Abstract

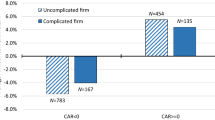

Popular press suggests that diversified firms are more aggressive in managing earnings than non-diversified firms. We examine this claim in the seasoned equity offering (SEO) setting, where firms have been shown to have the incentive to manage earnings upwards. Using the cross-sectional modified Jones [(1991) J Accounting Res 29:193–228] model to measure discretionary current accruals, we find that discretionary current accruals are higher among diversified firms than in non-diversified ones. Our evidence is consistent with the view that the extent of firm diversification is directly related to the degree of earnings management. We further show that diversified issuers with high discretionary accruals underperformed other SEO firms.

Similar content being viewed by others

Notes

Managers may exercise some discretion in computing earnings without violating generally accepted accounting principles. For example, firms may increase reported earnings by accelerating revenue recognition and deferring expense recognition, effectively shifting earnings to the current period from subsequent periods. Or they may increase earnings by changing accounting methods, revising their estimates of bad debt expense or the like, and using a variety of other techniques.

Our central thesis is to examine the degree of information asymmetry between multi-segment (diversified) and single-segment (focused) issuers. Although initial public offerings (IPO) provide another possible setting to test the managerial incentives in accruals management, only 15% of the IPO firms from SDC database reported two or more segments. This is in contrast with the SEO firms where 31% recorded multiple segments. Hence, we examine the managerial incentives for boosting earnings around the issuance of seasoned equity.

For example, Dechow et al. (1996) find that firms suspected by the SEC for earnings management show an average stock price decline of 9% upon announcement of earnings.

For example, Subramanyam (1996) finds that the parameter estimates in cross-sectional Jones models are more precise than their time-series counterparts due to the large number of degrees of freedom available in such a model.

We require the presence of at least 20 firms in each two-digit SIC to run the regression.

We subtract the increase in trade receivables (ΔTR i,t ) from the change in sales to allow for the possibility of credit sales manipulation by issuers, such as allowing for generous credit policies in order to obtain higher sales figures prior to an offering.

The widely used Jones and Jones-like models used in measuring discretionary accruals are potentially misspecified and can therefore result in misleading inferences about earnings management if no attempt is made to control for long-term earnings growth (McNichols 2000).

The use of a continuous measurement to capture managers’ incentive to avoid earnings decline and loss may cause serious econometric problems since the level of DCAs is used as a dependent variable and indirectly used as an explanatory variable in the regression model. The use of a dummy variable alleviates this econometric concern.

Although high quality auditors may constrain aggressive and opportunistic reporting (Becker et al. 1998), we do not include this variable in the model, as 98% of our firms are audited by the Big 5 or 6 audit firms. We also include the lag of DCAs to control for the reversal of discretionary accruals. We dropped this variable as it turned out to be highly insignificant.

Compustat footnote #1 indicates whether a firm engages in a merger or acquisition and Compustat item #66 records the size of discontinued operations.

Long run performance of SEOs is sensitive to the valuation method and depends on the choice of benchmarks used to measure the market return. Loughran and Ritter (2000) suggest that adopting the market return as a benchmark causes a test bias towards no abnormal return as the benchmark includes these SEOs. Lyon et al. (1999) recommend the use of buy-and-hold abnormal returns, which, without rebalancing, accurately represents investor experience.

The results remained qualitatively unchanged when we used the median DCA or PA_DCA1 as the cut-off.

References

Bartov E, Gul F, Tsui J (2001) Discretionary-accruals models and audit qualifications. J Account Econ 30:421–452

Becker C, DeFond M, Jiambalvo J Subramanyam K (1998) The effect of audit quality on earnings management. Contemp Account Res 15:1–24

Berger P, Hann R (2003) The Impact of SFAS No. 131 on information and monitoring. J Account Res 41:163–223

Berger P, Ofek E (1995) Diversification’s effect on firm value. J Financ Econ 37:39–65

Burgstahler D, Dichev I (1997) Earnings management to avoid earnings decreases and losses. J Account Econ 24:99–126

Bushee B (1998) The influence of institutional investors on myopic R&D investment behavior. Account Rev 73:305–333

Chandler A (1977) The visible hand. Cambridge: Belknap Press

Chen H, Guo R (2005) On corporate divestiture. Rev Quantitat Finance Account 24:399–421

Chen C, Steiner T (2000) An agency analysis of firm diversification: the consequences of discretionary cash and managerial risk considerations. Rev Quantitat Finance Account 14:247–260

Comment R, Jarell G (1995) Corporate focus and stock returns. J Financ Econ 37:67–87

Dechow P, Sloan R, Sweeney A (1995) Detecting earnings management. Account Rev 70:193–225

Dechow P, Sloan R, Sweeney A (1996) Causes and consequences of earnings manipulation: an analysis of firms’ subject to enforcement actions by the SEC. Contemp Account Res 13:1–36

DeFond M, Park C (2001) The reversal of abnormal accruals and the market valuation of earnings surprises. Account Rev 76:375–404

Denis D, Denis D, Sarin A (1997) Agency problems, equity ownership and corporate diversification. J Finance 56:2299–2335

Dye R (1988) Earnings management in an overlapping generations model. J Account Res 26:325–1360

Ernst & Young LLP (1998) Disclosures about segments of an enterprise and related information: FASB statement 131

Financial Accounting Standards Board (2002) Proposal: principles-based approach to US standard setting. File Reference No. 1125–001. Norwalk, CT: FASB

Fishman M, Hagerty K (1990) The optimal amount of discretion to allow in disclosure. Quart J Econ 195:427–444

