Abstract

Using plant-level data from the manufacturing sector of Chile for the period 1990–2000, this paper examines the effect of financial development on the probability of exporting at the plant level, with a special focus on the heterogeneous responses of plants with different characteristics. The main results are that an improvement in financial development increases the probability of exporting of more productive plants and those with foreign ownership operating in manufacturing sectors that are more dependent on external finance. Our estimates also show that financial development does not appear to improve the probability of exporting for relatively smaller and younger plants. This result suggests that, at least for the case of exporting in Chile, smaller and younger plants are not necessarily more likely to benefit than larger and older plants from improvements in access to credit.

Similar content being viewed by others

Notes

For a recent survey, see Wagner (2012).

Recent papers using a similar identification strategy with microeconomic data are Jaud and Kukenova (2011) which shows that agri-food products that require more external finance survive longer in foreign markets if the exporting country is more financially developed, and Tsoukas (2011) which presents evidence that stock market development is particularly beneficial to large firms.

Although a plant is not necessarily a firm, in the case of Chilean manufacturing, most firms have only one plant. Thus, the paper will refer to plants and firms interchangeable.

Most of the plants with foreign ownership have actually majority foreign ownership (over 50 % foreign ownership).

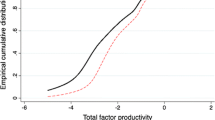

Total factor productivity is measured as the residual of a regression that estimates a Cobb–Douglas production function for each 3-digit industry using the method proposed by Olley and Pakes (1996) and later modified by Levinsohn and Petrin (2003), which corrects the simultaneity bias associated with the fact that productivity is not observed by the econometrician but it may be observed by the firm. In some cases, the production functions were estimated at the 2-digit level due to the small number of observations of some industries at the 3-digit level of disaggregation.

These marginal effects consider the results of column (4) in Table 3 and only the parameters that are statistically significant. In this case, the marginal effects are evaluated at the average of the variable foreign ownership. Given that the econometric results are very similar to those in Table 4 we do not present the effects corresponding to those results.

The high and low financially dependent industries are classified as in the previous exercise. In this case, the marginal effects are evaluated at the average of TFP.

References

Aghion, P., Fally, T., & Scarpetta, S. (2007). Credit constraints as a barrier to the entry and post-entry growth of firms. Economic Policy, 22(52), 731–779.

Alvarez, R., & López, R. A. (2005). Exporting and performance: Evidence from Chilean plants. Canadian Journal of Economics, 38(4), 1384–1400.

Beck, T. (2002). Financial development and international trade: Is there a link? Journal of International Economics, 57(1), 107–131.

Beck, T. (2003). Financial dependence and international trade. Review of International Economics, 11(2), 296–316.

Beck, T., Demirgüς-Kunt, A., Laeven, L., & Maksimovic, V. (2006). The determinants of financial obstacles. Journal of International Money and Finance, 25(6), 932–952.

Beck, T., Demirgüς-Kunt, A., & Levine, R. (2010). Financial institutions and markets across countries and over time: The updated financial development and structure database. World Bank Economic Review, 24(1), 77–92.

Bellone, F., Musso, P., Nesta, L., & Schiavo, S. (2010). Financial constraints and firm export behaviour. The World Economy, 33(3), 347–373.

Berman, N., & Héricourt, J. (2009). Financial factors and the margins of trade: Evidence from cross-country firm-level data. Journal of Development Economics, 93(2), 206–217.

Bernard, A. B., & Jensen, J. B. (1999). Exceptional exporter performance: Cause, effect, or both? Journal of International Economics, 47(1), 1–25.

Bernard, A. B., & Jensen, J. B. (2004). Why some firms export. Review of Economics and Statistics, 86(2), 561–569.

Braun, M. (2003). Financial Contractibility and Asset Hardness (Working Paper). Los Angeles: University of California.

Braun, M., & Raddatz, C. (2008). The Politics of financial development: Evidence from trade liberalization. The Journal of Finance, 63(3), 1469–1508.

Castellani, D. (2002). Export behavior and productivity growth: Evidence from Italian Manufacturing Firms. Review of World Economics/Weltwirtschaftliches Archiv, 138(4), 605–628.

Chaney, T. (2005). Liquidity Constrained Exporters (Working Paper). Chicago: University of Chicago.

Desai, M., Foley, C. F., & Hines, J. (2004). A multinational perspective on capital structure choice and internal capital markets. Journal of Finance, 59(6), 2451–2488.

Desai, M., Foley, C. F., & Forbes, K. J. (2008). Financial constraints and growth: Multinational and local firm responses to currency depreciations. Review of Financial Studies, 21(6), 2857–2888.

Do, T., & Levchenko, A. (2007). Comparative advantage, demand for external finance, and financial development. Journal of Financial Economics, 86(3), 796–834.

Greenaway, D., Guariglia, A., & Kneller, R. (2007). Financial factors and exporting decisions. Journal of International Economics, 73(2), 377–395.

Heckman, J. (1976). The common structure of statistical models of truncation, sample selection and limited dependent variables and a simple estimator for such models. Annals of Economic and Social Measurement, 5(4), 475–492.

Jaud, M., & Kukenova, M. (2011). Financial development and survival of African agri-food exports (Policy research working paper 5649). Washington, DC: World Bank.

Kasahara, H., & Rodrigue, J. (2008). Does the use of imported intermediates increase productivity? Plant-level evidence. Journal of Development Economics, 87(1), 106–118.

King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. Quarterly Journal of Economics, 108(3), 717–737.

Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of Economic Literature, 35(2), 688–726.

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46(1), 31–77.

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Review of Economic Studies, 70(2), 317–341.

López, R. A., & Yadav, N. (2010). Imports of intermediate inputs and spillover effects: Evidence from Chilean plants. Journal of Development Studies, 46(8), 1385–1403.

Manova, K. (2010). Credit Constraints, Heterogeneous Firms, and International Trade (Working Paper). Stanford: Stanford University.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Minetti, R., & Zhu, S. C. (2011). Credit constraints and firm export: Microeconomic evidence from Italy. Journal of International Economics, 83(2), 109–125.

Olley, G. S., & Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(6), 1263–1297.

Rajan, R. G., & Zingales, L. (1998). Financial development and growth. American Economic Review, 88(3), 559–586.

Roberts, M., & Tybout, J. (1997). An empirical model of sunk costs and the decision to export. American Economic Review, 87(4), 545–564.

Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158.

Tsoukas, S. (2011). Firms survival and financial development: Evidence form a panel of emerging markets. Journal of Banking & Finance, 35(7), 1736–1752.

Wagner, J. (2012). International trade and firm performance: A survey of empirical studies since 2006. Review of World Economics/Weltwirtschaftliches Archiv, 148(2), 235–267.

Demirgüç-Kunt, A., Beck, T., & Honohan, P. (2008). Finance for all? Policies and pitfalls in expanding access (A World Bank Policy Research Report). Washington, DC: The World Bank.

Acknowledgments

We would like to thank Rolando Campusano for excellent research assistance, and two anonymous referees and participants at the 6th Workshop of the International Study Group on Exports and Productivity (ISGEP) held at Leuphana University, Lüneburg, Germany, on September 28–30, 2011 for helpful comments on an earlier version of this paper. Alvarez thanks also the Millennium Science Initiative (Project NS 100017 “Centro Intelis”) for their financial support.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Alvarez, R., López, R.A. Financial development, exporting and firm heterogeneity in Chile. Rev World Econ 149, 183–207 (2013). https://doi.org/10.1007/s10290-012-0143-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-012-0143-0