Abstract

Complexity theory allows for a non-equilibrist approach to the economy, an approach that is shared by new institutional economics. Drawing on lessons from both schools of thought, this paper examines institutions as their own complex adaptive systems, even as they are nested in larger institutional systems and the broader economy. Tracing the evolution of an economy as the sum of its institutional parts, I examine the idea of development as the improvement of institutions. The key finding of this examination is that some aspects of complexity theory, relying on institutional and Austrian approaches, actually come full circle to a neoclassical prescription of laissez-faire in regard to institution-building. Given the complexity of both institutions and institutional systems, it is may be more important to remove political and other barriers from the path of institutional development than to actively engage in institution-building in order to encourage development. This too, unfortunately, faces challenges as a result of complexity.

Similar content being viewed by others

1 Introduction

Critiques of neoclassical economics have increased in frequency and vehemence over the past decade, spurred on by the global financial crisis, manifesting themselves in one of two variants. The first category has been termed by Arnsperger and Varoufakis (2006) as “unsophisticated:” criticisms that focus mostly on orthodox conceptions of economic behavior and the market, railing against assumptions of rationality or individualistic “instrumentalism” and debating neoclassical assumptions at their margins. These criticisms tend to call for more of the same as an antidote for perceived failings, such as increased regulation (Crotty 2009), better monetary policy oversight (Allen and Snyder 2009), or massive increases in government spending through monetary manipulation (Wray 2011).

However, a more sophisticated challenge to the ruling orthodoxy, arising from across the heterodox spectrum (O’Hara 2007 notes it may be the only thing uniting heterodox approaches), has instead confronted the entire foundation of neoclassical reasoning. This further critique has focused on Walrasian assumptions of equilibrium, taking up the original work of Scarf (1960) and Sonnenschein (1972) to call for a “post-Walrasian economics” (Colander Shelley 1998). Based in part upon real world experience (not least in the failures of development economics to bring much of the world out of poverty), the anti-equilibrium critique conjectured that reality contained multiple equilibria, and none of them was necessarily “natural”. Thus, the movement of an economy in the aggregate was highly path-dependent, a concept that was a direct repudiation of equilibrating tendencies supposedly nested within an economy (Davis 2006).

But if equilibrium theory is “still dead after all these years” (Ackerman 2002), what has taken its place? Early work dared not contemplate the full consequences of what a violation of the assumption of equilibrium would mean; as Colander (2003:19) noted, the question of a post-Walrasian world wouldn’t be “Why does the economy exhibit instability and fluctuations?” but rather “Why does it exhibit as little instability as it does?” It is only in recent years that complexity theory, with some (but not all) aspects borrowed from the natural sciences, appears to have stepped into explain what exists in this “unbridgeable gap between market behavior and equilibrium theory” (Matutinovic 2010:32). Focusing on an evolutionary approach to economics, and understanding that economic relations are enmeshed in a series of small and large complex adaptive systems (CAS), certain aspects of complexity theory embraces the idea that such systems may not tend to equilibrium. In fact, taken as a whole, complexity theories understand that “out of equilibrium” may be the most often observed state of an economy, pervasive in such areas as foreign exchange markets and the savings and investment nexus (Rosser 1999).

The increasing application of complexity theory to economic issues, and its provision of a valid alternative to neoclassical equilibrium-based foundations,Footnote 1 has occurred at the same time as another breakthrough in mainstream economic thinking: the acknowledgement of the importance of institutions in economic development. While Douglass North (1990) is credited with resurrecting institutional analysis in the guise of the “new institutional economics” (NIE), empirical research from Acemoglu et al. (2003, 2005), Rodrik et al. (2004), Glaeser et al. (2004), and more recently Fatás and Mihov (2013) and Flachaire et al. (2014) has confirmed the role that institutions play in determining the wealth or poverty of nations. These approaches have incorporated many of the tenets of new institutional economics, recognizing that economic outcomes are mediated and influenced by institutional make-up and the broader cultural currents in a given society.

While there has been a welcome permeation of NIE tenets into empirical growth work, the emphasis on institutions has still been somewhat limited: as Williamson (2000:595) famously remarked, “the confession is that we are still very ignorant about institutions”. Indeed, much of the development literature has only considered broader institutional changes or aggregated categories of institutions (such as “market-sustaining”, to use Rodrik et al.’s (2004) terminology), with a scarce few in-depth case studies examining the richness of institutional complexity and diversity (the entire body of Elinor Ostrom’s work, typified in Ostrom (2005), being the major exception to the neglect of institutions). To again quote Williamson (2000:595), the chief reason for this “ignorance is that institutions are very complex”, a reality that makes them difficult to tackle in an equilibrium framework, given that they have nonlinearities, exhibit threshold effects, and often lack definitive boundaries. In other words, institutions themselves are complex adaptive systems, more suited to a theoretical framework that recognizes this reality than standard neoclassical analysis.

This presents the development economist with a most terrible quandary: if institutions are crucial for development of an economy (which is a complex system) but institutions themselves are also complex adaptive systems, how can one possibly hope to achieve a state of higher development? The purpose of this paper is to further our knowledge of institutions in the pursuit of development by examining institutions explicitly from the standpoint of certain aspects of complexity theory. It is my contention that complexity theory has much to recommend it in terms of understanding institutional composition, which then in turn has a direct impact upon the development of a country’s (region’s/individual’s) economic outcomes. In particular, complexity theory may help economists to understand what a “good” institution is and how it can function in a sea of institutions, as well as shedding light on how such “good” institutions come to be.

Unfortunately, as this paper will show, the knowledge of the complexity of institutions also presents a difficulty in attempting to influence their development from either a centralized, planning sense or from an external (donor) agent. The key finding of this examination is that understanding economic complexities, relying on institutional and Austrian approaches, may actually come full circle to a neoclassical prescription of laissez-faire, even while eschewing the idea of equilibrium. In other words, equilibrium may exist, but the complex nature of institutions and their operations make it incredibly difficult for a policymaker to “create” (or even understand) this equilibrium. It is may thus be more important to remove barriers from the path to this better state than to actively engage in institution-building. While this faces its own challenges from the point of view of a complex system, it may be a reasonable solution for policymakers.

2 Institutions and Complexity Theory

Institutions have been integral to the development of heterodox alternatives to neoclassical and Walrasian approaches to economics, from the earlier work of the “old institutional economists” such as Veblen and Commons through to North, Coase, Williamson, and Ostrom and new institutional economics. While the old institutional approach was highly diverse and appeared to “differ greatly in terms of fundamental philosophical and psychological propositions” (Hodgson 2006:218), the NIE approach to economic analysis has been more unified in its underlying fundamentals. Starting from a basis of methodological individualism, deriving analysis from the actions of individuals (Klein 1999), the NIE distinguished itself from old institutionalism, which had a heavy reliance on collection action. Perhaps more importantly, as noted by Joskow (2008), the NIE approach attempted to encompass longer term dynamic considerations associated with technological change, the diffusion of innovations, and the impacts of institutions on the two as a central part of its analysis.

