Abstract

We develop an endogenous-growth model in which we distinguish between inventors and innovators. This distinction implies that stronger protection of intellectual property rights has an inverted U-shaped effect on economic growth. Intellectual property rights protection attributes part of the rents of commercial exploitation to the inventor that would otherwise accrue to the entrepreneur. Stronger patent protection will therefore increase the incentive to do research and development (R&D) and generate new knowledge. This new knowledge has a positive effect on entrepreneurship, innovation, and growth. However, after some point, further strengthening of patent protection will reduce the returns to entrepreneurship sufficiently to reduce the overall growth rate.

Similar content being viewed by others

1 Introduction

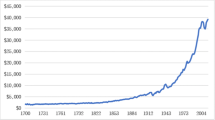

Reforms in the US patent system over the past few decades have caused an explosion in patent applications and grants (Gallini 2002; Jaffe and Lerner 2004). These reforms were aimed at strengthening the position of patent holders, and they were successful in increasing the productivity of research measured in patents. However, it has also been argued that the quality and importance of these patents have decreased and that the patent boom has not generated the economic growth that might have been expected (Jaffe and Lerner 2004). This has provoked a debate on the theoretical and empirical justifications for strengthening patent protection among policy-makers and academics.

The debate on patents is not new. In fact, for as long as patents have existed, scholars have debated the optimal length, strength, and breadth of protection. A strong rationale for more protection has been formalized in endogenous, innovation-driven growth models such as those put forth by Romer (1990), Aghion and Howitt (1992), Segerstrom et al. (1990), Grossman and Helpman (1991), Stokey (1995), and Young (1993). In these models knowledge creation drives economic growth in the long run. Consequently, intellectual property rights (IPR) protection is considered a key institution that allows inventors to market their inventions and thereby recover their costs. The logic in these models implies that stronger IPR protection stimulates investment in knowledge creation and consequently causes higher growth.

The empirical growth literature indeed strongly supports the notion that institutions in general (Barro 1996; Sala-I-Martin 1996; Acemoglu et al. 2001) and IPR protection in particular (Varsakelis 2001; Branstetter et al. 2006; Kanwar 2006; Allred and Park 2007) contribute to growth performance. However, this same literature does not support the premise that more and stronger protection is always better. Instead, evidence of an inverted-U-shaped relationship is growing (Gould and Gruben 1996), and some theoretical arguments for such a relationship have already been proposed; for example, Nordhaus (1969) pointed out that static efficiency losses need to be traded off against dynamic innovation gains, and several other mechanisms have been suggested in what one might label the patent literature.Footnote 1 This literature, however, relies largely on partial equilibrium modeling techniques. This makes it difficult to evaluate the importance of these mechanisms for overall economic growth and innovation. Analyzing the trade-offs in the context of general equilibrium, endogenous innovation-driven growth models is a recent research trajectory aimed at connecting these two literatures, and the area of focus in this paper.

Nordhaus’s arguments, for example, have been formalized in general equilibrium innovation-driven growth models by Kwan and Lai (2003) and Iwaisako and Futagami (2003). Both papers show that static losses can be weighed against dynamic gains, and thus, an optimum level of protection exists. Horii and Iwaisako (2007) and Furukawa (2007) focus on the reduced growth potential in an economy with more monopolized sectors. However, as O’Donoghue and Zweilmueller (2004) observe, little further analysis of the role of IPR protection in knowledge-driven general equilibrium models has been done.Footnote 2

While these models show that IPR protection can be too much of a good thing, they remain strongly committed to the assumption that patents provide economic incentives for innovation. They weigh static efficiency costs (that increase in the level of protection) against dynamic benefits of innovation (that remain constant or increase at a decreasing rate in the level of protection) to find an optimum. We present a model in which more protection can also reduce the rate of innovation in equilibrium.Footnote 3

Moreover, we argue that IPR protection cannot be understood in the context of existing modern general equilibrium endogenous growth models. Commercialization is, after all, assumed to be trivial. Innovation-driven endogenous growth models collapse the process of innovation, i.e., the subsequent generation, exploration, and exploitation of the knowledge that constitutes a commercial opportunity, into one rational decision that is entirely motivated by downstream commercial rents.

In this paper, we follow the knowledge spillover theory of entrepreneurship and stress the distinction between invention and innovation, as was suggested by Carlsson et al. (2009). Knowledge, created by inventors, spills over to the economy at large through commercialization and the activity of entrepreneurs and, once commercialized, helps future invention elsewhere.Footnote 4 This makes knowledge creation and commercialization dynamic complements in generating economic growth. We build on the same intuition presented in Michelacci (2003), who already suggested that knowledge creation and commercialization reinforce each other in the growth process. There, intuition was operationalized by modeling the matching of new ideas to entrepreneurs. More intensively searching entrepreneurs then also generate more invention, because there are more matches and that increases the ex ante expected returns to knowledge creation. We take this one step further by analyzing a direct knowledge spillover that makes R&D more productive as well.Footnote 5 Our contribution to the literature is to show that, even in the absence of matching, a relatively simple two-way knowledge spillover structure already generates qualitatively similar outcomes, and we do so in a standard endogenous growth framework.

Our model closely resembles the basic Romer (1990) variety expansion model. However, in our specification it is the entrepreneur who holds the residual claim to any monopoly rents that a new intermediate variety may generate once commercially introduced. In placing the entrepreneur center-stage, we bring back Schumpeter’s (1934) original assumption that knowledge creation and commercialization are two separate activities. Furthermore, entrepreneurs and not inventors are driven by the prospect of capturing commercial rents from an innovation. These rents are the entrepreneur’s reward for seeing the commercial potential, taking the risks, investing the resources, and organizing the production necessary for a new (intermediate) product or service. To our knowledge, we present the first general equilibrium endogenous growth model that explicitly separates invention from innovation and models the knowledge spillovers between the two activities.

To prevent our model from reverting to the exogenous Solow-esque “manna from heaven” models, we introduce an additional private economic incentive to generate new knowledge. This incentive in our model comes primarily from cost competition among final goods producers. They will invest resources in R&D to improve upon existing product lines, and we assume that, in the course of that activity, they generate knowledge that is of no direct commercial value to them. That knowledge, however, presents an opportunity for entrepreneurs, who are willing and able to take the risks to develop and commercialize it. An entrepreneur will do so when the expected (risk-adjusted) returns justify that investment. Without IPR protection, the knowledge spillover is costless and the investment is set equal to the wages foregone in engaging in the venture.

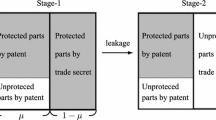

Patent protection then shifts rents from the entrepreneur to the inventor, and more patent protection reduces the incentives to commercialize new knowledge, as well as creates incentives to generate more. The latter mechanism is well understood. Our model now introduces an offsetting effect that explains why the relationship between innovation and IPR protection is not strictly positive. Consequently, there is an optimum level of protection that can be exceeded.

This question is highly relevant for modern knowledge-based economies. In a system without protection of intellectual property, invention may well be the bottleneck in the innovative cycle. Initially, patents were awarded to benefit royal favorites. When the connection between invention and exclusive property rights was introduced, it was an institutional revolution that helped spur invention and arguably paved the way for the Industrial Revolution.Footnote 6 So it is now the inventor, not the entrepreneur, who is allowed to establish legal ownership over an invention in current patent systems. We argue that a delicate balancing act is required once such a system is in place. In most Organisation for Economic Co-operation and Development (OECD) countries today, entrepreneurship and not invention seems to have become the bottleneck in the innovative process (Carlsson et al. 2010), and the balance may well be beyond the tipping point.

