Abstract

Under an artificial stock market composed of bounded-rational and heterogeneous traders, this paper examines whether or not price limits generate the negative effects on the market. Through testing the volatility spillover hypothesis, the delayed price discovery hypothesis, and the trading interference hypothesis, we find that no evidence of volatility spillover is observed. However, the phenomena of delayed price discovery and trading interference indeed exist, and their significance depends on the level of the price limits.

Similar content being viewed by others

Notes

Actually, our model is a variant of the TASM. It is written in C\(++\) on the Borland C\(++\) Builder 6, and is built from the perspective of object-oriented programming (OOP). In addition, the DA mechanism is employed to determine market prices, while a simple price adjustment scheme which is purely based on the excess demand is considered in the previous version of the TASM.

The value of \(K\) can be set as 1, 12, 52, and 250 when the trading periods are a year, month, week, and day, respectively.

Unlike Arthur et al. (1997) and LeBaron et al. (1999), traders in our model are not presumed to have any idea about the stock’s fundamental value. Directly deriving \(E_{i,t}(\cdot )\) by the GP may lead the price dynamics quite volatile. Therefore, we confine the expectations formation to an appropriate range that may be perceived as some sort of prior knowledge.

With this kind of functional form, the traders are still able to take a chance on the martingale hypothesis when \(f_{i,t}=0\). A similar functional form with the same motif is also employed in Chen and Yeh (2001).

Our software code is currently provided on the web: http://comp-int.mis.yzu.edu.tw/faculty/yeh/software/. The interested readers can freely download and test it.

In Anufriev and Panchenko (2009), market dynamics under different market mechanisms such as Walrasian auction, price- and order-driven trading protocols are examined. Pellizzari and Westerhoff (2009) investigate the effects of a transaction tax under a continuous double auction market and a dealership market.

The amount of \(\varDelta h\) is selected under the consideration of market size, i.e. the number of traders in the market. Of course, the quantities of each transaction may play an important role. In practice, each trader should also independently make a decision regarding how many shares of stock he would like to trade. Incorporating this factor into the trader’s decision may involve a new development that makes the modeling of traders’ behavior quite complicated. In addition, the results obtained in such a framework would be biased if the number of traders in our simulations were not so large, e.g. 100 in our simulations. However, the simulations with large market size, e.g. 500 or above, are quite time consuming. Due to the constraint on our current computational resources, it would not be practical for us to perform such large-scale simulations to examine this issue at the moment.

During the 1972–2008 period, the \(\alpha \) values of the Dow Jones Industrial Average Index (DJIA), Nasdaq Composite Index, and the S&P 500 are 3.74, 3.71, and 4.02, respectively.

During the 1972–2008 period, the Hurst exponents of the raw returns (absolute returns) of the DJIA, Nasdaq, and the S&P 500 are 0.53, 0.56, and 0.53 (0.96, 0.97, and 0.96), respectively.

In actual fact, we have examined the markets with larger price limits, such as 20 and 30 % price limits. We find that, even though the frequency of (locked) limit hits is quite low, traders’ heterogeneity, e.g. the standard deviations of reservation prices and expectations, is not the same as that in the market without price limits.

Of course, there are other patterns for the relationship between \([P^{R, L}, P^{R, U}]\) and \([P^{L}, P^{U}]\). However, according to our simulation results, approximately 99 % of all locked limit days belong to the case of \([P^{L}, P^{U}]\subset [P^{R, L}, P^{R, U}]\).

The ranges here are selected under the consideration that our market is not large enough. Excessively large ranges will make some traders significantly dominate the market dynamics. The purpose of maintaining the total shares of stock being 100 is to keep the fundamental value invariant.

Actually, we also conduct the simulations where traders’ initial shares of stock are uniformly distributed over [0, 5] with the constraint on the total shares of stock being 100, and initial amount of money is uniformly distributed over [100, 1000]. Most of the properties regarding the tests of the three hypotheses do not change.

