Abstract

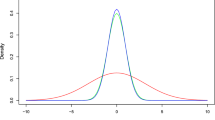

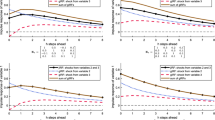

This paper proposes a unified framework to analyse the skewness, tail heaviness, quantiles and expectiles of the return distribution based on a stochastic volatility model using a new parametrisation of the skew exponential power (SEP) distribution. The SEP distribution can express a wide range of distribution shapes through two shape parameters and one skewness parameter. Since the asymmetric Laplace and skew normal distributions are included as special cases, the proposed model is related to quantile regression and expectile regression. The efficient and simple Markov chain Monte Carlo estimation methods are also described. The proposed model is demonstrated using the simulated data and real data on daily return of foreign exchange rate.

Similar content being viewed by others

References

Aas K, Haff IH (2006) The generalized hyperbolic skew student’s \(t\)-distribution. J Financ Econom 4:275–309

Aas K, Czado C, Frigessi A, Bakken H (2009) Pair-copula constructions of multiple dependence. Insur Math Econ 44:182–198

Azzalini A (1985) A class of distributions which includes the normal ones. Scand J Stat 12:171–178

Azzalini A (1986) Further results on a class of distributions which includes the normal ones. Statistica 46:199–208

Balakrishnan N, Lai CD (2009) Continuous bivariate distributions. Springer, New York

Bauwens L, Hafner CM, Laurent S (2012) Handbook of volatility models and their applications. Wiley, Hoboken

Bedford T, Cooke RM (2002) Vines: a new graphical model for dependent random variables. Ann Stat 30:1031–1068

Bottazzi G, Secchi A (2011) A new class of asymmetric exponential power densities with applications to economics and finance. Ind Corp Change 20:991–1030

Cappuccio N, Lubian D, Raggi D (2004) MCMC Bayesian estimation of a skew-GED stochastic volatility model. Stud Nonlinear Dyn Econ 8:1–29

Chen CWS, Gerlach RH, Wei DCM (2009) Bayesian causal effects in quantiles: accounting for heteroscedasticity. Comput Stat Data Anal 53:1993–2007

Chen CWS, Liu FC, So MKP (2013) Threshold variable selection of asymmetric stochastic volatility models. Comput Stat 28:2415–2447

Chen Q, Gerlach RH, Lu Z (2012) Bayesian Value-at-Risk and expected shortfall forecasting via the asymmetric Laplace distribution. Comput Stat Data Anal 56:3498–3516

Chib S (1995) Marginal likelihood from the Gibbs output. J Am Stat Assoc 90:1313–1321

Chib S (2001) Markov chain Monte Carlo methods: computation and inference. In: Heckman JJ, Leamer E (eds) Handbook of econometrics. North Holland, Amsterdam, pp 3569–3649

Chib S, Jeliazkov I (2001) Marginal likelihood from the Metropolis–Hastings output. J Am Stat Assoc 97:270–291

Chib S, Nardari F, Shephard N (2002) Markov chain Monte Carlo methods for stochastic volatility models. J Econ 108:281–316

Chollete L, Heinen A, Valdesogo A (2009) Modeling international financial returns with a multivariate regime-switching copula. J Financ Econ 7:237–480

Choy STB, Wan WY, Chan CM (2008) Bayesian student-\(t\) stochastic volatility models via scale mixtures. Adv Econ 23:595–618

Christoffersen P (1998) Evaluating interval forecasts. Int Econ Rev 39:841–862

Christoffersen PF, Pelletier D (2004) Backtesting Value-at-Risk: a duration based approach. J Financ Econ 2:84–108

de Jong P, Shephard N (1995) The simulation smoother for time series models. Biometrika 82:339–350

De Rossi G, Harvey A (2009) Quantiles, expectiles, and splines. J Econ 152:179–185

Doornik J (2007) Ox: object oriented matrix programming. Timberlake Consultants Press, London

Dufour J-M (2006) Monte Carlo tests with nuisance parameters: a general approach to finite sample inference and nonstandard asymptotics. J Econ 133:443–477

Durbin J, Koopman SJ (2002) A simple and efficient simulation smoother for state space time series analysis. Biometrika 89:603–615

Embrechts P, Kaufmann R, Patie P (2005) Strategic long-term financial risks: single risk factors. Comput Optim Appl 32:61–90

Engle RF, Russell JR (1998) Autoregressive conditional duration: a new model for irregularly spaced transaction data. Econometrica 66:1127–1162

