Abstract

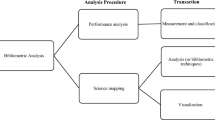

This paper conducts a bibliometric analysis and a review of existing literature focusing on past 20 years (2000–2019) of research on corporate risk disclosures. The bibliometric data are gathered from two of the most widely referred repositories: Web of Science (WoS) and Scopus. The paper analysed various performance parameters such as research growth, most productive and highly cited authors, top source journal, affiliation analysis (institution-wise and country-wise), annual publication output, country affiliation analysis, document-based citation analysis, cited author-based co-citation Analysis and Top 30 highly influential papers from both databases WoS and Scopus. Apart from this, based on bibliometric analysis, authors’ country of origin, document-based citation analysis and cited authors-based co-citation analysis are visualized using VOSviewer software. This paper also listed thirty highly cited titles from both the databases.

Similar content being viewed by others

References

Abraham, S., and P. Cox. 2007. Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review 39 (3): 227–248.

Allini, A., F. Manes Rossi, and K. Hussainey. 2016. The board’s role in risk disclosure: An exploratory study of Italian listed state-owned enterprises. Public Money & Management 36 (2): 113–120.

Beretta, S., and S. Bozzolan. 2004. A framework for the analysis of firm risk communication. The International Journal of Accounting 39 (3): 265–288.

Boyle, F., and D. Sherman. 2006. Scopus™: The product and its development. The Serials Librarian 49 (3): 147–153.

Broadus, R. 1987. Toward a definition of “bibliometrics.” Scientometrics 12 (5–6): 373–379.

Cabedo, J.D., and M.J. Tirado. 2004. The disclosure of risk in financial statements. Accounting Forum 28 (2): 181–200.

Campbell, J.L., H. Chen, D.S. Dhaliwal, H.M. Lu, and L.B. Steele. 2014. The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies 19 (1): 396–455.

Cordazzo, M., M. Papa, and P. Rossi. 2017. The interaction between mandatory and voluntary risk disclosure: A comparative study. Managerial Auditing Journal 32 (7): 682–714.

Crouhy, M., D. Galai, and R. Mark. 2006. The essentials of risk management, vol. 1. New York: McGraw-Hill.

Deumes, R. 2008. Corporate risk reporting: A content analysis of narrative risk disclosures in prospectuses. The Journal of Business Communication (1973) 45 (2): 120–157.

Dobler, M., K. Lajili, and D. Zéghal. 2011. Attributes of corporate risk disclosure: An international investigation in the manufacturing sector. Journal of International Accounting Research 10 (2): 1–22.

Elshandidy, T., I. Fraser, and K. Hussainey. 2013. Aggregated, voluntary, and mandatory risk disclosure incentives: Evidence from UK FTSE all-share companies. International Review of Financial Analysis 30: 320–333.

Elshandidy, T., L. Neri, and Y. Guo. 2018. Determinants and impacts of risk disclosure quality: Evidence from China. Journal of Applied Accounting Research 19 (4): 518–536.

Elzahar, H., and K. Hussainey. 2012. Determinants of narrative risk disclosures in UK interim reports. The Journal of Risk Finance 13 (2): 133–147.

German Accounting Standards Committee GASC. 2000. GASn◦5. Risk reporting. Berlin: GASC.

Habtoor, O.S., N. Ahmad, N.R. Mohamad, and M.H. Che Haat. 2017. Linking corporate risk disclosure practices with firm-specific characteristics in Saudi Arabia. Gadjah Mada International Journal of Business 19 (3): 247.

Hassan, M.K. 2009. UAE corporations-specific characteristics and level of risk disclosure. Managerial Auditing Journal 24 (7): 668–687.

Hassan, M.K. 2014. Risk narrative disclosure strategies to enhance organizational legitimacy: Evidence from UAE financial institutions. International Journal of Disclosure and Governance 11 (1): 1–17.

Khlif, H., and K. Hussainey. 2014. The association between risk disclosure and firm characteristics: A meta-analysis. Journal of Risk Research 19 (2): 181–211.

Konishi, N., and M.M. Ali. 2007. Risk reporting of Japanese companies and its association with corporate characteristics. International Journal of Accounting, Auditing and Performance Evaluation 4 (3): 263–285.

Lajili, K. 2009. Corporate risk disclosure and corporate governance. Journal of Risk and Financial Management 2 (1): 94–117.

Linsley, P.M., and M.J. Lawrence. 2007. Risk reporting by the largest UK companies: Readability and lack of obfuscation. Accounting, Auditing & Accountability Journal 20 (4): 620–627.

Linsley, P.M., and P.J. Shrives. 2005a. Transparency and the disclosure of risk information in the banking sector. Journal of Financial Regulation and Compliance 13 (3): 205–214.

