Abstract

This study aims to measure the contribution of banks, financial services institutions, and insurance companies to China’s systemic risk during the 2004–2018 period. This study also evaluates the effect of CEO (chief executive officer) overconfidence and firm-level factors on systemic risk. We employ ΔCoVaR (delta conditional value-at-risk) as a measure of systemic risk and earnings forecast bias to measure CEO overconfidence. We use a fixed effects panel regression approach to evaluate the effect of CEO overconfidence, firm-level factors, and systemic risk. Our findings show that banks that are managed by overconfident CEOs enhance the firm’s contributions to systemic risk. Empirical results also show that the firm’s size, leverage ratio, and loan ratio increase the firm’s contributions to systemic risk. Furthermore, return on assets is found to have an inverse relation with systemic risk. The results of this study are important for constructing financial regulations and policies to mitigate the impact of these factors on systemic risk in China.

Similar content being viewed by others

Introduction

China's economy has transformed from a closed economy to a modern global economy. During the 2000–2008 period, China’s average GDP growth reached a rate of 13%, but its economic growth dropped to 6.9% in 2015 (World Bank 2017). Despite this rapid growth, China’s financial system has experienced many highs and lows (Sornette et al. 2015). The fragility of the financial system was first exposed during the financial crisis of 2008–2009 and China’s stock market crisis of 2015–2016, in which instability in one sector was transferred to other areas of the economy. This transfer of instability from one industry to another affected asset values and economic activities in the country. The financial system is vulnerable to uncertainty due to the fragile nature of banks, financial services firms, and insurance companies. This instability of financial institutions is then transmitted to other sectors linked with the financial system and creates adverse economic shocks to the economy (Kleinow et al. 2017). These adverse shocks to the economy can trigger a collapse of the whole system, which is called systemic risk (Smaga 2014; Benoit et al. 2017).

Since the global financial crisis in 2008 and China’s stock market crisis of 2015–2016, there has been increasing analysis of the measures of and factors that enhance systemic risk. Several methods have been proposed to measure the systemic risk of the financial system (e.g., Lehar 2005; Adrian and Brunnermeier 2016; Pourkhanali et al. 2016; Liu 2017; Brownlees and Engle 2017; Acharya et al. 2017; Brunnermeier and Cheridito 2019 and Yun et al. 2019). Moreover, research has also been conducted to identify key financial institutions and firms that contribute more to systemic risk during distress (Vallascas and Keasey 2012 and Anginer et al. 2014). Several studies have also investigated the determinants of systemic risk and focus on firm-specific factors that enhance firms’ contribution to systemic risk (López-Espinosa et al. 2012; Engle et al. 2015; Cai et al. 2018 and De Mendonça and da Silva 2018). However, the literature has ignored the behavioral finance perspective, and few studies have explored the role of CEO overconfidence and behavioral biases. Overconfidence is an individual tendency to overestimate one’s abilities and actual performance. Overconfident CEOs may underrate risk and therefore take more risk, which may enhance the firm's contribution to systemic risk (Ben-David et al. 2013). Therefore, this study fills the gap in the literature and measures systemic risk and evaluates the effect of CEO overconfidence and other firm-level variables regarding systemic risk in China’s financial system.

This research paper contributes to the literature in several ways. First, to the best of the authors’ knowledge, no investigations focus on determining the impact of CEO overconfidence or firm-level factors on the systemic risk of China’s financial system. Second, this study separately measures banks’, financial services institutions’, and insurance companies' contribution to the systemic risk of the financial system. Third, this study evaluates the effect of firm-level factors of systemic risk on financial institutions in China. We measured systemic risk for state- and non-state-owned banks and financial services institutions and analyzed them separately. Empirical evidence regarding the systemic risk of state- and non-state-owned banks and financial services institutions may help policymakers and financial regulators reduce systemic risk in China.

This research helps illuminate the effect of CEO overconfidence and other firm-level factors on systemic risk. We calculate systemic risk for financial firms using the ∆CoVaR method proposed in the study of Adrian and Brunnermeier (2016). This study uses data from 84 financial institutions listed in the Shenzhen and Shanghai stock exchanges, and data are collected from the WIND data system for the 2004–2018 period. We employ a fixed effects panel regression analysis to determine the impact of CEO overconfidence and firm-level factors on China’s systemic risk.

The empirical results show the contribution of financial services firms to systemic risk to be higher in times of financial uncertainty than that of banks and insurance companies. Our results show that banks managed by overconfident CEOs enhance their contribution to systemic risk. This finding also reveals institution size to be statistically significantly associated with systemic risk. Furthermore, empirical findings show return on assets to have an inverse relation with systemic risk for banks and financial services institutions. The leverage enhances state-owned financial service institutions’, banks’, and insurance companies' contributions to systemic risk. Loan ratio is found to have positive influence on systemic risk in case of state-owned financial service institutions, non-state-owned banks, and insurance firms.

