Abstract

The success of policy involves not only good design but a good understanding of how the public will respond behaviorally to the benefits or detriments of that policy. Behavioral science has greatly contributed to how we understand the impact of monetary costs on behavior and has therefore contributed to policy design. Consumption taxes are a direct result of this; for example, cigarette taxes that aim to reduce cigarette consumption. In addition to monetary costs, time may also be conceptualized as a constraint on consumption. Time costs may therefore have policy implications, for example, long waiting times could deter people from accessing certain benefits. Recent data show that behavioral economic demand curve methods used to understand monetary cost may also be used to understand time costs. In this article we discuss how the impact of time cost can be conceptualized as a constraint on demand for public benefits utilization and public health when there are delays to receiving the benefits. Policy examples in which time costs may be relevant and demand curve methods may be useful are discussed in the areas of government benefits, public health, and transportation design.

Similar content being viewed by others

Although the intentions of policy and decision makers are often clear, the implementation of policy may be less so. In the end, implementation and adoption of policy is largely based on the quality of the public response. Public policy goals often require certain behaviors on the part of individuals—increasing retirement savings requires individuals to forego spending money and instead save it, increasing population vaccination coverage requires individuals to get vaccinated, and reducing driving-related deaths requires individuals to complete a number of safety-related behaviors, like wearing a seatbelt. Understanding basic behavior principles is, therefore, important in predicting public response to new policy and the ultimate success of the policy. One contribution of behavioral science to policy has been an evaluation of how constraints, such as monetary costs, affect behavior.

Monetary costs on consumption behavior are well-understood and have resulted in multiple policies aiming to change behavior. A large number of these policies have been implemented through the tax system. For example, behavior analysis has been used to investigate carbon taxes aimed to reduce consumption of CO2 emitting products (Ionescu, 2019), cigarette taxes aimed to reduce cigarette consumption (MacKillop et al., 2012), proposed sugary-drink taxes aimed to reduce sugar consumption (Allcott et al., 2019), and indoor tanning services taxes aimed to reduce indoor UV-light tanning (Reed et al., 2016). Behavioral analysis has provided methods of predicting responses to policies like consumption taxes; for example, analysis of demand curves can be used to forecast changes in consumption of a good or use of a service across a series of prices for that good or service. The examination of operant demand, a principle of behavioral economics, is increasingly recognized as a method of determining the relative value of commodities on an individual level. Operant demand refers to the measured levels of consumption of a good across a series of increasing operant tasks (e.g., a lever press) upon which receipt of the good is conditioned (Hursh, 1984). Demand curves plot the consumption of the good against price and typically result in a positively accelerated, monotone-decreasing function. In human research, demand can be studied with actual responses and reinforcers (Greenwald & Hursh, 2006; Spiga et al., 2005) but more commonly demand curves are created with “hypothetical purchase tasks” (HPT; Jacobs & Bickel., 1999). The HPT asks participants the number of units of a good they are likely to purchase as prices increase. As an alternative, the task can be structured as measuring the likelihood (probability) of purchasing a good as prices increase (Roma et al., 2016), a strategy better suited for items that are purchased in small numbers, like refrigerators. Although HPTs measure hypothetical consumption, tasks for alcohol and cigarettes have been found to correlate well with actual consumption (Amlung et al., 2012; Amlung & MacKillop, 2015; Nighbor et al., 2020; Wilson et al., 2016). To quantify different dimensions of demand curves, they are fit with models designed to describe the level and slope of consumption of the good, more precisely stated as the consumption at zero-price and the rate of change in elasticity of the curve (Gilroy et al., 2021; Hursh & Silberberg, 2008; Koffarnus et al., 2015). In the example demand curves shown in Fig. 1, the consumption at zero-price is defined as demand amplitude or Q0, and this quantity is often correlated with addiction severity or predictive of substance use (Bernstein et al., 2014; MacKillop et al., 2016; Schwartz et al., 2021; Zvorsky et al., 2019). Demand elasticity is the rate of change in the slope (in log-log units) and describes how consumption changes with increases in price: elastic demand is characterized by the percent decrease in consumption exceeding the percent increase in price, whereas inelastic demand occurs when the percent decrease in consumption is less than the percent increase in price. There have been a few interpretations of elasticity in the demand curve literature. Demand models (Gilroy et al., 2021; Hursh & Silberberg, 2008; Koffarnus et al., 2015) typically use a decreasing exponential to describe the shape of the curve and the rate constant, α, is used to describe the rate of change in elasticity of the demand curve and roughly equates to the sensitivity of consumption to increases in price, see Fig. 1. Because high sensitivity is usually associated with low-valued goods, another term is often used that is proportional to the inverse of α, called essential value (see Hursh & Roma, 2013). A third approach finds the price at the point on the demand curve with an elasticity of -1, and that is called Pmax, the point at which demand shifts from inelastic to elastic demand and the point of maximum expenditure (Gilroy et al., 2021). Items with a higher Pmax indicate a willingness to defend baseline consumption at higher prices, in other words, the inelastic part of the demand curve stretches to higher prices. Although these measures all have a different mathematical basis, they all aim to describe, in some way, the sensitivity of consumption behavior to the price of a commodity in context (Hursh et al., 2013). It is important to note that differences in price sensitivity are correlated with health outcomes. For example, drug reinforcers that have relatively lower price sensitivity also appear to be more likely to be abused (Hursh et al., 2005; Hursh & Roma, 2013). Relatively low price-sensitivity for an abused substance has been shown to be related to the severity of an addiction (Zvorsky et al., 2019), and relatively low price-sensitivity in a patient undergoing treatment for an addiction can predict a higher likelihood to relapse into future use (Schwartz et al., 2021; Yoon et al., 2020). Taken together, Hursh and Silberberg (2008) have suggested that price sensitivity is a way to evaluate the relative value of an outcome independent of demand amplitude.