References

Anufriev M, Panchenko V (2009) Asset prices, traders’ behavior and market design. J Econ Dyn Control 33:1073–1090

Arthur WB, Holland J, LeBaron B, Palmer R, Tayler P (1997) Asset pricing under endogenous expectations in an artificial stock market. In: Arthur WB, Durlauf S, Lane D (eds) The economy as an evolving complex system II. Addison-Wesley, Reading, pp 15–44

Brock WA, Hommes CH (1998) Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J Econ Dyn Control 22:1235–1274

Chen H (1998) Price limits, overreaction, and price resolution in futures markets. J Futur Mark 18:243–263

Chen SH, Yeh CH (2001) Evolving traders and the business school with genetic programming: a new architecture of the agent-based artificial stock market. J Econ Dyn Control 25:363–393

Chen SH, Yeh CH (2002) On the emergent properties of artificial stock markets: the efficient market hypothesis and the rational expectations hypothesis. J Econ Behav Organ 49:217–239

Chiarella C (1992) The dynamics of speculative behaviour. Ann Oper Res 37:101–123

Chiarella C, He XZ (2001) Asset pricing and wealth dynamics under heterogeneous expectations. Quant Finance 1:509–526

Chiarella C, He XZ (2002) Heterogeneous beliefs, risk and learning in a simple asset pricing model. Comput Econ 19:95–132

Chiarella C, He XZ (2003) Heterogeneous beliefs, risk and learning in a simple asset pricing model with a market maker. Macroecon Dyn 7:503–536

Chiarella C, Dieci R, Gardini L (2002) Speculative behaviour and complex asset price dynamics: a global analysis. J Econ Behav Organ 49:173–197

Chiarella C, Dieci R, Gardini L (2006) Asset price and wealth dynamics in a financial market with heterogeneous agents. J Econ Dyn Control 30:1755–1786

Chiarella C, Iori G (2002) A simulation analysis of the microstructure of double auction markets. Quant Finance 2:346–353

Chiarella C, Iori G, Perelló J (2009) The impact of heterogeneous trading rules on the limit order book and order flows. J Econ Dyn Control 33:525–537

Day R, Huang W (1990) Bulls, bears and market sheep. J Econ Behav Organ 14:299–329

Fama EF (1989) Perspectives on October 1987, or what did we learn from the crash? In: Kamphuis RW Jr, Kormendi RC, Henry Watson JW (eds) Black monday and the future of the financial markets. Irwin, Homewood, IL, pp 71–82

Gode DK, Sunder S (1993) Allocative efficiency of markets with zero-intelligence traders: market as a partial substitute for individual rationality. J Polit Econ 101:119–137

He XZ, Li Y (2007) Power-law behaviour, heterogeneity, and trend chasing. J Econ Dyn Control 31:3396–3426

Hill B (1975) A simple general approach to inference about the tail of a distribution. Ann Stat 3:1163–1173

Hommes CH (2001) Financial markets as nonlinear adaptive evolutionary systems. Quant Finance 1:149–167

Isaac RM, Plott CR (1981) Price controls and the behavior of auction markets: an experimental examination. Am Econ Rev 71:448–459

Kim KA, Rhee SG (1997) Price limit performance: evidence from the Tokyo stock exchange. J Finance 52:885–901

Kirman A (1991) Epidemics of opinion and speculative bubbles in financial markets. In: Taylor M (ed) Money and financial markets. Blackwell, Oxford, pp 354–368

Kirman A (2006) Heterogeneity in economics. J Econ Interact Coord 1:89–117

Kodres LE, O’Brien DP (1994) The existence of pareto-superior price limits. Am Econ Rev 84:919–932

Ladley D, Schenk-Hoppé KR (2009) Do stylised facts of order book markets need strategic behaviour? J Econ Dyn Control 33:817–831

LeBaron B (2000) Agent based computational finance: suggested readings and early research. J Econ Dyn Control 24:P679–702

LeBaron B (2001) A builder’s guide to agent-based financial markets. Quant Finance 1:254–261

LeBaron B (2006) Agent-based computational finance. In: Tesfatsion L, Judd KL (eds) Handbook of computational economics, vol 2. Elsevier, Amsterdam, pp 1187–1233

LeBaron B, Arthur WB, Palmer R (1999) Time series properties of an artificial stock market. J Econ Dyn Control 23:1487–1516

Lee SB, Kim KJ (1995) The effect of price limits on stock price volatility: empirical evidence in Korea. J Bus Finance Account 22:257–267

Lehmann BN (1989) Commentary: volatility, price resolution, and the effectiveness of price limits. J Financial Serv Res 3:205–209

Liu X, Gregor S, Yang J (2008) The effects of behavioral and structural assumptions in artificial stock market. Phys A 387:2535–2546

Lux T (1995) Herd behavior, bubbles and crashes. Econ J 105:881–896

Lux T (1997) Time variation of second moments from a noise trader/infection model. J Econ Dyn Control 22:1–38

