Abstract

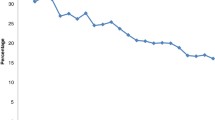

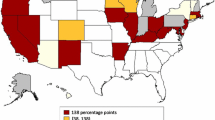

Using a multivariate framework, we analyze trends in employer provision of retiree health insurance (RHI), eligibility for new retirees, and retiree contributions. Data come for the Medical Expenditure Panel Survey—Insurance Component (MEPS-IC). While RHI provision to existing retirees decreased, eligibility for new retirees declined even more. Contribution requirements increased between 2000 and 2006 for retirees not yet eligible for Medicare (less than 65 years of age), but remained stable for those who were eligible (65 years of age or older). These results suggest growing financial instability for retirees.

Similar content being viewed by others

Notes

Despite its name, the insurance component of MEPS is actually an annual cross-sectional survey of establishments that are newly sampled each year.

Although the MEPS-IC was initially fielded in 1996, frequent changes in the RHI-related questions questionnaire affect the comparability of data over time. We therefore focus on the time period between 2000 and 2006, a period in which the questions remained stable.

In addition, this question was asked at the establishment level in 1997 and at the firm level in 1998. An establishment is a single physical location, while a firm (or company or enterprise) is comprised of all the establishments that operate under common ownership or control.

Although the information in the MEPS-IC is generally quite comprehensive, there are occasional cases where particular observations have missing data. In particular, we use the Census Bureau’s Longitudinal Business Database (LBD) to fill in firm age and industry.

Low wage is defined as less than $9.50 per hour in 2001-2003, less than $10.00 in 2004 and 2005, and less than $10.50 per hour in 2006.

While we see fewer older workers in businesses offering RHI from 2000 to 2006, we are concerned about the potential influence of the wording on the MEPS-IC questionnaire, which since 1998 has asked whether businesses “provide” RHI as a screener question for further data collection on RHI enrollment, eligibility, and contribution requirements. Conceivably, respondents interpret the term “provision” to mean that the business both offers RHI benefits, and that at least some workers take up this benefit. If this is how the question is interpreted, then businesses that provide RHI represent a subset of businesses that offer RHI. Zawacki (2006) reports some prima facie evidence for this claim, illustrating a sharp decline in the share of MEPS-IC establishments reporting RHI benefits between 1997 and 1998, the interval during which the questionnaire switched from screening based on eligibility to screening based on provision. Although we restrict our analysis to the post 2000 period, we are concerned about the phrasing of these questions because an even greater downward trend in offers might be masked if there is a simultaneous increase in the probability of taking up the benefit conditional on an offer (as would be the case, for example, if the share of retirees in the population is growing over time).

Both for early-retirees and Medicare-eligible retirees, we observe a decline in retiree contribution shares between 2000 and 2001. This decline could be related to a minor change in the wording of the questions between 2000 and 2001. Specifically, after 2001, the MEPS-IC question explicitly excluded COBRA coverage as a form of retiree health insurance.

References

Agency for Healthcare Research and Quality (2000) Medical expenditure panel survey—Table compendium. August 2003, Rockville, MD. http://www.meps.ahrq.gov

Banthin JS, Bernard DM (2006) Changes in financial burdens for health care: national estimates for the population younger than 65 years, 1996–2003. JAMA 296(22):2712–2719

Blau DM, Gilleskie DB (2001) Retiree health insurance and the labor force behavior of older men. Rev Econ Stat 83(1):64–80

Born P, Zawacki A (2006) Manufacturing firms’ decisions regarding retiree health insurance. Benefits Q 22(1):34–44

Buchmueller TC, DiNardo J, Valletta RG (2002) Union effects on health insurance provision and coverage in the United States. Ind Labor Relat Rev 55(4):610–627

Buchmueller TC, Johnson RW, LoSasso AT (2006) Trends in retiree health insurance, 1997–2003. Health Aff 25(6):1507–1516

Bundorf MK (2002) Employee demand for health insurance and employer health plan choices. J Health Econ 21:65–88

Bureau of Labor Statistics (2005) 2004–14 Employment Projections. U.S. Department of Labor New Release number USDL-05-2276, December 7, 2005. http://www.bls.gov/news.release/ecopro.nr0.htm (accessed August 28, 2006)

Bureau of Labor Statistics (2006) Union Members in 2005. U.S. Department of Labor news release number USDL-06-99, January 20, 2006. http://www.bls.gov/news.release/pdf/union2.pdf (accessed August 28, 2006)

Clark RL, Ghent LS, Headen AE (1994) Retiree health insurance and pension coverage: variations by firm characteristics. Journal of Gerontology 49(2):S53–S61

