Abstract

Policy in developed countries is often based on the assumption that higher business ownership rates induce economic value. Recent microeconomic empirical evidence may lead to a more nuanced view: Especially the top-performing business owners are responsible for the value creation of business owners. Other labor market participants would contribute more to economic value creation as an employee than as a business owner. The implied existence of an “optimal” business ownership rate would thus replace the dictum of “the more business owners, the merrier.” We attempt to establish whether there is such an optimal level, i.e., a quadratic relation between the business ownership rate and economic output rather than a linear or higher-order relationship, while investigating the role of tertiary education. Two findings stand out. First, by estimating extended versions of traditional Cobb–Douglas production functions on a sample of 19 OECD countries over the period 1981–2006, we indeed find robust evidence of an optimal business ownership rate. Second, the relation between business ownership and macroeconomic productivity is steeper for countries with higher participation rates in tertiary education. Thus, the optimal business ownership rate tends to decrease with tertiary education levels. This is consistent with microeconomic theory and evidence showing that business owners with higher levels of human capital run larger firms.

Similar content being viewed by others

1 Introduction

Policy makers believe a dangerous myth. They think that start-up companies are a magic bullet that will transform depressed economic regions, generate innovation, create jobs, and conduct all sorts of other economic wizardry.

(Shane 2009, p. 141)

Developed countries have installed many policy measures over the past decades based on the assumption that higher business ownership rates induce economic value creation (European Commission 2009, Chap. 3). Indeed, evidence has been collected of a positive relationship between business ownership rates and economic value creation (Parker 2009; Van Praag and Versloot 2007).Footnote 1

Recent microeconomic empirical evidence, however, shows a somewhat more nuanced view (e.g., Henrekson and Johansson 2010): Especially the top-performing end of the population of business owners is responsible for the largest part of the value creation of the whole population of business owners (Shane 2009). Other labor market participants would possibly contribute more to economic value creation as an employee (in the firms of these top business owners) than as a business owner (e.g., Hartog et al. 2010). Blanchflower (2004) already showed that the ratios of self-employed business owners are generally higher in poorer countries such as Greece, Turkey, Mexico, Korea, and Portugal than in richer countries. Thus, the common and rather popular assumption that “the more business owners, the merrier” would not hold and there could then be an “optimal” business ownership rate, i.e., a rate that maximizes economic output. Scott Shane even concludes that “encouraging more people to become entrepreneurs is bad public policy” (2009).Footnote 2

These recent insights are obtained in three strands (or corners) of microeconomic studies. The first consists of a few studies showing that a small percentage of (mostly relatively young) high-growth or “high-impact” firms measured in terms of sales or employment growth is responsible for the largest part of the total growth of net employment and sales (see a meta-analysis by Henrekson and Johansson 2010 and an extensive study on US firms by Acs et al. 2008 or many examples in Shane 2009). The second strand leads to this insight in a more indirect manner: There is ample evidence that only a fraction of the labor force actually receives a higher income as a business owner than as an employee (e.g., Hamilton 2000; Parker 2009). This evidence is (indirectly) in line with the presence of an optimal business ownership rate because individual incomes of business owners and their firm’s contribution to economic value creation are correlated strongly (see Parker 2009). Third, there is a strand of theoretical equilibrium models of occupational choice that lead to an equilibrium business ownership rate given the optimal division of the labor force across the occupations “entrepreneur” and “wage employee.” Early and influential examples of such models are those of Lucas (1978), Kanbur (1979), and Kihlstrom and Laffont (1979). The recent insights are thus supportive of equilibria obtained in these occupational choice models (Shane 2009).

Our main contribution to the literature is twofold. First, we perform a cross-country test of the empirical validity of the phenomenon of an optimal business ownership rate (and, if valid, what the estimated optimal rate is). The test is performed by estimating an extended version of traditional Cobb–Douglas production functions based on a panel of 19 OECD countries over the period 1981–2006. We test whether the relationship between log(GDP) and the business ownership rate is quadratic rather than linear (or of a higher power). Thus, we define the “optimal business ownership rate” as the rate of business ownership that maximizes GDP. Indeed, we find evidence consistent with the presence of an optimal business ownership rate (i.e., a quadratic relationship) and inconsistent with “the more, the merrier” (i.e., a linear relationship). Based on this we try to feed the discussion of “Are there too many or too few entrepreneurs?”, which may bear policy implications if one believes that public policy has a role in this (Parker 2005; Shane 2009; Parker and Van Praag 2010).

The second part of the paper focuses on the heterogeneity of this “optimal” business ownership rate across countries and over time. Microeconomic evidence supports the view that top business owners, i.e., the ones with high levels of performance (in terms of income and growth) that are in particular responsible for value creation, have superior levels of human capital. In other words, human capital, in particular education, is one of the most important individual drivers of the performance of business owners and the ensuing firm size. This has already been expressed by seminal economists such as Marshall (1890), Kaldor (1934), and Coase (1937), and these claims have obtained broad empirical support (Parker 2009; Parker and Van Praag 2006).

Even stronger, recent evidence, albeit solely based on US data, convincingly shows that especially those labor force participants with high levels of education and ability are the ones that earn a premium income as business owners, whereas others, with lower levels of human capital, are better off as employees. This is a combination of the fact that the returns to ability and education are higher in business-owning positions than in wage employment and that average incomes—conditional on observed characteristics—are higher for employees than business owners (Hamilton 2000; Hartog et al. 2010; Van Praag et al. 2009). This implies, at the macro level, that higher levels of education lead to more productive business ownership and thus to a steeper relationship between the business ownership rate and economic value creation (the macroeconomic equivalent of higher returns to human capital). And since more-productive business owners run larger firms, they require, on average, more employees, leading to a lower optimal business ownership rate. We consider the indicative evidence of these relationships obtained in our study to be its second contribution: We show that higher participation rates in tertiary education are associated with a steeper relationship between production outcomes and the business ownership rate and with lower levels of the “optimal” business ownership rate.

Our results are obtained using a methodology connecting two small strands of empirical literature that deal with the relationship between entrepreneurship and macroeconomic performance, while introducing the interplay between tertiary education and business ownership as a new element in the determination of macroeconomic production. In a first strand of literature, the relation between economic growth and shares of small and medium-sized enterprises (SMEs) or business ownership rates is analyzed for a group of developed countries (Audretsch et al. 2002a; Carree et al. 2002, 2007; Erken et al. 2008).Footnote 3 Most closely related are Carree et al., who model an “equilibrium” rate of business ownership and find a negative relationship between deviations of the actual business ownership rate from the “equilibrium” and subsequent macroeconomic growth. We try to corroborate the existence of an optimal business ownership rate, as implied by Carree et al. (2002, 2007), by enriching the model in the following respects: we allow for a nonlinear relationship between the business ownership rate and productivity—such that the presence of an optimum can actually be tested—in a formal production function framework, where the role of various input factors in the production process is explicitly acknowledged.Footnote 4

By estimating macroeconomic production functions, we follow the tradition of a second strand of literature which models output as a function of the traditional input factors physical capital, labor, and knowledge capital, and, in addition, of an input factor labeled entrepreneurship capital (see, for instance, Audretsch and Keilbach 2004a, b; Audretsch et al. 2006; Mueller 2007; Bosma et al. 2011; Fritsch and Schroeter 2011). We contribute to this strand of literature in two ways. First, instead of a regional comparison within one country—Germany or The Netherlands in the studies mentioned above—we perform an international comparison, using data for 19 OECD countries. Second, we focus on the relationship between economic outcomes and the business ownership rate, a static indicator of entrepreneurship capturing business owners in both new and incumbent firms. Earlier studies measured entrepreneurship in terms of the number of new-firm start-ups or the degree of business turbulence, i.e., dynamic indicators of entrepreneurship focusing on new firms but not on incumbent firms. Our (static) indicator may be more consistent with the occupational choice framework employed in microeconomic theory.Footnote 5

A third strand of literature, which is worth mentioning but somewhat more distinct from the present approach, involves the various Global Reports of the Global Entrepreneurship Monitor (GEM) showing a U-shaped relation between GEM’s well-known early-stage entrepreneurial activity rate and per capita income (see, e.g., Bosma et al. 2008, but also Wennekers et al. 2005). The U-shaped curve relates the rate of entrepreneurial activity to a country’s stage of economic development. Hence, these studies assess the relationship between the (actual) rate of entrepreneurship and economic development. A distinct feature of our study is that we estimate the relationship between the economic performance of a country and its business ownership rate in a Cobb–Douglas framework, thereby allowing the actual rate of entrepreneurship to differ from the optimal rate. If we find an “optimal” rate of business ownership, this would reflect the percentage of entrepreneurs that brings about maximal benefits to macroeconomic performance (conditional on the validity of certain specific assumptions). In contrast, in the GEM Global Reports, deviations from the estimated curve are not related to suboptimal economic performance. Thus, the relations estimated in these reports should be interpreted as an “average” entrepreneurship rate (given a certain level of per capita income) rather than an “optimal” rate.

