Abstract

The goal of this paper is to evaluate the results of regional economic growth model estimations at multiple spatial scales using spatial panel data models. The spatial scales examined are minimum comparable areas, microregions, mesoregions and states between 1970 and 2000. Alternative spatial panel data models with fixed effects were systematically estimated across those spatial scales to demonstrate that the estimated coefficients change with the scale level. The results show that the conclusions obtained from growth regressions depend on the choice of spatial scale. First, the values of spatial spillover coefficients vary according to the spatial scale under analysis. In general, such coefficients are statistically significant at the MCA, microregional and mesoregional levels, however, at state level those coefficients are no longer statistically significant, suggesting that spatial spillovers are bounded in space. Moreover, the positive average-years-of-schooling direct effect coefficient increases as more aggregate spatial scales are used. Population density coefficients show that higher populated areas are harmful to economic growth, indicating that congestion effects are operating in all spatial scales, but their magnitudes vary across geographic scales. Finally, the club convergence hypothesis cannot be rejected suggesting that there are differences in the convergence processes between the north and south in Brazil. Furthermore, the paper discusses the potential theoretical reasons for different results found across estimations at different spatial scales.

Similar content being viewed by others

1 Motivation

The goal of this paper was to evaluate the results of regional economic growth estimates at multiple spatial scales using alternative spatio-temporal models recently proposed in the spatial econometrics literature. During the last two decades, an increasing dissemination of spatial econometrics techniques has been observed among regional scientists, economists, and researchers in several fields (Anselin 1988; Lesage 1999; Conley 1999). The vast research of applied spatial econometrics on the interdependencies among spatial units and their effects on, among others, regional economic growth, trade flows, knowledge spillovers, migration, housing prices, tax interactions, and city’s growth controlsFootnote 1 is well known. However, this literature still lacks a better understanding of the potential reasons why models estimated at different geographic scales yield different results in the context of regional economic growth empirics.Footnote 2

Resende (2011) engages in an initial discussion on the determinants of Brazil’s regional economic growth at a variety of geographic scales using a cross-sectional data set over the 1990s period. Resende (2013) improves this analysis by using standard panel data models across several spatial scales, but the process of economic growth in Brazil is only examined using non-spatial panel data models. This investigation refers back to the modifiable areal unit problem (MAUP),Footnote 3 but it sheds new light on a core problem in the literature related to regional economic growth by estimating models that are able to provide more insights about different spatial spillover effects due to changes in the spatial scale. The choice of the spatial scale of analysis is a problematic issue in applied research (Behrens and Thisse 2007). This paper seeks to investigate the extent to which ambiguities about spatial scale undermine, or inform, our understanding of regional growth determinants and convergence.

With the exception of Resende (2011, 2013) and Resende and Cravo (2014)Footnote 4 studies thus far have only investigated the determinants of economic growth at a single spatial scale to infer the consistency of spatial growth models with reality (e.g., Rey and Montouri 1999; Fingleton 1999; López-Bazo et al. 2004; Ertur and Koch 2007; Elhorst 2010; Fischer 2011). For instance, Elhorst (2010) employ spatial econometric techniques to focus on time–space models, but they only examine the process of economic growth at a single spatial scale. To our knowledge, this is the first study of regional economic growth exploring both time and different spatial scale dimensions in the context of spatial panel data models.

The idea of this paper is to systematically repeat a spatial panel data model originally developed to examine this phenomenon at a single geographic scale across multiple scales. The spatial scales examined are minimum comparable areas (referred to as municipalities), microregions, mesoregions and states, which are often employed in the empirical literature about Brazil and cover the period between 1970 and 2000.Footnote 5 Initially, this approach led us to the investigation of the measurement issue that might cause variability in regional economic growth estimates due to the use of different spatial scales, likely due to the MAUP. However, it is important to bear in mind that structural (theory based) issues may be underlying economic growth at different scales; thus, we provide theoretical arguments for such variability in empirical results found across different geographic scales.Footnote 6

The paper is organized as follows. Section 2 discusses the potential theoretical reasons for different results found across economic growth models estimated at different spatial scales. Section 3 describes the spatial panel data models employed in the empirical analysis. In Sect. 4, the data set and spatial scales are explained. Section 5 presents the results and the respective discussion follows in Sect. 6. Section 7 concludes the paper.

2 The spatial scope of economic growth determinants: potential theoretical reasons for different results across models estimated at different spatial scales

In mainstream economics, economic growth theories provide several factors that may have been responsible for driving regional performance. The debate on long-run economic growth determinants came with Solow’s (1956) growth model and has been augmented by many others by the inclusion of human capital (Mankiw et al. 1992), migration (Barro and Sala-i Martin 2003) and growth externalities (López-Bazo et al. 2004; Ertur and Koch 2007). Moreover, the so-called endogenous growth models, pioneered by Romer (1986) and Lucas (1988), seek to explain why differences in per capita income arise and persist over time. Herein, we provide theoretical explanations of how the explanatory variables used in the econometric specifications discussed in the next section may impact economic growth at different spatial scales.

-

Physical capital (and the convergence hypotheses) Information on physical capital is often unavailable at subnational levels, and thus, this variable is excluded from the set of explanatory variables of regional growth regressions. The lack of availability of physical capital measures at finer regional level is not restricted to Brazil, as noted in Lesage and Fischer (2008) in a study for Europe. This fact is problematic; it causes the omitted variable problem, which may bias the regression estimates. Some panel data approaches partially deal with this problem by including fixed effects which might control for this kind of omitted variable (Islam 1995). Despite such omissions, the neoclassical growth framework (Solow 1956) provides a simple rationale for the convergence hypothesis. The convergence property comes from the law of decreasing returns to capital accumulation [i.e., capital tends to accumulate more slowly (more quickly) in regions where it is relatively abundant (scarce)]. We introduce the initial level of income to control for decreasing returns to capital accumulation (Ottaviano and Pinelli 2006). It is important to explain why we expect to verify differences in the magnitudes of the convergence coefficient at different spatial scales. In the regression estimates, the sizes of the initial income per capita coefficients are expected to be larger at finer spatial scales, because, for instance, municipalities resemble the notion of open economies with perfect capital mobility. Barro et al.’s (1995) neoclassical model of open economy with perfect capital mobility predicts (the possibility) that economies will jump instantaneously to a steady state of income per capita; this can be understood by a higher rate of convergence. The assumption of a more open economy is not difficult to justify in the municipal level context in Brazil, considering that the intensity of flows of capital, trade and people across municipal borders is higher than across state borders. States can thus be viewed as more closed economies than municipalities.

-

Human capital Glaeser et al. (2003) show that the presence of positive spillovers or strategic complementarities creates a “social multiplier” where aggregate coefficients of human capital (proxied, for instance, by years of schooling) will be greater than individual coefficients. In the context of this current study, we can think of municipalities as the micro (individual) level of analysis. For this reason, it is possible to argue that at the aggregate level (e.g., at microregional or state level), the coefficient of human capital may be inflated by externalities. Glaeser et al. (2003) point out that the coefficients may increase with the level of aggregation due to the existence of a social multiplier, which also supports the idea that there are human capital spillovers, as suggested by a wide body of literature (e.g., Lucas 1988; Rauch 1993).