Despite attempting to distinguish itself from the neoclassical paradigm (and of course commonly classified as “heterodox”), new institutional economics also seemed to be content during the 1990s to focus on the “unsophisticated” critique of neoclassical economics; this can be seen in some early writings of North, which called for economists to “abandon… instrumental rationality—the assumption of neoclassical economics that has made it an institution-free theory” (North 1992:3). Similarly, as Joskow (2008:5) put it in a summary of the early NIE research, “institutions may be analyzed using the same types of rigorous theoretical and empirical methods which have been developed in the neoclassical tradition whilst recognizing that additional tools may be useful to better understand the development and role of institutions in affecting economic performance”. However, over the past decade, much of the NIE school has moved away from equilibrium thinking, taking up the mantle of Coase, who famously noted that equilibrist thinking “has directed economists’ attention away from the main question, which is how alternative arrangements will actually work in practice…. until we realize that we are choosing between social arrangements which are all more or less failures, we are not likely to make much headway” (Coase 1964:195). In short, new institutional economics started to inch closer to the tenets of complexity theory as its defining structure.

Colander (1996) was one of the first to bring into play the “additional tools” that Joskow (2008) spoke of, pointing to the synergies between complexity theory and the approaches of new institutional economics. Meshing the idea of an economy with multiple equilibria, comprised of individuals acting on the basis of local, bounded rationality, Colander (1996) explicitly noted that institutions that underpin systemic stability were a crucial component of complex systems. That is, economic relationships amongst individuals were mediated and facilitated by institutions, but also institutions placed a limit on (presumably harmful) human actions (Foster 2000), engendering stability of the complex system of the economy. Institutions themselves were the product of complex forces at play in the broader economy, an emphasis on context that converged with Hodgson’s (1998:168) note that “institutionalists do not attempt to build a single, general model on the basis of (rules, habits, and institutions). Instead, these ideas facilitate a strong impetus toward specific and historically located approaches to analysis”. From a complexity standpoint, institutions were thus part of the web of interacting agents within an economy, tailored to and arising from their particular circumstances but playing a key role in influencing the path of an economic system.

2.1 Institutions as Complex Systems

This complexity approach to institutions placed institutions front and center as part of complex adaptive systems, mediating economic outcomes, determining paths of growth or stagnation, and shaping economic behavior. However, more importantly from a development standpoint, institutions themselves appear to exhibit complex adaptive traits, independent of their involvement in larger economic systems. As Duit and Galaz (2008) note, complex adaptive systems are comprised of agents acting on the basis of locally (not globally) available information, self-organizing and evolving in a manner that creates multiple (and temporary) equilibria and limited systemic predictability (Anderson 1999).

Taken against these benchmarks, institutions such as democracy or property rights fit these characteristics and effects perfectly. In the first instance, institutions are by their nature out-of-equilibria, in that they exist to shape and facilitate transactions but are enmeshed in a world that is always changing. We will explore these interactions more below, but suffice it to say at the moment that institutions are, as Coase said, all in some way failures: for example, no political institution can successfully rein in human nature in every situation, thus necessitating more and more elaborate ways to create checks and balances. Or, to take another more dramatic case, even the “stability” engendered by an autocracy can suddenly and irrevocably shift in a “surprise” in response to an act such as special police shooting protestors, turning a specific act of “law and order” into a major institutional shift. When such a thing happens, as in Ukraine’s Maidan in 2014, one can only ask, was the old order actually stable? Or was the political institution of the presidency in a temporary equilibrium that shifted quickly because of new information and behavioral shifts in outside agents?

The reality of institutions being in unstable equilibria or even continuously out of equilibrium also implicitly informs the way the economics profession examines institutions, in that we can rarely observe institutions in equilibrium… or sometimes at all. An inexact parallel can be drawn from the natural sciences, as it appears that institutions often seem to behave in ways analogous to Heisenberg´s Uncertainty Principle, a result derived from quantum theory. Heisenberg postulated that we can measure either the position or the momentum of a particle, but it would be impossible to simultaneously measure both. In many ways, a similar type of uncertainty is precisely the issue with institutions, in that we only see institutions by how they are designed and how what they’re supposed to do (position) or how they are changing (momentum), but never both at the same time.

I note this is an inexact parallel because, of course, institutions do not adhere to rigid physical laws as do particles, weather, or other natural phenomena; this is a recurring issue in the application of complexity as observed in nature to an area such as human action, which is unbound by such rigidities (Blaseio 1986). But the idea of uncertainty does indeed apply to the manner in which we study economic systems and, by extension, institutions, as observation of institutions embodies a host of uncertainty regarding an institution’s movement and position within the system. Such uncertainty is even more difficult to grapple with than in the natural sciences, where aforementioned physical laws constrain the space of possibilities available to any event (e.g. weather). No such constraint exists for institutions mainly due to human action (an issue we will return to later).

This uncertainty, an outgrowth of the complexity of institutions, makes it incredibly hard to prescribe an accurate path for an institution if we cannot understand where it is at any given moment. To further extend the Heisenberg metaphor, let us examine perhaps the most important institution for a functioning market economy, property rights (Hartwell 2013). Observing the position of property rights is often impossible, given that it requires such precise timing that we cannot begin to aggregate all of the transactions that show that property rights are working (and observing one business being opened does not suffice as proof of property rights). In this situation, we have to tease out property rights levels by looking at the inputs of the institution, gauging a country’s property rights protection by (usually, but not always) the legislative framework surrounding contract enforcement. In quantitative institutional economics, this is often done by using subjective indicators such as the International Country Risk Guide (ICRG) measures for investor protection or another index such as the Heritage Foundation’s Index of Property Rights. Of course, this also runs into the issue that the legislation that may provide guidance for an institution is itself part of a complex system and derived from that system (Ruhl 1996), but for the purposes of observations, we treat the priors to the legislation as exogenous.

But, if instead of observing the level (position) of property rights, we wish to instead observe its trend (an institutional analogue to the natural science idea of momentum), we are often forced to observe property rights in the breach rather than their observance. That is, knowing what the position of property rights is in a legislative framework is of no use in determining how they are implemented in practice, and we often only see the results of property rights when the institution is not functioning (but again, in the aggregate, as seeing one business closed does not prove the absence of property rights). In practical terms in economics, this means a reliance on objective indicators (see Voigt 2013 for a good overview of the subjective versus objective debate) to capture this idea of “momentum;” in the case of property rights, an often-used objective metric is “contract-intensive money”, which captures the amount of money inside the formal banking sector as a percentage of all money (Clague et al. 1996). Contract intensive money captures how people perceive their property rights after the fact, and thus captures the trend of these rights in one direction, but as it is an expression of a complex system, looking at the constituent pieces of this number on any 1 day tells us little about property rights overall.

As noted, in addition to the difficulties in observing institutions across their multiple equilibria, institutions also retain a key attribute of complex systems in that they display, as noted, little in the way of defined boundaries.Footnote 2 As Cilliers (2001:138–139) notes, “In order to be recognizable as such, a system must be bounded in some way… [b]ut complex systems are open systems where the relationships amongst the components of the system are usually more important than the components themselves. Since there are also relationships with the environment, specifying clearly where a boundary could be, is not obvious”. To return to our example of property rights, all theories of property rights formation (see Demsetz 1967 or Mijiyawa 2013) recognize that these rights are shaped by cultural, political, and other economic institutions, but part of the difficulty in recognizing property rights is that we are quite unsure where they end or begin. Is it limited solely to the legislative framework governing sale and transfer of land, does it encompass business legislation, or does it extend to an independent judiciary and ease of land titling? To be sure, we have knowledge of a core of property rights as serving “a dual purpose of using (although not necessarily needing) the state for enforcement while also guarding against the state’s own encroachment on the individual’s property” (Hartwell 2016a:173). However, the instruments surrounding this institution are in many ways difficult to define, and can be diversified across cultures, national boundaries, and societies.

