Abstract

In an evolutionary delegation game, we investigate the effects on market outputs of different levels of information about the way managers are compensated. When managers are informed about their opponents, the long–run configuration of the industry depends on market conditions. When managers are informed only of the current composition of the population, only profit maximizing firms survive, no matter what market condition prevails. However, if we further lower the level of information –by hiding the current composition of the industry– then we show how managers’ beliefs affect the long run equilibrium.

Similar content being viewed by others

Notes

This weight can be thought of as an average incentive for managers in a specific industrial sector and depends on a bargaining process between owners and managers, as discussed in Van Witteloostuijn et al. (2007).

A similar modeling structure has been employed in evolutionary oligopolies to investigate the effect of competition among players with different information or with different objective functions. In Droste et al. (2002), at each (discrete) time period a large population is matched in pairs to play a Cournot game. For the simple duopoly setting with two behavioral rules on current period’s quantity – a best reply rule and a (costly, since sophisticated) Nash rule – the authors show that complicated and endogenous fluctuations may arise. More recently, Hommes et al. (2011) studied an evolutionary model with N Cournot competitors where, based on past performance, firms switch between different expectation rules concerning aggregate output of their rivals. They find that the result in Theocharis (1960) about the instability of the Nash equilibrium for more than three firms is qualitatively confirmed under evolutionary competition between heterogeneous (costly and costless) expectation heuristics. Along the same line of research, evolutionary models of oligopoly competition where firms can employ different behavioral rules have been studied in Bischi et al. (2015) and Cerboni Baiardi et al. (2015). In Kopel et al. (2014), a mixed evolutionary duopoly is considered with competition between standard profit maximizers and corporate social responsible firms. In particular, conditions for coexistence in the industry of both types of firms are provided, assuming that firms are Nash players or best reply players.

As remarked in Ok and Vega-Redondo (2001), this kind of dynamics can be thought of as a combination of fast-slow dynamics: fast dynamics lead agents to play a (Bayesian-)Nash equilibrium, given the population composition; slow dynamics take place through evolutionary selection and increase the share of more successful strategies.

The weight α put on revenues in the delegation contract is itself a strategic variable. However, an endogenous choice of this weight would imply a level of rationality and information by owners that is higher than what is assumed in the paper. Also this would imply an additional stage in the underlying evolutionary game. For these reasons, as well as the reasons discussed in the introduction, we do not address this point in this paper and treat α as a parameter of the model.

Implicit in the model is that managers are risk-neutral and their contracts have a fixed and a variable component, the latter being proportional to Eqs. 2 or 3 for a P-manager or a R-manager respectively. In any case, the reservation wage for managers is zero and the fixed component is adjusted such that the salary of the managers is at least equal to the reservation wage.

The choice of evolutionary selection in discrete rather than continuous time appears more coherent with the setup of an underlying two-stage game. In any case, similar considerations can be provided with continuous time evolution.

Notice that the assumption introduced here is stronger than the usual monotonicity assumption (see Cressman 2003).

In this paper, the analysis focuses only on semi-symmetric equilibria where all players of the same type behave identically.

The switching function is thus \(G(r)=r\frac {dG}{dr}+z\) where:

13 where: h 1 =(2+(N−2)γ) 2 −α(4+4(N−2)γ+(6−6N+N 2 )γ 2 +(N−1)γ 3 ) and

When 0 < γ ≤ 1 this last inequality holds for any 0 < r < 1. When −1 ≤ γ < 0, it can be shown that it holds for any \(\bar {r}<r<1\), with an opportune \(\bar {r} \geq 0\) that depends on N.

The case δ = 0 corresponds to the case in which all agents reconsider their strategies (synchronous updating) similarly to Brock and Hommes (1997), whereas with δ = 1 the model reduces a nonevolutionary setting.

However, aligning the interests of managers and shareholders can be harmful to consumers, see Van Witteloostuijn et al. (2007) on the point.

Overlined variables denote expected quantities produced by managers. See Appendix B for precise definition.