An example of two demand curves plotted in the typical log–log coordinate space. Note. The maximal level of demand with zero constraint is Q0 and defines demand amplitude. The rate of change in slope (elasticity) is captured in the rate constant of the exponential demand model, α. The upper curve is relatively insensitive to increasing cost and has a smaller α = 0.0005 compared to the lower curve that is relatively more sensitive to increasing cost and a larger α = 0.005

The field of behavioral economics can also provide an understanding of how time functions as a cost in the context of behavioral choices. Delay discounting and the quantification of individual discounting rates provide unique contributions to understanding how delays to reward affect behavior. Delay discounting refers to the devaluation of larger, future rewards relative to smaller and more immediately available rewards. The common preference for immediate rewards is highly related to negative health behaviors such as substance use disorder and obesity (Amlung et al., 2016; Bickel et al., 2012). Most tasks used to assess delay discounting rates involve asking the participant to make multiple selections of their preference for an immediate reward and a larger but delayed reward (e.g., $50 now or $500 in a year). From these choices, the timepoint at which the delayed, larger and immediate, smaller reward are equivalent (indifference points) are determined and used to calculate the discounting rate for that individual, which represents the slope of a hyperbolic function of the participant’s subjective value of delayed rewards (Ainslie & Haslam, 1992). The typical hyperbolic function contains a time constant, k, that represents the discount rate. Discount rates can be determined for different commodities, different individuals, or in relation to different alternatives.

Demand curve analysis and delay discounting are typically done as separate analyses using separate tasks and separate models to assess value. However, there remains a question as to whether traditional demand curve methods can be applied with time costs instead of monetary costs, whether those results would approximate delay discounting experiment results, and whether conceptualizing time as a cost within a consumer demand framework provides added value compared to delay discounting models. Within the domain of public policy, treating time as a cost factor would allow for evaluation of time and money costs within the same framework used to forecast the behavioral impact of the policy. Previous animal research has shown that temporal delays also act as an economic cost, driving down consumption with increases in time delays to reward (Bauman, 1991; Tsunematsu, 2001). It may then be possible to measure changes in reward value due to time delays in humans by measuring tolerance for increasing delays on an HPT. A first test of this concept would be to establish that demand curves created with time constraints are functionally similar to those created with monetary constraints. There is some evidence that this is the case. Gunawan (2021) found that probability hypothetical purchase tasks for cigarettes using time costs resulted in demand curves similar to those with monetary costs and with adequate fits by demand models. Likewise, Greenwald et al. (2021) found that demand parameters estimated using time costs were functionally similar to those created using monetary costs.

In our own test of this concept, we collected data from 43 healthy college-aged participants who completed both monetary-cost and time-cost HPTs. Participants completed both HPT types for cigarettes, alcohol, a snack item, earbud-type headphones, shoes, and toilet paper within a 30-min session. For monetary cost tasks, participants indicated the probability of purchasing the item at a series of increasing prices. Minimum prices were 0, median prices were real-world market values of those goods, and maximum prices were the median price x 100. For time-cost tasks, participants indicated the probability of purchasing an item at a specified market price at a series of increasing time delays to receiving the item. The time delays ranged from no delay to a 2-year delay. Participant data were screened for nonsystematic data (see Stein et al., 2015), transformed, and fit the normalized zero-bounded exponential (ZBEn) model of demand (Gilroy et al., 2021), an extension of the exponential demand model (Hursh & Silberberg, 2008) that replaces the log scaling with a log-like scale (inverse hyperbolic transform) that evaluates at zero values. Resulting time-cost demand curves (Fig. 2b) were monotone-decreasing positively accelerating functions that behaved similarly to the demand curves created with monetary costs (Fig. 2a). The ZBEn model fit the monetary-cost and time-cost data well, with a mean R2 of 0.99 (range: 0.97–1.0) and 0.96 (range: 0.93–0.99), respectively. Root mean square errors were also calculated to determine how closely the model fit the mean of the data. For money-cost curves, the mean RMSE was 0.056 (range: 0.015–0.101) and for the time-cost curves the mean RMSE was 0.106 (range: 0.013–0.162). The points at which elasticity of demand changes from inelastic to elastic (Pmax) were also compared across commodities and those values for time-cost curves are provided in Fig. 3. Goods that are consumed, like alcohol and food, had lower Pmax values than durable goods like headphones and shoes. In other words, they were less willing to wait for these consumable commodities. The α values were also compared: α values for the consumable goods were higher (more time sensitive) than the α values for the nonconsumable goods (cigarettes: α = 0.064; alcohol: α = 0.004; food: α = 0.007; headphones: α = 0.0008; shoes: α = 0.0005; toilet paper: α = 0.0001). These data provide limited initial evidence that demand curve analysis can be applied to behavior restricted by time instead of monetary costs and that time cost tolerances vary across commodities.

One limitation that deserves further exploration relates to the perception of time costs and how that might be functionally different from the perception of money costs, for example. Rachlin and Killeen both suggest that time perception is a power function (Jones & Rachlin, 2006; Killeen, 2015; Kim & Zauberman, 2019; Zauberman et al., 2009), which implies that exponential demand may need an additional parameter to reflect the nonlinearity of time perception. As a test of this idea, we included a power transform on time by adding an exponent, s, to the time-cost term in the ZBEn model and reapplied the model to the time-cost curve for food, which had the lowest goodness-of-fit of all the time-cost curves in Fig. 2b. To assess goodness-of-fit, we used a standard deviation of the residuals (Sy.x) because it adjusts for the additional parameter added to the model. The addition of the s parameter greatly improved the fit to the data (R2 = 0.99; Sy.x = 0.058) compared to the ZBEn model without the exponent on time (R2 = 0.90; Sy.x = 0.167; see Fig. 4). An extra-sum-of-squares F test determined that the modified ZBEn model was a better fit to the data than the ZBEn model (F[1,14) = 109, p < 0.0001). The error for the modified ZBEn fit compares favorably to the money-cost demand curve (Sy.x = 0.047 with money cost). Although further research is needed, it is clear that the exponential demand model, perhaps including a time perception parameter, can be used to quantify the relationship between consumption and time delays and potentially be combined with money costs to evaluate the overall impact on demand.

