Abstract

Purpose of Review

The medium- and heavy-duty vehicle sectors are responsible for an outsized portion of greenhouse gas emissions and harmful particulate emissions. Decarbonizing this sector is challenging and extremely necessary. This paper provides an overview of the current and future state of electrifying this sector.

Recent Findings

Recent research has shown that zero-emission vehicles used for medium- and heavy-duty applications are available and cost-saving over their lifetimes. This is especially true for buses and delivery trucks.

Summary

Electrification of the medium- and heavy-duty sector is critical and is possible in the next 2 decades with complementary policies at the federal level in the USA.

Similar content being viewed by others

Introduction

The freight sector is increasingly important to ensure that goods such as food, medicine, home supplies, and business needs can be delivered on time. But the freight sector is also a major source of both local and climate pollution. A long-term strategy to reduce greenhouse gas (GHG) and particulate emissions to levels needed to reduce the worst impacts of climate change and improve public health outcomes must include ambitious advancements in the medium- and heavy-duty transportation sectors. Defined as vehicles over 10,000 pounds, medium-duty vehicles (MDVs) and heavy-duty vehicles (HDVs) are used mostly for goods transport and delivery.

Emissions reduction strategies focus largely on passenger light-duty vehicles (LDVs) because they constitute the largest proportion of vehicles on the road. MDVs and HDVs are about 10% of the vehicles on the road but disproportionately contribute to emissions: about 29% of transportation GHG emissions, 45% of on-road NOx emissions, and 57% of direct PM2.5 (particulate matter ≤ 2.5 microns in diameter) emissions [1••, 2]. These emissions are also disproportionately located in communities of color and poorer areas, contributing to injustice.

MDVs and HDVs are critical to goods movement in the US—over 70% of all freight is moved by trucks, the vast majority of which are powered by diesel fuel [4••]. Globally, on-road freight is responsible for 6% of total GHG emissions and is increasing [5]. According to a 2017 report from the International Council on Clean Transportation (ICCT), MD/HD trucks accounted for 39% of global transportation GHG emissions but only 9% of the vehicle stock [6••]. This relates to both the size/weight and distances driven by these vehicles, especially long-haul trucking. MD/HD’s disproportionate contribution to global GHGs is expected to increase as road freight continues to increase steadily through 2050 [6••].

Interest in deploying clean technologies in the trucking industry is rapidly growing and gaining momentum because of increasing attention to pollution and environmental justice, concern for climate change, and because the costs of these trucks continue to decline. Cleaner trucks provide co-benefits such as reduced noise, safer driving, public health benefits, and improve equity.

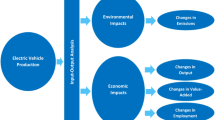

This report focuses on policy strategies to accelerate the decarbonization of on-road MDVs and HDVs and assesses the available technologies. Marine, rail, and aviation are important sectors to decarbonize but are not included in this report. On-road transportation is responsible for the majority of freight and transportation emissions, and off-road freight requires different technology and policy solutions (Fig. 1).

US transportation emissions by source according to EPA data [3]

Current State of Medium- and Heavy-Duty Vehicles

MDVs and HDVs include large pickup trucks, farm and construction equipment, freight trucks, and delivery vehicles. The use of MDVs and HDVs varies widely, but the majority in the USA are class 8 trucks and travel more than 10,000 miles per year [7]. Fig. 3 below shows the United States Department of Energy (USDOT) vehicle classifications based on weight, which will be referenced throughout the report. “Medium-duty” trucks are generally considered those in classes 3–6, while “heavy-duty” trucks are in classes 7–8. Those below 10,000 lbs are light-duty. See Figure 2.

