Abstract

This paper considers the investment decision of a firm where it has to decide about the timing and capacity. We obtain that in a fast-growing market, right after investment the firm produces below capacity, where the utilization rate (the proportion of capacity that is used for production right after the investment) increases with market uncertainty for a very big market trend, and shows no monotonicity for a moderately large market trend. On the other hand, we get that, for a slowly growing or shrinking market, the firm produces up to capacity right after investment. In the intermediate case, the firm produces up to capacity right after investment when uncertainty is low and below capacity when uncertainty is high, whereas the utilization rate decreases with the market uncertainty.

Similar content being viewed by others

Notes

The definitions of small, intermediate and large market trend, and examples of very large and moderately large market trends can be found in Section 4.2.

Note that we allow for \(r < c/\delta \).

Note that with this demand function, the optimal capacity size is always below \(1/(2 \gamma )\).

From “Proof of \(\partial \mathcal {F}(\theta , K) / \partial K < 0\) ” section, \(\beta _1 > 1\), \(\beta _2 < 0\), and \(F(\beta _2) >0\).

References

Adkins R and Paxson D (2012). Real input–output energy-switching options. Journal of Energy Markets 5(3):3–22.

Aguerrevere FL (2003). Equilibrium investment strategies and output price behavior: a real-options approach. Review of Financial Studies 16(4):1239–1272.

Anupindi R and Jiang L (2008). Capacity investment under postponement strategies, market competition, and demand uncertainty. Management Science 54(11):1876–1890.

Bar-Ilan A and Strange WC (1999). The timing and intensity of investment. Journal of Macroeconomics 21(1):57–77.

Brennan MJ and Schwartz ES (1985). Determinants of gnma mortgage prices. Real Estate Economics 13(3):209–228.

Chod J and Rudi N (2005). Resource flexibility with responsive pricing. Operations Research 53(3):532–548.

Dangl T (1999). Investment and capacity choice under uncertain demand. European Journal of Operational Research 117(3):415–428.

Dixit AK and Pindyck RS (1994). Investment Under Uncertainty. Princeton University Press, Princeton.

Fontes DB (2008). Fixed versus flexible production systems: a real options analysis. European Journal of Operational Research 188(1):169–184.

Hagspiel V, Huisman KJ and Kort PM (2016). Volume flexibility and capacity investment under demand uncertainty. International Journal of Production Economics 178:95–108.

He H and Pindyck RS (1992). Investments in flexible production capacity. Journal of Economic Dynamics and Control 16(3):575–599.

Huisman KJ and Kort PM (2015). Strategic capacity investment under uncertainty. The RAND Journal of Economics 46(2):376–408.

Manne AS (1961). Capacity expansion and probabilistic growth. Econometrica 29(4):632–649.

McDonald RL and Siegel DR (1985). Investment and the valuation of firms when there is an option to shut down. International Economic Review 26(2): 331–349.

Pindyck RS (1988). Irreversible investment, capacity choice, and the value of the firm. American Economic Review 78(5):969–85.

Sethi AK and Sethi SP (1990). Flexibility in manufacturing: a survey. International Journal of Flexible Manufacturing Systems 2(4):289–328.

Shibata T and Nishihara M (2015). Investment-based financing constraints and debt renegotiation. Journal of Banking & Finance 51:79–92.

Statista (2015). Global pc shipments from 1st quarter 2009 to 2nd quarter 2015, by vendor (in million units). http://www.statista.com/statistics/263393/global-pc-shipments-since-1st-quarter-2009-by-vendor/, [Online; accessed 9-September-2015].

Trigeorgis L (1996). Real Options: Managerial Flexibility and Strategy in Resource Allocation. MIT Press, Cambridge.

Van Mieghem JA and Dada M (1999). Price versus production postponement: capacity and competition. Management Science 45(12):1639–1649.

Wu J (2007). Capacity Preemption and Leadership Contest in a Market with Uncertainty. Tech. rep., working paper, University of Arizona, Tucson, Arizona, The United States of America.

