Abstract

This paper studies the evolution of trade freeness and of the agglomeration of production, and their relationship at the sectoral level in a selected group of EU countries. Our main objectives are the search for stylized facts about their relationship and to check how our findings relate to the theoretical prediction about it in case of the home market effect. Our sectoral focus requires an original testing approach based on the combination of different bootstrap distributions. The results discussed show that a systematic relationship between trade freeness and agglomeration does not emerge at the sectoral level, this is true also for those sectors which support the home market effect hypothesis.

Similar content being viewed by others

Notes

Such shares rule out the effect of comparative advantage and centrality advantage in the network of countries.

The HMME can also be derived as the derivative of the HME with respect to trade costs, see Head and Mayer (2004) equation 18.

Remember that the direct relationship between trade freeness and agglomeration translates into an inverse relationship between trade costs and agglomeration because decreasing trade costs imply increasing trade freeness.

The most common are as follows: (i) the absence of comparative advantage, (ii) one single sector economy, (iii) a two-country world, and (iv) the inclusion of a freely traded outside good which guarantees factor price equalization (Head and Mayer 2004; Crozet and Trionfetti 2008; Behrens et al. 2009).

Hanson and Xiang (2004) find that the HME is more likely in industries with high transport costs and more differentiated products than in industries with low transport costs and less differentiated products. In Crozet and Trionfetti (2008) the IRS–MC sector still experiences the HME but it is non-linear, its average magnitude is attenuated and its strength depends upon asymmetry between the two countries’ demand shares. Another contribution which considers also a two sectors economy is Laussel and Paul (2007) , this focuses on the effect of asymmetry in the size of the two countries considered.

This is already present in Crozet and Trionfetti (2008) which obtain results through numerical simulations. Analytical tractability depends greatly on the inclusion of the freely traded outside good which guarantees factor price equalization.

We aggregate years in 4 periods mainly to consider more significant variations of the indicators used in the analysis and to deal with missing values by using intra-period averages.

Differently, the stylized facts gained here will be discussed against the prediction in HME models in the next Sect. 5.

As Anderson and Wincoop (2004) explain the group of costs which actually affect trade is large and difficult to disentangle. Shipment costs are perhaps the easiest component to think about, but other factors too raise the cost of consuming a product in a different location. Border-related formalities, technical and non-technical barriers, tariffs and standards, trade insurance, and financing are just some other members of the trade costs family.

Actually, the TFI is to interpret as the endogenous trade-flows outcome to trade costs as well as to consumption preferences. Ideally, one would like to offset the effect of preferences. Chen and Novy (2011) follow this direction by engineering a modified version of the TFI. Their measure requires elasticity-of-substitution estimates obtained at a much lower level of sectoral aggregation than ours. Unfortunately, this is not possible in the context of our analysis. For this reason, we cannot apply their enhanced measurement and we, therefore, use the TFI in its original formulation. For a discussion of how the difference between imported and domestic consumption is due to the combined effect of preferences and restrictions to trade see Anderson and Wincoop (2003).

To wit, for \(\mathrm{TFI}=0.5\) (very high level, compare with Table 2) the product of bilateral trade (numerator) is one-forth the product of national trade (denominator), for \(\mathrm{TFI}=1\) bilateral trade is as much as national trade. TFI\(>\)1 is computationally possible, however, it is not at all realistic. This is why the TFI range is restricted to 0-1 in practice, where 1 represents the free trade case.

Given non-normality of the bootstrap distribution in the bulk of sectors, we resort to Bias-corrected and Accelerated Confidence Intervals (BCA-CI)to define rejection areas. For more information about the bootstrap procedure used, check Appendix A.

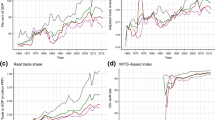

To ease the exposition, we do not report the subperiod values in Table 2 but only display them in Fig. 1. The across-periods differences based on the values in Fig. 1 are in Table 4. These show that the TFI has decreased from period 1 to period 2 in almost all sectors, but it has increased more markedly afterwards across the periods 2–3 and 3–4. The last marked increase between periods 3–4 is more likely due to the Euro’s trade effects.

The two measures coincide for a group of geographic units of identical size, but they do not if geo-units differ in size. For a comparison of absolute and relative concentration see Cafiso (2009).