Gertner R H, Scharfstein D S, Stein J C (1994) Internal versus external capital markets. Quart J Econ 109:1211–1230

Gilson S, Healy P, Noe C, Palepu K (2001) Analyst specialization and conglomerate stock breakups. J Account Res 39:565–582

Graves S (1988) Institutional ownership and corporate R&D in the computer industry. Acad Manage J 31:417–428

Habib M, Johnsen D, Naik N (1997) Spinoffs and information. J Financ Intermed 6:153–176

Hadlock C, Ryngaert M, Thomas S (2001) Corporate structure and equity offerings: are there benefits to diversification? J Bus 74:613–635

Herrmann D, Thomas W (2000) An analysis of segment disclosures under SFAS No. 131 and SFAS No. 14. Account Horizons 14:287–302

Hribar P, Collins D (2002) Errors in estimating accruals: implications for empirical research. J Account Res 40:105–134

Jones J (1991) Earnings management during import relief investigations. J Account Res 29:193–228

Kasznik R (1999) On the association between voluntary disclosure and earnings management. J Account Res 37:57–81

Kothari S, Leone A, Wasley C (2005) Performance matched discretionary accruals. J Account Econ 39:163–197

Krishnaswami S, Subramanian V (1999) Information asymmetry, valuation, and the corporate spin-off decision. J Financ Econ 53:73–112

Lamont O (1997) Cash flow and investment: evidence from internal capital markets. J Finance 52:83–109

Leland H (1998) Agency costs, risk management, and capital structure. J Finance 53:1212–1243

Lewellen W (1971) A pure financial rationale for the conglomerate merger. J Finance 26:521–537

Loughran T, Ritter J (1995) The new issue puzzle. J Finance 50:23–51

Loughran T, Ritter J (1997) The operating performance of firms conducting seasoned equity offerings. J Finance 52:1823–1850

Loughran T, Ritter J (2000) Uniformly least powerful tests of market efficiency. J Financ Econ 55:361–389

Lyon J D, Barber B M, Tsai C (1999) Improved methods for tests of long-run abnormal stock returns. J Finance 54:165–201

Matsusaka J G, Nanda V (2002) Internal capital markets and corporate refocusing. J Financ Intermed 11:176–211

McNichols M (2000) Research designs issues in earnings management studies. J Account Publ Policy 19:313–345

Munter P (1999) SEC sharply criticizes “earnings management” accounting. J Corp Account Finance 31–38

Nanda V, Narayanan M (1999) Disentangling value: financial needs, firm scope, and divestitures. J Financ Intermed 8:174–204

Rajan R, Servaes H, Ziangales L (2000) The cost of diversity: the diversification discount and inefficient investment. J Finance 55:35–60

Rajgopal S, Venkatachalam M, Jiambalvo J (1999) Is institutional ownership associated with earnings management and the extent to which stock prices reflect future earnings? Working Paper, University of Washington

Rangan S (1998) Earnings management and the performance of seasoned equity offerings. J Financ Econ 50:101–122

Richardson V (2000) Information asymmetry and earnings management: some evidence. Rev Quantitat Finance Account 15:325–347

Ruland W, Zhou P (2005) Debt, diversification, and valuation. Rev Quantitat Finance Account 25:277–291

Shin H, Stulz R (1998) Are internal capital markets efficient? Quart J Econ 113:531–553

Shivakumar L (2000) Do firms mislead investors by overstating before seasoned equity offerings. J Account Econ 29:339–371

Siddiqi M, Warganegara D (2003) Using spinoffs to reduce capital mis-allocations. Rev Quantitat Finance Account 20:35–47

Skinner D (1993) The investment opportunity set and accounting procedure choice: preliminary evidence. J Account Econ 16:407–455

Smith C, Stulz R (1985) The determinants of firms hedging policies. J Financ Econ 22:249–281

Spiess L, Affleck-Graves J (1995) Underperformance in long-run stock returns following seasoned equity offerings. J Financ Econ 38:243–267

Stein J (1997) Internal capital markets and the competition for corporate resources. J Finance 52:111–133

Street D, Nichols N, Gray S (2000) Segment disclosures under SFAS No. 131: has business segment reporting improved? Account Horizons 14:259–285

Stulz R (1990) Managerial discretion and optimal financing policies. J Financ Econ 26: 3–27

Subramanyam K (1996) The pricing of abnormal accruals. J Account Econ 22:249–282

Teoh S, Welch I, Wong T J (1998) Earnings management and the underperformance of seasoned equity offerings. J Financ Econ 50:63–99

Trueman B, Titman S (1988) An explanation for accounting income smoothing. J Account Res 26:127–139

Warfield T, Wild J, Wild K (1995) Managerial ownership, accounting choices and informativeness of earnings. J Account Econ 20:61–91

Watts R, Zimmerman J (1986) Positive accounting theory. Englewood Cliffs, NJ: Prentice Hall

Acknowledgements

The authors gratefully acknowledge the helpful suggestions and comments on previous versions of the paper by Jay Ritter, Hun-Tong Tan, Huai Zhang, Divesh Shankar Sharma, and seminar participants at the Nanyang Business School’s Faculty Workshop.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lim, C.Y., Thong, T.Y. & Ding, D.K. Firm diversification and earnings management: evidence from seasoned equity offerings. Rev Quant Finan Acc 30, 69–92 (2008). https://doi.org/10.1007/s11156-007-0043-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-007-0043-x

Keywords

- Seasoned equity offerings

- Corporate diversification

- Earnings management

- Accruals

- Stock market performance