Our results are important for financial regulators and policymakers, as they identify systemically important institutions and factors that enhance a firm’s contribution to systemic risk. The empirical findings of this research may help financial regulators and policymakers construct financial regulations, and a regulatory framework created by considering the findings of this research study may help decrease systemic risk. The remainder of the paper is arranged as follows: the second part of the paper provides a review of the relevant existing literature, the third part explains the data sources and methodology adopted in this study, the fourth part explains and discusses the results, and the final part of the study provides the conclusion and policy recommendations.

Literature review

Several research studies have explored the determinants of systemic risk; Kleinow et al. (2017) conducted a research study to evaluate the determinants of systemic risk in the financial firms of Latin American countries. The results of their research show that firm size and market concentration are significant determinants of systemic risk. Similarly, a research study conducted by Gropp et al. (2011) showed firm size to be an essential determinant of systemic risk. Several other research studies have also explored the association between firm size and systemic risk, and their results show that firm size significantly predicts systemic risk (De Jonghe 2010; Haq and Heaney 2012; Hovakimian et al. 2012; Berger and Bouwman 2013; Zhang et al. 2015; Kleinow and Nell 2015; Pourkhanali et al. 2016; Liu 2017; Laeven et al. 2016; Brunnermeier and Cheridito 2019 and Brunnermeier et al. 2019).

Adrian and Brunnermeier (2016) conducted an empirical investigation to determine individual banks’ contribution to systemic risk. The results of their research study show that firm-level variables such as asset price booms, leverage, maturity mismatch, and bank size are significant determinants of systemic risk. Similarly, Laeven et al. (2016) examined the effect of firm size and capital on systemic risk. The results of their study show that bank size and systemic risk grow together, whereas bank capital is inversely related to systemic risk.

In the behavioral finance literature, several research studies have established the relation between corporate decision making and overconfidence. Malmendier and Tate (2005) investigated the effect of CEO overconfidence on financial decision making. The findings of their study show that overconfident CEOs view external funds as very expensive. Furthermore, for firms that rely on equity, the investments of overconfident CEOs are overly dependent on the firm's cash flows. Malmendier and Tate’s (2008) study showed that overconfident managers overestimate the firm’s ability to generate returns and, as a result, invest in risky projects and undertake poor mergers. Research studies show overconfident managers to be more money-oriented than non-overconfident managers (Ferris et al. 2013).

Studies conducted on financing decisions show that overconfidence has an impact on managers’ debt maturity choices (Wei et al. 2011; Huang et al. 2016; Ataullah et al. 2018). Landier and Thesmar's (2009) study showed that firms with overconfident CEOs prefer short-term debt to long-term debt. Similarly, the findings of the study conducted by Huang et al. (2016) show that overconfident CEOs prefer to take short-term debt, believing that they can increase stock value by overestimating the possibility of refinancing this short-term debt with low costs in the future. Studies also show that firms with overconfident CEOs overestimate their own and the firm’s ability to generate returns and meet liabilities and thus choose higher debt levels (Hackbarth 2009). Furthermore, studies have also shown that overconfident CEOs favor debt over equity, and firms with overconfident CEOs have significantly high leverage ratios (Malmendier et al. 2011). Similarly, He et al. (2019) investigated the relationship between internal financing and CEO overconfidence. Their findings reveal that internal financing can alleviate capital shortages and fund business opportunities, but firms with overconfident managers may engage in excessive investment. This problem of overinvestment is more significant for state-owned enterprises managed by overconfident managers. Several studies have shown that firms with overconfident CEOs are inclined to invest and take on risky projects because they overestimate their returns on these projects (Goel and Thakor 2008, Campbell et al. 2011 and Gervais et al. 2011).

Moreover, studies have also been carried out to evaluate the effect of CEO overconfidence on firms’ corporate activity, such as management forecasting (Hribar and Yang 2016), risk management (Adam et al. 2015), innovation (Hirshleifer et al. 2012), CEO turnover (Campbel et al. 2011), dividend policy (Deshmukh et al. 2013), R&D intensity (Wang et al. 2018), and audit fees (Duellman et al. 2015).

Despite the large number of studies on the effect of CEO overconfidence and financial decision making, few studies have explored the relationship between CEO overconfidence and risk for financial firms. Ho et al. (2016) investigated the effect of managerial overconfidence on bank risk-taking behavior during financial crises. They use stock market options as a measure of managerial overconfidence, and their results show that overconfident CEOs increase banks’ leverage and weaken their lending standards before crises and expose banks to more shocks in times of financial crisis. Similarly, Niu (2010) investigated the effect of managerial overconfidence and bank risk using press data as a measure of overconfidence and the standard deviation of stock returns as a measure of bank risk. The results of his study show that overconfident CEOs of banks take more risk than non-overconfident CEOs.

Lee et al. (2019) investigated the effect of CEO overconfidence on systemic risk for U.S. banks using data between 1995 and 2014. CEO overconfident was measured using stock-based options, and systemic risk was measured using three different methods. They computed systemic risk using the MES (marginal expected shortfall) method put forward by Acharya et al. (2017), the systemic risk index using Brownlees and Engle (2017), and the delta conditional value-at-risk measure of Adrian and Brunnermeier (2016). Their findings reveal that firms with overconfident CEOs contribute more to systemic risk than other firms. Moreover, their study also reveals that during times of financial distress, banks with overconfident CEOs contribute significantly more to systemic risk than other banks.