-

Population density New economic geography models (Baldwin and Forslid 2000) show the positive impact of agglomeration externalities on economic growth rates. Population density is expected to be the proxy for agglomeration effects within a region. The magnitude of these agglomeration effects may depend on the spatial scale of analysis, because, for instance, population density will likely appear to be higher at a finer scale (e.g., municipalities) than population density at a spatial scale within larger regions (such as a state). Thus, the centripetal effect of agglomerations might be operating at finer scales or, in other words, agglomeration-related centripetal forces may be much more relevant at the local than at the state level.

-

Transportation costs Theoretical models (Ottaviano and Puga 1998; Lafourcade 2008) have shown that with decreasing transportation costs, regional inequalities will increase and then decrease. Other models integrate an endogenous growth model with the core-periphery model showing that a decrease in transportation costs may have nonlinear effects on growth (Baldwin et al. 2003). For the Brazilian case, Mata et al. (2007) have found that transportation costs are inversely related to the rate of economic growth. The impact of transportation infrastructure on economic growth may vary as the geographic scale of analysis changes. For instance, if this impact is analyzed at the state level, the focus will be on the connectivity among these aggregate regions. On the other hand, at the municipal level, such an analysis might examine the impact of transportation cost reductions within the borders of states.

-

Population growth Barro and Sala-i Martin (2003) point out that population growth represents the behavior of fertility, mortality and migration. The impacts of population growth on economic growth may display different results across different geographic scales, because migration patterns—which are one component of population growth—may vary across scale levels (e.g., intra- vs. inter-regional migration). For instance, the contrast in area sizes means that daytime commuting across municipalities can be more significant if compared to states. Moreover, if we are able to analyze only the migration effects, we need to bear in mind that, unlike those born into a community, migrants come with accumulated human capital. As such, the results depend on whether immigrants have more or less human capital (i.e., if they are typically skilled or unskilled) than the residents of the receiving region (Barro and Sala-i Martin 2003).

-

Spatial externalities The spatial growth model specifications discussed in the next section seek to capture the effects of spatial externalities. It is important to note that the extent and strength of these externalities may depend on the level of aggregation of the spatial units. For instance, spatial autocorrelation might be higher at the municipal level than at the state level, because, for instance, states are more self-contained than municipalities, or, in other words, states are much more closed economic entities than municipalities. As noted by Oates (1999), it is possible to increase the size of the jurisdiction to deal with such spillovers, thereby internalizing the benefits and costs. Corrado and Fingleton (2012) note that hierarchical models (also known as multilevel models) can be used in regional science and spatial economics to study a hierarchy of effects from cities, regions containing cities, and countries containing regions; thus, not recognizing the effects emanating from different hierarchical levels can lead to incorrect inferences. Herein, the adopted approach is to systematically replicate the regression specification chosen to examine the extent of spatial externalities at a single scale across multiple spatial scales. Lall and Shalizi (2003) enumerate theoretical reasons why location effects and spatial externalities matter in examining determinants of growth, that including (i) agglomeration economiesFootnote 7; (ii) Marshallian externalities of knowledge diffusion and labor market poolingFootnote 8; (iii) common informal norms and institutionsFootnote 9; and (iv) policy adoption.Footnote 10 Although many of these theoretical arguments on spatial externality are about their positive effects, it is possible to point out some reasons why negative spatial externality effects can be observed. For instance, with regard to the policy adoption argument discussed above, there could also “be negative policy imitation where governments may not necessarily maximize growth but maximize rent-seeking and this behavior may be imitated by governments in neighboring regions” (Lall and Shalizi 2003: 665). Moreover, Lall and Shalizi (2003: 679) suggest that improvements in the structural variables (e.g., economic structure, workforce quality and infrastructure quality) are likely to increase growth performance in the region; however, “if growth in a particular region is higher than that of its neighbors, the region is likely to attract mobile capital and skilled labor from neighboring regions, thereby having a detrimental effect on growth performance in neighboring regions.” The spatial models discussed next are a way to model these spatial externalities via spatial lags of the dependent and/or explanatory variables and/or spatial disturbances specifications.

3 Spatial panel data models

To study the impact of the explanatory variables on economic growth across a variety of geographic scales, we employ spatial panel data models. These models try to account for spatial correlations, allowing at the same time for the existence of idiosyncratic effects (fixed or random) for the regional observational units. Indeed, the presence of spatially autocorrelated residuals in the non-spatial growth regressions motivates the estimation of the spatially augmented Solow models—as presented in Montoury (1999), López-Bazo et al. (2004) and Ertur and Koch (2007)—to deal with such spatial autocorrelation.

However, it is worth noting that there are alternative explanations for the existence of spatial autocorrelation in the residuals of the growth equations. Nuisance spatial dependence (spatial error) is a potential justification. As explained by Magrini (2004: 2763), it “may result from measurement problems such as a mismatch between the spatial pattern of the process under study and the boundaries of the observational units.” It is also likely that regions that are geographically close together may experience random shocks that affect both simultaneously. Another explanation is related to unobserved determinants that are correlated across regions (Fingleton and López-Bazo 2006). Possible unobserved determinants of economic growth not considered in these models include cultural, institutional and technological factors, which might be correlated across spatial units.

Moreover, Fingleton and López-Bazo (2006) note that substantive dependence (spatial lag and/or spatial cross-regressive) assumes that across-region externalities are due to knowledge diffusion and pecuniary externalities. López-Bazo et al. (2004) discuss in some detail the substantive arguments for spatial dependence across regions. These authors built a spatially augmented growth model based on Mankiw et al. (1992) demonstrating that economic growth and initial productivity in the other regions boost growth in a given region, which is explained by regional spillovers of the diffusion of technology from other regions, caused by investments in physical and human capital. However, López-Bazo et al. (2004) recognize that it is also plausible that these externalities across economies might be caused by pecuniary externalities other than knowledge spillovers—such as those created by a specialized market for labor or output, or forward and backward linkages drawn from trade in intermediate goods—that are related to increasing returns at the firm level, as noted by contributors from the so-called new economic geography (Fujita et al. 1999).

Accounting for these spatial autocorrelations in growth regressions is essential to establishing reliable inferences. Of note, Baltagi and Pirotte (2010) examine standard panel data estimators under spatial dependence using Monte Carlo experiments. They show that when the spatial coefficients are large, hypothesis tests based on standard panel data estimators that ignore spatial dependence can lead to misleading inferences. Moreover, Arbia and Petrarca (2011) present a general framework to investigate the effects of MAUP on spatial econometric models showing how the presence of spatial effects affects the classical results. Arbia and Petrarca (2011) concentrate on the loss in efficiency of the parameters’ estimators due to aggregation.

Recently, new developments in spatial panel data models have emerged in the spatial econometrics literature, proposing alternative spatio-temporal models to investigate convergence and growth of regions (Elhorst 2010), regional markets (Keller and Shiue 2007) and labor economics (Foote 2007), among other fields. Anselin et al. (2008) provide a list of alternative spatial panel data models. In the same way, Elhorst (2012) examines a collection of spatial dynamic panel data (SDPD) models that include one or more of the following variables and/or error terms: “a dependent variable lagged in time, a dependent variable lagged in space, a dependent variable lagged in both space and time, independent variables lagged in time, independent variables lagged in space, serial error autocorrelation, spatial error autocorrelation, spatial-specific and time-period-specific effects.”

