Abstract

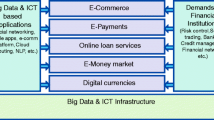

Financialization describes a phenomenon whereby financial markets assume an increasingly dominant role within the economy. This paper seeks to dissect the role of information and communications technology (ICT) in financialization by following a cross-disciplinary approach across finance, economics and information systems. Accordingly, we develop a general framework describing the relationship between ICT and financialization. This framework allows us to investigate the recent rise of online marketplaces for credit. Consequently, ICT is not only facilitating, but fundamentally driving a disintermediation of banks through advances in computing, communication and information technology. We also provide supporting evidence from interviews with almost 40 senior experts and C-level executives. Interestingly, only rather recent innovations have enabled the popularity of marketplace lending, such as cloud computing, big data, scalable IT infrastructures and comprehensive ecosystems of programming interfaces. In contrast, we observe a slow integration of advanced analytics in the field of risk management. Based on our analysis, the paper also discusses cross-country implications for marketplace lending, financialization and regulation.

Similar content being viewed by others

References

Adams, Z., and Glück, T. (2015). Financialization in Commodity Markets: A Passing Trend or the New Normal? Journal of Banking and Finance, 60, 93–111.

Allen, F., and Santomero, A.M. (2001). What do Financial Intermediaries Do? Journal of Banking and Finance, 25(2), 271–294.

Alloway, T. and Scully, M. (2015). Wall Street’s Thinking About Creating Derivatives on Peer-to-Peer Loans. Bloomberg. http://www.bloomberg.com/news/articles/2015-04-30/wall-street-s-latest-craze-meets-small-short-in-new-derivatives (visited on 12/22/2015).

Armbrust, M., Stoica, I., Zaharia, M., Fox, A., Griffith, R., Joseph, A. D., et al. (2010). A View of Cloud Computing. Communications of the ACM, 53(4), 50–58.

Bain, Jr., J.S. (1968). Industrial Organization, 2 edition. Wiley, New York.

Bakos, J.Y. (1991). A Strategic Analysis of Electronic Marketplaces. Mis Quarterly, 15(3), 295–310.

Bakos, J.Y. (1997). Reducing Buyer Search Costs: Implications for Electronic Marketplaces. Management Science, 43(12), 1676–1692.

Bakos, Y., Lucas, H.C., Oh, W., Simon, G., Viswanathan, S., and Weber, B.W. (2005). The Impact of E-Commerce on Competition in the Retail Brokerage Industry. Information Systems Research, 16(4), 352–371.

Bank for International Settlements (2001). Electronic Finance: A New Perspective and Challenges. BIS Papers, 7. https://www.bis.org/publ/bppdf/bispap07.htm (visited on 08/14/2016).

Berkeley, A.R. (1997). Nasdaq’s Technology Floor: Its President Takes Stock. IEEE Spectrum, 34(2), 66–67.

Bhimani, A. (2015). Exploring Big Data’s Strategic Consequences. Journal of Information Technology, 30(1), 66–69.

Black, F. (1971a). Toward a Fully Automated Stock Exchange, Part I. Financial Analysts Journal, 27(4), 28–35.

Black, F. (1971b). Toward a Fully Automated Stock Exchange, Part II. Financial Analysts Journal, 27(6), 24–28.

Bord, V., and Santos, J.A.C. (2012). The Rise of the Originate-to-Distribute Model and the Role of Banks in Financial Intermediation. Economic Policy Review, 18(2), 21–34.

Campbell-Kelly, M., and Garcia-Swartz, D.D. (2013). The History of the Internet: The Missing Narratives. Journal of Information Technology, 28(1), 18–33.

Chordia, T., Goyal, A., Lehmann, B.N., and Saar, G. (2013). High-Frequency Trading. Journal of Financial Markets, 16(4), 637–645.

Clemons, E.K., and Weber, B.W. (1997). Information Technology and Screen-Based Securities Trading: Pricing the Stock and Pricing the Trade. Management Science, 43(12), 1693–1708.

Davis, G.F. (2009). Managed by the Markets: How Finance Reshaped America. New York: Oxford University Press.

