Abstract

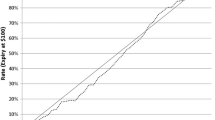

Large orders, particularly from institutions, are quite common these days and hence there is interest to know if institutional trading has any bearing on the price effect associated with large trades. Recent empirical studies contradict earlier evidence of negative price effect on selling large blocks and find no price effect associated with large trades. Existing theoretical framework suggests a monotonic and increasing adverse price effect for large trades, where the motivation for a large trade is private information. We model a trading system where pure information, information-liquidity, and pure liquidity traders trade small and large sizes. The pure information traders strategically choose an order size. Institutions trade only large sizes because of their low execution costs for large trades; they are information-liquidity traders whose ability to use an information signal to determine their trades is subject to a binding liquidity constraint. We show that in such a market a separating equilibrium where trade size is informative does not exist and hence there is no price effect for large trades. Trade size may be revealing only if there is a buy sell asymmetry (large buy size is not equal to large sell size) or the corresponding price effect is asymmetric (price effect due to a large buy is not equal to that of a large sell). Further for a pooling equilibrium to exist, where trade size is not informative, the width of the market denoted by the ratio of order size (large size/small size) needs to be small, while the shallowness (inverse depth) of the market denoted by the ratio between pure information and institutional trades and the information signal needs to be stronger (higher). Our results on bid and ask prices and spread confirm recent empirical evidence on price effect of large and institutional trades found in the literature.

Similar content being viewed by others

Notes

We focus on Easley and O’Hara (1987) because of its emphasis on trade size as a class rather than a continuous variable to determine its impact on bid ask spread. Glosten (1989) also suggests an increasing slope for the price order size relationship implying larger size trades transact at worse prices. One possible microstructure explanation for the recent muted effect of trade size on price effect is that many large blocks are crossed particularly through the upstairs market at NYSE. However only very large blocks and relatively few liquid securities are crossed.

There exists a vast literature on the trading motives of institutions. A few of those motives documented in the literature are tax loss selling, private information, portfolio balancing, and noise trading. For a review of the literature please see Sias et al. (2001).

The upstairs market in NYSE is not anonymous and as such trade motive is relatively transparent. Hasbrouck et al. (1993) report that in recent years only 10% of trades between 10,000 and 25,000 shares, 32% between 25,000 and 100,000 shares, and 57% above 100,000 shares were executed through the upstairs market. The upstairs market is a crossing market and some of the crosses may occur with non-institutional trades; however, almost all trades originating in the cross and a large majority of the crosses are institutional trades.

The literature on block trading addresses several important questions e.g., the optimal timing of block trades, the information asymmetry between institutions (upstairs market) and floor specialists, the justification of an upstairs market, and the effect of mergers between the upstairs and the downstairs markets on bid and ask prices and spread. In this paper we investigate how prices and spreads are determined in a market that has institutions. So in this market the existence of institutions who always trade large orders for whatever reason, is exogenous and not the subject of investigation. Easley and O’Hara (1987) predicts a non-negative relation between trade size and change in equity prices, which is supported by the overall empirical evidence, but does not assign a separate role for institutions, which trade in large quantities and may possess private value related information, yet their trades may reflect other motives.

Other than the liquidity constraint mentioned above, there are investment constraints e.g., mutual funds charters constraining position limits (Almazan et al. 2004) and the inclination of institutions not to deviate substantially from benchmark portfolios (Arnott 2003; Chan et al. 2002) which limit institutions’ ability to use information for trading purposes. Note that a single stock portfolio has the remainder in cash and thus altering the fraction of stock holding changes the liquidity component of the portfolio.

Easley and O’Hara (1987) define width (ratio between large and small trade sizes) and depth (ratio between large uninformed and all large trades) as two market conditions. In the literature, breadth and width are sometimes used synonymously, while depth is used in the context of market impact as in Lee et al. (1993).

Note that the game contains features of both order and quote driven markets. This is a multiple dealers’ market in which the dealers post quotes in response to an order as in an order driven market. The dealers do not maintain inventory and so do not trade with each other. However in a quote-driven market, market makers may post their complete quantity price schedules ahead of order arrivals. On the other hand, Easley and O’Hara (1987) argue that a specialist is hardly a monopolist since he faces competition from the limit order book, parallel exchanges, and also non-floor trading activities. Further with multiple listing and an integrated market system, the difference between a dealer (quote) market and a specialist (order) market is diminishing.

We are grateful to an anonymous Journal of Financial Economics referee for pointing it out to us that indeed the information-liquidity traders in our model satisfy CARA hypothesis.

In this paper, as in Easley and O’Hara (1987) pure information traders choose an order size based on the width and shallowness (inverse depth) of the market, which are functions of the parameters of the trading game. Other possible explanations include access to capital. Also, pure information motives include insider and speculative trading, and corporate control. Allen and Gale (1992) show how trade-based market manipulators succeed in affecting price in a market by trading a large quantity.

