Abstract

We analyze the procompetitive effects of dual pricing, that is, input market price discrimination. An upstream firm has an incentive to maintain competition downstream which is realized by selling at an advantageous price to an inefficient downstream firm when discrimination is possible while it would exit under uniform pricing. We augment the exit issue into existing frameworks of Katz (Am Econ Rev 77:154–167, 1987), DeGraba (Am Econ Rev 80:1246–1253, 1990), and Yoshida (Am Econ Rev 90:240–246, 2000) which allows us to show that price discrimination in intermediary goods markets tends to have positive effects on allocative, dynamic and productive efficiency, respectively. In contrast, a discrimination ban tends to facilitate exit of relatively inefficient firms, thereby strengthening downstream market concentration.

Similar content being viewed by others

Notes

For instance, in the US Section 2 of the Clayton Act, known as the Robinson–Patman Act due to a 1936 amendment, prohibits price discrimination that would lessen competition. Thus a supplier that charges one firm more than another violates Section 2 of the Clayton Act, unless they have objectively verifiable justifications. Acceptable justifications include that the price difference is attributable to cost differences, or that the price difference is a response to meeting competition (for an overview see Scherer and Ross 1990). In the EU, Article 102 (c) of the Treaty on the Functioning of the European Union prohibits the abuse of a dominant position, whereby one form of abuse consists in "applying dissimilar conditions to equivalent transactions with other trading parties, thereby placing them at a competitive disadvantage". In addition, the European Commission's 2010 guidelines on vertical restraints [SEC (2010) 411 final] consider in paragraph 52 any agreement "that the distributor shall pay a higher price for products intended to be resold by the distributor online than for products intended to be resold off-line" a hardcore restriction.

Input market discrimination is also an issue in network industries such as telecommunications, gas and electricity, or rail transport, where pricing rules for access to essential facilities are typically set by regulatory bodies. These access regulations almost always prescribe that access prices to upstream facilities have to be non-discriminatory (see, e.g., Vickers 1995).

All those works assume an upstream monopolist setting linear wholesale prices, while the downstream firms are competing à la Cournot in the final good market. See McAfee and Schwartz (1994), O’Brien and Shaffer (1994), and Inderst and Shaffer (2009) for models which analyze an input price discrimination ban when two-part tariffs are feasible.

Traditionally concerns against price discrimination have either circled around the anticompetitive effects on downstream rivals of a vertically integrated firm (see, e.g., Vickers 1995) or on potential adverse effects on consumer surplus. While the first concern relates to vertically integrated firms which may leverage their upstream marlet power to foreclose the downstream market, the latter reasoning has been heavily criticized already long ago by many economists such as Bork (1978) according to whom price discrimination is efficiency enhancing, as it allows monopolists to expand their output beyond the output level set at a uniform price. As Bork (1978, p. 397) has pointed out, price discrimination has often been discussed “as though the seller were instituting discrimination between two classes of customers he already serves, but discrimination may be a way of adding an entire category of customers he would not otherwise approach because the lower price would have spoiled his existing market.”

This result only holds if it is possible to order firms according to their efficiencies. If firms have more than one efficiency characteristic they cannot always be ordered unambiguously so that the above result may not hold any longer. Related is Valletti (2003) who also examines how the curvature of the demand function affects Yoshida’s results.

See Inderst and Valletti (2009) for a generalization of Katz’ analysis.

See also Banerjee and Lin (2003) who have shown that fixed price contracts can induce larger investments than floating price contracts.

See Haucap and Wey (2004a) which is an early version of our paper which was presented at annual conferences of EARIE, Verein für Socialpolitk, and IIOC in 2004–2005.

Dertwinkel-Kalt et al. (2015) have derived the positive entry effect under buyer power given that the powerful buyer’s outside option binds. The present paper, however, drops this assumption and shows that this scenario may arise endogenously. This result is not straightforward as the upstream firm may rather want to refrain from supplying the powerful buyer than to make him accept the offer.

Symmetric \(\alpha\)-efficiencies are plausible with respect to storable retailing and durable goods. However, firms may differ in their labor productivities such that (presumably, more capital-intense) firms can use their labor force more efficiently than others. Or, in the case of raw materials, some firms may produce less waste and thus use their inputs more efficiently in the production process of the final good. In the case of tradable emission rights for carbon dioxide, firms typically differ in their emission levels that are necessary to produce a given quantity of electricity, steel, or cement, to name just a few examples. In contrast, for instance retailers with heterogenous sales costs differ with respect to their \(\beta\)-efficiencies.