Lee and Yu (2010) examine recent developments in spatial panel data models for both static and dynamic cases that consider fixed effects, spatial lags and spatial disturbance specifications [for other surveys, see also Elhorst (2010, 2012)]. Specifically, these spatial dynamic panel data models can be applied to investigate the economic growth and convergence processes of regions that employ income per capita growth rates versus lagged levels of the explanatory variables. To study the robustness of the results, we consider several model specifications for the spatial dependence structure. Both fixed and random effect models were estimated, considering spatial lags for the dependent and explanatory variables, and considering different error spatial dependences.

The general model specification is given by:

where y is the vector with the dependent variable, X is the matrix with explanatory variables (which includes the log of the initial period level of the dependent variable), \(\beta \) is the vector of unknown coefficients and W is the standardized weight matrix built according to the neighborhood relations among observational units (see Anselin 1988). Coefficient \(\lambda \) corresponds to the autoregressive parameter, and it gives a measure of the spatial dependence between the response variable in different geographic units. We assume that \(\lambda \) is smaller than one in absolute value. The term \(I_T \) corresponds to the identity matrix, with dimension T (the number of time periods), and symbol \(\otimes \) corresponds to the Kronecker product. The matrix representation above assumes the data are sorted such that the first block of observations corresponds to the first time period, the second block corresponds to the second time period and so on.

The error term u can have several representations, varying according to the presence of idiosyncratic variability among regional units, and according to the spatial dependence structure. The discussion here considers only models with fixed or random effects, models without these effects can be easily derived from those presented below. Besides, the several specification tests performed on our empirical data rejected the hypothesis of no idiosyncratic terms.

Assuming that there are idiosyncratic effects, represented by the terms in the N dimensional vector \(\mu \) (where N is the number of observational units), the first specification considered for the term u is given by:

where \(i_T \) is a \(T\times 1\) vector of ones, \(I_N \) is an identity matrix with dimension N and \(\epsilon \) is a vector with dimension \(TN\times 1\), with the error terms. Spatial dependence can also be assumed for \(\epsilon \) according to

where \(\rho \) is an autoregressive coefficient for the error terms (we assume that \(\rho \) is smaller than one in absolute value) and \(\nu \) is a random vector, with all terms independent and normally distributed with zero mean and variance \(\sigma _\nu ^2 \). We refer to the representation in (2) as Baltagi’s representation (see Baltagi 2008, and Baltagi et al. 2003).

Another way to include spatial dependence along with idiosyncratic terms in the term u in Eq. (1) is by specifying the spatial lags directly for the term u, according to

with \(\epsilon =\left( {i_T \otimes I_N } \right) \mu +\nu \). This representation was considered in Kapoor et al. (2007). Because of the structure in (4), spatial correlation applies to both the individual effects in \(\mu \) and the remainder error terms in \(\epsilon \). We refer to this second model as Kapoor’s representation. Estimation of models including both the spatial lag term \(\left( {I_T \otimes W} \right) y\) and spatial dependence for the error components with Kapoor’s representation is possible only when using random effects estimation. For fixed effects, one can only use Baltagi’s representation.

It is important to note that Gibbons and Overman (2012) criticize these spatial models, arguing that distinguishing which of these spatial models generates the data that the researcher has at hand is very difficult in applied research. For instance, it is hard to discriminate the model implied in Eq. (1) from the model represented in Eq. (5):

Equation (5) describes the spatial model known as spatially lagged X regression model (SLX, or spatial cross-regressive model), which assumes that interactions between exogenous characteristics of nearby observations (WX) directly affect Gibbons and Overman (2012) point out that researchers interested in spatial spillovers should incorporate a reduced form specification such as in Eq. (5), which may better identify causality in most cases (see Partridge et al. 2012, for a comprehensive discussion).Footnote 11 Equation (5) may incorporate a spatial lag of the dependent variable (known as Spatial Durbin Model/SDM). Lesage and Fischer (2008) and Lesage and Pace (2009) advocate in favor of the SDM with the inclusion of spatial lags of the dependent and explanatory variables by showing that this specification better accommodates two statistical issues that affect regional spatial growth regressions: the spatial dependence in the disturbances of an ordinary least squares (OLS) regression, and endogeneity in the form of an omitted explanatory variable that follows a spatial autoregressive process. In addition, in the context of growth models, Ertur and Koch (2007) provide the theoretical justification for the inclusion of spatial spillovers in the form of an SDM model.

The empirical exercise conducted herein compares alternative spatial panel data growth models across a variety of geographic scales. The discussion of results focuses on the results of the SDM model based on the arguments above. The purpose of this approach is to better understand the determinants of Brazilian economic growth and their respective spatial spillovers as well as to show that the geographic scale of analysis is an unavoidable feature; growth determinants would differ across different spatial scales.

Finally, as discussed in Lesage and Pace (2009), Elhorst (2010) and Elhorst (2012) for spatial lag models, unveiling the effects of each independent variable on the dependent response is not as straightforward as in the linear regression set up. In plain linear regressions, each parameter corresponds to the partial derivative of the dependent variable with respect to the explanatory attribute \((\partial y_i /\partial x_{i,k} =\beta _k )\). For spatial lag models, there is a feedback effect because of the spatial lag for the response y, and this effect should be taken into account when obtaining the partial derivative \(\partial y_i /\partial x_{i,k} \), for each independent variable \(x_k \).

To simplify the discussion, consider the Spatial Durbin Model (SDM) for cross-section data, which includes lags for both the dependent variable and the independent predictors, rewritten as

where \({S}_{k} (W)=V(W)(I_{n} \beta _{k} +{W}\delta _{k})\) and \({V}({W})=(I_n - \lambda W)^{-1}\). The partial derivative \(\partial y_{i} /\partial {x}_{{j},{k}} \) is obtained by \(\frac{\partial {y}_{i} }{\partial {x}_{{j},{k}} }={S}_{k} ({W})_{ij} .\) Note that, unlike the plain linear regression case without spatial or temporal dependence, we may have \(\frac{\partial {y}_{i} }{\partial {x}_{{j},{k}} }={S}_{k} ({W})_{{ij}} \ne 0\), for \({i}\ne {j}\). This happens because changes in the independent variable for a single polygon may affect the dependent variable in all other polygons.

We report the average direct, indirect and total impacts for each independent variable \(x_k \) on the dependent response. The direct impacts correspond to the impacts on response \({y}_{ i} \) for observation i, due to changes in \(x_{i,k} \) (also for observation i). The total impacts correspond to changes in response \(y_i\), because of changes, by the same amount, for all n values \({x}_{j,k} \). The indirect impacts correspond to the difference between the total impacts and the direct impacts, which can be interpreted as spatial spillovers. In this paper, the reported average impacts are based on expressions discussed in Lesage and Pace (2009). Estimations presented in this paper were performed using the splm package in R (see Millo and Piras 2012).Footnote 12

4 Data

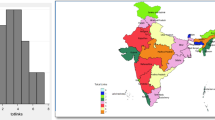

In order to evaluate the results of regional economic growth estimates at a variety of geographic scales, this paper applies alternative spatio-temporal models to the same data set used in Resende (2013). Figure 1 presents the four Brazilian geographic stratifications in the data set—27 states, 134 mesoregions, 522 microregions and 3657 minimum comparable areas (MCAs)—and presents statistics concerning their sizes (in square kilometers). The data are drawn from the MCA level, which is the most disaggregated spatial units in this study, and then grouped to form the other spatial scales.