Acknowledgements

The authors would like to thank the anonymous referee and Verena Hagspiel for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

1.1 Identification of \(L\left( K \right) \), \(M_1 \left( K \right) \), \(M_2\) and \(N \left( K \right) \)

Given the value function in different regions and according to the value matching and smooth pasting conditions at \(\theta _1 = c\) and \(\theta _2 = \frac{c}{1 - 2 \gamma K}\), it holds that

Take

\(M_1 \left( K \right) \) can be derived from (23) and (24) as

We get \(L\left( K\right) \) from (21) as

From (23), we get \(N \left( K \right) \) as

1.2 Proof of Proposition 2

The proof of Proposition 2 consists of two parts. The first part derives the optimal investment timing and investment capacity for producing below and producing up to capacity right after the investment. The second part derives conditions when the firm will produce up to or below capacity right after the investment.

1.2.1 Derivation of optimal investment timing and capacity

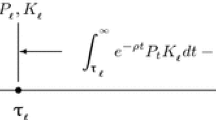

First, for any \(\theta >0\) find the optimal value of the investment capacity, \(K(\theta )\), that maximizes the option value minus the cost of investment \(V(\theta , K) - \delta K\). Then the optimal investment timing \(\theta ^*\) is derived by using this optimal value. For \(\theta < \theta ^*\), assume the value of the investment option in the continuation region is \(A \theta ^{\beta _1}\). According to value matching and smooth pasting conditions at \(\theta ^*\), we have

so \(\theta ^*\) is a solution of the equation

because

-

If the firm does not produce right after the investment, then \(K(\theta )\) should maximize \(V(\theta , K) - \delta K\), which is

$$\begin{aligned} \frac{c^{1-\beta _1} \theta ^{\beta _1} \left[ 1 - \left( 1 - 2 \gamma K \right) ^{1 +\beta _1}\right] }{4 \gamma \left( \beta _1 - \beta _2 \right) }F \left( \beta _2 \right) - \delta K. \end{aligned}$$The first-order condition implies

$$\begin{aligned} \frac{\left( 1 + \beta _1 \right) F\left( \beta _2 \right) c ^{1 - \beta _1} \left( 1 - 2 \gamma K \left( \theta \right) \right) ^{\beta _1}}{2 \left( \beta _1 - \beta _2 \right) } \theta ^{\beta _1} - \delta = 0 . \end{aligned}$$Then

$$\begin{aligned} K \left( \theta \right) = \frac{1}{2 \gamma } \left[ 1 - \frac{c}{\theta } \left[ \frac{2 \delta \left( \beta _1 - \beta _2 \right) }{c \left( 1 + \beta _1 \right) F \left( \beta _2 \right) } \right] ^{\frac{1}{\beta _1}} \right] . \end{aligned}$$(29)The second-order partial derivative with respect to K is negative,Footnote 4 so there is a global maximum for \(V(\theta , K) - \delta K\) when the firm does not produce right after the investment.

Determine the optimal investment timing \(\theta ^*\) according to (28), then \(\theta ^*\) is the solution for the following equation,

$$\begin{aligned}&\frac{c^{1-\beta _1} \theta ^{\beta _1} \left[ 1 - \left( 1 - 2 \gamma K(\theta ) \right) ^{1 +\beta _1}\right] }{4 \gamma \left( \beta _1 - \beta _2 \right) }F \left( \beta _2 \right) - \delta K(\theta ) \\&\quad = \frac{c^{1-\beta _1} \theta ^{\beta _1} \left[ 1 - \left( 1 - 2 \gamma K(\theta ) \right) ^{1 +\beta _1}\right] }{4 \gamma (\beta _1 - \beta _2)} F(\beta _2), \end{aligned}$$which is equivalent to \(K(\theta ^*) = 0\), contradicting the assumption that firm invests but does not produce right after investment. So the firm does not invest if there is no production right after the investment.

-

If the firm produces below capacity right after the investment, then the option value of the project is

$$\begin{aligned} V \left( \theta , K \right) = M_1\left( K \right) \theta ^{\beta _1} + M_2 \theta ^{\beta _2} + \frac{\theta }{4 \gamma \left( r - \alpha \right) } - \frac{2c}{4 \gamma r} + \frac{c^2}{4 \gamma \left( r + \alpha - \sigma ^2 \right) \theta }, \end{aligned}$$with \(M_1(K)\), \(M_2\) as in (26) and (25). The first-order partial derivative of \(V \left( \theta , K \right) - \delta K\) with respect to K equal to 0 gives \(K \left( \theta \right) \), the same as (29). Because the second-order partial derivative of \(V(\theta , K) - \delta K\) with respect to K is negative, there is a global maximum at \(K\left( \theta \right) \).

