Abstract

Recently, some new techniques have been proposed for the estimation of semi-parametric fixed effects varying coefficient panel data models. These new techniques fall within the class of the so-called differencing estimators. In particular, we consider first-differences and within local linear regression estimators. Analyzing their asymptotic properties it turns out that, keeping the same order of magnitude for the bias term, these estimators exhibit different asymptotic bounds for the variance. In both cases, the consequences are suboptimal non-parametric rates of convergence. In order to solve this problem, by exploiting the additive structure of this model, a one-step backfitting algorithm is proposed. Under fairly general conditions, it turns out that the resulting estimators show optimal rates of convergence and exhibit the oracle efficiency property. Since both estimators are asymptotically equivalent, it is of interest to analyze their behavior in small sample sizes. In a fully parametric context, it is well-known that, under strict exogeneity assumptions the performance of both first-differences and within estimators is going to depend on the stochastic structure of the idiosyncratic random errors. However, in the non-parametric setting, apart from the previous issues other factors such as dimensionality or sample size are of great interest. In particular, we would be interested in learning about their relative average mean square error under different scenarios. The simulation results basically confirm the theoretical findings for both local linear regression and one-step backfitting estimators. However, we have found out that within estimators are rather sensitive to the size of number of time observations.

Similar content being viewed by others

References

Altonji J, Matzkin R (2005) Cross section and panel data estimators for nonseparable models with endogenous regressors. Econometrica 73:1053–1102

Bester A, Hansen C (2009) Identification of marginal effects in a nonparametric correlated random effects model. J Bus Econ Stat 27:235–250

Buja A, Hastie T, Tibshirani R (1989) Linear smoothers and additive models. Ann Stat 17:453–510

Card D (2001) Estimating the return to schooling: progress on some persistent econometric problems. Econometrica 69:1127–1160

Fan J, Gijbels I (1995a) Data-driven bandwidth selection in local polynomial fitting: variable bandwdith and spatial adaption. J R Stat Soc Ser B(57):371–394

Fan J, Gijbels I (1995b) Local polynomial modelling and its applications. Chapman and Hall, London

Fan J, Zhang W (1999) Statistical estimation in varying coefficient models. Ann Stat 27:1491–1518

Henderson D, Caroll R, Li Q (2008) Nonparametric estimation and testing of fixed effects panel data model. J Econom 144:257–275

Hoderlein S, White H (2012) Nonparametric identification in nonseparable panel data models with generalized fixed effects. J Econom 168:300–314

Kottaridi C, Stengos T (2010) Foreign direct investment, human capital and nonlinearities in economics growth. J Macroecon 32:858–871

Kuan C, Chen C (2013) Effects of national health insurance on precautionary saving: new evidence from Taiwan. Empir Econ 44:942–943

Li Q, Huang C, Li D, Fu T (2002) Semiparametric smooth coefficient models. J Bus Econ Stat 20(3):412–422

Mammen E, Støve B, Tjøstheim D (2009) Nonparametric additive models for panels of time series. Econ Theory 25:442–481

Masry E (1996) Multivariate local polynomial regression for time series: uniform strong consistency rate. J Time Ser Anal 17:571–599

Qian J, Wang L (2012) Estimating semiparametric panel data models by marginal integration. J Econom 167:483–493

Rodriguez-Poo J, Soberon A (2013) Direct semiparametric estimation of fixed effects panel data varying coefficient models. Econom J 17(1):107–138

Rodriguez-Poo J, Soberon A (2015) Nonparametric estimation of fixed effects panel data varying coefficient models. J Multivar Anal 133:95–122

Su L, Lu X (2013) Nonparametric dynamic panel data models: kernel estimation and specification testing. J Econom 176(2):112–133

Su L, Ullah A (2011) Nonparametric and semiparametric panel econometric models: estimation and testing. In: Ullah A, Giles DEA (eds) Handbook of empirical economics and finance. Taylor and Francis, New York

Sun Y, Carroll R, Li D (2009) Semiparametric estimation of fixed effects panel data varying coefficient models. Adv Econom 25:101–130

Wooldridge J (2002) Econometric analysis of cross section and panel data. MIT Press, Camdridge