Note that Lemma 1 is phrased in terms of bad news since V, the Bernoulli process is defined in terms of δ, the probability of bad news. Clearly, without losing any generality, Lemma 1 can also be phrased in terms of (1−δ), the probability of good news.

This situation resembles an index fund that trades a large size but for liquidity reason, where liquidity needs are uncorrelated with the information signal.

References

Allen F, Gale D (1992) Stock price manipulation. Rev Finan Stud 5:503–529

Almazan A, Brown K, Carlson M, Chapman D (2004) Why constrain your mutual fund manager? J Finan Econ 73:289–321

Arnott R (2003) What risk matters? Finan Anal J 59:3

Barclay M, Warner J (1993) Stealth trading and volatility: which trades move prices? J Finan Econ 34:281–306

Barber B, Odean T (2000) Trading is hazardous to your wealth: the common stock investment performance of individual investors. J Finan 55:773–806

Bernhardt D, Dvoracek V, Hughson E, Werner I (2000) Why do large orders receive discounts on the London stock exchange? SSRN Working Paper

Bertisimas D, Lo A (1998) Optimal control of execution costs. J Finan Markets 1(1):159–163

Brennan M, Jegadeesh N, Swaminathan B (1993) Investment analysis and the adjustment of stock prices to common information. Rev Finan Stud 6:799–824

Chakrovarty S (2001) Stealth trading, which traders move stock prices. J Finan Econ 61(2):289–307

Chan L, Chen H, Lakonishok J (2002) On mutual fund investment styles. Rev Finan Stud 15:1406–1437

Cohen J, Zinbarg E, Ziekel A (1987) Investment analysis and portfolio management, 5th edn. Irwin

Coller M, Yohn TL (1997) Management forecasts and information asymmetry: an examination of bid-ask spreads. J Accounting Res 35:181–194

Dey M, Radhakrishna B (2007) Who trades around earnings announcements? Evidence from TORQ data. J Bus Finan Acc 34:269–291

Dey MK, Harris J, Radhakrishna B (2003) Institutional trading and spread. Working paper

Diamond DW, Verrecchia RE (1981) Information aggregation in a noisy rational expectations model. J Finan Econ 9:221–235

Easley D, O’Hara M (1987) Price, trade size, and information in securities markets. J Finan Econ 19:69–90

Easley D, O’Hara M (1992) Adverse selection and large trade volume: the implications for market efficiency. J Finan Quant Anal 27:185–208

Easley D, Kiefer N, O’Hara M, Paperman J (1996) Liquidity, information, and infrequently traded stocks. J Finan 51:1405–1436

Easley D, Kiefer N, O’Hara M (1997a) One day in the life of a very common stock. Rev Finan Stud 10:805–835

Easley D, Kiefer N, O’Hara M (1997b) The information content of the trading process. J Emp Finan 4:159–186

Fehle F (2004) Bid-ask spreads and institutional ownership. Rev Quant Finan Acc 22:275–292

Glosten L (1989) Insider trading, liquidity, and the role of the monopolist specialist. J Bus 62:211–236

Gompers PA, Metrick A (2001) Institutional ownership and equity prices. Quart J Econ 116:229–259

Hasbrouck J (1991) Measuring the information content of stock trades. J Finan 46(1):179–207

Hasbrouck J, Sofianos G, Sosebee D (1993) New York stock exchange systems and trading procedures. NYSE Working Paper

Holthausen R, Leftwich R, Mayers D (1987) The effect of large block transactions on security prices. J Finan Econ 19:237–267

Holthausen R, Leftwich R, Mayers D (1990) Large block transactions, the speed of response, and temporary and permanent stock price effects. J Finan Econ 26:71–95

Keim D, Madhavan A (1996) The upstairs market for large block transactions: analysis and measurement of price effects. Rev Finan Stud 9:1–36

Kim O, Verrecchia R (1994) market liquidity and volume around earnings announcements. J Acc Econ 17:41–67

Koski J, Michaely R (2000) Prices, liquidity, and information content in trades. Rev Finan Stud 13:659–696

Lee C, Radhakrishna B (1998) Inferring investor behavior: evidence from TORQ data. J Finan Markets 3(2):183–204

Lee C, Mucklow B, Ready M (1993) Spreads, depths, and the impact of earnings information: an intraday analysis. Rev Finan Stud 6:345–374

Leuz C, Verrecchia R (2000) The economic consequences of increased disclosure. J Acc Res 38:91–124

Lin J-C, Sanger G, Booth G (1995) Order size and components of the bid ask spread. Rev Finan Stud 8:1153–1183

Madhavan A, Cheng M (1997) In search of liquidity: block trades in the upstairs and downstairs market. Rev Finan Stud 10:175–204

McInish T, Wood R (1992) An analysis of intra-day patterns in bid/ask spread for NYSE stocks. J Finan 47:753–764

Rahman S, Krishnamurthy C, Lee A (2005) The dynamics of security trades, quote revisions, and market depths for actively traded stocks. Rev Quant Finan Acc 25:91–124