There are other limitations to interpretation of these and similar data sets. First, more research is needed to understand if time-constraint demand curves conform to the same assumptions and limitations applied to money-cost curves. Certain parameters, for example Pmax, may have a conceptually different meaning when the constraints are different. Even more, one might expect them to be different: time costs might have more of an effect than monetary costs because of the temporal properties intrinsic to some consummatory goods. For example, if an individual is undergoing heroin withdrawal, the amount of time they’re willing to wait to purchase heroin might be very low (high cost-sensitivity), but the amount of money they’d be willing to pay for it would be high (low cost-sensitivity). However, although more tests of the concept of time as a demand-curve constraint are required, these data show that at a basic level, time costs demand is functionally similar to money cost demand.

Despite these limitations, and the requirement for more tests of the concept of time as a demand-curve constraint, there are three primary advantages to treating time factors from a cost and demand perspective compared to treating them from a discounting perspective. The first advantage arises directly from the use of the exponential model to evaluate time factors (Hursh & Silberberg, 2008). The model treats the level or amplitude of demand, captured by the level at minimal price (Q0), separately from the change of consumption with increasing cost captured by α. It is important to note that the rate constant (i.e., the exponent of the exponential in the model, in which Q0 is multiplied by the current price and α) normalizes for Q0 so that the α value is independent from the base level of consumption. This is important for determining the real cost of each unit of time required to obtain the outcome. The real cost refers to not only the amount of time you need to wait for a commodity, but the number of units of the commodity required to meet your baseline needs. For example, if an individual needs three packs of cigarettes per day but has to wait 1 day per pack, the real cost of waiting is greater than a person who only needs one pack per day, even though the waiting time for one unit (one pack) is the same. Hence, the true time cost depends on the value of Q0, a factor not normally included in delay discounting determinations. Although discounting models can consider baseline consumption (typically the A parameter), the models don’t control for it when estimating the slope or k value. As a result, it may seem that the hyperbolic delay discounting rate, k, represents the same information as α, the rate of change in consumption, but that is not strictly true because k does not account for differences in base level and real cost, at least not without additional parameters in the model. Later, when we discuss policy applications, we will illustrate why that is an important consideration.

The second advantage arises from the body of literature on demand that makes it clear that elasticity is not a property of the commodity in isolation but rather a property of the commodity in the context of alternatives. Elasticity will be greater for a commodity with many available replacements or substitutes compared to a commodity with few substitutes. As a result, when examining temporal elasticity, it is assumed that it is functionally tied to the context and not a fundamental property of the commodity or the person making the judgements. This can prove to be very important in understanding temporal factors associated with different commodities such as money, drugs, consumables, or public services or when choices are between one alternative with a low time cost compared to another commodity with a higher time cost. The concept of commodity interactions, such as substitutability and complementarity, becomes particularly important in the context of cross-commodity discounting, reviewed by Pritschmann et al. (2021) and illustrated in Bickel et al. (2011). The important point here is that from a delay discounting perspective, discount rates may depend on the context of substitutes and complements. Theoretically, discount rates could be compartmentalized based on context, but the temporal demand framework provides tools to directly quantify commodity interactions based on cross-price elasticity (Hursh et al., 2013; Hursh & Roma, 2013) and relate them to changes in own-price temporal elasticity. Examples in relation to public policy are provided below.

The third advantage is that time costs are often additive when examining the use of a product, pursuing a public service, or treating a disease. The nature of the question helps determine the most appropriate method and model. If the question is how much a service or commodity will be accessed if offered to the public, the time costs can be combined, and we can examine how total time cost affects demand. Within a discounting framework we can examine how the total time would devalue the outcome and how decisions may change for a person with the passage of time as a result of the hyperbolic nature of delay discounting. However, delay discounting is less well-suited for evaluating how time factors might change the overall level of consumption or utilization of a service in a community. In this case, the advantage of the demand framework is that it more directly answers questions about consumption or utilization than a delay discounting perspective that is designed to assess relative value, not overall consumption.

Considering Time Costs in Policy

Insight into the relationship between time delays and consumption can be useful in understanding behavior generally. The effects of time are apparent when people do the mental math of a cost-benefit analysis. One might weigh the benefit of an ice cream cone not only with the monetary cost of the ice cream, but also with the time cost of having to wait in line for the ice cream. The longer the wait in line, the less demand the person might have for the ice cream cone. This is an example of a common queuing problem studied with economic models, and time and money are often combined as cost factors in those models (Lu et al., 2013). Although understanding how time constraints affect behavior would greatly contribute to behavior-analytic fields in general, it is also important to understand how these constraints can affect behavior in a specific way that is relevant to public policy. In the following sections, we will illustrate several examples of how time cost could be a significant factor in public policy decisions.