Linsley, P.M., and P.J. Shrives. 2005b. Examining risk reporting in UK public companies. The Journal of Risk Finance 6 (4): 292–305.

Linsley, P.M., and P.J. Shrives. 2006. Risk reporting: A study of risk disclosures in the annual reports of UK companies. The British Accounting Review 38 (4): 387–404.

Lombardi, R., D. Coluccia, G. Russo, and S. Solimene. 2016. Exploring financial risks from corporate disclosure: Evidence from Italian listed companies. Journal of the Knowledge Economy 7 (1): 309–327.

Madrigal, M.H., B.A. Guzmán, and C.A. Guzmán. 2015. Determinants of corporate risk disclosure in large Spanish companies: A snapshot. Contaduría y Administración 60 (4): 757–775.

Marzouk, M. 2016. Risk reporting during a crisis: Evidence from the Egyptian capital market. Journal of Applied Accounting Research 17 (4): 378–396.

Miihkinen, A. 2013. The usefulness of firm risk disclosures under different firm riskiness, investor-interest, and market conditions: New evidence from Finland. Advances in Accounting 29 (2): 312–331.

Ntim, C.G., S. Lindop, and D.A. Thomas. 2013. Corporate governance and risk reporting in South Africa: A study of corporate risk disclosures in the pre-and post-2007/2008 global financial crisis periods. International Review of Financial Analysis 30: 363–383.

Oliveira, J., L. Lima Rodrigues, and R. Craig. 2011. Risk-related disclosures by non-finance companies: Portuguese practices and disclosure characteristics. Managerial Auditing Journal 26 (9): 817–839.

Oliveira, J., R. Serrasqueiro, and S.N. Mota. 2017. Determinants of risk reporting by Portuguese and Spanish non-finance companies. European Business Review 30 (3): 311–339.

Pritchard, A. 1969. Statistical bibliography or bibliometrics. Journal of Documentation 25 (4): 348–349.

Saggar, R., and B. Singh. 2017. Corporate governance and risk reporting: Indian evidence. Managerial Auditing Journal 32 (4/5): 378–405.

Solomon, J.F., A. Solomon, S.D. Norton, and N.L. Joseph. 2000. A conceptual framework for corporate risk disclosure emerging from the agenda for corporate governance reform. The British Accounting Review 32 (4): 447–478.

Taylor, G., G. Tower, and J. Neilson. 2010. Corporate communication of financial risk. Accounting & Finance 50 (2): 417–446.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Top 30 most highly cited papers in WoS

R | Author/s | Year | Title | Journal | TC |

|---|---|---|---|---|---|

1 | Elshandidy, T; Fraser, I; Hussainey, K | 2016 | Aggregated, voluntary, and mandatory risk disclosure incentives: Evidence from UK FTSE all-share companies | International Review of Financial Analysis | 39 |

2 | Ntim, CG; Lindop, S; Thomas, DA | 2016 | Corporate governance and risk reporting in South Africa: A study of corporate risk disclosures in the pre- and post-2007/2008 global financial crisis periods | International Review of Financial Analysis | 37 |

3 | Abraham, S; Shrives, PJ | 2016 | Improving the relevance of risk factor disclosure in corporate annual reports | British Accounting Review | 33 |

4 | Chess, C | 2018 | Organizational theory and the stages of risk communication | Risk Analysis | 33 |

5 | Elshandidy, T; Neri, L | 2017 | Corporate Governance, Risk Disclosure Practices, and Market Liquidity: Comparative Evidence from the UK and Italy | Corporate Governance-An International Review | 28 |

6 | Elshandidy, T; Fraser, I; Hussainey, K | 2016 | What drives mandatory and voluntary risk reporting variations across Germany, UK and US? | British Accounting Review | 16 |

7 | Allini, A; Rossi, FM; Hussainey, K | 2016 | The board's role in risk disclosure: an exploratory study of Italian listed state-owned enterprises | Public Money & Management | 12 |

8 | Raemaekers, K; Maroun, W; Padia, N | 2015 | Risk disclosures by South African listed companies post-King III | South African Journal of Accounting Research | 12 |

9 | Moumen, N; Ben Othman, H; Hussainey, K | 2018 | The value relevance of risk disclosure in annual reports: Evidence from MENA emerging markets | Research in International Business And Finance | 11 |

10 | Hill, P; Short, H | 2018 | Risk disclosures on the second tier markets of the London Stock Exchange | Accounting and Finance | 11 |

11 | Horing, D; Grundl, H | 2018 | Investigating Risk Disclosure Practices in the European Insurance Industry | Geneva Papers on Risk and Insurance-Issues and Practice | 8 |

