Abstract

A hybrid new Keynesian Phillips curve is estimated with spatial interaction effects among the dependent and the independent variables using data of 67 provinces across Turkey over the period 1987–2001. In contrast to previous studies, backward-looking behavior appears to be more or equally important than forward looking behavior. Furthermore, when the impact of this behavior is split up into a direct effect on the own province and an indirect effect on neighboring provinces, which due to employing a spatial econometric approach is possible, we find significant evidence in favor of convergence. This is an important finding since it corroborates a process of regional integration of inflation rates across Turkey, which is a precondition in the accession process of Turkey to the European Union.

Similar content being viewed by others

1 Introduction

Inflation is one of the central issues in macroeconomics and a major concern in many countries. Over the period 1987–2001, inflation rates in Turkey ranged from 6.6 % in the province of Nevsehir in 1992 to 122.3 % in the province of Giresun in 1997. Important advances have emerged in the theoretical modeling of inflation dynamics. Originally, Phillips (1958) found a negative relationship between wage inflation and unemployment. This paper was based on empirical generalizations and initially did not have a theoretical foundation; theories that fit the data were developed only afterwards (Phelps 1967; Friedman 1968). By contrast, the new Keynesian Phillips curve (NKPC) states that wage and price setting decisions can be derived from an optimization problem in which forward-looking agents set their price optimally, subject to a constraint on the frequency of price adjustments (Taylor 1980; Calvo 1983). Aggregating over individual behavior then leads to a relationship comparable to the traditional Phillips curve. Due to the general failure of the new Keynesian Phillips curve to explain inflation dynamics empirically, this model has been further extended to include lags of inflation to account for backward-looking behavior. A theoretical foundation of this model, today known as the hybrid NKPC, has been developed by Gali and Gertler (1999). It should be stressed that the precise specification of the Phillips curve may have important implications from a central bank perspective. According to Jondeau and Le Bihan (2005), a fully credible central bank can engineer a disinflation at no cost in terms of output if inflation is a forward-looking phenomenon, whereas lowering steady-state inflation requires a recession in the context of the traditional, backward-looking Phillips curve.

The contribution of this paper to the literature is twofold. First, we estimate a hybrid NKPC for Turkey using regional data observed at the NUTS 3 level (67 provinces) over the period 1987–2001. Just like many previous studies, Turkish economists have investigated the validity of the Phillips curve hypothesis in Turkey at the country level (Avşar and Gür 2004; Önder 2004, 2009; Kuştepeli 2005; Yazgan and Yilmazkuday 2005). However, almost nobody has investigated the existence of a Phillips curve from a regional perspective, neither for Turkey nor for any other country in the world. Two notable exceptions are Vaona (2007) and Berk and Swank (2007). Understanding inflation dynamics at the regional level, especially in Turkey, is important since regional integration is one of the requirements imposed on Turkey in the accession process to the European Union. This requirement is understandable since GDP per capita in 2006 in the western part of Turkey was two to four times as high as in the eastern part of Turkey (European Commission 2010), and different studies found a positive cross-sectional relationship between inflation and inequality, among which Crowe (2006).

Vaona (2007) specifies three reasons why a regional approach of inflation dynamics is beneficial, of which some of them are taken from previous studies. Firstly, most studies are based on time-series variation of a single country over time only. By considering different regions over time, the parameter estimates will also be based on cross-sectional variability. Considering different countries over time is an alternative way to add cross-sectional variability. This explains the popularity of the panel data approach followed in studies of, among others, DiNardo and Moore (1999), Karanassou et al. (2003), Vaona (2007), Berk and Swank (2007), Russell (2007), and Bjørnstad and Nymoen (2008). Secondly, by redistributing demand between regions, it is possible to minimize the long-run national unemployment rate. Thirdly, and related to the second point, persistence in macroeconomic time series could be the result of aggregation, as a result of which moving from a very aggregate level to the meso-level can offer a way to empirically test this claim. Vaona (2007), who estimates a hybrid Phillips curve for 81 Italian provinces over the period 1986–1998, finds that regional inflation rates in Italy range between 0 and 8 % and that forward-looking behavior is more important than backward looking behavior.

Berk and Swank (2007) also estimates a hybrid Phillips curve, one for countries located in the European Union and one for states in the US. They investigate whether regional inflation differentials in a monetary union are a cause for concern. If regional inflation differentials would be due to rigidities in wage and price formation in certain regions, thereby thwarting rather than effectuating price-level convergence, monetary policy aimed at controlling the average rate of inflation may be suboptimal for individual regions. In contrast to Vaona (2007), Berk and Swark find that that backward- and forward-looking behavior in the EU are almost nearly important and that backward-looking behavior in the US is even more important.

