Abstract

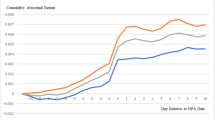

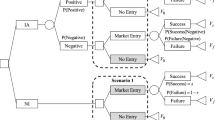

Previous studies have shown that the pattern of first day returns to initialpublic offerings is consistent with the hypotheses of underpricing and price support. We examine two different periods, 1975–1984 and 1996–2002, and find that in each case the measures of price support and underpricing are substantially affected by the initial public offerings' beginning price. During the period 1975–1984, the mean and standard deviation of returns to the price supported group are nearly always zero regardless of price, whileg the mean of the returns to the underpriced group is smile-shaped: high for low-priced and high-priced stocks but lower for stocks offered at intermediate prices. The patterns are different in the most recent data: the mean and standard deviation of both the price supported and underpriced groups are smile-shaped. For the lowest priced stocks, the measures in the later period mirror those for the 1975–1984 period, but for more expensive stocks the measures are substantially higher. The results apply to the first day returns of both firm commitment and best efforts offerings. Once price is taken into account, other than the difference in the probability of price support, the differences among offering types seem to be of secondary importance in explaining first day returns.

Similar content being viewed by others

References

Aggrawal, Reena, “Stabilization Activities by Underwriters after Initial Public Offerings.” Journal of Finance 55, 1075–1103 (2000).

Allen, Franklin and Gerald Faulhaber, “Signaling by Underpricing in the IPO Market.” Journal of Financial Economics 23, 303–323 (1989).

Asquith, Daniel, Jones, Jonathan D. and Kieschnick, Robert, “Evidence on Price Stabilization and Underpricing in Early IPO Returns.” The Journal of Finance, 63, 1759–1773 (1998).

Ball, C., W. Torous and A. Tschoegl, “The Degree of Price Resolution: The Case of the Gold Market.” Journal of Futures Markets 5, 29–43 (1985).

Baron, David, “A model of the Demand of Investment Banking Advising And Distribution Services for New Issues.” Journal of Finance 37, 955–976 (1982).

Benveniste, Lawrence M, Sina M. Erdal, and Wilhelm J. Jr. Wilhelm, “Who Benefit from Secondary Market Price Stabilization of IPOs?” Journal of Banking & Finance 22, 741–767 (1998).

Benveniste, Lawrence M, and Paul Spindt, “How Investment Bankers Determine the Offer price and Allocation of New Issues.” Journal of Financial Economics 24, 343–361 (1989).

Chalk, Andrew J. and John W. Peavy III, “Initial Public Offerings: Daily Returns, Offering Types and the Price Effect.” Financial Analyst Journal 43, 65–69 (1987).

Fernando, Chitru S., Srinivasan Krishnamurthy and Paul A. Spindt, “Is the Offer Price in IPO Informative? Underpricing, Ownership Structure, and Performance.” Working paper of Wharton Financial Institutions Center Working Paper # 01–33 2002.

Hanley, Kathleen Weiss, “The Underpricing of IPOs and the Partial Adjustment Phenomenon.” Journal of Financial Economics 34, 231–250 (1993).

Hanley, Kathleen Weiss, A, Arun Kumar and Paul Seguin, “Price Stabilization in the Market for New Issues.” Journal of Financial Economics 34, 177–198 (1993).

Ibbotson, Roger. G., Jody L. Sindelar and Jay R. Ritter, “Initial Public Offerings.” Journal of Applied Corporate Finance 6, 37–45 (1988).

Loughran, T., J. R. Ritter and K. Rydqvist, “Initial Public Offerings: International Insights.” Pacific-Basin Finance Journal 2, 165–199 (1994).

Loughran, T. and J. R. Ritter, “Why Has IPO underpricing Changed Over Time?” Working paper, 2004.

Rock, Kevin, “Why New Issues Are Under Priced.” Journal of Financial Economics 15, 187–212 (1986).

Ruud, Judith S., “Underwriter Price Support and the IPO Underpricing Puzzle.” Journal of Financial Economics 34, 135–151 (1993).

Seguin, Paul J. and M. M. Smoller, “Share Price and Mortality: An Empirical Evaluation of Newly Listed Nasdaq Stocks.” Journal of Financial Economics 45, 333–364 (1997).

Welch, Ivo, “Seasoned Offering, Imitation Costs, and the Underpricing of Initial Public Offerings.” Journal of Finance 44, 421–449 (1989).

Author information

Authors and Affiliations

Additional information

JEL Classification: 1, G12, G24

Rights and permissions

About this article

Cite this article

Sopranzetti, B.J., Venezian, E. & Wang, X. The Market for New Issues: Impact of Offering Price on Price Support and Underpricing. Rev Quant Finan Acc 26, 165–176 (2006). https://doi.org/10.1007/s11156-006-7214-z

Issue Date:

DOI: https://doi.org/10.1007/s11156-006-7214-z