Abstract

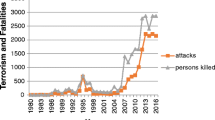

The study examines cointegration and causal relationship between FDI, terrorism and economic growth in Pakistan using quarterly frequencies for the period 1988–2010. For empirical analysis data is divided into two sub-periods i.e. pre 9/11 (1988–2001) and post 9/11 (2002–2010) periods. The results show that long run cointegration holds between FDI, terrorism and economic growth. Granger causality results indicate that there is bidirectional short and long run causality between economic growth and FDI for both sub-samples. These findings are supported by variance decomposition and impulse response analysis. The findings suggest applicability of modernization theory to explain FDI and economic growth relationship. The results also reveal that terrorism has a deteriorating impact on FDI.

Similar content being viewed by others

Notes

However, none of the time series should be I (2) as the calculated F-statistics cannot determine cointegration in this case.

ARDL bound testing procedure can also be specified by using \(\Delta \ln G_{t}\) and \(\Delta \ln TR_{t}\) as dependent variables. However, we have not presented these specifications to save space and given the fact that our interest is primarily in Eq. (6) only.

References

Abadie, A., & Gardeazabal, J. (2003). The economic costs of conflict: a case study of the Basque Country. American Economic Review, 93(1), 113–132.

Abadie, A., & Gardeazabal, J. (2008). Terrorism and the world economy. European Economic Review, 52(1), 1–27.

Adams, S. (2009). Foreign Direct Investment, domestic investment, and economic growth in Sub-Saharan Africa. Journal of Policy Modeling, 31(6), 939–949.

Agrawal, S. (2011). The Impact of Terrorism on Foreign Direct Investment: Which Sectors are More Vulnerable? CMC Senior Theses Paper 124

Bhagwati, J. N. (1978). Anatomy and consequences of exchange control regimes. Cambridge, MA: Ballinger Press for NBER.

Blomberg, S. B., & Hess, G. D. (2002). The temporal links between conflict and economic activity. Journal of Conflict Resolution, 46(1), 74–90.

Blomberg, S. B., Hess, G. D., & Weerapana, A. (2004). Economic conditions and terrorism. European Journal of Political Economy, 20(2), 463–478.

Blomberg, S. B., & Mody, A. (2005). How severely does violence deter international investment?. Working paper (01), Claremont McKenna College.

Buckelew, A. H. (1984). Terrorism and the american response. San Rafael, CA: Mira Academic Press.

Buckley, P. J., Clegg, J., Wang, C., & Cross, A. R. (2002). FDI, regional differences and economic growth: panel data evidence from China. Transnational Corporation, 11, 1–23.

Clemente, J., Montanes, A., & Reyes, M. (1998). Testing for a unit root in variables with a double change in the mean. Economics Letters, 59(2), 175–182.

De Mesquita, E. B. (2005). The quality of terror. American Journal of Political Science, 49(3), 515–530.

Enders, W., Sachsida, A., & Sandler, T. (2006). The Impact of transnational terrorism on US foreign direct investment. Political Research Quarterly, 59(4), 517–531.

Enders, W., & Sandler, T. (1996). Terrorism and foreign direct investment in Spain and Greece. Kyklos, 49(3), 331–352.

Engle, R. F., & Granger, C. W. J. (1987). Cointegration and error correction representation: Estimation and testing. Econometrica, 55(2), 251–276.

Feridun, M., & Sezgin, S. (2008). Regional under development and terrorism: The case of South Eastern Turkey. Defence and Peace Economics, 19, 225–233.

Granger, C. W., Bwo-Nung, H., & Chin-Wei, Y. (2000). A bivariate causality between stock prices and exchange rates: Evidence from recent Asian flu. Quarterly Review of Economics and Finance, 40, 337–354.

Gupta, S., Clements, B., Bhattacharya, R., & Chakravarti, S. (2004). Fiscal consequences of armed conflict and terrorism in low- and middle income countries. European Journal of Political Economy, 20, 403–421.

Ismail, A., & Amjad, S. (2014). Determinants of terrorism in Pakistan: An empirical investigation. Economic Modelling, 37, 320–331.

Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12(2), 231–254.

Johansen, S., & Juselies, K. (1990). Maximum likelihood estimation and inferences on cointegration. Oxford Bulletin of Economics and Statistics, 52(2), 169–210.

Llussá, F., & Tavares, J. (2007). The economics of terrorism: A synopsis. Economics of Peace and Security Journal, 2(1), 62–70.

Masih, A. M., & Masih, R. (1996). Energy consumption, real income and temporal causality: Results from a multi-country study based on cointegration and error-correction modelling techniques. Energy Economics, 18(3), 165–183.

Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics, 37(17), 1979–1990.

Narayan, P. K., & Narayan, S. (2005). Estimating income and price elasticities of imports for Fiji in a cointegration framework. Economic Modelling, 22(3), 423–438.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Pesaran, M. H., & Smith, R. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics, 68(1), 79–113.

Phillips, P. C. B., & Hansen, B. E. (1990). Statistical inference in instrumental variables regression with I(1) processes. Review of Economic Studies, 57(1), 99–125.

Saltz, I. S. (1992). The negative correlation between foreign direct investment and economic growth in the Third World: Theory and evidence. Rivista Internazionale di Scienze Economiche e Commerciali, 39(7), 617–633.

Shahbaz, M. (2013). Linkages between inflation, economic growth and terrorism in Pakistan. Economic Modelling, 32, 496–506.

Shahbaz, M., & Shabbir, M. S. (2012). Military spending and economic growth in Pakistan: New evidence from rolling window approach. Ekonomska istraživanja, 25(1), 144–159.

Shahbaz, M., Shabbir, M. S., Malik, M. N., & Wolters, M. E. (2013). An analysis of a causal relationship between economic growth and terrorism in Pakistan. Economic Modelling, 35, 21–29.

Wagner, D. (2006). The impact of terrorism on foreign direct investment. International Risk Management Institute

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Shahzad, S.J.H., Zakaria, M., Rehman, M.U. et al. Relationship Between FDI, Terrorism and Economic Growth in Pakistan: Pre and Post 9/11 Analysis. Soc Indic Res 127, 179–194 (2016). https://doi.org/10.1007/s11205-015-0950-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-015-0950-5