Thus, we use macroeconomic data and measures of income and productivity instead of microeconomic equivalents to estimate the relationships between education, business ownership, and productivity. Many of the studies measuring these relationships, so far, have used micro data. Several studies have found evidence that the estimates of these relationships are likely to be biased due to underreporting of incomes by business owners when using microeconomic data (Parker 2009; Lyssiotou et al. 2004; Schuetze 2002). Since we use macrolevel data, in particular GDP, which measures the sum of incomes of all individuals in a country, biased results due to underreporting by individual business owners are highly unlikely to occur in the present study.

The remainder of the paper is organized as follows. The next section develops propositions to be tested. In Sects. 3 and 4, we discuss the empirical methodology and the data. Section 5 is devoted to the estimation results, while Sect. 6 concludes.

2 Propositions

Considerable research effort has been put into quantifying the relationship between economic value creation and entrepreneurship. Are more entrepreneurs associated with better economic performance? Based on a meta-analysis of studies (Van Praag and Versloot 2007), it is concluded that the answer to this question is positive, but does certainly require more nuance.

Entrepreneur(ial firm)s create relatively more employment than a control group of nonentrepreneurial firms, where in each of the studies that form the basis of the meta-analysis a comparison is made between (i) young versus older firms, or (ii) new versus incumbent firms, or (iii) small versus large firms. However, the jobs created in entrepreneurial firms are less secure and, on average, pay worse. At the macro level, new firms have, in addition, an indirect effect on employment. This effect is negative shortly after they have entered the market due to the fact that some of the incumbent firms cannot cope with the competition caused by the new entrants and shrink or get out of the market altogether. In addition, many of the new firms do not survive the first years after the start. The indirect effect on employment turns positive after 5–8 years because new firms have a disciplinary effect on (surviving) incumbents. Depending on the quality of the new firms, the positive effect in the longer term is larger than the short-term negative effect, such that the net indirect effect of start-ups on employment is positive (Fritsch and Mueller 2004; Van Stel and Suddle 2008). Moreover, entrepreneurial firms are associated with higher levels of labor/factor productivity, with (the commercialization of) innovation, and with knowledge diffusion (Braunerhjelm et al. 2010).

The studies discussed above show that, if anything, the association between entrepreneurship and economic outcomes is positive. However, these studies do not address the highly relevant question: “Is more entrepreneurship better in general, or can we have, instead, too many entrepreneurs?” In other words, can it be that there is some sort of optimal rate of business ownership (a common empirical equivalent of entrepreneurship)? Blanchflower (2004) provides suggestive evidence that, at least, more business ownership is not always associated with country wealth.

Carree et al. (2002) summarize arguments stemming from macroeconomic studies as to why the level of business ownership may be too low or too high, as follows: “A shortage of business owners is likely to diminish competition with detrimental effects for static efficiency and competitiveness of the national economy. It will also diminish variety, learning and selection and thereby harm dynamic efficiency (innovation). On the other hand, a glut of self-employment will cause the average scale of operations to remain below optimum. It will result in large numbers of marginal entrepreneurs, absorbing capital and human energy that could have been allocated more productively elsewhere.” (p. 276).

Occupational choice theory provides a micro foundation for the phenomenon of an optimal business ownership rate. As we shall see in the sequel, there is a close correspondence between the micro relationship, i.e., likelihood of business ownership, individual business performance, and individual education level, on the one hand, and the macro relationship, i.e., the countrywide business ownership share, the country’s GDP, and the enrollment rates in higher or tertiary education, on the other.

Early and influential occupational choice models include those of Lucas (1978), Kanbur (1979), and Kihlstrom and Laffont (1979), who describe the division of a given workforce over the two classes of entrepreneurs and wage-earners, or employers and employees. This division depends on the distribution of individual characteristics. For Lucas (1978) this is entrepreneurial aptitude, in addition to capital; for Kanbur (1979) and Kihlstrom and Laffont (1979) the emphasis is on risk with respect to entrepreneurial aptitude, which is unknown until it has been proven. In all of these models, a certain equilibrium rate of entrepreneurship results.Footnote 6

Proposition 1

There is an optimal business ownership rate.

The quality of business owners, in terms of their contribution to economic growth, may well have implications for the link between business ownership and productivity at the country level. Lucas’s influential model of occupational choice (1978) forms a strong basis for this argument. In his model, individuals are selected into entrepreneurial positions based on their (entrepreneurial) ability, drawn from a continuous probability distribution. An individual’s higher entrepreneurial ability translates into lower (marginal) production costs. In equilibrium, only people with an ability level above a certain threshold run firms, whereas the others obtain higher utility levels as wage workers (with a uniform wage rate).Footnote 7 People with the highest levels of ability run the largest firms, i.e., employ more personnel.Footnote 8

At the macro level, a higher participation rate in tertiary education translates into relatively more individuals with higher ability levels, i.e., in a fatter right-hand side tail of the ability distribution. Hence, there are more individuals willing and able to run large firms. This means that the demand for workers (employees) increases, which leads to higher wages. The higher wages, in turn, increase the level of ability of the marginal business owner (the business owner with the lowest entrepreneurial ability), so that in the end the equilibrium business ownership rate decreases as a result of higher participation levels in tertiary education. The business owners for whom it is still profitable to remain a business owner, on average, run larger firms. As a consequence, the business ownership rate will be lower. Lucas’s model is strongly related to earlier seminal contributions to the entrepreneurship literature that all lead to the conclusion that the quality of business owners may affect the relationship between economic value and the business ownership rate.

Marshall claimed already in 1890 that “There is a far more close correspondence between the ability of business men and the size of the businesses they own than at first sight would appear probable.” (Marshall 1890 [1930], p. 312). Or, as Kaldor expressed this in 1934 in his seminal article “The Equilibrium of the Firm,” the production factor which is most determining for the size of any (mature) firm is the coordinating ability of the entrepreneur leading the firm. There can be at most one coordinator, coordinating all transactions in which the firm is involved, thereby restricting the size of the firm. The amount of all other factors of production employed is limited by the fixed supply of coordinating ability by the unique entrepreneur. In another seminal contribution, Coase (1937) argued similarly that there are “diminishing returns to management” in the sense of decreasing returns to scale at a given level of entrepreneurial ability.

Based on Lucas’s model and these seminal arguments, we are interested in the determinants of the quality and thus optimal firm size of business owners insofar as these determinants can be aggregated to the country level and serve as a possible determinant of the heterogeneity of the optimal business ownership rate across countries and over time. The most widely recognized determinant of labor market performance in general and of business owners in particular is human capital (Mincer 1958; Becker 1964). Citing Parker’s handbook:

Overall, the literature suggests that human capital is the major determinant of entrepreneurs’ earnings (van Praag 2005, p. 9). Few other explanatory variables, including ethnicity, family background, social capital, business strategy, or organisational structure of the venture, possess much explanatory power.