Waiting Time for Public Assistance

Conceptualizing time as a cost can directly apply to the design of policy, especially for government-provided benefits. For example, large time costs to access benefits may reduce the efficiency of distribution of those benefits. A number of studies have investigated the fairly low numbers of FAFSA (Free Application for Federal Student Aid) application completions (Kofoed, 2017). The application is complex, long, and doesn’t provide information about aid eligibility immediately after completion. Students must wait until January of their senior year of high school to complete the application. The applications are then sent to the U.S. Department of Education, which determines the contribution each family can make. These estimates are then provided to the schools that the applicant applied to, and the schools provide the applicant with a personalized grant or loan program when they send acceptance letters in March and April (Dynarski & Scott-Clayton, 2006). Although the complexity of the FAFSA application is certainly a barrier to completion, the length of time in between completing the forms and receiving the benefit, or knowledge of eligibility for benefits, may prevent students from taking advantage of federal student aid. Indeed, every year billions of dollars in federal aid go unclaimed (Kofoed, 2017), and in the largest school districts up to 50% of students do not complete the forms (Bird et al., 2021). Many studies have focused on behavioral economic tools to encourage FAFSA applications (Bettinger et al., 2012; Dynarski & Scott-Clayton, 2006; Page et al., 2020), but few have focused on the impact that the delay to benefit (knowledge of eligibility) has on application. Although this could be characterized as a loss of value due to discounting, what is most useful for the policy maker is how that loss of value affects uptake of the program. A program that does not utilize its funds will be subject to cuts in the competitive government budgeting process; that can have a catastrophic effect—an inefficient program that falls short of providing public value because of delays is ultimately cut to the point that it is no longer available, even if the efficiencies are corrected. This illustrates the crucial importance of understanding the impact of time costs on program utilization, not only for maximizing short-term public welfare but also for the long-term survival of programs.

Public Health Policy

Utilization of public health services can also be affected by time delays and, therefore, provides an example of the benefits of analyzing time-costs on demand. Time delays can be consequential for various disease testing, such as HIV testing. Rapid HIV testing that provides same-day results, as opposed to standard testing that required individuals to return for results at a later time (Valdiserri et al., 1993), has increased the number of people learning of their HIV status (Kassler et al., 1997; Liang et al., 2005). In order to accurately measure the utilization of free testing, policymakers might want to understand how such delays affect the likelihood of accessing tests. Strickland et al. (2022) asked participants the likelihood of accessing COVID-19 diagnostic tests when there was a delay to receiving the test or a delay to receiving the results. The price of the test ($125 or free) was also manipulated. They found that the likelihood of getting a free test was systematically reduced as time delays increased, with longer delays to receive the test tolerated more than delays to receive the test results. In addition, when the tests cost $125 there was no differential effect of delay type, but likelihood was significantly reduced from free tests, illustrating the joint effect of both monetary and time costs on the probability of accessing a test.

These data suggest that policy makers could use such techniques to determine the impact of queuing times on test utilization and the value of rapid testing. This illustrates more general principles related to the impact of queuing times on demand. At first, the ability to get COVID-19 tests was greatly limited by the availability of testing and this may have discouraged test seeking, with consequent interference with contact tracing. In the end, with the infusion of government funding, general testing and techniques of rapid and accurate testing became more economical and available. It is important to note that policy makers rightly assessed that minimizing time and money costs would encourage more testing and implemented public policies in the United States to make testing more available and reimbursable by insurance (U.S. Department of Health & Human Services, 2022). This illustrates how both time and monetary costs can theoretically combine inversely to drive demand. Reducing money costs of tests can drive up demand with a counterproductive increase in waiting times to access the tests; temporal elasticity of demand could then counteract the original increase in demand based on reduced money cost. All of this could be tested in an equilibrium model to determine prices that increase demand, but not so much that excessive waiting times reduce utilization; or combining the reduced money cost with increasing test sites can be assessed to minimize temporal disincentives. Such a model would guide both the pricing model and the logistical planning to maximize the success of the program. Similar public health challenges can use behavioral economic techniques to judge the time elasticity of demand for medical services to guide the necessary level of availability to make the policies effective.

Delays to receiving health-related benefits can have consequences for uptake. Consider vaccine hesitancy, a global health problem (World Health Organization, 2014) and major barrier to reducing the spread of preventable diseases. Although understanding and addressing hesitancy via interventions is a much-researched topic, the availability of vaccinations is an important factor in these interventions. If an intervention targets the acceptance of a vaccine, immediate availability of the vaccine will likely improve actual uptake. If there is an additional delay, then there may be a risk that acceptance wanes. The COVID-19 pandemic stimulated useful behavioral economic studies of vaccine acceptance that can serve as a model for effective public health response to any future health crisis, be it an infectious disease or other environmental threat (Hursh et al., 2020; Strickland et al., 2022).

Transportation Infrastructure Policy

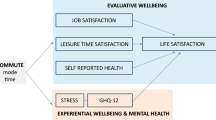

Another area of public policy planning is transportation infrastructure, such as roads and rail transit systems. Time factors are commonly considered in the design of highways and signaling systems (Tarnoff, 2004, 2005). The common denominator is the time to transit from one part of the system to another, especially at peak times of demand. When those times become aversive due to congestion and poor control systems, policy makers must consider alternatives to address the problem. Some of the solutions are relatively inexpensive, like timing traffic signals to minimize delays, whereas others are much more expensive, such as building additional lanes or entirely new highways around congested areas (Paniati, 2004). Furthermore, in many cities, the highway system is in competition with the public transit system. Policy makers seeking to encourage more climate friendly solutions may wish to shift commuters from the highways to the transit system (Tiboni et al., 2021). Given the pervasive importance of time factors in controlling the behavior of commuters and their choice of alternatives, behavioral economic tools provide a relatively inexpensive and rapid way to assess how time delays affect the demand for different alternative means of travel. The assessment of investments in road construction versus public transit is a classic case of imperfect substitution. The time factors are a major part of that calculus. For example, using a personal vehicle saves the time involved in getting to the transit system and from the transit station to the destination, and may save overall transit time depending on congestion. In comparison, the public transit alternative provides the opportunity to engage in other activities while in transit, reducing to some extent the added burden of the time cost. And of course, there are other monetary costs to consider like the cost of the transit ticket, parking, fuel, wear and tear on the personal vehicle, and cost of insurance. In order to assess demand for alternatives, it is important to conduct rigorous purchase task experiments with well-defined scenarios so that cross-price elasticities can be assessed, in addition to the own-price demand for each alternative. There are also numerous natural experiments across cities (e.g., Castrogiovanni et al., 2020) that could serve to validate the predictions of such purchase task experiments.