Gabel J, McDevitt R, Gandolfo L, Pickreign J, Hawkins S, Fahlman C (2006) Generosity and adjusted premiums in job-based insurance: Hawaii is up, Wyoming is down. Health Aff 25(3):832–843

Gruber J, Madrian BC (1993) Health insurance and early retirement: evidence from the availability of continuation coverage. NBER Working Paper #4594

Fronstin P (2005) The impact of the erosion of retiree health benefits on workers and retirees. Employee Benefit Research Institute (EBRI) Issue Brief, No. 279, March, 2005

Johnson RW, Davidoff AJ, Perese K (2003) Health insurance costs and early retirement decisions. Ind Labor Relat Rev 56(4):716–729

Kaiser Family Foundation and Hewitt Associates (2004) Current trends and future outlook for retiree health benefits: findings from the Kaiser/Hewitt 2004 Survey on Retiree Health Benefits. http://www.kff.org/medicare/7194/index.cfm (accessed October 11, 2006)

Kaiser Family Foundation and Health Research and Educational Trust (2006) Employer health benefits 2006 annual survey. http://www.kff.org/insurance/7527/upload/7527.pdf (accessed October 11, 2006)

Karoly LA, Rogowski JA (1994) The effect of access to post-retirement health insurance on the decision to retire early. Ind Labor Relat Rev 48(1):103–123

Lazear EP (1986) Retirement from the labor force. In: Ashenfelter O, Layarad R (eds) Handbook of industrial and labor relations, vol. 1, chapter 5, pp. 305–355

Levy H (2002) The economic consequences of being uninsured. ERIU Working paper 12, October 2002

Maxfield M, Achman L, Cook A (2006) National estimates of mental health insurance benefits. DHHS Pub No. (SMA) 04-3872. Rockville, MD: Center for Mental Health Services, Substance Abuse and Mental Health Services Administration, 2004. (GAO study as well).

McArdle FB, Neuman P, Kitchman M, Kirland K, Yamamoto D (2004) Large firms’ retiree health benefits before medicare reform: 2003 survey results. Health Aff (web exclusive), January 14, 2004

McCormack LA, Gabel JR, Berkman ND, Whitmore H, Hutchison KB, Anderson WL, Pickreign J, West N (2002) Retiree health insurance: recent trends and tomorrow’s prospects. Health Care Financ Rev 23(3):17–34

Mittelstaedt HF, Nichols WD, Regier PR (1995) SFAS and benefit reductions in employer-sponsored retiree health care plans. Account Rev 70(4):535–556

Papke Leslie E, Wooldridge JM (1996) Econometric methods for fractional response variables with an application to 401(k) plan participation rates. J Appl Econ 11(6):619–632

Rogowski J, Karoly L (2000) Health insurance and retirement behavior: evidence from the health and retirement survey. J Health Econ 19(4):529–539

U.S. Census Bureau (2000) Projections of the total resident population by 5-year age groups, and sex with special age categories: middle series, 2011 to 2015. National Population Projections, Summary Files (consistent with 1990 Census). http://www.census.gov/population/projections/nation/summary/np-t3-d.txt (accessed August 29, 2006)

U.S. Census Bureau (2005) Table HINC-02, “Age of householder-households, by total money income in 2004, type of household, race, and hispanic origin of householder”. Current Population Survey, 2005 Annual Social and Economic Supplement. http://pubdb3.census.gov/macro/032005/hhinc/new02_001.htm (accessed August 28, 2006)

U.S. Government Accountability Office (GAO) (2001) Retiree health benefits: employer-sponsored benefits may be vulnerable to further erosion. GAO-01-374, May 2001

U.S. Government Accountability Office (GAO) (2005) Retiree health benefits: options for employment based prescription drug benefits. GAO-05-205, February 2005

Zawacki A (2006) Using the MEPS-IC to study retiree health insurance. U.S. Census Bureau, Center for Economic Studies Working Paper Series, CES 06-13

Acknowledgments

Any views, findings, or opinions expressed in this paper are those of the authors and do not necessarily reflect those of the U.S. Census Bureau. This work is unofficial and thus has not undergone the review accorded official Census Bureau publications. The authors thank Carole Roan Gresenz and M. Susan Marquis for invaluable guidance in developing this project, and Randy Becker for numerous insightful comments on a preliminary draft. We also thank Arnold Reznek, Anurag Singal, and Ann Schatzer for support at the Census Bureau’s Research Data Center. This research was funded by the U.S. Department of Labor.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zawacki, A.M., Eibner, C. & Zimmerman, E.M. Older Workers’ Access to Employer-Sponsored Retiree Health Insurance, 2000–2006. J Labor Res 30, 350–364 (2009). https://doi.org/10.1007/s12122-009-9070-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12122-009-9070-9