Parker (2009), p. 582

Human capital refers to the stock of skills and knowledge relevant to produce economic value and is gained through education and experience. It was first defined as such by Adam Smith (1776 [1904]). Investments in human capital do not only increase the productivity of business owners but can also be used as a signal of their quality toward suppliers of capital (Parker and van Praag 2006) or (prospective) customers and qualified employees (Backes-Gellner and Werner 2007).

Microeconomic evidence supports the view that top business owners, i.e., the ones with high levels of performance [in terms of income and growth] that are in particular responsible for value creation, have superior levels of human capital in terms of ability and education. These are the most important individual drivers of the performance of business owners and the ensuing firm size.Footnote 9

Interestingly, as analyzed and implied by Van Praag et al. (2009), the large return to human capital for entrepreneurs seems to be driven by the autonomy or control of entrepreneurs. Van Praag et al. (2009) indicate that the larger decision authority of entrepreneurs relative to employees or managers regarding how to employ and combine all capital inputs increases returns to these inputs. This implies that the ownership of the firm by entrepreneurs creates greater returns from the management of the resources of the firm, including their own human capital. Thus, the unique combination of ownership and management that characterizes entrepreneurship causes the greater returns to human capital.

This implies, at the macro level, that higher levels of education lead to more productive business owners and thus to a steeper relationship between the business ownership rate and economic value creation (the macroeconomic equivalent of higher returns to human capital). And since more productive business owners run larger firms, they require, on average, more employees, leading to a lower optimal business ownership rate.

Measures of human capital or education have often been included in empirical macroeconomic growth models; For instance, in his seminal work, Barro (1991) estimates a strong positive association between school enrollment rates at the primary and secondary levels and the growth rate of real per capita GDP on a cross-section of countries, including both developed and developing countries. This positive association turns, however, insignificant when estimated on a sample of developed countries only; see the overview by Krueger and Lindahl (2001). Vandenbussche et al. (2006) explain this counterintuitive result, both theoretically and empirically, by emphasizing the crucial role of skilled human capital for economic growth in developed economies. They associate skilled human capital with innovation, whereas the measures of education used in the studies reviewed by Krueger and Lindahl are indicators of total human capital, which is associated with imitation rather than innovation. Vandenbussche et al. conclude that “skilled human capital has a stronger growth-enhancing effect in economies which are closer to the technological frontier” (p. 122). Accordingly, they also conclude that it is crucial to distinguish between primary/secondary versus tertiary educational attainment. We follow this argument by employing participation rates in tertiary education, the measure of (skilled) education that is more crucial than participation in lower levels of education or average educational attainment (Hanushek and Woessmann 2008) for enhancing economic growth in developed economies.

Proposition 2

The relationship between economic productivity and the business ownership rate is steeper if the participation rate in tertiary education is higher.

Proposition 3

The optimal business ownership rate is lower if the participation rate in tertiary education is higher.

3 Methodology

3.1 Developing estimation equations

As mentioned, we estimate Cobb–Douglas production functions explaining output. In the neoclassical production function, the key inputs of production are (physical) capital and labor (Solow 1956). In endogenous growth theory, knowledge is added as an important factor of production (Romer 1986, 1990, 1994). A typical production function model, written in log-linear form, then looks as follows:

where Y is output, K is physical capital, L is labor (total employment), and R is knowledge capital (often operationalized as research and development).

Audretsch and Keilbach (2004a) add a fourth input factor to the production function: entrepreneurship capital, operationalized as the number of new-firm start-ups, i.e., a dynamic measure capturing the notion that entrepreneurship is about newness. We extend Eq. (1) by including a static measure of entrepreneurship capital, to be specific, the number of (new and incumbent) business owners relative to the labor force (the business ownership rate, BOR). As mentioned before, this measure is more closely related to the occupational choice framework underlying our empirical model. BOR is operationalized as the number of owner-managers of unincorporated and incorporated businesses as a share of the labor force (see Sect. 4).

Next, we also include a (second-order) polynomial of BOR to enable testing the hypothesis of decreasing marginal returns to business ownership. The third equation that we will estimate results:Footnote 10

In this model the β coefficients are output elasticities.Footnote 11 Next, we extend Eq. (3) by including education, in particular, as we motivated based on Vandenbussche et al. (2006), the participation rate in tertiary education, such that the fourth equation results as:

where EDUC is education (in terms of participation in tertiary education). In addition to including this measure of education in a linear way, we also allow for the possibility that education mediates the relationship between the business ownership rate and macroeconomic production, in order to enable testing the validity of propositions 2 and 3. Equation (5) results:

We will estimate Eqs. (1–5). We compute the optimal business ownership rates in Eqs. (3) and (5) as \( \frac{{ - \gamma_{1} }}{{2\gamma_{2} }} \) and \( \frac{{ - (\gamma_{1} + \gamma_{4} {\text{EDUC}})}}{{2(\gamma_{2} + \gamma_{5} {\text{EDUC}})}} \), respectively.

Two more remarks are in order. First, we estimate the equations in levels rather than in growth rates. While differences in growth rates across countries may be mostly transitory, levels capture the differences in long-run economic performance, which are more directly relevant to welfare (Hall and Jones 1999, p. 85). As business ownership rates change only slowly over time, we follow this argument and estimate the equations in levels. Second, we add time dummies to the model so that we focus on explaining cross-country variations, thereby following the usual approach in the empirical growth literature (e.g., Barro 1991, 1997; Barro and Sala-i-Martin 1992; Beck et al. 2005; Bleaney and Nishiyama 2002; Hall and Jones 1999; Mankiw et al. 1992).

4 Data and sample

We estimate the model expressed in Eqs. (1–5) using data for 19 OECD countries over the period 1981–2006. The 19 countries are chosen on the basis of data availability for our model variables.Footnote 12 For reasons explained below, the data available for Greece and Italy have been excluded from the sample, which originally consisted of 21 countries. Our measure for knowledge capital is available only from 1981 onwards, defining our sample period as running from 1981 onwards. As a result, the equations are estimated using 494 observations, corresponding to a panel of 19 countries and 26 years. We provide the definitions and data sources for our model variables below.

4.1 Output (Y)

We measure Y as gross domestic product (GDP) in constant prices of 1990. Purchasing power parities of 1990 are used to make the monetary units comparable across countries. Data are obtained from OECD National Accounts.

4.2 Physical capital (K)

Our measure of K is obtained from Kamps’ (2004) internationally comparable net capital stock estimates for 22 OECD countries over the period 1960–2001, based on OECD series of real gross fixed capital formation. Capital stock estimates are constructed applying the perpetual inventory method, assuming that depreciation (i.e., consumption of fixed capital) follows a geometric pattern. In particular, we use the variable “real total net capital stock as a percentage of real GDP,” where “total” refers to the overall private and public-sector net capital stock (see Kamps 2004, for more details). For the period 2002–2006 these percentages are extrapolated based on average annual changes over the 5-year period 1997–2001. We multiply the resulting capital share series with the real GDP variable (as defined above). Thus, we obtain physical capital stock estimates expressed in purchasing power parities per US dollar in 1990 prices.

4.3 Research and development (knowledge capital) (R)

The indicator of research and development (knowledge capital) we use is the variable gross domestic expenditure on R&D (GERD) as a share of GDP, as provided by OECD (Science, Technology and R&D database). These data are available from 1981 onwards. We multiply the R&D share series with our real GDP variable (as defined above), so that we obtain knowledge capital stock estimates expressed in purchasing power parities per US dollar in 1990 prices.

4.4 Labor (L)

Total employment is defined as the number of persons in the total labor force minus the number of unemployed. Data on total labor force are taken from OECD Labour Force Statistics, while the number of unemployed is calculated using the standardized unemployment rate published in OECD Main Economic Indicators. Some missing values in the unemployment series are estimated using data from OECD Labour Force Statistics. Total employment measures the labor contribution to the macroeconomic production process of both employees and business owners.

