Abstract

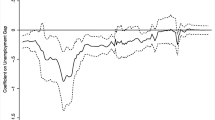

This paper analyzes the relationship between sticky information and inflation persistence by implementing a novel approach to estimate the Sticky Information Phillips Curve (SIPC). The degree of sticky information is estimated using a GMM estimator that matches the covariance between inflation and the shocks that affect firms’ pricing decisions. Although the SIPC contains an infinite number of terms, the theoretical covariances derived from the model have finite dimensions, thus allowing the estimation of the structural parameters without any truncation of the original model. This work shows that sticky information is significantly different if the model is estimated by matching inflation persistence or inflation variance. Previous empirical literature found that the SIPC model does not provide an accurate representation of the US postwar inflation. This paper qualifies such a finding by demonstrating that the SIPC is able to match the inflation persistence only at the cost of mismatching the inflation variance.

Similar content being viewed by others

Notes

Mankiw and Reis (2002) presented the SIPC as an alternative (theory of inflation) to the New Keynesian Phillips Curve (NKPC), which was criticized because of its lack of intrinsic persistence. Such criticisms pointed out that (i) the actual inflation responds gradually to monetary policy shocks, whereas the NKPC implies an immediate adjustment; (ii) output losses typically accompany a reduction in inflation, but this is not true with the NKPC; (iii) the NKPC implies that announced disinflation causes a boom, but in the actual economy the opposite is true. In general, if we assume that firms maximize profits and have rational expectations, then they would react to any exogenous shock by adjusting their prices as soon as they acquire information on the incoming shock and in each period, they would acquire all of the information available to identify new shocks. Hence, the effect of a shock on prices lasts for few periods and as a result, the only source of persistence in inflation dynamics is the one of exogenous shocks (e.g., cost push shocks, monetary policy shocks, demand shocks).

Note that for \(\lambda =1\), the SIPC encompasses the rational expectations model with monopolistic competition and flexible prices, which has repeatedly been shown in the literature to generate little endogenous persistence in inflation dynamics.

The whole estimation procedure is based on Molinari (2007).

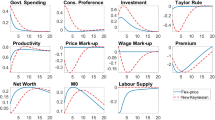

Following MR, the SIPC is simulated by assuming that the growth rate of nominal output, i.e., \(\Delta m_{t}=\Delta y_{t}+\pi _{t}\), is exogenous and follows an autoregressive process of order 1. As a result, inflation from the SIPC can be easily simulated using its moving average representation as function of the exogenous errors in the autoregressive process. The calibration of the autoregressive coefficient and the variance of the exogenous shocks are taken from Reis (2006).

The average duration of information is \(D=\left( 1-(1-\lambda )\right) ^{-1}\). Thus, in the quarterly model used by MR, \(\lambda =0.25\) implies \(D=4\), i.e., four quarters.

Equation (3) follows after multiplying (2) by \(\left( \delta \varepsilon _{t-i}\right) ^{\prime }\) and taking the expectation conditional on the information at time \(t\). This calculation uses the fact that the errors are uncorrelated, i.e., \(E\left[ \varepsilon _{t}\varepsilon _{t-i}\right] =0\) for \(i\ge 1\). In Appendix B, the orthogonality conditions (3) are referred to as \(g_{1,t}\).

Given that \(Z_{t}\) is ergodic (see Proposition 1), then \(E\left[ \delta Z_{t}\cdot (\delta \varepsilon _{t-i})^{\prime }\right] =E\left[ \delta Z_{t-i}\cdot (\delta \varepsilon _{t})^{\prime }\right] \).

If \(\left\{ \widehat{\varepsilon }_{t},\widehat{A}_{i},\Sigma _{T}\right\} \) are consistent estimates of \(\left\{ \varepsilon _{t},A_{i},\Sigma \right\} \), it can be shown that the sample analog:

$$\begin{aligned} \frac{1}{T}\sum _{t=1}^{T}\left[ \left( \frac{\alpha \lambda }{1-\lambda } y_{t}+\alpha \Delta y_{t}\right) \left( \delta \widehat{\varepsilon } _{t-i}\right) ^{\prime }-\left( 1-\lambda \right) ^{i}\delta \widehat{A} _{i}\Sigma _{T}\delta ^{\prime }\right] =0 \end{aligned}$$converges almost surely to the population moment (3).