D’Avolio, G., Gildor, E., and Andrei, S. (2001). Technology, Information Production, and Market Efficiency. Cambridge, MA: Harvard Institute of Economic Research.

Dewan, S., and Mendelson, H. (2001). Information Technology and Trader Competition in Financial Markets: Endogenous Liquidity. Management Science, 47(12), 1581–1587.

Epstein, G.A. (2005). Financialization and the World Economy. Cheltenham: Edward Elgar.

Erb, C.B., and Harvey, C.R. (2006). The Strategic and Tactical Value of Commodity Futures. Financial Analysts Journal, 62(2), 69–97.

Ericsson. (2015). Ericsson Mobility Report: On the Pulse of the Networked Society: June 2015. Ed. by P. Cerwall. https://www.ericsson.com/res/docs/2015/ericsson-mobility-report-june-2015.pdf (visited on 08/24/2016).

Gideon, L. (Ed.). (2012). Handbook of Survey Methodology for the Social Sciences. New York: Springer.

Gomber, P., and Haferkorn, M. (2013). High-Frequency-Trading: High-Frequency-trading Technologies and Their Implications for Electronic Securities Trading. Business and Information Systems Engineering, 5(2), 97–99.

Haas, P., Blohm, I., Peters, C., and Leimeister, J.M. (2015). Modularization of Crowdfunding Services: Designing Disruptive Innovations in the Banking Industry. In 36th International Conference on Information Systems (ICIS).

Hendershott, T., Jones, C., and Menkveld, A. (2011). Does Algorithmic Trading Improve Liquidity? Journal of Finance, 66(1), 1–33.

Holloway, H. (1989). Information Technology and Company Policy: Financial Transactions: The International Stock Exchange. Journal of Information Technology, 4(2), 104–107.

Huang, J., Makoju, E., Newell, S., and Galliers, R.D. (2003). Opportunities to Learn from ’Failure’ with Electronic Commerce: A Case Study of Electronic Banking. Journal of Information Technology, 18(1), 17–26.

Huang, R.D., and Stoll, H.R. (1996). Dealer Versus Auction Markets: A Paired Comparison of Execution Costs on Nasdaq and the NYSE. Journal of Financial Economics, 41(3), 313–357.

Jain, P.K. (2005). Financial Market Design and the Equity Premium: Electronic Versus Floor Trading. Journal of Finance, 60(6), 2955–2985.

Jenkins, P. (2016). US Peer-to-Peer Lending Model has Parallels with Subprime Crisis. Financial Times. https://www.ft.com/content/84f696ec-2436-11e6-9d4d-c11776a5124d (visited on 09/19/2016).

Jordá, Ò., Schularick, M., and Taylor, A.M. (2016). The Great Mortgaging: Housing Finance, Crises, and Business Cycles. Economic Policy, 31(85), 107–152.

Kaniadakis, A. and Constantinides, P. (2014). Innovating Financial Information Infrastructures: The Transition of Legacy Assets to the Securitization Market. Journal of the Association for Information Systems, 15(Special Issue): 2014.

Keim, D.B., and Madhavan, A. (1997). Transactions Costs and Investment Style: An Inter-Exchange Analysis of Institutional Equity Trades. Journal of Financial Economics, 46(3), 265–292.

Kim, Y.K. (2013). Household Debt, Financialization, and Macroeconomic Performance in the United States, 1951–2009. Journal of Post Keynesian Economics, 35(4), 675–694.

Krippner, G.R. (2005). The Financialization of the American Economy. Socio-Economic Review, 3(2), 173–208.

Lagoarde-Segot, T. (2016). Financialization: Towards a New Research Agenda. International Review of Financial Analysis (in press).

Lechman, E., and Marszk, A. (2015). ICT Technologies and Financial Innovations: The Case of Exchange Traded Funds in Brazil, Japan, Mexico, South Korea and the United States. Technological Forecasting and Social Change, 99, 355–376.

Lending Club (2015). How has Lending Clubs Investor Base Changed. http://kb.lendingclub.com/investor/articles/Investor/How-has-Lending-Club-s-investor-base-changed (visited on 09/19/2016).