Next, we determine the optimal investment timing \(\theta ^*\). If (28) has admissible solutions, then we get

$$\begin{aligned}&M_1 \left( K \left( \theta ^* \right) \right) \theta ^{*\beta _1} + M_2 \theta ^{* \beta _2} + \frac{\theta ^*}{4 \gamma \left( r - \alpha \right) } - \frac{2c}{4 \gamma r} + \frac{c^2}{4 \gamma \left( r + \alpha - \sigma ^2 \right) \theta ^*} - \delta K\left( \theta ^* \right) \\&\quad = \frac{\theta ^*}{\beta _1} \left[ \frac{\partial V \left( \theta ^*, K \left( \theta ^* \right) \right) }{\partial \theta } + \frac{\partial V \left( \theta ^*, K \left( \theta ^* \right) \right) }{\partial K} \frac{d K \left( \theta ^* \right) }{d \theta } \right] \\&\quad = \frac{\theta ^*}{\beta _1} \left[ \beta _1 M_1 \left( K \left( \theta ^* \right) \right) \theta ^{* \beta _1 - 1} + \beta _2 M_2 \theta ^{ * \beta _2 - 1} + \frac{1}{4 \gamma \left( r - \alpha \right) } - \frac{c^2}{4 \gamma \left( r + \alpha - \sigma ^2 \right) \theta ^{* 2}} \right] \\&\quad = M_1 \left( K \left( \theta ^* \right) \right) \theta ^{* \beta _1} + \frac{\beta _2}{\beta _1} M_2 \theta ^{* \beta _2} + \frac{\theta ^*}{4 \gamma \beta _1 \left( r - \alpha \right) } - \frac{c^2}{4 \gamma \beta _1 \left( r + \alpha - \sigma ^2 \right) \theta ^*} . \end{aligned}$$So \(\theta ^*\) should satisfy the implicit expression

$$\begin{aligned}&\frac{\beta _1 - \beta _2}{\beta _1} M_2 \theta ^{* \beta _2} - \delta K\left( \theta ^* \right) \\&\quad + \frac{1}{4 \gamma } \left[ \frac{\beta _1 - 1}{\beta _1} \frac{\theta ^*}{r - \alpha } - \frac{2c}{r} + \frac{ \beta _1 + 1}{\beta _1} \frac{c^2}{\left( r + \alpha - \sigma ^2 \right) \theta ^*}\right] = 0 . \end{aligned}$$In case the derived \(K\left( \theta ^* \right) \) is such that \(K\left( \theta ^* \right) \le \frac{\theta ^* - c}{2 \gamma \theta ^*}\), i.e., the capacity is not bigger than the optimal output, then it contradicts that the firm produces below capacity right after the investment. Thus, the firm would not invest for this case.

-

If the firm produces up to capacity right after the investment, then the value of the project is

$$\begin{aligned} V \left( \theta , K \right) = N \left( K \right) \theta ^{\beta _2} + \frac{\left( 1- \gamma K \right) K }{r - \alpha } \theta - \frac{c K }{r}, \end{aligned}$$where \(N \left( K \right) \) is as in (27). The first-order condition of \(V \left( \theta , K \right) - \delta K\) with respect to K implies that the optimal value for capacity, \(K\left( \theta \right) \), should implicitly satisfy

$$\begin{aligned} \frac{\left( \beta _2 + 1 \right) F\left( \beta _1 \right) }{2 \left( \beta _1 - \beta _2 \right) } \frac{\left( 1 - 2 \gamma K(\theta ) \right) ^{\beta _2}}{c^{\beta _2-1}} \theta ^{\beta _2} + \frac{1 - 2 \gamma K\left( \theta \right) }{r - \alpha } \theta - \frac{c}{r} - \delta = 0. \end{aligned}$$(30)In order to check the second-order partial derivative of \(V \left( \theta , K \right) - \delta K\) with respect to K, we let