4.5 Business ownership rate (BOR)

Business ownership is defined as the total number of unincorporated and incorporated self-employed outside the agriculture, hunting, forestry, and fishing industries who carry out self-employment as their primary employment activity (see Van Stel 2005, p. 108). Unpaid family workers are excluded. These data are taken from EIM’s COMPENDIA database (version 2006.1).Footnote 13 In this database, self-employment numbers as published in OECD Labour Force Statistics are corrected for measurement differences across countries and over time and thus harmonized. Finally, to arrive at a business ownership rate, the number of business owners is divided by the total labor force. Obviously, given the purpose to estimate an optimal business ownership rate, the harmonized character of these rates is of vital importance.Footnote 14

4.6 Education (EDUC)

As we discussed, and based on Vandenbussche et al. (2006), the measure of education that is most likely to be associated with productivity is participation in tertiary education, as a rough proxy of “skilled” human capital in a country, rather than primary or secondary enrollment rates as used by Barro (1991). The empirical measure of tertiary education that we use is the gross enrollment rate for tertiary education, published by the World Bank in their EdStats database. It is defined as the number of pupils enrolled in tertiary education, regardless of age, expressed as a percentage of the population of the 5-year age group following on from the secondary school leaving age. Where necessary, interpolations have been applied.

Descriptive statistics

In Table 1 we provide summary statistics for our main variables of interest, the business ownership rate and the gross tertiary enrollment rate. We observe great country variations in business ownership rates. In 2006 (nonagricultural) business ownership amounts to 6.6 % of the total labor force in Switzerland and 15.2 % in Australia. These country differences are related to differences in institutions and cultural attitudes towards entrepreneurship (Freytag and Thurik 2007). Furthermore, in most but not all OECD countries, business ownership has increased between 1981 and 2006. Notable exceptions are France and Japan. We also observe considerable variations in tertiary enrollment rates, both across countries and over time. As expected, the enrollment rate in tertiary education has increased considerably over the period studied.

5 Results

This section presents the estimation results of the models specified above, i.e., Eqs. (1–5). In Table 2, we present the main results. The first two columns of Table 2 provide results of Eq. (1), including (physical) capital (K), knowledge capital (R), and labor (L) as production factors in the production function. All three factors contribute significantly to production, and the estimated production function exhibits constant returns to scale: The sum of the estimated elasticities, i.e., \( \beta_{K} + \beta_{R} + \beta_{L}\), does not differ significantly from unity. The difference between Eqs. (1) and (1′) is the inclusion of year dummies in the latter. Based on a comparison of the log-likelihood values, we conclude that including year dummies significantly contributes to the model explanation. Equation (1′) is used as the benchmark.

5.1 Optimal business ownership rate

The business ownership rate (BOR) is added in Eq. (2). The positive and highly significant coefficient γ 1 for BOR indicates that marginally higher business ownership rates are associated with marginally higher production levels, holding constant the actual levels of the production factors K, R, and L. Assuming that an optimal business ownership actually exists, i.e., γ 2 < 0, this finding implies that, during the period 1981–2006, most countries in our sample had a business ownership rate below the optimum.

Next, Eq. (3) includes a squared BOR term and tests whether an optimal level of business ownership can actually be found for our estimation sample, i.e., \( \gamma_{2} < 0 \). Indeed, there seems to be such an optimal level, consistent with the highly significant and negative coefficient for BOR2 in Eq. (3). The likelihood ratio test, between Eqs. (2) and (3), supports that the inclusion of BOR2 in the model increases its explanatory power significantly. Moreover, including third or higher orders of the business ownership rate turned out not to add any more explanatory power to the model. According to these model estimates, the relationship between production and the business ownership rate is inverse U-shaped. Thus, we find empirical support for the first proposition that there is, indeed, an inverse U-shaped relationship between log(GDP) and the business ownership rate.

Column (3′) in Table 2 shows estimates of the same specification as in Eq. (3), however, this time excluding nine observations for Germany in the period 1981–1989, for which there are no observations available for tertiary education. Since this variable is added to the model in Eq. (4) and further, column (3′) is used as a benchmark so that the added value of the specifications including indicators of enrollment rates in tertiary education can be assessed. The results from estimating Eq. (3′) are similar to Eq. (3). We now turn to discussing the results from including the gross tertiary enrollment rate (EDUC) into the equations.

5.2 Education and the optimal business ownership rate

In Eq. (4) we include the enrollment rate in tertiary education (EDUC) in the equation. As expected, the coefficient γ 3 is significantly positive. Equation (5) is used to test whether there is an interaction between business ownership and education in determining macroeconomic production. Using this equation, one can assess if and to what extent propositions 2 and 3 are empirically valid. Is the relationship between the business ownership rate and production steeper for higher levels of higher education? And, as a consequence, is the optimal business ownership rate lower for higher enrollment rates in tertiary education? The estimated values of γ 4 and γ 5 are significantly positive and negative, respectively. We thus find support in our data for the hypothesis that a marginal increase in the enrollment rate of tertiary education makes business ownership more valuable for production. Moreover, the optimal business ownership rate decreases upon a marginal increase in EDUC.

The log-likelihood tests reveal that the model fit only improves marginally on including interaction terms of BOR and EDUC. This is due to the fact that the significance of the parameter estimates shifts from BOR and BOR2 (without interaction) to BOR * EDUC and BOR2 * EDUC. In terms of Eqs. (4) and (5) in the previous section, the significance shifts from parameters γ 1 and γ 2 (in Eq. 4) to parameters γ 4 and γ 5 (in Eq. 5). The results indicate that the inverse U-shaped relationship between the business ownership rate and macroeconomic outcomes depends on the participation rate in tertiary education in a way that is consistent with propositions 2 and 3.

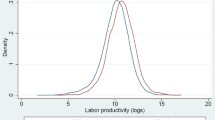

Figure 1 illustrates the relation between education, business ownership, and macroeconomic output, where we fix the levels of the production factors capital, R&D, and employment at the levels of their respective sample averages. The relation between the business ownership rate (BOR) and output is depicted for three levels of the enrollment rate in tertiary education, i.e., the 25, 50, and 75 % centile values in our sample. The figure illuminates that the relationship between the business ownership rate and production is steeper and that the optimal business ownership rate is lower with higher enrollment rates in tertiary education.

The relationship between the business ownership rate (BOR) and log(GDP). Note: The figure is based on the estimates of Eq. (5). The three curves correspond to the 0.25, 0.50, and 0.75 centiles of the variable EDUC

Table 3 presents the numbers underlying Fig. 1; i.e., it tabulates the derivative of log(GDP) with respect to BOR, i.e., the marginal effect on output of increases in BOR. For instance, the table shows that, for the 75 % centile value of EDUC (0.61), an increase in BOR from 0.05 to 0.06 increases log(GDP) with 0.064, i.e., a 6.4 %-point increase in output. The same increase in BOR at a level of 0.10 increases output by 1.6 %. Hence, it is clear that the marginal returns to business ownership are decreasing in the level of business ownership. The table also illustrates, in line with proposition 3, that the level of BOR at which the marginal returns become negative (i.e., the optimal business ownership rate) decreases with education.

This is in fact consistent with the formula derived at the end of the previous section, which, in terms of Eq. (5), expressed the optimal BOR as a function of EDUC, as follows: \( \frac{{ - (\gamma_{1} + \gamma_{4} {\text{EDUC}})}}{{2(\gamma_{2} + \gamma_{5} {\text{EDUC}})}} \). Using the parameter estimates obtained from estimating Eq. (5), the function is depicted in Fig. 2. The optimal business ownership rate is decreasing in the participation rate of the population in higher education.

Relationship between the tertiary enrollment rate and the optimal business ownership rate (BOR). Note: The figure is based on the estimates from Eq. (5)

5.3 Robustness tests

We perform four robustness tests. The first test relates to the question “Are the results that we observe driven by a particular subperiod of the long time period we study, i.e., 1981–2006?” In other words, is the structure of the macroeconomic production process constant over time? Is an optimal business ownership rate present in both the earlier and the later period? And if so, is it at approximately the same level in both subperiods? And is its relationship with the enrollment rate in tertiary education subject to changes over time? To answer this set of questions, we split the sample into two (equally long) time spans. Table 4 presents the results of estimating Eqs. (4) and (5) on these two subsamples.