Externalities From Internal Combustion Engine Trucks

Currently, 98% of class 8 trucks are Internal Combustion Engines (ICEs) mostly fueled by diesel. Because MDVs and HDVs frequently use diesel and have high mileage, they contribute significantly to air pollution, especially in disadvantaged communities (DACs). NOx and PM2.5 are shown to contribute to significant health risks, including birth defects, preterm birth, heart attacks, cancer, lung disease, and asthma [1, 9]

This type of pollution disproportionately burdens communities of color and low-income communities, particularly in the USA [10]. Legacy housing practices, such as redlining, have placed these communities closer to highways and near “magnet” freight centers such as shipping warehouses and truck terminals and ports. In the most polluted census tracts, PM2.5 concentrations can be nearly four times higher than the regional average. Communities of color in the mid-Atlantic and northeast regions of the USA breathe 6% more pollution from on-road vehicles than white residents in those regions [10].

Traffic and noise also have major negative effects on human health. Noise pollution is a major cause of hearing loss, heart disease, and sleep disturbance [11]. Populations living closer to highways and high-traffic areas such as ports are also more likely to suffer from traffic-related injuries and deaths and have less access to safe pedestrian infrastructure [12].

Truck Uses and Duty Cycles

As outlined above, there are various types of MDVs and HDVs, with many different duty applications and driving cycles. Fig. 2 in the previous section provides an indication of the range of vehicles in each class.

The types of jobs these vehicles perform, the distance they drive each day, and their opportunities for stopping for short or long periods of time have a major impact on the types of drivetrains they accommodate and the infrastructure needed to support them. Prospects for electrification will depend on these and other factors, such as required payload and weights of batteries that may reduce available payload. Here we review some of the major types of vehicles, with consideration of their suitability for electrification.

In 2015, transportation was responsible for almost 13 million barrels per day of petroleum consumption per day. The medium- and heavy-duty (classes 3–8 and buses) were responsible for 15% of US petroleum consumption. About 80% of this MD/HDV consumption, and in turn, carbon dioxide emissions, are from class 7 and class 8 trucks, which consumed 2.3 million barrels of petroleum per day [13].

Long-Haul Trucking

Long-haul trucks in the USA typically travel 300 or more miles per day, sometimes up to 800 miles, and travel more than 100,000 miles per year. These are typically tractor trailers with 80,000 lbs gross vehicle weight (GVW) and are capable of hauling nearly 40,000 lbs of goods. They are designed for distance travel, and diesel fuel is perfectly suited for this given its energy density. Electrification of long-haul trucks would require one or more fast charges per day and faces a loss of payload due to additional weight of the battery pack. However, there could be important energy and maintenance cost savings from electrifying long-haul trucks, and different delivery systems could be developed, such as “pony express” with trailers dropped between trucks going shorter distances, or battery swap systems so trucks can “recharge” in just a few minutes. This category of truck is currently considered among the most challenging to electrify by many industry experts (e.g., Wood-Mackenzie, 2020) [14].

Drayage

Drayage trucks move freight off port sites and deliver these to rail hubs, warehouses, or final destinations. They are typically class 8 tractor trailers. The distances traveled range from a few miles up to hundreds of miles, but a typical distance is under 100 miles. The short range and fixed routes mean that electrification can work reasonably well in this trucking application, depending on the specifics of each truck’s daily drive cycle.

Delivery Trucks

Delivery trucks can range from class 4 to 7 in weight depending on their use. A common example is the “UPS truck,” typically a class 4 or 5 step truck. These trucks usually travel under 100 miles per day, make many stops, and use an urban travel cycle that benefits from the electric battery system efficiency in that application. The tradeoff for these trucks is identifying the needed capacity of batteries (requiring weight and payload compromises) to avoid significant daytime charging.

Heavy-Duty Pickup Trucks

Heavy-duty pickup trucks are class 2b or 3 and are larger versions of household pickup trucks. They are among the largest stock of trucks in the USA and typically are used by construction, repair, and other service-oriented small businesses. Trucks may be housed in small fleets or even at homes. Providing electric charging infrastructure may be challenging for some operators. They may have a wide range of daily travel patterns, carry a substantial payload, and possess towing capability. These requirements necessitate large batteries that significantly increase the capital cost. Thus they are currently considered challenging to electrify, at least in many cases.