The exact parameter ranges are specified below.

We focus on the \(\alpha\)-efficiency to obtain a raising rivals’ cost result which is not possible if firms only differ in their \(\beta\)-parameter. If they only differ in their \(\beta\)-parameter, firm 1 cannot obtain a competitive advantage through a higher uniform input price. If, however, the firms differ in their \(\alpha\)-efficiency, a higher input price impacts overproportionally on the less efficient firm which is necessary to obtain a raising rivals’ cost outcome.

See Yoshida (2000, Proposition 2), where it is shown that a sufficient condition for this result is that firms can be ordered along the lines of their productive efficiency (as is the case in our setting). However, as pointed out above, Yoshida’s analysis takes the number of active firms as exogenously given.

However, due to the \(\alpha\)-inefficiency of firm 2 the upstream monopolist does not necessarily want to set a high price, since he benefits from the inefficient firm’s high demand in case of low input prices. Thus, we had to restrict the parameter space (precisely, \(\alpha <\alpha ^{\prime \prime }\)) in A2 to guarantee that the upstream monopolist prefers exit of firm 2 (see the proof to Proposition 2 in the Appendix).

Binarity of the investment decision is a plausible assumption for example with respect to technology choice. FIrm 1 can decide either to upgrade to a new technology or to stay with the old one.

The equilibrium output of firm 1 under regime U is given by \(q_{E,1} ^{U}=(2a-2c+7\theta +5\Delta )/12\), which is increasing in \(\Delta\).

Kreps and Scheinkman (1983) have shown that the Cournot solution is the equilibrium outcome of a two stage game where firms first set their production capacities and then compete in prices.

References

Banerjee, S., & Lin, P. (2003). Downstream R&D. Raising rivals’ costs, and input price contracts. International Journal of Industrial Organization, 21, 79–96.

Bester, H., & Petrakis, E. (1993). The incentives for cost reduction in a differentiated industry. International Journal of Industrial Organization, 11, 519–534.

Bork, R. (1978). The antitrust paradox. New York: Basic Books.

Buccirossi, P. (2013). Vertical restraints for online sales, note prepared for the OECD roundtable, DAF/COMP (2013) 1. Paris: OECD.

DeGraba, P. (1990). Input market price discrimination and the choice of technology. American Economic Review, 80, 1246–1253.

Dertwinkel-Kalt, M., Haucap, J., & Wey, C. (2015). Raising rivals’ cost through Buyer power. Economics Letters, 126, 181–184.

German Federal Cartel Office (2013) Annual Report.

Haucap, J., & Wey, C. (2004a). Input price discrimination (bans), entry and welfare. Paper presented at the annual conderence 2004 of the Verein für Socialpolitik, Dresden. http://www.diw.de/sixcms/detail.php/42127.

Haucap, J., & Wey, C. (2004b). Unionization structures and innovation incentives. Economic Journal, 114, C149–C165.

Haucap, J., Pauly, U., & Wey, C. (2001). Collective wage setting when wages are generally binding: An antitrust perspective. International Review of Law and Economics, 21, 287–307.

Hausman, J., & McKie-Mason, J. K. (1988). Price discrimination and patent policy. Rand Journal of Economics, 19, 253–265.

Herweg, F., & Müller, D. (2012). Price discrimination in input markets: Downstream entry and efficiency. Journal of Economics and Management Strategy, 21, 773–799.

Inderst, R., & Shaffer, G. (2009). Market power, price discrimination, and allocative efficiency in intermediate-goods markets. Rand Journal of Economics, 40, 658–672.

Inderst, R., & Valletti, T. (2009). Price discrimination in input markets. Rand Journal of Economics, 40, 1–19.

Katz, M. (1987). The welfare effects of third-degree price discrimination in intermediate goods markets. American Economic Review, 77, 154–167.

Kreps, D. M., & Scheinkman, J. A. (1983). Quantity precommitment and Bertrand competition yield Cournot outcomes. Bell Journal of Economics, 14, 326–337.