MCAs were defined by Reis et al. (2005) as sets of municipalities with constant borders between 1970 and 2000 to address the comparability problem generated by the increase in the number of municipalities from 3920 in 1970 to 5507 in 2000. Brazil is divided into 27 statesFootnote 13 that are the main political-administrative units in the country. Municipalities (MCAs in this paper) represent the smallest administrative level, dealing with local policy implementation and management. Micro- and mesoregions are homogeneous regions defined by IBGE (2011) (Brazilian Institute of Geography and Statistics—Instituto Brasileiro de Geografia e Estatística) as a group of contiguous municipalities within the same state.

Data were collected from IPEADATA (Institute of Applied Economic Research—Instituto de Pesquisa Econômica Aplicada/IPEA), which has organized the population census information (from IBGE) of 1970, 1980, 1991 and 2000. Based on these four data points, the dependent variable was calculated as the average annual income per capita growth rateFootnote 14 for each time span: 1970–1980, 1980–1991 and 1991–2000. Per capita income information is deflated to the Real (R$, the Brazilian currency) in 2000.

Table 1 presents summary statistics for the dependent variable for each of the three time periods at the different spatial scales. For each decade, the simple mean of the average annual income per capita growth rates increases in absolute value with the level of disaggregation. In the first period (1970–1980), while the average of income per capita growth rates was 8.81 % at the state level, it was 9.36 % at the MCA level. Similarly, in the period between 1980 and 1991, the fall in income per capita was more intense at the MCA level (\(-\)1.71 %) than at the state level (\(-\)0.72 %). The same pattern occurred between 1991 and 2000, when the average growth of income per capita reached 6.83 % at the MCA level against 6.10 % at the municipal level. Data dispersion is also higher in the more disaggregated geographic scales.

Explanatory variables are given in terms of initial values, that is, values in 1970, 1980 and 1991. The socioeconomic data are logged per capita income, logged average years of schooling, logged population density and population growth.Footnote 15 Logged transportation costs between MCAs and São Paulo city are also from IPEADATA. The cost of transportation to São Paulo is calculated through a linear program procedure as the minimum cost (given road and vehicle conditions) of traveling between an MCA‘s major headquarters and São Paulo. Transportation cost data are available for the years 1968, 1980 and 1995. Values for the years 1970 and 1991 were estimated via interpolation. Finally, the econometric specifications include time dummies for the decades of 1980 and 1990 (the time dummy for the 1970s was excluded from the regressions to avoid perfect multicollinearity).

The spatial weight (W) matrix used herein is the standardized first-order contiguity matrix (also called the queen contiguity matrix), in which the element \({w}_{ij}\) in the matrix is 1, if areas i and j share borders or vertices, and 0 otherwise. Moreover, k-nearest neighbors weight matrices (in which each region has the same number of neighbors) were used (\({k}=5\) and \({k}=10\)) for robustness checks and the main qualitative results remain the same. In the next section, we present the results for models estimated for different geographic scales in Brazil.

5 Empirical results

Initially, we employed Lagrange multiplier (LM) tests for panel data models to test for the presence of spatial correlation in the observations and for the presence of idiosyncratic effects (regional individual effects). These tests are discussed in Baltagi et al. (2003) and Millo and Piras (2012). See “Appendix 1” (Table 7) for a summary of the tests results at the MCA. The LM results indicate (at all spatial scales) the presence of both idiosyncratic effects and spatial correlation in the panel regression models.

Based on the test results, we proceed to parameter estimation. We estimated both fixed effects and random effects models so as to ascertain the robustness of our conclusions. The results for the fixed effects and the random effects models are quite similar. However, we have evidence in favor of considering the results from the fixed effects model.Footnote 16 Indeed, Durlauf et al. (2005) note that most of panel data growth studies employ a fixed effects (within-group) estimator rather than a random effects estimator.Footnote 17 Herein, we analyze the fixed effects models across the four geographic scales under investigation. In the conclusion section, the empirical results are compared.

5.1 Results at MCA level

Table 2 presents results for different fixed effects models at the MCAs level. We note that the coefficients for spatial dependence \((\lambda \, \hbox {and}\,\rho )\) are statistically significant for all fixed effects specifications. The estimates for \(\rho \) seem to be higher than the estimates for \({\lambda }\).

The results of models 2, 3 and 4 show that higher economic growth rates at the MCA level are positively related to education and negatively associated with income per capita (conditional convergence) and population density.

To better understand the variables affecting municipality growth, we add spatial lags for the explanatory variables (WX) to the list of right-hand side variables (columns 5 and 6), and the results are very similar. Gibbons and Overman (2012) favor model (column 5) and argue that the SLX model is better in taking endogeneity into account. Nevertheless, the SDM reported in column 6 is the focus of our analysis. As argued in Sect. 3, Lesage and Fischer (2008) prefer the SDM specification, arguing that the conjunction of plausible circumstances is likely to arise in applied spatial growth regression modeling and Ertur and Koch (2007) provide a theoretical justification for the use of the SDM specification in growth models.

The estimates for the SDM model shows that higher economic growth within one MCA is negatively related to income per capita (conditional convergence) and positively associated with population growth and education. Furthermore, as argued by Sardadvar (2012), the results show how education levels are beneficial to economic growth if found within one MCA, but disadvantageous if found in neighboring regions (W*log education). Moreover, the results show that economic growth within one MCA is positively influenced by its neighbors’ income per capita levels (W*log per capita income).Footnote 18

In the SDM estimation, a change in an explanatory variable in region i has a direct impact on region i and an indirect impact on other regions. Nevertheless, the standard SDM estimation presented in Table 2 is unable to disentangle the direct and indirect effects of explanatory variables on regional growth and raises difficulties in the interpretation of the estimated coefficients. Table 3 provides results of our preferred SDM estimations computing the total, indirect and direct effects, as suggested by Lesage and Pace (2009).

The coefficients of the direct effects (column 1) are in line with the results provided in Table 2. These coefficients can be compared to the non-spatial estimations. The direct effect estimation suggests that economic growth within one MCA is negatively related to income per capita (contributing to conditional convergence) and positively associated with population growth and education.

Interesting results emerge from the indirect effects (column 2). The coefficient related to initial per capita income is positive, confirming that there is a positive spillover effect stemming from per capita income levels. This positive spillover effect is in line with models with endogenous growth characteristics (e.g., López-Bazo et al. 2004; Ertur and Koch 2007; Sardadvar 2012). Nevertheless, the spillover effect stemming from the per capita income level is much smaller than the direct effect, and the total effect (column 3) of per capita income level indicates conditional convergence.

The indirect effect coefficients also suggest that being surrounded by highly educated and populated municipalities has a negative effect on growth. The estimation of the indirect spillover effect related to human capital confirms indications of this pattern in Brazil as suggested by Cravo et al. (2015) based on panel data SDM estimations. An increase in the level of human capital in one municipality is caused mainly by migration of the educated population from neighboring municipalities.Footnote 19

5.2 Results at the microregional level

In total, the country is divided into 522 microregions. The results for the SDM estimations with direct, indirect and total effects are reported in Table 4. The alternative fixed effects estimation with and without spatial lags for explanatory variables, is provided in “Appendix 2” (Table 8). In Table 4, the total effect of the per capita income coefficient is negative, and statistically significant, indicating the process of conditional convergence at the microregional level.Footnote 20 As in the case for the municipalities, the direct effect of initial per capita income is negative, and the indirect effect indicates the existence of positive spillovers stemming from initial income levels. The positive coefficient of the indirect effect of income per capita means that one microregion located in a relatively rich neighborhood will tend to have a higher per capita income growth (with other things being equal). This result also provides support for spatial growth models with endogenous growth characteristics.