Transit Buses

Transit buses are large class 7 vehicles carrying large numbers of people on fixed routes. Drive cycles include short distance routes, low average speeds, and repeated stops and starts. This activity leads to significantly higher efficiency for electric vehicles than ICE buses. Electrification of both transit buses and school buses would benefit air quality and have a short payback period (the number of years of operations cost savings to pay back a higher purchase cost) because of their use-case.

Vocational Trucks

Vocational trucks are used for vocational work and hauling, such as garbage trucks, dump trucks, and cement mixers. They use a power take-off unit to transfer power to auxiliary devices rather than to propel the vehicle. Vocational trucks typically have short ranges and drive to locations where they park and supply power for work-related activities. Electric trucks can supply external power quietly with zero emissions enabling them to work at times and in locations where diesel power may be limited and without health consequences from diesel emissions for the vocational workers.

Off-Road

Off-road vehicles are another potential market application for electric trucks. Examples include airport ground support equipment, port cargo handling equipment, locomotives, industrial equipment, construction, and mining. In some cases, there is already significant market penetration of electric vehicles, and California, for example, has developed or is in the process of developing regulations requiring zero-emission sales [15].

Cost Assessment

A new paper by Burke et al. [16] provides a detailed comparison of the costs of purchasing and operating electric versus diesel trucks, by application. It takes into account upfront purchase costs, operating costs (energy and maintenance), and battery-related costs now and in the future, as they are expected to decline. This report indicates that by 2025, the “payback period” (when higher purchase cost is paid back by energy/operational savings) is only about 2–3 years for transit buses and in the range of 4–7 years for many truck applications. By 2030, these time periods fall to 3 years or less for all but long-haul (500 mile) trucking (Table 1).

Eventually, purchase costs will be lower for most types of electric trucks, so the payback times will be below zero; i.e., they will be cheaper than ICE trucks from day 1. This payback analysis includes an estimate of the energy costs, which for electricity includes charging station cost amortized over the expected number of vehicles and years of operation, but it does not include the cost of make-ready infrastructure. Make-ready infrastructure includes all hardware required to bring power from the grid to the charging stations and can include transformers, trenching, conduits, and power cables. The overall cost of make-ready infrastructure necessary to greatly expand the electric vehicle fleet is not well known but is expected to be significant. The analysis also does not include any changes that must be made in operations, such as changes to duty cycles or operating times to allow for recharging, which could add cost.

The lower operating costs of battery electric trucks will ultimately mean a lower cost for the movement of goods, which will benefit the economy. From a societal cost perspective, over the life of a truck, these vehicles, compared to ICE trucks, already offer a lower “total cost of ownership” (TCO) and thus a very low or negative cost of reductions to CO2 emissions (since battery electric vehicles [BEVs] in most places, with most operations, will have significantly lower well-to-wheel CO2 emissions).

Hydrogen fuel cell trucking is another electric vehicle technology in development and is expected to eventually provide important options for longer-range trucking. The similarities of fuel cell to diesel trucks in terms of short refueling times and somewhat longer ranges are attractive to a range of fleets, though their purchase and operating costs are expected to be higher than battery electric trucks for at least the next decade. The extent to which fleets will pay more for vehicles that provide a broader service is an open question, but over the next 5 years, there will be a number of medium- and heavy-duty fuel cell vehicle models entering the market, and answers to this question will begin to emerge.

Current Policy Landscape

Federal policies targeting MDVs and HDVs have so far focused on requiring improved fuel efficiency for emissions reductions. In 2011, the US Environmental Protection Agency (USEPA) and the Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) adopted the first emissions standards for heavy-duty engines, requiring both the engine and vehicle manufacturers to use more efficient systems. In 2013, the California Air Resources Board (CARB) came to an agreement with the USEPA and NHTSA to start phase two and begin permitting trucks for more stringent emissions standards starting in 2018 [17]. This rule covers model years 2018–2027 for some trailers and 2021–2027 for semi-trucks, large pickup trucks, vans, and all buses and work trucks. According to the EPA, the phase 2 rule is expected to decrease CO2 emissions by 1.1 billion metric tons or around 30% of baseline MD/HDV CO2 through 2027 [18].