By enforcing patents more strictly and allowing inventors to patent much more easily, Jaffe and Lerner (2004) argue that the US patent system has now exceeded the optimum and that rents should be redistributed to the entrepreneurs. However, in their analysis, it is not the static efficiency losses from monopoly that offset the dynamic gains. They argue that strengthening IPR protection where it was already strong has actually hurt the innovation process by killing incentives to commercialize.Footnote 7 Our paper embeds their narrative in a well-established general equilibrium framework with endogenous innovation-driven growth and firm decision-theoretical microfoundations. Following Schumpeter (1934), our model also places the entrepreneur at the heart of growth theory.

The structure of this paper is as follows: We present our model in Sect. 2 and derive the equilibrium properties and implications of intellectual property rights protection in Sect. 3. In Sect. 4 we examine comparative statics and the impact of stronger patent protection. We conclude the paper in Sect. 5.

2 The basic model

2.1 Final consumption and production

The basic structure of our model follows Romer (1990) and is standard in the literature (see, for example, Barro and Sala-I-Martin 2004). First assume that consumers are infinitely lived and choose consumption, C, to maximize their lifetime utility. We follow the textbook case where direct utility is given by U = log(C(t)). Under the standard intertemporal budget constraint, where income can be spent on the consumption of final goods or the purchase of new bonds that yield a return, r(t), we obtain that in equilibrium \( \dot{C}(t)/C(t) = r(t) - \rho, \) where a dot represents a time derivative and ρ is the discount rate.Footnote 8

In final goods production a mass 1 of identical firms j is assumed to have the same constant returns to scale production function

where X j (t) is the output of final goods by producer j at time t, L Pj (t) is production labor that earns wage w P(t), and x j (i,t) is the quantity of intermediate i bought at price χ(i,t). All these quantities are flows. A j (t) represents the level of accumulated knowledge in the firm, and n(t) is the number of available varieties of intermediate goods at time t. These variables are stock variables. By employing specialized R&D labor, L Rj (t), that earns a wage w R(t), the firm’s knowledge base can be expanded according to

The presence of A j (t) reflects an intertemporal knowledge spillover. R&D is more productive when a large knowledge base has been developed in the past but at a decreasing rate. The presence of n(t) represents the positive spillover effect of more variety in intermediates on process R&D. With more variety in intermediates, the final goods-producing sector has more degrees of flexibility to organize the production process more efficiently and thereby generate more total factor-augmenting technical change for a given level of R&D effort. Alternatively, one can say that the relevant knowledge base for firm j’s R&D is assumed to be a Cobb–Douglas aggregate of public and private knowledge, proxied by n and A j , respectively. ψ is a scaling productivity parameter. We have chosen a linear specification in R&D labor, following Romer (1990).

A higher stock of relevant production knowledge already provides an incentive to employ R&D workers. However, in addition, we introduce the possibility to patent knowledge that is generated in the R&D process but not directly relevant to the firm itself. If these patents are licensed out, the total license income of the firm, Y j , depends on the profits that the licensees can generate, Π(t), on the strength of the relative bargaining position of licensor and licensee, ξ, and on the growth rate of the firm-specific knowledge base. We assume that license income is proportional to the rate of knowledge creation, relative bargaining power, and licensees’ profits and is given byFootnote 9

Assuming perfect competition in final goods production and normalizing the price of the final good to 1, all firms then choose L Pj (t), x j (i,t), and L Rj (t) to maximize the value function

As wages and prices as well as the number of intermediate varieties are given to the firm, the dynamic optimization problem has 2 + n control and 1 state variables. Dropping time arguments to save on notation and substituting for output, knowledge creation, and license income using Eqs. 1–3, this problem is characterized by the Hamiltonian

where the levels of employment, L Pj and L Rj , and intermediate use, x j (i), are control variables and the stock of firm-specific knowledge, A j , is the relevant state variable. The solution is therefore characterized by n + 5 first-order conditions. From the first-order conditions, we first obtain the standard Cobb–Douglas result that labor demand is given by

The total wage sum for production workers is then βX. For given employment levels, Eq. 4 shows that wages grow at the same rate as total output in equilibrium.Footnote 10 For intermediates the firm will choose the levels of each variety to satisfy n first-order conditions that yield isoelastic demand curves for each variety i by final goods producer j:

Multiplying (5) by χ(i) and summing over all varieties i shows that the total expenditure on intermediates by firm j is (1 − α − β)X j .Footnote 11 Together with the result on the wage costs, this implies that the final goods sector makes an operating profit of αX.

It can be verified that, at the value maximizing levels of employment and intermediate use, the firm’s output is proportional to its knowledge stock, A j (t).Footnote 12 Firms can therefore invest resources in R&D to increase output and operating profits. Moreover, the R&D generates license income if the knowledge generated is commercially valuable [Π(t) > 0] and the patent system allows patent owners to capture some of the rents from commercialization (ξ > 0). Intuitively, final goods producer will increase R&D activity as long as the discounted future benefits of doing so exceed the current labor costs at the margin. As R&D is a deterministic process in our model, the firms can decide to spend on R&D exactly up to that point. The solution is formally characterized by two first-order conditions, one transversality condition, and the law of motion for A j :Footnote 13

where the first condition implies that firms will hire R&D labor until the marginal cost, w R, equals the sum of the discounted present value of marginal benefits, which consist of the license income and the shadow value, μ j , of a higher knowledge stock that a unit of R&D creates at the margin. Solving for that shadow value yields

Taking the time derivative and setting that expression equal to minus the right-hand side in the second condition equates the marginal return on A j to the time derivative of this shadow value. Substituting the inverted law of motion (2) and the inverted production function (1) for L Rj and L Pj , respectively, we obtain, after rearranging,

Equation 6 defines the wage level at which R&D workers will be employed by firm j. The wage level that solves (6) represents a horizontal demand function for R&D labor. If R&D wages exceed the threshold, no R&D workers will be employed by firm j. As long as R&D wages fall short, firm j will hire additional R&D workers.Footnote 14 We obtain for the threshold:

where we have substituted for X j using (4) and (5) in (1).Footnote 15 As (7) holds for all firms j and all firms are price takers in input markets, an equilibrium in the R&D labor market requires that all firms that hire R&D pay the same wage. It can be verified in (7) that the threshold wage is firm specific and depends nonmonotonically on the value of A j . The slope of the right-hand side switches sign from negative to positive at

This implies that the right-hand side of (7) is decreasing in A j for A j < A S, and increasing in A j for A j > A S. Assuming for simplicity that firms always start at an initial level of knowledge A 0 > A S, there is a unique level of A j that all firms must attain to hire R&D labor.Footnote 16 The mechanism is that the firms with A j = A max then also have the highest threshold wage for R&D. They will thus bid up R&D wages to this threshold level and employ a positive amount of R&D. Their level of A will then rise according to (2), and those with A S ≤ A j < A max will not hire any R&D and their A j remains stable. The rise in A max pushes up the threshold but also increases the average A, causing production wages and intermediate prices to rise. In any equilibrium with R&D, only those firms that have A j = A max can stay in the race, whereas others are forced to bring down their production employment and intermediate use levels to 0.Footnote 17 If we assume therefore that all firms start from the same initial level of A j (0) = A 0 > A S, the above implies that A j (t) = A max(t) = A(t) for all j and we obtain for (7) that

We have shown above that a stable labor demand in production requires an equilibrium in which wages grow at the same rate as output. Equation 8 shows that the threshold wage level for R&D workers will also satisfy that constraint as long as A and n grow at the same rate and total profits grow in proportion to final output. We show below that these conditions are satisfied in the steady state, so there is no long-run relative wage divergence between R&D and production labor wages, and the income distribution is stable.

