Abstract

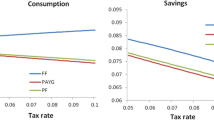

So far the economic literature has concentrated on analyzing the income tax and pension scheme in isolation. The present paper asks how both transfer schemes should be optimally designed in a society where individuals differ in productivity and rationality. Rational agents (if not liquidity constrained) smooth consumption over lifetime while myopic agents suffer from self-control problems and overconsume in young age, even though, ex post they regret their earlier decisions. The government’s aim is twofold. On the one hand, it wants to redistribute income from high- to low-productivity agents. On the other hand, it aims to secure old-age consumption possibilities for myopic agents. Analytical and numerical results show that, redistribution of the income tax scheme is increasing in society’s prevalence of self-control problems while it is decreasing in the pension scheme. The two transfer schemes are perfect substitutes when individuals do not suffer from self-control problems.

Similar content being viewed by others

Notes

This paper abstracts from the third type of redistribution implied by the pension system particularly when they are financed on a pay as you go basis, namely, that between generations.

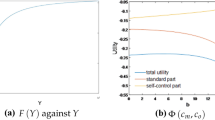

Unlike the framework by Cremer et al. (2008) in which myopic individuals solely consider first period utility and thus do not save at all, this paper deals with a more general distribution of self-control problems.

An example of such a setting is one with four types which obtains when \(w_i\in \{w_l,w_h\}\) and \(\beta _i\in \{\beta _M,\beta _R\}\). This 4-type specification will be used for the simulation in Sect. 4.

Given the assumptions on utility and labor disutility, the FOCs are both necessary and sufficient for a maximum.

It is useful to emphasize that this 2-period model is a stylized version of a more realistic framework in which agents make their consumption decisions time after time. In multi-period models self-control problems are most often modeled with a (quasi-)hyperbolic discounting function (see, e.g. Laibson 1997). Myopic consumption decisions in one period are then regretted in all other future periods and a welfare function that considers true long-run time preferences is appropriate under essentially any perspective; see also O’Donoghue and Rabin (2006).

For an in depth discussion on fresh starts see Fleurbaey (2008, Chap. 7).

One could also assume one common budget for both welfare schemes. If \(t\) were restricted to be positive this assumption would advance an additional degree of freedom since then the pension scheme could effectively be financed via lump-sum transfers, i.e. \(-\tau =B\). However, as both transfer schemes are linearly conditional on the same tax base \(w_i\ell _i\) and the tax rate \(t\) can well be negative (see Sect. 4 when this is indeed the case), no welfare gains can be achieved by assuming one common budget.

The adjustments of savings are given in the Appendix.

The utility function precludes income effects implying that the compensated and uncompensated labor supply effects coincide.

If some individuals had \(\beta _{i}>1\) implying overconsumption in old-age rather than in young-age, would tend to reduce the optimal pension contribution rate. But, still, as long as the predominant error in society is a preference for current consumption rather than for future consumption (as the evidence indicates), a positive pension contribution will be optimal.

Although the pension scheme comes along with labor supply distortions, these distortions are second-order at \(b=0\) while the increase in old-age consumption for completely myopic individuals is first-order.

Usually borrowing constraints are considered to be welfare decreasing. In this framework, however, it turns out that the government may find it optimal to induce a binding liquidity constraint. In other words, if capital markets were perfect it would ban to sell claims on public pension benefits.

The adjustment in savings can be both positive or negative; see Appendix.

See also Kifmann (2008) who studies the optimal age-dependent tax and pension parameters for a society with rational agents.

The overall share of high productivity and rational agents thus amounts to \(1-\pi ^l\) and \(1-\pi _M\) respectively.

