Abstract

When does the general public lose trust in banks? We provide empirical evidence using responses by Dutch survey participants to eight hypothetical scenarios. We find that members of the general public care strongly about executive compensation. Negative media reports, falling stock prices, and opaque product information also affect trust in banks. Experiencing a bank bailout leads to less concern about government intervention, while experience of a bank failure leads to greater concern on bonuses.

Similar content being viewed by others

Notes

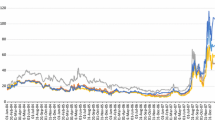

Source: http://www.financialtrustindex.org/resultswave15.htm. ULR last accessed 31 January 2013.

In the 2010 survey, respondents were initially presented with more than eight scenarios. In 2012 we used the eight scenarios where differences of opinion are more likely to occur. Examples of not-repeated scenarios are: ‘One of the bank’s executives faces prosecution’ and ‘The bank receives a fine from the financial supervisor’. One consideration for limiting the number of scenarios was the potential negative effect on survey response.

In using demeaned responses, we automatically rely on a complete cases analysis. The results are similar, however, if we perform an available cases analysis.

According to Statistics Netherlands, in the Dutch population over 16, the average age is 47, the percentage of males is around 49 %, and the percentage of individuals with a bachelor or master degree is around 28 %.

Here and in the further analysis, we exclude five observations for 2010, where the weights are larger than 15.

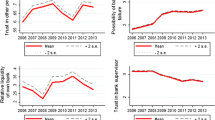

Some outliers are not plotted to improve legibility of the graphs.

We thank an anonymous referee for this suggestion. Detailed results available upon request.

Complete regression tables are available upon request.

References

Alesina A, La Ferrara E (2002) Who trusts others J Public Econ 85:207–234

Bagehot W (1920) Lombard Street. A description of the money market. 14th edition, reprinted. John Murray, London

Bebchuk LA, Fried J (2004) Pay without performance: The unfulfilled promise of executive compensation. Harvard University Press, Cambridge (MA)

Bebchuk LA, Fried J (2010) Paying for long-term performance. Univ Pa Law Rev 158:1915–1959

Bebchuk L A, Spamann H (2010) Regulating bankers’ pay. Georget Law J 98:247–287

Bolton P, Brunnermeier MK, Veldkamp L (2012) Leadership, coordination, and corporate culture. Rev Econ Stud 80:512–537

Carbó Valverde S, Maqui-López E, Ródriguez-Fernández F (2013) Trust in banks: Evidence from the Spanish financial crisis. Accessed 2 May 2014. http://ssrn.com/abstract=2310273

De Haan J, Vlahu R (2013) Corporate Governance of Banks: A Survey. De Nederlandsche Bank Working Paper No:386

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91:401–419

Fahlenbrach R, Stulz R (2011) Bank CEO incentives and the credit crisis. J Financ Econ 99:11–26

Flandreau M, Ugolini S (2011) Where it all began: lending of last resort and the Bank of England during the Overend-Gurney panic of 1866. Norges Bank Working Paper:2011–03

Friedman M, Schwartz AJ (1963) A monetary history of the United States, 1867–1960. Princeton University Press, New Jersey

Glasman L R, Albarracín D (2006) Forming attitudes that predict future behavior: A meta-analysis of the attitude-behavior relation. Psychol Bull 132:778–822

Goldsmith-Pinkham P, Yorulmazer T (2010) Liquidity, bank runs, and bailouts: Spillover effects during the Northern Rock episode. J Financ Serv Res 37:83–98

Guiso L (2010) A trust-driven financial crisis. Implications for the future of financial markets. Einaudi Institute for Economic and Finance Working Paper, 1006

Haleblian J, Finkelstein S (1993) Top management team size, CEO dominance, and firm performance: the moderating roles of environmental turbulence and discretion. Acad Manag J 36:844–863

Hurd M, Van Rooij MCJ, Winter J (2011) Stock Market Expectations of Dutch Households. J Appl Econom 26:416–436

Iyer R, Puri M (2008) Understanding bank runs: The importance of depositor-bank relationships and networks. Am Econ Rev 102:1414–1445

Iyer R, Puri M, Ryan N (2012) Do Depositors Monitor Banks? Mimeo

Klapper L, Lusardi A, Panos GA (2013) Financial literacy and its consequences: Evidence from Russia during the financial crisis. J Bank Financ 37:3904–3923

Knell M, Stix H (2009) Trust in banks? Evidence from normal times and from times of crisis. Oesterreichische Nationalbank Working Paper, 158

Laeven L, Valencia F (2013) Systemic banking crises database. IMF Econ Rev 61:225–270

Lusardi A, Mitchell OS (2008) Planning and financial literacy. How do women fare? Am Econ Rev 98:413–417

Lusardi A, Mitchell OS (2011) Financial literacy around the world: an overview. J Pension Econ Financ 10:497–508

Lusardi A, Mitchell OS, Curto V (2010) Financial literacy among the young. J Consum Aff 44:358–380