The second contribution of this paper is the attention for spatial dependence among the observations. If economic activity in one region increases and causes an upward pressure on prices, firms may hire labor and consumers and may buy commodities from neighboring regions, as a result of which, prices in these neighboring regions may also increase. Similarly, if inflation goes up elsewhere, forward-looking agents may expect prices in their own region to increase too. Both Berk and Swank (2007) and Vaona (2007) recognize that spatial dependence might be a problem. Berk and Swank (2007) point out that panel unit root tests should be used accounting for cross-sectional dependence, since different regions in a monetary union may be hit by correlated shocks. In addition, the Phillips curve should be estimated allowing the disturbances to be correlated across regions. Vaona (2007) tests whether the variables are spatially autocorrelated using Moran’s I test statistic. Since these tests cannot be rejected, he spatially filters the variables in his model using the eigenfunction decomposition approach of Getis and Griffith (2002). Next, the Phillips curve is estimated using these spatially filtered variables. The problem of the first study is that it tests for spatial interaction effects among the error terms, but not for spatial interaction effects among the dependent variable and the independent variables. LeSage and Pace (2009, pp. 155–158) stress that the cost of ignoring spatial dependence in the dependent variable and/or in the independent variables is relatively high since the econometrics literature has pointed out that if one or more relevant explanatory variable are omitted from a regression equation, the estimator of the coefficients for the remaining variables is biased and inconsistent. In contrast, ignoring spatial dependence in the disturbances, if present, will only cause a loss of efficiency. The problem of the second study is that it separates inflation dynamics over time from inflation dynamics over space, while it is more likely that these two types of dynamics are interdependent; structural changes in one region may have spatial spillover effects on other regions, and these spillover effects may have immediate or future feedback effects on the region that instigated these changes. Both problems indicate that modeling of spatial interactions in a hybrid Phillips curve presents many methodological challenges for which we will apply advanced spatial econometric techniques. Important issues such as estimation methods, test procedures for spatial interaction effects, spatial non-stationarity, regional and time-period fixed effects, and direct and indirect effects estimates will be addressed together with the discussion of our empirical results.

The remainder of this paper is set up as follows. Section 2 provides a brief overview of the different Phillips curve models that have been developed and discusses some of the main issues put forward in previous studies. In Sect. 3, we discuss and analyze our data set. In Sect. 4, we present the results of our empirical analysis dovetailed with our spatial econometric approach to test for and to model spatial dependence, and discuss some policy implications. In Sect. 5, we summarize our main findings and draw conclusions.

2 Overview of Phillips curve models

The hybrid new Keynesian Phillips curve (HNKPC) may be considered as a general specification that covers the simple Phillips curve (1958), the expectations-augmented Phillips curve (Phelps 1967; Friedman 1968), and the NKPC as a special case. Inflation \(\pi _{t}\) is a function of expected inflation one period ahead, \(\pi _{t+1}^e\), lagged inflation in time, \(\pi _{t-1}\), and a forcing variable \(x_{t}\); this variable either represents excess demand, the level of output in deviation of its steady-state value or the unemployment rate in deviation of the natural rate of unemployment, or the marginal costs mostly measured as the wage share. The model reads as

where \(\varepsilon _t\) is a stochastic error term and \(\gamma _f\), \(\gamma _b\) and \(\mu \) are reduced-form parameters to be estimated. The hybrid Phillips curve allows economic agents to have both forward-looking and backward-looking behavior and has underpinned theoretically by Gali and Gertler (1999). They assume that firms operate in monopolistic competitive markets. In any given period, a fraction \(\theta \) of firms keep their prices unchanged, while a faction \(1-\theta \) adjusts their prices. Of those firms that adjust their prices, only a fraction of \(1-\omega \) is able to set prices optimally based on expected future marginal cost. A fraction \(\omega \), on the other hand, does not have sufficient information to adopt optimal pricing rules and simply set prices equal to the average newly adjusted prices in the last period plus an adjustment for expected inflation. This expectation is based on \(\pi _{t-1}\) observed in the previous period. The result is the hybrid Phillips curve in (1), where the forcing variable \(x_{t}\) is determined by marginal cost considerations and \(\gamma _{f}, \gamma _{b}\) and \(\mu \) are reduced-form parameters that depend on \(\theta , \omega \) and a subjective discount factor \(r\) (see Gali and Gertler 1999 for mathematical details).

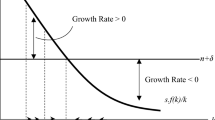

The original Phillips curve (1958) is a special case of Eq. (1) and is obtained if \(\gamma _f =0, \gamma _b =0\), and \(x_{t}\) is measured by the unemployment rate in deviation of the natural rate of unemployment. From the HNKPC point of view, this replacement of the forcing variable is difficult to justify. One explanation might be the wage curve (Blanchflower and Oswald 1994); a downward-sloping convex curve between the wage rate and the unemployment rate.

The expectations-augmented Phillips curve (Phelps 1967; Friedman 1968) is obtained if \(\gamma _f =1, \gamma _b =0\), and \(x_{t}\) is measured by the output gap; economic agents formulate their expectations of this period’s inflation in a backward-looking manner. Gali and Gertler (1999) point out that under certain conditions marginal costs can be written as a linear proportionate relation of the output gap. However, when they estimate the Phillips curve using quarterly data for the US over the period 1960:1–1997:4, they find that the inflation rate depends negatively on the output gap rather than positively, which it should to satisfy the conditions underlying the linear proportionate relation between marginal costs and of the output gap.

Finally, the NKPC (Taylor 1980; Calvo 1983) is obtained if \(\gamma _f =0\) and \(\gamma _b =1\); economic agents are purely forward looking. Many studies have estimated the hybrid Phillips curve and have found that these restrictions on the data, and thus, the NKPC needs to be rejected. Examples, among others, are Gali and Gertler (1999), Gali et al. (2005), Jondeau and Le Bihan (2005), Lindé (2005), Vaona (2007), and Berk and Swank (2007).