$$\begin{aligned} \mathcal {F}\left( \theta , K \right)&= \frac{d N \left( K \right) }{d K} \theta ^{\beta _2} + \frac{1 - 2 \gamma K}{r - \alpha } \theta - \frac{c}{r} - \delta \\&= \frac{F\left( \beta _1 \right) c^{1-\beta _2}\left( \beta _2 + 1 \right) }{2 \left( \beta _1 - \beta _2 \right) } \left( 1 - 2 \gamma K \right) ^{\beta _2} \theta ^{\beta _2}+ \frac{1 - 2 \gamma K}{r - \alpha } \theta - \frac{c}{r} - \delta , \end{aligned}$$and from Appendix 2,

$$\begin{aligned} \frac{\partial \mathcal {F} \left( \theta , K \right) }{\partial K} < 0 . \end{aligned}$$So the second-order partial derivative of \(V \left( \theta , K \right) - \delta K\) with respect to K is negative, implying if equation (30) has an admissible solution, there is a maximum \(V \left( \theta , K \left( \theta \right) \right) - \delta K \left( \theta \right) \). If (30) does not have any admissible solution, then \(V \left( \theta , K \right) - \delta K\) is increasing or decreasing with K, and the firm would not invest for this case. We can rule out the increasing case, because it implies more capacity is better. Particularly, capacity that is bigger than \((\theta - c)/(2 \gamma \theta )\) is better. This suggests the firm should invest for the case of producing below capacity right after the investment. For the decreasing case, it implies that the optimal investment capacity is 0, we can also rule out the decreasing case.

If (28) has admissible solutions, then the optimal investment threshold \(\theta ^*\) is the solution of the following equation,

$$\begin{aligned}&N\left( K \left( \theta \right) \right) \theta ^{ \beta _2} + \frac{\left( 1 - \gamma K \left( \theta \right) \right) K \left( \theta \right) }{r - \alpha } \theta - \frac{c K \left( \theta \right) }{r} - \delta K \left( \theta \right) \\&\quad = \frac{\theta }{\beta _1}\left[ \beta _2 N \left( K \left( \theta \right) \right) \theta ^{ \beta _2 - 1} + \frac{\left( 1 - \gamma K \left( \theta \right) \right) K \left( \theta \right) }{r - \alpha } \right] . \end{aligned}$$Rearranging terms gives that \(\theta ^*\) implicitly satisfies

$$\begin{aligned}&\frac{\beta _1 - \beta _2}{\beta _1}N \left( K \left( \theta ^* \right) \right) \theta ^{* \beta _2} + \frac{\beta _1 - 1}{\beta _1} \frac{\left( 1 - \gamma K \left( \theta ^* \right) \right) K \left( \theta ^* \right) \theta ^*}{r - \alpha } \\&\quad - \frac{c K \left( \theta ^* \right) }{r} - \delta K \left( \theta ^* \right) = 0 . \end{aligned}$$If this equation does not give any admissible solution or gives a solution that is smaller than c, or \(K \left( \theta ^* \right) > (\theta ^* - c)/(2 \gamma \theta ^*)\), then the firm would not invest in this case.

1.2.2 Derivation of conditions for producing up to or below capacity right after the investment

If the firm produces below capacity right after the investment (Region 2), then for \(\theta \ge c\), it holds that

which is equivalent to

For any \(\theta \ge c\), right after the investment, the firm either produces below capacity or up to capacity. So the firm produces up to capacity right after the investment if

At the boundary of the two regions, the equality holds. For Region 2, we get the optimal value for investment capacity at the boundary is

The optimal value of investment capacity at the boundary for Region 3 is the solution to (30) when

Then (30) can be written as

\(K(\theta ) = \frac{\theta - c}{2 \gamma \theta }\) is a solution for this equation, implying there is smooth transfer from Region 2 and Region 3. However, there is no overlap at the boundary because the optimal capacity is equal to production at the boundary, implying it is Region 3.