Interpreting IPR protection as a strengthening of the relative bargaining power of knowledge creators, i.e., increasing ξ, Eq. 8 shows the traditional innovation-enhancing effect of patent protection. Higher levels of IPR protection will cause the threshold wage level to go up for a given level of intermediate sector profits. If R&D then competes for its labor inputs with other activities in the model, stronger protection implies higher R&D and productivity improvement.Footnote 18

To bring out our argument in the model we assume that R&D in final goods-producing firms competes over skilled labor with innovative activity (entry) in the intermediate sector. With all the differences one can think of, R&D and entrepreneurship are both largely non-routine and highly skilled activities that distinguish themselves more from routine unskilled production labor than from each other. We now turn to the intermediate goods sector.

2.2 Intermediate producers and entrepreneurs

The intermediate sector produces intermediate goods according to some specific process available to one intermediate firm only. We assume, however, that there are n varieties available to compete as imperfect substitutes and that new ones are allowed to enter.

One can think of the intermediate designs as being codified in a blueprint and protected by a patent, as in Romer (1990). Entrepreneurs, however, often bring a unique combination of tacit knowledge, training, talent, access to finance and support networks, etc., to their ventures, and by definition come up with a commercial opportunity that no-one recognized before.Footnote 19 Therefore, we can justify the assumption that, even in the absence of patent protection, every intermediate will be produced exclusively by one firm, and subsequent entry with a perfect substitute is not possible. The big difference now is that knowledge is excludable but not tradable. As in Romer (1990), the producers in this sector are monopolists that set their own price and compete only with imperfect substitutes.

By the assumed symmetry in the final goods-production function, all varieties face the same, isoelastic demand curve for their variety. All intermediates are produced using a simple one-for-one technology out of raw capital, K, and we assume that the monopolists are price takers in that input market, paying the market interest rate, r. The problem is then identical for every intermediate producer i. Formally, they solve the static and standard profit-maximization problem given by

It follows that prices are set at\( \chi (i) = {\frac{r}{1 - \alpha - \beta }} \) and do not vary over varieties i anymore. As every intermediate producer sets his price equal to this value and faces the same demand function, all intermediates are demanded in the same quantity. This implies that, in equilibrium, the stock of raw capital is divided equally among all n varieties of intermediate goods and the capital share in income is given by \( rK = (1 - \alpha - \beta )^{2} X \), whereas the monopoly rents in the intermediate sector will be given by

These profits accrue to the entrepreneur who organized the intermediate production unit, as no other inputs or fixed (entry) costs have been assumed. However, not all rents can remain with the entrepreneur. If intermediate i is based on knowledge that is protected by a patent, then the patent holder can charge a license fee that reduces the flow of rents to the entrepreneur. As assumed above, the share retained by the entrepreneurs is (1 − ξ).

The positive (expected) flow of retained rents attracts new entrants. These entrants cannot enter an existing intermediate variety market, as we assume that these are protected by trade secrets, unique essential entrepreneurial traits or otherwise. However, the existence of these rents and the knowledge that there is a latent demand for new varieties makes it attractive to start one’s own venture and enter with a new intermediate variety. The value of such a new venture depends on the level of retainable profits. We assume for simplicity that all entrants receive their idea as a knowledge spillover from downstream final goods producers’ process R&D, such that all new entrants take into account the license fees that will be due.

In Eq. 3 we assumed that the final goods sector appropriates a share ξ of total intermediate profits for every 100% expansion of their knowledge base. This total license income is collected from the n intermediate firms that exist at time t. As all intermediate firms are fully symmetric, we assume that all contribute an equal amount to total license fees.Footnote 20 With total profits given in Eq. 9 as n times π i and taking the discounted present value of retained profits as the value of a new venture, we obtain as the value of a new firm to the owner at time T asFootnote 21

where r is the discount rate that the entrepreneur applies.Footnote 22 We assume that the entrepreneur, as owner of the firm, can appropriate this value but also propose that this requires the investment of time and is therefore costly in terms of (skilled/R&D) wages foregone. The entry function is given by

As the final production process is better understood, more ideas for new and further specialized intermediates are likely to emerge. We, therefore, assume that entry is positive in the accumulated knowledge in final goods-producers process R&D, A(t). The presence of n(t) reflects the fact that accumulated entrepreneurial experience increases the entry rate for given levels of activity and knowledge availability. Alternatively, one can interpret this specification as stating that entry is proportional to a Cobb–Douglas aggregate of accumulated public knowledge in entrepreneurship and R&D. φ is a scaling productivity parameter, and as before we have assumed constant returns to skilled entrepreneurial labor, L E.

δ may be interpreted as a parameter that reflects the knowledge filter. This concept was first coined by Acs et al. (2004) to describe the institutional, informational, and otherwise existing barriers to knowledge spillover between knowledge creators and commercializers. In the context of our model, one could think of nondisclosure agreements, labor contract limitations on moving to competing firms, and defensive patenting strategies in final goods-producing firms. Anything the final goods-producing firms does to limit the spillover of knowledge, including legal and other action, will reduce δ. This reduces the entry of new intermediates for given increases in knowledge and levels of entrepreneurial activity.Footnote 23 Rent income to the marginal entrepreneur at the time of entry at time T is then given by

As this trade-off is identical for entrants over time, we can replace T by t and Eq. 11 can be rewritten as the flow of income for entrepreneurial labor, where we assume that, at the time of entry, entrepreneurs expect output and variety to expand at a constant rate (as they will in steady state), such that \( X(t) = X(T){\text{e}}^{{\dot{X}/X \times t}} \)and \( n(t) = n(T){\text{e}}^{{\dot{n}/n \times t}}. \) Dropping time arguments to save on notation, we obtainFootnote 24

As we assume that entrepreneurship competes with R&D for skilled labor, no entry will take place if the skilled wage exceeds this level. The opportunity costs are too high, and all skilled labor is employed in R&D. If it falls below this level, however, all skilled labor will switch to entrepreneurial activity. We thus have a bang–bang equilibrium due to the constant returns to L E and L R. Note that this implies that, in such a bang–bang equilibrium, either variety n or knowledge A increases, while the other is stable. This implies that A/n changes until the threshold wages in (12) and (8) equalize. We use this property to derive first the skilled labor market and then the steady-state equilibrium in Sect. 3. We analyze the relevant comparative statics in Sect. 4.

3 Equilibrium

3.1 The skilled labor market

The skilled labor market is in equilibrium when wages equate total exogenous supply to the demand in R&D and entrepreneurship and both activities earn the same income.Footnote 25 Formally, we have \( \bar{w}_{{\rm R}} = \bar{w}_{{\rm E}} \) and \( 1 = L_{{\rm R}} + L_{{\rm E}} \) to determine the equilibrium, but let us first consider what happens out of equilibrium. If \( \bar{w}_{{\rm R}} > \bar{w}_{{\rm E}}, \) then all skilled labor is allocated to R&D and none to entrepreneurship. This implies that A/n will rise. If \( \bar{w}_{{\rm E}} > \bar{w}_{{\rm R}} \) instead, all skilled labor is allocated to entrepreneurship and A/n will fall. Such changes in A/n will push the threshold wages in (8) and (12) towards each other. Only when \( \bar{w}_{{\rm R}} = \bar{w}_{{\rm E}} \) is the labor market allocation stable at positive levels of both activities.