Engle RF, Manganelli S (2004) CAViaR: conditional autoregressive value at risk by regression quantiles. J Bus Econ Stat 22:367–381

Fernández C, Steel MFJ (1995) On Bayesian modeling of fat tails and skewness. J Am Stat Assoc 93:359–371

Gerlach RH, Chen CWS, Chan NYC (2011) Bayesian time-varying quantile forecasting for Value-at-Risk in financial markets. J Bus Econ Stat 29:481–492

Gerlach RH, Chen CWS, Lin L (2012) Bayesian semi-parametric expected shortfall forecasting in financial markets. The University of Sydney Business School, BA Working Paper 01/2012

Hafner CM, Manner H (2012) Dynamic stochastic copula models: estimation, inference and applications. J Appl Econ 27:269–295

Ishihara T, Omori Y (2012) Efficient Bayesian estimation of a multivariate stochastic volatility model with cross leverage and heavy-tailed errors. Comput Stat Data Anal 56:3674–3689

Jones MC (1994) Expectiles and M-quantiles are quantiles. Stat Probab Lett 20:149–153

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46:33–50

Koenker R (2005) Quantile regression. Cambridge University Press, New York

Kozumi H, Kobayashi G (2011) Gibbs sampling methods for Bayesian quantile regression. J Stat Comput Simul 81:1565–1578

Kupiec P (1995) Techniques for verifying the accuracy of risk measurement models. J Deriv 3:73–84

Li S (2011) Three essays on econometrics: asymmetric exponential power distribution, econometric computation, and multifactor model. Ph.D. Thesis, Rutgers The State University of New Jersey, New Brunswick

Nakajima J, Omori Y (2009) Leverage, heavy-tails and correlated jumps in stochastic volatility models. Comput Stat Data Anal 53:2535–2553

Nakajima J, Omori Y (2012) Stochastic volatility model with leverage and asymmetrically heavy-tailed error using GH skew student’s-\(t\) distribution. Comput Stat Data Anal 56:3690–3704

Nakajima J (2013) Stochastic volatility model with regime-switching skewness in heavy-tailed errors for exchange rate returns. Stud Nonlinear Dyn Econ 17:499–520

Nakajima J (2014) Bayesian analysis of multivariate stochastic volatility with skew distribution. Econ Rev. doi:10.1080/07474938.2014.977093

Naranjo L, Pérez CJ, Martín J (2012) Bayesian analysis of a skewed exponential power distribution. In: Proceedings of COMPSTAT 2012, 20th international conference on computational statistics, pp 641–652

Naranjo L, Pérez CJ, Martín J (2015) Bayesian analysis of some models that use the asymmetric exponential power distribution. Stat Comput 25:497–514

Nelsen RB (2006) An introduction to copulas. Springer, Yew York

Newey WK, Powell JL (1987) Asymmetric least squares estimation and testing. Econometrica 55:819–847

Omori Y, Chib S, Shephard N, Nakajima J (2007) Stochastic volatility with leverage: fast likelihood inference. J Econ 140:425–449

Omori Y, Watanabe T (2008) Block sampler and posterior mode estimation for asymmetric stochastic volatility models. Comput Stat Data Anal 52:2892–2910

Park T, van Dyk D (2008) Partially collapsed Gibbs samplers: theory and methods. J Am Stat Assoc 103:790–796

Pitt MK, Shephard N (1999) Filtering via simulation: auxiliary particle filter. J Am Stat Assoc 94:590–599

Rubio FJ, Steel MFJ (2013) Bayesian modelling of skewness and kurtosis with two-piece scale and shape transformations. CRiSM working paper 13–10, University of Warwick

Shephard N, Pitt MK (1997) Likelihood analysis of non-Gaussian measurement time series. Biometrika 84:653–667

Steel MFJ (1998) Bayesian analysis of stochastic volatility models with flexible tails. Econ Rev 17:109–143

Takahashi M, Omori Y, Watanabe T (2009) Estimating stochastic volatility models using daily returns and realized volatility simultaneously. Comput Stat Data Anal 53:2404–2426

Takahashi M, Watanabe T, Omori Y (2014) Volatility and quantile forecasts by realized stochastic volatility models with generalized hyperbolic distribution. CIRJE discussion papers 949

Tsiotas G (2012) On generalised asymmetric stochastic volatility models. Comput Stat Data Anal 56:151–172

Watanabe T, Omori Y (2004) A multi-move sampler for estimating non-Gaussian time series models: comments on Shephard and Pitt (1997). Biometrika 91:246–248

