Abstract

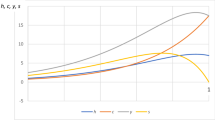

The paper develops a general equilibrium endogenous growth model involving heterogeneous consumption by an age-structured population with uncertain but limited life span and balanced life-time budget without bequests. The heterogeneity is introduced via weights which the individuals attribute in their utility function to consumption of different goods depending on the vintage of the good. The goods are produced by monopolistically competitive firms and the variety of available goods/technologies is determined endogenously through R&D investments. A competitive bank sector provides financial resources for investments, secured by agents’ savings and future firms profits. The general equilibrium is characterized by a system of functional equations and is analytically or numerically determined for several particular weight functions. It is shown that the investments by agents alone may be insufficient to sustain growth, while additional investments provided by the bank sector may lead to growth. The resulting imbalance between agents’ assets and the total value of firms can grow unboundedly in the case of homogeneous consumption. The results exhibit the qualitative difference between the dynamics of the model with heterogeneous versus homogeneous consumption. In particular heterogeneous consumption (when old goods are discounted) reduces the additional investments by the financial sector so that the values of firms become balanced by the assets of agents in the long run.

Similar content being viewed by others

Notes

The wage w(t) ≡ 1 is assumed to be equal for all jobs, which is reasonable in a model where qualification is not taken into account.

The equal saving/debt redistribution of deceased agent only within her cohort satisfies the balance of fare insurance, because agents from the same cohort have the same assets and probability of death. This redistribution is possible due to the assumption that there are always some people in the cohort until it becomes ω years old (n(τ, t) > 0 for 0 ≤ t − τ < ω).

The functional form \(m\!\left (\tau ,t,q,Q(t)\right )\) is given exogenously, thus it differs from the quality in quality-adjusted Dixit-Stiglitz consumption index used in some models with vertical innovations (e.g., Dinopoulos & Thompson 1998)

The net profit of the firm is its operating profit π minus taxes (that will be introduced later) and minus interest on debt.

We do not require the aggregated assets of agents to be equal to the total debts of firms like it is done in Sorger 2011, because in our model the optimal consumption profile and investments of a finitely living agent are completely defined via initial condition (6) and terminal conditions (7), like in Cass and Yaari 1967; d’Albis and Augeraud-Véron 2011, which is not the case for infinitely living households in Sorger (2011), where he needs additional condition V(t) ≡ A(t) to specify general equilibrium.

The case of γ = 0 corresponds to homogeneous consumption studied above.

We consider exponentially heterogeneous preferences, where in the limit \(\tilde {M}(\infty )\) is finite. Although, in the excluded cases of not exponential discounting of old goods, \(\tilde {M}(Q)\) could be unbounded. For example, when m = q/Q(t), we would have \(\tilde {M}(Q) = \frac {1-\alpha }{2-\alpha } Q \rightarrow \infty \) as \(Q \rightarrow \infty \), as follows from the definition of \(\tilde {M}\) and Eq. 58. Then, the total value of patents would be \(V(t) = \frac {1-\alpha }{2-\alpha }\frac {(Q(t))^{1-\varphi }}{\beta }\), which is close to Eq. 67 in the homogeneous case.

Note that for φ < 0 even small tax rate δ > 0 improves agents’ utilities in the long run, because the derivative \(\left .\frac {\text {d}}{\text {d} \delta }\frac {\left . u(\tau )\right |_{\delta = 0}}{\left . u(\tau )\right |_{\delta > 0}}\right |_{\delta = 0} = \alpha \varphi \frac {1-\alpha }{1-\varphi }\) becomes negative. A value φ < 0 means that past inventions make it more difficult to find new ideas, which we think to be unlikely.

References

Belyakov AO, Haunschmied JL, Veliov VM (2012) General equilibriummodel with horizontal innovations and heterogeneous products (Research Report No. 2012-01). Operations Research and Control Systems, Institute of Mathematical Methods in Economics, Vienna University of Technology. Retrieved from http://orcos.tuwien.ac.at/fileadmin/t/orcos/ResearchReports/2012-01Bely-VV-HS.pdf

Belyakov AO, Tsachev T, Veliov VM (2011) Optimal control of heterogeneous systems with endogenous domain of heterogeneity. Appl Math Optim 64(2):287-311

Blanchard O (1985) Debt, deficits and finate horizons. J Polit Econ 93:223-247

Boucekkine R, de la Croix D, Licandro O (2002) Vintage human capital, demographic trends, and endogenous growth. J Econ Theory 104(2):340–375

Cass D, Yaari ME (1967) Individual saving, aggregate capital accumulation, and efficient growth. In: Shell K (ed) Essays on the theory of optimal economic growth. pp 233–268. MIT, Cambridge

d’Albis H, Augeraud-Véron E (2011) Continuous-time overlapping generations models. In: Boucekkine R, Hritonenko N, Yatsenko Y (eds) Optimal control of age-structured population in economy, demography, and the environment. routledge explorations in environmental economics. pp 45-69. Taylor and Francis

Diamond PA (1965) National debt in a neoclassical growth model. Am Econ Rev 55:1126-1150

Dinopoulos E, Thompson P (1998) Schumpeterian growth without scale effects. J Econ Growth 3(4): 313-335

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297-308

Gale D (1973) Pure exchange equilibrium of dynamic economic models. J Econ Theory 6:12-36

Grossman MG, Helpman E (1989) Product development and international trade. J Polit Econ 97(6):1261-1283

Grossman MG, Helpman E (1991) Innovation and growth in the global economy. MIT Press

Jones CI (1995a) R&d-based models of economic growth. J Polit Econ 103:759-784

Jones CI (1995b) Time-series tests of endogenous growth models. Q J Econ 110:495-525

Jones CI (1999) Growth: With or without scale effects? Am Econ Rev 89:139-144

Judd KL (1985) On the performance of patents. Econometrica 53:567-585

Prettner K (2013) Population aging and endogenous economic growth. J Popul Econ 26(2):811–834. doi:10.1007/s00148-012-0441-9

Romer PM (1990) Endogenous technological change. J Polit Econ 98:71-102

Samuelson PA (1958) An exact consumption-loan model of interest with or without the social contrivance of money. J Polit Econ 66:467-482

Sorger G (2011) Horizontal innovations with endogenous quality choice. Economica 78(312):697-722. doi:10.1111/j.1468-0335.2010.00852.x

Yaari ME (1965) Uncertain lifetime, life insurance and the theory of the consumer. Rev Econ Stud 70: 83-101

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors would like to thank for helpful comments Alain Venditti, David de la Croix, and all participants of Workshop Overlapping Generations Days, Marseille, May 14-16, 2012. We also want to express our gratitude for fruitful discussions to Michael Kuhn and Klaus Prettner. This research was partly financed by Wiener Wissenschafts-, Forschungs- und Technologiefonds (WWTF) under grant No MA07-002 and by the Austrian Science Foundation (FWF) under grant No I 476-N13.

About this article

Cite this article

Belyakov, A.O., Haunschmied, J.L. & Veliov, V.M. Heterogeneous consumption in OLG model with horizontal innovations. Port Econ J 13, 167–193 (2014). https://doi.org/10.1007/s10258-014-0105-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-014-0105-7