A couple of issues dominate the (empirical) literature on the HNKPC that are relevant for the empirical analysis conducted in this paper. The variable \(\pi _{t+1}^e\) should be treated as an endogenous explanatory variable when estimating the hybrid Phillips curve. Assuming rational expectations and i.i.d. error terms \(\varepsilon _{t}\), Gali and Gertler (1999) use generalized method of moments (GMM) with variables dated \(t-1\) and earlier as instruments. Rudd and Whelan (2005) demonstrate that since the hybrid Phillips curve is a linear model, GMM is equivalent to two-stages least squares (2SLS). Some studies use panel data and argue in favor of spatial and/or time-period fixed effects. If spatial fixed effects are included, the lagged inflation rate \(\pi _{t-1}\) should be treated as an endogenous explanatory variable too (on penalty of the Nickell bias), since it will then no longer be independent of the error term \(\varepsilon _{t}\).

It should be stressed that the hybrid Phillips curve in Eq. (1) does not contain an intercept. If Eq. (1) is estimated using panel data and spatial fixed effects are controlled for, one should avoid the inclusion of an intercept hidden in these fixed effects. This is possible by imposing the restriction(s) that the spatial fixed effects sum to zero.

Another issue is whether or not the restriction \(\gamma _f +\gamma _b =1\) should be imposed. If the sum of these two coefficients is smaller than one, the long-run inflation rate will also depend on the forcing variable \(x_{t}\). If it is greater than one, the model would result in non-stationary dynamics of inflation. For this reason, some studies also estimate the hybrid Phillips curve under the restriction \(\gamma _f +\gamma _b =1\) (Gali and Gertler 1999; Gali et al. 2005; Jondeau and Le Bihan 2005; Lindé 2005).

Finally, some studies recognize that countries are open economies and therefore also control for the change in real import prices (Berk and Swank 2007; Bjørnstad and Nymoen 2008). However, if the empirical analysis is aimed at explaining inflation dynamics across regions within one country, this variable is of limited importance, also because these regions have the same currency.

3 Data and descriptive analysis

To estimate the hybrid Phillips curve, we use annual data of 67 provinces (NUTS 3) over the period 1987–2001. Data were obtained from the electronic delivery system of TUIK. In 2002 Turkey switched from collecting data at the NUTS 3 level to the NUTS 2 level; this explains why data after 2001 are not used in this study. The rate of inflation is defined by the relative change in the consumer price index (\(P\)) with \(1987 = 100\) and measured by \(\pi _t =\ln \left( {P_t } \right) -\ln \left( {P_{t-1} } \right) \). The forcing variable \(x_{t}\) is approached by the output gap variable, the difference between real and potential or equilibrium GDP. Output is measured by real GDP (in prices of 1987) and potential GDP using the HP filter (with \(\lambda =100\) since we have annual data).

The calculation of inflation rates in Turkey is based on the consumer price index, which in 1987 consisted of seven major expenditure groups and 347 commodities. The geographical coverage of the index consists of urban settlements with a population of over 20,000 people. The prices of goods and services included in the index are retail prices including taxes but excluding any deposits and installments. Prices of fresh fruit, vegetables and petroleum products are collected once a week; other prices are collected twice a month and rents are collected once a month.Footnote 1

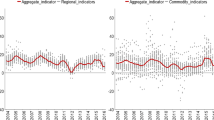

Figure 1 graphs the inflation rates of the 67 Turkish provinces over the period 1987–2001. Whereas inflation was below 10 % in the 1960s and 1970s, Turkey experienced very high inflation for the first time in 1979–1980. A stabilization program, launched in 1980, reduced inflation dramatically, but in the mid-1980s macroeconomic balances deteriorated again, and since then annual inflation rates in Turkey have been very high. The major reasons for these persistent high rates are public sector deficits, devaluations, the Gulf crisis and earthquakes. The Turkish government launched several new disinflation measures in 1989, 1994, 1999, and 2001, but these measures had only limited effects.

Although regional inflation rates have the tendency to move up and down together over time, one can also observe large differences and identify regions that follow region-specific patterns different from the national trend. Vaona and Ascari (2012) also find that inflation patterns across Italian regions are statistically different, even though the dispersion in these patterns does not show up as an aggregation bias in the national inflation rate. In addition, Turkey is characterized by large regional disparities, especially between the western and the eastern part of the country. Figure 2 graphs the disparities among the 67 regions in our sample at different moments in time, based on four quantiles. It is the eastern part of Turkey that experienced the highest inflation rates in 1987 and 1990. There are several reasons for this. Lack of trade due to closed borders with neighboring countries, lack of infrastructure (hardly any highways and telecommunication facilities), and relatively few public investments compared to the western part of the country. Since the 1960s Turkey has directed its economic and social development through Five-Year Development Plans (FYDP) aimed at reducing regional disparities and establishing economic and social balances. Although there is no clear evidence whether these FYDPs led to convergence in inflation and income per capita (Gezici and Hewings 2004; Kılıçaslan and Özatağan 2007; Yilmazkuday 2013), Figs. 1 and 2 show that inflation after the mid-1990s diminished and that the regional imbalance partly shifted to the West, though, at a lower level.

To test whether regional inflation rates observed within each year are spatially autocorrelated, we perform Moran’s I. The spatial weights matrix used in these calculations is a row-normalized binary contiguity matrix. If firms hire labor or consumers buy commodities from neighboring regions instead of their own region due to high or increasing inflation, it is most likely that they divert to adjacent regions. The average outcome of Moran’s I test statistic over our 15-year sample period is 0.123 with a \(t\)-value of 1.66, indicating that inflation rates are weakly spatially dependent (significant at the 10 % level only). In 4 years, however, the degree of spatial dependence exceeds the 5 % significance level, namely 1990, 1993, 1994 and 1997. In sum, we may conclude that spatial dependence should at least be tested for when estimating the hybrid Phillips curve.