This follows immediately from the fact that the quadratic terms in (4) are all positive definite. Note that there is only one additional task required to compute (4) beyond the GMM estimation of (3), i.e., one needs to derive \(\frac{\partial g_{1,t}}{\partial \beta ^{\prime }}\) and to evaluate it at \(\{\beta _{T}^\mathrm{VAR},\theta _{T}^{2s}\}\). All of the other terms that appear in (4) are already computed in the two-stage estimation. \(\frac{\partial g_{1,t}}{\partial \lambda }\) and \(\Sigma _{g_{1}}^{-1}\) are delivered by the GMM algorithm that computes \(\lambda _{T}^{2s}\), and \(\left( E\frac{\partial g_{2,t}^{\prime }}{\partial \beta }\Sigma _{g_{2}}^{-1} E\frac{\partial g_{2,t}}{\partial \beta ^{\prime }}\right) \), the VCV matrix of VAR coefficients, is delivered by the algorithm that estimates the VAR(p) model.

See Sect. 4.2.

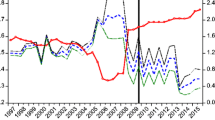

All data used in this paper come from the FRED-II database issued by the Federal Reserve Bank of St. Louis.

The output gap is the real GDP detrended with the HP filter.

The GMM model has a total of seven orthogonality conditions, including the contemporaneous moment (\(i=0\)). Results using a higher number of o.c. are quite similar to those reported and are available upon request.

In his baseline estimation, Coibion (2010) estimated \(\alpha \) and \(\lambda \) jointly, finding that they both are not significant. That result, however, is obtained using either subjective or out-of-sample VAR forecasts to generate the expectation terms present in the SIPC. When he uses in-sample forecasts (from a single VAR estimated over the entire period as the one estimated in this paper) instead, he finds estimates of \(\lambda \) significant and in the range [0.37, 0.42].

For a more precise comparison, I estimated \(\lambda \) using the same information as used in previous papers, which turns out to be the information contained in the covariances between inflation and the first \(L\) lags of \(\delta Z_{t-i}\). In this case, using Eq. (2) and lagged \(\delta Z_{t-i}\) as instruments, I derive and estimate the following orthogonality conditions:

$$\begin{aligned} E\left[ \left( \frac{\alpha \lambda }{1-\lambda }y_{t}+\alpha \Delta y_{t}\right) \left( \delta Z_{t-i}\right) ^{\prime }\right] = \sum _{j=0}^{\infty }\left( 1-\lambda \right) ^{i+j}\delta A_{i+j}\Sigma A_{j}^{\prime }\delta ^{\prime } \quad \mathrm{for}\; i =1,\ldots ,L \end{aligned}$$(6)where the infinite summation on the RHS of (6) is simulated at each step of the GMM algorithm, replacing \(\infty \) with \(J_{max}=120\). In the estimation of (6), \(\lambda _{T}^{2s}\) ranges between \(\left[ 0.30,0.41\right] \), a result in line with that obtained using lagged \(\varepsilon _{t}\) as instruments and very close to the estimates of Khan and Zhu (2006), Kiley (2006) and Korenok (2008).

The min RMSE VAR uses five extra variables to predict \(\pi _{t}\) and \(\Delta y_{t}\) with respect to the baseline VAR. As a result, the residuals \(\widehat{\varepsilon }_{t}\) from the min RMSE VAR are smaller than the ones of the baseline VAR.

Following similar GMM estimates in the literature, e.g., Galí and Gertler (1999), I use 19 instruments: a constant, 4 lags of inflation, 4 lags of output gap, and 2 lags of unemployment rate, interest rate, marginal cost, money growth, and term spread.

In this case, the GMM point estimates of \(\lambda _{T}^{2s}\) coincides with the estimate of the non-linear IV estimator, but with smaller variance.

I also estimated the model with \(\alpha = 0.15\) to control for a possible non-monotonic effect of \(\alpha \) on \(\lambda _{T}^{2s}\) within the \(\left[ 0.1,0.2\right] \) interval. These results are in line with those for \(\alpha =0.1\) presented in Table 8, and are available upon request.

See Angeloni et al. (2006).

Dupor et al. (2005) developed a similar model. They proposed a model of “dual stickiness” in which producers change prices sporadically and absorb the relevant information for price setting in random periods, as in the SIPC. Basically, Dupor–Kitamura–Tsuruga nested together Calvo’s sticky price framework with the sticky information of MR. As a result, inflation in period \(t\) is a function of all past periods’ expectations of future variables indexed from \(t+1\) onwards. The econometric strategy presented in Sect. 2.2 is computationally burdensome when applied to such a model, and therefore, in this paper I do not estimate Dupor–Kitamura–Tsuruga model but rather derive and estimate an alternative model with sticky information and adaptive agents.

The reduced form VAR(p) model used in Sect. 3.1 encompasses both the SIPC model and the hybrid versions derived in this section.

Andrews’s test looks for structural breaks with unknown timing by cutting the tails of the sample and computing recursively for each observation in the remaining middle part which is the most likely period where a break might have occurred.

The oil shock occurred in the middle of the sample and lasted sufficiently long to be included in each of the two sub-sample statistics calculated by Andrews’s test. Thus, if the effect of the oil shock were sufficiently large, any change in the inflation dynamics of one sub-sample, due to variations in the degree of sticky information, would not be detected by the test.