California has also taken further policy steps to aggressively reduce the emissions from MDVs and HDVs, including trucks and buses. In 2018, CARB approved a regulation called the Innovative Clean Transit (ICT) Regulation that sets a goal for all California transit agencies to transition to 100% zero-emissions buses in a phased approach from 2023 to 2029 [19]. Transit agencies present a well-suited use-case for zero-emission technologies because of their stop-and-go urban routes where idling and acceleration cause dangerous particulate emissions in areas where pedestrians congregate. The agency calculates that transitioning from these buses would reduce emissions by the equivalent of taking 4 million cars off the road [20].

California is also the first state to implement incentive programs for HDVs similar to those that exist for light-duty vehicles. The most well-established is called the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Program (HVIP). HVIP was launched in 2009 and provides a point-of-sale discount for trucks and buses to commercial providers, to help remove the burden of the capital cost. The HVIP program includes the Clean Truck and Bus Vouchers program [21], which offers vouchers up to $315,000 to operators (public or private) to purchase a qualifying bus. There are also several grant programs targeting trucks and buses, such as the Clean Mobility in Schools Pilot program [22], the Carl Moyer Memorial Air Quality Standards Attainment Program [23], and the Zero and Near Zero-Emissions Freight Facilities (ZANZEFF) [24].

In 2020, CARB approved the Advanced Clean Truck (ACT) Rule, requiring class 2b–8 chassis medium- and heavy-duty truck manufacturers to phase-in a minimum number of trucks they sell to be zero-emission in California starting in 2024. By 2035, 55% of class 2b–3 truck sales, 75% of class 4–8 trucks, and 40% of truck tractor sales must be zero emission [25]. CARB is also developing the Advanced Clean Fleets regulation to set a target for 100% zero-emission truck and bus sales in California by 2045, with earlier goals for short-haul trucks, such as urban delivery and drayage vehicles [26]. This rule, like California’s fuel efficiency standards, requires a waiver from the United States EPA before it can be implemented in California.

The development of both the ICT and ACT regulations have been taken into consideration under Governor Gavin Newson’s 2020 executive order requiring that CARB develop regulations to mandate that 100% of medium- and heavy-duty operations are zero emission by 2045 “where feasible.” This will require partnerships with CARB, the private sector, and other California agencies, such as the Energy Commission and California Department of Transportation, to ensure infrastructure and markets are supported to achieve this ambitious goal [27, 28].

The day after CARB announced the ACT rule, seven additional states—Connecticut, Oregon, Maine, Massachusetts, New Jersey, Rhode Island, and Vermont—plus the District of Columbia, in a state coalition called the Northeast States for Coordinated Air Use Management, signed a statement of intent to develop a plan to deploy zero-emission trucks and buses [29]. The announcement also invited other states to join and sign onto the commitment [30].

Current Market for Zero-Emission Technologies

The market for zero-emission technologies, notably battery electric bus and truck models, is growing rapidly, with over 70 models in development or available across classes. Much of the focus is on the California market because of the policies outlined above requiring adoption of zero-emission vehicles (ZEVs, including battery electric, plug-in hybrid, and fuel cell vehicles). Calstart, a non-profit focused on zero-emission transportation, partnered with CARB to form the Global Commercial Drive to Zero and have developed a tracking tool, the Zero-Emission Technology Inventory (ZETI), for monitoring the announcements and production of ZEVs. They have used this to organize the trends into a series of “waves” as shown in Fig. 3 [31].