Prior to this, we test whether the inflation rate and the output gap variable are stationary. For this purpose, we perform the individual cross-sectionally augmented Dickey-Fuller (CADF) test developed by Pesaran (2007). The test statistic is the \(t\)-value of the lagged dependent variable in a standard augmented Dickey-Fuller regression augmented with the cross-section averages of lagged levels and first-differences of the individual series. These additional variables are important since we will extend the model with spatial (which are cross-sectional) interaction effects below. Busetti et al. (2006) apply unit root and stationary tests to study convergence of prices and rates of inflation in Italian regions, but treat these regions as independent entities.

The null hypothesis of a unit root needs to be rejected for all 67 time series of the inflation rate and for 55 of the 67 time series of the output gap variable at 5 % significance. However, given the short time-span of our time series—each time series consists of only 13 observations—the results may suffer as a result of low power. Therefore, we also perform the CADF panel data unit root test of Pesaran (2007). This test statistic is based on the average of the individual CADF tests. We find –20.61 for the inflation rate and –8.10 for the output gap variable, which represents a rejection of a unit root in both variables at 1 % significance (the critical value according to Pesaran’s Table II(b) is approximately \(-1.66\)). The conclusion must be that the variables are stationary and that the hybrid Phillips curve may be estimated both according to Eq. (1) and the spatial extensions which will be considered below.

4 Empirical analysis

The standard approach in most empirical work using spatial econometric techniques is to start with a non-spatial regression model and then to test whether or not the model needs to be extended with spatial interaction effects. This approach is known as the specific-to-general approach. Table 1 reports the estimation results when spatial interaction effects are not accounted for. We consider two different lag structures of our instrumental variables. The short lag structure consists of instruments observed in \(t-1\) and \(t-2\), while the long lag structure also includes instruments observed in \(t-3\). The longer lag structure is considered to explore whether the estimated importance of forward-looking behavior depends on the length of the lag structure. Similar robustness checks have been carried out in Gali and Gertler (1999).

The results reported in Table 1 show that the coefficients of both the expected future and the lagged inflation rate are significant, indicating that economic agents in Turkey are both forward and backward looking. The quantitative importance of backward-looking behavior appears to be larger than that of forward looking behavior, especially when the long lag structure is used, which can be explained by the fact that inflation rates in Turkey compared to other OECD countries are relatively high. The fact that both coefficients are different from zero significant statistically also implies that the traditional, the expectations-augmented, and the NKPC need to be rejected in favor of the hybrid Phillips curve.

The coefficient of the output gap is positive and when using the long lag structure also significant. If a region produces more output than its equilibrium output level, this will overheat the local economy causing an upward pressure on prices. The coefficients \(\gamma _{f}\) and \(\gamma _{b}\) sum up to 0.991 when using the short lag structure and to 0.957 when using the long lag structure. Throughout this paper we could never reject the hypothesis that the sum of these two coefficients equals unity. Perhaps more important, therefore, is the finding that the sum is smaller rather than greater than one, because it indicates that not only the individual variables, but also the hybrid Phillips curve may said to be stationary. The somewhat lower value in the latter case is caused by the higher and also significant value of the output gap variable, showing that the long-run inflation rate partly depends on the output gap variable.

To test whether spatial interaction effects need to be accounted for, we use the classic Lagrange Multiplier (LM) tests for panel data proposed by Anselin et al. (2008), as well as the robust LM tests proposed by Elhorst (2010a). These tests have been developed for models without endogenous explanatory variables, while the Phillips curve is estimated by 2SLS due to endogeneity of the expected inflation rate. The 2SLS estimator may be seen as the result of a double application of least squares. In the first stage each of the exogenous or endogenous variables in the \(X=\left[ {{\begin{array}{lll} {\pi _{t+1}^e }&{} {\pi _{t-1} }&{} {x_t } \\ \end{array} }} \right] \) matrix are regressed on the exogenous variables in this matrix and the instrumental variables to obtain a matrix of fitted values \(\hat{X}\). In the second stage the dependent variable is regressed on \(\hat{X}\). To test for spatial dependence, we used this second stage least squares estimator. The LM statistics test for spatial interaction effects among the dependent variable, known as the spatial lag model, and for spatial interaction effects among the error term, known as the spatial error model. The robust LM statistics test for one type of spatial interaction effects in the local presence of the other type of spatial interaction effects. Both the classic and the robust tests are based on the residuals of the non-spatial model and follow a chi-squared distribution with one degree of freedom. Using the classic tests, both the hypothesis of no spatially lagged dependent variable and the hypothesis of no spatially autocorrelated error term must be rejected. When using the robust tests, the hypothesis of no spatially lagged dependent variable must still be rejected, whereas the hypothesis of no spatially autocorrelated error term can no longer be rejected. This indicates that the spatial lag model is more appropriate.

