Abstract

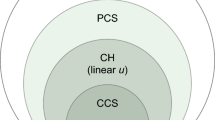

Stochastic goal programming is a suitable solution approach for multi-objective stochastic programs when a unique goal is settled for each objective function. In this paper, we address the case of multiple stochastic goals for an objective function. We derive results from studying the agent portfolio selection problem. The proposed multiple stochastic goal programming approach allows investors to set different goals for the return objective function. A chance constrained approach is proposed to address the stochastic investors’ minimum acceptable rate of return and a recourse approach to deal with investors’ ideal rate of return. An empirical study from Bahrain stock market is reported.

Similar content being viewed by others

References

Ameur, H. B., & Prigent, J. L. (2014). Portfolio Insurance: Gap risk under conditional multiples. European Journal of Operational Research, 236(1), 238–253.

Aouni, B. (2009). Multi-attribute portfolio selection: New perspectives. INFOR: Information Systems and Operational Research, 47(1), 1–4.

Aouni, B., Ben Abdelaziz, F., & Martel, J. M. (2005). Decision-maker’s preferences modeling in the stochastic goal programming. European Journal of Operational Research, 162(3), 610–618.

Aouni, B., Colapinto, C., & La Torre, D. (2014). Financial portfolio management through the goal programming model: Current state-of-the-art. European Journal of Operational Research, 234(2), 536–545.

Arenas Parra, M., Bilbao-Terol, A., & Rodrıguez Urıa, M. (2001). A fuzzy goal programming approach to portfolio selection. European Journal of Operational Research, 133(2), 287–297.

Ben Abdelaziz, F. (2012). Solution approaches for the multiobjective stochastic programming. European Journal of Operational Research, 216(1), 1–16.

Ben Abdelaziz, F., Aouni, B., & Fayedh, R. E. (2007). Multi-objective stochastic programming for portfolio selection. European Journal of Operational Research, 177(3), 1811–1823.

Bilbao-Terol, A., Arenas-Parra, M., & Cañal-Fernández, V. (2012). Selection of socially responsible portfolios using goal programming and fuzzy technology. Information Sciences, 189, 110–125.

Charnes, A., & Cooper, W. W. (1959). Chance-constrained programming. Management Science, 6(1), 73–79.

Heinkel, R., & Stoughton, N. M. (1994). The dynamics of portfolio management contracts. Review of Financial Studies, 7(2), 351–387.

Hirschberger, M., Qi, Y., & Steuer, R. E. (2010). Large-scale MV efficient frontier computation via a procedure of parametric quadratic programming. European Journal of Operational Research, 204(3), 581–588.

Hirshleifer, J. (1965). Investment decision under uncertainty: Choice-theoretic approaches. The Quarterly Journal of Economics, 79(4), 510–536.

Lu, H. C., & Chen, T. L. (2013). Efficient model for interval goal programming with arbitrary penalty function. Optimization Letters, 7(2), 325–341.

Markowitz, H. M. (1952). Portfolio selection. The Journal of Finance, 7, 77–91.

Martel, J. M., & Aouni, B. (1990). Incorporating the decision-maker’s preferences in the goal-programming model. Journal of the Operational Research Society, 41(12), 1121–1132.

Masmoudi, M., & Ben Abdelaziz, F. (2012). A recourse goal programming approach for the portfolio selection problem. INFOR: Information Systems and Operational Research, 50(3), 134–139.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425–442.

Steuer, R. E., & Na, P. (2003). Multiple criteria decision making combined with finance: A categorized bibliographic study. European Journal of Operational Research, 150(3), 496–515.

Steuer, R. E., Qi, Y., & Hirschberger, M. (2007). Suitable-portfolio investors, nondominated frontier sensitivity, and the effect of multiple objectives on standard portfolio selection. Annals of Operations Research, 152(1), 297–317.

Author information

Authors and Affiliations

Corresponding author

Additional information

The work in this paper was funded by the University of Bahrain.

Rights and permissions

About this article

Cite this article

Masri, H. A multiple stochastic goal programming approach for the agent portfolio selection problem. Ann Oper Res 251, 179–192 (2017). https://doi.org/10.1007/s10479-015-1884-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-1884-7