Liang et al. (2019) examined the effect of CEO overconfidence on the crash risk of non-state-owned institutions for 2000–2012. The results of their study show that firms with overconfident managers are more prone to stock price crashes than other firms. Furthermore, their findings show that this relation is particularly high for firms with low transparency.

Kim et al. (2016) investigated the effect of CEO overconfidence and stock price crash risk for the 1993–2010 period. Their findings reveal that overconfident CEOs are more vulnerable to stock crash risk than other CEOs. Moreover, the effect of CEO overconfidence on stock price crash risk is significantly more evident for organizations in which the CEO holds a dominant position in the organization and there is a significant difference of opinion among investors.

Data sources and theoretical framework

This paper studies the effect of CEO overconfidence and firm-level factors on the systemic risk of China’s financial system. The selected sample for this research includes 25 banks, 54 financial services institutions, and 5 insurance companies listed on the Shanghai and Shenzhen stock exchanges, indicated by a subscript “i”, for the period 2004–2018, indicated by a subscript “t”. Unlike previous studies, this study divides banks and financial services institutions into state- and non-state-ownedFootnote 1 institutions: the data consist of five state-owned and 20 non-state-owned banks and 31 state-owned and 23 non-state-owned financial services institutions. An earnings forecast-based proxy is used as a measure of CEO overconfidence (\(OC_{i,t} )\), and to measure systemic risk, we employed the \(\Delta CoVaR_{i,t}\) (delta conditional value-at-risk) method. The firm-level variables are the accounting data for the firm obtained from the Wind database. We use return on assets (\(ROA_{i,t}\)), which considers the firm’s profitability and is estimated as the net income to the total assets of the firm; firm size (\(Size_{i,t}\)) is calculated by taking the log of total assets; loan ratio (\(LR_{i,t}\)) is estimated as the total loans of the firm to total assets; and the leverage ratio (\(Lev_{i,t}\)) shows the firm’s ability to meet its liabilities and is estimated by dividing the firm's total liabilities by its total shareholder equity. The firms are selected based on the availability of data and are collected from the Wind database for the period from 2004Q1 to 2018Q4. A fixed effects panel regression analysis is employed to evaluate the effects of CEO overconfidence, firm-level factors, and systemic risk. Following Safi et al. (2020), the model specification for this study is given as:

The basic econometric equation for this study is given as:

The rationale for using the selected variables in the above equation is mainly due to strong theoretical motivation resulting from the past literature. In addition to Lee et al. (2019), the earlier studies of Haq and Heaney (2012), Hovakimian et al. (2012), Zhang et al. (2015), Kleinow and Nell (2015) Adrian and Brunnermeier (2016), Varotto and Zhao (2018), and Zeb and Rashid (2019) used firm-level determinants of systemic risk, ignoring overconfidence and the behavioral finance perspective. It is thus imperative to take into account the effect of CEO overconfidence and firm-level factors that may increase or decrease systemic risk in China.

Systemic risk measure

This study uses the ∆CoVaR method of Adrian and Brunnermeier (2016) to measure the contribution of individual financial firms to systemic risk. To calculate ∆CoVaR, we calculated the VaR (value-at-risk), given as alpha (α), which is the maximum loss within the given α%-confidence interval. CoVaR is an upgraded VaR that determines risk spillovers from financial firms and allows us to overcome idiosyncratic risk. We use the ∆CoVaR method to calculate the financial institution's contributions to systemic risk and calculate it by taking the difference between the CoVaR of financial intuitions “x” from the financial institution “i” that is in distress. We calculate ∆CoVaR for financial institutions using the formula given below:

∆CoVaR indicates the marginal contribution of the financial firm to the systemic risk of another firm when the firm is in distress rather than under normal conditions. To estimate ∆CoVaR, we calculate the VaR and CoVaR of banks, financial service institutions, and insurance companies in a normal situation and in a time of financial distress. We employ quantile regression, similar to the study of Adrian and Brunnermeier (2016), to calculate the relationship among the worst 1% and normal 50% quantiles of financial institutions’ return and the risk factors. To prevent the overfitting of the data, we choose a small number of risk factors. The risk factors are as follows: change in credit spread calculated by subtracting the corporate bond rate and the 10-year treasury bond rate, the change in the liquidity spread estimated by subtracting the 3-month treasury bills rate from federal funds rate, the change in the 3-month yield estimated as a variation in the 3-month treasury bill rate, equity volatility estimated as the standard deviation of daily returns, the change in yield spread estimated by subtracting the long-term from the 3-month treasury bond rate, and the equity return of the financial system. We calculate the returns of the financial institutions in the normal and distress situations. In this study, the 1% quantile is considered the worst condition, whereas the 50% quantile is considered the normal situation. To obtain the predicated VaR for the financial system, we calculate regression analysis separately for each financial company at the 1% and 50% quantile levels.

\(R_{t\left( q \right)}^{i}\) is the financial institution monthly market return, \(\alpha_{q}^{i}\) is a constant, and \(RE_{t}\) is a risk factor vector. Then, the regression values give \(\widehat{{VaR_{t}^{i} }}\left( q \right)\) at the 1% and 50% quantile levels.