Note that with γ > 0, it is \(\bar {\bar {c}}<A\) for all values of N, all 0 ≤ α < 1 and all 0 ≤ w < 1.

References

Abdellaoui M, L’Haridon O, Zank H (2010) Separating curvature and elevation: a parametric probability weighting function. J Risk Uncertain 41:39–65

Aguilera RV, Cuervo-Cazurra A (2004) Codes of good governance worldwide: What is the trigger? Organ Stud 25(3):417–446

Alger I, Weibull J (2013) Homo moralis - preference evolution under incomplete information and assortative matching. Econometrica 81(6):2269–2302

Bischi GI, Dawid H, Kopel M (2003) Spillover effects and the evolution of firm clusters. J Econ Behav Organ 50:47–75

Bischi GI, Lamantia F, Radi D (2015) An evolutionary Cournot model with limited market knowledge. J Econ Behav Organ 116:219–238

Brock WH, Hommes CH (1997) A rational route to randomness. Econometrica 65(5):1059–1096

Broom M, Rychtář J (2013) Game-Theoretical Models in Biology. CRC Press, Boca Raton

Cerboni Baiardi L, Lamantia F, Radi D (2015) Evolutionary competition between boundedly rational behavioral rules in oligopoly games. Chaos, Solitons Fractals 79:204–225

Chirco A, Colombo C, Scrimitore M (2013) Quantity competition, endogenous motives and behavioral heterogeneity. Theor Decis 74(1):55–74

Cressman R (2003) Evolutionary dynamics and extensive form games. The M.I.T. Press, Cambridge

Dawid H (1999) On the stability of monotone discrete selection dynamics with inertia. Math Soc Sci 39:265–280

Dawid H (2007) Evolutionary game dynamics and the analysis of agent-based imitation models: The long run, the medium run and the importance of global analysis. J Econ Dyn Control 31:2108–2133

Dekel E, Ely JC, Yilankaya O (2007) Evolution of preferences. Rev Econ Stud 74:685–704

Dixon HD, Wallis S, Moss S (2002) Axelrod meets Cournot: Oligopoly and the evolutionary metaphor. Comput Econ 20(3):139–156

Droste E, Hommes C, Tuinstra J (2002) Endogenous fluctuations under evolutionary pressure in Cournot competition. Games Econ Behav 40:232–269

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77(5):926–940

Fershtman C, Kalai E (1997) Unobserved delegation. Int Econ Rev 38 (4):763–774

Friedman M (1953) Essays in positive economics. University of Chicago Press, Chicago

Friedman M (1970) The social responsibility of business is to increase its profits. The New York Times, September 13th

Häckner J (2000) A note on price and quantity competition in differentiated oligopolies. J Econ Theory 93:233–239

Heifetz A, Shannon C, Spiegel Y (2007) What to maximize if you must. J Econ Theory 133(1):31–57

Hofbauer J, Weibull J (1996) Evolutionary selection against dominated strategies. J Econ Theory 71:558–573

Hommes C (2009) Bounded rationality and learning in complex markets. In: Handbook of economic complexity. Edward Elgar, Cheltenham

Hommes C, Ochea M, Tuinstra J (2011) On the stability of the Cournot equilibrium: an evolutionary approach. WP, http://www1.fee.uva.nl/cendef/publications/papers/HOT2011.pdf

Jansen T, van Lier A, van Witteloostuijn A (2007) A note on strategic delegation The market share case. Int J Ind Organ 25:531–539

Kahneman D, Tversky A (1979) Prospect Theory: An analysis of decision under risk. Econometrica 47(2):263–291

Koçkesen L, Ok EA (2004) Strategic delegation by unobservable incentive contracts. Rev Econ Stud 71(2):397–424

Kopel M, Lamantia F, Szidarovszky F (2014) Evolutionary competition in a mixed market with socially concerned firms. J Econ Dyn Control 48:394–409

Manasakis C, Mitrokostas E, Petrakis E (2010) Endogenous managerial incentive contracts in a differentiated duopoly, with and without commitment. Manag Decis Econ 31:531–543