References

Angeletos G-M, Laibson D, Repetto A, Tobacman J, Weinberg S (2001) The hyperbolic consumption model: calibration, simulation, and empirical evaluation. J Econ Perspect 15(3):47–68

Atkinson AB, Stiglitz JE (1980) Lectures on public economics. McGraw-Hill, New York

Barr N, Diamond P (2006) The economics of pensions. Oxf Rev Econ Policy 22(1):15–39

Bernheim BD, Skinner J, Weinberg S (2001) What accounts for the variation in retirement wealth among U.S. households? Am Econ Rev 91:832–857

Choi JJ, Laibson D, Madrian BC, Metrick A (2001) Defined contribution pensions: plan rules, participant choices, and the path of least resistance. NBER Working Paper, No 8655

Cigno A (2008) Is there a social security tax wedge? Labour Econ 15:68–77

Cremer H, De Donder P, Maldonado D, Pestieau P (2008) Designing a linear pension scheme with forced savings and wage heterogeneity. Int Tax Public Finance 15(5):547–562

Cremer H, De Donder P, Maldonado D, Pestieau P (2009) Forced saving, redistribution and nonlinear social security schemes. Southern Econ J 76(1):86–98

Diamond PA (1977) A framework of social security analysis. J Public Econ 8:275–298

Diamond PA (2004) Social security. Am Econ Rev 94:1–24

Diamond PA (2009) Taxes and pensions. Southern Econ J 76(1):2–15

Diamond PA, Hausman JA (1984) Individual retirement and savings behavior. J Public Econ 23:81–114

Dixit A, Sandmo A (1977) Some simplified formulae for optimal income taxation. Scand J Econ 79(4):417–423

Feldstein M (1985) The optimal level of social security benefits. Q J Econ C(2):303–320

Feldstein M, Liebman JB (2002) Social security. Handb Public Econ 4:2245–2324

Fleurbaey M (2008) Fairness, responsibility, and welfare. Oxford University Press, Oxford

Kahnemann D (1994) New challenges to the rationality assumption. J Inst Theor Econ 150:18–36

Kaplow L (2006) Myopia and the Effects of Social Security and Capital Taxation on Labor Supply. NBER Working Paper 12452

Kifmann M (2008) Age-dependent taxation and the optimal retirement benefit formula. Ger Econ Rev 9:41–64

Laibson D (1997) Hyperbolic discounting and golden eggs. Q J Econ 112(2):443–477

Laibson D, Repetto A, Tobacman J (1998) Self-control and saving for retirement. Brookings Papers Econ Activ 1:91–196

Myles GD (1995) Public economics. Cambridge University Press, Cambridge

O’Donoghue T, Rabin M (2003) Studying optimal paternalism, illustrated by a model of sin taxes. Am Econ Rev 93(2):186–191

O’Donoghue T, Rabin M (2006) Optimal sin taxes. J Public Econ 90:1825–1849

Sheshinski E (1972) The optimal linear income tax-benefit. Rev Econ Stud 39:297–302

Tenhunen S, Tuomala M (2010) On optimal lifetime redistribution policy. J Public Econ Theory 12(1): 171–198

Thaler RH, Sunstein CR (2003) Libertarian paternalism. Am Econ Rev 93(2):175–179

Acknowledgments

I am grateful to two anonymous referees and Marc Fleurbaey for their constructive comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Comparative statics

With the above equations and noting that \(\frac{\partial \ell _i}{\partial t}=\frac{\partial \ell _i}{\partial b}\) for \(\alpha =0\):

1.2 Proof of Proposition 1

Setting \(\beta _i=1\) and noting that then \(u^{\prime }(x_i)=u^{\prime }(d_i)\) (see Eq. (6)), the FOCs of the government reduce to

Making use of (9) and noting that \(\text{ Cov }(u^{\prime }(x_i),w_i\ell _i)=\text{ Cov }(u^{\prime }(d_i),w_i\ell _i)\) for rational unrestricted individuals, each equation in (30) can be written as

The right hand-side of (31) depends on the expression \(t+(1-\alpha )b\); equalizing first- and second-period consumption defined in (3) and (4) and solving for savings amounts to

With the above equation and by defining \(\xi \equiv t+(1-\alpha )b\), (31) can be rewritten as

Since \(\ell _i=v^{\prime -1}((1-\xi )w_i)\) the solution to (30) is solely determined by \(\xi \). Thus, the tax and pension system are perfect substitutes and either \(t\) or \(b\) can be set equal to zero. \(\square \)

Rights and permissions

About this article

Cite this article

Roeder, K. Optimal taxes and pensions with myopic agents. Soc Choice Welf 42, 597–618 (2014). https://doi.org/10.1007/s00355-013-0743-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-013-0743-1