Vehicle weight classes as defined by the Federal Highway Administration (FHWA) in the US Department of Transportation (USDOT). Figure taken from the Department of Energy, Office of Energy Efficiency and Renewable Energy [8]

By 2020, “wave 2” was well underway, with an increasing number of models available for transit buses, class 3 delivery vans, and tractors (for tractor-trailers) with short range for “yard” duties and other short-haul functions. By 2022, a much wider range of battery electric truck models will be on the market, including a wider range of delivery vans, box trucks, class 7 straight trucks, and the widely anticipated Tesla long-haul BEV and Nikola long-haul fuel cell tractor trailer.

Charging infrastructure for medium- and heavy-duty ZEVs must be designed quite differently than light-duty vehicles. Charging infrastructure will need to support a fleet-style hub with short refueling times and non-public shared and public access for long-haul trucks. Fast charging stations should be located, for example, at trucking and rest stops along interstate highways, where drivers can stop to sleep while their vehicles are charged.

Fast chargers will also be required along travel corridors for these purposes, but there is little data available on what type of Electric Vehicle Supply Equipment (EVSE) and what vehicle-to-charger ratio will be needed for medium- and heavy-duty vehicles. Most assumptions in the research literature state that class 4–8 vehicles will charge at a “home base,” where most can be charged with 50–150kW chargers, and a small percent will need 350kW chargers [17, 33] (Fig. 3).

Policy Implications

Decarbonizing MDVs and HDVs will lead to lower operating costs and lower public health costs, but policies need to be implemented to accelerate their adoption in order to realize the full benefits of electrification. Some countries, such as China, have already rapidly innovated and deployed these vehicles, especially buses. In addition to monetary investment, a National ZEV policy should include incentives, regulations, and policies that are supportive of state and local governments.

Increase Funding

Increasing funding for research in programs such as the Department of Energy’s Vehicle Technologies Office and Hydrogen Office will accelerate the development of longer-range batteries, charging technologies, and energy efficiency features that will create domestic jobs and help US competitiveness in the development of advanced vehicle technologies. Such research will help develop new battery and charging technologies, improve aerodynamics and materials of trucks and buses, and help plan infrastructure and deployment.

The EPA’s Diesel Emissions Reduction Act (DERA) should also be reformed and expanded to more than the current $75 million per year, to specifically replace diesel trucks with zero-emission trucks. This expansion would help accelerate the turnover of current diesel vehicles on the road.

Tax Incentives

Light-duty ZEVs benefit from a $7500 federal tax credit for new purchases. While this policy will likely be reformed and expanded to be more equitable, it has resulted in an increase in consumer demand for ZEV passenger vehicles. There is no equivalent incentive for the medium- and heavy-duty industry. If freight companies and transit agencies could benefit from a tax credit for procuring and utilizing ZEV trucks and buses, they would have a lower upfront cost barrier to purchase ZEV trucks. A federal HVIP-like program is one policy option, where operators are given a voucher to purchase zero-emission buses and trucks at a discounted rate at the point of sale.

Incentives for charging infrastructure and electricity costs will also encourage the adoption of ZEV trucks and buses. Utility and charging companies should ensure that trucks and buses are paying fair rates on their electricity and that time-of-use of charging is taken into consideration to benefit the electrical grid. Because of the nature of freight and public transportation, delivery vehicles and buses can easily be charged during off-peak times and times when renewable production is high on the grid. Vehicle-to-grid technology (V2G) could be utilized for fleets to provide energy storage for use as emergency generators during power outages. In turn, truck and bus operators would save even further on fuel costs.

Major freight corridors will require significant investments in ZEV infrastructure from federal, state, and local governments and utility companies. Utility companies will need to support the upgrades of electrical transmission and distribution and installation of additional capacity in rural areas. Governments should also offer rebates and other incentives for the installation of EVSE that supports the zero-emission trucks and buses along freight corridors and urban delivery and bus routes.