Although the data used to estimate the hybrid Phillips curve appeared to be stationary in time, the observation from Fig. 1 that regional inflation rates have the tendency to move up and down together over time and the relatively high outcome of the classic LM error test statistic nonetheless raise the question whether the hybrid Phillips curve is also stationary in space. Lauridsen and Kosfeld (2006) have developed a strategy to test for this. Under spatial non-stationarity the spatial autocorrelation coefficient would be equal to 1, a value for which the maximum likelihood function of the spatial error model is not defined. To test for spatial non-stationarity, they propose to test for spatial autocorrelation using the classic LM error test statistic.Footnote 2 Next, they propose to transform the model in spatial first-differences, that is, by taking every variable in Eq. (1) in deviation of its spatially lagged value. Mathematically, this is equivalent by multiplying Eq. (1) by the matrix \(\varDelta =(I-W)\),

where \(I\) denotes the identity matrix of order \(N\) and \(W\) describes the spatial arrangement of the regions in the sample. Finally, they propose to carry out the classic LM test for spatial interaction effects among the error terms using this transformed equation. If the error terms \(\varepsilon \) in Eq. (1) would follow a spatial autoregressive process with autocorrelation coefficient \(\rho _{\varepsilon }=1\), the error terms \(\varDelta \varepsilon \) in Eq. (2) are i.i.d. with zero mean and variance \(\upsigma ^{2}\). This implies that the LM error test statistic of Eq. (2) will not be different from zero significant statistically. By contrast, if the hypothesis \(\rho _{\varepsilon }=1\) does not hold since \(\rho _{\varepsilon }<1\), the reformulation of the Eq. (1) in spatial first-differences leads to “overdifferencing” (see p. 366 of Lauridsen and Kosfeld 2006 for this terminology), as a result of which the LM error test statistic of Eq. (2) will become significant.

Table 2 reports the estimation results of the hybrid Phillips curve when the data are transformed in spatial first-differences. The LM error test statistic points out that the hypothesis of spatial non-stationarity needs to be rejected, indicating that the hybrid Phillips curve is also stationary in space. Although the results reported in Table 2 are thus due to overdifferencing, they are still interesting since they also control for (hidden) time-period fixed effects and therefore open the opportunity to analyze their effect. Suppose the error term specification of the original Eq. (1) is extended to include one dummy \(\alpha _t\) for every time period in the sample, \(\varepsilon _t=\alpha _t e_n +v_t \), where \(e_n\) is an \(N\times 1\) vector of ones and \(v_t\) is stochastic error term with mean zero and finite variance \(\sigma ^{2}\). Since \(\left( {I-W} \right) \alpha _t e_n =0\), all time-period fixed are eliminated from Eq. (1) when this equation is reformulated in spatial first-differences. Nevertheless, these time-period fixed effects remain effective, since the estimation of model formulated in levels extended to include time-period fixed effects produces the same parameter estimates as the estimation of that model reformulated in spatial first-differences without time-period fixed effects (Eq. 2).

The results in Table 2 show that the significance levels of all the explanatory variables fall. Actually, only the coefficient of the lagged inflation rate remains significant. Furthermore, the quantitative importance of forward-looking behavior increases a little at the expense of backward-looking behavior. Since most studies investigating the (hybrid) Phillips curve use data of one single country only, such as Gali and Gertler (1999), Ma (2002), Gali et al. (2005), Jondeau and Le Bihan (2005), Lindé (2005), and Rudd and Whelan (2005), it may be characterized as a typical time-series model. By reformulating the model in spatial first-differences, which in this study is possible due to having data in panel, and thus, by focusing on the cross-sectional component rather than the time-series component of the data, as is usual, significance levels go down and backward looking behavior becomes less important. Another observation is that the sum of the coefficients \(\gamma _{f}\) and \(\gamma _{b}\) exceeds 1 (1.003) when using the short lag structure and falls to a rather low value of 0.850 when using the long lag structure. Apparently, these are the side effects of overdifferencing the data and controlling for time-period fixed effects.

The (robust) LM tests applied to Eq. (1) discussed above showed that the spatial lag model is more appropriate than the spatial error model. LeSage and Pace (2009) and Elhorst (2010b), however, argue that even if the non-spatial model on the basis of these LM tests is rejected, in this case in favor of the spatial lag model, one should be careful to endorse this model. This is because the spatial econometrics literature is divided about whether to apply the specific-to-general approach or the general-to-specific approach (Florax et al. 2003; Mur and Angulo 2009). Therefore, one better mixes both approaches and also considers the spatial Durbin model, a model with spatial interaction effects among the dependent variable and among each of the explanatory variables. First, the non-spatial model is estimated to test it against the spatial lag and the spatial error model (specific-to-general approach). In case the non-spatial model is rejected, the spatial Durbin model is estimated next to test whether it can be simplified to the spatial lag or the spatial error model (general-to-specific approach). If both tests point to either the spatial lag or the spatial error model, it is safe to conclude that that model best describes the data. By contrast, if the non-spatial model is rejected in favor of either the spatial lag or the spatial error model, whereas the spatial Durbin model is not, one better adopts this more general model.

The spatial Durbin model specification of the hybrid Phillips curve takes the form

where a variable premultiplied with \(W\) represents its spatially lagged value and \(\delta \) the corresponding parameter of that variable. The parameters of this model have been estimated using the optimal spatial 2SLS estimation procedure developed by Lee (2003). This estimator treats \(W\pi _t\) as an endogenous explanatory variable, since this variable posits that the inflation rate observed in one region affects the inflation rate in another region, and vice versa, provided that these regions belong to each other’s neighborhood set. Furthermore, this estimator has been extended for the additional endogeneity of the expected inflation rate, following the approach set out in Fingleton and Le Gallo (2008). Table 3 reports the estimation results of this model. The results show that only three variables have significant coefficients. The first one is the inflation rate observed in neighboring regions representing the endogenous interaction effects among regions, the second one is the lagged inflation rate in the own region, and the final one is the lagged inflation rate observed in neighboring regions, representing one of the three exogenous interaction effects among regions incorporated in the spatial Durbin model. The other coefficients appear to be insignificant.