12 | Hemrit, W; Ben Arab, M | 2017 | The disclosure of operational risk in Tunisian insurance companies | Journal of Operational Risk | 8 |

13 | Kallenberg, K | 2016 | The role of risk in corporate value: A case study of the ABB asbestos litigation | Journal of Risk Research | 8 |

14 | Abdallaha, AAN; Hassanb, MK; McClellanda, PL | 2016 | Islamic financial institutions, corporate governance, and corporate risk disclosure in Gulf Cooperation Council countries | Journal of Multinational Financial Management | 7 |

15 | Sale, HA; Langevoort, DC | 2016 | We Believe: Omnicare, legal risk disclosure and corporate governance | Duke Law Journal | 6 |

16 | Tauringana, V; Chithambo, L | 2018 | Determinants of risk disclosure compliance in Malawi: a mixed-method approach | Journal of Accounting In Emerging Economies | 6 |

17 | Martikainen, M; Kinnunen, J; Miihkinen, A; Troberg, P | 2017 | Board's financial incentives, competence, and firm risk disclosure Evidence from Finnish index listed companies | Journal of Applied Accounting Research | 5 |

18 | Saggar, R; Singh, B | 2016 | Corporate governance and risk reporting: Indian evidence | Managerial Auditing Journal | 3 |

19 | Carmona, P; de Fuentes, C; Ruiz, C | 2016 | Risk disclosure analysis in the corporate governance annual report using fuzzy-set qualitative comparative analysis | Rae-Revista De Administracao De Empresas | 3 |

20 | Lombardi, R; Coluccia, D; Russo, G; Solimene, S | 2015 | Exploring Financial Risks from Corporate Disclosure: Evidence from Italian Listed Companies | Journal of The Knowledge Economy | 3 |

21 | Nahar, S; Jubb, C; Azim, MI | 2018 | Risk governance and performance: a developing country perspective | Managerial Auditing Journal | 3 |

22 | Neifar, S; Jarboui, A | 2018 | Corporate governance and operational risk voluntary disclosure: Evidence from Islamic banks | Research in International Business and Finance | 2 |

23 | Cordazzo, M; Papa, M; Rossi, P | 2018 | The interaction between mandatory and voluntary risk disclosure: a comparative study | Managerial Auditing Journal | 2 |

24 | Marzouk, M | 2017 | Risk reporting during a crisis: evidence from the Egyptian capital market | Journal of Applied Accounting Research | 2 |

25 | Viljoen, C; Bruwer, BW; Enslin, Z | 2016 | Determinants of enhanced risk disclosure of JSE Top 40 Companies: the board risk committee composition, frequency of meetings and the chief risk officer | Southern African Business Review | 2 |

26 | Dobler, M; Lajili, K; Zeghal, D | 2016 | Corporate environmental sustainability disclosures and environmental risk Alternative tests of socio-political theories | Journal of Accounting and Organizational Change | 2 |

27 | Ho, VH | 2016 | Nonfinancial Risk Disclosure and the Costs of Private Ordering | American Business Law Journal | 1 |

28 | Mazumder, MMM; Hossain, DM | 2018 | Research on Corporate Risk Reporting: Current Trends and Future Avenues | Journal of Asian Finance Economics and Business | 1 |

29 | Yang, R; Yu, Y; Liu, ML; Wu, K | 2017 | Corporate Risk Disclosure and Audit Fee: A Text Mining Approach | European Accounting Review | 1 |

30 | Bravo, F | 2016 | Are risk disclosures an effective tool to increase firm value? | Managerial and Decision Economics | 1 |

Appendix 2: Top 30 most highly cited papers in Scopus

R | Authors | Year | Title | Source title | TC |

|---|---|---|---|---|---|

1 | Abraham S., Cox P | 2007 | Analysing the determinants of narrative risk information in UK FTSE 100 annual reports | British Accounting Review | 147 |

2 | Solomon J.F., Solomon A., Norton S.D., Joseph N.L | 2000 | A conceptual framework for corporate risk disclosure emerging from the agenda for corporate governance reform | British Accounting Review | 87 |

3 | Campbell J.L., Chen H., Dhaliwal D.S., Lu H.-M., Steele L.B | 2014 | The information content of mandatory risk factor disclosures in corporate filings | Review of Accounting Studies | 82 |

4 | Ntim C.G., Lindop S., Thomas D.A | 2013 | Corporate governance and risk reporting in South Africa: A study of corporate risk disclosures in the pre- and post-2007/2008 global financial crisis periods | International Review of Financial Analysis | 71 |

5 | Elzahar H., Hussainey K | 2012 | Determinants of narrative risk disclosures in UK interim reports | Journal of Risk Finance | 64 |