A further contribution to arguing for institutions as complex systems is their evolutionary nature, typified in their persistence or, to use another term borrowed from the regional economics debate (Simmie and Martin 2010), “resilience” over time. In the words of Potts (2007:342), institutions are “structures that coordinate a system of agents, but also processes that exist in historical time subject to evolution and entropy”. This definition also highlights that the development of particular institutions is also highly path-dependent, with many potential multiple paths and equilibria depending upon the culture, society and, as we will see, other institutions. A key point to note here, however, as Martin (2010) does, is that institutional evolution and its path dependence also does not exist in an equilibrist paradigm, in that institutions can choose many “wrong” paths but only one “right” one to bring it to equilibrium; rather, the complex approach to institutional evolution would emphasize change rather than steady state, recognizing that an institution’s function may remain the same even as its instruments or organization may differ depending upon the circumstances.

This complexity approach links well with the economic analysis of institutions, which notes that one of the key defining features of an institution is its semi-permanence (Hartwell 2013). In fact, what distinguishes an institution from a “policy” is how it continues to exist and adapt and mediate behavior while particular policies come and go, thus truly making it part of a system. And nowhere is this staying power of institutions more apparent in how institutional effects can persist over time and space, even after the institution itself has vanished. An exciting new area of scholarship has begun to look at the effects of long-ago institutions in shaping today’s economic outcomes, with papers such as Becker et al. (2016) positing that Austro-Hungarian empire’s institutions continue to influence attitudes towards trust and corruption even today. Similarly, Grosfeld and Zhuravskaya (2015) look at the partition of Poland amongst the three empires of Austria-Hungary, Russia, and Prussia, and test if being under the sway of a particular empire and its institutional system left an indelible mark on contemporary Poland (they find, perhaps surprisingly, that the main effects were cultural, including religiosity and attitudes towards democracy).

Of course, this work can possibly be capturing the broader cultural currents rather than the reality of complexity: one can plausibly conjecture that the imposition of an Austro-Hungarian administrative state in a cultural ethos that was already inured to such organization does not tell us about the failures of Austro-Hungarian institutions but about the informal cultural institutions already at work. But keeping a focus on complexity, it would be folly to think that these same cultural institutions did not also influence the growth or development of the Austro-Hungarian institutions as well. This supports the argument that, while institutions themselves are complex adaptive systems, they are further nested in an economy within a complex institutional structure which, taken in its totality, influences the economic system.

2.2 Institutional Systems as Aggregations of Complex Adaptive Systems

Indeed, when observing a broader institutional system or its overarching governance structure (Williamson 1979), the applicability of complexity theory becomes even more apparent. Not only do discrete institutions such as property rights rely on broader cultural or legal developments, they are dependent upon other institutional developments as well (and in turn help to shape these other institutions). This reality too fits in with the ideas of complexity theory, which posit that complex systems generate their own “system effects” that typically fall into one of three categories (Duit and Galaz 2008):

-

Threshold Effects Change often comes in a disjointed manner and is rarely smooth, either characterized by abrupt shifts or slow transitions that result in an entirely different internal organization (Gunderson and Holling 2002). In particular, small changes that might not appear consequential can, in the right atmosphere and at the right time, cause monumental shifts (e.g. as in the self-organized criticality of the last grain of sand that causes the pile to collapse, Bak et al. (1987)). This effect can be observed within a particular institution, but also is a characteristic of institutional systems—the grain of sand is insular until it interacts with other grains to become a sand pile.

-

Surprises As interaction mechanisms are poorly understood, the system may generate surprise outcomes, i.e. outcomes not even expected by those intimately acquainted with the system and its rules or past behavior. Given the unpredictability of systemic evolution, surprises are inevitable (Ruhl 1996), and can cause (or be caused by) discrete institutional changes.

-

Cascading Effects Finally, interconnected complex systems have intense feedback and pass-through effects that can amplify an original event; Duit and Galaz (2008) use the example of droughts in India, which caused poverty for families that were previously more secure, which in turn led to health-related problems in vulnerable populations. In an economic system, such feedback can be easily seen through monetary policy stimulus, which can influence financial markets, investment decisions of firms, individual decisions to make large purchases, and, when the stimulus is withdrawn, a cascade of business failures, bankruptcies, and clamor for more monetary stimulus.

In addition to these effects, an additional aspect of the complexity of institutional systems is the diverse nature of institutions that make up such a system (a concept championed by Ostrom (2005)). In any given economic system, there may be institutions that depend upon others (i.e. a central bank is dependent upon a government for its existence), institutions that fill holes created by others (various financial institutions that cater to clientele underserved due to legislation or political maneuvering), and even institutions that work directly counter to other ones in the system (police versus organized crime, or informal markets against communist planning organs). Indeed, the presence of duplicative and contradictory institutions may unnecessarily increase the complexity of a system while still keeping an overall balance to the system itself.

In this sense, and contra to Colander (1996), while single institutions may help to guarantee systemic stability, the complexity of an institutional system may create permanent instability, guaranteeing change rather than continuity. Or, as Bak et al. (1988) noted in their study of self-organized criticality, the system may settle into the most-unstable stability, a state where actions introduced from outside the system might cause systemic collapse but, in the absence of such exogenous pressure, the system remains intact (like the proverbial sand pile). However, Strambach (2010) also notes that institutional systems also tend to be characterized by varying levels of influence of constituent institutions (i.e. not every institution has equal weight), and thus a “dominant” institutional system may provide bounds for systemic instability via institutions that are more powerful than others. This issue, of a differing distribution of weights of institutions within a system, is something we will return to later.

Finally, building on this idea of “dominant” institutional systems in institutional complexity is the familiar Schumpeterian process of “creative destruction” (Schumpeter 1942). While institutions are characterized by their resilience, this does not mean that they exist forever (especially in the political sphere): like individuals, institutions age, transform, and if no longer needed, die within a broader institutional system. The system is therefore also undergoing an evolutionary process, one by which inefficient institutions die out and are overrun by “fit” ones (Bisignano (1998) shows this process for financial sector institutions). This process need not be instantaneous, however, and many “inefficient” institutions may survive long past their sell by date due to the reality of institutional inertia, vested interests keeping institutions on life-support, or the sheer complexity of institutional interrelatedness making the cost of changing one institution prohibitively high (Setterfield 1993).Footnote 3

3 Complexity, Institutions, Development

If institutions are complex systems unto themselves, further nested in a complex institutional system, it is easy to see that, as Potts (2007:341) correctly noted, that “as institutions evolve, so do economic systems”. This evolution of institutions and institutional systems is what brings us to the heart of the relationship between complex institutions and economic development. Taking these relationships to the next logical step, it is apparent to see as institutional change necessarily leads to changes in the broader economic environment, these complex methods of adaptation thus are economic development.Footnote 4 As Barder (2012) noted, “Development is not the sum of well-being of people in the economy and we cannot bring it about simply by making enough people in the economy better off. Development is instead a system-wide manifestation of the way that people, firms, technologies and institutions interact with each other within the economic, social and political system”. Understood properly, this means that development, like the institutions that make up the economic system, is path dependent, a form of economic evolution that is shaped internally while external forces prod and shape various evolutionary paths. It is also the point where strict parallels with natural phenomena starts to break down, as natural systems are rigidly bound by physical laws, and there is way to consider “improvement” in a system, as it implies a state beyond the existing system (i.e. the creation of new, heretofore undiscovered and non-existent forms of weather). But this still relates to many tenets of complexity theory for, as Holcombe (2012) asserts, the idea of progress is explicitly a non-equilibrist position, as economies in motion are not in equilibrium.