\(\widehat{\alpha }_{q}^{i}\) and \(\beta_{q}^{i}\) are taken from Eq. (4). The intrinsic risk of each financial institution is estimated by the above regression equation; however, it does not consider the financial system state of stock returns. After estimating \(\widehat{{VaR_{t}^{i} }}\left( q \right)\) for each institution, the returns for the whole financial system are calculated using the following equation:

In Eq. (6), \(R_{t}^{m}\) are the monthly returns of the financial market, whereas \(MC_{i,t - 1}\) is the market capitalization of the financial system and is one month lagged. After this estimation, we calculate the regression at the quantile levels of 1% and 50%. The estimated value gives \(\widehat{{CoVaR_{t}^{mt} }}\left( q \right)\) at both the 1% quantile level and 50% quantile levels.

where \(\alpha_{q}^{m|i }\) is a constant, \(RE_{t}^{ }\) is the risk factor vector, \(R_{t}^{i}\) is the returns of financial institutions, and \(\varepsilon_{t}^{m|i }\) is the error term. To calculate systemic risk \(\widehat{\Delta CoVaR}\), we subtract the predicted CoVaR at the 1% and then at the 50% quantile levels. Moreover, \(\widehat{\Delta CoVaR}\) shows the marginal contribution of all financial institutions (financial services, insurance companies, and banks).

where \(\widehat{{CoVaR_{q}^{m|i} }}\left( q \right)\) is CoVaR predicted values and \(\hat{\alpha }_{q}^{m|i}\), \(\hat{\beta }_{q}^{m|i}\), and \(\hat{\vartheta }_{q}^{m|i}\) are taken from Eq. (7). After this, we calculated the marginal contribution of financial firms to systemic risk.

at 50%

Finally, \(\widehat{{CoVaR_{t}^{m|i} }}\left( q \right)\) represents the proportion at which each financial firm transmits risk to the whole financial system. Generally, \(\widehat{\Delta CoVaR}\) values are negative, as it is estimated from the worst 1% returns of financial firms (i.e., banks, financial services institutions, and insurance companies). As a result, we used the absolute values of \(\widehat{\Delta CoVaR}\) for interpretation. The greater the value of \(\widehat{\Delta CoVaR}\) is, the greater the contribution of the firm to systemic risk.

Overconfidence measure

It is challenging to measure psychological biases directly. CEO decisions and actions are taken as a proxy to measure their confidence. An overconfident CEO overvalues the future earnings of the firm, issues more debt, defers the execution of stock options, undertakes more mergers and acquisitions, and acquires more shares of their firm stocks than non-overconfident CEOs. This, in turn, contributes to risk (Ahmed and Duellman 2013; Huang and Kisgen 2013; Kim et al. 2016; Lee et al. 2019). Earlier studies have adopted different measures of CEO overconfidence, such as executive compensation (Jiang et al. 2009), corporate earnings forecasting (Wang et al. 2008; Hribar and Yang 2016 and He et al. 2019), CEOs’ shareholdings (Minggui et al. 2006; Hirshleifer et al. 2012), manager characteristics (gender, work experience, tenure, etc.), and the number of mergers and acquisitions undertaken by the CEO (Doukas and Petmezas 2007). Considering the measures and data availability for China’s securities market, we have adopted corporate earnings forecasts as our measure of CEO overconfidence, as suggested by the studies of Wang et al. (2008), Hribar and Yang (2016), and He et al. (2019). A CEO is regarded as overconfident if the actual earnings of the firm are lower than the expected/forecasted earnings of the firm. A dummy variable is created, and the value of “1” is given if the CEO is overconfident, and the value of “0” is given if the CEO is not overconfident.

Results and discussion

This section explains the results obtained from different econometric techniques. Table 1 shows the summary statics for systemic risk measured by ∆CoVaR. The table shows summary statistics for all financial institutions, banks, financial service institutions, and insurance companies. Statistics for state-owned and non-state-owned banks and financial services institutions are also given in the table. Higher mean values of ∆CoVaR indicate a greater contribution of the financial sector to systemic risk. The mean values in Table 1 suggest that financial services companies contribute more to systemic risk than banks and insurance companies. The values of ∆CoVaR also show that non-state-owned banks and financial services firms are more systematically important than state-owned banks and financial services firms, these results are also similar to the study of Wen, Wang & Zhou (2020). This means that non-state-owned banks and financial services firms are more sensitive and volatile to systemic risk. Insurance companies were found to have the least contribution to systemic risk.

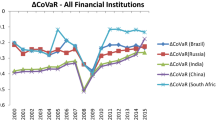

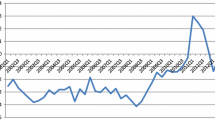

Figures 1, 2, 3, and 4 show the graphical representation of ∆CoVaR for financial firms and for state- and non-state-owned banks and financial services firms separately. The graphs show a rise in systemic risk in the global financial crisis of 2007–2008 and the Chinese stock market crisis of 2015–2016. In the 2007–2008 financial crisis, banks contributed more to systemic risk than financial service firms. In contrast, in the 2015–2016 Chinese stock market crisis, financial services institutions contributed more to systemic risk than banks and insurance companies.