In this study, we aimed to use the GINI coefficient as a robustness check. However, the GINI coefficient does not satisfy the two above-mentioned properties. Then, its validity as robustness check is limited. Nonetheless, we have computed it as well, this robustness check is discussed in Appendix A.

The ThI is obtained from the formula of the Generalized Class of Entropy Indices when the sensitivity parameter \(\alpha \) is set equal to 1; if \(\alpha =2\) one obtains the Half Square Coefficient of Variation. The more positive \(\alpha \) is, the more sensitive the index to differences at the top of the distribution; the less \(\alpha \) is, the more sensitive to differences at the bottom of the distribution. For a discussion of inequality indices, check Cowell (2000).

When the within contribution is higher than the between, concentration depends mainly upon an uneven distribution within countries; the across-countries distribution is relatively less unequal. To wit, if a sector were spread unevenly between countries but equally among the regions of each country, concentration would depend only upon across-countries diversity.

The Shapiro–Francia test (Shapiro and Francia 1972) signals a normal bootstrap distribution for sectors 3, 4, 5, 6, 8, 10, 11, 14, 16, 17, 18, 19. We use again Bias-Corrected and Accelerated Confidence Intervals (BCA-CI) for coherence with the \(\Delta \mathrm{TFI}\) test. As a matter of fact, non-normality does not bias the Z-test, since we get the same sectoral outcome when we refer to rejection areas based on the normal distribution. This holds both for trade freeness and agglomeration.

Namely, likely simultaneity between production and demand shares used, respectively, as regressors when estimating the effect of trade costs on agglomeration.

20 pairs (one for each sector) for the differences between P4-P3, twenty for P3-P2 and twenty for P2-P1.

If the test were always executable, we would have 60 results (three time differences times twenty sectors). However, it is not in eight sector/time difference combinations. We decide not to bootstrap when the observed sample contains more than 50 % missing values, otherwise it would run on a sample with too little information.

We report results only for the Pairwise–Average Z-test, results for the Country and World–Average tests are available upon request.

It is to notice that the robustness level \(\gamma \) is inversely related to the significance level \(\alpha \) used in standard hypothesis testing as applied in Sect. 4.3. In the former, the lower is \(\gamma \) the more likely the rejection of \(H_{0}\) is. On the contrary, in conventional hypothesis testing, the lower is \(\alpha \), the less likely the rejection of \(H_{0}\) is.

References

Anderson JE, van Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93(1):170–192

Anderson J, van Wincoop E (2004) Trade costs. J Econ Lit 42(3):691–751

Behrens K, Lamorgese A, Ottaviano G, Tabuchi T (2005) Testing the home market effect in a multi-country world, Discussion Paper 2005/55, UCLouvain-CORE

Behrens K, Lamorgese A, Ottaviano G, Tabuchi T (2009) Beyond the home market effect: market size and specialization in a multi-country world. J Int Econ 79(2):259–265

Brülhart M (2001) Evolving geographical concentration of European manufacturing industries. Rev World Econ 137(2):215–243

Brülhart M (2011) The spatial effects of trade openness: a survey. Rev World Econ 147(1):59–83

Brulhart M, Traeger R (2005) An account of geographic concentration patterns in Europe. Reg Sci Urban Econ 35(6):597–624

Cafiso G (2009) Sectorial border effects in the european single market: an explanation through industrial concentration, Working Paper Series 1116, European Central Bank

Cafiso G (2011) Sectoral border effects and the geographic concentration of production. Rev World Econ (Weltwirtschaftliches Archiv) 147(3):543–566

Cairncross F (2001) The death of distance: how the communications revolution is changing our lives. Harvard Business Press, Boston

Cameron A, Trivedi P (2005) Microeconometrics: methods and applications. Cambridge University Press, New York

Chen N, Novy D (2011) Gravity, trade integration, and heterogeneity across industries. J Int Econ 85(2):206–221

Combes P, Overman H (2004) The spatial distribution of economic activities in the european union. In: Henderson J, Thisse JF (eds) Handbook of regional and urban economics, vol 4. Elsevier, Amsterdam, pp 2845–2909

Conover WJ (1999) Practical nonparametric statistics. Wiley, New York

Cowell F (2000) Measurement of Inequality. In: Atkinson AB, Bourguignon F (eds) Handbook of income distribution, vol 1. Elsevier, pp 87–166

