Abstract

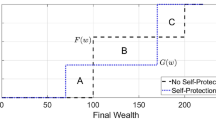

We develop four experimental markets to examine how individuals respond to risk: self-protection and self-insurance in both private and collective auctions. First, we find evidence that the mechanism used to reduce risk is important. Results indicate that the upper and lower bounds on value were elicited by the private self-protection and the collective self-insurance markets, respectively. Second, the robustness of these results declined with low-probability lotteries. We find further evidence that individuals overestimate the impact of low-probability events. Overestimation decreased, however, with repeated market exposure. Third, the four markets induced rapid value formation. Usually only one or two additional market trials were necessary before an individual's perception and valuation of reduced risk stabilized.

Similar content being viewed by others

References

Bennett, J. (1987). “Strategic Behavior,” Journal of Public Economics 32, 355–368.

Boyer, M. and G. Dionne. (1983). “Variations in the Probability and Magnitude of Loss: Their Impacts on Risk,” Canadian Journal of Economics 16, 409–419.

Brookshire, D., M. Thayer, J. Tschirhart, and W. Schulze. (1985). “A Test of the Expected Utility Model: Evidence from Earthquake Risks,” Journal of Political Economy 93, 369–389.

Centner, T., and M. Wetzstein. (1987). “Reducing Moral Hazard Associated with Implied Warranties of Animal Health,” American Journal of Agricultural Economics 69, 143–150.

Change, Y.-M., and I. Ehrlich. (1985). “Insurance, Protection from Risk, and Risk-Bearing,” Canadian Journal of Economics 18, 574–586.

Coppinger, V., V.L. Smith, and J. Titus. (1980). “Incentives and Behavior in English, Dutch and Sealed-Bid Auctions,” Economic Inquiry 18, 1–22.

Coursey, D. (1987). “Markets and the Measurement of Value,” Public Choice 55, 291–297.

Coursey, D., J. Hovis, and W. Schulze. (1987). “The Disparity Between Willingness to Accept and Willingness to Pay Measures of Value,” Quarterly Journal of Economics 102, 679–690.

Coursey, D., and W. Schulze. (1986). “The Application of Laboratory Experimental Economics to the Contingent Valuation of Public Goods,” Public Choice 49, 47–68.

Covello, V. (1984). “Actual and Perceived Risk: A Review of the Literature,” In P. Ricci, L. Sagen, and C. Whipple (eds.), Technological Risk Assessment The Hague: Martinus Nijhoff Publishers, pp. 225–246.

Ehrlich, I. and G. Becker. (1972). “Market Insurance, Self-Protection, and Self-Insurance,” Journal of Political Economy 80, 623–648.

Fischhoff, B., et al. (1984). Acceptable Risk. Cambridge: Cambridge University Press.

Forsythe, R., T. Palfrey, and C. Plott. (1982). “Asset Valuation in an Experimental Market,” Econometrica 50, 537–567.

Hayek, F. (1945). “The Use of Knowledge in Society,” American Economic Review 35, 519–530.

Hiebert, L. (1983). “Self-Insurance, Self-Protection, and the Theory of the Competitive Firm,” Southern Economic Journal 50, 160–168.

Kunreuther, H., W. Sanderson, and R. Vetschera. (1985). “A Behavioral Model of the Adoption of Protective Activities,” Journal of Economic Behavior and Organization 6, 1–15.

Lattimore, P., A. Whittle, and J. Baker. (1988). “An Empirical Assessment of Alternative Models of Risky Decision Making,” NBER (National Bureau of Economic Research) working paper no. 2717.

Machina, M. (1982). “‘Expected Utility’ Analysis without the Independence Axiom,” Econometrica 50, 277–323.

Machina, M. (1983). “The Economic Theory of Individual Behavior Toward Risk: Theory, Evidence, and New Directions,” Technical Report No. 433, Stanford University.

Plott, C., and S. Sunder. (1982). “Efficiency of Experimental Securities Markets with Insider Information: An Application of Rational Expectations Models,” Journal of Political Economy 90, 663–698.

Schulze, W., G. McClelland, and D. Coursey. (1986). “Valuing Risk: A Comparison of Expected Utility with Models from Cognitive Psychology,” unpublished manuscript.

Shogren, J. (1988). “Valuing Risk in Experimental Markets: Self-Protection, Self-Insurance, and Collective Action,” final draft report, U.S. Environmental Protection Agency.

Shogren, J., and T. Crocker. (1990a). Risk, Self-Protection, and Ex Ante Economic Value, Journal of Environmental Economics and Management (forthcoming).

Shogren, J., and T. Crocker. (1990b). “Adaptation and the Option Value of Uncertain Environmental Resources,” Ecological Economics (forthcoming).

Smith, V.K., and W. Desvousges. (1987). “An Empirical Analysis of the Economic Value of Risk Changes,” Journal of Political Economy 95, 89–114.

Smith, V.L. (1980). “Experiments with a Decentralized Mechanism for Public Good Decisions,” American Economic Review 70, 548–590.

Smith, V.L. (1982). “Microeconomic Systems as an Experimental Science,” American Economic Review 72, 923–955.

Tversky, A., and D. Kahneman. (1981). “The Framing of Decisions and the Psychology of Choice,” Science 211, 453–458.

Vickrey, W. (1961). “Counterspeculation, Auctions and Competitive Sealed Tenders,” Journal of Finance 16, 8–37.

Viscusi, W.K. (1979). “Insurance and Individual Incentives in Adaptive Contexts,” Econometrica 47, 1195–1207.

Viscusi, W.K., W. Magat, and J. Huber. (1986). “Information Regulation of Consumer Health Risks: An Empirical Evaluation of Hazard Warnings,” Rand Journal of Economics 17, 351–365.

Viscusi, W.K., and W. Magat. (1987). Learning about Risk: Consumer and Worker Responses to Hazard Information. Cambridge: Harvard University Press.

Weinstein, M., D. Shepard, and J. Pliskin. (1980). “The Economic Value of Changing Mortality Probabilities: A Decision-Theoretic Approach,” Quarterly Journal of Economics 94, 373–396.

Yaari, M. (1987). “The Dual Theory of Choice Under Risk,” Econometrica 55, 95–115.

Author information

Authors and Affiliations

Additional information

The financial support of the U.S. Environmental Protection Agency and the John A. Walker College of Business, Appalachian State University is gratefully acknowledged. The comments of Tom Crocker, Don Coursey, Cliff Nowell, and Mark Thayer concerning experimental design have been helpful. Joe Kerkvliet, Fred Wallace, Charles Plott, an anonymous referee, and especially W. Kip Viscusi provided useful advice. Kris Etter, Todd Holt, and Kevin Long provided valuable research assistance. The author accepts sole responsibility for all remaining errors.

Rights and permissions

About this article

Cite this article

Shogren, J.F. The impact of self-protection and self-insurance on individual response to risk. J Risk Uncertainty 3, 191–204 (1990). https://doi.org/10.1007/BF00056372

Issue Date:

DOI: https://doi.org/10.1007/BF00056372