Layson, S. K. (1994). Market opening under third-degree price discrimination. Journal of Industrial Economics, 42, 335–340.

McAfee, R. P., & Schwartz, M. (1994). Opportunism in multilateral vertical contracting: Nondiscrimination, exclusivity, and uniformity. American Economic Review, 84, 210–230.

O’Brien, D. P., & Shaffer, G. (1994). The welfare effects of forbidding discriminatory discounts: A secondary line analysis of Robinson–Patman Act. Journal of Law, Economics, and Organization, 10, 296–318.

Scherer, F. A., & Ross, D. (1990). Industrial market structure and economic performance. Boston: Houghton Mifflin.

Valletti, T. (2003). Input price discrimination with downstream cournot competitors. International Journal of Industrial Organization, 21, 969–988.

Vickers, J. (1995). Competition and regulation in vertically related markets. Review of Economic Studies, 62, 1–17.

Vogel, L. (2012). EU competition law applicable to distribution agreements: Review of 2011 and Outlook for 2012. Journal of European Competition Law & Practice, 3, 271–286.

Williamson, O. E. (1968). Wages Rates as a barrier to entry: The Pennington case in perspective. Quarterly Journal of Economics, 82, 85–116.

Yoshida, Y. (2000). Third-degree price discrimination in input markets: Output and welfare. American Economic Review, 90, 240–246.

Acknowledgments

A former version of this paper has been circulated under the title "Input Price Discrimination (Bans), Entry and Welfare". We like to thank Pio Baake, Stephane Caprice, Paul Heidhues, Lars-Hendrik Röller, Norbert Schulz, and Francisco Ruiz-Aliseda and two anonymous referees for helpful comments. This paper benefited from presentations at annual conferences held by EARIE, IIOC, and Verein für Socialpolitik as well as from comments received at the 2nd workshop on “Market Power in Vertically Related Markets” (Paris, 2011) and at the annual workshop of the Industrial Economics group of the Verein für Socialpolitik (Würzburg, 2013). Financial support by the German Science Foundation (DFG) for the research project “Market Power in Vertically Related Markets” is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In this Appendix we present the omitted proofs and we derive Assumptions 2 and 3.

Proof of Lemma 2

We have to compare the upstream monopolist’s profit depending on whether or not the less efficient downstream firm 2 is served. With the monopoly input price given by (5) firm 2 remains active for all \(\Delta <2(a-c)/7\), in which case the upstream monopoly profit becomes \(L_{NE}^{U}=\left[ 2(a-c)-\Delta \right] ^{2}/24\). Note that the upstream monopolist’s profit is strictly decreasing in \(\Delta\).

If, however, the monopolist prefers to serve only the efficient downstream firm, then its profit maximizing input price is \(w_{E}^{U}=(a-c)/2\), for all \(\Delta \ge (a-c)/4\). However, for all \(\Delta <(a-c)/4\) the inefficient firm would purchase inputs at a price of \(w_{E}^{U}\). In those cases, therefore, the input monopolist has to charge the exit inducing input price \(\overline{w}\) if he wants to ensure that only one firm is served. Clearly, the monopoly profit at \(\overline{w}\) is strictly smaller than the profit at \(w_{E}^{U}\), which is given by \(L_{E}^{U}(w_{E}^{U})=\left( a-c\right) ^{2}/8\). Note that this expression is independent of \(\Delta\). Comparing \(L_{NE}^{U}\) and \(L_{E}^{U}\), we obtain the unique threshold value \(\widetilde{\Delta } =(2-\sqrt{3})(a-c)\), with \(L_{NE}^{U}<L_{E}^{U}\), for all \(\Delta >\widetilde{\Delta }\), and \(L_{NE}^{U}>L_{E}^{U}\), for all \(\Delta <\widetilde{\Delta }\). Note that \(\widetilde{\Delta }>(a-c)/4\), so that \(w_{E}^{U}\) is a feasible pricing option for the monopolist for all \(\Delta >\widetilde{\Delta }\). In addition, \(\widetilde{\Delta }<2(a-c)/7\). Hence, for all \(\Delta \in [\widetilde{\Delta },2(a-c)/7]\) the input monopolist decides to serve only firm 1 at \(w_{E}^{U}\) even though he could also serve both firms at \(w_{NE}^{U}\). It follows that the monopolist sets the exit inducing input price, \(w_{E}^{U}\), for all \(\Delta \ge \widetilde{\Delta }\), and the monopoly input price, \(w_{NE}^{U}\), with both firms being active for all \(\Delta <\widetilde{\Delta }\). \(\square\)