6 | Oliveira J., Rodrigues L.L., Craig R | 2011 | Risk-related disclosures by non-finance companies: Portuguese practices and disclosure characteristics | Managerial Auditing Journal | 57 |

7 | Dobler M., Lajili K., Zéghal D | 2011 | Attributes of corporate risk disclosure: An international investigation in the manufacturing sector | Journal of International Accounting Research | 56 |

8 | Deumes R | 2008 | Corporate risk reporting: A content analysis of narrative risk disclosures in prospectuses | Journal of Business Communication | 56 |

9 | Elshandidy T., Fraser I., Hussainey K | 2013 | Aggregated, voluntary, and mandatory risk disclosure incentives: Evidence from UK FTSE all-share companies | International Review of Financial Analysis | 52 |

10 | Hassan M.K | 2009 | UAE corporations-specific characteristics and level of risk disclosure | Managerial Auditing Journal | 51 |

11 | Abraham S., Shrives P.J | 2014 | Improving the relevance of risk factor disclosure in corporate annual reports | British Accounting Review | 39 |

12 | Elshandidy T., Neri L | 2015 | Corporate Governance, Risk Disclosure Practices, and Market Liquidity: Comparative Evidence from the UK and Italy | Corporate Governance: An International Review | 38 |

13 | Chess C | 2001 | Organizational theory and the stages of risk communication | Risk Analysis | 37 |

14 | Linsley P.M., Shrives P.J | 2005 | Examining risk reporting in UK public companies | Journal of Risk Finance | 36 |

15 | Mokhtar E.S., Mellett H | 2013 | Competition, corporate governance, ownership structure and risk reporting | Managerial Auditing Journal | 31 |

16 | Miihkinen A | 2013 | The usefulness of firm risk disclosures under different firm riskiness, investor-interest, and market conditions: New evidence from Finland | Advances in Accounting | 30 |

17 | Linsley P.M., Shrives P.J | 2005 | Transparency and the disclosure of risk information in the banking sector | Journal of Financial Regulation and Compliance | 29 |

18 | Rajab B., Handley-Schachler M | 2009 | Corporate risk disclosure by UK firms: Trends and determinants | World Review of Entrepreneurship, Management and Sustainable Development | 27 |

19 | Al-Hadi A., Hasan M.M., Habib A | 2016 | Risk Committee, Firm Life Cycle, and Market Risk Disclosures | Corporate Governance: An International Review | 20 |

20 | Konishi N., Ali Md.M | 2007 | Risk reporting of Japanese companies and its association with corporate characteristics | International Journal of Accounting, Auditing and Performance Evaluation | 19 |

21 | Allini A., Manes Rossi F., Hussainey K | 2016 | The board's role in risk disclosure: an exploratory study of Italian listed state-owned enterprises | Public Money and Management | 18 |

22 | Carlon S., Loftus J.A., Miller M.C | 2003 | The challenge of risk reporting: Regulatory and corporate responses | Australian Accounting Review | 16 |

23 | Probohudono A.N., Tower G., Rusmin R | 2013 | Risk disclosure during the global financial crisis | Social Responsibility Journal | 15 |

24 | Combes-Thuélin E., Henneron S., Touron P | 2006 | Risk regulations and financial disclosure: An investigation based on corporate communication in French traded companies | Corporate Communications | 15 |

25 | Khlif H., Hussainey K | 2016 | The association between risk disclosure and firm characteristics: A meta-analysis | Journal of Risk Research | 14 |

26 | Abdallah A.A.-N, Hassan M.K., McClelland P.L | 2015 | Islamic financial institutions, corporate governance, and corporate risk disclosure in Gulf Cooperation Council countries | Journal of Multinational Financial Management | 10 |

27 | Hassan M.K | 2014 | Risk narrative disclosure strategies to enhance organizational legitimacy: Evidence from UAE financial institutions | International Journal of Disclosure and Governance | 10 |

28 | Hemrit W., Ben Arab M | 2011 | The disclosure of operational risk in Tunisian insurance companies | Journal of Operational Risk | 9 |

29 | Al-Maghzom A., Hussainey K., Aly D | 2016 | Corporate governance and risk disclosure: Evidence from Saudi Arabia | Corporate Ownership and Control | 8 |

30 | Hernández Madrigal M., Aibar Guzmán B., Aibar Guzmán C | 2015 | Determinants of corporate risk disclosure in large Spanish companies: A snapshot | Contaduria y Administracion | 8 |

Rights and permissions

About this article

Cite this article

Khandelwal, C., Kumar, S. & Sureka, R. Mapping the intellectual structure of corporate risk reporting research: a bibliometric analysis. Int J Discl Gov 19, 129–143 (2022). https://doi.org/10.1057/s41310-022-00141-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41310-022-00141-9