Next, we determine \(\bar{\sigma }\) such that equation (31) holds as illustrated in Figure 2. Substituting \(\beta _1, \beta _2\) and \(F \left( \beta _2 \right) \) from (13)–(15) into (31) gives

Two cases are considered:

-

(a)

\(2 \delta r \left( r - \alpha \right) \le \alpha c\) (or \(\alpha \ge \frac{2 \delta r^2}{c + 2 \delta r}\)). According to (32), for \(\sigma >0\), then

$$\begin{aligned} \left[ 2 \delta r \left( r - \alpha \right) - \alpha c \right] \sqrt{\left( \bar{\sigma }^2 - 2 \alpha \right) ^2 + 8 r \bar{\sigma }^2} \le 0 < c \left( 2 r \bar{\sigma }^2+ 2 \alpha ^2 - \alpha \bar{\sigma }^2\right) , \end{aligned}$$which implies

$$\begin{aligned} 2 \delta \left( \beta _1 - \beta _2 \right) < c \left( 1 + \beta _1 \right) F \left( \beta _2 \right) , \end{aligned}$$and Region 2 is defined.

-

(b)

\(2 \delta r \left( r - \alpha \right) > \alpha c\) (or \(\alpha < \frac{2 \delta r^2}{c + 2 \delta r }\)). Then (32) becomes

$$\begin{aligned} \left( \left( \bar{\sigma }^2 - 2 \alpha \right) ^2 + 8 r \bar{\sigma }^2 \right) \left( 2 \delta r \left( r - \alpha \right) - \alpha c \right) ^2 = c^2 \left( 2 r \bar{\sigma }^2 + 2 \alpha ^2 - \alpha \bar{\sigma }^2 \right) ^2, \end{aligned}$$which can also be written as

$$\begin{aligned} \left( \Lambda - \left( 2 r - \alpha \right) ^2 \right) \bar{\sigma }^4 + 4 \left( \Lambda - \alpha ^2 \right) \left( 2 r - \alpha \right) \bar{\sigma }^2 + 4 \Lambda \alpha ^2 - 4 \alpha ^4 = 0, \end{aligned}$$(33)with

$$\begin{aligned} \Lambda = \left( \frac{2 \delta r \left( r - \alpha \right) - \alpha c }{c} \right) ^2. \end{aligned}$$The discriminant for (33) is

$$\begin{aligned} \Delta = 64 \Lambda r \left( \Lambda - \alpha ^2 \right) \left( r - \alpha \right) , \end{aligned}$$and the possible solutions for \(\bar{\sigma }>0\) are supposed to satisfy either

$$\begin{aligned} \bar{\sigma }^2_1&= \frac{-2\left( \Lambda - \alpha ^2 \right) \left( 2 r - \alpha \right) + 4 \sqrt{r \Lambda \left( \Lambda - \alpha ^2 \right) \left( r - \alpha \right) }}{\Lambda - \left( 2 r - \alpha \right) ^2} \end{aligned}$$or

$$\begin{aligned} \bar{\sigma }^2_2&= \frac{-2\left( \Lambda - \alpha ^2 \right) \left( 2 r - \alpha \right) - 4 \sqrt{r \Lambda \left( \Lambda - \alpha ^2 \right) \left( r - \alpha \right) }}{\Lambda - \left( 2 r - \alpha \right) ^2}. \end{aligned}$$Then we have the following subcases.

-

If \( 0< \Lambda < \alpha ^2\), which is \(\alpha > \frac{r^2 \delta }{c + r \delta }\), then \(\Delta < 0\) and (33) has no solution for \(\bar{\sigma }^2\). Then for all \(\sigma >0 \),

$$\begin{aligned} \left( \Lambda - \left( 2 r - \alpha \right) ^2 \right) {\sigma }^4 + 4 \left( \Lambda - \alpha ^2 \right) \left( 2 r - \alpha \right) {\sigma }^2 + 4 \Lambda \alpha ^2 - 4 \alpha ^4 < 0, \end{aligned}$$which implies

$$\begin{aligned} 2 \delta \left( \beta _1 - \beta _2 \right) < c \left( 1 + \beta _1 \right) F \left( \beta _2 \right) . \end{aligned}$$So, it is Region 2.

-

If \(\alpha ^2 \le \Lambda < \left( 2 r - \alpha \right) ^2\), which is equivalent to \(r-\frac{c}{\delta } < \alpha \le \frac{\delta r^2}{c + \delta r}\), then \(\Delta \ge 0\), and it holds that \(\bar{\sigma }^2_1 \le 0\) and \(\bar{\sigma }^2_2 \ge 0\). So there is one solution for \(\bar{\sigma }>0\) and \(\bar{\sigma } = \bar{\sigma }_2\). For any \(\sigma >0\), Region 3 is defined when \(0 <\sigma \le \bar{\sigma }\) and Region 2 is defined when \(\sigma \ge \bar{\sigma }\).