Proof of Proposition 1

Part (i): We have to compare social welfare, \(W_{\psi }^{R}\), (the sum of upstream and downstream producer surplus plus consumer surplus) under the two regimes \(R\in \{D,U\}\). Under price discrimination, D, social welfare is defined as \(W^{D} =L^{D}+\sum _{i}\pi _{i}^{D}+CS^{D}\), which gives \(W^{D}=(20(a-c)^{2} -20\Delta (a-c)+23\Delta ^{2})/72\). Similarly, with one firm active under uniform input pricing welfare is given by \(W_{E}^{U}=L_{E}^{U}+\pi _{1,E} ^{U}+CS_{E}^{U}=7\left( a-c\right) ^{2}/32\). Solving \(W^{D}-W_{E}^{U}=0\) we obtain the threshold value \(\Delta ^{U}:=17(a-c)/46\). Moreover, welfare under regime U with both firms active can be written as \(W_{NE}^{U}=(20(a-c)^{2} -20\Delta (a-c)+41\Delta ^{2})/72\). The welfare comparison then yields \(W^{D}-W_{NE}^{U}<0\). Hence, \(W_{NE}^{U}>W^{D}\) holds for all \(\Delta \in (0,\widetilde{\Delta })\).

Part (ii): Equilibrium consumer surplus, \(CS^{R}\), under the two regimes, \(R\in \{D,U\}\), is increasing with total output, \(Q^{R}\), with \(CS^{R}=(Q^{R})^{2}/2\). Comparison yields that total output (and hence, consumer surplus) is always at least as large under regime D as under regime U, as \(Q^{D}=Q_{E}^{U}=\left[ 3(a-c)-\Delta \right] /8\) is strictly larger than \(Q_{NE}^{U}=(a-c)/3\) for all \(\Delta <\widehat{\Delta }\). It follows that \(CS^{D}>CS_{NE}^{U}\) if \(\Delta >\widetilde{\Delta }\) and \(CS^{D}=CS_{E}^{U}\) if \(\Delta \le \widetilde{\Delta }\).

Proof of Proposition 2

The proof proceeds in two steps. Part (i) shows that \(w^{U}=(a+7v)/6\) is the unique equilibrium and part (ii) proves the orderings of consumer surplus and social welfare.

Part (i): For the exit-inducing input price \(w^{U}=(a+7v)/6\) the supplier realizes the profit level \(L^{U}=\frac{1}{72}(a+7v)(5a-7v)\). Firstly, by not matching firm 1’s outside option, the supplier could gain at most \(L^{OO}\). Since \(L^{U}-L^{OO}=(5a^{2}+28av-49v^{2}-3a-3v)/72>0\), the upstream monopolist wants to prevent firm 1 from picking up its outside option. Secondly, the supplier wants to set a uniform input price which induces exit due to the following reasoning. To see this, suppose that firm 1 has no buyer power (i.e., the outside option never binds). Firm 1’s profit is then given by \(\pi _{1}=(a-2w+\alpha w)^{2}/9\) and thus increases in the input price w. The supplier’s profit, however, is given by \(L(w)=(aw-2w^{2}+2\alpha w^{2}+a\alpha w-2\alpha ^{2}w^{2})/3\) which has a strict maximum at \(w^{NOO}=a(1+\alpha )/(4-4\alpha +4\alpha ^{2})\), while \(\partial L/\partial w<0\), for \(w>w^{NOO}\).