Wichitaksorn N,Wang JJJ, ChoySTB, Gerlach R (2014) Analyzing return asymmetry and quantiles through stochastic volatility models using asymmetric Laplace error via uniform scale mixtures. Appl Stoch Models Bus Ind. doi: 10.1002/asmb/2062

Yu K, Moyeed RA (2001) Bayesian quantile regression. Stat Probab Lett 54:437–447

Zhu D, Zinde-Walsh V (2009) Properties and estimation of asymmetric exponential power distribution. J Econ 148:86–99

Zhu D, Galbraith JW (2011) Modeling and forecasting expected shortfall with the generalized asymmetric student-\(t\) and asymmetric exponential power distributions. J Empir Financ 18:765–778

Acknowledgments

The author sincerely thanks the reviewers for their valuable suggestions regarding improvements in this paper. This work is partly supported by JSPS KAKENHI Grant Numbers 15K17036 and 25245035, and Grant-in-Aid for JSPS Fellows PD (13J06738). The computational results are obtained using Ox version 6.21 (Doornik 2007).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: SEP distribution and double two-piece family

Rubio and Steel (2013) proposed the double two-piece (DTP) family. Let \(f(y|\delta ,\sigma ,\theta )=\frac{1}{\sigma }f(\frac{y-\delta }{\sigma }|\theta )\) be the probability density function for the family of of continuous, unimodal, symmetric distribution where \(\delta \in \mathbb {R}\) is the mode and the location parameter, \(\sigma >0\) is the scale parameter, and \(\theta \) is the shape parameter. Then the probability density function of the DTP family is given by

where \(I(\cdot )\) is the indicator function and

The density (9) is continuous, unimodal with mode at \(\delta \), and the amount of mass to the left of its mode is given by \(\epsilon \).

By letting \(\sigma _1=\frac{\sigma }{(1-p)^{1/\theta _1}}\) and \(\sigma _2=\frac{\sigma }{p^{1/\theta _2}}\), the probability density function of the SEP distribution (1) becomes the parameterisation of Naranjo et al. (2012):

It can be immediately seen that (10) belongs to the DTP family based on the exponential power distribution given by (6).

Appendix 2: MCMC methods for SEPSV

1.1 Single-move sampler with MH updates for \(\psi _0\) and \(\psi _1\)

Using the mixture representation for the SEP distribution (7), the return equation can be rewritten as

where \(u_1\sim Ga(1+1/\theta _1, 1)\), \(u_2\sim Ga(1+1/\theta _2, 1)\), and \(\pi _1\) and \(\pi _2\) are defined in (2).

The sampling scheme described here samples the values of \(\psi _0\), \(\psi _1\), \(\theta _1\), \(\theta _2\), p, \(\mu \), \(\phi \), \(\tau ^2\), \(\{u_{1t}\}_{t=1}^T\), \(\{u_{2t}\}_{t=1}^T\), and \(\{h_t\}_{t=1}^T\) alternately from their full conditional distributions (FCDs). The single-move sampler samples each \(h_t\) at a time from its FCD.

Sampling of \(\psi _0\), \(\psi _1\), \(\theta _1\), \(\theta _2\), and p We integrate out the latent variables \(u_{1t}\) and \(u_{2t}\) (see, e.g., Park and van Dyk 2008) and implement the Metropolis–Hastings (MH) algorithm which samples the following three blocks: \(\psi _0\), \(\psi _1\), and \({\varvec{\theta }}=(\theta _1,\theta _2,p)\). The acceptance probability of the MH algorithm for \(\psi _0\) is given by

where \(\psi _0^*\) is the proposed value, \(q(\cdot |\cdot )\) is the proposal density, and \(\pi (\cdot )\) is the prior density. Similarly, the acceptance probabilities are given by

for \(\psi _1\), and

for \({\varvec{\theta }}\), where \(\psi _1^*\) and \({\varvec{\theta }}^*\) are the proposed values. We use the normal distribution centred at the current state as the proposal distribution. The variance of the proposal distribution is chosen such that the acceptance rate is between 0.2 and 0.4.

Sampling of \(u_{1t}\) and \(u_{2t}\) The FCD of \(u_{1t}\) is the exponential distribution with mean 1 truncated to the region in which the value of \(u_{1t}\) satisfies the mixture representation as

for \(t=1,\dots ,T\) where \(u_{1t}|-\) denotes \(u_{1t}\) conditional on all other variables. The value of \(u_{2t}\) is sampled in a similar manner from

See also Naranjo et al. (2012, 2015).

Sampling of \(h_t\) Utilising the mixture representation for the SEP distribution, the FCD for \(h_t\) is the truncated normal distribution. Therefore, no MH type update is required.