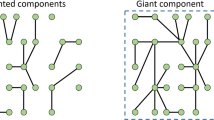

However, the concept of “economic development” itself, while not explicitly equilibrist, does imply linearity, measured by increasing GDP per capita, more happiness, or increases in other metrics that attempt to capture the sum of well-being in the economy. In this sense, both the term and the concept “economic development” exhibit not a positive description but instead a normative prescription: if economic development can be properly thought of as a complex evolutionary process, it does not need to be linear or historically determined. This distinction if crucial for, when one speaks of “economic development” in mainstream economics, they are not talking about development but about improvement. An economic system can go in many directions, but it is implicit that the “development” really goes in only one (see Fig. 1).

Taking all of these facts into account means that economic improvement commonly referred to as development must be related directly to the improvement of the institutions that make up the economic system. Policies may play a short-term role in shaping expectations, but development is primarily related to the upgrading of the economic interactions in a system and how they are facilitated. But in order to improve economic interaction, we need to refer back to the level of the individual institution within the larger economic system and how it interacts with the larger institutional structure and broader economic system as a whole. A large school of thought has grown up around “transaction cost economics” (Williamson 1979), with researchers noting that the existence of institutions is related directly to their ability to surmount informational asymmetries, reduce uncertainty, and establish stability for interactions at the margins to occur (Meyer 2001). This is true to a point, as many institutions do provide clear rules of the game and reduce uncertainty, property rights paramount amongst them.

But these market-facilitating institutions (borrowing the nomenclature from Hartwell 2013) are not the only ones that exist in a broader institutional system, as noted above; political institutions, for example, that have an explicitly re-distributive nature about them may only add to uncertainty and certainly do not facilitate (at least formal) economic interactions. When thinking about development, it is then perhaps important to recognize that some institutions are a priori better than others, at least in fostering the conditions needed for an economic system to improve. Institutions that facilitate market interactions and, most importantly, lower the transaction costs of these interactions, appear to be paramount for systemic improvement, as they would create the environment for an economic system to develop. In a world of complexity, institutions that streamline costs, facilitating information flows, and make interactions easier also make life simpler for the individuals that comprise an economy. Complexity creates its own demand for simplicity, even if the system itself remains unfathomably complex.

Narrowing down further to the types of institutions that could make the existing complex facets of an economy simple, it is possible that they could be political in nature, for example, those that codify property rights or enforce them, such as an independent judiciary. It is more likely, however, that they would be primarily economic institutions, as they are “concerned, as a matter of design, with maximizing the utility of principals in the economic sphere; that is, in solely influencing and mediating economic outcomes” (Hartwell 2013:32). Given that market interactions are entirely economic, it logically follows that institutions concerned with this sphere would be more essential than, say, democratic accountability. Moreover, the crucial institutions for economic improvement need not only be formal institutions, such as government-created courts, but more likely will also encompass informal and social institutions such as churches, civil society, and other informal mechanisms arising organically from a society. And finally, these institutions need not be complicated; as many authors have noted, complex doesn’t mean complicated (Waldrop 1992), and many of the most resilient institutions (as with biological organisms) are often the simplest.

With a concentration on lowered transaction costs, development in the “correct” direction could occur more easily. However, a focus on the lowering of transaction costs may also paradoxically increase complexity within a system, by facilitating entry into the system and requiring new institutions to deal with new entrants (Kauffman 1993). For example, removing political institutions to increase economic interaction, the end result is that more agents will become involved in economic relationships.Footnote 5 An example of this would be removal of a government’s oversight role in occupational safety; such a diminution of these costs would likely increase entrepreneurial entry into the economic system, thus entailing additional institutional mechanisms to ensure safety is still achieved (consumer demand for safety does not disappear simply because the institution charged with it disappears). Similarly, decentralization of fiscal functions within a government may lead to better outcomes based on subsidiarity and lowering of transaction costs, but the fragmentation of institutional knowledge may increase the complexity across new units in the system.

Thus, a key point in understanding “development” is that it requires institutional improvement, especially for economic institutions which deal with transaction costs, but such improvement does not necessarily make a complex system simpler in its totality. That is, it is not a truism that better institutions → less complexity → development as, if anything, more complex systems at the country level exhibit more development. Manifestations of such an increase in complexity could include technological innovation (Wolter and Veloso 2008), new firm creation (Frenken and Boschma 2011), or the realization of entirely new sectors of the economy (Saviotti and Pyka 2004), all of which make dealing in a country institutional system more difficult in the short-run. Indeed, transaction costs may even increase in the short-run as institutions within the system adjust to the new higher levels of complexity and/or new ones arise to cope with the new complexity. But these adjustments within the system necessarily create what we refer to as “development”, as they foster the conditions for improved economic outcomes without necessarily putting a normative constraint on what those outcomes should be in equilibrium.

3.1 Building Institutions for Development?

If institutions that lower transaction costs matter for development, then how these institutions come to be must then be the crucial question to attaining development. It is here that the ideas of complexity take on a whole new meaning, for the question of institutional development is reliant upon several intersecting complex adaptive systems (as shown in Fig. 1), each with its own influence.

Indeed, there is a long and distinguished pedigree in both the political science and economics (as well as sociological, anthropological, and other) literature on how institutions develop and what matters most. Recent mainstream economics research has coalesced around what has been termed the “legal origins theory” (Glaeser and Shleifer (2002)), where a key determinant of institutional path development in (mostly) colonized nations was the type of legal system that was imported. La Porta et al. (1999) show empirically the relationship between various types of legal regimes and subsequent growth, finding that common law countries have deeper financial markets and more advanced property rights than civil law countries. Although their approach has been challenged on methodological grounds (Spamann 2010), a more pertinent critique from the complexity approach concerns the supposed exogeneity of legal systems (Armour et al. 2009). Legal systems do not arise in a vacuum, a point acknowledged in a follow-up article by the original authors (Shleifer et al. 2008) but one that they countered by widening the definition of “legal regime” to encompass many other facets of the complex system of institutions (Michaels 2009). Indeed, informal and formal legal institutions often arise in tandem, one influencing the other, with informal rules become formal laws and formal laws relegated to obscurity when informal norms change. In such a complex environment, formal legal institutions are very difficult to disentangle from their informal counterparts, and thus understanding which came first can be problematic for institutional creation. As complexity theorists have asserted, measurement of initial conditions is infinitely sensitive, as the “slightest discrepancy in measurement could throw out the results by a vast amount” (Hartston 1997).

Taking up this challenge of institutional endogeneity in a similar but contrary vein, a variety of theories on state formation have asserted that the legal framework that gives rise to an institution only comes about from the institution of the government, or, put another way, that political institutions determine economic institutions. This view, voiced most prominently in Charron et al. (2012), claims that the organs of government and how they develop (whether they are “patrimonial” or “bureaucratic”) determines the legal structure and thus creates economic institutions as well. Charron et al. (2012) distinguish themselves from the La Porta et al. (1999) analysis by focusing exclusively on OECD countries, thus taking a further step back; while La Porta et al. (1999) examine the colonized lands and the legal system that was brought there, Charron et al. (2012) instead examine the colonizers and how they created such a legal system in the first place.