A related example that illustrates the value of time-cost demand analysis pertains to the demand for electric vehicles (EVs). Two factors that affect the acceptability of an EV are the time required to recharge the battery and the range of the vehicle that affects the time between charging. Consider two EVs, one with a range of 250 miles (vehicle A) and another with a range of 500 miles (vehicle B). We seek to understand how recharging time will affect the demand for each vehicle. We could assess the discount rate associated with waiting for the EV to recharge, but it is critical to also consider the range. For a given hypothetical trip of 1,000 miles (assuming we want to end the trip with a full battery), vehicle A will have to stop four times to recharge whereas vehicle B will only have to stop twice. To fairly assess the impact of recharge time, we need to consider the base level of demand or Q0 which is four for vehicle A and two for vehicle B; the real price of a recharge is time to recharge, t, multiplied by the frequency of recharging, Q0. In practice, a recharge time of 30 min, for example, would be a lower real price for vehicle B, as it has a longer range. If one were to estimate discount rates, the time delays must correct for real temporal cost to properly reflect the discounting of an EV. However, this is naturally factored into demand models, as the α term tells us temporal elasticity of demand, normalized for the real temporal cost.

Integrating BE Methods into Policy Measurement

HPTs can be used to assess choices and overall demand for transportation projects, as well as demand by selected demographics. For example, do specific public investments, such as toll roads, selectively favor one class of commuters over another? Is the willingness to pay the toll sufficiently strong to pay for the capital investment in the project? Are the monetary costs of express lane access offset by the savings in time and does that time savings vary by time of day? All of these examples can be addressed using the tools of behavioral economics. At present, common preference in economics for measuring potential behavioral response to policy are stated preferences, like willingness-to-pay tasks, and revealed preferences. Willingness-to-pay tasks typically ask the respondent to indicate how much money they are willing to pay for a specified good or benefit. Revealed preferences examine real-world data to determine how individuals respond to an implemented tax or other cost. Each of these methods has advantages and disadvantages. One drawback to revealed preference data is that there are limitations on the variations in actual costs. For example, there is limited variation in toll prices to test a full range of decisions made by drivers using general or managed lanes (Devarasetty et al., 2012). Therefore, stated preference experiments can help increase the range of conditions under which responses are elicited. However, the stated preference experiments may also be limited by the context of the scenario. To address these limitations, hypothetical choice tasks can complement these methods by providing explicit scenarios and asking for probability of purchase across a range of time delays and determining individual and group elasticities. HPTs allow for highly constrained vignettes or scenarios that can assess demand in a particular context. Besides controlling for the conditions of the choices, these procedures result in orderly demand curves that can be modeled with well-established nonlinear demand equations (Gilroy et al., 2021; Hursh & Silberberg, 2008) that provide estimates of point elasticity across a full range of time delays.

The utility of using purchase tasks in policy-related decision making can be illustrated using the transportation industry example. HPTs for different travel alternatives with time cost as a constraint, either alone or in combination with other costs such as fuel, tolls, and parking, would provide a technique to set targets for transit times and monetary costs. With that information, policy makers can then set targets for transit times and then work backward through various structural alternatives to find the most economical approach to reaching those goals. One by-product of this approach is that it can potentially avoid committing tax dollars to solutions that will not achieve the explicit intent of the policies because the traveling public does not choose to exercise the alternatives that were provided. For example, one solution to urban traffic congestion is the construction of high-occupancy toll lanes. Several economic studies have focused on commuter decision making (Burris et al., 2012; Sheikh et al., 2015) related to such toll lanes. This is an obvious example of how measurement of explicit time costs in combination with toll costs could inform public policy regarding such investments.

Limitations

The conceptualization offered here is more a hypothesis than an established framework. Additional research is needed to verify that models of demand can be applied to time costs with similar accuracy as with monetary and other forms of cost. For example, we have assumed here that time values are additive, but it is possible that time costs in different components of a sequence of behaviors are not strictly additive, with delays later in the sequence more powerful than early delays (Abarca & Fantino, 1982). For example, waiting to get diagnostic test and then waiting for the results of the test are two different parts of a sequence. Strickland et al. (2022) showed that participants were more tolerate of delays to a test than delays to the results, indicating time costs may not be additive. There are also methodological considerations regarding the HPTs. They are hypothetical, and although there is evidence for some commodities that they accurately predict actual consumption (Amlung et al., 2012; Amlung & MacKillop, 2015; Nighbor et al., 2020; Wilson et al., 2016), research is needed to understand how they fare with a larger variety of commodities. As a tool for policy, government agencies will expect concrete evidence that HPTs make realistic estimates of future behavior. In other words, agencies will want assurances that the tools and models based on HPTs are valid forecasts of future behavior. The challenge for future behavioral research is to verify that estimates of demand and elasticities derived from HPTs are useful to guide public policy and the expenditure of public money. Finally, it is important to point out that the temporal demand approach has specific advantages for assessing the impact of time on consumption or service utilization when that is the public policy question. However, if the public policy question relates to time-inconsistent choices, such as reversals of choice predicted by hyperbolic discounting, then a delay discounting account may be more appropriate.