The VAR(p) model (5) is assumed to have errors \(\varepsilon _{t}\sim i.i.d. N\left( 0,\Sigma \right) \) and is estimated least square equation by equation.

References

Andrews D (1993) Test for parameter instability and structural change with unknown change point. Econometrica 61(4):821–856

Angeloni I, Aucremanne L, Ehrmann M, Galí J, Levin A, Smets F (2006) New evidence on inflation persistence and price stickiness in the Euro area: implications for macro modeling. J Eur Econ Assoc 4(2–3):562–574

Batchelor RA (1982) Expectations, output and inflation: the European experience. Eur Econ Rev 17(1): 1–25. http://www.sciencedirect.com/science/article/pii/0014292182900393

Bayoumi T, Sgherri S (2004) Monetary magic? How the fed improved the flexibility of the U.S. economy. IMF wp 04–24

Christiano L, Eichenbaum M, Evans C (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Polit Econ 113(1):1–45

Cogley T, Primicieri GE, Sargent TJ (2010) Inflation-gap persistence in the US. Am Econ J: Macroecon 2(1):43–69

Coibion O (2010) Testing the sticky information Phillips curve. Rev Econ Stat 92:87–101

Coibion O, Gorodnichenko Y (2012) What can survey forecasts tell us about information rigidities? J Polit Econ 120:116–159

Dupor B, Kitamura T, Tsuruga T (2005) Do sticky prices need to be replaced with sticky information? IMES Discussion Paper Series no. 2006-E-23, Bank of Japan

Fischer S (1977) Long-term contracts, rational expectations, and the optimal money supply rule. J Polit Econ 85:191–205

Galí J, Gertler M (2006) Inflation dynamics: a structural econometric analysis. J Monet Econ 44:195–222

Khan H, Zhu Z (2006) Estimates of the sticky-information Phillips curve for the United States. J Money Credit Bank 38(1):195–207

Kiley MT (2006) A quantitative comparison of sticky-price and sticky-information models of price setting. Finance and Economics Discussion series no. 2006–2045, Federal Reserve Board

Korenok O (2008) Empirical comparison of sticky price and sticky information models. J Macroecon 30(3):906–927

Laforte J-P (2007) Pricing models: a Bayesian DSGE approach for the US. J Money Credit Bank 39:127–154

Lucas RE Jr (1973) Some international evidence on output-inflation tradeoffs. Am Econ Rev 63:326–334

Mankiw GN, Reis R (2002) Sticky information versus sticky prices: a proposal to replace the new Keynesian Phillips curve. Q J Econ 17(4):1295–1328

Mankiw GN, Reis R (2007) Sticky information in general equilibrium. J Eur Econ Assoc 5:603–613

Molinari B (2007) The role of sticky information in inflation dynamics: estimates and findings. Ente Luigi Einaudi Temi di Ricerca no. 50

Reis R (2006) Inattentive producers. Rev Econ Stud 73:793–821

Stock J, Watson M (2003) Forecasting output and inflation: the role of asset prices. J Econ Lit XLI:788–829

Wang P, Wen Y (2006) Solving linear difference systems with lagged expectations by a method of undetermined coefficients. Federal Reserve Bank of St. Louis, Working Paper 2006–003C

Woodford M (2003) Interest and prices. Princeton University Press, Princeton

Acknowledgments

I am grateful to Albert Marcet for valuable comments and discussion regarding this paper. I also thank Klaus Adam, Luca Gambetti, Pau Rabanal, Jaume Ventura, Michael Reiter, Wouter den Haan, an anonymous referee, and the participants at the UPF macroeconomic seminars, the Asset 2007 Conference, and the 8th Annual Bank of Finland/CEPR Conference “Expectations and the Business Cycle” for useful comments. Any remaining errors are my responsibility. Financial support from Ente Luigi Einaudi (EIEF) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

A Proof of Proposition 1

Denoting the \(j\)-periods-ahead forecast error as \(\displaystyle \varepsilon _{t\mid t-j}^{F}=Z_{t}-E\left[ Z_{t}\mid \Omega _{t-j}\right] \), the SIPC can be written as:

where \(Z_{t}\) is any covariance stationary vector of variables that includes inflation and output gap, and \(\delta \) is a \(\left( 1\times n\right) \) row vector of zeros and constants that picks \(\left( \pi _{t}+\alpha \Delta y_{t}\right) \) within \(Z_{t}\). From the definition of \(\delta Z_{t}\), we immediately see that Eq. (14) implies

Using the Wold decomposition of \(Z_{t}\), each forecast error can be written as:

Next, using (16) to substitute for \(\varepsilon _{t\mid t-j-1}^{F}\) in (15), we obtain:

Moreover, notice that:

Hence, by plugging (18) into (17), we obtain

which proves the proposition.

