Abstract

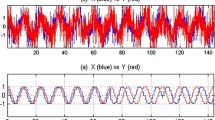

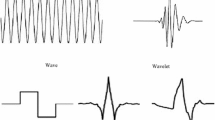

The paper examines the relationship between exchange rates and share prices using the wavelets approach, and more specifically the continuous wavelet power spectrum, cross-wavelet transform, and cross-wavelet coherency. Our results, based on Indian data, lend support to the traditional (Am Econ Rev 70:960–971, 1980) as well as the new portfolio hypothesis (Am Econ Rev 83:1356–1369, 1993), albeit over different time periods and across different time scales. The wavelet approach used in the paper has helped to uncover some interesting economic relationships within the time–frequency domain which have remained hidden thus far.

Similar content being viewed by others

Notes

Aguiar-Conraria et al. (2008) is the first study to examine macroeconomic relations using continuous wavelets.

The description of CWT, XWT, and WTC is drawn from the work of Grinsted et al. (2004). We are grateful to Grinsted and co-authors for making the codes available at: http://www.pol.ac.uk/home/research/waveletcoherence/ which we used in the present study.

References

Abdalla I, Murinde V (1997) Exchange rates and stock price interactions in emerging financial markets: evidence on India, Korea, Pakistan and the Philippines. Applied Financ Econ 7:25–35

Aggarwala R (1981) Exchange rates and stock prices: a study of the us capital markets under floating exchange rates. Akron Bus Econ Rev 12:7–12

Aguiar-Conraria L, Azevedo N, Soares MJ (2008) Using wavelets to decompose the time-frequency effects of monetary policy. Phys A 387:2863–2878

Aguiar-Conraria L, Soares MJ (2011a) Oil and the macroeconomy: using wavelets to analyze old issues. Empir Econ 40:645–655

Aguiar-Conraria L, Soares MJ (2011b) Business cycle synchronization and the Euro: a wavelet analysis. J Macroecon 33(3):477–489

Ajayi AR, Mougoue M (1996) On the dynamic relation between stock prices and exchange rates. J Financ Res XIX(2):193–207

Ajayi RA, Friedman J, Mehdian SM (1998) On the relationship between stock returns and exchange rates: tests of granger causality. Glob Financ J 9:241–251

Baubeau P, Cazelles B (2009) French economic cycles: a wavelet analysis of French retrospective GNP series. Cliometrica 3:275–300

Bhattacharya B, Mukherjee J (2003) Causal relationship between stock market and exchange rate. foreign exchange reserves and value of trade balance: a case study for India. Paper presented at the Fifth Annual Conference on Money and finance in the Indian economy, Jan 2003

Caraiani P (2012) Stylized facts of business cycles in a transition economy in time and frequency. Econ Modell 29(6):2163–2173

Crowley P, Mayes D (2008) How fused is the Euro area core?: an evaluation of growth cycle co-movement and synchronization using wavelet analysis. J Bus Cycle Meas Anal 4:63–95

Dacorogna M, Gençay R, Müller U, Olsen R, Pictet V (2001) An introduction to high-frequency finance. Academic Press, San Diego, California

Dornbusch R, Fischer S (1980) Exchange rates and current account. Am Econ Rev 70:960–971

Frank P, Young A (1972) Stock price reaction of multinational firms to exchange realignments. Financ Manag 1(3):66–73

Frankel J (1993) Does foreign exchange intervention matter? The portfolio effect. Am Econ Rev 83:1356–1369

Gabor D (1946) Theory of communication. J Inst of Electr Eng 93:429–457

Gallegati M, Ramsey JB, Semmler W (2011) The US wage Phillips curve across frequencies and over time. Oxf Bull Econ Stat 73(4):0305–9049

Ge Z (2007) Significance tests for the wavelet power and the wavelet power spectrum. Ann Geophys 25:2259–2269

Ge Z (2008) Significance tests for the wavelet cross spectrum and wavelet linear coherence. Ann Geophys 26:3819–3829

Granger CWJ, Huang BN, Yang CW (2000) A bivariate causality between stock prices and exchange rates: evidence from recent Asian flu. Q Rev of Econ Financ 40:337–354

Grinsted A, Moore JC, Jevrejeva S (2004) Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Process Geophys 11:561–566

Hudgins L, Friehe C, Mayer M (1993) Wavelet transforms and atmospheric turbulence. Phys Rev Lett 71(20):3279–3282

Jammazi R (2012) Cross dynamics of oil-stock interactions: a redundant wavelet analysis. Energy 44(1):750–777

Ma KC, Kao GW (1990) On exchange rate changes and stock price reactions. J Bus Account 17(3):441–449

Madaleno M, Pinho C (2012) International stock market indices comovements: a new look. Int J Financ Econ 17:89–102

Maraun D, Kurths J (2004) Cross wavelet analysis: significance testing and pitfalls. Nonlinear Processes Geophys 11:505–514

Maraun D, Kurths J, Holschneider M (2007) Non-stationary Gaussian processes in wavelet domain: Synthesis, estimation, and significance testing. Phys Rev E 75(016707):1–14

Mishra AK (2004) Stock market and foreign exchange market in India: are they related? South Asia Econ J 5:209–232

Muhammad N, Rasheed A (2002) Stock prices and exchange rates: are they related? evidence from south asian countries. Paper presented at the 18th Annual general meeting and conference, Pakistan society of development economists, Islamabad, 13–15 Jan 2003

Phylaktis K, Ravazzolo F (2000) Stock prices and exchange rate dynamics. pp. 17–37. See at http://www.cass.city.ac.UK/emg/workingpapers/stock-prices-and-exchange.pdf Accessed 07 July 2012

Rahman L, Uddin J (2009) Dynamic relationship between stock prices and exchange rates: evidence from three south Asian countries. Int Bus Res 2(2):167–174

Raihan S, Wen Y, Zeng B (2005) Wavelet: a new tool for business cycle analysis. Working Paper 2005–050A, Federal Reserve Bank of St. Louis

Rua A (2012) Money growth and inflation in the Euro Area: a time–frequency view. Oxf Bull Econ Stat 74(6):0305–9049

Rua A, Nunes LC (2009) International co-movement of stock market returns: a wavelet analysis. J Empir Financ 16:632–639

Smith C (1992) Stock markets and the exchange rate: a multi-country approach. J Macroecon 14(4):607–629

Soenen L, Hennigar E (1988) An analysis of exchange rates and stock prices-the us experience between 1980s and 1986. Akron Bus Econ Rev 19(4):71–76

Solonik B (1987) Using financial prices to test exchange models. A note. J Financ 42(1):141–149

Tiwari AK, Dar AB, Bhanja N (2013) Oil price and exchange rates: a wavelet based analysis for India. Econ Modell 31:414–422

Torrence C, Compo GP (1998) A practical guide to wavelet analysis. Bull Am Meteor Soc 79:605–618

Torrence C, Webster P (1999) Interdecadal changes in the esnom on soon system. J Clim 12:2679–2690

Venkateshwarlu M, Tiwari R (2005) Causality between stock prices and exchange rates: some evidence for India. ICFAI J Appl Financ 11:5–15

Acknowledgments

We are very thankful to the reviewers for pointing out some very critical issues that helped us to improve the quality of the paper. We also express our gratitude to them for providing us with relevant references. Standard caveats apply.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tiwari, A.K., Bhanja, N., Dar, A.B. et al. Time–frequency relationship between share prices and exchange rates in India: Evidence from continuous wavelets. Empir Econ 48, 699–714 (2015). https://doi.org/10.1007/s00181-014-0800-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-014-0800-3