Acknowledgments

The authors acknowledge financial support from the Dirección Nacional de Investigación Científica y Técnica (Ref. ECO2013-48326-C2-2-P). We would also like to tank Wenceslao Gonzalez-Manteiga and Miguel A. Delgado for their very helpful comments and suggestions. We also acknowledge the very insightful comments made by the referees. All them contributed to improve the quality of the paper. Of course, all possible errors and mistakes are ours.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Assumptions

To analyze the asymptotic distributions of the above estimators we need to establish some assumptions

Assumption A.1

Let \(\left( Y_{it},X_{it},Z_{it}\right) _{i=1,\ldots ,N;t=1,\ldots ,T}\) be a set of independent and identically distributed \({\mathbb {R}}^{1+d+q}\)-random variables in the subscript \(i\) for each fixed \(t\) and strictly stationary over \(t\) for fixed \(i\).

Assumption A.2

The random errors \(v_{it}\) are independent and identically distributed, with zero mean and homoscedastic variance, \(\sigma _v^2<\infty \). They are also independent of \(X_{it}\) and \(Z_{it}\) for all \(i\) and \(t\). In addition, \(E\left| v_{it}\right| ^{2+\delta }\), for some \(\delta >0\).

Assumption A.3

The unobserved cross-sectional effect, \(\mu _i\), can be arbitrarily correlated with both \(X_{it}\) and/or \(Z_{it}\) with an unknown correlation structure.

Assumption A.4

Let \(f_{Z_{1t}}\left( \cdot \right) , f_{Z_{1t},Z_{1(t-1)}}\left( \cdot ,\cdot \right) , f_{Z_{1t},Z_{1(t-1)},Z_{1(t-2)}}\left( \cdot ,\cdot ,\cdot \right) \) be respectively the probability density function of \(Z_{1t}, \left( Z_{1t},Z_{1(t-1)}\right) \) and \((Z_{1t},Z_{1(t-1)},Z_{1(t-2)})\). All density functions are continuously differentiable in all their arguments and they are bounded from above and below in any point of their support.

Assumption A.5

Let \(z\) an interior point in the support of \(f_{Z_{1t}}\). All second-order derivatives of \(m_1(\cdot ),m_2(\cdot ),\ldots ,m_d(\cdot )\) are bounded and uniformly continuous.

Assumption A.6

The \(q\)-variate Kernel functions \(K\) are compactly supported, bounded kernel such that \(\int uu^{\top }K(u)du=\mu _2(K)I\) and \(\int K^2(u)du=R(K)\), where \(\mu _2(K)\ne 0\) and \(R(K)\ne 0\) are scalars and \(I\) is the \(q\times q\) identity matrix. In addition, all odd-order moments of \(K\) vanish, that is \(\int u_1^{\imath _1}\ldots u_q^{\imath _q}K(u)du=0\), for all nonnegative integers \(\imath _1,\ldots ,\imath _q\) such that their sum is odd.

Assumption A.7

The bandwidth matrix \(H\) is symmetric and strictly definite positive. Furthermore, each entry of the matrix tends to zero as \(N\rightarrow \infty \) in such a way that \(N|H|\rightarrow \infty \).

Assumption A.8

Let \(\Vert A\Vert = \sqrt{tr(A^{\top }A)}\), then \(E\{\Vert X_{it}X^{\top }_{it}\Vert ^2\big |Z_{it}=z_1,Z_{i(t-1)}=z_2 \}\) is bounded and uniformly continuous in its support. Furthermore, let

Also, the following matrix functions \(E\left( \left. {\fancyscript{X}}_{it}{\fancyscript{X}}^{\top }_{it}\right| Z_{it}=z_1,Z_{i(t-1)}=z_2\right) , E({\fancyscript{X}}_{it}{\fancyscript{X}}^{\top }_{it}\big |Z_{it}=z_1,Z_{i(t-1)}=z_2,Z_{i(t-2)}=z_3), E\left( \left. \varDelta {\fancyscript{X}}_{it}\varDelta {\fancyscript{X}}^{\top }_{it}\right| Z_{it}=z_1,Z_{i(t-1)}=z_2\right) \) and \(E\left( \left. {\fancyscript{X}}_{it}\varDelta {\fancyscript{X}}^{\top }_{it}\right| Z_{it}=z_1,Z_{i(t-1)}=z_2,Z_{i(t-2)}=z_3\right) \) are bounded and uniformly continuous in their support.