The estimates of Eq. (4), represented in the left-hand side panel of the table, show for each subperiod highly significant coefficients for both the linear and the squared BOR term, consistent with an optimal BOR in each period. However, the optimal business ownership rate is lower in the period 1994–2006 compared with the earlier period. Considering that education levels are increasing over time (Table 1), this finding is consistent with the negative relation between tertiary education and the optimal business ownership rate, depicted in Fig. 2. It also shows that the estimated optimal BOR level is dependent on the sample selection, whereas the presence of an optimum itself is not.

The columns in the right-hand side of Table 4 show the estimates of Eq. (5) for both subperiods. For the earlier period the interaction terms between education and the business ownership rate are highly significant and in accordance with the results obtained from the whole period sample. However, for the later period the interaction terms are not significant. Given the shape of Fig. 2, where the relation between the optimal BOR and education is much steeper for lower levels of education, this result is not surprising (as education levels are lower in the earlier period).

The second robustness test pertains to the definition of business ownership. In particular, we vary the denominator of the business ownership rate, which may influence the results. The default denominator is the total labor force, i.e., the sum of private-sector employment, government employment, and unemployment, consistent with the definition used in the COMPENDIA database (Van Stel 2005). However, our microeconomic theoretical underpinning assumes that the labor force is split into a group of business owners and a group of employees, where the first group employs the second, as in Lucas (1978), such that the business ownership rate is (inversely) related to the average firm size. The COMPENDIA definition of the business ownership rate thus deviates from the definition that would best fit the theoretical notion of the business ownership rate, i.e., excluding the unemployed and public-sector workers from the labor force. This may bias our results due to cross-country variation in rates of unemployment or the employment share of the government; For instance, Anglo-Saxon countries in general have small governments while Scandinavian countries have larger governments. In Table 5, we estimate Eqs. (4) and (5) using three different BOR denominators: total labor force, total employment (i.e., excluding unemployment), and private-sector employment (i.e., excluding unemployment and government employment). The results are qualitatively the same and seem to be independent of the definition of BOR. Importantly, an inverse U-shaped pattern between BOR and log(GDP) is found in all three columns representing estimates of Eq. (4), suggesting that the existence of an optimal business ownership rate does not depend on the definition of BOR. The estimates based on Eq. (5) in the right-hand side panel of the table show that the association of education with the optimal business ownership rate remains qualitatively the same upon variations in the definition of the business ownership rate. Naturally, in both equations, since the values of the alternative business ownership rates are higher (as denominators are smaller), the estimated optimal rates are also higher for the alternative measures (i.e., BOR2 and BOR3 in Table 5).

The third robustness test addresses the issue of endogeneity. The estimated relationship between the business ownership rate and economic performance is not necessarily a causal impact. In particular, the possibility that the coefficients reflect, to some extent, the influence of macroeconomic performance on the business ownership rate, i.e., reversed causality, or, alternatively, that there is some underlying unobserved factor covarying with both economic outcomes and the business ownership rate, i.e., unobserved heterogeneity, cannot be ruled out.Footnote 15 Thus, we only address the issue of endogeneity of the business ownership rate leaving education out of the equation. We acknowledge that education may as well be an endogenous variable in this equation, but we do not further pursue this issue.

We test whether instrumental variable (IV) estimation where the business ownership rate (and its squared term) are treated as endogenous explanatory variables leads to similar results. Three instrumental variables that are known to influence business ownership rates (but not the level of GDP) are used; see Audretsch et al. (2002b). The first is the growth rate of per capita income, the second the share of the population living in rural areas, and the third the age composition of the population (operationalized as the share of the population aged 25–39 years within the population aged 25–64 years).Footnote 16 Table 6 presents the results of our IV estimations for Eqs. (2) and (3).

Results of the first stage (not shown), i.e., the regression of the business ownership rate (BOR) on our identifying instrumental variables in combination with all the exogenous regressors included in the second stage, reveal that our instruments are sound. The estimated effects of our set of identifying instruments on BOR are highly significant and in line with expectations: countries with higher economic growth rates and with higher shares of 25–39-year-old individuals (the age class with a higher share of entrepreneurs) have more business owners, whereas countries with many people living in rural areas have fewer business owners (for most economic activities, cities are more attractive locations for business ownership). The usual F-test establishes that the set of identifying instruments consisting of these three variables is of sufficient quality (i.e., generating F-statistics of 12.7, 47.0, and 66.9, i.e., >10); see Bound et al. (1995).

To facilitate comparison, in the first two columns of Table 6 the ordinary least squares (OLS) results from Table 2 are repeated. The third and fourth column show the results from instrumental variable estimation. In these IV estimations, BOR and BOR squared are considered endogenous regressors, so that the number of identifying instrumental variables (three) exceeds the number of endogenous regressors (one in Eq. 2 and two in Eq. 3). Hence, the model may be overidentified, and an F-test on the overidentification of restrictions is necessary. In the IV estimation of Eq. (2) in Table 6 we see that the positive linear impact of BOR found in Table 2 is confirmed. The IV estimate is even higher compared with OLS estimation (the coefficient is 4.83 versus 1.43 for OLS). However, the F-test on valid instruments is not passed. In the next column, the BOR squared term is added, and this time the instruments do pass the test. Compared with the OLS estimates, the IV coefficients of BOR and BOR squared are higher in magnitude, implying a steeper relation between business ownership and production. Reassuringly, the optimal business ownership rate is similar to the one obtained using OLS (11.5 % versus 12.7 %). We conclude that IV results are qualitatively similar to OLS results, and hence that it is likely that the impact of business ownership on production in our model is in fact causal.

The results from the fourth and final robustness check indicate why we have excluded two countries from the sample, i.e., Greece and Italy. Table 7 presents results when these two countries are included in the sample, i.e., when the number of observations is 546 instead of 494. The first column presents results for Eq. (2) which are similar to those in Table 2, where the two countries were excluded. However, when we allow coefficients for BOR to be different for the group of 19 original sample countries on the one hand, and Greece and Italy on the other (second column), we see that the coefficient for these two countries is significantly smaller compared with the other countries (1.26 versus 1.92). A likelihood ratio (LR) test between Eqs. (2) and (2″) indeed reveals that the model fit significantly increases when allowing the coefficient for BOR to be different for Greece and Italy. Interestingly, the coefficient for the total sample in the first column (1.27) is almost the same as that of Greece and Italy in the second column (1.26). This suggests that the impact of the two countries on the total sample estimate is disproportionally large, providing support for our decision to exclude these two countries from our sample.

The last two columns present results when the squared business ownership variable is included as well. Like in the sample of 19 countries where Greece and Italy are excluded, we find evidence of the existence of an optimal BOR, i.e., a significant coefficient for the squared BOR-percentage. The optimal business ownership rate is now estimated to be 15.9 % (versus an estimated optimum of 12.7 % when excluding Greece and Italy; see Table 2). Hence, similar to Eq. (2), the impact of these two countries on the overall estimate of Eq. (3) is quite large in terms of the estimated optimal BOR. When allowing the estimates for BOR and BOR squared to be different for the two groups of countries, the LR test again reveals that this significantly improves the model fit.Footnote 17 Moreover, the separate estimation for the two groups of countries shows an estimated optimal BOR for the original sample countries of 13.4 %, which is rather close to the original estimates in Table 2. Like in Table 4, we find that the estimated optimal BOR level is dependent on the sample selection, whereas the presence of an optimum itself is not.