The estimates for population growth are in line with results presented in Table 3 for municipalities. The direct effect of population growth fosters economic growth within one microregion. However, the indirect effect does not rule out that there are negative spillovers from population growth. These two effects might counterbalance each other and contribute to the result that indicates that the total effect of population growth is not significant.

As in the estimates for municipalities, the results for microregions suggest that the total effect of human capital is not significantly related to economic growth. However, for the case of microregions neither direct nor indirect effects are statistically significant. Finally, we document that the positive effect of the total effect of transportation cost is driven by indirect effects. Municipalities and microregions benefit from bad infrastructure in neighboring regions, perhaps because regions with better infrastructure attract investment away from neighboring regions with poorer infrastructure.

5.3 Results at the mesoregional level

We now present the results using 134 Brazilian mesoregions. In Table 5, the total effect of the per capita income coefficient is statistically significant and indicates that direct effects drive the conditional convergence process at the mesoregional level, as in the case of municipalities and microregions. Nevertheless, for the case of mesoregions, the indirect effect of initial per capita income is positive but not significant, indicating a lack of spillover stemming from this variable. Moreover, the total effect of education is not significantly related to higher economic growth. The results for the education variable show that only the direct effect is significant, indicating once again that improving education at the regional level has a direct impact on economic growth. At the mesoregional level, there is no negative spillover effect of education.

The indirect effect of population density continues to driving the negative total effect of this variable. The higher population density of neighboring mesoregions negatively influences economic growth. The results also indicate that the coefficients of transportation cost and population growth are not related to economic growth at the mesoregional level.

5.4 Results at state level

The results presented in Table 6 confirm that growth convergence occurs at all geographic scales in Brazil. Interestingly, as in the case of mesoregions, there are no significant spillover effects from per capita income at state level. Indeed, Resende (2013) suggests that the diagnostics for spatial autocorrelation in the error terms using Moran’s I statistics in non-spatial panel models are not statistically significant at the state level in Brazil. This finding indicates that the spatial dependence is weaker at the mesoregional and state levels than at finer geographic scales such as municipalities and microregions. Spillovers are operating inside the borders of larger mesoregions and states.

At state level, the total effect of education on growth is also not statistically significant. There is a positive and significant direct effect of education on growth and an opposite negative indirect effect of education on growth. The negative effect of population density on growth is also driven by the indirect effect of this variable. Higher population density of neighboring states negatively influences economic growth.

6 Discussion

This section discusses the results of economic growth regressions estimated at four geographic scales (MCAs, microregions, mesoregions, and states) using spatial panel data methods controlling for fixed effects.

First, we note that the total effect of the coefficients of (log) initial income per capita is negative and statistically significant in all estimations and geographic scales. This negative correlation between the per capita income growth rate and the initial per capita income indicates conditional \(\beta \)-convergence. This effect is driven by the direct effect of initial income per capita for all geographic scales. Interestingly, the coefficients of the indirect effect are positive and suggest positive spillovers stemming from income per capita level. This effect is significant only for municipalities and microregions, indicating that spillovers of income level occur mainly at finer geographic scales. In other words, spillovers occur inside mesoregions and states. These results support the arguments of new economic geography models that consider that spatial dependence in per capita income might be associated with increasing returns to scale characteristics. The positive coefficient of the indirect effect of per capita income means that regions with the same parameters can have different growth rates if neighboring regions have different levels of per capita income. This result can also be interpreted as a sign that there are spatial externalities stemming from physical capital as noted by López-Bazo et al. (2004). An alternative interpretation is that some of the spillovers could have been caused by pecuniary externalities present in models of new economic geography (e.g. Krugman 1991). These results confirm indications from previous research on Brazil that suggests positive spillover effects from per capita income (e.g., Cravo et al. 2015). However, our work provides for the first time, estimations that properly disentangle direct and indirect effects in the context of panel growth regressions to provide more reliable results about the spillover effects.

Interestingly, the results suggest that human capital has a direct effect and a negative spillover effect on growth. The direct effect of the average-year-of-schooling coefficient inflates as more aggregate data is used. For instance, using the spatial lag model, the years-of-schooling coefficient is 0.0013 at the MCA (municipality) level, 0.0015 at the microregional level, 0.0013 at the mesoregional level and 0.04 at the state level. This might suggest the strength of the spatial interactions across individuals within regions, a phenomenon coined as the “social multiplier” effect by Glaeser et al. (2003). The larger the geographic unit, the stronger this effect. On the other hand, the indirect effect provides support to Olejnik (2008) and Cravo et al. (2015) who argue that the level of human capital in neighboring regions may have a negative effect on the level of per capita income in a given region. A reduction in the level of human capital in a region is caused mainly by migration of the educated population to neighboring regions. This reduction in human capital negatively affects economic growth. This is in accordance with the argument linked to new economic geography models, where more skilled labor is an important factor that constitutes a centripetal force toward geographic concentration (e.g., Krugman 1999). Despite the indication that the total effect of human capital is not positively related to economic growth due to negative spillover effects, the direct effect reinforces the need for localized investments in human capital.

In all cases, the coefficients of the total effect of population growth are not statistically significant at the 5 % level. The population growth coefficient likely becomes statistically insignificant because of a balance between countervailing behavior effects of fertility, mortality, and migration. The indirect effect at municipality level suggests negative spillover stemming from population growth; having neighbors with higher population growth is harmful to local economic growth. This is in line with new economic geography models (e.g., Krugman 1999), which demonstrate a tendency for population to concentrate in a few cities. The negative spillover effect from population density in all estimations is also a sign that population concentrates in a few places.

The coefficients of the total effect of population density are negative and statistically significant at all spatial scales. These results are contrary to the argument that agglomeration effects are beneficial to economic growth because the negative signs of the population density coefficients mean that more highly populated areas are harmful to economic growth, demonstrating that congestion effects might explain this negative effect for the analyzed period (1970–2000).

It is worth noting that when panel data with fixed effects are adopted in economic growth analyses, it creates a bridge between development economics and the neoclassical empirics of growth, because this framework allows for unobservable differences in the production function and focuses attention on all the tangible and intangible factors (e.g., institutional characteristics) that may enter into its respective individual effect. Islam (1995) argues that persistent differences in technology level and, for instance, institutions are important factors in understanding economic growth across regions. When these variables are included in the regressions in the form of fixed effects, the convergence process occurs at a faster rate.Footnote 21

Herein, when the spatial distribution of these fixed effect terms is analyzed across the four geographic scales (see Fig. 2 in “Appendix 3”)Footnote 22 we observe a clustering of high values in the South, Southeast and Central-West of Brazil at the MCA spatial scale, for instance. This fact suggests that fixed effects are really capturing a higher level of, for example, technology and institutions in these regions, which are the most developed areas in Brazil, generating higher growth rates in the analyzed period. However, the spatial distribution of the fixed effects shows some variation across spatial scales. If we observe the fixed effect at the MCAs within each state, we clearly find such variability. For instance, we may conclude that the state of São Paulo presents a higher fixed effect—which may be interpreted as good institutions—that generates higher growth rates. However, we need to bear in mind that within this state we have MCAs (municipalities) that present values for fixed effects as low as those seen in MCAs in the North and Northeast regions where we observe the clustering of low fixed effects values.

