Abstract

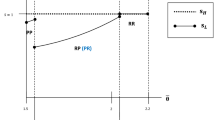

This paper examines a two-stage competition where firms simultaneously choose the number of products and qualities in the first stage, and then compete in prices. It is shown that a monopolist must sell a single product. In addition, in any equilibrium of multiproduct duopoly, there are segmented patterns of quality differentiation. Entangled configurations never emerge because each firm has an incentive to reduce the number of products facing direct competition with its rival. This result contrasts sharply with the equilibrium of non-segmented quality differentiation when firms compete in quantities. Furthermore, we find that the high-quality firm never offers more products than the low-quality firm, and quality differentiation between firms is greater than that within a firm.

Similar content being viewed by others

Notes

The analysis of Gilbert and Matutes (1993) is based on both a one-stage game and a three-stage game (the two firms choose product quality sequentially) respectively, and they show that firms may specialize only product provision if they can make a commitment to restrict the product offerings.

These prices are from their official websites; they denote the suggested retail price of each class with basic equipment.

The term “variety/quality” denotes the case where firms may choose both the number of products and the associated quality levels of their products.

In contrast to the finding of single-quality outcome in Champsaur and Rochet (1989, Proposition 3; 1990, Proposition 2) where the market is assumed to be fully covered, Cheng et al. (2011) show that each firm always has an incentive to provide multiple qualities in a partially covered market (i.e., the market size is endogenously determined) when the unit costs of quality are increasing and quadratic.

The standard model on endogeneous vertical differentiation like the paper by Tirole (1988) and Motta (1993), they examine a single-product duopoly where consumers’ valuations for quality are different and distributed uniformly, and shows that firms differentiate their product qualities in the market. In contrast, Herweg and Relaxing (2012) examines two-part tariff competition in a single-product duopoly where consumers have identical quality tastes and each of them may purchase more than one product. He shows that firms will differentiate their qualities if and only if two-part tariffs are feasible.

In contrast to the literature on endogeneous choice of vertical quality differentiation where quality is a long-run variable and thus the firms usually compete sequentially on quality and price, Chioveanu (2012) examines the one-stage competition of sing-product firms with simultaneous quality-and-price choices in a model of two-type consumers and two qualities where quality differentiation is exogenously given. Her analysis is suitable for the markets where quality choices do not require long-term investments, such as professional services.

In Lambertini and Tedeschi (2007), the quadratic costs of quality improvement fall upon the fixed costs, and firms choose their quality sequentially rather than simultaneously.

Some literature examines an uncovered market, such as Katz (1984), Moorthy (1988), Choi and Shin (1992) and Motta (1993), the others assume a covered market, such as Crampes and Hollander (1995) and Champsaur and Rochet (1989). Meanwhile, the market coverage is endogenously determined in some studies such as Wauthy (1996).

Note that if \(N=1\), the demand is reduced to \({\widetilde{x}}_{1}(p,q)=\bar{ \theta }-\theta _{1}=\bar{\theta }-\frac{{\widetilde{p}}_{1}}{{{\widetilde{q}}_{1}}}\).

The other solution, \(q_{a1}=\frac{\bar{\theta }}{\alpha }\) and \(p_{a1}=\frac{ \bar{\theta }^{2}}{\alpha }\), does not satisfy the second-order conditions.

The other solution, \(q_{a1}=\frac{2{\bar{\theta }}}{3\alpha }\), \(q_{a2}=\frac{ {\bar{\theta }}}{3\alpha }\), \(p_{a1}=\frac{5{\bar{\theta }}^{2}}{9\alpha }\) and \( p_{a2}=\frac{2{\bar{\theta }}^{2}}{9\alpha }\), does not satisfy the second-order conditions.

The detailed derivation is available from the authors.

The equilibrium qualities in \((abba)\) and \((abab)\) are too complex to solve analytically, so we treat \(0.1\) as an interval to make all combinations of \(\{r,s,t\}\) initial values, and employ Newton’s method to search for the solution to \(\{r,s,t\}\), where \(r=\frac{\widetilde{q}_{2}}{{{\widetilde{q}}_{1}}} \), \(s=\frac{{\widetilde{q}}_{3}}{{{\widetilde{q}}_{1}}}\) and \(t=\frac{{\widetilde{q}}_{4}}{{{\widetilde{q}}_{1}}}\). It is shown that there is no admissible interior solution. The derivation will be provided upon request.