Regression analysis

This section explains the fixed effects regression estimations that are obtained to evaluate the effect of overconfidence and firm-level determinants on systemic risk. We used a fixed effects regression analysis for banks, financial services, and insurance companies. We separately check the impact of overconfidence and firm-level factors on systemic risk for all banks and state- and non-state-owned banks. Table 2 shows the fixed effects analysis for all banks and state- and non-state-owned banks. Table 3 shows the results for all financial intuitions, state-owned financial intuitions, non-state-owned financial intuitions, and insurance companies. Because there are a limited number of insurance companies, they are not divided into subcategories. The values of the F-statistic and adjusted R-square show that the model has a good fit to the data.

Table 2 shows that CEO overconfidence has a significantly positive impact on the banking sector and state- and non-state-owned banks’ systemic risk. This finding implies that banks that are managed by overconfident CEOs have a high contribution to systemic risk. These findings are similar to those of Lee et al. (2019) and can also be explained by a behavioral finance theory that argues that firms managed by overconfident CEOs will contribute more towards systemic risk, as overconfident CEOs underrate risk, overestimate their performance, and therefore take on risky projects (Ben-David et al. 2013).

The findings show that return on assets has an inverse effect on the systemic risk of all banks overall and state-owned banks, whereas for non-state-owned banks, the result is negative but insignificant. Return on assets is predicted to have an inverse effect on systemic risk, as firms that perform well are usually less risky than others. These findings are in line with Lee et al. (2019). The results show a positive effect of firm size on systemic risk in the case of banks, which means that the larger the size of the bank, the greater its contribution to systemic risk. Our findings are similar to those of De Jonghe (2010), Haq and Heaney (2012), Hovakimian et al. (2012), Zhang et al. (2015), Kleinow and Nell (2015), Adrian and Brunnermeier (2016), Varotto and Zhao (2018), and Zeb and Rashid (2019).

Moreover, our results show that the loan ratio has a positive effect on systemic risk in the case of non-state-owned banks; this finding implies that an increase in loans will increase the firm’s contribution to systemic risk. A high volume of loans indicates the firm’s inability to diversify risk and results in increased systemic risk. Our findings are supported by the studies of Vukovic and Domazet (2013) and Zeb and Rashid (2019). The leverage ratio is estimated to have a positive impact on systemic risk. A high leverage value indicates overinvestment and a high probability of default; it also shows a firm’s risk-taking behavior that may lead to systemic risk. The leverage ratio for banks overall and for non-state-owned banks has a significant positive effect on systemic risk. The leverage ratio is included in the Basel IIIFootnote 2 financial regulations, and the results are also in accordance with the research study of Zeb and Rashid (2019).

Table 3 shows the results for financial institutions, state-owned financial institutions, and non-state-owned financial and insurance companies. The results of the study show an insignificant relationship between overconfidence and systemic risk for financial institutions. The reason for this finding could be low or no competition in the non-banking financial system, as it is protected and isolated from competition by the Chinese government (Cheng and Degryse, 2010). The results for the firm-level variable show that return on assets is significantly negatively related to systemic risk. These findings mean that well-performing firms contribute less to systemic risk than other firms. Firm size has a positive effect on systemic risk, which implies that large financial institutions contribute more to systemic risk than small institutions. The loan ratio is positively significantly associated with systemic risk in the case of state-owned financial institutions only. This finding shows that the leverage ratio has a positive effect on systemic risk and indicates that a firm that has high leverage contributes more towards systemic risk than firms with low leverage. The results of this study are similar to the findings of Zeb and Rashid (2019).

The results for insurance companies show that CEO overconfidence, firm size, the loan ratio, and leverage have a significant and positive association with systemic risk. These findings are supported by previous research studies of De Jonghe (2010) and Lee et al. (2019). In contrast, return on assets was found to be negative but insignificant.

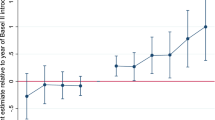

Robustness test analysis

To further validate the results, following Xie et al. (2020), we employ the two-stage least squares (2SLS) method and adopt the instrumental variable technique to determine the relationship between the dependent and independent variables. We use the province average of CEOs overconfidence as an instrumental variable. The results in Table 4 show that banks and insurance firms with overconfident CEOs make a greater contribution to systemic risk than those with non-overconfident CEOs. The results of the 2SLS method further validate the results previously obtained using fixed effects regression analysis.

