Abstract

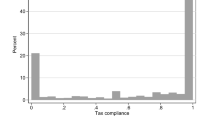

In most experimental studies of tax evasion, participants are instructed that they may report any amount of income from zero up to the amount they actually earned or received. This amounts to an invitation to gamble. In contrast, real-world tax authorities unambiguously demand compliance. We develop two new settings for conducting tax experiments. Both involve an explicit demand for compliance. Thus, we can determine whether knowing that the experimental authority would regard evasion as wrongful disobedience will influence compliance decisions. We demonstrate that simply telling people that they are required to pay a “participation fee” analogous to a tax produces remarkably high compliance rates and less sensitivity to changes in economic variables than in the earlier experimental literature using invitation-to-gamble language. This suggests that many people pay taxes despite the financial attraction of non-compliance because they are strongly inclined towards obeying authority. Furthermore, we show that giving participants a week to make their reporting decisions at home without an authority figure physically present overcomes the inclination to obey for some people, significantly lowering compliance rates. However, the majority still complies, even after the audit rate falls from 25% to 1%, which would make non-compliance extremely attractive if it were viewed only as a simple matter of risk and expected return.

Similar content being viewed by others

References

Akerlof, G. (1991). “Procrastination and Obedience.” American Economic Review. 91, 1–19.

Allingham, M. G., & Sandmo, A. (1972). “Income Tax Evasion: A Theoretical Analysis.” Journal of Public Economics. 1, 323–338.

Alm, J., Cronshaw, M., & McKee, M. (1993a). “Tax Compliance with Endogenous Audit Selection Rules.” Kyklos. 46, 27–45.

Alm, J., Jackson, B., & McKee, M. (1992a). “Institutional Uncertainty and Taxpayer Compliance.” American Economic Review. 82, 1018–1026.

Alm, J., Jackson, B., & McKee, M. (1992b). “Estimating the Determinants of Taxpayer Compliance with Experimental Data.” National Tax Journal. 45, 107–114.

Alm, J., Jackson, B., & McKee, M. (1993b). “Fiscal Exchange, Collective Decision Institutions and Tax Compliance.” Journal of Economic Behavior and Organization. 22, 285–303.

Alm, J., McClelland, G. H., & Schulze, W. D. (1992c). “Why Do People Pay Taxes?” Journal of Public Economics. 48, 21–38.

Alm, J., McKee, M., & Beck, W. (1990). “Amazing Grace: Tax Amnesties and Compliance.” National Tax Journal. 43, 23–37.

Alm, J., Sanchez, I., & de Juan, A. (1995). “Economic and Noneconomic Factors in Tax Compliance.” Kyklos. 48, 3–18.

Alm, J., McClelland, G. H., & Schulze, W. D. (1999). “Changing the Social Norm of Tax Compliance by Voting.” Kyklos. 52, 141–171.

Beron, K. J., Tauchen, H. V., & Witte, A. D. (1992). “The Effect of Audits and Socioeconomic Variables on Compliance.” In: Slemrod, J. (ed.), Why People Pay Taxes: Tax Compliance and Enforcement. Ann Arbor: The University of Michigan Press, pp. 67–89.

Boylan, S. J., & Sprinkle, G. B. (2001). “Experimental Evidence on the Relation between Tax Rates and Compliance: The Effect of Earned Versus Endowed Income.” Journal of the American Taxation Association. 23, 75–90.

Cialdini, R. B. (2001). Influence: Science and Practice. Fourth Edition. Boston: Allyn and Bacon.

Elffers, H. (2000). “But Taxpayers Do Cooperate!” In: Van Vugt, M., Snyder, M., Tyler, T. R., & Biel, A. (eds.), Cooperation in Modern Society: Promoting the Welfare of Communities, States and Organizations. London: Routledge, pp. 184–94.

Feld, L. P., & Tyran, J. R. (2002). “Tax Evasion and Voting: An Experimental Analysis.” Kyklos. 55, 197–221.

Graetz, M. J., & Wilde, L. (1985). “The Economics of Tax Compliance: Fact and Fantasy.” National Tax Journal. 38, 355–363.

