Abstract

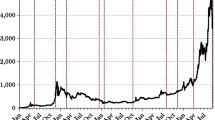

This paper is saddled with the task of investigating the Bitcoin market behavior in the presence of a government risk. This is because both the institutional and retail investors’ interests in the Bitcoin market are growing rapidly. Conversely, the seemingly unregulated nature of this market is a serious concern to most economies and results to the placement of ban on Initial Coin Offering (ICO) in some economies by the government. Daily series of return and volume within the window of the ICO ban in China was used for the Bitcoin market and S&P500 stock market to examine the effect of a government risk in the Bitcoin market and possible hedging capabilities. Empirical results show that the ban dampened Bitcoin returns and the returns from each market can predict the other. The Exogenous Dynamic Conditional Correlation (Exo-DCC) model result suggests that, yes! the S&P500 stocks are capable of hedging Bitcoin risk, while Bitcoin can also hedge S&P500 stocks’ risks and vice versa. The Exogenous BEKK (Exo-BEKK) model result shows evidence of bidirectional volatility spill over between the two markets studied. In practice, investors (institutions and retailers) can comfortably form a robust investment portfolio with (at least) these two assets and develop a hedging strategy, such that the impacts of risks on the portfolio’s returns are safely hedged.

Similar content being viewed by others

Change history

25 September 2019

There were some inconsistencies in Table 4, 5, and 7 in the online PDF. The corrected tables are given below. The original article has been corrected.

Notes

The risk introduced in this analysis is the government risk in form of Initial Coin Offering (ICO) ban in China.

For univariate cases, \(m_{{it}} = \left| {\alpha _{{it}} } \right| /\sqrt {h_{{it}} } \sim N(0,1)\).

References

Ashley, R. A., & Patterson, D. M. (2010). A test of the GARCH(1, 1) specification for daily stock returns. Macroeconomic Dynamics, 14, 137–144.

Baba, Y., Engle, R. F., & Kroner, K. F. (1995). Multivariate simultaneous generalized arch. Econometric Theory, 11(1), 122–150.

Baur, D. G., & Lucey, B. M. (2010). Is gold a hedge or a safe haven? An analysis of stocks, bonds, and gold. The Financial Review, 45, 217–229.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307–327.

Bouri, E., Azzi, G., & Dyhrberg, A. H. (2017a). On the return-volatility relationship in the Bitcoin market around the price crash of 2013. Economics: The Open-Access, Open-Assessment E-Journal, 11, 1–16. (ISSN: 1864-6042).

Bouri, E., Gupta, R., Tiwari, A. K., & Roubaud, D. (2017b). Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Finance Research Letters, 23, 87–95.

Browne, R., & Imbert, F. (2018, July 16). Bitcoin extends gains as BlackRock looks into crypto and Blockchain. New York. Retrieved from https://www.cnbc.com/2018/07/16/bitcoin-jumps-after-report-says-blackrock-exploring-cryptocurrencies.html.

Capie, F., Mills, T., & Wood, G. (2005). Gold as a Hedge against the dollar. Journal of International Financial Markets, Institutions and Money, 15(4), 343–352.

Cont, R. (2001). Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance, 1(1), 223–236.

Dergunov, V. (2018, July 20). Bitcoin: Increased institutional interest, improving sentiment, seeking alpha. Retrieved from https://seekingalpha.com/article/4188602-bitcoin-increased-institutional-interest-improving-sentiment.

Dyhrberg, A. H. (2015). Hedging capabilities of bitcoin. Is it the virtual gold? Finance Research Letters, 16, 39–144.

Engle, R., & Shepard, K. (2002). Dynamic conditional correlation: A simple class of multivariate Garch models. Journal of Business and Economic Statistics, 42(1), 231–265.

Glaser, F., Kai, Z., Martin, H., Christian, W. M., & Michael, S. (2014). Bitcoin: Asset or currency? Reveling users’ hidden intentions. Twenty second European conference on information systems in Tel Aviv 2014 (pp. 1–14). Europe: Working Paper.

Glosten, L. R., Jagannathan, R., & Runkle, D. E. (1993). On the relation between the expected value and the volatility of the nominal excess return. Journal of Finance, 48(5), 1779–1801.

Hansen, P. R., & Lunde, A. (2005). A forecast comparison of volatility models: Does anything beat a GARCH (1,1)? Journal of Applied Econometrics, 20(7), 873–889.

Lim, C. M., & Sek, S. K. (2013). Comparing the performances of GARCH-type models in capturing the stock market volatility in Malaysia. Procedia Economics and Finance, 5, 478–487.

Liu, R., Zhichao, S., Wei, G., & Wang, W. (2017). GARCH model with fat-tailed distributions and Bitcoin exchange rate returns. Journal of Accounting, Business and Finance Research, 1(1), 71–75.

Panagiotidis, T., Stengos, T., & Vravosinos, O. (2018). On the determinants of bitcoin returns: A LASSO approach. Finance Research Letters, 27, 235–240.

Sims, C. A. (1980). Macroeconomics and reality. Econometrica, 48(1), 1–48.

Wang, J., Xue, Y., & Liu, M. (2016). An analysis of Bitcoin price based on VEC model. International conference on economics and management innovations (ICEMI 2016). Atlantis Press.

Yang, J., Zhou, Y., & Leung, W. K. (2012). Asymmetric correlation and volatility dynamics among stock, bond, and securitized real estate markets. Journal of Real Estate Financial Economics, 45, 491–521.

Zhang, Q., & Jaffry, S. (2015). High frequency volatility spillover effect based on the Shanghai–Hong Kong Stock Connect Program. Investment Management and Financial Innovations, 12(2), 8–15.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original version of this article was revised: Tables 4, 5, and 7 were wrongly displayed in the online PDF.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Okorie, D.I. Could stock hedge Bitcoin risk(s) and vice versa?. Digit Finance 2, 117–136 (2020). https://doi.org/10.1007/s42521-019-00011-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42521-019-00011-0