Abstract

This paper studies the strategic choice of a spatial price policy between mill pricing and uniform-delivered pricing (UDP) under transportation asymmetry. Mill pricing in the model emerges as an equilibrium price policy, but it contains different types of strategic interaction, depending on the level of discrepancy between two firms’ transportation rates. If the transportation rate discrepancy is not too great, then mill pricing is a dominant strategy. When the discrepancy is large enough, mill pricing is viewed as a M-matching strategy, whereby the low-transportation-cost firm prefers matching the rival’s strategy, but the high-transportation-cost firm does not do so. There is no “Prisoner’s Dilemma” like the argument that Thisse and Vives (Am Econ Rev 78(1):122–137, 1988, AER) proposes, and there is no robustness for firms to choose a UDP policy like Kats and Thisse (in: Ohta and Thisse (eds) Does economic space matter? St Martin’s, New York, 1993) do. Our study matches the current trend of technology advancement in transportation.

Similar content being viewed by others

Notes

In the case of mill pricing, a consumer must bear the freight rate and transport the product his/herself. If this transportation is provided by a firm, then the consumer is just billed for the shipping services at the same freight rate. A billing behavior that is a linear payment-transfer does not change the essential analytical results in the models.

Price discrimination is generally socially undesirable since it distorts consumption decisions and may be socially desirable only if it expands industry production. In particular, if demand is linear, then industry output is equal and thus total welfare is higher under mill pricing than under perfect discriminatory pricing. See Beckmann (1976), Greenhut and Ohta (1972), Holahan (1975), and Hwang and Mai (1990).

See Lederer and Hurter (1986) for a justification of this assumption.

Because \(G(p_1)\) is the probability of \(0 < p_2 \le p_1\) for firm 1, \(G(p_1)\) means that firm 1 uses a conceding strategy.

References

Aguirre I, Martin AM (2001) On the strategic choice of spatial price policy: the role of the pricing game rules. Econ Bull 12(2):1–7

Anderson SP, de Palma A, Thisse J-F (1989) Spatial price policies reconsidered. J Ind Econ 38(1):1–18

Beckmann MJ (1973) Spatial oligopoly as a noncooperative game. Int J Game Theory 2:263–268

Beckmann MJ (1976) Spatial price policies revisited. Bell J Econ 7(2):619–630

d’Aspremont C, Gabszewicz JJ, Thisse J-F (1979) On Hotelling’s stability in competition. Econometrica 47(5):1145–1151

Dasgupta P, Maskin E (1986) The existence of equilibrium in discontinuous economic games. I and II: theory. Rev Econ Stud 53:1–41

de Palma A, Labbe M, Thisse J-F (1986) On the existence of price equilibria under mill and uniform delivered prices. In: Norman G (ed) Spatial pricing and differentiated markets. Pion Limited, London

Eber N (1997) A note on the strategic choice of spatial price discrimination. Econ Lett 55:419–423

Furlong WJ, Slotsve GA (1983) Will that be pickup or delivery?: An alternative spatial pricing strategy. Bell J Econ 4(1):271–274

Greenhut ML (1981) Spatial pricing in the United States, West Germany and Japan. Economica 48:79–86

Greenhut ML, Norman G, Hung C-S (1987) The economics of imperfect competition: a spatial approach. Cambridge University Press, New York

Greenhut ML, Ohta H (1972) Monopoly output under alternative spatial pricing techniques. Am Econ Rev 62(4):705–713

Gronberg T, Meyer J (1981) Transport inefficiency and the choice of spatial pricing mode. J Reg Sci 21:541–549

Hobbs BF (1986) Mill pricing versus spatial price discrimination under Bertrand and Cournot spatial competition. J Ind Econ 35:173–191

Holahan WL (1975) The welfare effects of spatial price discrimination. Am Econ Rev 65:498–503

Hotelling H (1929) Stability in competition. Econ J 39:41–57

Hwang H, Mai CC (1990) Effects of spatial price discrimination on output, welfare, and location. Am Econ Rev 80(3):567–575

Kats A, Thisse J-F (1993) Spatial oligopolies with uniform delivered pricing. In: Ohta H, Thisse J-F (eds) Does economic space matter?. St Martin’s, New York

Lederer PJ (2011) Competitive delivered pricing by mail-order and Internet retailers. Netw Spat Econ 11(2):315–342

Lederer PJ, Hurter AP (1986) Competition of firms: discriminatory pricing and location. Econometrica 54(3):623–640

Norman G (1981) Uniform pricing as an optimal spatial pricing policy. Economica 48(189):87–91

Osborne MJ, Pitchik C (1987) Equilibrium in Hotelling’s model of spatial competition. Econometrica 55:911–922