Furthermore, the evidence of conditional convergence using the fixed effects approach may lead us to conclude that the club convergence hypothesisFootnote 23 cannot be ruled out. Indeed, there is growing evidence that the club convergence hypothesis is the correct one for the Brazilian case. Classifying regions into similar groups (or clubs) has been the approach adopted in recent studies (Andrade et al. 2004; Laurini et al. 2005; Coelho and Figueiredo 2007; Cravo 2010; Resende 2011; Cravo and Resende 2013; Cravo et al. 2015). Moreover, the variability of conditional \(\beta \)-convergence coefficients due to the geographic scale of analysis seems to be small using fixed effects models. It is worth noting that higher rates of convergence at the MCA level suggest that municipalities are more open economies (Barro et al. 1995) than more aggregated regions such as mesoregions. For this reason, MCAs present faster convergence rates towards their own state-steady levels of income per capita.

Finally, the evidence collected from spatial spillover coefficients shows that their magnitudes vary according to the spatial scale under analysis. In the SDM specification, the spatial lag for the dependent variable \((\lambda )\) presents positive and statistically significant coefficients at the MCA (0.0744), microregional (0.6188) and mesoregional (0.4310) levels (last column of Tables 2, 8, 9 and 10). On the other hand, at state level such coefficient is no longer statistically significant suggesting that spatial spillovers are bounded in space, as found in Resende (2011). In the growth model proposed by Ertur and Koch (2007), this spatial autoregressive parameter can be interpreted as the magnitude of interregional spillovers stemming from technological spatial interdependence. According to this model, the results suggest that technological spillovers are bounded within state borders. Moreover, as pointed out earlier, the mechanisms that might explain the spatial interactions among regions may be related to nuisance or substantive arguments. The results suggest that both mechanisms may be the origin of the spatial linkages observed in this empirical exercise. This model can be supported by theoretical spatial growth model such as those developed by López-Bazo et al. (2004), Ertur and Koch (2007) and Sardadvar (2012). For instance, spatial Solow growth models demonstrate that regional spillovers of the diffusion of technology across regions are caused by the spatial dimension of investments in physical and human capital (López-Bazo et al. (2004). However, it is important to note that the correct identification of the most appropriate empirical spatial model is still a challenging issue to be addressed by the spatial econometric literature [see, for instance, Partridge et al. (2012) and Gibbons and Overman (2012)].

7 Conclusions

The goal of this paper was to analyze the results of regional economic growth estimates at multiple spatial scales using spatial panel data models. The spatial scales examined were minimum comparable areas, microregions, mesoregions and states between 1970 and 2000. Spatial panel data models with fixed effects that estimate the direct, indirect, and total effects of regression coefficients were systematically estimated across those spatial scales to demonstrate that the estimated coefficients change with the scale level.

Spillovers stemming from per capita income level and its growth are stronger at the finer geographic scales of municipalities and microregions, suggesting that spatial spillovers are bounded in space. The total effect of the average-years-of-schooling coefficient is not significant in all spatial scales. However, the direct effect is positive and increases as more aggregate spatial scales are used. Noticeably, there is an indication of negative human capital spillovers. These findings reinforce the need for localized investments in human capital and suggest regional competition for human capital. Qualified workers seem to migrate to regions with better labor market conditions.

In all cases, the coefficients of the total effect of population growth are not statistically significant. The population growth coefficient likely becomes statistically insignificant because of a balance between countervailing behavior effects of fertility, mortality and migration. The indirect effect at the municipality level suggests a negative spillover stemming from population growth; having neighbors with higher population growth is harmful to local economic growth.

Interestingly, the fixed effects used in the spatial models allowed differences in the aggregate production function focusing attention on all the tangible and intangible fixed effects that underlie much of the discussion of development economics. Improvements in unobserved fixed factors (e.g., institutions) produced positive effects on growth rates at the four spatial levels. The spatial distribution of these fixed effect terms is clustered across space and indicates that there are differences in the convergence processes between the north and south in Brazil.

In sum, the empirical evidence in this paper raises some public policy issues. The indication of spatial spillover from income level and its growth, especially at municipality and microregional levels, suggests that it would be desirable for economic growth policy to be coordinated with a broader regional focus in order to explore possible income and technology externalities. The negative spillover effect of human capital should not discourage local authorities from investing in human capital. The results, indeed, encourage local human capital investment, as the direct effect is positive. Particularly, state governments should pay particular attention to investments in human capital as a result of possible stronger “social multiplier effects” at state level. Finally, fixed effect estimations are in line with the argument that policy makers should improve institutional settings to promote regional economic growth. Our results indicate that this multiscalar approach provides better insights to explain regional economic growth process.

Notes

MAUP is associated with the uncertainties between choice of an alternative number of zones (or zoning systems) and the implications that this holds for spatial analysis (Openshaw and Taylor 1981).

Of note, Ávila and Monastério (2008) analyze MAUP on per capita income convergence process in the Rio Grande do Sul state in Brazil using two geographic scales (municipalities and “Conselhos Regionais de Desenvolvimento”/COREDEs).

All different spatial scales are used in the decision-making process in Brazil. States and municipalities have elected officials and are self-governed. Microregions and mesoregions are administrative regions effectively used by states and federal government for planning and policy making. For instance, the new National Policy of Regional Development of the Ministry of National Integration sets many of its goals at the microregional level.

“Drawing on the central argument of the ‘new economic geography’ literature, growth in any region is influenced by its ability to access large markets (Krugman 1995; Venables 1998). These economies are not a function of the size of a specific industry but of the overall size of the agglomeration. Thus, competitive enterprises accessing larger markets can enhance productivity. In addition to market size, agglomeration benefits potentially include access to specialized services (banking and finance), interindustry linkages, physical and economic infrastructure, and a larger medium for information exchange. Limiting the scope of the analysis to administrative units without considering the economic agglomeration (to which the region may belong) and the effects of market access are likely to limit the scope of the analysis” (Lall and Shalizi 2003: 664).

“For technological externalities, innovations in one region are adopted in neighboring regions through diffusion, thereby creating convergence in production processes and linkages in development outcomes. In Marshall (1920) terminology, diffusion is spatially localized and does not extend to all locations. The second source of Marshallian agglomeration is labor market pooling, where production units in one region can gain access to a shared pool of labor in the larger regional economy” (Lall and Shalizi 2003: 664).

Partridge et al. (2012: 170) further explain: “Gibbons and Overman argue that their preferred starting point is natural experiments that use geographical, institutional, or historic factors to identify causality. While natural experimental approaches raise their own problems of only assessing ‘cute’ experiments or searching for valid instruments, Gibbons and Overman argue that identification is more transparent and less prone to the errors we described above.”

We adapt previous R-language spatial functions to produce the correct direct and indirect effect estimates.

More precisely, there are 26 states and one federal district.

The income per capita growth rates are averaged over 10 years because MCA data are only available from the Brazilian population censuses conducted every 10 years. Furthermore, given the presence of business cycle effects, the choice of 10-year growth averages seems to be a reasonable approach to avoid those influences (Caselli et al. 1996). For instance, the 1973 and 1979 “oil price shocks” affected the Brazilian economy. In 1994, Brazil launched the “Plano Real” (Real Plan), the stabilization program that ended a long period of high inflation rates that had started in the 1970s.