Knowing how time can affect behavior is an important first step in designing policy, and behavior analysis and behavioral economics can provide methods of quantifying those effects. Demand curves have been used to estimate the effects of monetary costs on behavior, and based on recent data, it is likely the same method can be used to quantify the effects of time-costs.

References

Abarca, N., & Fantino, E. (1982). Choice and foraging. Journal of the Experimental Analysis of Behavior, 38(2), 117–123. https://doi.org/10.1901/jeab.1982.38-117

Ainslie, G., & Haslam, N. (1992). Hyperbolic discounting. In G. Loewenstein & J. Elster (Eds.), Choice over time (pp. 57–92). Russell Sage Foundation.

Allcott, H., Lockwood, B. B., & Taubinsky, D. (2019). Should we tax sugar-sweetened beverages? An overview of theory and evidence. Journal of Economic Perspectives, 33(3), 202–227. https://doi.org/10.1257/jep.33.3.202

Amlung, M., & MacKillop, J. (2015). Further evidence of close correspondence for alcohol demand decision making for hypothetical and incentivized rewards. Behavioural Processes, 113, 187–191. https://doi.org/10.1016/j.beproc.2015.02.012

Amlung, M. T., Acker, J., Stojek, M. K., Murphy, J. G., & MacKillop, J. (2012). Is talk “cheap?” An initial investigation of the equivalence of alcohol purchase task performance for hypothetical and actual rewards. Alcoholism, Clinical and Experimental Research, 36(4), 716–724. https://doi.org/10.1111/j.1530-0277.2011.01656.x

Amlung, M., Petker, T., Jackson, J., Balodis, I., & MacKillop, J. (2016). Steep discounting of delayed monetary and food rewards in obesity: A meta-analysis. Psychological Medicine, 46(11), 2423–2434. https://doi.org/10.1017/S0033291716000866

Bauman, R. (1991). An experimental analysis of the cost of food in a closed economy. Journal of the Experimental Analysis of Behavior, 56(1), 33–50. https://doi.org/10.1901/jeab.1991.56-33

Bernstein, M., Murphy, J., MacKillop, J., & Colby, S. (2014). Alcohol demand indices predict outcomes among heavy-drinking young adults receiving a brief intervention. Drug & Alcohol Dependence, 140, e13. https://doi.org/10.1016/j.drugalcdep.2014.02.056

Bettinger, E. P., Long, B. T., Oreopoulos, P., & Sanbonmatsu, L. (2012). The role of application assistance and information in college decisions: Results from the h&h block FAFSA experiment. Quarterly Journal of Economics, 127(3), 1205–1242. https://doi.org/10.1093/qje/qjs017

Bickel, W. K., Landes, R. D., Christensen, D. R., Jackson, L., Jones, B. A., Kurth-Nelson, Z., & Redish, A. D. (2011). Single- and cross-commodity discounting among cocaine addicts: The commodity and its temporal location determine discounting rate. Psychopharmacology, 217(2), 177–187. https://doi.org/10.1007/s00213-011-2272-x

Bickel, W. K., Jarmolowicz, D. P., Mueller, E. T., Koffarnus, M. N., & Gatchalian, K. M. (2012). Excessive discounting of delayed reinforcers as a trans-disease process contributing to addiction and other disease-related vulnerabilities: Emerging evidence. Pharmacology & Therapeutics, 134(3), 287–297. https://doi.org/10.1016/j.pharmthera.2012.02.004

Bird, K. A., Castleman, B. L., Denning, J. T., Goodman, J., Lamberton, C., & Rosinger, K. O. (2021). Nudging at scale: Experimental evidence from FAFSA completion campaigns. Journal of Economic Behavior & Organization, 183, 105–128. https://doi.org/10.1016/j.jebo.2020.12.022

Burris, M., Nelson, S., Kelley, P., Gupta, P., & Cho, Y. (2012). Willingness to pay for high-occupancy toll lanes: Empirical analysis from I-15 and I-394. (No. 2297; Transportation Research Record: Journal of the Transportation Research Board, pp. 47–55). Transportation Research Board of the National Academies.

Castrogiovanni, P., Fadda, E., Perboli, G., & Rizzo, A. (2020). Smartphone data classification technique for detecting the usage of public or private transportation modes. IEEE Access, 8, 58377–58391. https://doi.org/10.1109/ACCESS.2020.2982218

Devarasetty, P. C., Burris, M., & Douglass Shaw, W. (2012). The value of travel time and reliability-evidence from a stated preference survey and actual usage. Transportation Research Part A: Policy & Practice, 46(8), 1227–1240. https://doi.org/10.1016/j.tra.2012.05.002

Dynarski, S. M., & Scott-Clayton, J. E. (2006). The cost of complexity in federal student aid: Lessons from optimal tax theory and behavioral economics. National Tax Journal, 59(2), 319–356. https://doi.org/10.17310/ntj.2006.2.07

Gilroy, S. P., Kaplan, B. A., Schwartz, L. P., Reed, D. D., & Hursh, S. R. (2021). A zero-bounded model of operant demand. Journal of the Experimental Analysis of Behavior, 115(3), 729–746. https://doi.org/10.1002/jeab.679

Greenwald, M. K., & Hursh, S. R. (2006). Behavioral economic analysis of opioid consumption in heroin-dependent individuals: Effects of unit price and pre-session drug supply. Drug & Alcohol Dependence, 85(1), 35–48. https://doi.org/10.1016/j.drugalcdep.2006.03.007

Greenwald, M. K., Sarvepalli, S. S., Cohn, J. A., & Lundahl, L. H. (2021). Demand curve analysis of marijuana use among persons living with HIV. Drug & Alcohol Dependence, 220, 108524. https://doi.org/10.1016/j.drugalcdep.2021.108524

Gunawan, T. (2021). Time costs in the demand of cigarettes [Doctoral dissertation, American University]. ProQuest Dissertations and Theses Database.