B Proof of Proposition 2

Let \(g_{1,t}\) be the set of orthogonality conditions (3), i.e.,

where \(m=L+1\) is the number of orthogonality conditions, \(\beta \!=\!\mathrm{vec}\!\left( \left[ B_{1}^{\prime },\ldots ,B_{p}^{\prime }\right] ^{\prime }\right) , B_{j}\) are the matrices of parameters defined in (5), vec\(\left( \cdot \right) \) is the column stacking operator, and \(Y_{t}=\{y_{t},y_{t-1}\}\). Using the same notation, let \(g_{2,t}\) be the orthogonality conditions used to estimate the VAR(p) model (5), i.e.,

where \(X_{t}\) are the \(n\) endogenous variables of the VAR(p), and \(k=np+1\).Footnote 29

The correct variance of \(\lambda _{T}^{2s}\) should take into account the variance of the stochastic regressors \(\beta _{T}^\mathrm{VAR}\), whereas the two-stage estimator mistreats \(\beta _{T}^\mathrm{VAR}\) as fixed variables, therefore failing to account for the volatility of \(X_{t}\) when computing the variance of \(\lambda _{T}^{2s}\). To overcome this problem, I first construct a GMM model that jointly estimates \(\{\lambda ,\,\beta \}\) pooling together the orthogonality conditions \(\{g_{1,t}, g_{2,t}\}\). Next, I show that the point estimates of this estimator coincide with that of the two-stage estimator, even though the variances are different because the variance of \(\lambda _{T}\) correctly incorporates the volatility of \(X_{t}\) through the effect of \(\beta \) on \(g_{1,t}\), whereas the variance of \(\lambda _{T}\) does not. Thus, I calculate the variance of \(\theta _{T}\) in the pooled model and use it as the adjusted variance of \(\theta _{T}^{2s}\).

The pooled GMM model

The vector of parameters \(\left\{ \lambda , \beta \right\} \) can be jointly estimated by GMM using the pooled vector of o.c.

where (19) and (20) are stacked column-wise, with a weighting matrix \(W\) equal to:

The equivalence result

Denote the one-stage estimator of \(\lambda \) from the pooled model (21) as \(\lambda _{T}\), and note that \(\displaystyle \frac{\partial E\left[ g_{2}\left( \beta ,X_{t}\right) \right] }{\partial \lambda }=0\) by construction and that the weighting matrix (22) is block diagonal. In this case two conditions hold. First, the objective function of the GMM estimation of (21), \(\displaystyle J(\lambda _{T})=E(g_{1,t})\cdot \Sigma _{g_{1}}^{-1}\cdot E(g_{1,t}^{\prime })\), exactly coincides with the objective function of the two-stage GMM estimator \(\lambda _{T}^{2s}\) that uses the inverse of its VCV matrix, \(\Sigma _{g_{1}}^{-1}\), as the (optimal) weighting matrix. Second, the estimates \(\beta _{T}\) coincide with the VAR model estimation, i.e., the equation by equation estimation of (20), which are the regressors used to estimate \(\lambda _{T}^{2s}\) in the two-stage estimation.

Calculation of the variance of \(\lambda _{T}\)

Under the assumption that the covariance between \(g_{1,t}\) and \(g_{2,t}\) is zero, \(W\) is the optimal weighting matrix for the model (21), and accordingly, the VCV matrix of \(\theta _{T}\) is:

where \(G\) is a \(\left( k n+m\right) \times \left( k n+1\right) \) matrix. The variance (23) can be written as:

where \(\displaystyle \Sigma _{g_{h}}=E\left( g_{h,t}\cdot g_{h,t}^{\prime }\right) \) for \(h=\{1,2\}\) and \(O\) denotes a matrix of zeros of needed dimensions. After some algebra manipulation, this variance can be written as:

In particular, using the simplifying formula for the inverse of partitioned matrices, the variance of \(\lambda _{T}\) from Eq. (24) can be written as:

where \(\displaystyle V_\mathrm{na}(\lambda _{T}^{2s})=\left( T\cdot E\frac{\partial g_{1,t}^{\prime }}{\partial \lambda }\Sigma _{g_{1}}^{-1}E\frac{\partial g_{1,t}}{\partial \lambda }\right) ^{-1}\) is the non-adjusted variance of \(\lambda _{T}^{2s}\) computed by the algorithm of the two-stage GMM estimation. Equation (25) proves the proposition.

Robustness analysis: tables

See Tables 8, 9, 10, 11, 12 and 13.

Rights and permissions

About this article

Cite this article

Molinari, B. Sticky information and inflation persistence: evidence from the U.S. data. Empir Econ 46, 903–935 (2014). https://doi.org/10.1007/s00181-013-0700-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-013-0700-y