Crozet M, Trionfetti F (2008) Trade costs and the home market effect. J Int Econ 76(2):309–321

Diciccio TJ, Romano JP (1988) A review of bootstrap confidence intervals. J R Stat Soc B (Methodological) 50(3):338–354

Disdier A, Head K (2008) The puzzling persistence of the distance effect on bilateral trade. Rev Econ Stat 90(1):37–48

Haaland J, Kind H, Knarvik K, Torstensson J (1999) What determines the economic geography of Europe?, Discussion Paper 2072, CEPR

Hanson G, Xiang C (2004) The home-market effect and bilateral trade patterns. Am Econ Rev 94(4):1108–1129

Head K, Mayer T (2004) The empirics of agglomeration and trade. In: Henderson JV, Thisse JF (eds) Handbook of regional and urban economics, chapter 59, vol 4. Elsevier, Amsterdam, pp 2609–2669

Head K, Ries J (2001) Increasing returns versus national product differentiation as an explanation for the pattern of US–Canada trade. Am Econ Rev 91(4):858–876

Helpman E, Krugman P (1985) Market structure and foreign trade. MIT Press, Cambridge

Henderson V, Thisse J-F (2004) Handbook of regional and urban economics: cities and geography, vol 4. Elsevier, Amsterdam

Jacks DS (2009) On the death of distance and borders: evidence from the nineteenth century. Econ Lett 105(3):230–233

Krugman P (1980) Scale economies, product differentiation, and the pattern of trade. Am Econ Rev 70(5):950–959

Krugman P (1991) Increasing returns and economic geography. J Polit Econ 99(3):483

Krugman PR (1979) Increasing returns, monopolistic competition, and international trade. J Int Econ 9(4):469–479

Laussel D, Paul T (2007) Trade and the location of industries: some new results. J Int Econ 71(1):148–166

Niepmann F, Felbermayr G (2010) Globalisation and the spatial concentration of production. World Econ 33(5):680–709

Ottaviano G, Thisse J-F (2004) Agglomeration and economic geography. In: Henderson JV, Thisse JF (eds) Handbook of regional and urban economics, chapter 58, vol 4. Elsevier, Amsterdam, pp 2563–2608

Shapiro S, Francia R (1972) An approximate analysis of variance test for normality. J Am Stat Assoc 67(337):215–216

Acknowledgments

I thank the participants to the seminar series at the Economics Department of the University of Catania for very helpful comments; a special thank to Antonio Punzo for statistical support. Gratitude goes also to Luca De Benedicts for comments and suggestions at the 52nd Annual Meeting of the SIE in Rome.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Data, bootstrap and robustness

Throughout the paper we consider twenty-one sectors of activity classified according to ISIC rev.3/NACE 1.1, these sectors are as follows: -a- the aggregate for “Mining and Quarrying” (NACE: C, ISIC:10-14), -b- 18 subgroups of manufacture as partition of the “Total Manufacturing” aggregate (NACE: D, ISIC: 15-37; see Table 1 for the list of all the sectors), -c- the aggregate for “Electricity, Gas and Water Supply” (NACE: E, ISIC: 40-41), and -d- the aggregate for “Agriculture, Hunting and Forestry” (NACE: A, ISIC: 01-02). The countries comprised in the analysis are those in the EU-15 group: Austria, Belgium-Luxembourg, Denmark, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, Sweden, and the United Kingdom. Data for Belgium and Luxembourg are recorded together for the so-called Belgium-Luxembourg Economic Union (BLEU). The time range is 1995–2006, whole-period figures are the average of all the yearly observations. We use values for four sequential subperiods defined as follows: period 1 values are the average of 1995–1997 yearly figures, period 2 of 1998–2000, period 3 of 2001–2003, and period 4 of 2004–2006.

1.1 Agglomeration analysis

To calculate the sectoral Theil Index we use employment figures (number of employees) at the Nuts-2 regional level; data are extracted from the Eurostat Regio database. We start with 207 Nuts-2 regions: Austria, 9 regions; Belgium, 10 regions; Germany, 38 regions; Denmark, 5 regions (5 deleted); Spain, 19 regions (8 deleted); Finland, 5 regions (1 deleted); France, 22 regions; Greece, 13 regions (1 deleted); Ireland, 2 regions; Italy, 21 regions; Luxembourg, 1 region (1 deleted); the Netherlands, 12 regions; Portugal, 5 regions; Sweden, 8 regions; and United Kingdom, 37 regions. Some regions were deleted in case of too many missing values. Employment data for sector 21 “Agriculture, Hunting and Forestry” were not available in the Eurostat Regio database, we, therefore, did not consider this sector for the agglomeration analysis.