These exercises show that the statistical relation between business ownership and production is indeed different for the outliers Greece and Italy.Footnote 18 We argue that Greece and Italy are outliers due to certain extraordinary characteristics that have also become more evident outside the scope of our research very recently in 2011. Within the scope of our research data, the most visible extraordinary characteristics are extremely high business ownership rates. In 2006 the (nonagricultural) business ownership rates in Greece and Italy were at least one-third higher than in any other country in the sample, i.e., 19.7 and 21.0 %, respectively (Australia has a BOR of 15.2 %; see Table 1).Footnote 19

5.4 Types of entrepreneurship

A limitation of our business ownership measure is that it does not distinguish between different types of entrepreneurship. By now, it is generally accepted that the contribution of entrepreneurship to macroeconomic development is contingent on the type of entrepreneurship (Dejardin and Fritsch 2011; Stam and Van Stel 2011). Examples of typologies of entrepreneurship are high-technology versus low-technology entrepreneurs, higher- versus lower-educated entrepreneurs, own-account workers versus employers, and necessity versus opportunity entrepreneurs. In particular, the distinction of opportunity versus necessity entrepreneurship is generally considered relevant (Bosma et al. 2008).

Although we cannot distinguish between these types of entrepreneurship in the data, we can make indirect inference concerning the share of opportunity entrepreneurs from an exercise where the deviation between the actual and optimal business ownership rate is related to the level of employment protection in a country. Theoretically, employment protection (EP) discourages opportunity entrepreneurship and promotes necessity entrepreneurship. When EP is high, low-skilled labor market participants will find it hard to find a paid job (Lindbeck and Snower 2001; Skedinger 2010). Therefore, these “outsiders” may decide to start a new firm out of necessity (Bosma et al. 2008). Moreover, in a situation of high EP, high-skilled labor market participants will find it less attractive to become entrepreneurs, for two reasons. First, high EP reduces the flexibility of entrepreneurs to grow their businesses. Second, high EP makes a paid job relatively more attractive, discouraging high-skilled individuals from becoming entrepreneurs (Román Díaz 2010). Thus, we use the available measure of EP (defined below) as an indicator for the relative presence of necessity entrepreneurship vis-à-vis opportunity entrepreneurship. We relate this measure of EP to the deviation between the actual and the optimal business ownership rate (BOR − BOR*). A positive relationship would indicate that, on average, necessity entrepreneurs dominate in the business ownership population for the countries in our database, whereas a negative sign would indicate a higher share of opportunity entrepreneurs.

Table 8 presents results from an OLS regression where (BOR − BOR*) is explained by EP and EP squared. For BOR* we use the optimal business ownership rate associated with Eq. (5) from Table 2. For EP we use an indicator of employment protection legislation from the CEP-OECD Institutions Data Set (Nickell 2006), where higher values correspond to increasing strictness of employment protection.

It is clear from the results that the relation is U-shaped. For countries with weak employment protection, such as the USA, a negative relation exists between BOR − BOR* and EP, suggesting that the business ownership population is dominated by opportunity entrepreneurs. On the other hand, for countries with strong employment protection such as Portugal, the relation is positive, suggesting a majority of necessity entrepreneurs. Of course, this exploratory evidence is very indirect, but at least it provides some insights as regards the composition of the business ownership population in different countries (in terms of necessity versus opportunity entrepreneurship). Of course, more research is necessary to corroborate these results.

6 Conclusions

Many policy measures in developed countries are based on the assumption that higher business ownership rates induce economic value creation. This has led to the commonly accepted paradigm of “the more business owners, the better.” The positive relation between business ownership and macroeconomic performance found in many empirical studies may indicate that in a majority of (developed) countries business ownership rates have been (too) low in recent periods, so that countries with higher levels indeed perform better. However, the possibility that countries may also have too many business owners has, as yet, not been much considered, even though microeconomic theories on occupational choice predict that only a fraction of the population is more productive as a business owner than as an employee. Indeed, Shane (2009) has recently argued, based on anecdotal evidence, that “the more business owners, the merrier” assumption would not always hold, leading to the phenomenon of an “optimal” business ownership rate.

This paper has explored empirically whether there is indeed evidence of such an optimal business ownership rate and, if so, to what extent it varies with variations in education levels across countries and over time. The motivation for our study to focus on the heterogeneity caused by variations in education is as follows. The vast collection of research into the drivers of entrepreneurship performance to date has rather convincingly shown that human capital is a main driver of performance (and education a primary source of human capital). This implies, at the macro level, that higher levels of education lead to more productive business owners and thus to a steeper relationship between the business ownership rate and value creation. And since more-productive business owners run larger firms, they require, on average, more employees, leading to a lower optimal business ownership rate in equilibrium.

By estimating an extended version of traditional Cobb–Douglas production functions on a sample of 19 OECD countries over the period 1981–2006, we find rather robust support for all propositions that we derive from combining macro- and microeconomic framed theory and evidence. We find empirical support for the phenomenon of an “optimal” business ownership rate (of around 12.5 %, on average). The quadratic relationship between business ownership rates and log(GDP) is a quite robust finding, surviving robustness checks that address the particular definition of the business ownership rate, the composition of the sample in terms of countries and years, and the possible endogeneity of the business ownership rate in equations of economic growth.

In addition, we show indicative evidence of a set of two related propositions we have developed with respect to education: (i) a stronger relationship between the business ownership rate and economic value for higher levels of education leading to (ii) a negative relationship between the optimal business ownership rate and education in equilibrium. The result is significant and robust against changing the definition of the business ownership rate.

Our paper may have policy implications. In particular, we add quantified insights to the discussion of “Are there too many or too few business owners?” Various theoretical models and ideas have been developed to further our understanding of why the actual business ownership rate may be higher or lower than optimal. This may be due to market imperfections in credit markets (Stiglitz and Weiss 1981; De Meza and Webb 1987) or labor markets (Parker and Van Praag 2010), positive external effects of entrepreneurship (Parker 2009), distorted incentives due to tax systems (e.g., Schuetze 2000), large (perceived) nonpecuniary gains from entrepreneurship (e.g., Benz and Frey 2008; Blanchflower and Oswald 1998) or cognitive biases arising from, for instance, overoptimism (Lowe and Ziedonis 2006; Dushnitsky 2009) or overconfidence (Hayward et al. 2006). Many of these underlying mechanisms leading to a possible under- or oversupply of business owners have been supported empirically and thus underscore the relevance of obtaining more insight into the level of the optimal business ownership rate. Only then can an assessment be made of whether policy measures that fight against a lack of business ownership or its abundance are appropriate.

Thus, countries may have too few or too many entrepreneurs and should devise their policy measures accordingly; For instance, governments should be careful with implementing active stimulation programs for business ownership, in particular when business ownership rates are already relatively high and when the programs target all parts of the population (i.e., making no distinction by education levels). Such a general stimulation policy may attract individuals who would be more productive working as an employee (Mueller et al. 2008; Shane 2009). Rather than providing guidance with regards to the exact policy measure to be implemented, we show that policies as such may depend on the level of business ownership already present in the country. Policy measures are also likely to depend on the education level in a country. Education and business ownership policies may be considered in tandem.

We are aware of at least four limitations of our work. First, our country-level analysis does not allow a distinction between sectors of industry. The industry composition of economies may impact the country-level rate of business ownership, and future work should focus on estimating the model at the industry level. Second, our business ownership measure does not allow a distinction between different types of businesses, e.g., high-technology versus low-technology, or employers versus solo self-employed. Although our exploratory exercise in Sect. 5.4 indirectly pointed at a possible abundance of necessity business owners in countries with strict employment protection, much more work is needed in this field. In particular, data which directly distinguish between different types of businesses are required. However, to date the required cross-country data are not available.Footnote 20 Third, our results may suffer from the use of Cobb–Douglas functions, which are restrictive in several respects.Footnote 21 A fourth drawback of our study is that we are not able in this framework and based on the current sample to endogenize the education variable at our disposal.

Notes

Value creation is mostly measured in terms of a firm’s contribution to economic growth, labor demand or innovation (Van Praag and Versloot 2007).

When comparing our study with the literature, we consider studies of entrepreneurs to be informative and relevant for our application. We acknowledge, though, that we study business owners and that not all business owners are entrepreneurs and vice versa. Business owners perform a large variety of more or less entrepreneurial activities, making it a far from ideal measure of entrepreneurship, whereas employees and managers may very well be involved in entrepreneurial activity. Nevertheless, many empirical studies employ business ownership as the empirical equivalent of entrepreneurship. To circumvent such a discussion, we consistently use the term “business owner” for the phenomenon that we study (and not “entrepreneur”).