Next, let \(\widehat{w}=(a-7v)/(4\alpha -8)\) denote the input price for which both firms are active and for which firm 1’s outside option is binding (i.e., \(\widehat{w}:\pi _{1}(q_{1}(w,w),q_{2}(w,w)=\pi _{1}^{OO}\)). Note that \(v<4a/91\) and \(\alpha >\alpha ^{\prime }\) ensure \(w^{NOO}<\widehat{w}\). Consequently, if firm 1 has buyer power and the upstream monopolist wants to supply both firms, it will set \(w=\widehat{w}\) since firm 1 would not accept a lower uniform input price and \(L(w)<L(\widehat{w})\) for \(w>\widehat{w}\). The input price \(\widehat{w}\) ensures the profit \(L(\widehat{w})=\frac{1}{24}(a-7v)(-5a-\alpha a+7v-7v\alpha +\alpha ^{2}a+7v\alpha ^{2})/(\alpha -2)^{2}\). The difference

is negative for all \(\alpha <\alpha ^{\prime \prime }\). Thus, the supplier strictly prefers to offer \(w^{U}\), so that exit occurs.

Part (ii): We compare the equilibrium values of consumer surplus and welfare under the different regimes. For regime \(R\in \{D,U\}\) and market structure \(\psi =\{E,NE\}\) we denote the overall produced equilibrium quantity \(Q_{\psi }^{R}\). For the parameter ranges under consideration, regime D prevents exit and we obtain

Concerning welfare we obtain

and

We find that \(CD_{NE}^{D}-CS_{E}^{U}=\frac{35}{384}a^{2}-\frac{21}{64} av-\frac{245}{384}v^{2}>0\) holds for all \(v<\frac{a}{5}\) and \(W_{NE}^{D} -W_{E}^{U}=\frac{3}{128}a^{2}+\frac{35}{192}av+\frac{49}{384}v^{2}\) holds for all \(v>0\), which means that the discriminatory pricing regime is beneficial both for consumers and for overall welfare. \(\square\)

Proof of Proposition 3

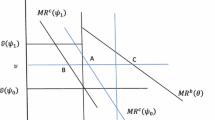

It is straightforward to calculate firm 1’s innovation incentives \(\Psi ^{R}(\psi _{\theta },\psi _{0})=\pi _{1} ^{R}(\psi _{\theta })-\pi _{1}^{R}(\psi _{0})\), where the argument \(\psi _{\theta }\) stands for the downstream market structure after the innovation and \(\psi _{\theta }\) indicates the market structure before the innovation, with \(\psi _{(.)}\in \{NE,E\}\). We then obtain

Similarly, we can calculate firm 1’s innovation incentives \(\Psi ^{U} (\psi _{\theta },\psi _{0})\) under regime U, which are given by

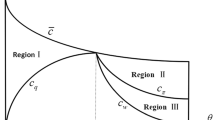

We now have to pairwise compare \(\Psi ^{U}(\psi _{\theta },\psi _{0})\) and \(\Psi ^{D}(\psi _{\theta },\psi _{0})\).

Parts (i) and (ii): Given that \(\Delta ^{\prime \prime }>\Delta ^{\prime }\) for all \(\theta >0\) we have to compare \(\Psi ^{U}(NE,NE)\) versus \(\Psi ^{D}(NE,NE)\) for the case where \(\Delta <\Delta ^{\prime }\). In addition, we have to compare \(\Psi ^{U}(E,E)\) versus \(\Psi ^{D}(NE,NE)\) and \(\Psi ^{D}(E,NE)\) for the cases where \(\Delta \ge \widetilde{\Delta }\). Firstly, note that \(\Psi ^{U}(NE,NE)-\Psi ^{D}(NE,NE)>0\) can be rewritten as \(4\theta (a-c)+18\Delta \theta +11\theta ^{2}>0\), which is clearly always fulfilled. Secondly, we can rewrite \(\Psi ^{U}(E,E)-\Psi ^{D}(E,NE)<0\) as \(\frac{1}{144}(5a-5c+2\Delta )(-a+c+2\Delta )<0\). This inequality unambiguously holds for all \(\Delta <\widehat{\Delta }\) which we have assumed in A1. And thirdly, note that \(\Psi ^{U}(E,E)-\Psi ^{D}(NE,NE)<0\) if \(\theta (-7\theta +2a-2c-16\Delta )/144<0\) which holds for \(\Delta \ge \widetilde{\Delta }\).

Part (iii): We can rewrite \(\Psi ^{D}(E,NE)-\Psi ^{U}(E,NE)>0\) as \(\frac{1}{48}\Delta (4a-4c+7\Delta )>0\), which always holds.

