Abstract

Using the multivariate quantile autoregression technique, we examine how equity returns of Islamic and conventional banks are affected by shocks to major financial indices such as the DJUSI index, the MSCI World Index, the VIX index and the United States 10-years Treasury bond interest rate. We compare the stability of the two banking systems to financial risk spillovers at the global and regional levels based on data from 16 countries for the period after the 2008 crisis. The empirical findings suggest that Islamic banks’ equities have weaker codependency with major equity markets than conventional banks at the global level while Islamic banks’ codependency with the 10-years US Treasury bond rate tends to be stronger than conventional banks indicating the sensitivity of Islamic banks to global interest rates. The empirical results also reveal that there does not seem to be any significant difference between stock price reactions of Islamic and conventional banks both at the regional and global levels in response to shocks to major financial indices. Regarding regional comparison of Islamic banks only, we find that Islamic bank performance does not vary much across heterogeneous geographic regions.

Similar content being viewed by others

Availability of data and material

Thomson Reuters Datastream.

Code availability

MATLAB.

Notes

Islamic Financial Services Board.

The Dow Jones 65 Composite Average consists of the 30 stocks that form the Dow Jones Industrial Average (DJIA), 20 stocks that make up the Dow Jones Transportation Average, and 15 stocks of the Dow Jones Utility Average. All of the Dow Jones averages are price-weighted indices.

23 countries are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US.

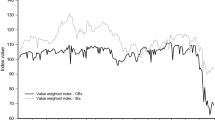

In quantile figures, we sort banks according to 1st day effect of 1% quantiles of bank equity returns regardless of bank types. These figures describe both Islamic and conventional banks’ equity price performances according to different financial shocks in the same graph.

References

Abdelsalam, O., Dimitropoulos, P., Elnahass, M., & Leventis, S. (2016). Earnings management behaviors under different monitoring mechanisms: The case of Islamic and conventional banks. Journal of Economic Behavior & Organization, 132, 155–173.

Abedifar, P., Molyneux, P., & Tarazi, A. (2013). Risk in Islamic banking. Review of Finance, 17(6), 2035–2096.

Acharya, V., Pedersen, L., Philippon, T., & Richardson, M. (2010). Measuring systemic risk technical report. New York University.

Allegret, J. P., Raymond, H., & Rharrabti, H. (2017). The impact of the European sovereign debt crisis on banks stocks. Some evidence of shift contagion in Europe. Journal of Banking & Finance, 74, 24–37.

Alotaibi, A. R., & Mishra, A. V. (2015). Global and regional volatility spillovers to GCC stock markets. Economic Modelling, 45, 38–49.

Alqahtani, F., Trabelsi, N., Samargandi, N., & Shahzad, S. J. H. (2020). Tail dependence and risk Spillover from the US to GCC banking sectors. Mathematics, 8(11), 2055.

Beccalli, E., Casu, B., & Girardone, C. (2006). Efficiency and stock performance in European banking. Journal of Business Finance & Accounting, 33(1–2), 245–262.

Beck, T., Demirgüç-Kunt, A., & Merrouche, O. (2013). Islamic vs. conventional banking: Business model, efficiency and stability. Journal of Banking & Finance, 37, 433–447.

Boumediene, A., & Caby, J. (2009). The stability of Islamic banks during the subprime crisis. Available at SSRN 1524775.

Boumediene, A. (2010). Is credit risk really higher in Islamic banks? Available at SSRN 1689885.

Bourkhis, K., & Nabi, M. S. (2013). Islamic and conventional banks’ soundness during the 2007–2008 financial crisis. Review of Financial Economics, 22(2), 68–77.

Cevik, S., & Charap, J. (2011). The behavior of conventional and Islamic bank deposit returns in Malaysia and Turkey. IMF Working Papers, 1–23.

Chuliá, H., Gupta, R., Uribe, J. M., & Wohar, M. E. (2017). Impact of US uncertainties on emerging and mature markets: Evidence from a quantile-vector autoregressive approach. Journal of International Financial Markets, Institutions and Money, 48, 178–191.

Čihák, M., & Hesse, H. (2010). Islamic banks and financial stability: An empirical analysis. Journal of Financial Services Research, 38(2–3), 95–113.

Doumpos, M., Hasan, I., & Pasiouras, F. (2017). Bank overall financial strength: Islamic versus conventional banks. Economic Modelling, 64, 513–523.

Elyasiani, E., & Mansur, I. (2003). International spillover of risk and return among major banking institutions: A bivariate GARCH model. Journal of Accounting, Auditing & Finance, 18(2), 303–330.

Engle, R. F., & Manganelli, S. (2004). CAViaR: Conditional autoregressive value at risk by regression quantiles. Journal of International Commerce, Economics and Policy., 22, 367–381.

Ergeç, E. H., & Arslan, B. G. (2013). Impact of interest rates on Islamic and conventional banks: The case of Turkey. Applied Economics, 45(17), 2381–2388.

Ernst & Young (2013) World Islamic banking competitiveness report 2013–2014: the transition begins. Available at: www.ey.com/Publication/vwLUAssets/World_Islamic_Banking_Competitiveness_Report_2013-14/$FILE/ World Islamic Banking Competitiveness Report 2013–14.pdf. Accessed 18 November 2019

Fahlenbrach, R., Prilmeier, R., & Stulz, R. M. (2012). This time is the same: Using bank performance in 1998 to explain bank performance during the recent financial crisis. The Journal of Finance, 67(6), 2139–2185.