Figure 1 plots the ratio \( \bar{w}_{{\rm R}} /\bar{w}_{{\rm E}} \) against A/n. The above implies that the labor market may clear at any ratio in the short run, but the corresponding allocation of labor over R&D or entrepreneurship implies that we will move towards the point where this ratio equals 1.

Even then, however, the model is not in a steady state. The position of the convex curve still depends on the various growth rates in the model, as can be verified when we take the ratio of (8) over (12) and substitute for the growth rate and level of total profits using (9):

Out of steady-state equilibrium, the labor market will thus ensure that first A/n is at (A/n)*, but due to the fact that (13) depends on the growth rates of output, skilled wages, the interest rate, and the growth rate of n, this (A/n)* is not necessarily the steady-state ratio. A steady state is reached at (A/n)* only when knowledge stocks have adjusted to such levels that A and n grow at the same positive rate and (A/n)* remains stable. We analyze the steady state below.

3.2 The steady state

The model is in steady-state equilibrium when all variables expand at a constant rate and the skilled labor market allocation is stable. From the arbitrage Eqs. 8 and 12 and the analysis of the labor market above we can derive that the allocation of skilled labor is stable when A and n expand at the same rate.Footnote 26 Output, by the production function (1) and the fact that all intermediates are used at level K/n, will then grow at rate

Using the fact that output in steady state grows at the same rate as both wages, total wage income, and consumption, we know that asset income must also grow at that rate by the budget constraint of consumers. Hence, asset and raw capital accumulation must also take place at the growth rate of output. Using this fact and Eq. 14 we obtain

As a stable labor allocation requires a constant ratio A/n, the steady-state growth rates will be equal to:

This solves the model if we can obtain the steady-state growth rate of n (and A). The first steady-state condition follows from rewriting Eq. 13 for the steady state. The ratio in Eq. 13 is 1 in equilibrium and can be solved for A/n to yield

where we define auxiliary parameters \( \Upomega \equiv (\alpha + \beta )(1 - \alpha - \beta ),\,\Upphi \equiv \alpha + \Upomega \rho \xi \), and functions \( \Upxi (\dot{n}/n) = 1 - \xi \dot{n}/n \) and \( \Upgamma (\dot{n}/n) = {\frac{{\rho + \gamma \dot{n}/n}}{{\rho + \dot{n}/n}}} \) to save on notation. Equation 15 solves in parameters only for the special case that ξ = 0 (no license income) and ρ = 0 (no time preference). Using the condition that, in steady state, variety expansion, \( \dot{n}/n \), equals productivity growth, \( \dot{A}/A \), we can derive a second steady-state relation between entrepreneurial activity and R&D labor using Eqs. 2 and 10 as

Using the labor market clearing condition \( 1 = L_{{\rm R}} + L_{{\rm E}} \) we can compute the steady-state level of entrepreneurial and R&D activity. We thus obtain the steady-state allocation of skilled labor as

Plugging the level of entrepreneurship in (16) into the entry function in Eq. 10, dividing both sides by n, and using (15) to solve for the rate of variety expansion yields

This equation determines the growth rate in steady state by the fact that the right-hand side is a function of that growth rate, but it cannot be solved analytically.Footnote 27 Equation 17 does allow us to make the following proposition:

Proposition I

There exists a positive, unique, and stable steady-state equilibrium growth rate.

The proof is presented in Appendix 1.

4 Comparative statics and the impact of stronger IPR protection

4.1 The key result

The effects of stronger IPR protection can now be analyzed by deriving the impact of a higher ξ on this steady-state growth rate, and we formulate our key proposition.

Proposition II

Strengthening the level of patent protection as captured by an increase in ξ in our model will only generate increases in the overall rate of innovation if the initial level of protection is low enough. More patent protection is beneficial for economic growth as long as: \( \xi < {\frac{1 - \alpha }{{\psi^{{{\frac{\delta }{\gamma + \delta }}}} \varphi^{{{\frac{\gamma }{\gamma + \delta }}}}\, {\frac{\delta }{\gamma }} + {\frac{\rho }{\delta }}}}}. \)

Corollary I

An increase in patent protection when initial levels of patent protection are already high will result in a reduction of overall innovation. This negative effect will certainly arise when: \( \xi > {\frac{1 - \alpha \gamma }{{\psi^{{{\frac{\delta }{\gamma + \delta }}}} \varphi^{{{\frac{\gamma }{\gamma + \delta }}}} \,{\frac{\delta }{\gamma }} + {\frac{\rho \gamma }{\delta }}}}}. \)

Appendix 2 provides the proofs.

The threshold level for ξ in Proposition II and Corollary I are reached faster when the output elasticity of knowledge in final goods production, α, is large. Intuitively, this means patent protection is less likely to be beneficial when private incentives to R&D are already strong. The effects of the knowledge spillover parameters in the R&D and the entry functions, γ and δ, are ambiguous, but the threshold also shows that more productive, highly skilled labor, higher φ and ψ, and more impatient consumers, higher ρ, unambiguously reduce the growth-maximizing level of patent protection. The intuition for these results is that more productive labor in innovation increases the rate of innovation without patents. Therefore, higher productivity reduces the effectiveness of patents to increase R&D activity through shifting incentives from innovation to invention. Finally, impatience reduces innovation with and without patents in two ways. Consumers’ willingness to finance investments in R&D is reduced. This reduces the benefits of strong patent protection for the incumbents. Moreover, increasing the rental cost of capital reduces the profitability of the intermediate sector. This reduces the incentives to invest in commercialization. Strong patent protection will reduce those incentives even more. Consequently the growth-maximizing level of protection is lower when consumers are less patient.

4.2 Discussion

We have introduced the parameter ξ to represent the strength, length, and breadth of patent protection. This parameter determines how much of the commercial rents of innovation the original generator of knowledge can expropriate from the commercializer of that knowledge. We argue that this parameter captures the essence of the patent system and the strength of patent protection. We envision patents as an instrument of the legislature to redistribute commercial rents from innovation between the creator and commercializer of knowledge. Stronger patents imply stronger bargaining power for the knowledge creator and hence allow him to extract a larger share of the rents. Longer patenting spells, patentability of a broader knowledge base in earlier stages of development, bias in patent infringement courts, and lower costs of patenting all work to increase the share of the knowledge creator versus the potential commercializer. Recent reforms in the US patent system (see Jaffe and Lerner 2004) are therefore largely covered by an increase in our parameter ξ. We have shown that there may be an offsetting effect of strengthening patent protection on the rate of innovation and growth, when invention and innovation draw on the same scarce resources.

These results strongly contradict the traditional idea-based growth models of Romer (1990) and others like him, who do not separate knowledge creation from commercialization. In the absence of this separation, one would conclude that internalization of spillovers through (re)enforcing intellectual property rights of R&D laboratories is always a good idea. Less spillover implies more appropriability and more R&D, which cause higher growth in the modern growth literature. This is not merely of academic interest, as these models lend strong and perhaps oversimplified support to claims made by patent lawyers, firms with large R&D laboratories, and developed countries in World Trade Organization (WTO) rounds. Our model demonstrates that support for more and better patent protection needs to at least be qualified.