1.2 Trade freeness

For the trade freeness indicator we use bilateral export among the EU-15 countries which constitute our sample, plus National Trade figures computed as “total production less total export.” All figures are in current US dollars. Bilateral export, total production, and total export are extracted from the OECD Stan database.

1.3 Production and demand shares for the HME

To test the HME we use sectoral-production and aggregate-demand country shares. Production shares are calculated using sectoral value-added figures, we use Domestic Absorption to account for demand. Domestic absorption is computed as “production less export plus import.” Value added, national production, export, and import in US dollars are extracted from the OECD Stan database.

1.4 The GINI coefficient as a robustness check for agglomeration

As written in the text, we have computed the GINI coefficient as a robustness check for the Agglomeration of Production. For this purpose, we calculate the GINI coefficient using all the available Nuts-2 regions and it ,therefore, accounts for geographic disparities across regions. The comparison with the Theil-Total index is straightforward. The ranking of the sectors is highly comparable, with 10 out of twenty sectors having the same ranking position as the one based on the Theil-Total Index. Furthermore, a similar bootstrap test based on the GINI coefficient rejects the null of “no significant variation” for 4 sectors. These are among the 6 sectors for which the bootstrap test for the Theil-Total Index (Table 3) rejects the same null.

On the contrary, a comparison with the Theil-Between is not straightforward because the GINI coefficient is not decomposable by groups. We have attempted it, however, by annulling within countries regional differences. This was done by replacing the regional observations with the within-country regional averages. By so doing, the GINI coefficient gets conceptually closer to the Theil-Between which is indeed calculated on the country means instead of the regional observations (Brulhart and Traeger 2005). Results show that in this way the between-agglomeration ranking of the sectors is close to the one based on the Theil-Between. We did not run any bootstrap test for this case because the artifact applied would bias too much the resampling. All results are available upon request.

1.5 Bootstrap-based test for the TFI variation

We test the hypothesis \(\Delta \mathrm{TFI}_{p.p-1}^{k}\ne 0\) (where \(\Delta \mathrm{TFI}_{p.p-1}^{k}=\mathrm{TFI}_{p}^{k}-\mathrm{TFI}_{p-1}^{k})\) by using bootstrap simulations to generate two distributions with \(R\) observations each: one of \( \mathrm{TFI}_{p}^{k} \) and one of \(\mathrm{TFI}_{p-1}^{k}\) values. Each bootstrap runs \(R=1000\) replications. The same procedure is executed \(K\) times, one for each sector \( k.\) The procedure is described here sequentially, we omit the superscript \(k\) in what follows:

-

1.

We start with two observed samples of \(\mathrm{TFI}_{ij,p}\) values of size \( N_{p}\) \(\left( p=1,2\right) \); one for each period considered for the time difference.

-

2.

The bootstrap generates \(R\) samples \(\left( r=1,...,R\right) \) of size \(N_{p}\;\left( N_{p}^{r}\right) \) of bootstrap-generated \(\mathrm{TFI}_{ij,p}\) values. This is done twice: once for \(p\) and once for \(p-1.\)

-

3.

For each sample \(r,\) we calculate the average of the \(N_{p}^{r}\) bootstrap-generated \(\mathrm{TFI}_{ij,p}\) values:\(\mathrm{TFI}_{p}^{r}\). So that we have two distributions (one for \(p\) and one for \(p-1\)) of \(R\) values \(\mathrm{TFI}_{p}^{r}.\)

-

4.

We calculate the \(R\) differences \(\Delta \mathrm{TFI}_{p.p-1}^{r}=TFI_{p}^{r}-\mathrm{TFI}_{p-1}^{r}\), by so doing we have for each sector \(k\) a distribution of \(\Delta \mathrm{TFI}_{p.p-1}^{r}\)(\(R\) observations).

-

5.