Population growth is adjusted for depreciation \((\delta )\) and technological growth (g), under the usual assumption that \(\delta +{g}\) equals 0.05 (e.g., Mankiw et al. 1992). The natural log of this variable is not taken due to the presence of negative values.

The random effects models assume that the regional individual effects are uncorrelated with the error terms, whereas for the fixed effect models, this correlation need not be null. To test whether the zero correlation assumption is valid, so that we can rely on the random effects estimation results, we can resort to the spatial Hausman test, discussed in Mutl and Pfaermayr (2011). The results for the spatial Hausman test, considering an underlying model with both spatial lag \((\lambda \ne 0)\) and error spatial dependence \((\rho \ne 0)\), rejected the null hypothesis that both fixed effects and random effects models are equivalent, with a p value smaller than 1.0e–10 indicating that the fixed effects model is more appropriate.

Durlauf et al. (2005) explain that standard random effects estimators require that the individual effects are distributed independently of the explanatory variables, and this requirement is clearly violated for a dynamic panel by construction given the dependence of log initial period level of the dependent variable on individual effects.

Sardadvar (2012) develops a spatial neoclassical growth model explaining these results.

Islam (1995) explains the faster convergence rate in the FE framework compared with the pooled OLS approach, arguing that in the latter approach (or in the framework of single cross-section regression) the technology variable, A(0), being unobservable or unmeasurable, is left out of the equation (or incorporated in the error term): “[t]his actually creates an omitted variable problem. Since this omitted variable is correlated with the included explanatory variables, it causes the estimates of the coefficients of these variables to be biased. The direction of bias can be assessed from the standard formula for omitted variable bias. The partial correlation between A(0) and the initial value of y (income per capita) is likely to be positive, and the expected sign of the A(0) term in the full regression, (...), is also positive. Thus, the estimated coefficient of \(y_i,t-1\), is biased upward. (...) This explains why we get lower convergence rates from single cross-section regressions and pooled regressions that ignore correlated individual country effects” Islam (1995: 1147).

These fixed effects come from the Spatial Durbin Model (SDM). The spatial distribution of fixed effects using other spatial models is very similar, and for this reason, they are not shown here.

See Ertur et al. (2006).

References

Andrade E, Laurini M, Madalozzo R, Pereira P (2004) Convergence clubs among Brazilian municipalities. Econ Lett 83:179–184

Anselin L (1988) Spatial econometrics: methods and models. Kluwer Academic Publisher, Dordrecht

Anselin L, le Gallo J, Jayet H (2008) Spatial panel econometrics. In: Mátyás L, Sevestre P (eds) The econometrics of panel data: fundamentals and recent developments in theory and practice. Kluwer, Dordrecht, pp 627–662

Arbia G, Petrarca F (2011) Effects of MAUP on spatial econometric models. Lett Spat Resour Sci 4:173–185

Ávila RP, Monastério LM (2008) MAUP e a análise espacial: Um estudo de caso para o Rio Grande do Sul. Anál Econ (UFRGS) 26:239–265

Azzoni CR (2001) Economic growth and regional income inequality in Brazil. Ann Reg Sci 35:133–152

Baldwin R, Forslid R (2000) The core-periphery model and endogenous growth: stabilizing and destabilizing integration. Economica 67:307–324

Baldwin R, Forslid R, Martin P, Ottaviano G, Robert-Nicoud F (2003) Economic geography and public policy. Princeton University Press, Princeton, N.J

Baltagi BH (2008) Econometric analysis of panel data, 4th edn. Wiley, New York

Baltagi BH, Pirotte A (2010) Panel data inference under spatial dependence. Econ Model 27(6):1368–1381

Baltagi BH, Song SH, Koh W (2003) Testing panel data regression models with spatial error correlation. J Econ 117:123–150

Barro R, Mankiw G, Sala-I-Martin X (1995) Capital mobility in neoclassical models of growth. Am Econ Rev 85(1):103–115

Barro R, Sala-I-Martin X (2003) Economic growth, 2nd edn. MIT, Cambridge

Behrens K, Thisse JF (2007) Regional economics: a new economic geography perspective. Reg Sci Urban Econ 37:457–465

Briant A, Combes PP, Lafourcade M (2010) Dots to boxes: do the size and shape of spatial units jeopardize economic geography estimations? J Urban Econ 67:287–302

Brueckner JK (1998) J Urban Econ. Testing for strategic interaction among local governments: the case of growth controls 44:438–467

Caselli F, Esquivel G, Lefort F (1996) Reopening the convergence debate: a new look at cross country growth empirics. J Econ Growth 1(3):363–389

Coelho RLP, Figueiredo L (2007) Uma análise da hipótese da convergência para os municípios Brasileiros. Rev Bras Econ 61:331–352

Conley T (1999) GMM estimation with cross-sectional dependence. J Econ 92(1):1–45

Corrado L, Fingleton B (2012) Where is the economics in spatial econometrics? J Reg Sci 52(2):210–239

Cravo TA (2010) SMEs and economic growth in the Brazilian micro-regions. Pap Reg Sci 89:711–734

Cravo T, Resende GM (2013) Economic growth in Brazil: a spatial filtering approach. Ann Reg Sci 50(2):555–575

Cravo T, Becker B, Gourlay A (2015) Regional growth and SMEs in Brazil: a spatial panel approach. Reg Stud 49(12):1995–2016

Da Mata D, Deichmann U, Henderson JV, Lall SV, Wang HG (2007a) Determinants of city growth in Brazil. J Urban Econ 62:252–272

Durlauf SN, Johnson PA, Temple JRW (2005) Growth econometrics. In: Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier, Amsterdam

Easterly W, Levine R (1998) Troubles with the neighbours: Africa’s problems, Africa’s opportunity. J Afr Econ 7:120–142

Elhorst JP (2010) Spatial panel data models. In: Fischer M, Getis A (eds) Handbook of applied spatial analysis. Springer, Berlin, Heidelberg and New York, pp 377–407

Elhorst JP (2012) Dynamic spatial panels: models, methods, and inferences. J Geogr Syst 14:5–28

Elhorst JP, Piras G, Arbia G (2010) Growth and convergence in a multi-regional model with space–time dynamics. Geogr Anal 42(3):338–355

Ertur C, Le Gallo J, Baumont C (2006) The European regional convergence process, 1980–1995: do spatial regimes and spatial dependence matter?. Int Reg Sci Rev 29:3–34

Ertur C, Koch W (2007) Growth, technological interdependence and spatial externalities: theory and evidence. J Appl Econ 22:1033–1062

Fingleton B (1999) Estimates of time to economic convergence: an analysis of regions of the European Union. Int Reg Sci Rev 22:3–34

Fingleton B (2011) The empirical performance of the NEG with reference to small areas. J Econ Geogr 11:267–279

Fingleton B, López-Bazo E (2006) Empirical growth models with spatial effects. Pap Reg Sci 85:177–198

Fischer M (2011) A spatial Mankiw–Romer–Weil model: theory and evidence. Ann Reg Sci 47(2):419–436

Fischer M, Scherngell T, Reismann M (2009) Knowledge spillovers and total factor productivity: evidence using a spatial panel data model. Geogr Anal 41(2):204–220