As we have argued and shown above, our result emerges when commercialization and invention are no longer assumed to collapse into one decision. When commercialization of new opportunities has to take place outside the existing and inventing firm, then barriers to the knowledge spillover may reduce growth. The risks of being sued for patent infringement and losing that case in court can overturn the initial benefits of being able to legally protect monopoly profits.Footnote 28 This problem is aggravated when the patent office allows inventors to patent ideas and knowledge which they never intended to commercialize themselves. The public policy implications of this model are therefore straightforward but also unconventional. To facilitate the spilling over of knowledge, governments should stop enforcing nondisclosure agreements in labor contracts, stop enforcing defensive patenting, stop patenting knowledge unless a working prototype of a commercial product can be shown, encourage dissemination of knowledge and labor mobility between entrepreneurship and wage employment, and try to facilitate generation and diffusion of corporate R&D output.

Following the traditional endogenous growth theorists, we argue there is a case for R&D to be stimulated, for example through subsidies, but we add to that usual result the qualification that the subsidy must be used as leverage to promote commercialization of results inside and outside the firm. In this way, government can reduce deadweight losses (subsidizing R&D investments that incumbent firms would have undertaken anyway) and maximize resulting economic growth and innovation.

5 Conclusions

We have presented an endogenous growth model in which monopoly rents provide the incentive to innovate. In our model, rents motivate the commercialization of existing knowledge rather than the generation of new ideas. The model has entrepreneurs invest resources in commercialization and capture the rents from innovation. They do not, however, produce the opportunities themselves. Incumbent firms do R&D to maintain competitiveness through efficiency improvements on their final output, and in our model the commercial opportunities spill over from this R&D. We then analyze the impact of stronger IPR protection and patents in the context of our model.

The implications of this amended model are more than trivial. R&D spillovers contribute to growth but, as spinouts are growth enhancing, nondisclosure agreements and patenting may turn out to be growth inhibiting. Patent protection increases incentives to create and patent knowledge but reduces incentives to commercialize it. The latter effect may overtake the former and reduce the aggregate rate of growth. When IPR protection and patents shift a share of the rents from knowledge commercializers to knowledge generators, the resulting rate of innovation in the economy follows an inverted U-shape in the level of protection.

New growth theory correctly asserts that the knowledge generated by commercial R&D can be a source of steady-state growth, but inaccurately considers it a sufficient precondition or even the most important one. Protecting and giving incentives for generation of knowledge are useful and necessary, but doing so through mechanisms such as patents and IPR may shift the balance of power in the ex post bargain over rents too much in favor of knowledge creators. This can reduce incentives to commercialize to the extent that economic growth falls. As both the inventor and the innovator generate large positive spillovers to society, a more balanced approach to IPR protection is required.

Knowledge is only valuable to society when it is commercialized in new products and services. The patent system was never intended to enable large firms’ legal departments to bully small competitors out of adjacent market niches, or to enable individual inventors who lack the motivation, talent or means to commercialize their ideas to discourage others from doing so. As Jaffe and Lerner (2004) have argued forcefully, however, that is exactly what the most recent reforms in the US patent system have accomplished.

In our model we have abstracted from uncertainty and have introduced IPR protection at a very high abstraction level as part of the bargain between knowledge creator and commercializer. That bargain and the relative bargaining power of the parties involved may have many other possible legal, institutional, and economic aspects to be considered. Possible extensions at this point include the role of intermediaries such as venture capitalists and university technology transfer offices. Also, our crude parameterization of IPR leaves much to be desired when it comes to the many dimensions of IPR protection. O’Donoghue and Zweilmueller (2004), for example, distinguish leading and lagging breadth, patentability requirements, and patent length as relevant and distinct dimensions of patent protection systems. Stronger protection in one or another of these dimensions may have a quite different impact on the relative bargaining power of commercializing entrepreneurs vis-à-vis patent owners.Footnote 29 Optimization of patent design over these dimensions would require a more explicit model of the bargaining process to specify how patents affect relative bargaining strength and the consequent bargaining outcome that our parameter reflects. This extension, however, we leave for future research. In future work, we also aim to be more explicit on the issue of risk and to derive more precisely how the ex ante value of new ventures is shared among parties involved in the innovation process. Although, to our knowledge, our model assumptions do not contradict the empirical evidence, its predictions are yet to be tested against the data.

Notes

There exists, for example, a literature in contract theory (e.g., Grossman and Hart 1986; Aghion and Tirole 1994) as well as a large industrial organization literature on the strategic use of patents (e.g., Teece 1986, 2006) and the implications for optimal patent policy design. In particular, issues such as disclosure in sequential innovation processes, fragmented innovation processes, and cumulative or cooperative research projects have been addressed. Examples of papers in this literature include Gilbert and Shapiro (1990), Gallini (1992), Scotchmer (1991), Green and Scotchmer (1995), Chang (1995), Matutes et al. (1996), Scotchmer (1996), Van Dijk (1996), O’Donoghue (1998), O’Donoghue et al. (1998), Hunt (1999), Gallini and Scotchmer (2001), Maurer and Scotchmer (2002), Bessen and Mashkin (2006), and Kullti and Takalo (2008). Gallini (2002) gives a good overview. We thank Josh Lerner for bringing this literature to our attention.

O’Donoghue and Zweilmueller (2004) then examine the role of patent policy and explore how a general equilibrium analysis can contribute to the patent design literature. Other notable exceptions in this literature are Chou and Shy (1993), Helpman (1993), Davidson and Segerstrom (1998), Cheng and Tao (1999), and Li (2001). However, the aim of this paper is not to contribute to the patent design literature, as our crude, one-dimensional representation of IPR protection simply does not allow for such analysis. Instead we abstract from the complexity of optimal patent design and analyze the impact on growth of all IPR instruments that shift the distribution of the rents of innovation between inventors and commercializers.

Admittedly we analyze a very reduced form of IPR protection by recognizing only one dimension of IPR protection in the model. We feel this is appropriate as we aim to illustrate a more fundamental mechanism at work. Our model is not very useful in the search for the optimal patent design but rather puts that search in a broader perspective.

Here, we define “entrepreneurship” to be the act of actually commercializing an already existing opportunity for innovation. The extant literature (e.g., Gartner 1990; Churchill and Muzyka 1994; Venkataraman 1997; Brazael 1999; Shane and Venkataraman 2000; Brown et al. 2001; and many more) offers a broad range of definitions, from Kirznerian (1973) arbitrageurs to Schumpeterian (1934) innovators. Our Schumpeterian “entrepreneurs” have the function to recognize and exploit opportunities, created by other agents (inventors) in the model. We assume this to separate the two stages in the process. It is very possible for actual entrepreneurs to create, recognize, and commercialize an opportunity. In our model, the same person then creates the opportunity as an inventor and commercializes it as entrepreneur. Modeling this as one decision, however, would obscure the impact of strong IPR protection that we aim to uncover.

In the Michelacci (2003) paper entrepreneurial activity makes R&D more attractive but not more productive. The positive effect on growth comes from generating stronger incentives for R&D. In our model commercialization makes new knowledge creation more productive directly.

Jaffe and Lerner (2004) mention, for example, the case of Texas Instruments, where the patent enforcement department has grown to become the second largest profit center in the corporation.