The FCD of \(h_t\) is given by

where \(TN_{(a,b)}(\mu ,\sigma )\) denotes the normal distribution with mean \(\mu \) and variance \(\sigma \) truncated on the interval (a, b),

A similar method can be found, e.g., in Choy et al. (2008), where the SV model with Student’s t distribution was estimated using the scale mixture of uniforms representation.

Sampling of \(\mu \) The FCD of \(\mu \) is given by

where

Sampling of \(\tau ^2\) The FCD of \(\tau ^2\) is given by

where

Sampling of \(\phi \) The FCD of \(\phi \) is given by

where

We can sample from this FCD using the independence MH algorithm with the \(N(k_1,t_1)\) proposal distribution and the acceptance probability is given by

1.2 Single-move sampler with Gibbs updates for \(\psi _0\) and \(\psi _1\)

An alternative sampling method draws the values of \(\psi _0\) and \(\psi _1\) from the FCDs derived directly from the mixture representation (11) as Naranjo et al. (2012, 2015). The rest of the steps for \(\theta _1\), \(\theta _2\), p, \(\mu \), \(\phi \), \(\tau ^2\), \(\{u_{1t}\}_{t=1}^T\), \(\{u_{2t}\}_{t=1}^T\), and \(\{h_t\}_{t=1}^T\) is identical to the sampler described previously.

Sampling of \(\psi _0\) The FCD of \(\psi _0\) is the truncated normal distribution given by

where

Sampling of \(\psi _1\) The FCD of \(\psi _1\) is given by

where

1.3 Block sampler

A block sampler (Shephard and Pitt 1997; Watanabe and Omori 2004; Omori and Watanabe 2008) samples \((h_s,\dots ,s_{s+m-1})\) in blocks in stead of sampling each \(h_t\) at a time. Let \(\alpha _t=h_t-\mu \) and \(\psi _t=\psi _0+\psi _1y_{t-1}\). We divide \((\alpha _1,\dots ,\alpha _T)\) into \(K+1\) blocks, \((\alpha _{k_{i-1}+1},\dots ,\alpha _{k_i})\) for \(i=1,\dots ,K+1\), with \(k_0=0\), \(k_{K+1}=T\), and \(k_i-k_{i-1}\ge 2\). How to determine K and \(k_i\) are described below.

The posterior distribution of \({\varvec{\eta }}=( \eta _s,\dots ,\eta _{s+m-1})\) conditional on \(\Xi =(\alpha _s, \alpha _{s+m}, \psi _0,\psi _1,\theta _1,\theta _2,p,\mu ,\tau ^2,\phi , \mathbf{y})\) is given by

where

and

We sample \({\varvec{\eta }}\) from (14) using the acceptance–rejection (AR) MH algorithm. To construct a proposal distribution, consider the second-order Taylor expansion of

around the mode \(\hat{\alpha }_t\) (hence \(\hat{\eta }_t\)) such that

where

\(\widehat{\ell }_t=\ell _t|_{\alpha _t=\hat{\alpha }_t}\), \(\widehat{\ell }'_t=\ell '_t|_{\alpha _t=\hat{\alpha }_t}\), and \(\widehat{\ell }''_t=\ell ''_t|_{\alpha _t=\hat{\alpha }_t}\). How to obtain the mode \(\hat{\alpha }_t\) is described below. Note that we do not use the mixture representation (11) to construct the block sampler for the SEPSV model. This is because if we use (11), the resulting \(\ell ''_t\) is not strictly negative as required by Shephard and Pitt (1997).

The proposal distribution is formed as

where

and

Then consider the linear Gaussian state space model given by

with \(\alpha _1\sim N(0, \tau ^2/(1-\phi ^2))\). To sample from (15), we first use the Kalman filter and disturbance smoother with respect to (16) to obtain the mode of the posterior distribution. Then the simulation smoother (de Jong and Shephard 1995; Durbin and Koopman 2002) with the accept–rejection (AR) algorithm is applied to sample values around the posterior mode. Finally, the candidate values are accepted based on the MH ratio.

Suppose the current state is \({\varvec{\eta }}\). The algorithm can be summarised as follows.

-

1.

Initialise \((\hat{\eta }_s,\dots ,\hat{\eta }_{s+m-1})\) and \((\hat{\alpha }_s,\dots ,\hat{\alpha }_{s+m-1})\).

-

2.

