Abstract

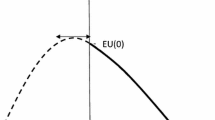

Will a more risk-averse individual spend more or less to improve probabilities, say on marketing efforts that enhance the chance of a sale? For any two payoffs and starting probabilities, the answer is unfortunately indeterminate. However, interpreting gambling as increasing small chances of good outcomes and insurance as reducing small chances of bad outcomes, the more risk-averse individual will pay less (more) to gamble (insure). We find a critical switching probability that depends on the individuals and outcomes involved. If the good outcome is less (more) likely than this critical value, the expenditures represent gambling (insurance).

Similar content being viewed by others

References

Arrow, Kenneth J. (1963). “Uncertainty and the Welfare Economics of Medical Care,” American Economic Review 53, 941–973.

Dionne, Georges and Louis, Eeckhoudt. (1985). “Self-Insurance, Self-Protection, and Increased Risk Aversion,” Economic Letters 17, 39–42.

Ehrlich, Isaac and Gary S., Becker. (1972). “Market Insurance, Self-Insurance, and Self-Protection,” Journal of Political Economy 80, 623–648.

Hirshleifer, Jack and John G. Riley. (1979). “The Analytics of Uncertainty and Information—An Expository Survey,” Journal of Economic Literature 17, 1375–1421.

McGuire, Martin C. (1988). “Alliance Protection Against National Emergency: Prevention, Preparedness, and Reciprocal Insurance,” mimeo, Department of Economics, University of Maryland.

McGuire, Martin C. and Hirofumi Shibata. (1988). “Protection of Domestic Industries vs. Defense Against Possible Disruptions: Some Neglected Dimensions,” Pew Working Paper, University of Maryland, May.

Pauly, Mark V. (1974). “Overinsurance and Public Provision of Insurance,” Quarterly Journal of Economics 88, 44–62.

Author information

Authors and Affiliations

Additional information

Zeckhauser's research was supported in part by the Bradley Foundation. After this work was essentially complete, we encountered working papers by George Sweeney and T. Randolph Beard of Vanderbilt University, titled “Self-Protection in the State-Independent Expected Utility Model,” and “Self-Protection, Risk Aversion, and Caution,” which address some of the issues in this article. A referee provided helpful comments.

Rights and permissions

About this article

Cite this article

McGuire, M., Pratt, J. & Zeckhauser, R. Paying to improve your chances: Gambling or insurance?. J Risk Uncertainty 4, 329–338 (1991). https://doi.org/10.1007/BF00056159

Issue Date:

DOI: https://doi.org/10.1007/BF00056159