See, e.g., Barro and Sala-I-Martin (2004). It is also useful to note at this stage that, in such a setup, growth maximization and welfare maximization are equivalent for given initial wealth levels (see, e.g., Barro 1990; Greiner 1998). We refer to this equivalence and only discuss the growth-maximizing level of IPR protection below.

We assume that the firm must generate a steady flow of new knowledge to sustain a constant level of license income to reflect the fact that patents expire and license fees fall with the age of the patent as more substitutes are available.

Note that we assume zero population growth.

Summing over all final goods producers j then yields the result that total expenditure on intermediates in the economy is (1 − α − β)X.

Substituting firm-level labor demand from (4) and the demand for intermediate goods in (5) into (1) and using \( \bar{\chi } \) to represent the average price of intermediate goods, we obtain for output: \( X_{j} = \left( {{\frac{\beta }{{w_{{\rm P}} }}}} \right)^{{{\frac{\beta }{\alpha }}}} \left( {{\frac{1 - \alpha - \beta }{{\bar{\chi }}}}} \right)^{{{\frac{1 - \alpha - \beta }{\alpha }}}} n^{{{\frac{\alpha + \beta }{\alpha }}}} A_{j} \).

Time arguments have been included in the transversality condition as the limit is taken for time to infinity.

This so-called bang–bang equilibrium is a result of the constant returns to R&D labor assumption that we have made.

See footnote 12.

If we do not make this assumption, there might be firms that wish to hire R&D labor at the market wage but reduce that willingness as that R&D increases their A j . These firms would withdraw from the market after some time as long as there is at least one final goods producer that has A j ≥ A S.

Taken literally, this result may appear unrealistic, and it yields the undesirable result that initial levels of production knowledge have to be exactly equal. However, it is worth noting that, for example, uncertainty in the R&D process and fixed costs have been assumed away. In real life, the uncertainty in R&D outcomes would create a range, rather than a precise level, for the threshold wage, and fixed costs would cause firms to actually exit when employment levels fall below a critical level. Then, the prediction is that a group of technology leaders will be able to survive in the market, where they must “run to stand still,” and a shake-out will cause firms with less than efficient production processes to exit in the transition to the steady state. Such processes are well known in the empirical literature on industrial dynamics (Gort and Klepper 1982; Klepper 1996). They are present in a very stylized form in our model.

Our model can thus generate a trade-off between dynamic benefits of more innovation against the static loss of current output lost by assuming innovation and production compete over the same limited resources. This is a different channel for the trade-off than in Nordhaus (1969), as process innovation, investments in firm-specific knowledge, do not create monopoly profits.

There are quite a few definitions of entrepreneurship in the literature. We follow the Schumpeterian tradition that defines the entrepreneur as the agent that implements an invention commercially; see, e.g., Braunerhjelm (2008) for a discussion and further references.

Or, equivalently, run an identical ex ante risk of being charged and forced to pay license fees, such that the expected value is equal to the average license fees per intermediate firm.

Note that we ignore the marginal effect of adding one more variety to the profits per variety. The value of a marginal new intermediate firm is then equal to the value of an existing intermediate firm.

We do not consider the possibility that this rate deviates from the risk-free interest rate due to the risky nature of entrepreneurial ventures and/or capital market imperfections they may face. This does not affect our results qualitatively, and there are extensions to be addressed by further research. If the profit flow is at risk, for example, the discount rate includes a risk premium that captures the flow probability of losing the entire profit flow. As was argued by Jaffe and Lerner (2004), with excessive patent protection this parameter turns positive in the strength of patent protection. Of course, a patent infringement suit is usually settled out of court and does not result in the entire profit flow disappearing. However, by assuming that a high probability of losing some profits reduces the value of the firm to the entrepreneur in the same way as a low probability to lose the entire profit flow, we can still interpret the risk premium as reflecting the ease of obtaining and upholding patents in court. See, for example, Aghion and Howitt (1998), who show that a positive flow probability of losing a profit flow can be incorporated by including that probability in the discount rate.

From the derivative of Eq. 10 with respect to δ it can be verified that the impact is positive for A/n > 1. This we can assume to hold without loss of generality, as A can be normalized to any positive number by an appropriate choice of units in final goods production. Note that we now have two ways in which IPR protection can inhibit innovation: (1) through reducing the incentives to commercialize idle ideas, captured by ξ, and (2) by blocking the diffusion of such idle ideas, captured by δ. We will focus on the former as more relevant in this paper.

Where we have to assume that the growth rate of n does not exceed the growth rate of output plus the interest rate, to ensure that the integral can be evaluated. It will be shown below that this assumption holds in the steady state.

We can normalize total skilled labor supply to 1 by an appropriate choice of the scaling parameters φ and ψ.

Substituting for profits and computing the growth rates for (8) and (12) immediately shows that, in any steady-state equilibrium, the skilled wage will grow at rate \( {\frac{{\dot{w}_{{\rm R}} }}{{w_{{\rm R}} }}} = {\frac{{\dot{X}}}{X}} - \gamma \left( {{\frac{{\dot{A}}}{A}} - {\frac{{\dot{n}}}{n}}} \right) = {\frac{{\dot{w}_{{\rm E}} }}{{w_{{\rm E}} }}} = {\frac{{\dot{X}}}{X}} + \delta \left( {{\frac{{\dot{A}}}{A}} - {\frac{{\dot{n}}}{n}}} \right) \).

Equation 4 has also shown that a stable steady-state demand for production workers implies that the growth rate of unskilled wages equals the growth rate of output. Both wage levels grow at the same rate as output for a stable ratio A/n.

Note that the analytical solution can be computed for the special case ρ = 0, such that Γ = γ and ξ = 0 such that Φ = 1. As that would imply no discounting and no license income, and we are primarily interested in the impact of stronger patent protection, that special case is less relevant for the purpose of this paper.

Particularly in industries where the need for formal and legal protection is not so high.

O’Donoghue and Zweilmueller (2004), for example, argue from a quality ladder model that leading patent breadth should be strengthened whereas patentability requirements should be increased. Such nuanced strategies could have a mixed effect on the net bargaining position of inventors.

References

Acemoglu, D., Johnson, S., & Robinson, J. (2001). The colonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369–1401.

Acs, Z., Audretsch, D., Braunerhjelm, P., & Carlsson, B. (2004). The missing link: The knowledge filter and entrepreneurship in endogenous growth. In Center for economic policy research discussion paper. No. 4783.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60, 323–351.

Aghion, P., & Howitt, P. (1998). Endogenous growth theory. Cambridge, MA: The MIT Press.

Aghion, P., & Tirole, J. (1994). The management of innovation. Quarterly Journal of Economics, 109(4), 1185–1209.

Allred, B., & Park, W. (2007). The influence of patent protection on firm innovation investment in manufacturing industries. Journal of International Management, 13, 91–109.

Barro, R. (1990). Government spending in a simple model of endogenous growth. Journal of Political Economy, 98(5), S103–S125.

Barro, R. (1996). Democracy and growth. Journal of Economic Growth, 1(1), 1–27.

Barro, R., & Sala-I-Martin, X. (2004). Economic growth (2nd ed.). Cambridge, MA: The MIT Press.

Bessen, J., & Mashkin, E. (2006). Sequential innovation, patents and imitation. In Economic working papers. No. 0025. Cambridge, MA: Institute for Advanced Study, School of Social Science.

Branstetter, L., Fishman, R., & Foley, F. (2006). Do stronger intellectual property rights increase international technology transfer? Empirical evidence from US firm-level panel data. Quarterly Journal of Economics, 121(1), 321–349.