Find mode \((\hat{\alpha }_s,\dots ,\hat{\alpha }_{s+m-1})\) by repeating the following steps several times:

-

(a)

Compute \((\alpha ^*_s,\dots ,\alpha ^*_{s+m-1})\) and \((\sigma ^{2*}_s,\dots ,\sigma ^{2*}_{s+m-1})\).

-

(b)

Apply Kalman filter and disturbance smoother to the linear Gaussian state space model (16) and obtain the posterior mode \((\hat{\alpha }_s,\dots ,\hat{\alpha }_{s+m-1})\).

-

(a)

-

3.

Given the posterior mode, compute \((\alpha ^*_s,\dots ,\alpha ^*_{s+m-1})\) and \((\sigma ^{2*}_s,\dots ,\sigma ^{2*}_{s+m-1})\).

-

4.

(AR-step) Repeat the following until a candidate is accepted.

-

(a)

Apply simulation smoother to (16) to draw a candidate \(\tilde{{\varvec{\eta }}}=(\tilde{\eta }_s,\dots ,\tilde{\eta }_{s+m-1})\).

-

(b)

Accept \(\tilde{{\varvec{\eta }}}\) with probability

$$\begin{aligned} \frac{\min \left\{ \pi (\tilde{{\varvec{\eta }}}|\Xi ),cq(\tilde{{\varvec{\eta }}}|\Xi )\right\} }{cq(\tilde{{\varvec{\eta }}}|\Xi )}, \end{aligned}$$where \(c>0\) is a constant.

-

(a)

-

5.

(MH-step) Accept \(\tilde{{\varvec{\eta }}}\) with probability

$$\begin{aligned} \min \left\{ 1,\frac{\pi (\tilde{{\varvec{\eta }}}|\Xi )\min \left\{ \pi ({\varvec{\eta }}|\Xi ),cq({\varvec{\eta }})\right\} }{\pi ({\varvec{\eta }}|\Xi )\min \left\{ \pi (\tilde{{\varvec{\eta }}}|\Xi ),cq(\tilde{{\varvec{\eta }}})\right\} } \right\} . \end{aligned}$$

To determine the blocks, we employ the stochastic knots (Shephard and Pitt 1997) based on \(k_i=\text {int}\left[ T(i+U_i)/(K+2)\right] \) where \(U_i\sim U(0,1)\). It is known that the stochastic knots approach can improve the efficiency of MCMC by randomly changing the conditioning sets over the iterations. The tuning parameter K is determined such that the size of block is neither too small nor too large (see, e.g., Omori and Watanabe 2008). When K is too small, the sampler would resemble the single move sampler using an MH algorithm and would be inefficient. Choosing K too large would lead to low acceptance rate and to inefficiency of the sampler as well. Therefore, we choose the value of K such that the number of points in a block is 30 on average. This choice of K works well in the numerical examples in this paper.

The sampling scheme for the rest, \(\psi _0\), \(\psi _1\), \(\theta _1\), \(\theta _2\), p, \(\mu \), \(\phi \), and \(\tau ^2\), is the same as in the case of the single-move sampler with MH updates.

1.4 Sampling from the posterior predictive distribution

To compute one-day-ahead VaR and ES forecasts, the following steps are added after a sweep of an MCMC scheme described above. We generate daily return forecast utilising the mixture representation (11).

-

1.

Generate \(h_{t+1}\) from \(N(\mu +\phi (h_t-\mu ), \tau ^2)\).

-

2.

Generate u from U(0, 1).

-

if \(\pi _1>u\)

-

(a)

Generate \(u_1\) from \(Ga(1+1/\theta _1,1)\).

-

(b)

Generate \(y_{t+1}\) from \(U\left( \psi _0+\psi _1y_t-\frac{e^{h_{t+1}/2}}{s_{\varvec{\theta }}}\left( \frac{u_1}{1-p}\right) ^{1/\theta _1}, \psi _0+\psi _1y_t\right) \).

-

(a)

-

else

-

(a)

Generate \(u_2\) from \(Ga(1+1/\theta _2,1)\).

-

(b)

Generate \(y_{t+1}\) from \(U\left( \psi _0+\psi _1y_t, \psi _0+\psi _1y_t+\frac{e^{h_{t+1}/2}}{s_{\varvec{\theta }}}\left( \frac{u_2}{p}\right) ^{1/\theta _2}\right) \).

-

(a)

-

Rights and permissions

About this article

Cite this article

Kobayashi, G. Skew exponential power stochastic volatility model for analysis of skewness, non-normal tails, quantiles and expectiles. Comput Stat 31, 49–88 (2016). https://doi.org/10.1007/s00180-015-0596-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-015-0596-4