-

If \(\Lambda > \left( 2 r - \alpha \right) ^2\), which is \(\alpha < r - \frac{c}{\delta }\), then \(\bar{\sigma }^2_1 < 0\) and \(\bar{\sigma }^2_2 < 0\). So there is no solution for \(\bar{\sigma }>0\), and for all \(\sigma >0\), we have

$$\begin{aligned} \left( \Lambda - \left( 2 r - \alpha \right) ^2 \right) {\sigma }^4 + 4 \left( \Lambda - \alpha ^2 \right) \left( 2 r - \alpha \right) {\sigma }^2 + 4 \Lambda \alpha ^2 - 4 \alpha ^4 > 0, \end{aligned}$$which implies

$$\begin{aligned} {2 \delta \left( \beta _1 - \beta _2 \right) } > {c \left( 1 + \beta _1 \right) F \left( \beta _2 \right) }. \end{aligned}$$It is only Region 3.

-

If \(\Lambda = \left( 2 r - \alpha \right) ^2\), then \(\delta \left( r - \alpha \right) = c\) and

$$\begin{aligned}&\left[ 2 \delta r \left( r - \alpha \right) - \alpha c \right] ^2 \left[ \left( {\sigma }^2 - 2 \alpha \right) ^2 + 8 r {\sigma }^2 \right] - c^2 \left( 2 r {\sigma }^2+ 2 \alpha ^2 - \alpha {\sigma }^2\right) ^2 \\&\quad = c^2 (2r- \alpha )^2 \left[ \left( {\sigma }^2 - 2 \alpha \right) ^2 + 8 r {\sigma }^2 \right] - c^2 \left[ (2r-\alpha ) \sigma ^2 + 2 \alpha ^2 \right] ^2 \\&\quad = c^2 (2r-\alpha )^2 \left( \sigma ^2 - 2 \alpha \right) ^2 + 8 r c^2 \sigma ^2 (2r-\alpha )^2 - c^2 \sigma ^4 (2r-\alpha )^2 \\&\qquad - 4 \alpha ^2 \sigma ^2 c^2 (2r-\alpha ) - 4 c^2 \alpha ^4 \\&\quad = 4 c^2 (2r-\alpha )^2 \left( \alpha ^2 - \alpha \sigma ^2 + 2 r \sigma ^2\right) - 4 c^2 \alpha ^2 \left( \alpha ^2 - \alpha \sigma ^2+ 2r \sigma ^2\right) \\&\quad = 16 r c^2 (r-\alpha ) \left( \alpha ^2 - \alpha \sigma ^2 + 2 r \sigma ^2\right) > 0. \end{aligned}$$It implies that

$$\begin{aligned} {2 \delta \left( \beta _1 - \beta _2 \right) }>{c \left( 1 + \beta _1 \right) F \left( \beta _2 \right) } , \end{aligned}$$and Region 3 is defined.

-

Summarizing the above cases, it can be concluded that when \(\alpha > { \delta r^2}/{(c + \delta r)}\), it is always Region 2 that is defined. When \(r - c/\delta < \alpha \le \delta r^2/(c + \delta r)\), there exists \(\bar{\sigma }>0\) such that if \(\bar{\sigma }^2 < r + \alpha \), then it is Region 3 for \(\sigma \le \bar{\sigma }\) and Region 2 for \(\sigma > \bar{\sigma }\); if \(\bar{\sigma }^2 \ge r + \alpha \), then it is always Region 3. When \(\alpha \le r - c/\delta \), then it is Region 3 that is defined.