See also Shaffer (2006) who investigates the link between the growth rates of median household income at the USA county level and the average size of establishments for four sectors of economic activity.

Occupational choice models, in general, distinguish between self-employment and wage employment (and sometimes unemployment). The further distinction between self-employed people in new or incumbent firms is uncommon. Likewise, our business ownership measure does not distinguish between self-employment in new and incumbent firms.

Many more recent applications of these models follow Lucas’s idea that (entrepreneurial) ability is the main driver of occupational choice (e.g., Blanchflower and Oswald 1998; Calvo and Wellisz 1980; Evans and Jovanovic 1989; Jovanovic 1994; Lazear 2005; Parker and Van Praag 2010; Van Praag and Cramer 2001).

Of course, in reality not only wage employment may be an alternative to business ownership, but also unemployment. In particular, it may be argued that wage employment is an alternative to opportunity entrepreneurship and unemployment is an alternative to necessity entrepreneurship (Bosma et al. 2008). In Subsect. 5.4 we will try to provide indirect evidence as to which type of business ownership (opportunity versus necessity) dominates the business ownership populations in the countries in our dataset.

This is a direct consequence of the assumption that marginal production costs decrease with entrepreneurial ability.

Recent studies have shown that the returns to ability (Hartog et al. 2010), education (Van Praag et al. 2009), and being a generalist rather than a specialist (Lazear 2005) are even larger for business owners than employees. In these studies the performance measure in terms of which these returns are measured is, necessarily, income, since this is the only performance measure that is available for both employees and business owners.

We also estimated this and the following equations upon the inclusion of a third-order polynomial, i.e., by including BOR to the third power. However, this did not significantly improve the model fit and it is further left out.

For instance, the output elasticity with respect to labor is \( e_{Y,L} \equiv \frac{\partial Y}{\partial L}\frac{L}{Y} \equiv \frac{\partial \log Y}{\partial \log L} = \beta_{L}. \)

The 19 countries are Austria, Belgium, Denmark, Finland, France, Germany, Ireland, The Netherlands, Portugal, Spain, Sweden, UK, Norway, Switzerland, USA, Japan, Canada, Australia, and New Zealand.

COMPENDIA is an acronym for COMParative ENtrepreneurship Data for International Analysis. See http://www.entrepreneurship-sme.eu for the data and Van Stel (2005) for a justification of the harmonization methods. This database has been used and acknowledged widely (see, among other studies, Armour and Cumming 2008; Carree et al. 2002, 2007; Davis 2008, p. 54; Koellinger and Thurik 2012; Nyström 2008).

Data taken directly from the OECD Labour Force Statistics suffer from a lack of comparability across countries and over time. In particular, owner-managers of incorporated businesses (OMIBs) are counted as self-employed in some countries but as employees in other countries. Also, the raw OECD data suffer from many trend breaks relating to changes in self-employment definitions (Van Stel 2005).

Theoretically, though, reversed causality is unlikely due to the definition of the dependent variable in the production function in terms of the level of GDP rather than the growth of GDP. Hence, the usual reversed causality argument of fast-growing economies attracting more entrepreneurs does not apply.

The sources of data are OECD National Accounts, the World Bank EdStats database, and the US Census Bureau International Database, respectively.

The LR test statistic is 2 × (514.7 − 500.2) = 29.0, which is greater than 9.21, the 1 % critical value for the chi-squared distribution with two degrees of freedom.

From exercises not presented here we find that the role of education in the relation is also different for Greece and Italy.

Greece has also a relatively high share of agriculture in economic activity. More than 10 % of civilian employment was in agriculture in 2006 (source: OECD Labour Force Statistics), where the structure of production is different. Moreover, Greece is an outlier with regards to education: According to the World Bank’s EdStats database, Greece has the highest-but-three gross enrollment rate of all countries for which data are available (90.8 %; as an illustration, the USA has 81.7 %). We find this counterintuitive. Also, in 2000 the gross enrollment rate in Greece was only 51 %, implying a huge increase in education during the first decade of the 21st century. Such extreme fluctuations do not occur for the other countries in our database. Thus, the inclusion of Greece may well distort the estimation results regarding education. For further documentation of why Italy is an outlier as regards business ownership, we refer to Carree et al. (2002, 2007).

The Global Entrepreneurship Monitor (GEM) consortium collects cross-country data on entrepreneurship while making a distinction between necessity versus opportunity entrepreneurship (Bosma et al. 2008). Note, however, that GEM primarily captures dynamic indicators of entrepreneurship, whereas the present study called for a static indicator, capturing business owners of both new and incumbent firms.

For instance, the Cobb–Douglas function forces the elasticity of substitution between capital and labor to be unity.

References

Acs, Z., Parsons, W., & Tracy, S. (2008). High-impact firms: Gazelles revisited, Report commissioned by the SBA Office of Advocacy. Washington, DC: SBA Office of Advocacy.

Armour, J., & Cumming, D. (2008). Bankruptcy law and entrepreneurship. American Law and Economics Review, 10(2), 303–350.

Audretsch, D., Carree, M., van Stel, A., & Thurik, R. (2002a). Impeded industrial restructuring: The growth penalty. Kyklos, 55(1), 81–98.

Audretsch, D., & Keilbach, M. (2004a). Entrepreneurship capital and economic performance. Regional Studies, 38, 949–959.

Audretsch, D., & Keilbach, M. (2004b). Entrepreneurship and regional growth: An evolutionary interpretation. Journal of Evolutionary Economics, 14(5), 605–616.

Audretsch, D., Keilbach, M., & Lehmann, E. (2006). Entrepreneurship and economic growth. New York: Oxford University Press.

Audretsch, D., Thurik, R., Verheul, I., & Wennekers, S. (2002b). Entrepreneurship: Determinants and policy in a European-US comparison. Boston/Dordrecht: Kluwer Academic.

Backes-Gellner, U., & Werner, A. (2007). Entrepreneurial signalling via education: A success factor in innovative start-ups. Small Business Economics, 29, 173–190.

Barro, R. (1991). Economic growth in a cross-section of countries. Quarterly Journal of Economics, 106, 407–433.

Barro, R. (1997). Determinants of economic growth: A cross-country empirical study. Cambridge, MA: MIT Press.

Barro, R., & Sala-i-Martin, X. (1992). Convergence. Journal of Political Economy, 100, 223–251.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2005). SMEs, growth, and poverty: Cross-country evidence. Journal of Economic Growth, 10, 199–229.

Becker, G. (1964) Human capital: A theoretical and empirical analysis with special reference to education (3rd edn., 1993). Chicago, IL: University of Chicago Press.

Benz, M., & Frey, B. (2008). Being independent is a great thing: Subjective evaluations of self-employment and hierarchy. Economica, 75(298), 362–383.

Blanchflower, D. (2004). Self-employment: More may not be better. Swedish Economic Policy Review, 11, 15–73.

Blanchflower, D., & Oswald, A. (1998). What makes an entrepreneur? Journal of Labor Economics, 16, 26–60.

Bleaney, M., & Nishiyama, A. (2002). Explaining growth: A contest between models. Journal of Economic Growth, 7, 43–56.

Bosma, N., Jones, K., Autio, E., & Levie, J. (2008). Global entrepreneurship monitor: 2007 Executive Report. Wellesley, MA: Babson College and London: London Business School.

Bosma, N., Stam, E., & Schutjens, V. (2011). Creative destruction and regional productivity growth: Evidence from the Dutch manufacturing and services industries. Small Business Economics, 36(4), 401–418.

Bound, J., Jaeger, D., & Baker, M. (1995). Problems with instrumental variables estimation when the correlation between the instruments and the endogenous explanatory variable is weak. Journal of the American Statistical Association, 90(430), 443–450.