Of course, the Charron et al. (2012) analysis suffers from its own empirical and theoretical flaws. By focusing only on OECD countries, it ignores much more recent examples of endogenous institutional development (to whit, the transition countries of Central and Eastern Europe and the former Soviet Union) in favor of “safer” territory. But their analysis also suffers from intense theoretical flaws as well, focusing only on formal institutions (and explicitly on political institutions), arbitrarily drawing the line on when a “state” is formed and when law arises. Framing their entire argument on the tension between “society’s efficiency” and a ruler’s propensity to grab and run, they neglect what other complexities contributed to the ruling arrangements in the first place. Napoleon, one of their prime examples of a ruler who chose a particular legal regime, was a product of a very specific time, place, and cultural milieu, something that could explain the emergence of a bureaucracy inimical to property rights.

As can be seen from these opposing viewpoints, the difficulty in determining institutional genesis vanishes once a clear demarcating line pre-institution has been set. If we set the beginning of the institution as when it achieves formality or is protected in law (i.e. legal status), then we can argue that the legal system is the reason that this particular institution came to be. Similarly, if we say that the legal system needed to come from somewhere, and it was a particular government that created the legal system, we can draw the line at the formation of the government and proudly exclaim the need for a state to create institutions. However, of course, neither of these approaches are accurate, as the legal system and the government came from earlier origins rooted in culture, exogenous forces, and the intricacies of the complex adaptive system in which they formed.

Perhaps a better explanator for institutional genesis would be Acemoglu and Robinson (2001), who isolated an exogenous (to the system) variable in exploring the mortality rates of settlers as the determinant of institutional paths. This has the benefit of a clear starting point (the moment that settlers arrived at a virgin land), a clear path dependence (dead men create no institutions), and somewhat recognizes that, by self-selecting out of one complex adaptive system (the home country), settlers may be creating an entirely new one organically. The drawbacks of this approach are, of course, that it applies only in specific historical circumstances; moreover, and perhaps more importantly (as with the examples of Poland and Austria-Hungary above), the effects of prior institutions in the home country may be more powerful than is assumed by this approach. That is, even if the new world appears to be tabula rasa, the individuals that settle it still bring their pre-formed notions of the rules and norms governing interactions. It would not be a case so much of creating a new complex system than of the original system undergoing meiosis, creating a smaller version of itself that then combines with new stimuli to create a new, fused system.

3.2 Importing Conditions, Importing Institutions

It is precisely this complexity of institutional genesis that makes assisting institutional development a dangerous game for development, especially as it relates to foreign aid or formal development assistance. While there has been a greater recognition in the international donor community of the importance of institutions over the past 25 years, the approach towards institutional change has been ignorant of the complexity of institutional genesis. In many instances, donors have attempted to create development in poorer countries by exporting institutions wholesale (Jayasuriya 2001; Sherieff 2014), a process that has assumed imposing a foreign object into a country’s national institutional structure can somehow dominate the structure and pull the entire system in the direction of development.

Ironically, this approach was harshly critiqued during the transition process in Central/Eastern Europe and the former Soviet Union, albeit from a different angle. During the 1990s, the argument was, for the most part, not that “institutions were not being built” (although Kołodko 1999 differs), but that the wrong kind of institutions were being built. A brilliant example of this thinking is Stiglitz (1999), where he asserts that transition would be completed if tax administrations could just be improved, a belief which is contra to all of transaction cost economics and, as it turned out, history as well. Unfortunately, assertions such as this still assume information about the system that is inherently unpredictable, and in most cases, unknowable, so that talking of specific institutions to assist is surely a guessing game with no provable counterfactual. Even surely novel recommendations, such as Durlauf (1998), that policymakers should gather more evidence before implementing a policy appears to be worthless in the face of complex adaptive systems.

Moreover, the vast bulk of development assistance has been on creating or assisting formal, political institutions,Footnote 6 which also presupposes that the political structure in an economy can effect major institutional changes throughout the entire institutional system. Of course, a major failing in thinking about “governments” and what they can do to further institutional development is that we often think of government as its own monolithic creature, a fallacy that public choice literature has highlighted again and again (Buchanan 1984). Governments are themselves political institutions pursuing economic goals via a variety of means, influencing their environment and in turn interacting with those outside of government, while being shaped from within by political actors, differing institutions, and the polity at large. Treating government as one indivisible institution capable of influencing other institutions ignores the complexity within even a single government agency, not to mention across a large and multi-faceted organism like a federal government; this approach also often only deals with centralized governmental institutions, impacting not only broader economic institutions within the system but even disrupting information flows between central and local government institutions (Berkes 2002). It also ignores the inherent non-linearity of government actions, which, due to exigencies of a democratic system (to take one example) can suddenly reverse from 1 year to the next or be changed entirely due to election results (Richards and Doyle 2000). Even best practices which note the need for “political will” in building institutions can flounder on the realities of complexity.

Despite the amounts of money and time invested, there has been little rigorous research on the effects of top-down political institution building. As Bräutigam and Knack (2004:260) note, “the way large amounts of aid are delivered can weaken institutions rather than build them… through the high transaction costs that accompany aid, the fragmentation that multiple donor projects and agendas promote, problems of ‘poaching,’ obstruction of opportunities to learn, and the impact of aid on the budget process”. There is some empirical basis for this supposition, as Remmer (2004) has found that foreign assistance not only increases the absolute size of government but degrades the government’s own ability to generate revenue. Similarly, from the point of view of donors, an early survey by Moore et al. (1995:60) for the Swedish International Development Agency (SIDA) concluded that (as complexity theory would predict),

…institution building projects tend to be less successful than [aid agencies’] other projects. The most common explanation focuses on the nature of aid agencies themselves: the fact that their relatively bureaucratic procedures and “alien” status in host countries make it difficult for them to meet the needs of institution building projects: flexibility; sensitivity to local circumstances; focus on process rather than on meeting targets, especially expenditure targets; willingness to experiment and learn; and long-term commitments.

This reality appears to carry through to the present day, as Humphreys et al. (2013) show that a project in Eastern Congo funded by the UK government had virtually no impact on behavior in the region.

To some extent, there has been an acknowledgement of this reality in development assistance: if the “exporting” approach to institutional development, a simple solution to a complex issue, is ineffective, perhaps the next-best solution is to import the legislation that can create the institution. An outgrowth of the “law and development” tradition that took hold in the 1960s (Trubek 2006), international donor agencies have been instrumental in bringing “best practice” law to developing countries, adapting developed country legislation in order to create the conditions for institutional genesis. As a theoretical basis, this approach comports with legal origins theory, in that the legal regime, if taken from the correct tradition, could help to push institutional change.

However, the importation of foreign legislation also has had little success in the aggregate, as the entire process of importing a legal regime runs into a large problem of reverse causality. In particular, it is highly plausible that countries that see success in adopting a foreign legal regime would have approximated that regime anyway, due to other traits of the economic system and culture. To return to our application of Heisenberg to institutional development, one may observe the success of a particular piece of legislation, but that observation does not mean we have the knowledge of what created that position (what momentum went into creating such legislation). Similarly, while an argument can be made that development assistance helped to speed up the process, this also doesn’t consider the costs of such an implementation against the benefit of immediate legal change. Moreover, consider the myriad of instances where importing legislation did not work (Davis and Trebilcock 2008); the approach of Charron et al. (2012) can provide an insight on the failures of legal grafting in these cases, as laws without either an appropriate bureaucratic base to implement them (see the issue of corruption in Ukraine in Shelley 1998) or broad acceptance in society can be subverted. The legislative school also, as with importing institutions, has a heavy reliance on centralized governmental procedures, once again focusing on one set of institutions to the exclusion of others.