Malmendier Ulrike, Nagel Stefan (2011) Depression babies: Do macroeconomic experiences affect risk-taking? Q J Econ 126:373–416

Malmendier U, Tate G, Yan J (2011) Overconfidence and early-life experiences: The effect of managerial traits on corporate financial policies. J Financ 66:1687–1733

Mehran H, Morrison A, Shapiro J (2011) Corporate Governance and Banks: What have we learned from the financial crisis. Federal Reserve Bank of New York Staff Reports No, 502

Olfson M, Marcus SC, Druss B (2008) Effects of food and drug administration warnings on antidepressant use in a national sample. Arch Gener Psychiatry 65:94–101

Osili UO, Paulson A (2014) Crises and confidence: Systemic banking crises and depositor behavior. J Financ Econ 111:646–660

Penas MF, Tümer-Alkan G (2010) Bank disclosure and market assessment of financial fragility: Evidence from Turkish banks’ equity prices. J Financ Serv Res 37:159–178

Schwartz AJ (1987) Money in historical perspective. University of Chicago Press, Chicago

Shin HS (2009) Reflections on Northern Rock: The bank run that heralded the global financial crisis. J Econ Perspect 23:101–119

Stevenson B, Wolfers J (2011) Trust in public institutions over the business cycle. Am Econ Rev 101:281–287

Tang J, Crossan MM, Rowe WG (2011) Dominant CEO, deviant strategy, and extreme performance: The moderating role of a powerful board. J Manag Stud 48:1479–1503

Teppa F, Vis C (2012) The CentERpanel and the DNB household survey: Methodological aspects. De Nederlandsche Bank Occassional Studies 10 (4)

Van der Cruijsen CAB, De Haan J, Jansen D, Mosch RHJ (2012) Households’ decisions on savings accounts after negative experiences with banks during the financial crisis. J Consum Aff 46:436–456

Van der Cruijsen CAB, De Haan J, Jansen D, Mosch RHJ (2013) Knowledge and opinions about banking supervision: Evidence from a survey of Dutch households. J Financ Stab 9:219–229

Van der Cruijsen CAB, De Haan J, Jansen D (2013) Trust and financial crisis experiences. De Nederlandsche Bank Working Paper no:389

Van Rooij MCJ, Lusardi A, Alessie RJM (2011) Financial literacy and retirement planning in the Netherlands. J Econ Psychol 32:593–608

Webb TL, Sheeran P (2006) Does changing behavioral intentions engender behavior change? A meta-analysis of the experimental evidence. Psychol Bull 132:249–268

Yang AS (2013) Decision making for individual investors: A measurement of latent difficulties. J Financ Serv Res 44:303–329

Acknowledgments

This paper relies on survey material collected in 2010 by the second author and Kirstin Spahr van der Hoek as well as material collected by the authors and Jakob de Haan, also in 2010. We are grateful to both of them. Corrie Vis (CentERdata) helped arranging the various surveys using the CentERpanel. Jansen thanks DNB’s Governance and Accounting Department for hospitality while starting work on this paper. We thank conference participants at the University of Surrey, workshop participants at the Radboud University Nijmegen, seminar participants at DNB, Jakob de Haan, Marco van der Leij, Haluk Ünal (the editor), and an anonymous referee for constructive feedback. Any errors and omissions are our own responsibility. Views expressed in this article do not necessarily coincide with those of de Nederlandsche Bank, the Eurosystem or the International Monetary Fund.

Author information

Authors and Affiliations

Corresponding author

Appendix : Questions from the surveys

Appendix : Questions from the surveys

-

A. We submitted the following questions on trust to the members of the CentERpanel in 2010 and 2012.

Introduction:

This questionnaire is on trust in your bank(s).

Q1: How likely is it, that because of the following events, you will withdraw the funds from your bank, as you no longer trust the bank due to these events?

-

1 = highly unlikely

-

4 = neutral

-

7 = highly likely

-

? = I do not know.

-

a) The bank is led by a dominant person.

-

b) Managers of this bank are receiving large bonuses.

-

c) The explanations related to financial products of this bank are lengthy and difficult to read.

-

d) The share price of this bank drops sharply.

-

e) Family and friends are advising you to withdraw funds from this bank.

-

f) There are media reports that customers of this bank are withdrawing funds.

-

g) The bank receives government support to stay financially healthy.

-

h) The government nationalizes the bank.

-

B. We submitted the following questions on crisis experiences to the members of the CentERpanel in 2010.

Q27: During the past 3 years did a bank at which you were customer go bankrupt?

-

a) yes, DSB.

-

b) yes, Icesave.

-

c) yes, other .

-

d) no.

Q28: During the past 3 years did a bank at which you were customer survive with the help of government support?

-

a) yes.

-

b) no.

-

c) I don’t know.

Rights and permissions

About this article

Cite this article

Jansen, DJ., Mosch, R.H.J. & van der Cruijsen, C.A.B. When Does the General Public Lose Trust in Banks?. J Financ Serv Res 48, 127–141 (2015). https://doi.org/10.1007/s10693-014-0201-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-014-0201-y