Abstract

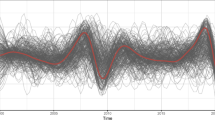

In this paper we analyze a time series of daily average prices in the Italian electricity market, which started to operate as a Pool in April 2004. Our objective is to model the high degree of autocorrelation and the multiple seasonalities in electricity prices. We use periodic time series models with GARCH disturbances and leptokurtic distributions and compare their performance with more classical ARMA-GARCH processes. The within-year seasonal variation is modelled using the low-frequency components of physical quantities, which are very regular throughout the sample. Our results reveal that much of the variability in the price series is explained by the interactions between deterministic multiple seasonalities. Periodic AR-GARCH models seem to perform quite well in mimicking the features of the stochastic part of the price process.

Similar content being viewed by others

Notes

The computations in this section were carried out using EViews 4 (regressions and low-pass filtering through the state-space object), GiveWin 2 (kernel density estimates and sample autocorrelations), PcGive 10 (descriptive statistics and normality test).

In most of the existing literature only daily means are considered.

The computations in this section were carried out using EViews 4 (conditional ML estimates of the Reg-PAR-GARCH models through the logl object) and R 2.1.0 with the pear package (sample periodic autocorrelations and partial autocorrelations).

The first (and so far only) application of a PAR model to daily electricity prices was carried out by Koopman et al. (2005).

The Generalized Error Distribution (GED) (sometimes referred to as Exponential Power Distribution) has a shape parameter, r, that for r = 2 makes it a Normal distribution, for r ∈ (0, 2) makes it leptokurtic and for r ∈ (2, ∞) turns it into a platykurtic distribution (cf. Nelson 1991). The GED we used has zero mean and unit variance.

It is hard to believe that the price of oil, which follows an integrated process, does not affect the price of electricity. If this is true, mean reversion is not a sensible hypothesis. What we may affirm is that for the limited length of our time series, the (possible) underlying unit root process takes account of a negligible degree of variance with respect to other components: seasonalities and short memory noise, in particular. A better description of this might be local mean reversion.

References

Bhanot, K. (2000). Behaviour of power prices: Implications for the valuation and hedging of financial contracts. Journal of Risk, 2(3), 43–62, Spring.

Bollerslev, T., & Ghysels, E. (1994). On periodic autoregressive conditional heteroskedasticity. September 1994, CIRANO Scientific Series No. 94s-3, Montreal.

Byström, H. (2005). Extreme value theory and extremely large electricity price changes. International Review of Economics and Finance, 14(1), 41–55.

Deidersen, J., & Trück, S. (2002). Energy price dynamics. Quantitative studies and stochastic processes. Technical Report TR-ISWM-12/2002, University of Karlsruhe.

Doornik, J. A., & Hansen, H. (1994). A practical test for univariate and multivariate normality. Working Paper, Nuffield College, Oxford, November.

Escribano, A., Peña, J. I., & Villaplana, P. (2002). Modelling electricity prices: international evidence. Economic Series 08, Working Paper 02-27, Universidad Carlos III de Madrid, June.

Fabra, N., & Toro, J. (2005). Price wars and collusion in the Spanish electricity market. International Journal of Industrial Organization, 23(3–4), 155–181, April.

Franses, P. H., & Paap, R. (2004). Periodic Time Series Models. Oxford, UK: Oxford University Press.

Hamilton, J. D. (1994). Time Series Analysis. Princeton, NJ: Princeton University Press.

Jones, R. H., & Brelsford, W. M. (1967). Time series with periodic structure. Biometrika, 54(3–4), 403–408, December.

Knittel, C., & Roberts, M. R. (2005). An empirical examination of restructured electricity prices. Energy Economics, 27(5), 791–817, September.

Koopman, S. J., Ooms, M., & Carnero, M. A. (2007). Periodic seasonal reg-ARFIMA-GARCH models for daily electricity spot prices. Journal of the American Statistical Association, 102(477), 16–27(12), March.

Lucia, J., & Schwartz, E. (2002). Electricity prices and power derivatives: Evidence from the Nordic Power Exchange. Review of Derivatives Research, 5(1), 5–50, January.