Hursh, S. R. (1984). Behavioral economics. Journal of the Experimental Analysis of Behavior, 42(3), 435–452. https://doi.org/10.1901/jeab.1984.42-435

Hursh, S. R., & Roma, P. G. (2013). Behavioral economics and empirical public policy. Journal of the Experimental Analysis of Behavior, 99(1), 98–124. https://doi.org/10.1002/jeab.7

Hursh, S. R., & Silberberg, A. (2008). Economic demand and essential value. Psychological Review, 115(1), 186–198. https://doi.org/10.1037/0033-295X.115.1.186

Hursh, S. R., Galuska, C. M., Winger, G., & Woods, J. H. (2005). The economics of drug abuse: A quantitative assessment of drug demand. Molecular Interventions, 5(1), 20–28. https://doi.org/10.1124/mi.5.1.6

Hursh, S. R., Madden, G. J., Spiga, R., DeLeon, I. G., & Francisco, M. T. (2013). The translational utility of behavioral economics: The experimental analysis of consumption and choice. In G. J. Madden, W. V. Dube, T. D. Hackenberg, G. P. Hanley, & K. A. Lattal (Eds.), APA handbook of behavior analysis, Vol. 2: Translating principles into practice (pp. 191–224). American Psychological Association. https://doi.org/10.1037/13938-008

Hursh, S. R., Strickland, J. C., Schwartz, L. P., & Reed, D. D. (2020). Quantifying the impact of public perceptions on vaccine acceptance using behavioral economics. Frontiers in Public Health, 8, 608852. https://doi.org/10.3389/fpubh.2020.608852

Ionescu, L. (2019). Towards a sustainable and inclusive low-carbon economy: Why carbon taxes, and not schemes of emission trading, are a cost-effective economic instrument to curb greenhouse gas emission. Journal of Self-Governance & Management Economics, 7(4), 35–41.

Jacobs, E. A., & Bickel, W. K. (1999). Modeling drug consumption in the clinic using simulation procedures: Demand for heroin and cigarettes in opioid-dependent outpatients. Experimental and Clinical Psychopharmacology, 7(4), 412–426. https://doi.org/10.1037/1064-1297.7.4.412

Jones, B., & Rachlin, H. (2006). Social discounting. Psychological Science, 17(4), 283–286. https://doi.org/10.1111/j.1467-9280.2006.01699.x

Kassler, W. J., Dillon, B. A., Haley, C., Jones, W. K., & Goldman, A. (1997). On-site, rapid HIV testing with same-day results and counseling. AIDS, 11(8), 1045–1051.

Killeen, P. R. (2015). The arithmetic of discounting. Journal of the Experimental Analysis of Behavior, 103(1), 249–259. https://doi.org/10.1002/jeab.130

Kim, B. K., & Zauberman, G. (2019). Psychological time and intertemporal preference. Current Opinion in Psychology, 26, 90–93. https://doi.org/10.1016/j.copsyc.2018.06.005

Koffarnus, M. N., Franck, C. T., Stein, J. S., & Bickel, W. K. (2015). A modified exponential behavioral economic demand model to better describe consumption data. Experimental and Clinical Psychopharmacology, 23(6), 504–512. https://doi.org/10.1037/pha0000045

Kofoed, M. S. (2017). To apply or not to apply: FAFSA completion and financial aid gaps. Research in Higher Education, 58(1), 1–39. https://doi.org/10.1007/s11162-016-9418-y

Liang, T. S., Erbelding, E., Jacob, C. A., Wicker, H., Christmyer, C., Brunson, S., Richardson, D., & Ellen, J. M. (2005). Rapid HIV testing of clients of a mobile STD/HIV clinic. AIDS Patient Care and STDs, 19(4), 253–257. https://doi.org/10.1089/apc.2005.19.253

Lu, Y., Musalem, A., Olivares, M., & Schilkrut, A. (2013). Measuring the effect of queues on customer purchases. Management Science, 59(8), 1743–1763. https://doi.org/10.1287/mnsc.1120.1686

MacKillop, J., Few, L. R., Murphy, J. G., Wier, L. M., Acker, J., Murphy, C., Stojek, M., Carrigan, M., & Chaloupka, F. (2012). High-resolution behavioral economic analysis of cigarette demand to inform tax policy: High-resolution analysis of cigarette demand. Addiction, 107(12), 2191–2200. https://doi.org/10.1111/j.1360-0443.2012.03991.x

MacKillop, J., Murphy, C. M., Martin, R. A., Stojek, M., Tidey, J. W., Colby, S. M., & Rohsenow, D. J. (2016). Predictive validity of a cigarette purchase task in a randomized controlled trial of contingent vouchers for smoking in individuals with substance use disorders. Nicotine & Tobacco Research, 18(5), 531–537. https://doi.org/10.1093/ntr/ntv233

Nighbor, T. D., Barrows, A. J., Bunn, J. Y., DeSarno, M. J., Oliver, A. C., Coleman, S. R. M., Davis, D. R., Streck, J. M., Reed, E. N., Reed, D. D., & Higgins, S. T. (2020). Comparing participant estimated demand intensity on the cigarette purchase task to consumption when usual-brand cigarettes were provided free. Preventive Medicine, 140, 106221. https://doi.org/10.1016/j.ypmed.2020.106221

Page, L. C., Castleman, B. L., & Meyer, K. (2020). Customized nudging to improve FAFSA completion and income verification. Educational Evaluation and Policy Analysis, 42(1), 3–21. https://doi.org/10.3102/0162373719876916

Paniati, J. (2004). Operational solutions to traffic congestion. Public Roads, Federal Highway Administration, 68(3), 2–8.