Saar G (2001) Price impact asymmetry of block trades: an institutional trading explanation. Rev Finan Stud 14:1153–1182

Scholes M (1972) The market for securities: substitution versus price pressure and the effects of information on share prices. J Bus 45:179–211

Seppi D (1990) Equilibrium block trading and asymmetric information. J Finan 45:73–94

Sias R, Starks L, Titman S (2001) The price impact of institutional trading. SSRN Working paper

Acknowledgments

We gratefully acknowledge comments received from Ananth Madhavan and the participants in the FMA annual meetings, Accounting Workshop at the Carlson School of Management, University of Minnesota, and Finance Workshops at the University of Connecticut, University of Massachusetts-Amherst, and University of Strathclyde. We also gratefully acknowledge the research assistance by Rubun Dey in running the simulations for the paper. Finally, we are enormously grateful to an anonymous referee for providing substantial insights and thoughtful comments on this paper. The current version has substantially improved due to those comments and suggestions. We are solely responsible for all errors.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is based on a chapter from the first author’s dissertation at the University of Massachusetts-Amherst. It was previously circulated under a different title.

Appendix

Appendix

The conditional probabilities are computed as follows:

Proof of Lemma 1

Note that separating conditions imply θ = 0. Hence \(\delta ({S_1 })=\delta \left({\varepsilon \pi ({1-\tau } )+({1-\varepsilon })({1-\tau } )}/{\varepsilon \pi ({1-\tau })+( {1-\varepsilon })({1-\tau })}\right)\) which implies δ(S 1) = δ.

Also note that \(\delta ({S_2 })=\delta \left({\alpha +({1-\alpha -\pi })\gamma _H }/{\delta \alpha +\delta ({1-\alpha -\pi })\gamma _H +({1-\delta } )({1-\alpha -\pi })\gamma _L }\right)\). δ(S 2) > δ if and only if α + (1−α −π )γ H > δα + δ(1−α −π )γ H + (1−δ)(1−α −π)γ L , which implies \(({1-\delta })\left[{\alpha +({1-\alpha -\pi })({\gamma _H -\gamma _L })} \right] \ge 0\). If all priors are positive, δ(S 2) ≥ δ. Similarly, it is shown that δ(B 1) = δ and δ(B 2) ≤ δ.

Proof of Lemma 2

When 0 < θ < 1 informed traders trade both small and large quantities and hence

δ(S 1) ≥ δ if and only if ɛ α θ (1−δ) ≥ 0. If all priors are positive δ(S 1) ≥ δ. Similarly, δ(S 2) ≥ δ while δ(B 1) ≤ δ and δ(B 2) ≤ δ. Further for θ = (1−θ ) = 0.5, δ(S 2) ≥ δ(S 1) implies:

Clearly for δ > 0,

and

Therefore, θ = (1−θ) does not lead to conditional probabilities of small and large order sizes to be equal. Nevertheless, there exists a set of other priors for which δ(S 2) ≥ δ(S 1).

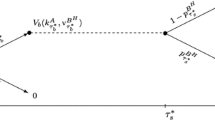

Proof of Proposition 1

A separating equilibrium exists if in case of a low (high) signal, the following two conditions are satisfied:

-

(1)

Pure information motivated traders uniformly prefer large size to small size, S 2 over S 1 (B 2 over B 1). Information motivated traders would do so if S 2 (b 2 − v L ) >S 1(b 1 − v L ) which implies \(\frac{S_2 }{S_1 } > \frac{({b_1 -v_L })}{({b_2 -v_L })} > 1\).

-

(2)

Further information-liquidity traders trade large sell (buy) over large buy (sell) implying \(\frac{S_2 }{B_2 } > \frac{({v_H -a_2 })}{({b_2 -v_L })}\).

Computation shows

Therefore a separating equilibrium exists on the sell side if

The buy side is symmetric and a separating equilibrium exists if

Proof of Proposition 2

A pooling equilibrium is feasible on the sell side if there exists a fraction of informed traders, θ > 0 who prefer a small size to a large size implying S 1(b 1 − v L ) = S 2(b 2 − v L ). Note that for θ > 0 b 2 and b 1 are as follows:

where

and

Clearly for some 0 < θ < 1 the above conditions are true. Thus a pooling equilibrium is feasible on the sell and buy sides of the market respectively if the following conditions hold:

Proof of Proposition 3

Spreads for small and large trades under two separating and pooling equilibrium conditions are as follows:

where \(\Upomega=\frac{\sigma _v^2 }{({v_H -v_L })^{2}}\) .

We show below the derivations for pooling equilibrium spread for δ = .5. For a separating equilibrium, θ = 0.

Therefore,

Similarly,

but

Rights and permissions

About this article

Cite this article

Dey, M.K., Kazemi, H. Bid ask spread in a competitive market with institutions and order size. Rev Quant Finan Acc 30, 433–453 (2008). https://doi.org/10.1007/s11156-007-0056-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-007-0056-5