Abstract

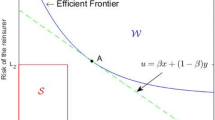

We consider the classical Cramér-Lundberg model with dynamic proportional reinsurance and solve the problem of finding the optimal reinsurance strategy which minimizes the expected quadratic distance of the risk reserve to a given benchmark. This result is extended to a mean-variance problem.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bäuerle, N. Benchmark and mean-variance problems for insurers. Math Meth Oper Res 62, 159–165 (2005). https://doi.org/10.1007/s00186-005-0446-1

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/s00186-005-0446-1