Pritschmann, R. K., Yurasek, A. M., & Yi, R. (2021). A review of cross-commodity delay discounting research with relevance to addiction. Behavioural Processes, 186, 104339. https://doi.org/10.1016/j.beproc.2021.104339

Roma, P. G., Hursh, S. R., & Hudja, S. (2016). Hypothetical purchase task questionnaires for behavioral economic assessments of value and motivation. Managerial and Decision Economics, 37(4–5), 306–323. https://doi.org/10.1002/mde.2718

Reed, D. D., Kaplan, B. A., Becirevic, A., Roma, P. G., & Hursh, S. R. (2016). Toward quantifying the abuse liability of ultraviolet tanning: A behavioral economic approach to tanning addiction. Journal of the Experimental Analysis of Behavior, 106(1), 93–106. https://doi.org/10.1002/jeab.216

Schwartz, L. P., Blank, L., & Hursh, S. R. (2021). Behavioral economic demand in opioid treatment: Predictive validity of hypothetical purchase tasks for heroin, cocaine, and benzodiazepines. Drug & Alcohol Dependence, 221, 108562. https://doi.org/10.1016/j.drugalcdep.2021.108562

Sheikh, A., Misra, A., & Guensler, R. (2015). High-occupancy toll lane decision making: Income effects on I-85 express lanes, Atlanta Georgia. Transportation Research Record: Journal of the Transportation Research Board, 2531(1), 45–53.

Spiga, R., Martinetti, M. P., Meisch, R. A., Cowan, K., & Hursh, S. (2005). Methadone and nicotine self-administration in humans: A behavioral economic analysis. Psychopharmacology, 178(2–3), 223–231. https://doi.org/10.1007/s00213-004-2020-6

Stein, J. S., Koffarnus, M. N., Snider, S. E., Quisenberry, A. J., & Bickel, W. K. (2015). Identification and management of nonsystematic purchase task data: Toward best practice. Experimental and Clinical Psychopharmacology, 23(5), 377–386. https://doi.org/10.1037/pha0000020

Strickland, J. C., Reed, D. D., Hursh, S. R., Schwartz, L. P., Foster, R. N. S., Gelino, B. W., LeComte, R. S., Oda, F. S., Salzer, A. R., Schneider, T. D., Dayton, L., Latkin, C., & Johnson, M. W. (2022). Behavioral economic methods to inform infectious disease response: Prevention, testing, and vaccination in the COVID-19 pandemic. PLoS One, 17(1), e0258828. https://doi.org/10.1371/journal.pone.0258828

Tarnoff, P. (2004). Traffic signal clearance intervals. Institute of Transportation Engineers Journal, 74(4), 20–24.

Tarnoff, P. (2005). Customer-focused performance measures. Institute of Transportation Engineers Journal, 75(5), 33–36.

Tiboni, M., Rossetti, S., Vetturi, D., Torrisi, V., Botticini, F., & Schaefer, M. D. (2021). Urban policies and planning approaches for a safer and climate friendlier mobility in cities: Strategies, initiatives and some analysis. Sustainability, 13(4), 1778. https://doi.org/10.3390/su13041778

Tsunematsu, S. (2001). Effort- and time-cost effects on demand curves for food by pigeons under short session closed economies. Behavioural Processes, 53(1–2), 47–56. https://doi.org/10.1016/S0376-6357(00)00147-9

U.S. Department of Health & Human Services. (2022, January 10). Biden-Harris administration requires insurance companies and group health plans to cover the cost of at-home COVID-19 tests, increasing access to free tests.

Valdiserri, R. O., Moore, M., Gerber, A. R., Campbell, C. H., Dillon, B. A., & West, G. R. (1993). A study of clients returning for counseling after HIV testing: Implications for improving rates of return. Public Health Reports (Washington, D.C.: 1974), 108(1), 12–18.

Wilson, A. G., Franck, C. T., Koffarnus, M. N., & Bickel, W. K. (2016). Behavioral economics of cigarette purchase tasks: Within-subject comparison of real, potentially real, and hypothetical cigarettes. Nicotine & Tobacco Research, 18(5), 524–530. https://doi.org/10.1093/ntr/ntv154

World Health Organization. (2014). Report of the sage working group on vaccine hesitancy. https://www.who.int/immunization/sage/meetings/2014/october/1_Report_WORKING_GROUP_vaccine_hesitancy_final.pdf. Accessed 25 Sept 2021.

Yoon, J. H., Suchting, R., McKay, S. A., San Miguel, G. G., Vujanovic, A. A., Stotts, A. L., Lane, S. D., Vincent, J. N., Weaver, M. F., Lin, A., & Schmitz, J. M. (2020). Baseline cocaine demand predicts contingency management treatment outcomes for cocaine-use disorder. Psychology of Addictive Behaviors, 34(1), 164–174. https://doi.org/10.1037/adb0000475

Zauberman, G., Kim, B. K., Malkoc, S. A., & Bettman, J. R. (2009). Discounting time and time discounting: Subjective time perception and intertemporal preferences. Journal of Marketing Research, 46(4), 543–556. https://doi.org/10.1509/jmkr.46.4.543

Zvorsky, I., Nighbor, T. D., Kurti, A. N., DeSarno, M., Naudé, G., Reed, D. D., & Higgins, S. T. (2019). Sensitivity of hypothetical purchase task indices when studying substance use: A systematic literature review. Preventive Medicine, 128, 105789. https://doi.org/10.1016/j.ypmed.2019.105789

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest

The authors declare no conflicts of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Schwartz, L.P., Hursh, S.R. Time Cost and Demand: Implications for Public Policy. Perspect Behav Sci 46, 51–66 (2023). https://doi.org/10.1007/s40614-022-00349-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40614-022-00349-8