Braunerhjelm, P. (2008). Entrepreneurship, knowledge, and economic growth. Foundations and Trends in Entrepreneurship, 4(5), 451–533.

Brazael, D. (1999). The genesis of entrepreneurship. Entrepreneurship Theory and Practice, 23(3), 29–45.

Brown, T., Davidsson, P., & Wiklund, J. (2001). An operationalization of Stevenson’s conceptualization of entrepreneurship as opportunity-based firm behavior. Strategic Management Journal, 22(10), 953–968.

Carlsson, B., Acs, Z., Braunerhjelm, P., & Audretsch, D. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Carlsson, B., Braunerhjelm, P., Acs, Z., & Audretsch, D. (2010). The missing link: Knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125.

Chang, H. (1995). Patent scope, antitrust policy and cumulative innovation. The Rand Journal of Economics, 26, 34–57.

Cheng, L., & Tao, Z. (1999). The impact of public policies on innovation and imitation: The role of R&D technology in growth models. International Economic Review, 40, 187–207.

Chou, C., & Shy, O. (1993). The crowding-out effects of long patent durations. The Rand Journal of Economics, 24, 304–312.

Churchill, N., & Muzyka, D. (1994). Defining and conceptualizing entrepreneurship: A process approach. In G. Hills (Ed.), Marketing and entrepreneurship (pp. 11–23). Westport, CT: Quorum Books.

Davidson, C., & Segerstrom, P. (1998). R&D subsidies and economic growth. The Rand Journal of Economics, 29(3), 548–577.

Fox, H. (1947). Monopolies and patents. Toronto: University of Toronto Press.

Furukawa, Y. (2007). The protection of intellectual property rights and endogenous growth: Is stronger always better? Journal of Economic Dynamics and Control, 31, 3644–3670.

Gallini, N. (1992). Patent policy and costly imitation. The Rand Journal of Economics, 23(1), 52–63.

Gallini, N. (2002). The economics of patents: Lessons from recent us patent reform. Journal of Economic Perspectives, 16(2), 131–154.

Gallini, N., & Scotchmer, S. (2001). Intellectual property: When is it the best incentive system? In A. Jaffe, J. Lerner, & S. Stern (Eds.), Innovation policy and the economy (Vol. 2). Cambridge, MA: The MIT Press.

Gartner, W. (1990). What are we talking about when we talk about entrepreneurship? Journal of Business Venturing, 5(1), 15–28.

Gilbert, R., & Shapiro, C. (1990). Optimal patent length and breadth. The Rand Journal of Economics, 21(1), 106–112.

Gort, M., & Klepper, S. (1982). Time paths in the diffusion of product innovations. The Economic Journal, 92(367), 630–653.

Gould, D., & Gruben, W. (1996). The role of intellectual property rights in economic growth. Journal of Development Economics, 48, 323–350.

Greasley, D., & Oxley, L. (2007). Patenting, intellectual property rights and sectoral outputs in industrial revolution Britain, 1780–1851. Journal of Econometrics, 139, 340–354.

Green, J., & Scotchmer, S. (1995). On the division of profit in sequential innovation. The Rand Journal of Economics, 26(1), 20–33.

Greiner, A. (1998). Fiscal policy in an endogenous growth model with public investment: A note. Journal of Economics, 68(2), 193–198.

Grossman, S., & Hart, O. (1986). The costs and benefits of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94(4), 691–719.

Grossman, G., & Helpman, E. (1991). Innovation and growth in the global economy. Cambridge, MA: The MIT Press.

Helpman, E. (1993). Innovation, imitation and intellectual property rights. Econometrica, 61, 1247–1280.

Horii, R., & Iwaisako, T. (2007). Economic growth with imperfect protection of intellectual property rights. Journal of Economics, 90(1), 45–85.

Hunt, R. (1999). Nonobviousness and the incentive to innovate: An economic analysis of intellectual property reform. In Federal Reserve Bank of Philadelphia working paper. No. 99-3. Philadelphia, PE: Federal Reserve Bank of Philadelphia.

Iwaisako, T., & Futagami, K. (2003). Patent policy in an endogenous growth model. Journal of Economics, 78, 239–258.

Jaffe, A., & Lerner, J. (2004). Innovation and its discontents: How our broken patent system is endangering innovation and progress, and what to do about it. Princeton, NJ: Princeton University Press.

Kanwar, S. (2006). Innovation and intellectual property rights. In Center for development economics working paper. No. 142. Delhi, India: Delhi School of Economics.

Kirzner, I. (1973). Competition and entrepreneurship. Chicago, IL: University of Chicago Press.

Klepper, S. (1996). Entry, exit, growth and innovation over the product life cycle. American Economic Review, 86(3), 562–583.

Kullti, K., & Takalo, T. (2008). Optimal fragmentation of Intellectual Property Rights. International Journal of Industrial Organization, 26(1), 137–149.

Kwan, Y., & Lai, E. (2003). Intellectual property rights protection and endogenous economic growth. Journal of Economic Dynamics and Control, 27, 853–873.

Li, C. (2001). On the policy implications of endogenous technical progress. Economic Journal, 111, C164–C179.

Matutes, C., Regibeau, P., & Rockett, K. (1996). Optimal patent design and the diffusion of innovations. The Rand Journal of Economics, 27, 60–83.

Maurer, S., & Scotchmer, S. (2002). Independent-invention defence in intellectual property. Economica, 69, 535–547.

Michelacci, C. (2003). Low returns in R&D due to the lack of entrepreneurial skills. Economic Journal, 113, 207–225.

Nordhaus, W. (1969). Invention growth and welfare: A theoretical treatment of technological change. Cambridge, MA: The MIT Press.

North, D. (1981). Structure and change in economic history. New York, NY: Norton.

O’Donoghue, T. (1998). A patentability requirement for sequential innovation. The Rand Journal of Economics, 29, 654–679.

O’Donoghue, T., Scotchmer, S., & Thisse, J. (1998). Patent breadth, patent life and the pace of technological progress. Journal of Economics and Management Strategy, 7, 1–32.

O’Donoghue, T., & Zweilmueller, J. (2004). Patents in a model of endogenous growth. Journal of Economic Growth, 9, 81–123.

Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98, S71–S102.

Sala-I-Martin, X. (1996). I just ran two million regressions. American Economic Review, 87(2), 178–183.

Schumpeter, J. (1934). The theory of economic development. Cambridge, MA: Harvard University Press.

Scotchmer, S. (1991). Standing on the shoulders of giants: Cumulative research and the patent law. Journal of Economic Perspectives, 5(1), 29–41.

Scotchmer, S. (1996). Protecting early innovators: Should second-generation products be patentable? The Rand Journal of Economics, 27(2), 322–331.

Segerstrom, Anant, P. T., & Dinopoulos, E. (1990). A Schumpeterian model of the product life cycle. American Economic Review, 80, 1077–1091.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25, 217–226.

Stokey, N. (1995). R&D and economic growth. Review of Economic Studies, 62(3), 469–489.

Teece, D. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15, 285–305.

Teece, D. (2006). Reflections on profiting from innovation. Research Policy, 35, 1131–1149.

Van Dijk, T. (1996). Patent height and competition in product improvements. Journal of Industrial Economics, 44, 151–167.

Varsakelis, N. (2001). The impact of patent protection, economy openness and national culture on R&D investment: A cross-country empirical investigation. Research Policy, 30(7), 1059–1068.

