Abstract

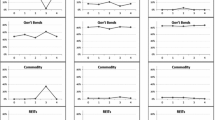

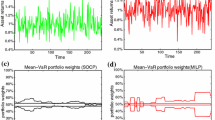

Most of previous work on robust equity portfolio optimization has focused on its formulation and performance. In contrast, in this paper we analyze the behavior of robust equity portfolios to determine whether reducing the sensitivity to input estimation errors is all robust models do and investigate any side-effects of robust formulations. Therefore, our focus is on the relationship between fundamental factors and robust models in order to determine if robust equity portfolios are consistently investing more in the factors opposed to individual asset movements. To do so, we perform regressions with factor returns to explain how robust portfolios behave compared to portfolios generated from the Markowitz’s mean-variance model. We find that robust equity portfolios consistently show higher correlation with the three fundamental factors used in the Fama-French factor model. Furthermore, more robustness among robust portfolios results in a higher correlation with the Fama-French three factors. In fact, we show that as equity portfolios under no constraints on portfolio weights become more robust, they consistently depend more on the market and large factors. These results show that robust models are betting on the fundamental factors instead of individual asset movements.

Similar content being viewed by others

Notes

Data obtained from the online data library of Kenneth R. French (http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html).

For the estimation error covariance matrix Σ μ in the robust models with ellipsoidal uncertainty sets, we use the diagonal matrix containing the estimation variances, which is known to work well in practice for robust optimization. For further details, see Stubbs and Vance (2005).

The values of λ are chosen to represent five portfolios with standard deviation less than 0.3 that are equally spread-out when plotted on the mean-variance efficient frontier.

The value of δ does not directly represent confidence levels (90 %, 95 %, etc.). Asset returns are assumed to follow a normal distribution when setting the confidence interval. For example, a 95 % confidence level for the box model uses \(\delta_{i}=1.96\sigma_{i}/\sqrt{T}\), where T is the sample size (Fabozzi et al. 2007a, 2007b, 2010). For the ellipsoid model, we assume the square of estimation error δ 2 follows a χ 2 distribution with degrees of freedom as the number of assets in the portfolio (Fabozzi et al. 2007a, 2007b, 2010).

The first curve uses return data from 1970 to 1974, the second curve uses return data from 1975–1979, and so on.

References

Best, M. J., & Grauer, R. R. (1991). On the sensitivity of mean-variance-efficient portfolios to changes in asset means: some analytical and computational results. The Review of Financial Studies, 4(2), 315–342.

Black, F., & Litterman, R. (1991). Asset allocation: combining investor views with market equilibrium. The Journal of Fixed Income, 1(2), 7–18.

Black, F., & Litterman, R. (1992). Global portfolio optimization. Financial Analysts Journal, 48(5), 28–43.

Blume, M. E., & Friend, I. (1975). The asset structure of individual portfolios and some implications for utility functions. The Journal of Finance, 30(2), 585–604.

Broadie, M. (1993). Computing efficient frontiers using estimated parameters. Annals of Operations Research, 45(1), 21–58.

Chopra, V. K., & Ziemba, W. T. (1993). The effect of errors in means, variances, and covariances on optimal portfolio choice. The Journal of Portfolio Management, 19(2), 6–11.

Fabozzi, F. J., Kolm, P. N., Pachamanova, D. A., & Focardi, S. M. (2007a). Robust portfolio optimization. The Journal of Portfolio Management, 33, 40–48.

Fabozzi, F. J., Kolm, P. N., Pachamanova, D. A., & Focardi, S. M. (2007b). Robust portfolio optimization and management. Hoboken: Wiley.

Fabozzi, F. J., Huang, D., & Zhou, G. (2010). Robust portfolios: contributions from operations research and finance. Annals of Operations Research, 176, 191–220.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Fama, E. F., & French, K. R. (1995). Size and book-to-market factors in earnings and returns. The Journal of Finance, 50(1), 131–155.

Fama, E. F., & French, K. R. (1997). Industry costs of equity. Journal of Financial Economics, 43(2), 153–193.

Goetzmann, W., & Kumar, A. (2008). Equity portfolio diversification. Review of Finance, 12(3), 433–463.

Goldfarb, D., & Iyengar, G. (2003). Robust portfolio selection problems. Mathematics of Operations Research, 28(1), 1–38.

Jensen, M. C., Black, F., & Scholes, M. S. (1972). The capital asset pricing model: some empirical tests. In M. C. Jensen (Ed.), Studies in the theory of capital markets (pp. 79–121). New York: Praeger.

Kim, W. C., Kim, J. H., & Fabozzi, F. J. (2012). Deciphering robust portfolios (Working paper).

Kim, W. C., & Mulvey, J. M. (2009). Evaluating style investment—does a fund market defined along equity styles add value? Quantitative Finance, 9(6), 637–651.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Michaud, R. O. (1998). Efficient asset management: a practical guide to stock portfolio optimization and asset allocation. New York: Oxford University Press.

Michaud, R. O., & Michaud, R. (2008). Estimation error and portfolio optimization: a resampling solution. Journal of Investment Management, 6(1), 8–28.

Santos, A. A. P. (2010). The out-of-sample performance of robust portfolio optimization. Brazilian Review of Finance, 8(2), 141–166.

Scherer, B. (2007). Can robust portfolio optimization help to build better portfolios? Journal of Asset Management, 7(6), 374–387.

Stubbs, R. A., & Vance, P. (2005). Computing return estimation error matrices for robust optimization. Axioma, Inc.

Tütüncü, R. H., & Koenig, M. (2004). Robust asset allocation. Annals of Operations Research, 132, 157–187.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kim, W.C., Kim, J.H., Ahn, S.H. et al. What do robust equity portfolio models really do?. Ann Oper Res 205, 141–168 (2013). https://doi.org/10.1007/s10479-012-1247-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-012-1247-6