The hypothesis \(H_{0}{:}\,\delta _f =0,\delta _b =0,\delta _x =0\) can be used to test whether the spatial Durbin can be simplified to the spatial lag model, and the hypothesis and \(H_{0}{:}\,\delta _f -\delta \gamma _f =0,\delta _b -\delta \gamma _b =0,\delta _x -\delta \delta _x =0\) whether it can be simplified to the spatial error model. Both tests follow a chi-squared distribution with three degrees of freedom. The first hypothesis needs to be rejected, both for the short and the long lag structure. By contrast, the second hypothesis cannot be rejected; the simplification of the spatial Durbin model to the spatial error model appears to be acceptable on the data. This particular outcome is illustrative for the discussion among adherents of the specific-to-general approach on the one hand and the general-to-specific approach on the other. Whereas the (robust) LM tests rejected the non-spatial model in favor of the spatial lag model rather than the spatial error model, the Wald tests applied to the spatial Durbin model point to the spatial error model. In those cases, LeSage and Pace (2009) and Elhorst (2010b) recommend to adopt the spatial Durbin model because this model generalizes both the spatial lag and the spatial error model. By considering the direct, indirect and total effects below, we will see another reason why this model is preferable.

Next, it is investigated whether spatial fixed effects need to be controlled for. For this purpose, the spatial Durbin model has been re-estimated including one dummy \(c_i\) for every region \((i=1,{\ldots },N)\) in the sample, \(\varepsilon _t ={(c_1 ,\ldots ,c_N )}^{\prime }+v_t\), where \(v_t \) is stochastic error term with mean zero and finite variance \(\sigma ^{2}\). To avoid that these spatial fixed effects capture a hidden intercept, the restriction \(\sum \nolimits _{i=1}^N c_i =0\) is also imposed. Arguments in favor of spatial fixed effects have been given in several studies. Vaona (2007) states that spatial fixed effects account for spatial differences in the steady-state level of the forcing variable. Russell (2007) adds spatial fixed effects to allow for shifts in the mean rate of inflation across countries. By performing an \(F\) test on the residual sum of squares in the models with and without spatial fixed effectsFootnote 3 (\(N-1=66\) degrees of freedom in the numerator and \(N(T-1)-K=730\) or 663 degrees of freedom in the nominator, respectively, when using the short and long lag structure), it turns out that these spatial fixed effects are not jointly significant and thus do no need to be controlled for.

Starting from the results reported in Table 3 it is tempting to conclude that the expected inflation rate has no significant impact on the actual inflation rate, and that both the lagged inflation rate and the output gap variable have the wrong sign. These conclusions, however, would be wrong. Starting with Eq. (3), it can be seen that the matrix of marginal effects of a change in the expected inflation rate in region 1 up to region \(N\) at a particular point in time \(t\) is

Similar expressions can be derived for the lagged inflation rate and the output gap variable. Further note that the matrix of marginal effects is independent from the time index; this explains why the right-hand side does not contain the symbol \(t\). LeSage and Pace (2009) define the direct effect as the average of the diagonal elements of the matrix on the right-hand side of (4), and the indirect effect as the average of either the row sums or the column sums of the non-diagonal elements of that matrix. Although the numerical magnitudes of these two calculations of the indirect effect are the same, the interpretation is different. The average row effect quantifies the impact on the inflation rate of a particular region as a result of a unit change in the expected inflation rate in all other regions, while the average column effect quantifies the impact of a unit change in the expected inflation rate in one region on the inflation rate of all other regions. The latter interpretation is used more often and also known as the spatial spillover effect. The total effect is the sum of the direct effect and the indirect effect.

Table 4 reports the direct effect, indirect effect and total effect of the expected inflation rate, the lagged inflation rate and the output gap variable. In order to draw inferences regarding the statistical significance of these effects, we used the variation of 1,000 simulated parameters combinations drawn from the variance-covariance matrix implied by the optimal spatial 2SLS estimation procedure (see LeSage and Pace 2009 for mathematical details and the matlab routine “direct_indirect_effects_estimates” posted at www.regroningen/elhorst/software.nl for software).

The results in Table 4 show that not only the total effect of the lagged inflation rate is positive and significant, but also of the expected inflation rate. This is remarkable since both the coefficient of the expected inflation rate in the own region and the coefficient of the expected inflation rate in neighboring regions in Table 3 appeared to be insignificant. The total effect of both variables sum to 0.996 when using the short and to 0.991 when using the long lag structure. These values are not only below but also close to unity, which they should according to Jondeau and Le Bihan (2005). It implies that the spatially extended Turkish hybrid Phillips curve, just as its non-spatial counterpart, is stationary in time. According to the short lag structure, the quantitative importance of backward-looking behavior is greater than that of forward-looking behavior. In addition, it is greater than that in the non-spatial model and in the model reformulated in spatial first-differences. According to the long lag structure, the quantitative importance of backward-looking behavior is somewhat smaller than that of forward looking behavior, although the difference is not significant. In addition, it is smaller than that in the non-spatial model, but greater than in the model reformulated in spatial first-differences. In conclusion, we can say that backward-looking behavior is more or at least equally important than forward-looking behavior in Turkey.