In sum, it appears that donors trying to send their own institutions elsewhere without recognition of the complex adaptation process that create market-facilitating institutions are wasting economic resources from their own economic systems. But still we wish to see development progress, to return better economic outcomes and improve the lives of humanity. How then can this be done?

3.3 Is Development the Removal of Barriers?

While the difficulty of importing institutions creates a conundrum for policymakers who may want to do something (anything!), it provides a rich new area of analysis for economists: despite the statistical unlikelihood of anything ever happening anywhere in the universe, things still do happen and countries do develop. Given that this is the case, it is perhaps more important for policymakers to focus their energies elsewhere in pursuit of development. Perhaps the case may be that “efficient” institutions will emerge if they are not impeded by other institutions within the system. That is, if positive action cannot be implemented to ensure institutional development for the better, then perhaps removal of barriers that prevent the emergence of market-facilitating institutions could be paramount to creating development.

Put another way, it may not be possible to import directly institutions for development, or even to copy the legal regimes that give rise to “good” institutions, but the barriers to institutional development within a complex system can be identified and removed. A brief digression is needed here; by “barriers”, I mean either natural or humanly-devised constraints that prevent the emergence of key institutions. In some areas, barriers are readily identifiable: geographic idiosyncrasies that prevent trade institutions from flourishing are one such example, as are political requirements that equipment must be licensed and approved before use. Barriers such as these have varying levels of difficulty in overcoming, but each one, if removed, could help to facilitate the growth of market-enabling institutions.

This approach is not an equilibrist position, as all economies are transitioning and all institutions are in the state of flux, but is rather a way of letting the forces that already are part of a nation’s economic system developing along their own logic to improve economic outcomes. This approach would be the polar opposite of Arthur’s (1999) “gentle nudge” of government, taking an explicitly negative approach towards a system rather than a positive prescription for institution-building. Indeed, framing development as removal of barriers along a particular systemic path, rather than thinking of it as building something anew, may help to influence our understanding of institutional change in a complex adaptive system.

Removal of barriers would, as a practical matter and as noted above, be based on the metric of reduction of transaction costs within the institutional system. Such a metric would necessarily favor the preservation of formal and informal economic institutions, which should play a vital role in mitigating complexity for the individual, if not within the entire system. Thus, for a policymaker to remove barriers to institutional development, formal political institutions would likely be the first to be targeted for removal, given their ability to create complexity in an economic system (see for example Acemoglu and Robinson (2000) on political losers) and dampen rather than facilitate markets.Footnote 7 This approach turns the state formation theories of Charron et al. (2012) on their head in one particular respect: yes, government may be responsible for the current state of economic institutions, and isn’t that a pity. Moreover, political institutions are some of institutions that are the “easiest” to dismantle (at least relative to informal economic dealings or even formal property rights), and thus the balance in an economic system would be shifted away from political and toward economic institutions to achieve development.

That is not to say that this approach is itself not problematic from a complexity standpoint. In the first instance, any deliberate institutional changes will be subject to the same forces of complexity and unintended consequences that led to the creation of an institution in the first instance. Countries are always-evolving institutional systems, and the removal of institutional barriers may well create temporary instability within the system, at the very least increasing transaction costs in the short-run and perhaps also increasing uncertainty. But such instability will be very distinct (and likely much milder) than the issue noted above, that of importing an institution into an already-existing institutional system. The removal of an institution from an existing system will cause dislocation as institutions seek to fill the gap, but the institutions that exist already have knowledge of the complexities and intricacies of a country institutional system, as Hayek (1945) noted; foreign institutions grafted on to an existing system do not have this same knowledge, and thus can cause much more disruption, duplication, and dislocation. It is the difference between bringing a new couch blindly into a furnished apartment (with all the difficulties inherent in getting it through the door and having it match the current decor) versus rearranging the furniture when one piece breaks.

Other critiques of this approach are much more difficult to surmount. While policymakers may be intent on improving flows of knowledge to lower transaction costs, removing barriers as an action requires an incredibly deep understanding of which barriers or which institutions are impeding “development”. In a complex system of institutions, it may be nearly impossible to understand where transaction costs are derived from, as certain institutions may be masking where costs or frictions are generated. As Acemoglu and Robinson (2010:146) note, “many dysfunctional economic institutions are supported by a system of specific laws and regulations that relate to these institutions”. Does one begin by removing the tax man, the tax administration, the office of the Prime Minister who sets policy, or the entire government? Different theories of economic development would have different prescriptions, leaving us no wiser as to where the problem issues from.

A way around this issue may be for policymakers to focus on the more influential barriers in a society. As noted above, not all institutions within a system carry equal weight, and thus a rule of thumb for policymakers may be to focus on the more dominant institutions (in practice usually formal political institutions). The benefit of this approach is precisely that many other institutions depend upon this one institution, and thus removal can create a domino effect. But this approach may also be difficult in a polarized or fragmented society, as political institutions that have an explicit market-dampening effect may also create fierce political resistance if removed; one need only look at Malaysia’s complex web of racial policies to see such a system with deep roots. Removing both the formal racial quotas and the surrounding informal societal structures may lead to highly persistent systemic instability of the type detrimental to development.

Another possible way to effectively remove institutional barriers may be to reduce duplication. Also as noted above, institutional systems tend to be characterized by institutions (whether formal or informal) which directly contradict each other, thus increasing system complexity needlessly. Thus another informal rule that may provide guidance is removing formal institutions that are misaligned with informal institutions, such as monetary policies that are directly contradictory to black market exchange rates. In this manner, the removal of competing institutions can help to lessen institutional and institutional-system complexity while not increasing the complexity of the country-system as a whole. Of course, the difficulty that arises here is that it is sometimes the informal institution that contributes to instability (racism being one example); while it is easy to say that the institution that increases the complexity of the system by forming its opposite should be removed, this is more difficult in the case of entrenched societal values.

A final issue regarding the removal of institutional barriers relates to the issue of permanence. In a non-equilibrating system, institutions and institutional systems do not remain static but continue to evolve and change; while institutions themselves are characterized by semi-permanence, their environment is not. In such a fluid environment, there is no guarantee that institutional changes imposed from above, even if they may facilitate exchange and reduce transaction costs in the long run, will not themselves be reversed. This problem, of “time inconsistency” in economic parlance, has been treated better in the political science literature as an issue of “commitment” (see, for example, Bunce 1999 in the transition context). If one institution can impose its will over other institutions in the system, there is no guarantee that a decision will remain intact over time. This uncertainty over permanence that accompanies such a shift in the institutional system may also lead to increased transaction costs over time, negating the gains of the removal of the institution in the first instance. This would then translate to slower development, as resources are tied up in the waiting.

3.4 Institutional Adjustments for Development: An Example

This paper has thus far laid out a case for institutions and institutional systems as complex and adaptive, advancing the idea that the removal of barriers (i.e. transaction costs) within an economic system is the way for a system to achieve development but without imposing an equilibrium ideal. This idea animates much of “transaction cost economics”, as laid out by Williamson (1979), as well as the strain of new institutional economics which Douglass North led (see especially North 1990). These researchers, joined by many others, have provided many historical examples of how the emergence of institutions lessening transaction costs allowed for country economic systems to develop. Most importantly, as North (1990) pointed out, there has been a “diverse degree of success” amongst “developed” countries, with different institutional make-ups and organization; thus, there may not be one path to development, but the function (i.e. lessening of transaction costs) needs to be the same.