Braunerhjelm, P., Acs, Z., Audretsch, D., & Carlsson, B. (2010). The missing link: Knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125.

Calvo, G., & Wellisz, S. (1980). Technology, entrepreneurs and firm size. Quarterly Journal of Economics, 95, 663–678.

Carree, M., van Stel, A., Thurik, R., & Wennekers, S. (2002). Economic development and business ownership: An analysis using data of 23 OECD countries in the period 1976–1996. Small Business Economics, 19(3), 271–290.

Carree, M., van Stel, A., Thurik, R., & Wennekers, S. (2007). The relationship between economic development and business ownership revisited. Entrepreneurship and Regional Development, 19(3), 281–291.

Coase, R. (1937). The nature of the firm. Economica, NS, IV, 386–405.

Davis, T. (2008). Understanding entrepreneurship: Developing indicators for international comparisons and assessments. In E. Congregado (Ed.), Measuring entrepreneurship; building a statistical system (pp. 39–63). New York: Springer.

De Meza, D., & Webb, D. (1987). Too much investment: A problem of asymmetric information. Quarterly Journal of Economics, 102, 281–292.

Dejardin, M., & Fritsch, M. (2011). Entrepreneurial dynamics and regional growth. Small Business Economics, 36(4), 377–382.

Dushnitsky, G. (2009). A cross-country study of entrepreneurial optimism and valuations, University of Pennsylvania Working Paper, Philadelphia.

Erken, H., Donselaar, P., & Thurik, A. R. (2008). Total factor productivity and the role of entrepreneurship, Jena Economic Research Papers #2008-019, Jena: Friedrich Schiller University and Max Planck Institute of Economics.

European Commission. (2009). European Competitiveness Report 2008. Brussels: European Commission.

Evans, D., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97, 808–827.

Freytag, A., & Thurik, A. R. (2007). Entrepreneurship and its determinants in a cross-country setting. Journal of Evolutionary Economics, 17, 117–131.

Fritsch, M., & Mueller, P. (2004). Effects of new business formation on regional development over time. Regional Studies, 38(8), 961–975.

Fritsch, M., & Schroeter, A. (2011). Why does the effect of new business formation differ across regions? Small Business Economics, 36(4), 383–400.

Hall, R., & Jones, C. (1999). Why do some countries produce so much more output per worker than others? Quarterly Journal of Economics, 114, 83–116.

Hamilton, B. (2000). Does entrepreneurship pay? An empirical analysis of the returns to self-employment. Journal of Political Economy, 108(3), 604–631.

Hanushek, E., & Woessmann, L. (2008). The role of cognitive skills in economic development. Journal of Economic Literature, 46, 607–668.

Hartog, J., van Praag, M., & van der Sluis, J. (2010). If you are so smart, why aren’t you an entrepreneur? Returns to cognitive and social ability: Entrepreneurs versus employees. Journal of Economics and Management Strategy, 19(4), 947–989.

Hayward, M., Shepherd, D., & Griffin, D. (2006). A hubris theory of entrepreneurship. Management Science, 52(2), 160–172.

Henrekson, M., & Johansson, D. (2010). Gazelles as job creators: A survey and interpretation of the evidence. Small Business Economics, 35(2), 227–244.

Jovanovic, B. (1994). Firm formation with heterogeneous management and labor skills. Small Business Economics, 6, 185–191.

Kaldor, N. (1934). The equilibrium of the firm. Economic Journal, 44, 60–76.

Kamps, C. (2004). New estimates of government net capital stocks for 22 OECD countries 1960–2001, IMF Working Paper 04/67, Washington, DC: IMF.

Kanbur, S. M. (1979). Of risk taking and the personal distribution of income. Journal of Political Economy, 87, 769–797.

Kihlstrom, R., & Laffont, J. (1979). A general equilibrium entrepreneurial theory of firm formation based on risk aversion. Journal of Political Economy, 87, 719–749.

Koellinger, P., & Thurik, R. (2012). Entrepreneurship and the business cycle. Review of Economics and Statistics, forthcoming.

Krueger, A., & Lindahl, M. (2001). Education for growth: Why and for whom? Journal of Economic Literature, 39, 1101–1136.

Lazear, E. (2005). Entrepreneurship. Journal of Labor Economics, 23, 649–680.

Lindbeck, A., & Snower, D. J. (2001). Insiders versus outsiders. Journal of Economic Perspectives, 15(1), 165–188.

Lowe, R., & Ziedonis, A. (2006). Overoptimism and the performance of entrepreneurial firms. Management Science, 52(2), 173–186.

Lucas, R. (1978). On the size distribution of business firms. The Bell Journal of Economics, 9(2), 508–523.

Lyssiotou, P., Pashardes, P., & Stengos, T. (2004). Estimates of the black economy based on consumer demand approaches. Economic Journal, 114, 622–640.

Mankiw, N., Romer, D., & Weil, D. (1992). A contribution to the empirics of economic growth. Quarterly Journal of Economics, 107, 407–437.

Marshall, A. (1890 [1930]). Principles of economics, London, UK: Macmillan.

Mincer, J. (1958). Investment in human capital and personal income distribution. Journal of Political Economy, 66(4), 281–302.

Mueller, P. (2007). Exploiting entrepreneurial opportunities: The impact of entrepreneurship on growth. Small Business Economics, 28, 355–362.

Mueller, P., van Stel, A., & Storey, D. (2008). The effects of new firm formation on regional development over time: The case of Great Britain. Small Business Economics, 30(1), 59–71.

Nickell, W. (2006). The CEP-OECD Institutions Data Set (1960–2004), CEP Discussion Paper No. 759, London: Centre for Economic Performance.

Nyström, K. (2008). The institutions of economic freedom and entrepreneurship: Evidence from panel data. Public Choice, 136(3–4), 269–282.

Parker, S. (2005). The economics of entrepreneurship: What we know and what we don’t. Foundations & Trends in Entrepreneurship, 1(1), 1–55.

Parker, S. (2009). The economics of entrepreneurship. Cambridge, UK: Cambridge University Press.

Parker, S., & van Praag, M. (2006). Schooling, capital constraints and entrepreneurial performance: The endogenous triangle. Journal of Business and Economic Statistics, 24(4), 416–431.

Parker, S., & van Praag, M. (2010). Status and entrepreneurship. Journal of Economics and Management Strategy, 19(4), 919–945.

Román Díaz, C. (2010). Self-employment and labour market regulation, PhD thesis, University of Huelva, Spain.

Romer, P. (1986). Increasing returns and long run growth. Journal of Political Economy, 94, 1002–1037.

Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98, 71–101.

Romer, P. (1994). The origins of endogenous growth. Journal of Economic Perspectives, 8, 3–22.

Schuetze, H. (2000). Taxes, economic conditions and recent trends in male self-employment: A Canada–US comparison. Labour Economics, 7(5), 507–544.

Schuetze, H. (2002). Profiles of tax non-compliance among the self-employed in Canada: 1969 to 1992. Canadian Public Policy, 28(2), 219–237.

Shaffer, S. (2006). Establishment size by sector and county-level economic growth. Small Business Economics, 26, 145–154.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33, 141–149.

Skedinger, P. (2010). Employment protection legislation: Evolution, effects, winners and losers. Cheltenham, UK: Edward Elgar.

Smith, A. (1776 [1904]). An inquiry into the nature and causes of the wealth of nations. Methuen & Co, London (edited by E. Cannan, 1904, first published in 1776).

Solow, R. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70, 65–94.

Stam, E., & van Stel, A. (2011). Types of entrepreneurship and economic growth. In A. Szirmai, W. Naudé, & M. Goedhuys (Eds.), Entrepreneurship, innovation, and economic development (pp. 78–95). Oxford, UK: Oxford University Press.

Stiglitz, J., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71, 393–410.

van Praag, C. M. (2005). Successful entrepreneurship: Confronting economic theory with empirical practice. Cheltenham, UK: Edward Elgar.

Van Praag, M., & Cramer, J. (2001). The roots of entrepreneurship and labor demand. Economica, 269, 45–62.