<b^{i}_{s}\). Since the \(\bar{x}^{i}_{-s}\) represents the upper bounds on consumption in states \(-s\), we see that \(u^{i}(x^{i})<v^{0i}\) for any consumption plan \(x\in X\) such that \(x^{i}_{s}<b^{i}_{s}\). Repeating the argument for each state establishes the claim.

The requirement of stationarity is crucial here, since without it one typically has multiplicity of subgame-perfect equilibria.

We would like to thank the associate editor and a referee for raising these questions.

References

Aumann, R.J., Kurz, M.: Power and taxes. Econometrica 45, 1137–1161 (1977)

Bonnisseau, J.-M., Lachiri, O.: On the objective of firms under uncertainty with stock markets. J. Math. Econ. 40, 493–513 (2004)

Britz, V., Herings, P.J.J., Predtetchinski, A.: Non-cooperative support for the asymmetric Nash bargaining solution. J. Econ. Theory 145, 1951–1967 (2010)

DeMarzo, P.: Majority voting and corporate control: the rule of the dominant shareholder. Rev. Econ. Stud. 60, 713–734 (1993)

Demichelis, S., Ritzberger, K.: A general equilibrium analysis of corporate control and the stock market. Econ. Theory 46, 221–254 (2011)

Diamond, P.A.: The role of a stock market in a general equilibrium model with technological uncertainty. Am. Econ. Rev. 57, 759–776 (1967)

Dierker, E., Dierker, H.: Ownership structure and control in incomplete market economies with transferable utility. Econ. Theory (2011). doi:10.1007/s00199-011-0621-y

Dierker, E., Dierker, H., Grodal, B.: Nonexistence of constrained efficient equilibria when markets are incomplete. Econometrica 70, 1245–1251 (2002)

Drèze, J.H.: Investment under private ownership: optimality, equilibrium, and stability. In: Drèze, J.H. (ed.) Allocation Under Uncertainty: Equilibrium and Optimality 9. Macmillan, New York (1974)

Drèze, J.H., Lachiri, O., Minelli, E.: Stock prices, anticipations and investment in general equilibrium. CORE discussion paper, 83, 1–46 (2009)

Geanakoplos, J., Polemarchakis, H.: Existence, regularity, and constrained suboptimality of competitive equilibrium allocations when the asset market is incomplete. In: Heller, W.P., Ross, R.M., Starrett, D.A. (eds.) Uncertainty, Information, and Communication. Essays in honor of Kenneth J. Arrow, vol. III. Cambridge University Press, Cambridge (1986)

Geanakoplos, J., Magill, M., Quinzii, M., Drèze, J.H.: Generic inefficiency of stock market equilibrium when markets are incomplete. J. Math. Econ. 19, 113–151 (1990)

Grossman, S.J., Hart, O.: A theory of competitive equilibrium in stock market economies. Econometrica 47, 293–330 (1979)

Hart, S., Mas-Colell, A.: Bargaining and value. Econometrica 64, 357–380 (1996)

Kelsey, D., Milne, F.: The existence of equilibrium in incomplete markets and the objective function of the firm. J. Math. Econ. 25, 229–245 (1996)

Laruelle, A., Valenciano, F.: Bargaining in committees as an extension of Nash’s bargaining theory. J. Econ. Theory 132, 291–305 (2007)

Magill, M., Quinzii, M.: Theory of Incomplete Markets. MIT Press, Cambridge (1996)

Miyakawa, T.: Noncooperative foundation of \(n\)-person asymmetric Nash bargaining solution. J. Econ. Kwansei Gakuin Univ. 62, 1–18 (2008)

Rockafellar, R.T.: Convex Analysis. Princeton University Press, Princeton (1970)

Roth, A.E.: Risk aversion and the relationship between Nash’s solution and subgame perfect equilibrium of sequential bargaining. J. Risk Uncertain. 2, 353–365 (1989)

Tvede, M., Cres, H.: Voting in assemblies of shareholders and incomplete markets. Econ. Theory 26, 887–906 (2005)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors would like to thank Jacques Drèze, the associate editor, and two anonymous referees for helpful comments and suggestions. V. Britz would like to thank the Netherlands Organisation for Scientific Research (NWO) for financial support. P. J. J. Herings would like to thank the Netherlands Organisation for Scientific Research (NWO) for financial support. A. Predtetchinski This author would like to thank the Netherlands Organisation for Scientific Research (NWO) for financial support.

Rights and permissions

About this article

Cite this article

Britz, V., Herings, P.JJ. & Predtetchinski, A. A bargaining theory of the firm. Econ Theory 54, 45–75 (2013). https://doi.org/10.1007/s00199-012-0721-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-012-0721-3

Keywords

- Strategic bargaining

- Nash bargaining solution

- Incomplete markets

- Stock market equilibrium

- Objective function of the firm

- Profit-maximization