Hoffman, E., & Spitzer, M. L. (1985). “Entitlements, Rights, and Fairness: An Experimental Examination of Subjects’ Concepts of Distributive Justice.” Journal of Legal Studies. 14, 259–297.

Kilham, W., & Mann, L. (1974). “Level of Destructive Obedience as a Function of Transmitter and Executant Roles in the Milgram Obedience Paradigm.” Journal of Personality and Social Psychology. 29, 696–702.

Kinsey, K. A. (1992). “Deterrence and Alienation Effects of IRS Enforcement: An Analysis of Survey Data.” In: Slemrod, J. (ed.), Why People Pay Taxes: Tax Compliance and Enforcement. Ann Arbor: The University of Michigan Press, pp. 259–285.

Long, S., & Swingen, J. (1991) “The Conduct of Tax-Evasion Experiments: Validation, Analytical Methods, and Experimental Realism.” In: Webley, P., Robben, H., Elffers, H., & Hessing, D. (eds.), Tax Evasion: An Experimental Approach. Cambridge: Cambridge University Press, pp. 128–38.

Meeus, W.H.J., & Raaijmakers, Q.A.W. (1995). “Obedience in Modern Society: The Utrecht Studies.” Journal of Social Issues. 51, 155–175.

Milgram, S. (1963). “Behavioral Study of Obedience.” Journal of Abnormal and Social Psychology. 67, 371–378.

Milgram, S. (1974). Obedience to Authority: An Experimental View. New York: Harper and Row.

Moser, D. V., Evans, J. H. III, & Kim, C. K. (1995). “The Effects of Horizontal and Exchange Inequity on Tax Reporting Decisions.” The Accounting Review. 70, 619–634.

Scholz, J. T., & Pinney, N. (1995). “Duty, Fear, and Tax Compliance: The Heuristic Basis of Citizenship Behavior.” American Journal of Political Science. 39, 490–512.

Skinner, J., & Slemrod, J. (1985). “An Economic Perspective on Tax Evasion.” National Tax Journal. 38, 345–353.

Smith, K. W. (1992). “Reciprocity and Fairness: Positive Incentives for Tax Compliance. ” In: Slemrod, J. (ed.), Why People Pay Taxes: Tax Compliance and Enforcement. Ann Arbor: The University of Michigan Press, pp. 223–250.

Spicer, M., & L. Becker. (1980). “Fiscal Inequity and Tax Evasion: An Experimental Approach. ” National Tax Journal. 33, 171–175.

Spicer, M. W., & Hero, R. E. (1985). “Tax Evasion and Heuristics.” Journal of Public Economics. 26, 263–267.

Steenbergen, M. R., McGraw, K. M., & Scholz, J. T. (1992). “Taxpayer Adaptation to the 1986 Tax Reform Act: Do New Tax Laws Affect the Way Taxpayers Think About Taxes?” In: Slemrod, J. (ed.), Why People Pay Taxes: Tax Compliance and Enforcement. Ann Arbor: The University of Michigan Press, pp. 9–37.

Torgler, B. (2002). “Speaking to Theorists and Searching for Facts: Tax Morale and Tax Compliance in Experiments.” Journal of Economic Surveys. 16, 657–683.

Trivedi, V. U., & Chung, J. (2006). “The Impact of Compensation Level and Context on Income Reporting Behavior in the Laboratory.” Behavioral Research in Accounting (forthcoming).

Wartick, M. L., Madeo, S. A., & Vines, C. C. (1999). “Reward Dominance in Tax Reporting Experiments: The Role of Context.” The Journal of the American Taxation Association. 21, 20–31.

Webley, P., & Halstead, S. (1986). “Tax Evasion on the Micro: Significant Simulations or Expedient Experiments?” Journal of Interdisciplinary Economics. 1, 87–100.

Yitzhaki, S. (1974). “A Note on Income Tax Evasion: A Theoretical Analysis.” Journal of Public Economics. 3, 201–202.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification C91, H26

Electronic supplementary material

Rights and permissions

About this article

Cite this article

Cadsby, C.B., Maynes, E. & Trivedi, V.U. Tax compliance and obedience to authority at home and in the lab: A new experimental approach. Exp Econ 9, 343–359 (2006). https://doi.org/10.1007/s10683-006-7053-8

Received:

Revised:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/s10683-006-7053-8