Conclusions and policy recommendations

Due to the high economic and social costs of systemic risk, firms, financial regulators, and policymakers are worried about its influence on the financial system. Systemic risk affects economic activities in a country and has a significant impact on the credit supply in the economy, which leads to a decrease in investment that in turn affects consumption and employment. Therefore, this research investigates financial institutions' contribution to the systemic risk of China’s financial system. The paper also evaluates the effect of CEO overconfidence and firm-level factors on the systemic risk of all banks, state- and non-state-owned banks, all financial service firms, state- and non-state-owned financial service institutions, and insurance firms. The results of our research show that financial services firms contribute more to systemic risk in times of financial instability than banks and insurance companies. This finding reveals that banks managed by overconfident CEOs contribute more to systemic risk than those managed by non-overconfident CEOs. The results confirm that overconfident CEOs in the banking sector will increase systemic risk in times of financial distress. The findings on the effects of firm-level factors on systemic risk show that firm size statistically significantly explains systemic risk in the case of banks, financial services, and insurance companies. Furthermore, the empirical findings show that for banks, return on assets has a significant and negative effect on systemic risk in the case of all banks and state-owned banks. The leverage ratio has a significantly positive impact on systemic risk for banks and non-state-owned banks. The loan ratio is also found to be positively associated with systemic risk for non-state-owned banks. For financial services institutions, return on assets has an inverse relationship with the systemic risk of state-owned financial service firms. The loan ratio enhances the firm’s contributions to systemic risk in the case of state-owned institutions. Similarly, the leverage ratio also has a significant and positive effect on systemic risk in the case of financial service firms. The results for insurance companies show that CEO overconfidence, firm size, the loan ratio, and leverage are positively related to systemic risk.

The results of this study have important policy implications, as this study measures and identifies key factors that enhance systemic risk. Moreover, this study shows the trends and systemically important financial institutions. The results do not imply that firms should avoid overconfident CEOs, as studies have shown that overconfident CEOs are innovative and beneficial for the firm (Kim et al. 2016). However, firms, policymakers, and regulators should introduce certain mechanisms, such as conservative accounting policies, to keep CEOs in check and restrain them from overestimating or underestimating projects to decrease the influence of CEO overconfidence on systemic risk in China. Furthermore, the study also supports the view that big financial institutions contribute more to systemic risk and in order to mitigate the impact of size on systemic risk, policymakers and financial regulators should tighten the rules for financial institutions, such as the capital requirements, as suggested by Stein (2013). A regulatory framework created considering the findings of this research study may help decrease systemic risk in the financial system.

Future research can take into account the role CEO power, age, and incentive compensation and determine their impacts on systemic risk. Moreover, future research can also examine the role of female CEOs and/or directors and whether female CEOs help decrease systemic risk (see, e.g., Shahab et al. 2020). Future studies can also examine the role of organizational culture in systemic risk.

Notes

Non-state-owned institutions include public enterprises, foreign companies, and private enterprises.

Basel III is a committee formed to supervise and regulate banks.

References

Acharya, V.V., L.H. Pedersen, T. Philippon, and M. Richardson. 2017. Measuring systemic risk. The Review of Financial Studies 30 (1): 2–47.

Adam, T.R., C.S. Fernando, and E. Golubeva. 2015. Managerial overconfidence and corporate risk management. Journal of Banking & Finance 60: 195–208.

Adrian, T., and M.K. Brunnermeier. 2016. CoVaR. The American Economic Review 106 (7): 1705.

Ahmed, A.S., and S. Duellman. 2013. Managerial overconfidence and accounting conservatism. Journal of Accounting Research 51 (1): 1–30.

Allen, F., and E. Carletti. 2013. What is systemic risk? Journal of Money, Credit and Banking 45 (s1): 121–127.

Anginer, D., A. Demirguc-Kunt, and M. Zhu. 2014. How does competition affect bank systemic risk? Journal of financial Intermediation 23 (1): 1–26.

Ataullah, A., A. Vivian, and B. Xu. 2018. Time-varying managerial overconfidence and corporate debt maturity structure. The European Journal of Finance 24 (2): 157–181.

Ben-David, I., J.R. Graham, and C.R. Harvey. 2013. Managerial miscalibration. The Quarterly Journal of Economics 128 (4): 1547–1584.

Benoit, S., J.E. Colliard, C. Hurlin, and C. Pérignon. 2017. Where the risks lie: A survey on systemic risk. Review of Finance 21 (1): 109–152.

Berger, A.N., and C.H. Bouwman. 2013. How does capital affect bank performance during financial crises? Journal of Financial Economics 109 (1): 146–176.

Black, L.K., and L.N. Hazelwood. 2013. The effect of TARP on bank risk-taking. Journal of Financial Stability 9 (4): 790–803.

Brown, R., and N. Sarma. 2007. CEO overconfidence, CEO dominance and corporate acquisitions. Journal of Economics and business 59 (5): 358–379.

Brownlees, C., and R.F. Engle. 2017. SRISK: A conditional capital shortfall measure of systemic risk. The Review of Financial Studies 30 (1): 48–79.

Brunnermeier, M.K., and P. Cheridito. 2019. Measuring and allocating systemic risk. Risks 7 (2): 46.

Brunnermeier, M.K., G.N. Dong, and D. Palia. 2019. Banks' non-interest income and systemic risk. Available at SSRN 3328890.

Cai, J., F. Eidam, A. Saunders, and S. Steffen. 2018. Syndication, interconnectedness, and systemic risk. Journal of Financial Stability 34: 105–120.

Campbell, T.C., M. Gallmeyer, S.A. Johnson, J. Rutherford, and B.W. Stanley. 2011. CEO optimism and forced turnover. Journal of Financial Economics 101 (3): 695–712.

