Abstract

In this paper, we investigate the effects of uncertainty shocks on the US daily online price index by Cavallo and Rigobon (J Econ Perspect 30(2):151–78, 2016) within a VAR framework. We find evidence that shocks increasing uncertainty dampen prices significantly. This result is robust to various changes to the baseline model and rejects the Upward Pricing Bias that is often found in the Sticky-Price DSGE literature.

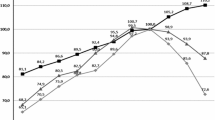

Sources: The US consumer price index is taken from the US Bureau of Labor Statistics. The online price index is taken from Cavallo and Rigobon (2016) (colour figure online)

Similar content being viewed by others

References

Abel, A. B. (1983). Optimal investment under uncertainty. American Economic Review, 73(1), 228–33.

Basu, S., & Bundick, B. (2017). Uncertainty shocks in a model of effective demand. Econometrica, 85(3), 937–958.

Bekaert, G., Hoerova, M., & Lo Duca, M. (2013). Risk, uncertainty and monetary policy. Journal of Monetary Economics, 60(7), 771–788.

Bernanke, B. S. (1983). Irreversibility, uncertainty, and cyclical investment. The Quarterly Journal of Economics, 98(1), 85–106.

Bloom, N. (2009). The impact of uncertainty shocks. Econometrica, 77(3), 623–685.

Bonciani, D., & van Roye, B. (2016). Uncertainty shocks, banking frictions and economic activity. Journal of Economic Dynamics and Control, 73, 200–219.

Born, B., & Pfeifer, J. (2014). Policy risk and the business cycle. Journal of Monetary Economics, 68, 68–85.

Cavallo, A., & Rigobon, R. (2016). The billion prices project: Using online prices for measurement and research. Journal of Economic Perspectives, 30(2), 151–78.

Christiano, L. J., Motto, R., & Rostagno, M. (2014). Risk shocks. American Economic Review, 104(1), 27–65.

Fernandez-Villaverde, J., Guerron-Quintana, P., Kuester, K., & Rubio-Ramirez, J. (2015). Fiscal volatility shocks and economic activity. American Economic Review, 105(11), 3352–84.

Ferrara, L., & Guérin, P. (2016). What are the macroeconomic effects of high-frequency uncertainty shocks. Technical report, Bank of Canada Staff Working Paper.

Gilchrist, S., Sim, J. W., & Zakrajšek, E. (2014). Uncertainty, financial frictions, and investment dynamics. NBER working papers 20038, National Bureau of Economic Research, Inc.

Hartman, R. (1976). Factor demand with output price uncertainty. American Economic Review, 66(4), 675–81.

Jorda, O. (2005). Estimation and inference of impulse responses by local projections. American Economic Review, 95(1), 161–182.

Leduc, S., & Liu, Z. (2016). Uncertainty shocks are aggregate demand shocks. Journal of Monetary Economics, 82(C), 20–35.

Leland, H. (1968). Saving and uncertainty: The precautionary demand for saving. Quarterly Journal of Economics, 82, 465–473.

Mumtaz, H., & Theodoridis, K. (2015). The international transmission of volatility shocks: An empirical analysis. Journal of the European Economic Association, 13(3), 512–533.

Oi, W. Y. (1961). The desirability of price instability under perfect competition. Econometrica, 29(1), 58–64.

Pindyck, R. S. (1988). Irreversible investment, capacity choice, and the value of the firm. American Economic Review, 78(5), 969–85.

Ramey, V. A. (2016). Macroeconomic shocks and their propagation. NBER working papers 21978, National Bureau of Economic Research, Inc.

Scotti, C. (2016). Surprise and uncertainty indexes: Real-time aggregation of real-activity macro-surprises. Journal of Monetary Economics, 82, 1–19.

Swanson, E. T., & Williams, J. C. (2014). Measuring the effect of the zero lower bound on medium-and longer-term interest rates. The American Economic Review, 104(10), 3154–3185.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bonciani, D., Tafuro, A. The Effects of Uncertainty Shocks on Daily Prices. J Bus Cycle Res 14, 89–104 (2018). https://doi.org/10.1007/s41549-018-0024-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-018-0024-2