Miller N, Pazgal A (2002) Relative performance as a strategic commitment mechanism. Manag Decis Econ 23(2):51–68

Ok EA, Vega-Redondo F (2001) On the evolution of individualistic preferences: an incomplete information scenario. J Econ Theory 97:231–254

Possajennikov A (2003) Imitation dynamics and Nash equilibrium in Cournot oligopoly with capacities. Inter Game Theory Rev 5(3):291–305

Rhode P, Stegeman M (2001) Non-Nash equilibria of Darwinian dynamics with applications to duopoly. Int J Ind Organ 19:415–453

Samuelson L, Swinkels J (2006) Information, evolution and utility. Theor Econ 1(1):119–142

Schaffer ME (1989) Are profit-maximizers the best survivors? J Econ Behav Organ 12:29–45

Sklivas SD (1987) The strategic choice of managerial incentives. RAND J Econ 18(3):452–458

Theocharis RD (1960) On the stability of the Cournot solution on the oligopoly problem. Rev Econ Stud 27:133–134

Vickers J (1985) Delegation and the theory of the firm. Econ J 95(S):138–147

Weibull J (1995) Evolutionary Game Theory. The M.I.T. Press, Cambridge

Van Witteloostuijn A, Jansen T, Van Lier A (2007) Bargaining over managerial contracts in delegation games: Managerial power, contract disclosure and cartel behavior. Manag Decis Econ 28:897–904

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank the participants to the 16th International Symposium on Dynamic Games and Applications, Amsterdam, July 2014. We are indebted to two anonymous Referees for their valuable advice and helpful suggestions. The usual disclaimer applies. The work of F. Lamantia has been done within the activities of the COST action IS1104 “The EU in the new complex geography of economic systems: models, tools and policy evaluation”.

Appendices

A Proofs

1.1 A.1 Proof of Lemma 1

The lemma follows from a standard local stability analysis on the map (7). In fact, a fixed point r ∗ ∈ (0, 1) is locally asymptotically stable provided that \(\left \vert \frac {dr(t+1)} {dr\left ( t\right ) }_{|r(t)=r^{\ast }}\right \vert <1\). By Assumption 4. on the Monotone Selection dynamics, r ∗ is stable whenever

which is equivalent to Eq. 8; a flip bifurcation occurs whenever \(\frac {dr(t+1)}{dr\left ( t\right ) }_{|r(t)=r^{\ast }}=-1\), i.e. at \(\frac {dG(r^{\ast })}{dr}=-\frac {2}{r^{\ast }\frac {\partial F\left ( r^{\ast },0\right ) }{\partial G}}\). It is straightforward to see from Eq. 20 that an inner steady state r ∗ with \(\frac {dG(r^{\ast })}{dr}>0\) is always unstable because of Assumption 1. QED

1.2 A.2 Proof of Proposition 4

To prove the claim, it is sufficient to show that G(w, r) in Eq. 18 is always positive if γ(N − 1) < 1. This indeed happens since |w − r| < 1.

1.3 A.3 Proof of Proposition 5

Consider the function g(r) = (w(r) − r)γ(N − 1) + 1, with w(r) defined in Eq. 19,

with 0 ≤ δ ≤ 1 and ν ∈ (0, 1)∪(1, + ∞). The roots of equation g(r) = 0 are also roots of G(w(r),r) = 0 in Eq. 18 and, by Assumption 3. on the evolutionary process, fixed points for Eq. 7.

Observe that g(0) = g(1) = 1 and that g is smooth in [0, 1], with derivative

Define:

and

Observe that:

-

h(ν, δ) = 0 for δ = 1, while for δ ∈ [0, 1), it is −1 < h(ν, δ) < 0 whenever 0 < ν < 1, and 0 < h(ν, δ) <1 for ν > 1;

-

l(ν, δ) = 0 for δ = 0, while for δ ∈ (0,1], it is −1 < l(ν, δ)<0 whenever ν > 1, and 0 < l(ν, δ)<1 for 0 < ν < 1.

