Abstract

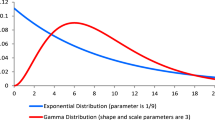

This work presents intensity-based credit risk models where the default intensity of the point process is modeled by an Ornstein-Uhlenbeck type process completely driven by jumps. Under this model we compute the default probability over time by linking it to the characteristic function of the integrated intensity process. In case of the Gamma and the Inverse Gaussian Ornstein-Uhlenbeck processes this leads to a closed-form expression for the default probability and to a straightforward estimate of credit default swaps prices. The model is calibrated to a series of real-market term structures and then used to price a digital default put option. Results are compared with the well known cases of Poisson and CIR dynamics. Possible extensions of the model to the multivariate setting are finally discussed.

Similar content being viewed by others

References

Barndorff-Nielsen OE (2001) Superposition of Ornstein-Uhlenbeck type processes. Theory Probab Appl 45(2): 175–194

Barndorff-Nielsen OE, Shephard N (2001a) Non-Gaussian Ornstein-Uhlenbeck-based models and some of their uses in financial economics. J Roy Stat Soc Ser B 63: 167–241

Barndorff-Nielsen OE, Shephard N (2001) Modelling by Lévy processes for financial econometrics. In: Barndorff-Nielsen OE, Mikosch T, Resnick S (eds) Lévy processes—theory and applications. Birkhäuser, Boston

Barndorff-Nielsen OE, Shephard N (2003) Integrated OU processes and non-Gaussian ou-based stochastic volatility models. Scand J Stat 30(2): 277–295

Bertoin J (1996) Lévy processes Cambridge tracts in mathematics 121. Cambridge University Press, Cambridge

Black F, Cox J (1976) Valuing corporate securities: some effects on bond indenture provisions. J Finance 31: 351–367

Cariboni J, Schoutens W (2006) Jumps in intenisty models, UCS Report 2006-01. K.U.Leuven

Cox J, Ingersoll J, Ross S (1985) A theory of the term structure of interest rates. Econometrica 41: 135–156

Duffie D, Singleton K (1999) Modelling term structures of defaultable risky bonds. Rev Financ Stud 12: 687–720

Elizalde A (2005) Default correlation in intensity models. Available at http://www.abelelizalde.com

Hull JC, White A (2003) The valuation of credit default swap options. J Deriv 10(3): 40–50

Jarrow R, Protter P (2004) Structural versus reduced form models: a new information based perspective. J Investment Manage 2(2): 1–10

Jarrow R, Turnbull S (1995) Pricing derivatives on financial securities subject to credit risk. J Finance 50(1): 53–86

Joshi MS, Stacey AM (2006) Intensity Gamma: a new approach to pricing portfolio credit derivatives. Risk Magazine, July Issue, pp 78–83

Jyrek ZJ, Vervaat W (1983) An integral representation for selfdecomposable Banach space valued random variables. Zeits Wahrscheinlichkeitstheorie verwandte Gebiete 62: 247–262

Kelley CT (1999) Iterative methods for optimisation. Society for Industrial and Applied Mathematics (SIAM), Philadelphia

Lagarias JC, Reeds JA, Wright MH, Wright PE (1999) Convergence properties of the Nelder–Mead simplex method in low dimension. SIAM J Optim 9(2): 112–147

Leland H (1994) Corporate debt value, bond covenants, and optimal capital structure. J Finance 49(4): 1213–1252

Longstaff F, Schwartz E (1995) A simple approach to valuing risky fixed and floating rate debt value, bond covenants, and optimal capital structure. J Finance 50(3): 789–819

Luciano E, Schoutens W (2006) A multivariate jump-driven financial asset model. Quant Finance 6(5): 385–402

Madan DB, Unal H (1998) Pricing the risk of default. Rev Derivatives Res 2: 121–160

Madan DB, Unal H (2000) A two factor hazard rate model for pricing risky debt and term structure of credit spreads. J Financ Quant Anal 35: 43–65

Madan DB, Carr P, Chang EC (1998) The variance gamma process and option pricing. Eur Finance Rev 2: 79–105

Merton R (1974) On the pricing of corporate debt: the risk structure of interest rates. J Finance 29: 449–470

Nicolato E, Venardos E (2003) Option pricing in stochastic volatility models of Ornstein-Uhlenbeck type. Math Finance 13: 445–466

Sato K (1999) Lévy Processes and Infinitely Divisible Distributions. Cambridge Studies in Advanced Mathematics 68. Cambridge University Press, Cambridge

Sato K, Yamazato M (1982) Stationary processes of Ornstein-Uhlenbeck type. In: Itô K, Prohorov JV (eds) Probability theory and mathematical statistics. Lecture Notes in Mathematics, vol 1021. Springer, Berlin

Sato K, Watanabe T, Yamazato M (1994) Recurrence conditions for multidimensional processes of Ornstein-Uhlenbeck type. J Math Soc Japan 46: 245–265

Schönbucher PJ (2003) Credit derivatives pricing models. Wiley, Finance

Schoutens W (2003) Lévy processes in finance: pricing financial derivatives. Wiley, New York

Schwefel HP (1995) Evolution and optimum seeking sixth-generation computer technology series. Wiley, New York

Tompkins R, Hubalek F (2000) On closed form solutions for pricing options with jumping volatility, Unpublished paper: Technical University, Vienna

Wolfe SJ (1982) On a continuous analogue of the stochastic difference equation ρ X n+1 + B n . Stoc Probab Appl 12: 301–312

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cariboni, J., Schoutens, W. Jumps in intensity models: investigating the performance of Ornstein-Uhlenbeck processes in credit risk modeling. Metrika 69, 173–198 (2009). https://doi.org/10.1007/s00184-008-0213-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00184-008-0213-4