Foote CL (2007) Space and time in macroeconomic panel data: young workers and state-level unemployment revisited. Working Paper No. 07-10. Federal Reserve Bank of Boston

Fujita M, Krugman P, Venables A (1999) The spatial economy. MIT, Cambridge

Gamboa ORE (2010) The (un)lucky neighbour: differences in export performance across Mexico’s states. Pap Reg Sci 89(4):777–799

Gérard M, Jayet H, Paty S (2010) Tax interactions among Belgian municipalities: do interregional differences matter? Reg Sci Urban Econ 40:336–342

Gibbons S, Overman H (2012) Mostly pointless spatial econometrics? J Reg Sci 52:172–191

Glaeser EL, Sacerdote BI, Scheinkman JA (2003) The social multiplier. J Eur Econ Assoc 1(2–3):345–353

IBGE (2011) Division into regions. Instituto Brasileiro de Geografia e Estatística. http://www.ibge.gov.br/english/geociencias/geografia/default_div_int.shtm. Accessed on 10 Jan 2011

IPEADATA. Dados macroeconômicos e regionais. http://www.ipeadata.gov.br

Islam N (1995) Growth empirics: a panel data approach. Q J Econ 110(4):1127–1170

Jeanty P, Partridge M, Irwin E (2010) Estimation of a spatial simultaneous equation model of population migration and housing price dynamics. Reg Sci Urban Econ 40:343–352

Kapoor M, Kelejian HH, Prucha IR (2007) Panel data model with spatially correlated error components. J Econ 140(1):97–130

Keller W, Shiue CH (2007) The origin of spatial interaction. J Econ 140:304–332

Krugman P (1991) Increasing returns and economic geography. J Pol Econ 99:483–499

Krugman P (1995) Development, geography, and economic theory. MIT Press, Cambridge

Krugman P (1999) The role of geography in development. Int Reg Sci Rev 22:142–161

Lafourcade M, Thisse J (2008) New economic geography: a guide to transport analysis. PSE Working Papers 2008-02. PSE. Ecole normale supérieure

Lall SV, Shalizi Z (2003) Location and growth in the Brazilian Northeast. J Reg Sci 43:663–681

Laurini M, Andrade E, Valls P (2005) Income convergence clubs for Brazilian Municipalities: a non-parametric analysis. Appl Econ 37(18):2099–2118

Lee L, Yu J (2010) Some recent developments in spatial panel data models. Reg Sci Urban Econ 40:255–271

Lesage JP (1999) Spatial econometrics. The Web Book of Regional Science, Regional Research Institute, West Virginia University, Morgantown, WV. http://www.rri.wvu.edu/WebBook/LeSage/spatial/spatial.html

Lesage JP, Fischer MM (2008) Spatial growth regressions: model specification, estimation and interpretation. Spat Econ Anal 3(3):275

Lesage JP, Pace RK (2009) Introduction to spatial econometrics. Chapman and Hall/CRC Press, Boca Raton

López-Bazo E, Artís M, Vayá E (2004) Regional externalities and growth: evidence from European regions. J Reg Sci 44:43–73

Lucas R (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

Magrini S (2004) Regional (di)convergence. In: Henderson JV, Thisse JF (eds) Handbook of regional and urban economics, 1st edn, vol 4, chapter 62. Elsevier, North-Holland, pp 2741–2796

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107:407–437

Marshall A (1920) Principles of economics. MacMillan, London

Menon C (2012) The bright side of MAUP: defining new measures of industrial agglomeration. Pap Reg Sci 91(1):3–28

Millo G, Piras G (2012) splm: Spatial panel data models in R. J Stat Softw 47(1):1–38

Mutl J, Pfaermayr M (2011) The Hausman test in a Cliff and Ord panel model. Econom J 14:48–76

North D (1990) Institutions, institutional change and economic performance. Cambridge University Press, Cambridge

Oates WE (1999) An essay on fiscal federalism. J Econ Lit 37:1120–1149

Olejnik A (2008) Using the spatial autoregressively distributed lag model in assessing the regional convergence of per-capita income in the EU25. Pap Reg Sci 87:371–385

Openshaw S, Taylor PJ (1981) The modifiable areal unit problem. In: Wrigley N, Bennett R (eds) Quantitative geography: a british view. Routledge and Kegan, London

Ottaviano G, Pinelli D (2006) Market potential and productivity: evidence from Finnish regions. Reg Sci Urban Econ 36:636–657

Ottaviano G, Puga D (1998) Agglomeration in the global economy: a survey of the new economic geography. World Econ 21:707–731

Partridge MD, Boarnet M, Brakman S, Ottaviano G (2012) Introduction: whither spatial econometrics? J Reg Sci 52(2):167–171

Rauch J (1993) Productivity gains from geographic concentration of human capital: evidence from the cities. J Urban Econ 34(3):380–400

Reis EJ, Tafner P, Pimentel M, Medina M, Magalhaes K, Reiff LO, Serra RV (2005) O PIB dos municípios brasileiros: metodologia e estimativas—1970–1996. IPEA Discussion Paper No. 1064. Brasília

Resende GM (2011) Multiple dimensions of regional economic growth: the Brazilian case, 1991–2000. Pap Reg Sci 90(3):629–662

Resende GM (2013) Spatial dimensions of economic growth in Brazil. ISRN Econ. doi:10.1155/2013/398021

Resende GM, Cravo T (2014) What about regions in regional science? A convergence exercise using different geographic scales of european union. Econ Bull 34(3):1381–1395

Rey SJ, Montoury BD (1999) US regional income convergence: a spatial econometric perspective. Reg Stud 33:143–156

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Sardadvar S (2012) Growth and disparities in Europe: insights from a spatial growth model. Pap Reg Sci 91(2):257–274

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Venables A (1998) Localization of industry and trade performance. Oxf Rev Econ Policy 12:52–60

Yamamoto D (2008) Scales of regional income disparities in the USA, 1955–2003. J Econ Geogr 8:79–103

Acknowledgments

Errors and misunderstandings are, of course, the responsibility of the authors. The views set out in this article are those of the authors and do not necessarily reflect the official opinion of IPEA and UNU-WIDER.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Lagrange Multiplier tests

A summary of the LM tests at the MCA level are presented in Table 7 below. To test for the presence of individual regional effects, the tests are based on random effect models. The null hypothesis contain an assumption that \(\sigma _\mu ^2 = 0\). Nonetheless, if the null hypothesis is rejected, there is evidence against using a pooled regression estimator or some variation of it, accounting for spatial dependence.

The results indicate the presence of both regional individual effects and spatial correlation in the panel regression model. For tests (2) and (3), the resulting tests statistics had negative values, which may be due to the fact that these tests assume the absence of spatial correlation. In the same way, test (5) had a resulting p value very close to one, although the unstandardized version resulted in p value close to zero. In any case, tests (2), (3), (4) and (5) suffer from a lack of robustness, because they assume either absence of spatial correlation or absence of regional individual effects. Tests (6) and (7) are more robust tests, and they both indicated the presence of both effects (spatial correlation and idiosyncratic effects).

Appendix 2

Appendix 3

See Fig. 2.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Resende, G.M., de Carvalho, A.X.Y., Sakowski, P.A.M. et al. Evaluating multiple spatial dimensions of economic growth in Brazil using spatial panel data models. Ann Reg Sci 56, 1–31 (2016). https://doi.org/10.1007/s00168-015-0706-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-015-0706-9