Now, proceed with the statements. We prove the first statement in the case δ = 0 and ν > 1 (the case δ = 1 and 0 < ν < 1 is similar).

Suppose δ = 0. The function g reduces to g(r) = 1+(1−(1−r)ν−r)γ(N − 1). Given ν > 1, it is g ′(r) > 0 when \(r<\bar {r}_{1}\) and g ′(r)<0 when \(r>\bar {r}_{1}\). Thus g(r)≥g(0) = g(1) = 1. This proves that g(r) > 0 for each r ∈ [0, 1].

Finally we prove the second statement (the third is similar). Suppose ν > 1 and observe that \(\bar {r}_{2}=\arg \min g(r)\), since g ′(r) < 0 for \(r<\bar {r}_{2}\) and g ′(r) > 0 when \(r>\bar {r}_{2}\). The minimum value of g is thus \(g(\bar {r}_{2})=1+\gamma (N-1)l(\nu ,\delta )\). Define the following sets:

-

\({E_{1}^{l}}(\gamma ,N)=\left \{ (\nu ,\delta )\text { s.t. }0<\delta \leq 1,l(\nu ,\delta )>\frac {-1}{\gamma (N-1)}\right \} ;\)

-

\({E_{2}^{l}}(\gamma ,N)=\left \{ (\nu ,\delta )\text { s.t. }0<\delta \leq 1,l(\nu ,\delta )=\frac {-1}{\gamma (N-1)}\right \} ;\)

-

\({E_{3}^{l}}(\gamma ,N)=\left \{ (\nu ,\delta )\text { s.t. }0<\delta \leq 1,l(\nu ,\delta )<\frac {-1}{\gamma (N-1)}\right \} \) ,

which are nonempty provided that the necessary condition γ(N − 1) ≥ 1 holds; these sets define the conditions on the plane (ν, δ) for the sign of \(g(\bar {r}_{2})\):

When \((\nu ,\delta )\in {E_{1}^{l}}(\gamma ,N)\), then \(g(\bar {r}_{2})>0\) and g(r) > 0 for each r ∈ [0,1].

When \((\nu ,\delta )\in {E_{2}^{l}}(\gamma ,N)\), then \(g(\bar {r}_{2})=0\) and g(r) > 0 for each \(r\in [0,1]\setminus \{\bar {r}_{2}\}\), while \(\bar {r}_{2}\) is a fixed point.

When \((\nu ,\delta )\in {E_{3}^{l}}(\gamma ,N)\), then \(g(\bar {r}_{2})<0\) and equation g(r) = 0 has two roots \(r_{1}^{*}<\bar {r}_{2}\) and \(r_{2}^{*}>\bar {r}_{2}\).

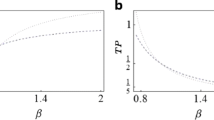

The stability analysis of these steady states for Eq. 7 follows from the proof of Proposition 1. The couple of fixed points (possibly stable and unstable) are created through a fold bifurcation for Eq. 7 on the bifurcation curves \({E_{2}^{l}}(\gamma ,N)\) (when ν > 1) and \({E_{2}^{h}} (\gamma ,N)\) (when 0 < ν < 1) in the parameter space (ν, δ).

B Derivation of uninformed managers’ expected utility

Consider, as in the case of informed managers, the (inverse) demand system (1), which can be written, for a given number K of P-firms, as follows

where, by symmetry, it is

Given K, the objective functions of managers in the i-th P-firm and j-th R-firm are, respectively,

At a given time, managers have beliefs w ∈ [0,1] that a P-firm is extracted from the population. To obtain the expected utility u R (r, x R, j ) of a R-manager we calculate

The expected utility u P (w, x P, i ) of a P-manager is calculated analogously.

Rights and permissions

About this article

Cite this article

De Giovanni, D., Lamantia, F. Control delegation, information and beliefs in evolutionary oligopolies. J Evol Econ 26, 1089–1116 (2016). https://doi.org/10.1007/s00191-016-0472-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-016-0472-6