Venkataraman, S. (1997). The distinctive domain of entrepreneurship research. In J. Katz & J. Brockhaus (Eds.), Advances in entrepreneurship, firm emergence and growth (pp. 119–138). Greenwich, CT: JAI Press.

Young, A. (1993). Invention and bounded learning by doing. Journal of Political Economy, 101, 443–472.

Acknowledgements

We are grateful to Daron Acemoglu, Josh Lerner, David Audretsch, Adriaan van Zon, Claire Economidou, Sameeksha Desai, Claudio Michellacci, Oded Galor, and participants at the 2008 IECER conference in Regensburg, Germany, the 2008 RENT conference in Covilhã, Portugal, and the 2009 Annual Meeting of the EEA, Barcelona, Spain for useful comments and discussion on earlier drafts. Any remaining mistakes remain the responsibility of the authors.

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Proposition I, the existence, uniqueness, and stability of the steady-state equilibrium

We can show the uniqueness of the steady-state equilibrium by investigating the properties of Eq. 17 in the text:

The left-hand side of this equation is a simple 45° line. A unique steady-state equilibrium can be established when we show that the right-hand side intersects that line once and only once in the positive quadrant. First consider the properties of the functions Γ(·) and Ξ(·) defined in the text. Γ(·) falls monotonically from 1 to γ as the growth rate increases from 0 to infinity. As Ξ(·) cannot fall below 0 (as that would imply that license incomes exceed total intermediate profits) we know that Ξ(·) falls from 1 to 0 as the growth rate increases from 0 to 1/ξ. This implies that Γ(·) × Ξ(·) falls from 1 to 0 as the growth rate increases from 0 to 1/ξ. The right-hand side of (17) equals \( {\frac{{\left( {\psi \Upphi } \right)^{{{\frac{\delta }{\gamma + \delta }}}} \left( {\varphi \Upomega } \right)^{{{\frac{\gamma }{\gamma + \delta }}}} }}{\Upomega + \Upphi }} \), a positive constant for \( \dot{n}/n = 0 \). It equals \( {\frac{{\left( {\psi \Upphi } \right)^{{{\frac{\delta }{\gamma + \delta }}}} \left( {\varphi \Upomega } \right)^{{{\frac{\gamma }{\gamma + \delta }}}} }}{0 + \infty }} = 0 \) for \( \dot{n}/n = 1/\xi \). As (17) is continuous in Γ(·) × Ξ(·) we have therefore shown that an uneven number and at least one equilibrium exists. The equilibrium, however, is not necessarily unique, and stability remains to be shown.

First consider the restriction for uniqueness. For multiple steady states it is required that the slope of the right-hand side of Eq. 17 switches sign at least twice. Once is insufficient, as the right-hand side starts from a positive intercept. To intersect the 45° line more than once the right-hand side needs to fall, then rise, and fall again, or alternatively rise, fall, rise, and fall again. As Γ(·) × Ξ(·) falls monotonically over the entire domain, this implies that the right-hand side of (17) needs to switch sign in Γ(·) * Ξ(·). Defining Ψ ≡ Γ(·) * Ξ(·) and taking the derivative of the denominator in the right-hand side of (17) with respect to Ψ yields

which can be shown to switch sign at most once over its domain \( \Uppsi \in \left\{ {0,1} \right\}, \) at

Thereby we show that there is one unique steady-state equilibrium in the model. By the fact that the right-hand side of (17) intersects the 45° line only once in the positive quadrant, we also know that it must intersect it from above. Also, as the right-hand side of (17) represents the implied growth rate of n when the highly skilled labor market is in equilibrium, an actual out-of-steady-state growth rate to the left of the intersection point implies a rate of variety expansion that exceeds the steady-state growth rate. This implies that A/n will fall and the knowledge spillovers to entrepreneurs and R&D workers adjust to re-establish the equality of variety expansion and productivity growth rates. This mechanism implies that the unique steady-state growth rate is also stable. Q.E.D.

Appendix 2: Proof of Proposition II and Corollary I, the comparative statics of increasing patent protection

To investigate the effect of an increase in ξ we need to consider its effect on the right-hand side of (17). As Appendix 1 has shown, this is a continuous curve over the domain 0–1/ξ that intersects the 45° line once and goes from a positive vertical intercept at \( \left\{ {0,\,{\frac{{\left( {\psi \Upphi } \right)^{{{\frac{\delta }{\gamma + \delta }}}} \left( {\varphi \Upomega } \right)^{{{\frac{\gamma }{\gamma + \delta }}}} }}{\Upomega + \Upphi }}} \right\} \) to a positive horizontal intercept at {1/ξ,0}, switching slope sign at most once (from positive to negative) in the positive quadrant. There are now three general possibilities, illustrated in Fig. 2. It is immediately clear that the horizontal intercept will shift inwards for higher levels of patent protection. Ceteris paribus this causes the steady-state growth rate to fall unambiguously in cases I and II and will first increase and then decrease the growth rate in case III. However, there is also an impact on the vertical intercept and the position of the curve when ξ increases.

First consider the impact on the point where RHS reaches a maximum. That point was defined in (19) by

where Ψ is negatively dependent on the growth rate of n through Γ(·) and Ξ(·) and negatively on ξ through Ξ(·). Φ is positively affected by an increase in ξ. This implies that the growth rate at which the right-hand side switches sign must fall for an increase in ξ. This implies that the equilibrium growth rate can only rise for an increase in ξ when there is an increase in the maximum of RHS. By plugging (19) into the right-hand side of (17), however, we obtain after some rearranging

It is obvious that this maximum value is not dependent on ξ. From this we can also conclude that the vertical intercept increases in ξ in cases I and III and drops in case II. This concludes the graphical analysis and allows us to state Proposition II. Only in case III will an increase in ξ cause an increase in the steady-state growth rate. Case III is characterized by the restriction that the maximum of RHS in (20) is less than the corresponding value of LHS, which is equal to the growth rate that satisfies the condition in (19). Recalling the definitions of Γ(·) and Ξ(·) and Φ and Ω, we can rewrite (19) into:

As the first fraction on the left-hand side must take a value between 1 and γ, the growth rate that satisfies this condition, S, satisfies

By taking the minimum value that S can attain we can be sure that we are in situation III when that minimum value exceeds the maximum value of RHS. We are definitely in situation III, where more patent protection increases the steady-state rate of innovation if

which is what we state in Proposition II. The proof of Corollary I follows from reversing the argument above and deriving the condition for which we are certain that the effect of increased patent protection on the steady-state rate of innovation is negative.

As the right-hand side of the condition is a positive constant, lower initial levels of patent protection make it more likely that the economy will benefit from increasing patent protection. It can also be verified that a lower output elasticity of knowledge in final goods production, α, increases that probability (as it reduces the private incentives to do R&D in the absence of license income). Also, less productive skilled labor, φ and ψ, strengthens the case for more protection. The intuition is that this higher productivity increases the growth rate at any level of patent protection, and therefore less protection is required to generate the positive spillovers. The effects of δ and γ are ambiguous. More patient consumers (lower ρ) also improves the case for patent protection.

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Acs, Z.J., Sanders, M. Patents, knowledge spillovers, and entrepreneurship. Small Bus Econ 39, 801–817 (2012). https://doi.org/10.1007/s11187-011-9322-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9322-y

Keywords

- Intellectual property rights

- Knowledge spillovers

- Endogenous growth

- Entrepreneurship

- R&D

- Innovation

- Invention processes

- Inventions