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: A new approach. Econometrica, 59(2), 347–370, March.

Pagano, M. (1978) On periodic and multiple autoregressions. Annals of Statistics, 6(6), 1310–1317, November.

Sakai, H. (1982). Circular lattice filtering using Pagano’s method. IEEE Transactions on Acoustic, Speech, and Signal Processing, 30(2), 279–287, April.

Tiao, G. C., & Grupe, M. R. (1980). Hidden periodic autoregressive-moving average models in time series data. Biometrika, 67(2), 365–373, August.

Vecchia, A. V., & Ballerini, R. (1991) Testing for periodic autocorrelations in seasonal time series data. Biometrika, 78(1), 53–63, March.

Wilkinson, L., & Winsen, J. (2002). What can we learn from a statistical analysis of electricity prices in New South Wales. The Electricity Journal, 15(3), 60–69, April.

Acknowledgments

This paper is part of a research program on the regulation of the electricity sector in Italy. We would like to thank the University of MilanBicocca for financing the research with a FAR 2003 (ex 60%) grant and MURST for a PRIN 2004 grant.

We thank REF (Researches in Economics and Finance, Milan, www.refonline.it/eng/) for providing us with the Italian data, and particularly Pia Saraceno, Claudia Checchi, Edoardo Settimio and Mara Zanini for comments and suggestions. All other data discussed in the paper have been obtained from electronic publications downloaded from the web site of the International Energy Agency (www.iea.org/Textbase/stats/rd.asp).

An earlier version of this paper was presented at the SixtyFirst International Atlantic Economic Conference. We thank Peter van der Hoek, Kinga Mazur, Martin McGuire and Michael Ye for useful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

In order to filter the low frequencies of the daily time series of electricity demand, we designed a partially model-based low-pass filter with time varying cut-off frequency. We used the model

with \( \omega _{j} = j \times {2\pi } \mathord{\left/ {\vphantom {{2\pi } 7}} \right. \kern-\nulldelimiterspace} 7{\text{, j = 1, 2, 3, }}\varepsilon _{t} \tilde{}N{\left( {0,\sigma ^{2}_{\varepsilon } } \right)}{\text{,}}\zeta _{t} \tilde{}N{\left( {0,\sigma ^{2}_{\varepsilon } } \right)}{\text{, }}\kappa ^{{{\left( j \right)}}}_{t} {\text{, }}\widetilde{\kappa }^{{{\left( j \right)}}}_{t} \tilde{}N{\left( {0,\sigma ^{2}_{\varepsilon } } \right)} \) μ t captures the low frequency movements in which we are interested, the γ t ’s take care of the within-week seasonality and ɛ t is white noise. Since the cut-off frequency of the low-pass filter for extracting μ t is determined by the signal-to-noise ratio \( \rho = {\sigma ^{2}_{\zeta } } \mathord{\left/ {\vphantom {{\sigma ^{2}_{\zeta } } {\sigma ^{2}_{\varepsilon } }}} \right. \kern-\nulldelimiterspace} {\sigma ^{2}_{\varepsilon } } \), we fixed it to 1,600 for “normal” days and to 100 for Christmas and summer vacations time (24th December–6th January and July–September). The other unknown variances have been estimated by ML. The filtered series was produced by the Kalman smoother.

The gain of the filter is given by

where

ρ is defined as above, r is the signal-to-noise ratio relative to the seasonal component (the estimated value is 48,660,207, meaning that the weekly seasonality is practically time-invariant) and \( \omega _{j} = {2\pi j} \mathord{\left/ {\vphantom {{2\pi j} 7}} \right. \kern-\nulldelimiterspace} 7 \).

The resulting cutoff frequency for normal times is 0.05π corresponding to a period of approximately 40 days. The cutoff frequency for vacation days is 0.10π (approximately 20 days).

Rights and permissions

About this article

Cite this article

Bosco, B.P., Parisio, L.P. & Pelagatti, M.M. Deregulated Wholesale Electricity Prices in Italy: An Empirical Analysis. Int Adv Econ Res 13, 415–432 (2007). https://doi.org/10.1007/s11294-007-9105-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-007-9105-z