Finally, removing tax burdens on zero-emission MDVs and HDVs will further accelerate the deployment of these technologies in the USA. Such policies include removing the 12% federal excise tax on zero-emission trucks to encourage their adoption over new combustion drive trains.

Regulations

New emissions standards should be a high priority for the Environmental Protection Agency (EPA), in line with California’s standards. A national phase out of diesel MDVs and HDVs will be the most effective way to move to 100% zero-emission MDVs and HDVs, using the federal standard for carbon dioxide emissions per mile to drive ZEV adoption. This could be accompanied by a phased-in road user tax or feebate program on trucks to make up for the difference in revenue generated by fuel taxes.

Clean fuel programs at the state level, such as California’s Low Carbon Fuel Standard, can use the market to generate credits for clean fuel operation, which includes electric charging events. However, the Renewable Fuel Standard does not currently support the use of electricity for Renewable Identification Number credits. The EPA should create an electric pathway that will reward electric producers, which would greatly benefit zero-emission MDVs and HDVs.

State and Local Policies

Some states, such as California, have already taken a leading role in developing low- and zero-emission trucking policies, but innovative road-use policies could compliment these already fruitful goals. For example, European cities have implemented “Low and zero-emissions zones,” meaning certain blocks in urban corridors that are accessible to only ZEVs. This would further incentivize the procurement and deployment of zero-emission delivery vehicles and transit vehicles in congested cities where air quality is the most impacted by particulate matter from traditionally diesel-powered vehicles.

Electrification of state and city government fleets—such as municipal waste, parks and rec vehicles, and other heavy-duty vehicles used for government operations—would go a long way to spur procurement, improve costs, and improve air quality in those localities.

Conclusions

Decarbonizing the transportation sector will require increased investment and policies that focus on the medium- and heavy-duty vehicle sector. The outsized contributions that diesel-powered trucks and buses have on dangerous particulate emissions, smog-forming pollutants, and GHGs can be vastly improved by electrifying trucks and buses into battery or fuel cell electric vehicles.

Because of the variability in medium- and heavy-duty vehicle use, the necessary infrastructure and relative time frame to electrify these vehicles are also variable. Short-haul medium-duty vehicles, such as delivery trucks, are an ideal use-case for electrification and have short payback periods. Similarly, transit buses and vocational vehicles that operate on fixed routes and are stored at hubs that could be used as charging terminals prove to be favorable use-cases for electrification. Long-haul heavy-duty trucks present a more challenging case because of battery needs and refueling time, but additional policies, research and development, and the availability of hydrogen fuel cell technology will help move these vehicles into electrification.

Supportive policies, including tax incentives, investment in research and development, and infrastructure development, are critical to accelerating the adoption of medium- and heavy-duty electric vehicles. California is a leader in this space, but additional federal, state, and local policies will be necessary to meet electrification goals set by California and emissions goals laid out in national and international climate plans.

Availability of data and material

Not applicable

Code availability

Not applicable

References

Papers of particular interest, published recently, have been highlighted as: •• Of major importance

•• O’Dea J. Ready for work: now is the time for heavy-duty electric vehicles [Internet]. Union of Concerned Scientists. 2019 Dec [cited 2021 Mar 14]. Available from: https://www.ucsusa.org/sites/default/files/2019-12/ReadyforWorkFullReport.pdf. This report gives an overview of the social and environmental impacts of medium- and heavy-duty trucks and buses, an overview of the electric models that are available, and policies to increase adoption

Center for Climate and Energy Solutions. Federal vehicle standards [Internet]. Center for Climate and Energy Solutions. 2020 [cited 2021 Mar 14]. Available from: https://www.c2es.org/content/regulating-transportation-sector-carbon-emissions/

US EPA O. Fast facts on transportation greenhouse gas emissions [Internet]. US EPA. 2015 [cited 2021 May 2]. Available from: https://www.epa.gov/greenvehicles/fast-facts-transportation-greenhouse-gas-emissions