Cheng, X., and H. Degryse. 2010. The impact of bank and non-bank financial institutions on local economic growth in China. Journal of Financial Services Research 37 (2–3): 179–199.

De Jonghe, O. 2010. Back to the basics in banking? A micro-analysis of banking system stability. Journal of financial intermediation 19 (3): 387–417.

De Jonghe, O., M. Diepstraten, and G. Schepens. 2015. Banks’ size, scope and systemic risk: What role for conflicts of interest? Journal of Banking & Finance 61: S3–S13.

de Mendonça, H.F., and R.B. da Silva. 2018. Effect of banking and macroeconomic variables on systemic risk: An application of ΔCOVAR for an emerging economy. The North American Journal of Economics and Finance 43: 141–157.

Deshmukh, S., A.M. Goel, and K.M. Howe. 2013. CEO overconfidence and dividend policy. Journal of Financial Intermediation 22 (3): 440–463.

Doukas, J.A., and D. Petmezas. 2007. Acquisitions, overconfident managers and self-attribution bias. European Financial Management 13 (3): 531–577.

Duellman, S., H. Hurwitz, and Y. Sun. 2015. Managerial overconfidence and audit fees. Journal of Contemporary Accounting & Economics 11 (2): 148–165.

Engle, R., E. Jondeau, and M. Rockinger. 2015. Systemic risk in Europe. Review of Finance 19 (1): 145–190.

Ferris, S.P., N. Jayaraman, and S. Sabherwal. 2013. CEO overconfidence and international merger and acquisition activity. Journal of Financial and Quantitative Analysis 48 (1): 137–164.

Gervais, S., J.B. Heaton, and T. Odean. 2011. Overconfidence, compensation contracts, and capital budgeting. The Journal of Finance 66 (5): 1735–1777.

Goel, A.M., and A.V. Thakor. 2008. Overconfidence, CEO selection, and corporate governance. The Journal of Finance 63 (6): 2737–2784.

Gropp, R., H. Hakenes, and I. Schnabel. 2011. Competition, risk-shifting, and public bail-out policies. The Review of Financial Studies 24 (6): 2084–2120.

Hackbarth, D. 2009. Determinants of corporate borrowing: A behavioral perspective. Journal of Corporate Finance 15 (4): 389–411.

Haq, M., and R. Heaney. 2012. Factors determining European bank risk. Journal of International Financial Markets, Institutions and Money 22 (4): 696–718.

Hayward, M.L., and D.C. Hambrick. 1997. Explaining the premiums paid for large acquisitions: Evidence of CEO hubris. Administrative Science Quarterly 42 (1): 103–127.

He, Y., C. Chen, and Y. Hu. 2019. Managerial overconfidence, internal financing, and investment efficiency: Evidence from China. Research in International Business and Finance 47: 501–510.

Hirshleifer, D., A. Low, and S.H. Teoh. 2012. Are overconfident CEOs better innovators? The Journal of Finance 67 (4): 1457–1498.

Ho, P.H., C.W. Huang, C.Y. Lin, and J.F. Yen. 2016. CEO overconfidence and financial crisis: Evidence from bank lending and leverage. Journal of Financial Economics 120 (1): 194–209.

Hovakimian, A., E.J. Kane, and L. Laeven. 2012. Variation in systemic risk at US banks during 1974–2010. National Bureau of Economic Research.

Hribar, P., and H. Yang. 2016. CEO overconfidence and management forecasting. Contemporary accounting research 33 (1): 204–227.

Huang, J., and D.J. Kisgen. 2013. Gender and corporate finance: Are male executives overconfident relative to female executives? Journal of financial Economics 108 (3): 822–839.

Huang, R., K.J.K. Tan, and R.W. Faff. 2016. CEO overconfidence and corporate debt maturity. Journal of Corporate Finance 36: 93–110.

Jiang, F.X., M. Zhang, Z.F. Lu, and C.D. Chen. 2009. Managerial overconfidence, firm expansion and financial distress. Economic Research Journal 1: 131–143.

Kim, J.B., Z. Wang, and L. Zhang. 2016. CEO overconfidence and stock price crash risk. Contemporary Accounting Research 33 (4): 1720–1749.

Kleinow, J., and T. Nell. 2015. Determinants of systemically important banks: the case of Europe. Journal of Financial Economic Policy 7 (4): 444–476.

Kleinow, J., F. Moreira, S. Strobl, and S. Vähämaa. 2017. Measuring systemic risk: A comparison of alternative market-based approaches. Finance Research Letters 21: 40–46.

Laeven, L., L. Ratnovski, and H. Tong. 2016. Bank size, capital, and systemic risk: Some international evidence. Journal of Banking & Finance 69: S25–S34.

Landier, A., and D. Thesmar. 2008. Financial contracting with optimistic entrepreneurs. The Review of Financial Studies 22 (1): 117–150.

Lee, J.P., E.M. Lin, J.J. Lin, and Y. Zhao. 2019. Bank systemic risk and CEO overconfidence. The North American Journal of Economics and Finance 54: 100946.

Lehar, A. 2005. Measuring systemic risk: A risk management approach. Journal of Banking & Finance 29 (10): 2577–2603.