Table 4 shows that the total effect is composed of a direct and an indirect effect (spatial spillover effect). The direct effect of the expected inflation rate amounts to 0.269 when using the short and 0.424 when using the long lag structure. Similarly, the indirect effect amounts to 0.117 and 0.094, respectively. This means that the ratio of the indirect effect to the direct effect of the expected inflation rate ranges between 22.2 and 43.5 %. In other words, if economic agents in a particular region expect the inflation rate to increase by one additional percentage point, 0.269–0.424 of this expectation will be realized in the next year, and 0.094–0.117 of their expectation will spill over to neighboring regions. The fact that the spatial spillover effect is smaller than the direct effect makes sense since the impact of a change will most likely be larger in the place that instigated the change. Nevertheless, we have to be careful here since the direct and indirect effects in contrast to the total effect do not appear to be significant.

The spatial spillover effect of the lagged inflation rate appears to be 5–6 times larger than the direct effect and to be opposite of sign. This result represents a convergence effect; the higher lagged inflation in the region itself, or the lower lagged inflation in neighboring regions, the lower the actual inflation rate, and vice versa. Furthermore, both the direct effect and the indirect effect appear to be significant; the \(t\)-value of the direct effect amounts to \(-2.32\) when using the short and \(-2.67\) when using the long lag structure. Similarly, the \(t\)-value of the indirect effects amounts to 4.35 and 5.95, respectively. The latter outcome demonstrates that the spatial Durbin model outperforms the spatial error model specification, since the spatial error model does not cover spatial spillover effects; they are set to zero by construction in advance (see Elhorst 2010b). This significant convergence effect evidences a process of regional integration of inflation rates across Turkey, which is important since it is a precondition in the accession process of Turkey to the European Union.

The direct, indirect and total effects of the output gap variables are all positive, but insignificant. Unlike the non-spatial model, the long-run inflation rate according to the spatial hybrid spatial Phillips curve does not depend on the output gap variable.

5 Conclusion

In this paper, a hybrid NKPC is estimated with spatial interaction effects among the dependent and the independent variables using data of 67 provinces across Turkey over the period 1987–2001. This analysis makes two important contributions to the literature. First, only a few studies have investigated the existence of a Phillips curve from a regional perspective. However, understanding inflation dynamics at the regional level, especially in Turkey, is important since regional integration is one of the requirements imposed on Turkey in the accession process to the European Union. Second, instead of estimating a non-spatial hybrid Phillips curve, we estimate a hybrid Phillips curve extended to include spatial interaction effects among the dependent and the independent variables. We find that this hybrid Phillips curve is not only stationary in time but also in space, using a test procedure proposed by Lauridsen and Kosfeld (2006) based on parameter estimations of the model formulated in levels and in spatial first-differences. In addition, we find that spatial and time-period effects do not need to be controlled for. The spatial fixed effects appear to be jointly insignificant, whereas the time-period fixed effects, investigated in combination with the reformulation of the model in spatial first-differences, lead to overdifferencing.

In contrast to previous studies, such as Gali and Gertler (1999) and Gali et al. (2001) at the national level and Vaona (2007) at the regional level, backward-looking behavior is found to be more or equally important than forward-looking behavior, depending on whether the expected inflation rate is instrumented using a short or a long lag structure for the instrumental variables. This outcome is understandable since inflation rates in Turkey compared to other countries are relatively high. However, the impact of backward looking behavior should not be overestimated. Overestimation occurs especially when using the non-spatial model approach, but also when adopting the long lag structure. Similarly, whereas the non-spatial approach suggests that the long-run inflation rate partly depends on the output gap variable, the spatial approach does not. When the impact of backward-looking behavior is split up into a direct and indirect effect, which is possible due to employing a spatial approach, we find significant evidence in favor of convergence. The higher lagged inflation in the province itself, or the lower lagged inflation in neighboring provinces, the lower the actual inflation rate, and vice versa. This is an important finding since it corroborates a process of regional integration of inflation rates across Turkey.

Notes

A full description of the methodology and types of data sources used for the base year 1987 is given in the “Monthly Bulletin of Wholesale and Consumer Price Indexes January–February–March 1990”.

Note that the spatial error model can be rewritten as a constrained spatial Durbin model, i.e., a spatial lag model extended to include spatial interaction effects among the explanatory variables and a restriction on the parameters. Unfortunately, the LM statistics test for a spatial lag or a spatial error model only and not for a spatial Durbin model, a topic to which we come back below. Although the robust LM error test statistic (unlike the classic LM error test statistic) is not different from zero significant statistically, this finding is therefore no guarantee that the hypothesis of spatial non-stationarity can already be rejected.

One complication of adding spatial fixed effects is the following. Since the inflation rate in each region becomes a function of its fixed effect, so does the lagged inflation rate (Baltagi 2001, p. 129). Therefore, the lagged inflation rate should, just as the expected inflation rate, be treated as an endogenous explanatory variable. The residual sum of squares calculated for the model with spatial fixed effects accounts for this adjustment of the estimation procedure.