•• Zhao H, Wang Q, Fulton L, Jaller M, Burke A. A comparison of zero-emission highway trucking technologies. 2018 Oct [cited 2021 Mar 14]; Available from: https://escholarship.org/uc/item/1584b5z9. This report provides a comprehensive overview of zero-emission trucking technology, including the vehicles and charging equipment, needed for long-haul freight movement

Project Drawdown. Efficient trucks [Internet]. Project Drawdown. 2020 [cited 2021 Mar 14]. Available from: https://www.drawdown.org/solutions/efficient-trucks/technical-summary

•• Transitioning to zero-emission heavy-duty freight vehicles | International Council on Clean Transportation [Internet]. [cited 2020 Mar 3]. Available from: https://theicct.org/publications/transitioning-zero-emission-heavy-duty-freight-vehicles. This report examines the zero-emission trucking technology in the U.S., China, and Europe, analyzing their cost of ownership and emissions profiles to determine cost-saving potential, GHG emissions impacts, and suitability of technologies

Brown AL, Fleming KL, Safford H. Prospects for a highly electric road transportation sector in the USA. current sustainable/renewable energy reports [Internet]. 2020 Feb 8 [cited 2021 Mar 14];(3/2020). Available from: https://www.springerprofessional.de/en/prospects-for-a-highly-electric-road-transportation-sector-in-th/18240302

U.S. Department of Energy. Fact #707: December 26, 2011 Illustration of truck classes [Internet]. Energy.gov. 2011 [cited 2021 Apr 2]. Available from: https://www.energy.gov/eere/vehicles/fact-707-december-26-2011-illustration-truck-classes

American Lung Association. Transportation [Internet]. [cited 2021 Mar 31]. Available from: /clean-air/outdoors/what-makes-air-unhealthy/transportation

Pinto de Moura MC, Reichmuth D. Inequitable exposure to air pollution from vehicles|union of concerned scientists [Internet]. 2019 [cited 2021 Mar 14]. Available from: https://www.ucsusa.org/resources/inequitable-exposure-air-pollution-vehicles

Theakston F. Weltgesundheitsorganisation, editors. Burden of disease from environmental noise: quantification of healthy life years lost in Europe. World Health Organization, Regional Office for Europe: Copenhagen; 2011. 106 p.

Fleming KL. Social equity considerations in the new age of transportation: electric, automated, and shared mobility. Journal of Science Policy and Governance. 2018;13(1):20.

Davis SC, Williams SE, Boundy RG. Transportation Energy Data Book: Edition 36. 2017 Dec;400.

Crooks E. The long haul for electric heavy trucks [Internet]. 2020 [cited 2021 Apr 2]. Available from: https://www.woodmac.com/news/opinion/the-long-haul-for-electric-heavy-trucks/

Miller MR. California off-road transportation electrification demand forecast. California Energy Commission; 2016 Sep p. 51.

Burke A, et al. Evaluation of the economics of battery-electric and fuel cell trucks and buses. UC Davis Sustainable Freight Research Center Report (Final ITS number TBD, expected publication date: April 2021);

Brown A, Sperling D, Austin B, DeShazo, J. R., Fulton, Lewis M., Lipman T, et al. Driving California’s transportation emissions to zero. University of California Institute of Transportation Studies; 2021 Apr. Report No.: https://doi.org/10.7922/G2MC8X9X.

US EPA O. Final rule for phase 2 greenhouse gas emissions standards and fuel efficiency standards for medium- and heavy-duty engines and vehicles [Internet]. US EPA. 2016 [cited 2021 Apr 2]. Available from: https://www.epa.gov/regulations-emissions-vehicles-and-engines/final-rule-phase-2-greenhouse-gas-emissions-standards-and

California Air Resources Board. Innovative Clean Transit (ICT) Regulation fact sheet [Internet]. [cited 2021 Mar 30]. Available from: https://ww2.arb.ca.gov/resources/fact-sheets/innovative-clean-transit-ict-regulation-fact-sheet