Phlips L (1988) The economics of price discrimination. Cambridge University Press, New York

Schuler RE, Hobbs BF (1982) Spatial price duopoly under uniform delivered pricing. J Ind Econ 31:175–187

Shilony Y (1977) Mixed pricing in oligopoly. J Econ Theory 14:373–388

Thisse J-F, Vives X (1988) On the strategic choice of spatial price policy. Am Econ Rev 78(1):122–137

Yao J-T, Lai F-C (2005) Incentive consistency and the choice of a spatial pricing mode. Ann Reg Sci 40(3):583–602

Zhang M, Sexton RJ (2001) Fob or uniform delivered prices: strategic choice and welfare effects. J Ind Econ 49(2):197–221

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Firm 2’s equilibrium profits under U–U competition

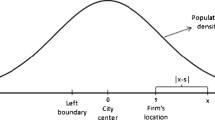

Recall that \(t_2=1\) and firm 2 is located at the right endpoint of the line market. Consider firm 2’s undercutting strategy, whereby \(p_2<p_1\). If so, firm 2 sells its product further to location \({\hat{y}}_1\) where its delivered price equals delivered cost, that is, \(p_2 = c + 1\cdot (1-{\hat{y}}_1) \Rightarrow {\hat{y}}_1 = 1+c-p_2\). Under this situation for any value of \(p_2<p_1\), firm 2’s profit \(\pi _2^+\) from undercutting 1’s price is

If firm 2 uses a concession strategy with \(p_2\ge p_1\), then firm 2 serves a place until it reaches the location \({\hat{y}}_2\) of the marginal consumer who is indifferent towards buying from firm 2 or firm 1. One thus has \(p_2 = c + t_1\cdot {\hat{y}}_2 \Rightarrow {\hat{y}}_2 = (p_2-c)/t_1\). Firm 2’s profit under a conceding strategy is then

Firm 2’s mixed strategy is expressed in terms of the cumulative distribution function \(G(p_2)\), which is firm 2’s probability of using a conceding strategy:

The expected payoff to firm 2 when it offers price \(p_2\) is

Since \(G(p_2)\) represents the mixed strategy for firm 2, in equilibrium it must satisfy the probability distribution of \(p_2 \in (0, \infty )\) in its support for \(E[\pi _2]=V_2\), where \(V_2\) is the value of firm 2’s profits. This implies

Solving this expression for \(G(p_2)\), we obtain

Let \(p_a > 0\) be the highest price that firm 2 will ever offer in a mixed-strategy equilibrium. Under this situation, \(G(p_a) = 1\), representing that firm 2 absolutely adopts a conceding strategy. Thus, from (16) we obtain

One can maximize \(V_2\) by choosing \(p_a\). Solving for the first-order condition \(\partial V_2/\partial p_a =0\) and then verifying the second-order condition provide firm 2’s best highest price commanded as below:

Plugging the solution \(p_a^*\) into the value of the game in (17) yields:

Let us denote \(p_b\) as the lowest price that firm 2 will ever offer. Under this situation, \(G(p_b)=0\), and firm 2 absolutely uses an undercutting strategy. If so, then \(V_2=\pi _2^{+}= ( p_b - c )^2/2\). In equilibrium, \(V_2=V_2^*\). This implies

The lowest optimal price commanded by firm 2 is thus

From (18) and (19), one obtains the range of \(p_2\) to sustain a mixed-strategy equilibrium as

If \(t_1=1\), i.e., under the situation of transportation symmetry, then firm 2’s range of \(p_2\) in (20) is the same as that of firm 1’s range \(p_1\) in (9). Given (20) we obtain firm 2’s mixed strategies in equilibrium as below:

Appendix 2: Both firms’ equilibrium profits under U–M competition

Recall that \(t_2=1\). Let firm 1 commit to adopt UDP, while firm 2 uses mill pricing. Under this situation an indifferent consumer is located at location \({\hat{x}}=1+p_2-p_1\). Both firms’ profits are, respectively,

Both firm’s first-order conditions are, respectively, \(\partial \pi _1/\partial p_1 =(1+t_1)p_2-(2+t_1)+t_1+c+1 = 0\) and \(\partial \pi _2/\partial p_2 =p_1-2p_2+c = 0\). Simultaneously solving the two equations provides equilibrium prices \(p_1^*\) and \(p_2^*\):

The equilibrium profits are thus, respectively,

About this article

Cite this article

Yao, JT. The impact of transportation asymmetry on the choice of a spatial price policy. Asia-Pac J Reg Sci 3, 793–811 (2019). https://doi.org/10.1007/s41685-019-00110-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-019-00110-1