Appendix 2: Additional Proof for Proposition 2

2.1 Proof of \(\partial \mathcal {F}(\theta , K) / \partial K < 0\)

Before we check the sign of \(\partial \mathcal {F}(\theta , K) / \partial K\), we first look at the signs for \(\beta _1\), \(\beta _2\) and \(F(\beta _1)\). \(r > 0\) and the assumption \(r > \alpha \) imply \((\frac{1}{2} - \frac{\alpha }{\sigma ^2})^2 + \frac{2r}{\sigma ^2} >(\frac{1}{2} + \frac{\alpha }{\sigma ^2})^2\), thus \(\beta _1 > 1\) and \(\beta _2 <0\). In order to check the sign of \(F(\beta _1)\), we take \(F(\beta )\) as a function of \(\beta \) and recall that

Define \(\beta _0\) such that \(F \left( \beta _0 \right) = 0\), then

The sign for \(F(\beta _1)\) and \(F(\beta _2)\) is analyzed according to \(F^\prime (\beta )\) and by comparing \(\beta _0\), \(\beta _1\) and \(\beta _2\). When \(r+\alpha > \sigma ^2\), and if \(2\alpha < \sigma ^2\), then

if \(\sigma ^2 < 2 \alpha \), then

So \(F'(\beta )<0\) for \(\sigma ^2 < r+\alpha \). When \(2\alpha<r+\alpha < \sigma ^2\), and if \(r\sigma ^2 + 2 \alpha ^2-2\alpha \sigma ^2 >0\), we have \(\beta _0 <0\) and \(F^\prime (\beta ) > 0\); if \(r\sigma ^2 + 2 \alpha ^2-2\alpha \sigma ^2 <0\), it holds that \(\beta _0 > 0\) and \(F^\prime (\beta )<0\).

In order to compare the values for \(\beta _0\), \(\beta _1\) and \(\beta _2\), let

\(\beta _1\) and \(\beta _2\) are the intersection points of \(G \left( \beta \right) \) and the \(\beta \)-axis. If we can show that \(G\left( \beta _0 \right) < 0\), then \(\beta _1> \beta _0 > \beta _2\). If \(G(\beta _0)>0\), then it is either \(\beta _0> \beta _1 >\beta _2\), or \(\beta _0< \beta _2 < \beta _1\).

Moreover,

Because \(r> \alpha \), and when \(\sigma ^2 < r + \alpha \), we get \(G\left( \beta _0 \right) < 0\) and \(\beta _2<-1\). From \(F^\prime (\beta ) <0\), \(F(\beta _1) < 0\) and \(F(\beta _2) > 0\). When \(\sigma ^2 > r+\alpha \), it holds that \(G(\beta _0)>0\) and \(-1<\beta _2<0\). For \(\beta _0<0\) and \(F^\prime (\beta ) >0\), it can be concluded that \(\beta _0< \beta _2 < \beta _1\) and \(F(\beta _1)>0\), \(F(\beta _2)>0\). For \(\beta _0 >0\) and \(F^\prime (\beta ) <0\), it holds that \(\beta _0> \beta _1 > \beta _2\), \(F(\beta _1)>0\) and \(F(\beta _2)>0\). Thus, it is such that \(F(\beta _2)>0\) always holds. \(F(\beta _1)<0\) and \(\beta _2 < -1\) if \(\sigma ^2 < r + \alpha \); \(F(\beta _1)>0\) and \(-1<\beta _2<0\) if \(\sigma ^2 > r+ \alpha \). Next, we check the sign for \({\partial \mathcal {F} \left( \theta , K \right) }/{\partial K}\).

where

Because Region 3 is defined such that \(\theta \ge \frac{c}{1 - 2 \gamma K}\), we have

and

Since \(\beta _1 > 0 \), \(\beta _2 < 0\), and \(r - \alpha > 0\), we conclude that if \(2 \alpha - \sigma ^2 \ge 0\), then \({\partial \mathcal {F} \left( \theta , K \right) }/{\partial K} < 0\). However, if \(2 \alpha< \sigma ^2 < r+ \alpha \), then we continue with the expression above and get

This further implies that \(\frac{\partial \mathcal {F}(\theta , K)}{\partial K}<0\) for \(\sigma ^2 < r+\alpha \). Similarly, if \(\sigma ^2 > r +\alpha \), we would get

We can further derive that \(\frac{\partial \mathcal {F}(\theta , K)}{\partial K}<0\) if \(\sigma ^2>r+\alpha \). Thus, the conclusion is

Rights and permissions

About this article

Cite this article

Wen, X., Kort, P.M. & Talman, D. Volume flexibility and capacity investment: a real options approach. J Oper Res Soc 68, 1633–1646 (2017). https://doi.org/10.1057/s41274-017-0196-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41274-017-0196-5