We show that \(\Psi ^{D}(NE,NE)-\Psi ^{U}(E,NE)>0\) if and only if \(\Delta \in [\Delta ^{*},\min \{ \Delta ^{\prime \prime },\widetilde{\Delta }\})\). Firstly, let us derive \(\Delta ^{*}\). The equation \(\Psi ^{D}(NE,NE)-\Psi ^{U}(E,NE)=0\) is equivalent to \(-5(a-c)^{2}/144-\theta (a-c)/72+5\Delta (a-c)/36+(5\Delta /12+2\theta /15)^{2}+37\theta ^{2}/1200=0\). Note that the left-hand side of this equation is increasing in \(\Delta\) and that

is the only feasible non-negative solution for the equation. Secondly, note that \(d\Delta ^{\prime \prime \prime }/d\theta <0,d\widetilde{\Delta }/d\theta =0\) and \(\Delta ^{\prime \prime \prime }(\theta )<\Delta ^{\prime \prime }(\theta )\) as well as \(d\Delta ^{\prime }/d\theta <0\) for all \(\theta\). Thirdly, note that at \(\theta =0\) we obtain \(\Delta ^{\prime }(0)=\widetilde{\Delta }>\Delta ^{\prime \prime \prime }(0)\). Fourthly, there exists a unique \(\widehat{\widehat{\theta }}\in (0,\widehat{\theta })\) with \(\Delta ^{\prime \prime \prime }(\widehat{\widehat{\theta }})=\Delta ^{\prime }(\widehat{\widehat{\theta }})\), which is \(\widehat{\widehat{\theta }}=(a-c)(171\sqrt{3}-4-\sqrt{35069+21532\sqrt{3}}))/129\approx 0.101(a-c)\). Thus, \(\Delta ^{\prime \prime \prime }(\theta )<\Delta ^{\prime }(\theta )\) for \(\theta <\widehat{\widehat{\theta }}\) and \(\Delta ^{\prime \prime \prime }(\theta )\in [\Delta ^{\prime }(\theta ),\min \{ \Delta ^{\prime \prime },\widetilde{\Delta }\})\) for \(\theta >\widehat{\widehat{\theta }}\). We define \(\Delta ^{*}=\max \{ \Delta ^{\prime \prime \prime }(\theta ),\Delta ^{\prime }(\theta )\}\).

Proof of Proposition 4

According to Proposition 3, it is possible that an innovation project \(I(\theta )\) is exclusively carried out under D, but not under regime U. Given \(\Delta \in [\Delta ^{*},\widetilde{\Delta })\), then it follows from Lemma 2 that firm 2 stays in the market if the innovation is not carried out under regime U. In that case, total output is given by \(Q_{NE}^{U}=\left[ 2(a-c)-\Delta \right] /6\). If the innovation is undertaken under regime D, equilibrium quantities can be computed as \(Q_{NE}^{D}=(2(a-c)+\theta -\Delta )/6\) for \(\Delta <\Delta ^{\prime \prime }\) and \(Q_{E}^{D}=(a-c+\theta )/4\) for \(\Delta >\Delta ^{\prime \prime }\). Obviously, \(Q_{NE}^{D}>Q_{NE}^{U}\) holds always for \(\theta >0\). Note that \(Q_{E}^{D}>Q_{NE}^{U}\) for \(\Delta >\Delta ^{\prime \prime }\) since \(\Delta ^{\prime \prime }>(a-c)/12\). Thus, consumer surplus is higher under the discriminatory regime.

Given \(\Delta \in [\widetilde{\Delta },\widehat{\Delta })\), according to Proposition 3, it may also happen that the innovation is exclusively taken out under regime D. Under both regimes only firm 1 is active and its produced quantity is strictly increasing in \(\theta\). Thus, consumer surplus is higher under regime D.

Also social welfare can be higher under the discriminatory regime if the innovation is large enough. For instance \(a=1\), \(c=0.05\), \(\theta =0.05\) gives that welfare is strictly higher under the discriminatory regime for all parameter values \(\Delta\). \(\square\)

Rights and permissions

About this article

Cite this article

Dertwinkel-Kalt, M., Haucap, J. & Wey, C. Procompetitive dual pricing. Eur J Law Econ 41, 537–557 (2016). https://doi.org/10.1007/s10657-015-9510-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10657-015-9510-3