Lux T (1998) The socio-economic dynamics of speculative markets: interacting agents, chaos, and the fat tails of return distributions. J Econ Behav Organ 33:143–165

Ma CK, Rao RP, Sears RS (1989) Limit moves and price resolution: the case of the treasury bond futures market. J Futur Mark 9:321–335

Mike S, Farmer JD (2008) An empirical behavioral model of liquidity and volatility. J Econ Dyn Control 32:200–234

Miller MH (1989) Commentary: volatility, price resolution, and the effectiveness of price limits. J Financial Serv Res 3:201–203

Pastore S, Ponta L, Cincotti S (2010) Heterogeneous information-based artificial stock market. N J Phys 12(053035)

Pellizzari P, Westerhoff F (2009) Some effects of transaction taxes under different microstructures. J Econ Behav Organ 72:850–863

Raberto M, Cincotti S, Focardi SM, Marchesi M (2001) Agent-based simulation of a financial market. Phys A 299:319–327

Smith E, Farmer JD, Gillemot L, Krishnamurthy S (2003) Statistical theory of the continuous double auction. Quant Finance 3:481–514

Tversky A, Kahneman D (1974) Judgement under uncertainty: heuristics and biases. Science 185:1124–1131

Westerhoff F (2003) Speculative markets and the effectiveness of price limits. J Econ Dyn Control 28:493–508

Westerhoff F (2006) Technical analysis based on price-volume signal and the power of trading breaks. Int J Theor Appl Finance 9:227–244

Westerhoff F (2008) The use of agent-based financial market models to test the effectiveness of regulatory policies. J Econ Stat 228:195–227

Yang J (2002) The efficiency of an artificial double auction stock market with neural learning agents. In: Chen SH (ed) Evolutionary computation in economics and finance. Physica-Verlag, Heidelberg, pp 85–105

Yeh CH (2007) The role of intelligence in time series properties. Comput Econ 30:95–123

Yeh CH (2008) The effects of intelligence on price discovery and market efficiency. J Econ Behav Organ 68:613–625

Yeh CH, Yang CY (2010) Examining the effectiveness of price limits in an artificial stock market. J Econ Dyn Control 34:2089–2108

Acknowledgments

The authors are grateful to the useful comments received from the editors and an anonymous referee. Research support from NSC Grant no. 97-2410-H-155-010 is also gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Different initial endowments for traders

Our simulations conducted above start with the same initial endowment for each trader, i.e. one share of stock and a hundred dollars in cash. To understand the effects of different initial endowments for traders, we further perform the simulations where traders’ initial shares of stock are uniformly distributed over [0, 2] with the constraint on the total shares of stock being 100, and initial amount of money is uniformly distributed over [100, 200].Footnote 13 The results regarding the tests of the three hypotheses are summarized in Tables 6, 7 and 8. Basically, the results are consistent with our previous findings. Endowing traders with heterogeneous amount of assets in the beginning of a run does not generate qualitatively different results.Footnote 14

Appendix B: Basic description regarding the implementation of GP

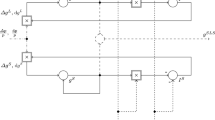

Typically, genetic programming is described as a parse tree structure that consists of terminals and functions. The elements in the terminal set are the available information and are usually composed of independent variables and constants. The functions in the function set are used to provide the functional relationship between the dependent variable and the terminals. Given the function set and terminal set, a population of randomly generated models is created. The population of models evolves via the genetic operators and according to the survival-of-the-fittest principle on which the design of the fitness function and the selection procedure are based.

The fitness function determines the performance of each model. Based on the fitness of each model, the selection procedure is employed to choose the candidate models to engage in the genetic operation. We adopt the tournament selection method by which two models are randomly selected (i.e. the tournament size is 2) from the current population of models, and the one with the better fit is chosen as the candidate model. The way new models are generated by our GP algorithm depends on one of the three operators: crossover, mutation, and immigration. Crossover is conducted by randomly and independently selecting one point in each of the two parental parse trees which are the candidates we selected, and then exchanging the parts below the selected points of these parents. Two offspring are then produced. Mutation is a process that gives rise to a random change in the subtree of the candidate model. Immigration is implemented by introducing a randomly created model.

Rights and permissions

About this article

Cite this article

Yeh, CH., Yang, CY. Do price limits hurt the market?. J Econ Interact Coord 8, 125–153 (2013). https://doi.org/10.1007/s11403-012-0107-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-012-0107-4