Assumption A.9

The function \(E\left[ \left. \varDelta X_{it} \varDelta X^{\top }_{it}\right| Z_{it}=z_1,Z_{i(t-1)}=z_2\right] \) is positive definite for any interior point of \((z_1,z_2)\) in the support of \(f_{Z_{it},Z_{i(t-1)}}\left( z_1,z_2\right) \).

Assumption A.10

For some \(\delta >0\), the functions \(E\big \{|X_{it}\varDelta v_{it}|^{2+\delta }\big |Z_{it}=z_1,Z_{i(t-1)}=z_2\big \}, E\left\{ \left. |X_{i(t-1)}\varDelta v_{it}|^{2+\delta }\right| Z_{it}=z_1,Z_{i(t-1)}=z_2\right\} \) and \(E\big \{|\varDelta X_{it}\varDelta v_{it}|^{2+\delta }\big |Z_{it}=z_1,Z_{i(t-1)}=z_2\}\) are bounded and uniformly continuous in any point of their support.

Assumption A.11

The function \(E(\ddot{X}_{it}\ddot{X}_{it}^{\top }\big |Z_{i1}=z,\ldots ,Z_{iT}=z)\) is definite positive for any interior point of \((z_1,z_2,\ldots ,z_T)\) in the support of \(f_{Z_{i1},\ldots ,Z_{iT}}(z_1,z_2,\ldots ,z_T)\).

Assumption A.12

Let \(\Vert A\Vert =\sqrt{tr\left( A^{\top }A\right) }\), then \(E\{\Vert X_{it}X_{it}^{\top }\Vert ^2\big |Z_{i1}=z,\ldots ,Z_{iT}=z\}\) is bounded and uniformly continuous in its support. Furthermore, let \({\fancyscript{X}}_{it}=\left( \begin{array}{cc}X_{it}^{\top }&X_{is}^{\top }\end{array}\right) ^{\top }\) the following matrix functions \(E({\fancyscript{X}}_{it}{\fancyscript{X}}_{it}^{\top }\big |Z_{i1}=z_1,\ldots ,Z_{iT}=z_T ), E(\ddot{X}_{it}\ddot{X}_{it}^{\top }\big |Z_{i1}=z_1,\ldots ,Z_{iT}=z_T )\) and \(E(\ddot{X}_{it}{\fancyscript{X}}_{it}^{\top }\big |Z_{i1}=z_1,\ldots ,Z_{iT}=z_T )\) are bounded and uniformly continuous in their support.

Assumption A.13

The functions \(E\{|X_{it}v_{it}|^{2+\delta }|Z_{i1}=z, \ldots ,Z_{iT}=z\}, E\{|X_{is}v_{it}|^{2+\delta }|Z_{i1}=z, \ldots ,Z_{iT}=z\}\) and \(E\{|\ddot{X}_{it}v_{it}|^{2+\delta }|Z_{i1}=z,\ldots , Z_{iT}=z\}\) are bounded and uniformly continuous in any point of their support, for some \(\delta >0\).

Assumption A.14

The bandwidth matrix \({\widetilde{H}}\) is symmetric and strictly definite positive. Furthermore, each entry of the matrix tends to zero as \(N\) tends to infinity in such a way that \(N\left| {\widetilde{H}}\right| \rightarrow \infty \).

Assumption A.15

The bandwidth matrices \(H\) and \({\widetilde{H}}\) must fulfill that \(N\left| H\right| \left| {\widetilde{H}}\right| /log(N)\rightarrow \infty \), and \(tr\left( H\right) /tr\left( {\widetilde{H}}\right) \rightarrow 0\) as \(N\) tends to infinity.

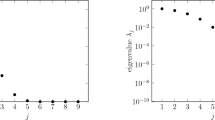

Appendix 2: Monte Carlo results

The results of the Monte Carlo experiments are summarized in the following Tables 1, 2, 3, 4, 5, 6, 7, 8 and 9.

Rights and permissions

About this article

Cite this article

Rodriguez-Poo, J.M., Soberón, A. Differencing techniques in semi-parametric panel data varying coefficient models with fixed effects: a Monte Carlo study. Comput Stat 30, 885–906 (2015). https://doi.org/10.1007/s00180-014-0549-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-014-0549-3

Keywords

- Semi-parametric varying coefficients model

- Panel data

- Local linear regression

- One-step backfitting algorithm

- First-differences estimator

- Within estimator

- Monte Carlo simulations