Such cost-reducing institutions dot the landscape of history in successful economies, with the example of Poland providing a good case study of such development.Footnote 8 Poland’s long March towards “development”, going back to the creation of the Polish-Lithuanian Commonwealth in 1386, has been a struggle between transaction cost-lessening and transaction cost-increasing institutions. In the early years of the Commonwealth, as elsewhere on the European continent, a myriad of institutional arrangements competed with each other within the national economy. While, as a Kingdom, Poland saw continuous efforts by the executive to concentrate power in the monarchy, Poland began its journey of capitalist development through a more decentralized institutional regime, predicated on the growth of towns granted self-governance by the crown (Murphy 2012). These smaller units created local-level enforcement mechanisms and implementing institutions such as village courts, creating an effective means for alleviating transaction costs and informational asymmetries (Guzowski 2014). In this sense, the broader political institutions governing the country had created the conditions for lowering transaction costs simply by decentralizing governance at the town level; such a move enabled the creation of distinct yet tailored institutional mechanisms which furthered commerce and created growth in the Polish countryside (Guzowski 2013).

Other institutions within the system were not so kind for transaction costs, however, and the persistence of feudal relations and particularly serfdom continued to constrain labor mobility and the ability of individuals to partake in independent economic relations. Moreover, as noted above, the history of the Polish state in the fifteenth through eighteenth centuries was of an executive continually trying to transfer power from the szlachta (the landed nobility) to himself; the competition that this created led to periodic rebellions and foreign adventurism, both of which handicapped the development of economic institutions within the country (Hartwell 2016b). The total effect of the sclerosis induced by serfdom and the institutional rot effected by continuous war was a collapse of the Polish state and partition, with parts of Poland absorbed into its three neighboring empires (Russia, Prussia, and Austria-Hungary).

Of course, as noted above, just because a country ceases to be does not mean that its institutions also must cease, as informal institutions are just as important in fashioning an economic system. In Poland, the process of institutional genesis and evolution stratified along the lines of Partition, with institutions evolving depending on which existing institutional regime they interacted with (Grosfeld and Zhuravskaya 2015). Practically, this meant the creation of Polish-only institutions such as cooperatives and even social groups, all of which attempted to lessen the transaction costs acquired by foreign domination for Poles in the occupied territories. In the Austro-Hungarian partition, these indigenous institutions were enabled by a somewhat more liberal governing regime, but in the Prussian and especially Russian partitions, Polish institutions were kept necessarily small-scale. Under Partition, thus, institutions for Poles arose generally to deal with the conditions of Partition, pushing development forward in spite of the institutional order which was imposed from above.

Poland’s experience after regaining its independence after the First World War, and throughout the interwar period, shows the difficulty of preserving such facilitating institutions, especially when political institutions have been given priority. The desire to foster a Polish nation and a Polish identity meant that the successive Polish governments from 1919 to 1939 were concerned with funneling development into a certain pre-determined path. This meant conscious erection of some barriers (protectionism), unwitting imposition of barriers in other spheres (profligate monetary policy resulting in hyperinflation), and a steady March towards proto-fascism in both the political and economic spheres. It is hard to argue that the policies undertaken by Poland’s interwar governments enabled “development”, in as much as they reinforced rigidity within the system, making it less able to adapt and more susceptible to collapse when faced with an external threat.

It was not until the fall of communism in 1989 that where Poland’s new generation of leaders set about radically removing barriers to institutional development (for an in-depth examination of this process, see Hartwell 2016b). Central to the process of transformation was the “Balcerowicz Plan”, named after the Deputy Prime Minister/Finance Minister Leszek Balcerowicz, which outlined a series of policies that Poland’s first post-communist government (elected in June 1989) were to follow in order to transition the economy to a market-based structure. While there was much debate at the time on “sequencing” and the virtues of “macroeconomic stabilization” above all else, the Balcerowicz plan had a much more ingenious approach to Poland’s development in that it acted precisely in the manner described above, removing barriers to voluntary exchange and allowing for institutional development to occur in a somewhat spontaneous fashion.

The heart of the Balcerowicz plan was its approach towards the relations between economic actors and the state. Under communism, the state was a planning apparatus, in charge of the means and distribution of production, effectively increasing transaction costs for private exchange to infinity (especially if one considers the pain of death in Stalin’s Soviet Union or in today’s North Korea for indulging in private exchange). In order to transition from this economic system, institutional change was required, but such a change needed to foster institutions that would facilitate the market economy while supplanting, reforming, or eliminating those that facilitated the planned economy. Given that nearly all formal institutions under communism were tied directly (financially and politically) to the state, the Plan’s point to “reject state intervention in the activities of competitive enterprises” meant a shift in the incentives of every enterprise in the country. In one fell swoop, it eliminated most artificial transaction costs to commerce, allowing for the evolution and embrace of market-facilitating institutions while causing “inefficient” communist-era institutions to wither on the vine.

The Polish experiment has not been an unequivocal success in driving development. In fact, there also was an equilibrium of sorts that subsequent Polish governments attempted to reach in the institutional make-up of the country, and that was the goal of EU accession. Indeed, after 1992, when EU accession seemed a possibility, and Brussels instituted a road-map for Poland and other CEE countries to follow, the institutional path was set. But in the heady, early days of transition, there was no such road-map to follow, and it was more important to remove barriers than (as the interwar government had done) set a path on which the country must proceed. And, as complexity theory would predict, the interaction of institutions within the new economic system created by post-communist Poland has seen some reversals and re-institution of barriers to development. More than anything, the example of Poland teaches that lessening transaction costs in a complex environment is not a one-time activity, and institutions must continuously adapt. But it also teaches that development occurs in the aftermath of such adaptation, in the spaces where transaction costs are actually diminished.

4 Conclusion

This paper has applied tenets of complexity theory to the study of institutions and institutional systems, showing the difficulty in achieving an inorganic path to development. The reality of institutional complexity and the difficulty of influencing institutional development from the outside appears to vindicate Austrian approaches to coordination (Hayek 1964) and “spontaneous order” (which Kilpatrick 2001 has argued is another variant of complexity theory). Institutions, even though they may serve similar functions, are different in different societies, and even knowing what outcome is desired from an institution is of little help in achieving that outcome in such a complex system as a national economy. Of course, just as there is very little movement towards a prescriptive institutional economics in the literature, there are also few normative prescriptions that can be found in an application of these aspects of complexity theory to institutional, and thus economic, development. If, as noted above, it is difficult to even observe institutions, it surely must be difficult to create them. And thus, it is especially difficult to improve institutions to foster development. In many cases, the only apparent prescription for policymakers boils down to the Hippocratic Oath’s injunction of first, do no harm.

Notes

Indeed, its popularity in policy, political science, and public administration journals have made complexity theory, in the words of Koppl (2006), “heterodox mainstream”.

Again, here is where there is some divergence from the natural world, as phenomena such as weather are bounded by a finite set of possibilities, even when accounting for interaction effects. Institutions, by contrast, exhibit no such space of all conceivable functional paths. Many thanks are due to Helmuth Blaseio for suggesting this point.

Acemoglu (2006) models how this might be so, although he does so utilizing a neoclassical assumption of institutional system equilibrium.

This equating of institutional change to economic development is parallel to the view that (as noted elsewhere, see Hartwell 2013) “transition” economics and the move from communism to capitalism was at its heart about institutional reform, and not about delivering better GDP results. Improved economic outcomes are a second-order effect of changed institutions.