The conditions for configurations \((a)\), \((abb)\) and \((aabb)\) to be an SPNE can be found in Appendix 3.

Compared the outcome \((ab)\) with \((abb)\), the market share of firm A decreases from \(0.279\overline{\theta }\) to \(0.270\overline{\theta }\) while the market share of firm B increases from \(0.345\overline{\theta }\) to \(0.4 \overline{\theta }\).

References

Bonnisseau JM, Lahmandi-Ayed R (2006) Vertical differentiation: multiproduct strategy to face entry? Berkeley Electron J Theor Econ 6:1–14

Champsaur P, Rochet JC (1989) Multiproduct duopolists. Econometrica 57:533–557

Champsaur P, Rochet JC et al (1990) Price competition and multiproduct firms. In: Champsaur P (ed) Essays in honor of Edmond Malinvaud. Microeconomics, vol 1. MIT Press, Cambridge, pp 163–187

Cheng Y-L, Peng S-K (2012) Quality and quantity competition in multiproduct duopoly. South Econ J 79:180–202

Cheng Y-L, Peng S-K, Tabuchi T (2011) Multiproduct duopoly with vertical differentiation. Berkeley Electron J Theor Econ 11 (Article 16)

Chioveanu I (2012) Price and quality competition. J Econ 107:23–44

Choi JC, Shin HS (1992) A comment on a model of vertical product differentiation. J Ind Econ 40:229–231

Crampes C, Hollander A (1995) Duopoly and quality standards. Eur Econ Rev 39:71–82

Gilbert RJ, Matutes C (1993) Product line rivalry with brand differentiation. J Ind Econ 41:223–240

Herweg F (2012) Relaxing competition through quality differentiation and price discrimination. J Econ 106:1–26

Katz M (1984) Firm specific differentiation and competition among multiproduct firms. J Bus 57:S149–166

Lambertini L, Tedeschi P (2007) On the social desirability of patents for sequential innovations in a vertically differentiated market. J Econ 90:193–214

Moorthy KS (1988) Product and price competition in a duopoly. Mark Sci 7:141–168

Motta M (1993) Endogenous quality choice: price vs. quantity competition. J Ind Econ 41:113–131

Tirole J (1988) The theory of industrial organization. MIT Press, Cambridge

Wauthy X (1996) Quality choice in models of vertical differentiation. J Ind Econ 44:345–353

Vives X (2008) Innovation pressure competitive. J Ind Econ 56:419–469

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank Takatoshi Tabuchi for his contributive discussions and insightful comments.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: Proof of Proposition 1

Proof

To ensure that it is not profitable for firm \(A\) to deviate to configuration \((a)\), we must have \(f\le 0.003\frac{\overline{\theta }^{3}}{\alpha }\). However, given \((q_{a1}^{*},q_{a2}^{*})=\) \((0.4\frac{\overline{ \theta }}{\alpha },0.2\frac{\overline{\theta }}{\alpha })\), we solve the first-order condition whereby firm \(B\) maximizes its profit \(\pi _{B}(aab)\) and then obtain \(q_{b1}^{**}=0.105\frac{\overline{\theta }}{\alpha }\) and \(\pi _{B}(0.4\frac{\overline{\theta }}{\alpha },0.2\frac{\overline{ \theta }}{\alpha },0.105\frac{\overline{\theta }}{\alpha })=0.005\frac{ \overline{\theta }^{3}}{\alpha }-f\). To ensure that firm \(B\) has no incentive to enter the market, we require that \(f\ge 0.005\frac{\overline{ \theta }^{3}}{\alpha }\). Thus, configuration \((aa)\) cannot be an SPNE. \(\square \)

Appendix 2: Proof of Remark 1

-

(i)

The following proof shows that the candidate \((aba)\) in Table 1, where \( (q_{a1}^{*},q_{a2}^{*},q_{b1}^{*})= (0.421\frac{\overline{ \theta }}{\alpha },0.033\frac{\overline{\theta }}{\alpha },0.214\frac{ \overline{\theta }}{\alpha })\), cannot be selected as an SPNE.

