Abstract.

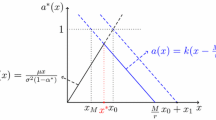

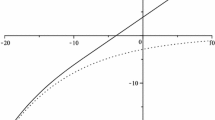

We consider a company where surplus follows a diffusion process and whose objective is to maximize expected discounted dividend payouts to the shareholders. It is well known that under some reasonable assumptions, optimality is achieved by using a barrier strategy, i.e. there is a level b* so that whenever suplus goes above b*, the excess is paid out as dividends. However, the optimal level b* may be unaccaptably low, and the company may be prohibited, either by internal clauses or by external reasons such as solvency restrictions imposed on an insurance company, to pay out dividends unless the surplus has reached a level b 0 > b *. We show that in this case a barrier strategy at b0 is optimal. Finally, it is discussed how the barrier b0 can be determined, and we suggest to use arguments from risk theory. More concretely, we let b0 be the smallest barrier so that the probability that the surplus will be negative within a time horizon T is not larger than some when initial surplus equals b0. It is shown theoretically how b0 can be calculated using this method, and examples are given for two special cases.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Manuscript received: February 2002; final version received: October 2002

This work was supported in part by the Norwegian Research Council and the University of Chicago. It was written while the author was visiting the Department of Statistics and the Mathematical Finance Program at the University of Chicago. I would like to thank them, and in particular Per Mykland, for their hospitality.

Rights and permissions

About this article

Cite this article

Paulsen, J. Optimal dividend payouts for diffusions with solvency constraints. Finance Stochast 7, 457–473 (2003). https://doi.org/10.1007/s007800200098

Issue Date:

DOI: https://doi.org/10.1007/s007800200098