Abstract

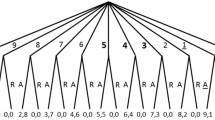

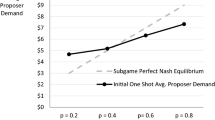

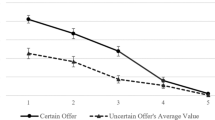

In an ultimatum game, player 1 makes an offer of $X from a total of $M to player 2. If player 2 accepts the offer, then player 1 is paid $(M-X) and player 2 receives $X; if player 2 rejects the offer, each gets zero. In the ultimatum game experiments reported in the literature,M is typically not more than $10 (see Forsythe, Horowitz, Savin and Sefton, 1994, hereafter FHSS; Hoffman, McCabe, Shachat and Smith, 1994, hereafter HMSS, and the literature cited therein). We report new results for 50 bargaining pairs in whichM=$100, and compare them with previous outcomes from 48 pairs withM=$10. The need for an examination of the effect of increased stakes on ultimatum bargaining is suggested by a literature survey of the effect of varying the stakes in a wide variety of decision making and market experiments over the last 33 years (Smith and Walker, 1993b). Many cases were found in which the predictions of theory were improved when the monetary rewards were increased. There were also cases in which the level of monetary rewards had no effect on the results. Consequently, it is necessary to examine the stakes question on a case by case basis. The previously reported effect of instructional changes, which define different institutional contexts, on ultimatum game outcomes, and the effect of stakes reported here, suggest a game formulation that explains changes in the behavior of both players as a result of changes in the instructional treatments. We formulate such a model and indicate how it might be further tested.

Similar content being viewed by others

References

Carter J, Irons M (1991) Are economists different, and if so why? Journal of Economic Perspectives 5: 171–177

Eckel CC, Grossman P (1992) The price of fairness: Gender differences in punishment games. Department of Economics, Virginia Polytechnic Institute

Forsythe R, Horowitz J, Savin NE, Sefton M (1994) Replicability, fairness and pay in experiments with simple bargaining games. Games and Economic Behavior 6: 347–369

Harlow WV, Brown K (1990) Understanding and assessing financial risk tolerance: A biological perspective. Financial Analysts Journal 46: 50–62

Hoffman E, McCabe K, Smith V (1996) Social distance and other-regarding behavior in dictator games. American Economic Review (forthcoming)

Hoffman E, McCabe K, Shachat K, Smith V (1994) Preferences, property rights and anonymity in bargaining games. Games and Economic Behaviour 7: 346–380

Kahneman D, Knetsch JL, Thaler RH (1986) Fairness and the assumptions of economics. In Hogarth RM, Reder MW (eds) Rational Choice, Chicago, University of Chicago Press 101–116

McCabe K (1989) Fiat money as a store of value in an experimental market. Journal of Economic Behavior and Organization 12: 215–231

McCloskey DN (1985) The loss function has been mislaid: The rhetoric of significance tests. American Economic Review 75: 201–205

Robinson JP, Shaver PR, Wrightsman LS (1991) Measures of personality and social psychological attitudes. New York, Academic Press

Roth AE, Prasnikar V, Okuno-Fujiwara M, Zamir S (1991) Bargaining and market behavior in Jerusalem, Ljubljana, Pittsburgh, and Tokyo: An experimental study. American Economic Review 81: 1068–1095

Smith VL, Walker JM (1993a) Rewards, experience and decision costs in first price auctions. Economic Inquiry 31: 237–244

Smith VL, Walker JM (1993b) Monetary rewards and decision costs in experimental economics. Economic Inquiry 31: 245–261

Telser KG (1993) The ultimatum game: A comment. Mimeo, Department of Economics, University of Chicago

Wolf C, Pohlman L (1983) The recovery of risk preferences from actual choices. Econometrica 51: 843–850

Author information

Authors and Affiliations

Additional information

The authors gratefully acknowledge research support from the National Science Foundation for the experimental study of bargaining under Grant SBR #9210052. This paper grew out of discussions following the presentation of our earlier work at the 1992 Amsterdam Workshop in Experimental Economics. We especially thank John Carter and Ron Harstad for numerous helpful comments on an earlier draft of this paper.

Rights and permissions

About this article

Cite this article

Hoffman, E., McCabe, K.A. & Smith, V.L. On expectations and the monetary stakes in ultimatum games. Int J Game Theory 25, 289–301 (1996). https://doi.org/10.1007/BF02425259

Issue Date:

DOI: https://doi.org/10.1007/BF02425259