Liang, Q., L. Ling, J. Tang, H. Zeng, and M. Zhuang. 2019. Managerial overconfidence, firm transparency, and stock price crash risk. China Finance Review International 10 (3): 271–296.

Liu, X. 2017. Measuring systemic risk with regime switching in tails. Economic Modelling 67: 55–72.

López-Espinosa, G., A. Moreno, A. Rubia, and L. Valderrama. 2012. Short-term wholesale funding and systemic risk: A global CoVaR approach. Journal of Banking & Finance 36 (12): 3150–3162.

López-Espinosa, G., A. Rubia, L. Valderrama, and M. Antón. 2013. Good for one, bad for all: Determinants of individual versus systemic risk. Journal of Financial Stability 9 (3): 287–299.

Malmendier, U., and G. Tate. 2005. CEO overconfidence and corporate investment. The Journal of Finance 60 (6): 2661–2700.

Malmendier, U., and G. Tate. 2008. Who makes acquisitions? CEO overconfidence and the market’s reaction. Journal of financial Economics 89 (1): 20–43.

Malmendier, U., G. Tate, and J. Yan. 2011. Overconfidence and early-life experiences: The effect of managerial traits on corporate financial policies. The Journal of Finance 66 (5): 1687–1733.

Minggui, Y., X. Xinping, and Z. Zhensong. 2006. The relationship between managers’ overconfidence and enterprises’ radical behavior in incurring debts. Management World 8: 358–379.

Niu, J. 2010. The effect of CEO overconfidence on bank risk taking. Economics Bulletin 30 (4): 3288–3299.

Pourkhanali, A., J.M. Kim, L. Tafakori, and F.A. Fard. 2016. Measuring systemic risk using vine-copula. Economic modelling 53: 63–74.

Safi, A., Y. Chen, S. Wahab, S. Ali, X. Yi, and M. Imran. 2020. Financial instability and consumption-based carbon emission in E-7 countries: The role of trade and economic growth. Sustainable Production and Consumption. https://doi.org/10.1016/j.spc.2020.10.034.

Shahab, Y., C.G. Ntim, F. Ullah, C. Yugang, and Z. Ye. 2020. CEO power and stock price crash risk in China: Do female directors’ critical mass and ownership structure matter? International Review of Financial Analysis 68: 101457.

Smaga, P. 2014. The concept of systemic risk. Systemic Risk Centre Special Paper, (5).

Sornette, D., G. Demos, Q. Zhang, P. Cauwels, V. Filimonov, and Q. Zhang. 2015. Real-time prediction and post-mortem analysis of the Shanghai 2015 stock market bubble and crash. Swiss Finance Institute Research Paper, (15–31).

Stein, Roger M. 2013. Aligning models and data for systemic risk analysis. Handbook of Systemic Risk: 37–65.

Vallascas, F., and K. Keasey. 2012. Bank resilience to systemic shocks and the stability of banking systems: Small is beautiful. Journal of International Money and Finance 31 (6): 1745–1776.

Varotto, S., and L. Zhao. 2018. Systemic risk and bank size. Journal of International Money and Finance 82: 45–70.

Vuković, V., and I. Domazet. 2013. Non-performing loans and systemic risk: Comparative analysis of Serbia and countries in transition CESEE. Industrija 41 (4): 59–73.

Wang, D., D. Sutherland, L. Ning, Y. Wang, and X. Pan. 2018. Exploring the influence of political connections and managerial overconfidence on R&D intensity in China’s large-scale private sector firms. Technovation 69: 40–53.

Wang, X., M. Zhang, and F.S. Yu. 2008. CEO overconfidence and distortion of firms’ investments: Some empirical evidence from China. Journal of NaiKai business review 2: 77–83.

Wei, J., X. Min, and Y. Jiaxing. 2011. Managerial overconfidence and debt maturity structure of firms. China Finance Review International 1 (3): 262–279.

Wen, F., K. Weng, and W.X. Zhou. 2020. Measuring the contribution of Chinese financial institutions to systemic risk: An extended asymmetric CoVaR approach. Risk Management 22: 310–337. https://doi.org/10.1057/s41283-020-00064-1.

World Bank Group. 2017. World development indicators 2017. World Bank. https://databank.worldbank.org/source/world-development-indicators

Xie, W., C. Ye, T. Wang, and Q. Shen. 2020. M&A goodwill, information asymmetry and stock price crash risk. Economic Research-Ekonomska Istraživanja 33 (1): 3385–3405.

Zeb, S., and A. Rashid. 2019. Systemic risk in financial institutions of BRICS: Measurement and identification of firm-specific determinants. Risk Management 21 (4): 243–264.

Zhang, Q., F. Vallascas, K. Keasey, and C.X. Cai. 2015. Are market-based measures of global systemic importance of financial institutions useful to regulators and supervisors? Journal of Money, Credit and Banking 47 (7): 1403–1442.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Safi, A., Yi, X., Wahab, S. et al. CEO overconfidence, firm-specific factors, and systemic risk: evidence from China. Risk Manag 23, 30–47 (2021). https://doi.org/10.1057/s41283-021-00066-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41283-021-00066-7