London Stock Exchange (2015). Regulatory Story: Investment Prospectus: P2P Global Investments PLC. http://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/P2P/12408791.html (visited on 12/21/2015).

Lucas, H.C., Oh, W., and Weber, B.W. (2009). The Defensive use of IT in a Newly Vulnerable Market: The New York Stock Exchange, 1980–2007. Journal of Strategic Information Systems, 18(1), 3–15.

Madhavan, A. (1995). Consolidation, Fragmentation, and the Disclosure of Trading Information. Review of Financial Studies, 8(3), 579–603.

Merton, R.C. (1995). Financial Innovation and the Management and Regulation of Financial Institutions. Journal of Banking and Finance, 19(3–4), 461–481.

Noonan, L. and Arnold, M. (2015). Beyond Banking: Alternative Groups Seize Business from Lenders. Financial Times. https://www.ft.com/content/cbba1ff2-65cf-11e5-a28b-50226830d644 (visited on 08/29/2016).

Palley, T.I. (2013). Financialization: The Economics of Finance Capital Domination. London: Palgrave Macmillan.

Parker, C., and Weber, B.W. (2014). Launching Successful E-Markets: A Broker-Level Order-Routing Analysis of Two Options Exchanges. Journal of Management Information Systems, 31(2), 47–76.

Purnanandam, A. (2011). Originate-to-Distribute Model and the Subprime Mortgage Crisis. Review of Financial Studies, 24(6), 1881–1915.

Reck, M. (1998). The Formal and Systematic Specification of Market Structures and Trading Services. Journal of Management Information Systems, 15(2), 9–21.

Schultze, U., and Avital, M. (2011). Designing Interviews to Generate Rich Data for Information Systems Research. Information and Organization, 21(1), 1–16.

Seddon, J.J.J.M. and Currie, W.L. (2016). A Model for Unpacking Big Data Analytics in High-Frequency Trading. Journal of Business Research, 70(2017), 300–307.

Stanley, M. (2015). Global Marketplace Lending: Disruptive Innovation in Financials.

Stein, J. C. (2010). Securitization, Shadow Banking and Financial Fragility. Daedalus, 139(4), 41–51.

Stockhammer, E. (2010) Financialization and the Global Economy. URL: http://www.peri.umass.edu/fileadmin/pdf/working_papers/working_papers_201-250/WP240.pdf (visited on 08/28/2016).

Stoll, H.R. (2006). Electronic Trading in Stock Markets. Journal of Economic Perspectives, 20(1), 153–174.

Tang, K. and Xiong, W. (2010) Index Investment and Financialization of Commodities. Cambridge, MA. http://www.nber.org/papers/w16385 (visited on 08/28/2016).

Tett, G. (2015). The Sharing Economy is Now a Playground for Wall Street. Financial Times. https://www.ft.com/content/62f2737e-6210-11e5-9846-de406ccb37f2.

Tufano, P. (2003). Financial Innovation. In G.M. Constantinides, M. Harris, and R.M. Stulz (Eds.), Handbook of the Economics and Finance (Vol. 1, pp. 307–335). Amsterdam: Elsevier.

van der Zwan, N. (2014). Making Sense of Financialization. Socio-Economic Review, 12(1), 99–129.

Venters, W., and Whitley, E.A. (2012). A Critical Review of Cloud Computing: Researching Desires and Realities. Journal of Information Technology, 27(3), 179–197.

Weber, B.W. (2006). Adoption of Electronic Trading At the International Securities Exchange. Decision Support Systems, 41(4), 728–746.

Woerner, S.L., and Wixom, B.H. (2015). Big Data: Extending the Business Strategy Toolbox. Journal of Information Technology, 30(1), 60–62.

Zhang, X., and Zhang, L. (2015). How Does the Internet Affect the Financial Market? An Equilibrium Model of Internet-Facilitated Feedback Trading. Management Information Systems Quarterly, 39(1), 17–37.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Drummer, D., Feuerriegel, S. & Neumann, D. Crossing the next frontier: the role of ICT in driving the financialization of credit. J Inf Technol 32, 218–233 (2017). https://doi.org/10.1057/s41265-017-0035-9

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41265-017-0035-9