Many thanks are due an anonymous referee who pointed out this fact.

Meyer’s (1992) premature worry that development assistance was shifting primarily to NGOs appears, in light of the history, to have been unfounded.

See the example of occupational health and safety agencies in the previous section.

This section is based on material found in Hartwell (2016b).

References

Acemoglu, D. (2006). A simple model of inefficient institutions. The Scandinavian Journal of Economics, 108(4), 515–546.

Acemoglu, D., Johnson, S., & Robinson, J. A. (2005). Institutions as a fundamental cause of long-run growth. Handbook of economic growth (pp. 385–472). North Holland: Elsevier.

Acemoglu, D., Johnson, S., Robinson, J., & Thaicharoen, Y. (2003). Institutional causes, macroeconomic symptoms: Volatility, crises and growth. Journal of Monetary Economics, 50(1), 49–123.

Acemoglu, D., & Robinson, J. A. (2000). Political losers as a barrier to economic development. American Economic Review, 90(2), 126–130.

Acemoglu, D., & Robinson, J. A. (2001). The colonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369–1401.

Acemoglu, D., & Robinson, J. A. (2010). The role of institutions in growth and development. In D. W. Brady & M. Spence (Eds.), Leadership and growth (pp. 135–164). Washington: World Bank Press.

Ackerman, F. (2002). Still dead after all these years: Interpreting the failure of general equilibrium theory. Journal of Economic Methodology, 9(2), 119–139.

Allen, R. E., & Snyder, D. (2009). New thinking on the financial crisis. Critical Perspectives on International Business, 5(1/2), 36–55.

Anderson, P. (1999). Complexity theory and organization science. Organization Science, 10(3), 216–232.

Armour, J., Deakin, S., Lele, P., & Siems, M. (2009). How do legal rules evolve? Evidence from a cross-country comparison of shareholder, creditor, and worker protection. American Journal of Comparative Law, 57(3), 579–629.

Arnsperger, C., & Varoufakis, Y. (2006). What is neoclassical economics? The three axioms responsible for its theoretical oeuvre, practical irrelevance and thus, discursive power. Panoeconomicus, 53(1), 5–18.

Arthur, W. B. (1999). Complexity and the economy. Science, 248, 107–109.

Bak, P., Tang, C., & Wiesenfeld, K. (1987). Self-organized criticality: An explanation of the 1/f noise. Physical Review Letters, 59(4), 381–384.

Bak, P., Tang, C., & Wiesenfeld, K. (1988). Self-organized criticality. Physical Review A, 38(1), 364–375.

Barder, O. (2012). The implications of complexity for development. Kapuściński Lecture at the Center for Global Development (Washington, DC), http://www.cgdev.org/blog/what-development. Accessed 20 Jan 2017.

Becker, S. O., Boeckh, K., Hainz, C., & Woessmann, L. (2016). The Empire is dead, long live the empire! Long-run persistence of trust and corruption in the bureaucracy. The Economic Journal, 126(590), 40–74.

Berkes, F. (2002). Cross-scale institutional linkages: Perspectives from the bottom up. In S. Stonich, P. C. Stern, N. Dolsak, T. Dietz, E. T. Ostrom, & E. U. Weber (Eds.), The drama of the commons (pp. 293–321). Washington: National Academies Press.

Bisignano, J. (1998). Towards an understanding of the changing structure of financial intermediation. Amsterdam: SUERF – The European Money and Finance Forum.

Blaseio, H. (1986). Das Kognos-Prinzip. Zur Dynamik sich-selbst-organisierender wirtschaftlicher und sozialer Systeme. Berlin: Duncker & Humblot.

Bräutigam, D. A., & Knack, S. (2004). Foreign Aid, Institutions, and Governance in Sub-Saharan Africa. Economic Development and Cultural Change, 52(2), 255–285.

Buchanan, J. M. (1984). Politics without romance: A sketch of positive public choice theory and its normative implications. In J. M. Buchanan & R. D. Tollison (Eds.), The theory of public choice II (pp. 11–22). Ann Arbor: University of Michigan Press.

Bunce, V. (1999). The political economy of post-socialism. Slavic Review, 58(4), 756–793.

Charron, N., Dahlström, C., & Lapuente, V. (2012). No law without a state. Journal of Comparative Economics, 40(2), 176–193.

Cilliers, P. (2001). Boundaries, hierarchies and networks in complex systems. International Journal of Innovation Management, 5(2), 135–147.

Clague, C., Keefer, P., Knack, S., & Olson, M. (1996). Property and contract rights in autocracies and democracies. Journal of Economic Growth, 1(2), 243–276.

Coase, R. H. (1964). The regulated industries: Discussion. American Economic Review, 54(3), 194–197.

Colander, D. (1996). Beyond New Keynesian economics: Towards a post Walrasian macroeconomics. In R. Rotheim (Ed.), New Keynesian Economics/Post Keynesian Alternatives (pp. 277–287). London: Routledge.

Colander, D. (2003). Post Walrasian macro policy and the economics of muddling through. International Journal of Political Economy, 33(2), 17–35.

Crotty, J. (2009). Structural causes of the global financial crisis: A critical assessment of the ‘new financial architecture’. Cambridge Journal of Economics, 33(4), 563–580.

Davis, J. B. (2006). The turn in economics: Neoclassical dominance to mainstream pluralism? Journal of Institutional Economics, 2(1), 1–20.

Davis, K. E., & Trebilcock, M. J. (2008). The Relationship between law and development: Optimists versus skeptics. American Journal of Comparative Law, 56(4), 895–946.

Demsetz, H. (1967). Toward a theory of property rights. American Economic Review, 57(2), 347–359.

Duit, A., & Galaz, V. (2008). Governance and complexity: Emerging issues for governance theory. Governance, 21(3), 311–335.

Durlauf, S. N. (1998). What should policymakers know about economic complexity? Washington Quarterly, 21(1), 155–165.

Fatás, A., & Mihov, I. (2013). Policy volatility, institutions, and economic growth. Review of Economics and Statistics, 95(2), 362–376.

Flachaire, E., García-Peñalosa, C., & Konte, M. (2014). Political versus economic institutions in the growth process. Journal of Comparative Economics, 42(1), 212–229.

Foster, J. (2000). Is there a role for transaction cost economics if we view firms as complex adaptive systems? Contemporary Economic Policy, 18(4), 369–385.

Frenken, K., & Boschma, R. (2011). Notes on a complexity theory of development. In C. Antonelli (Ed.), Handbook on the economic complexity of technological change (pp. 357–365). Cheltenham: Edward Elgar.

Glaeser, E. L., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2004). Do institutions cause growth? Journal of Economic Growth, 9(3), 271–303.

Glaeser, E. L., & Shleifer, A. (2002). Legal origins. Quarterly Journal of Economics, 117(4), 1193–1229.

Grosfeld, I., & Zhuravskaya, E. (2015). Cultural vs. economic legacies of empires: Evidence from the partition of Poland. Journal of Comparative Economics, 43(1), 55–75.

Gunderson, L. H., & Holling, C. S. (2002). Panarchy—Understanding transformations in systems of humans and nature. Washington, DC: Island Press.

Guzowski, P. (2013). Money economy and economic growth: The case of medieval and early modern Poland. Quaestiones Medii Aevi Novae, 18, 235–256.

Guzowski, P. (2014). Village court records and peasant credit in fifteenth-and sixteenth-century Poland. Continuity and Change, 29(1), 115–142.