California Air Resources Board. California transitioning to all-electric public bus fleet by 2040 [Internet]. [cited 2021 Mar 30]. Available from: https://ww2.arb.ca.gov/news/california-transitioning-all-electric-public-bus-fleet-2040

California Climate Investments. Clean truck and bus vouchers [Internet]. California Climate Investments. [cited 2021 Mar 30]. Available from: http://www.caclimateinvestments.ca.gov/clean-truck-and-bus-vouchers

California Air Resources Board. Low carbon transportation investments and AQIP grant solicitations [Internet]. [cited 2021 Mar 30]. Available from: https://ww2.arb.ca.gov/our-work/programs/low-carbon-transportation-investments-and-air-quality-improvement-program/low

California Air Resources Board. The Carl Moyer Program Guidelines [Internet]. 2017. Available from: https://ww2.arb.ca.gov/sites/default/files/2020-06/2017_cmpgl.pdf

Zlatar I. Zero- and Near Zero-Emission freight facilities project: long beach [Internet]. California Climate Investments. 2019 [cited 2021 Mar 30]. Available from: http://www.caclimateinvestments.ca.gov/2019-profiles/lct-zanzeff

Advanced Clean Trucks | California air resources board [Internet]. [cited 2020 Dec 3]. Available from: https://ww2.arb.ca.gov/our-work/programs/advanced-clean-trucks

California Air Resources Board. Advanced clean fleets [Internet]. [cited 2021 Mar 30]. Available from: https://ww2.arb.ca.gov/our-work/programs/advanced-clean-fleets

Newsom GG. Executive Order N-17-19 [Internet]. Aug 14, 2019. Available from: https://www.gov.ca.gov/wp-content/uploads/2019/08/Future-of-Work-EO-N-17-19.pdf

Office of Governor Gavin Newsom. Governor Newsom announces California will phase out gasoline-powered cars & drastically reduce demand for fossil fuel in California’s fight against climate change [Internet]. 2020. Available from: https://www.gov.ca.gov/2020/09/23/governor-newsom-announces-california-will-phase-out-gasoline-powered-cars-drastically-reduce-demand-for-fossil-fuel-in-californias-fight-against-climate-change/

Multi-state medium- and heavy-duty zero emission vehicle initiative, statement of intent [Internet]. 2019 [cited 2021 Mar 30]. Available from: https://www.nescaum.org/documents/medium-and-heavy-duty-zev-statement-of-intent.pdf

Portillo P, Mui S. Bipartisan group of states take steps to cut truck pollution [Internet]. NRDC. 2019 [cited 2021 Mar 30]. Available from: https://www.nrdc.org/experts/patricio-portillo/bipartisan-group-states-take-steps-cut-truck-pollution

CALSTART. Drive to Zero’s Zero-emission Technology Inventory (ZETI) tool version 5.9 [Internet]. 2020 [cited 2021 Mar 31]. Available from: https://globaldrivetozero.org/tools/zero-emission-technology-inventory/

Welch D. The beachhead model: catalyzing mass-market opportunities for zero-emission commercial vehicles [Internet]. 2020 Oct [cited 2021 Apr 2]. Available from: https://globaldrivetozero.org/public/The_Beachhead_Model.pdf

Nicholas M. Estimating electric vehicle charging infrastructure costs across major U.S. metropolitan areas | International Council on Clean Transportation [Internet]. 2019 Aug [cited 2021 May 2]. Available from: https://theicct.org/publications/charging-cost-US

Funding

This work was funded by the UC Davis Institute of Transportation Studies STEPS program and the Policy Institute for Energy, Environment, and the Economy.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the Topical Collection on Electrification

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fleming, K.L., Brown, A.L., Fulton, L. et al. Electrification of Medium- and Heavy-Duty Ground Transportation: Status Report. Curr Sustainable Renewable Energy Rep 8, 180–188 (2021). https://doi.org/10.1007/s40518-021-00187-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40518-021-00187-3