Farag, H., Mallin, C., & Ow-Yong, K. (2018). Corporate governance in Islamic banks: New insights for dual board structure and agency relationships. Journal of International Financial Markets, Institutions and Money, 54, 59–77.

Fatmawati, D., Ariffin, N. M., Abidin, N. H. Z., & Osman, A. Z. (2020). Shariah governance in Islamic banks: Practices, practitioners and praxis. Global Finance Journal. https://doi.org/10.1016/j.gfj.2020.100555

Hamza, H. (2016). Does investment deposit return in Islamic banks reflect PLS principle? Borsa Istanbul Review, 16(1), 32–42.

Hasan, M., & Dridi, J. (2011). The effects of the global crisis on Islamic and conventional banks: A comparative study. Journal of International Commerce, Economics and Policy, 2(02), 163–200.

Hassan, M. K., Aliyu, S., Huda, M., & Rashid, M. (2019a). A survey on Islamic finance and accounting standards. Borsa Istanbul Review, 19, S1–S13.

Hassan, M. K., Khan, A., & Paltrinieri, A. (2019b). Liquidity risk, credit risk and stability in Islamic and conventional banks. Research in International Business and Finance, 48, 17–31.

Ioannidis, C., Molyneux, P. and Pasiouras, F., 2008. The relationship between bank efficiency and stock returns: Evidence from Asia and Latin America. University of Bath, School of Management, Working Paper, (2008.10).

Islamic Finance Development Report. Available at: https://icd-ps.org/uploads/files/IFDI%202019%20DEF%20digital1574605094_7214.pdf. Accessed 02 February 2020

Islamic Finance Development Report. Available at: https://www.ifsb.org/download.php?id=4389&lang=English&pg=/published.php. Accessed 21 May 2021

Kabir, M. N., Worthington, A., & Gupta, R. (2015). Comparative credit risk in Islamic and conventional bank. Pacific-Basin Finance Journal, 34, 327–353.

Khaliq, A., Thaker, H. M. T., Thaker, M. A. M. T., & Pitchay, A. A. (2017). Interest rate risk management and Islamic banking: Evidence from Malaysia. Journal of Islamic Finance, 176(5527), 1–15.

Kirkwood, J., & Nahm, D. (2006). Australian banking efficiency and its relation to stock returns. Economic Record, 82(258), 253–267.

Koenker, R., & Bassett, G., Jr. (1978). Regression quantiles. Econometrica: Journal of the Econometric Society, 46, 33–50.

Lewis, M. (2015). Models of Islamic banking: The role of debt and equity contracts. Journal of King Abdulaziz University: Islamic Economics, 28(1), 151–163.

Majdoub, J., & Mansour, W. (2014). Islamic equity market integration and volatility spillover between emerging and US stock markets. The North American Journal of Economics and Finance, 29, 452–470.

Mollah, S., & Zaman, M. (2015). Shari’ah supervision, corporate governance and performance: Conventional vs. Islamic banks. Journal of Banking & Finance, 58, 418–435.

Moore, J., Nam, S., Suh, M., & Tepper, A. (2013). Estimating the impacts of US LSAP's on emerging market economies' local currency bond markets (No. 595). Staff Report.

Moussa, W. B. (2014). Bank stock volatility and contagion: An empirical investigation with application of multivariate GARCH models. Journal of Economic Development, 39(2), 1–24.

Nawaz, T., Haniffa, R., & Hudaib, M. (2021). On intellectual capital efficiency and shariah governance in Islamic banking business model. International Journal of Finance & Economics, 26(3), 3770–3787.

Nienhaus, V. (2014). Religion and development. In Handbook on Islam and economic life. Edward Elgar Publishing.

Nier, E. W. (2005). Bank stability and transparency. Journal of Financial Stability, 1(3), 342–354.

Nomran, N. M., Haron, R., & Hassan, R. (2018). Shari’ah supervisory board characteristics effects on Islamic banks’ performance. International Journal of Bank Marketing., 36(2), 290–304.

Pappas, V., Ongena, S., Izzeldin, M., & Fuertes, A. M. (2017). A survival analysis of Islamic and conventional banks. Journal of Financial Services Research, 51(2), 221–256.

Samarakoon, L. P. (2011). Stock market interdependence, contagion, and the US financial crisis: The case of emerging and frontier markets. Journal of International Financial Markets, Institutions and Money, 21(5), 724–742.

White, H., Kim, T. H., & Manganelli, S. (2015). VAR for VaR: Measuring tail dependence using multivariate regression quantiles. Journal of Econometrics, 187(1), 169–188.

Wilcoxon, F., Katti, S. K., & Wilcox, R. A. (1970). Critical values and probability levels for the Wilcoxon rank sum test and the Wilcoxon signed rank test. Selected Tables in Mathematical Statistics, 1, 171–259.

Zainol, Z., & Kassim, S. H. (2010). An analysis of Islamic banks’ exposure to rate of return risk. Journal of Economic Cooperation and Development, 31(1), 59–84.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

Not applicable.

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Aydemir, R., Atan, H.Z. & Guloglu, B. How do the global equity and bond markets affect Islamic and conventional banks? A comparative cross-country analysis using multivariate regression quantiles. Eurasian Econ Rev 12, 95–114 (2022). https://doi.org/10.1007/s40822-022-00198-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-022-00198-5

Keywords

- Quantile vector autoregression

- Tail codependence

- Dynamic value at risk

- Financial risk spillovers

- Islamic banks

- Equity markets