Proof

Given \(q_{b1}=0.214\frac{\overline{\theta }}{\alpha }\), by solving the first-order conditions whereby firm \(A\) maximizes its profit \(\pi _{A}(aab)\) by selling two products with qualities \((q_{a1},q_{a2})\) such that \( q_{a1}>q_{a2}>0.214\frac{\overline{\theta }}{\alpha }\), we derive \( q_{a1}=0.466\frac{\overline{\theta }}{\alpha }\) and \(q_{a2}=0.398\frac{ \overline{\theta }}{\alpha }\). Substituting them into the profit of firm \(A\) , we obtain \(\pi _{A}(0.466\frac{\overline{\theta }}{\alpha },0.398\frac{ \overline{\theta }}{\alpha },0.214\frac{\overline{\theta }}{\alpha })=0.01533 \frac{\overline{\theta }^{3}}{\alpha }-2f\), which is always higher than \(\pi _{A}(0.421\frac{\overline{\theta }}{\alpha },0.033\frac{\overline{\theta }}{ \alpha },0.214\frac{\overline{\theta }}{\alpha })=0.01526\frac{\overline{ \theta }^{3}}{\alpha }-2f\). \(\square \)

-

(ii)

The following proves that the candidate \((aab)\) in Table 1, where \( (q_{a1}^{*},q_{a2}^{*},q_{b1}^{*})=(0.457\frac{\overline{\theta } }{\alpha },0.371\frac{\overline{\theta }}{\alpha },0.183\frac{\overline{ \theta }}{\alpha })\), cannot be selected as an SPNE.

Proof

Given that firm \(B\) sells a single product with quality \(0.183\frac{ \overline{\theta }}{\alpha }\), we solve the first-order condition whereby firm \(A\) maximizes its profit \(\pi _{A}(ab)\) and derive \(q_{a1}=0.401\frac{ \overline{\theta }}{\alpha }\) and \(\pi _{A}(0.401\frac{\overline{\theta }}{ \alpha },0.183\frac{\overline{\theta }}{\alpha })=0.0178773\frac{\overline{ \theta }^{3}}{\alpha }-f\). Accordingly, to ensure that firm \(A\) will offer two products rather than one, it must be the case that \(0.0182949\frac{ \overline{\theta }^{3}}{\alpha }-2f\ge 0.0178773\frac{\overline{\theta }^{3} }{\alpha }-f\), i.e., \(f\le 0.0004176\frac{\overline{\theta }^{3}}{\alpha }\). Moreover, we solve the first-order condition that firm \(B\) maximizes its profit \(\pi _{B}(aabb)\) as firm \(A\) sells two products with qualities \( (0.457\frac{\overline{\theta }}{\alpha },0.371\frac{\overline{\theta }}{ \alpha })\), and obtain \(q_{b1}=0.195\frac{\overline{\theta }}{\alpha }\), \( q_{b1}=0.097\frac{\overline{\theta }}{\alpha }\) and \(\pi _{B}(0.457\frac{ \overline{\theta }}{\alpha },0.371\frac{\overline{\theta }}{\alpha },0.195 \frac{\overline{\theta }}{\alpha },0.097\frac{\overline{\theta }}{\alpha } )=0.011071\frac{\overline{\theta }^{3}}{\alpha }-2f\). Therefore, to ensure that firm \(B\) will not deviate to selling two products, we require that \( 0.0106517\frac{\overline{\theta }^{3}}{\alpha }-f\ge 0.0110711\frac{ \overline{\theta }^{3}}{\alpha }-2f\), i.e., \(f\ge 0.0004194\frac{\overline{ \theta }^{3}}{\alpha }\). Thus, the candidate \((aab)\) cannot be an SPNE since, if it is profitable for firm \(A\) to sell two products, firm \(B\) must have an incentive to deviate to selling two products. \(\square \)

Appendix 3: No deviation conditions of configurations \((a), (abb)\) and \((aabb)\)

Rights and permissions

About this article

Cite this article

Cheng , YL., Peng, SK. Price competition and quality differentiation with multiproduct firms. J Econ 112, 207–223 (2014). https://doi.org/10.1007/s00712-013-0367-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-013-0367-z

Keywords

- Multiproduct firms

- Vertical product differentiation

- Quality differentiation

- Quality competition

- Bertrand competition