Abstract

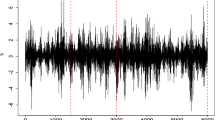

This paper discusses practical Bayesian estimation of stochastic volatility models based on OU processes with marginal Gamma laws. Estimation is based on a parameterization which is derived from the Rosiński representation, and has the advantage of being a non-centered parameterization. The parameterization is based on a marked point process, living on the positive real line, with uniformly distributed marks. We define a Markov chain Monte Carlo (MCMC) scheme which enables multiple updates of the latent point process, and generalizes single updating algorithm used earlier. At each MCMC draw more than one point is added or deleted from the latent point process. This is particularly useful for high intensity processes. Furthermore, the article deals with superposition models, where it discuss how the identifiability problem inherent in the superposition model may be avoided by the use of a Markov prior. Finally, applications to simulated data as well as exchange rate data are discussed.

Similar content being viewed by others

References

Andersen T.G., Lund J. (1997). Estimating continuous-time stochastic volatility models of the short-term interest rate. Journal of Econometrics 77: 343–377

Barndorff-Nielsen O.E., Shephard N. (2001). Non-Gaussian Ornstein-Uhlenbeck-based models and some of their uses in financial economics. Journal of Royal Statistical Society, Series B 63: 167–241

Black F., Scholes M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy 8: 1637–1659

Cox D.R., Isham V. (1988). Point processes. London, Chapman & Hall

Frühwirth-Schnatter S. (2001a). Discussion of the paper by O. Barndorff-Nielsen and N. Shephard on “Non-Gaussian OU based models and some of their uses in financial economics”. Journal of Royal Statistical Society, Series B 63: 220–222

Frühwirth-Schnatter S. (2001b). Markov chain Monte Carlo estimation of classical and dynamic switching and mixture models. Journal of the American Statistical Association 96: 194–209

Geyer C., Møller J. (1994). Simulation procedures and likelihood inference for spatial point processes. Scandinavian Journal of Statistics 21: 359–373

Griffin J.E., Steel M.F.J. (2006). Inference with non-Gaussian Ornstein-Uhlenbeck processes for stochastic volatility. Journal of Econometrics 134: 605–644

Hull J., White A. (1987). The pricing of options on assets with stochastic volatilities. The Journal of Finance 42: 281–300

Papaspiliopoulos O. (2001). Discussion of the paper by O. Barndorff-Nielsen and N. Shephard on “Non-Gaussian OU based models and some of their uses in financial economics”. Journal of Royal Statistical Society, Series B 63: 211–213

Papaspiliopoulos, O., Roberts, G., Skold, M. (2003). Non-centered parameterizations for hierarchical models and data augmentation. In J. M. Bernardo, M. J. Bayarri, J. O. Berger, A. Dawid, D. Heckerman, A. F. M. Smith, M. West (Eds.), Bayesian statistics 7, (pp. 307–326).

Roberts G.O. (2001). Discussion of the paper by O. Barndorff-Nielsen and N. Shephard on “Non-Gaussian OU based models and some of their uses in financial economics”. Journal of Royal Statistical Society, Series B 63: 209–211

Roberts G.O., Papaspiliopoulos O., Dellaportas P. (2004). Bayesian inference for non-Gaussian Ornstein-Uhlenbeck stochastic volatility processes. Journal of Royal Statistical Society, Series B 66: 369–393

Roeder K., Wasserman L.L. (1997). Practical Bayesian density estimation using mixtures of normals. Journal of the American Statistical Association 92: 894–902

Rosiński J. (2001). Series representations of Lévy processes from the perspective of point processes. In O. E. Barndorff-Nielsen, T. Mikosch, S. I. Resnick (Eds). Lévy processes: theory and applications. Birkhäuser.

Shephard N. (1996). Statistical aspects of ARCH and stochastic volatility. In: Cox D.R., Hinkley D.V., Barndorff-Nielsen O.E. (eds). Time series models: in econometrics, finance and other fields. London, Chapman & Hall, pp. 1–67

Stephens M. (2000). Dealing with label switching in mixture models. Journal of Royal Statistical Society, Series B 62: 795–809

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Frühwirth-Schnatter, S., Sögner, L. Bayesian estimation of stochastic volatility models based on OU processes with marginal Gamma law. Ann Inst Stat Math 61, 159–179 (2009). https://doi.org/10.1007/s10463-007-0130-8

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10463-007-0130-8