References

Anselin L, Le Gallo J, Jayet H (2008) Spatial panel econometrics. In: Mátyás L, Sevestre P (eds) The econometrics of panel data, fundamentals and recent developments in theory and practice, 3rd edn. Kluwer, Dordrecht, pp 627–662

Avşar RB, Gür TH (2004) How relevant is the new (Keynesian) Phillips curve: the case of Turkey. J Econ Cooperation 25:89–104

Baltagi BH (2001) Econometric analysis of panel data, 2nd edn. Wiley, Chichester

Berk JM, Swank J (2007) Regional real exchange rates and Phillips curves in monetary unions: evidence from the US and EMU. Netherlands Central Bank, Amsterdam

Bjørnstad R, Nymoen R (2008) The new Keynesian Phillips curve tested on OECD panel data. Econ Open Access Open Assess E J 2:1–18

Blanchflower DG, Oswald AJ (1994) The wage curve. MIT Press, Cambridge

Busetti F, Fabiani S, Harvey A (2006) Convergence of prices and rates of inflation. Oxford Bull Econ Stat 68(supplement):863–877

Calvo GA (1983) Staggered prices in a utility-maximizing framework. J Monet Econ 12:383–398

Crowe C (2006) Inflation, inequality and social conflict. IMF, working paper 06/158

DiNardo J, Moore MP (1999) The Phillips curve is back? Using panel data to analyze the relationship between unemployment and inflation in an open economy. National Bureau of Economic Research, NBER working papers 7328

Elhorst JP (2010a) Spatial panel data models. In: Fischer MM, Getis A (eds) Handbook of applied spatial analysis. Springer, Berlin, pp 377–407

Elhorst JP (2010b) Applied spatial econometrics: raising the bar. Spatial Econ Anal 5:9–28

European Commission (2010) Investing in Europe’s future. European Commission, Luxembourg

Fingleton B, Le Gallo J (2008) Estimating spatial models with endogenous variables, a spatial lag and spatially dependent disturbances: finite sample properties. Pap Reg Sci 87:319–339

Florax RJGM, Folmer H, Rey SJ (2003) Specification searches in spatial econometrics: the relevance of Hendry’s methodology. Reg Sci Urban Econ 33:557–579

Friedman M (1968) The role of monetary policy. Am Econ Rev 58:1–17

Gali J, Gertler M (1999) Inflation dynamics: a structural econometric analysis. J Monet Econ 44:195–222

Gali J, Gertler M, Lopez-Salido DJ (2001) European inflation dynamics. Eur Econ Rev 45:1237–1270

Gali J, Gertler M, Lopez-Salido DJ (2005) Robustness of the estimates of te hybrid new Keynesian Phillips curve. J Monet Econ 52:1107–1118

Getis A, Griffith DA (2002) Comparative spatial filtering in regression analysis. Geogr Anal 34:130–140

Gezici F, Hewings GJD (2004) Regional convergence and the economic performance of Peripheral areas in Turkey. Rev Urban Reg Dev Stud 16:113–132

Jondeau E, Le Bihan H (2005) Testing for the new Keynesian Phillips curve. Additional international evidence. Econ Modell 22:521–550

Karanassou M, Sala H, Snower DJ (2003) The European Phillips curve: does the NAIRU exist? Appl Econ Q 2:93–121

Kılıçaslan Y, Özatağan G (2007) Impact of relative population change on regional income convergence: evidence from Turkey. Rev Urban Reg Dev Stud 19:210–223

Kuştepeli Y (2005) A comprehensive short-run analysis of a (possible) Turkish Phillips curve. Appl Econ 37:581–591

Lauridsen J, Kosfeld R (2006) A test strategy for spurious spatial regression, spatial nonstationarity, and spatial cointegration. Pap Reg Sci 85:363–377

Lee LF (2003) Best spatial two-stage least squares estimator for a spatial autoregressive model with autoregressive disturbances. Econ Rev 22:307–335

LeSage JP, Pace RK (2009) Introduction to spatial econometrics. Taylor & Francis, Boca Raton

Lindé J (2005) Estimating new-Keynesian Phillips curves: a full information maximum likelihood approach. J Monet Econ 52:1135–1149

Ma A (2002) GMM estimation of the new Phillips curve. Econ Lett 76:411–417

Mur J, Angulo A (2009) Model selection strategies in a spatial setting: some additional results. Reg Sci Urban Econ 39:200–213

Önder AÖ (2004) Forecasting inflation in emerging markets by using the Phillips curve and alternative time series models. Emerg Mark Finance Trade 40:71–82

Önder AÖ (2009) The stability of the Turkish Phillips curve and alternative regime shifting models. Appl Econ 41:2597–2604

Pesaran MH (2007) A simple panel unit root test in the presence of cross section dependence. J Appl Econ 22:265–312

Phelps ES (1967) Phillips curves, expectations of inflation and optimal unemployment over time. Economica 34:254–281

Phillips AW (1958) The Relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1861–1957. Economica 25:283–299

Rudd J, Whelan K (2005) Modeling inflation dynamics: a critical review of recent research. J Money Credit Bank 39(s1):155–170

Russell B (2007) Non-stationary inflation and panel estimates of United States short and long-run Phillips curves. University of Dundee, Economic Studies, Discussion Papers 200

Taylor JB (1980) Aggregate dynamics and staggered contracts. J Political Econ 88:1–23

Vaona A (2007) Merging the purchasing power parity and the Phillips curve literatures: regional evidence from Italy. Int Reg Sci Rev 30:152–172

Vaona A, Ascari G (2012) Regional inflation persistence: evidence from Italy. Reg Stud 46:509–523

Yazgan ME, Yilmazkuday H (2005) Inflation dynamics of Turkey: a structural estimation. Stud Nonlinear Dyn Econ 9:1228–1228

Yilmazkuday H (2013) Inflation targeting, flexible exchange rates and inflation convergence. Appl Econ 45:593–603