Abstract

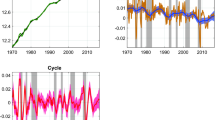

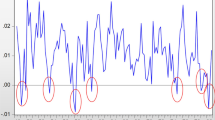

This paper presents business cycle stylized facts for the Greek economy and extends the relevant Greek literature in the following directions. First, the index of industrial production (IOP) is used to represent real economic activity and business cycle conditions. Second, the behavior of certain financial variables throughout the various phases of the business cycle is analyzed in order to assess their leading indicator properties. Third, possible non-linearities in these variables are investigated and tested for their relation to the business cycle states. The results imply that the most reliable leading indicators are real Treasury bill rates. Volatilities of real short-term interest rates may also contain useful predictive information for IOP volatility. Finally, mean non-linearities seem to be associated with business cycle asymmetries in the mean.

Similar content being viewed by others

References

Acemoglu, D.; Scott, A. “Asymmetries in the Cyclical Behaviour of UK Labour Markets,”Economic Journal, 104, 427, 1994, pp. 1303–23.

Andreou, E.; Osborn, R. D.; Sensier, M. “A Comparison of the Statistical Properties of Financial Variables in the U.S.A., U.K. and Germany Over the Business Cycle,”The Manchester School, 68, 4, 2000, pp. 396–418.

Apergis, N.; Eleftheriou, S. “Interest Rates, Inflation, and Stock Prices: The Case of the Athens Stock Exchange,”Journal of Policy Modeling, 24, 3, 2002, pp. 231–36.

Apergis, N.; Varelas, E.; Velentzas K. “Money Supply, Consumption and Deregulation: The Case of Greece,”Applied Economics Letters, 7, 6, 2000, pp. 385–90.

Apergis, N.; Velentzas K. “The Impact of Financial Deregulation in Greece on Consumption Patterns,”Economia Internazionale, 56, 3, 2003, pp. 283–95.

Canova, F.; De Nicoló, G. “Stock Returns, Term Structure and Real Activity: An International Perspective,” Department of Economics Working Paper, 1997, Universitat Pompeu Fabra.

Dimeli, S.; Kollintzas, T.; Christodoulakis, N. “Business Cycles and Growth in Greece and in Europe,” Athens, Greece, IMOP, 1997.

Estrella, A.; Hardouvelis, G. A. “The Term Structure as a Predictor of Real Economic Activity,”Journal of Finance, 46, 2, 1991, pp. 555–76.

Estrella, A.; Mishkin, F. S. “The Yield Curve as a Predictor of U.S. Recessions,”Federal Reserve Bank of New York: Current Issues in Economics and Finance, 2, 7, 1996, pp. 1–6.

Fama, E. F.; French, K. R. “Business Conditions and Expected Returns on Stocks and Bonds,”Journal of Financial Economics, 25, 1, 1989, pp. 23–49.

Fiorito, R.; Kollintzas, T. “Stylized Facts of Business Cycles in the G7 From a Real Business Cycles Perspective,”European Economic Review, 38, 2, 1994, pp. 235–69.

Friedman, M.; Schwartz, A. J. “Money and Business Cycles,”Review of Economics and Statistics, 45, 1, 1963, pp. 32–64.

Kaskarelis, I. A. “Investigating the Features of Greek Business Cycles,”Spoudai, 43, 1, 1993, pp. 19–32.

Malliaris, A. G.; Urrutia, J. L. “An Empirical Investigation Among Real, Monetary and Financial Variables,”Economics Letters, 37, 2, 1991, pp. 151–58.

Öcal, N.; Osborn, D. R. “Business Cycle Nonlinearities in UK Consumption and Production,”Journal of Applied Econometrics, 15, 1, 2000, pp. 27–43.

Papapetrou, E. “Oil Price Shocks, Stock Market, Economic Activity and Employment in Greece,”Energy Economics, 23, 5, 2001, pp. 511–32.

Sauer, C.; Scheide, J. “Money, Interest Rate Spreads, and Economic Activity,”Weltwirtschaftliches Archive, 131, 4, 1995, pp. 708–22.

Teräsvirta, T. “Usefulness of Proxy Variables in Linear Models with Stochastic Regressors,”Journal of Econometrics, 36, 3, 1987, pp. 377–82.

Varelas, E. “The M1 and the GDP of the G7-Countries and Greece. A Multivariate Description of the Business Cycle Stylized Facts,”Studi economici, 52, 61, 1997, pp. 79–95.

Author information

Authors and Affiliations

Additional information

The author wishes to express his gratitude to conference participants at the 55th International Atlantic Economic Conference held in Vienna, Austria, March 12–16, 2003, and an anonymous referee for their valuable comments and suggestions. The author is responsible for any shortcomings in the paper.

Rights and permissions

About this article

Cite this article

Mylonidis, N. Financial variables as leading indicators in Greece. International Advances in Economic Research 9, 268–278 (2003). https://doi.org/10.1007/BF02296175

Issue Date:

DOI: https://doi.org/10.1007/BF02296175