The \(\Delta \mathrm{TFI}_{p.p-1}^{r}\) distribution is used to generate standard errors to test the hypothesis \(\Delta \mathrm{TFI}_{p.p-1}^{r}\ne 0\).

We check normality of the \(\Delta \mathrm{TFI}_{p.p-1}^{r}\) distribution through the Shapiro-Francia Test (Shapiro and Francia 1972); normality is not rejected only in sectors 3, 7, 15. Given non-normality we resort to Bias-Corrected and Accelerated Confidence Intervals (BCA-CI) to define rejection areas. Sector 13 and 20 are not available for bootstrap simulation given the high number of missing values in the observed \(N_{p}\) sample.

For a discussion of the different confidence intervals for hypothesis testing available in this context, see Diciccio and Romano (1988) . We refer the reader to Cameron and Trivedi (2005) chapter 11 for more information about the Bootstrap.

Appendix B: A percentiles-based test of the sign

The test of the sign discussed in Sect. 4.3 checks whether the portion \((J^{k})\) of positive bootstrap-generated values is statistically larger than half for deciding about the sign of the product of the contemporaneous variations \((Y^{k})\). In this context, the word statistically makes the difference. Indeed, if we were not looking for a statistically significant result, one might simply check what is the percentage of positive values in the bootstrap distribution \(\left( Y_{r}^{k} \text { with }r=1,...,R\right) ,\) and conclude that \(Y^{k}\) is positive if more than 50 % \(Y_{r}^{k}\) values are positive. This reduces to observing the median of the distribution. The issue is that the median might be just one position away from zero. Then, a conclusion based only on the sign of the median could lead to a non-robust statement about the sign of \(Y^{k}\). In the paper, the statistical significance of the conclusion is guaranteed through the use of the \(Z_{1}^{k}\) statistic which has a normal distribution, and, therefore, parametric hypothesis testing is applied. We propose now an alternative way to decide about the sign of \(Y^{k}\) which guarantees robustness at specific levels.

In the spirit of hypothesis testing based on Percentiles Confidence Intervals (Cameron and Trivedi 2005, Sect. 11.2.7), one may define buffers around the median which guarantee to decide about \( H_{0}\) at a certain robustness level. We define these buffers \(\gamma \) as follows: when \(\gamma \) increases, the rejection area decreases; we get more restrictive on rejection of \(H_{0}\). We opt for this definition because it guarantees that more evidence is required to opt for either sign of the statistic when larger buffers are used. We consider three standard levels: \( \gamma =1~\%\), \(\gamma =5~\%\), and \(\gamma =10~\%\), and define, respectively, the rejection areas in the following Table 7.

The rationale behind the definition of the rejection areas for \(H_{0}\) is that when at least \(\left( 50+\gamma \right) \)% \(Y_{r}^{k}\) values are positive (negative), one can assume that \(Y^{k}\) is positive (negative) at a robustness level equal to \(\gamma \%\). On the contrary, if the portion of positive/negative is less than \(\left( 50+\gamma \right) \%\), one concludes that the sign is not distinguishable because there is not enough evidence.Footnote 30

We run the two tests discussed in Sect. 4.3 using \(\gamma =5~\%.\) The system of hypotheses is:

-

1.

“\(H_{0}:J^{k}=1/2\)” against “\(H_{1a}:J^{k}>1/2\)”; rejection area for \( 45p>0\).

-

2.

“\(H_{0}:J^{k}=1/2\)” against “\(H_{1b}:J^{k}<1/2\)”; rejection area for \( 55p<0\).

Results based on this approach are in the following Table 8, where are reported also the results based on the \(Z_{1}^{k}\) statistic discussed in Sect. 4.3 for comparison. Except for sector 18/diff(P4-P3), rejection of the null hypothesis for the same alternative is exactly in the same cases as those selected by the \(Z_{1}^{k}\) statistic \(\left( \alpha =1~\%\right) \). This is a nice finding which supports the results discussed in the main body of the paper.

Rights and permissions

About this article

Cite this article

Cafiso, G. Sectoral trade freeness and agglomeration in the EU: an empirical test approach. Empir Econ 48, 779–805 (2015). https://doi.org/10.1007/s00181-014-0799-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-014-0799-5

Keywords

- Trade freeness

- Agglomeration of production

- Home market effect

- Home market magnification effect

- Bootstrap