Abstract

Mine planning of land-based mineral deposits follows well-established methods. The deep sea is currently under exploration, but mine planning approaches are still lacking. A spatial planning tool to assess the techno-economic requirements and implications of manganese nodule mining on deep-sea deposits is proposed in this paper. The comprehensive approach has been validated using research findings of the Blue Mining project, which received funding from the European Commission. A part of the German exploration area E1, located in the Clarion-Clipperton Fracture Zone, Pacific Ocean, serves as a case study area. The approach contributes to a responsible utilization of mineral resources in the deep sea, considering geological, economic and financial as well as technical and operational aspects. The approach may also be applicable for an early-stage assessment of other projects related to spatially distributed mineral resources, e.g., marine phosphate nodules. Furthermore, it could also be helpful for the investigation of the environmental impacts of seafloor manganese nodule mining.

Similar content being viewed by others

Introduction

First mining activities go back to the Stone Age (Sieveking et al. 1972). Since then, technologies have evolved from manual picking to high-tech mining, from the surface to the underground, and from the land to the sea. In the future, mining operations to extract marine minerals could take place in the deep sea. Seafloor manganese nodules (SMnN) may be one target of deep-sea mining (DSM) beyond the limits of national jurisdiction (Petersen et al. 2016; Hein and Koschinsky 2014; Mero 1962). Covering vast abyssal plains, high-tech harvesters are envisaged to collect these potato-sized rock concretions in water depths between 4000 and 6500 m (Volkmann and Lehnen 2017). SMnN primarily contain manganese, but are also rich in nickel, cobalt, copper, and other metals, which make them economically interesting (Hein et al. 2013). However, the future of DSM is still uncertain. Regulations for the exploitation of SMnN are still under development (ISA 2017a). Moreover, mining technologies are yet to attain a technological readiness level to undertake DSM operations (Knodt et al. 2016; ECORYS 2014; ISA 2008).

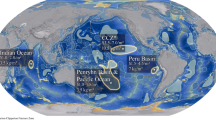

Exploitation technologies and methodologies as well as tools to plan for a sustainable exploitation must be developed in parallel to current exploration activities. If not, it will not be possible to exploit the resources once they are found, characterized, and whenever the market is ready. Spatial planning tools are used today in land-based mining (Preuße et al. 2016), for marine spatial planning purposes (Stelzenmüller et al. 2013) and in many other areas to plan human activities. Despite intensive research efforts since the 1970s, approaches to assess the techno-economic requirements and implications of SMnN mining are still lacking (Volkmann and Lehnen 2017; Sharma 2017; Abramowski 2016). In this light, a spatial planning tool and a method to valuate SMnN deposits is presented here and exemplified for a part of the eastern German license area, which is located in the Clarion-Clipperton Fracture Zone (CCZ), Pacific Ocean. The approach covers a whole range of disciplines—from exploration through to the financing of such projects and to the study of economics. To validate the results, research findings of the European research project “Blue Mining” are included as a specific case study (see “Background” section).

Blue Mining research contributes towards a sustainable spatial management and utilization of marine mineral resources (Volkmann 2014). Up to now, ecologic, economic, and societal aspects have been considered on a rather regional scale, i.e., for the entire CZZ (ISA 2017b; Lodge et al. 2014; Wedding et al. 2013). Although considered in marine spatial planning (Ehler and Douvere 2009; Ehler 2008; Ardron et al. 2008), the development of a spatial management strategy needs yet to be tackled for mining activities (Durden et al. 2017). Relating to this, the techno-economic requirements of commercial SMnN mining are assessed here and a planning approach is proposed. Besides mine planning by future mine operators, authorities may also apply the tool to identify and assess areas of potential commercial interest. The methodology may support the study of mining-related environmental impacts (Vanreusel et al. 2016; Mengerink et al. 2014) and human land use (Foley et al. 2005) in the deep sea—and may also be applicable to other spatially distributed marine mineral resources, e.g., phosphate nodules.

Background

This study uses background information of the Blue Mining project (2014–2018), which received funding from the European Commission (EC) in the 7th Framework Programme. Geological and technical aspects have been covered in an earlier publication with focus on the determination of production key figures (Volkmann and Lehnen 2017). Financial key figures were investigated by the Blue Mining project, but have only been partly published to date (Volkmann and Osterholt 2017). Exploration data have kindly been provided by the Federal Institute for Geosciences and Natural Resources (BGR).

Definitions

SMnN mining will mostly take place in international waters, on the seabed and subsoil beyond the limits of national jurisdiction termed “the Area” (Jenisch 2013). According to the United Nations Convention on the Law of the Sea (UNCLOS 1994), the International Seabed Authority (ISA or “the Authority”) shall organize, regulate, and control all activities in the Area, particularly with a view to administering its resources—the common heritage of mankind (Jaeckel et al. 2017). To plan future mining activities, clear definitions and demarcations are needed:

“Marine spatial planning” (MSP) is a “public process of analyzing and allocating the spatial and temporal distribution of human activities in marine areas to achieve ecological, economic and social objectives that are usually specified through a political process.” (Ehler and Douvere 2009). MSP should be ecosystem-based, with the goal “to maintain an ecosystem in a healthy, productive and resilient condition so that it can provide the goods and services humans want and need” (Ehler and Douvere 2009).

In contrast to MSP, “spatial mine planning” (SMP) is a process of analyzing and allocating the spatial and temporal distribution of human activities on the seafloor, which are related to a mining project. A spatial planning and management strategy to exploit SMnN in the most sustainable manner needs yet to be developed and, therefore, objectives, indicators, and regulations need to be defined. One main focus of research, as an important part of SMP, is the identification of the so-called “mineable area.”

The “mineable area” is the basis for other activities related to SMP, e.g., the identification of mine sites, mining fields, and routes (Volkmann and Lehnen 2017). In general, mining the seafloor area must be legally permitted and technically and economically feasible. As legal and environmental aspects are not included in the spatial planning tool presented here (see “Development of a spatial planning tool for SMnN mining” section), and since the future of SMnN mining is still uncertain, we refer to area(s) of potential commercial interest.

A “spatial (mine) planning tool” refers to a device that is necessary to or aids in the performance of SMP. A graphical calculating device, a nomogram, has been developed to determine the techno-economic requirements of a SMnN mining project and is used to identify the areas of (potential) commercial interest. Nomograms have roots back to the 1880s and “provide engineers with fast graphical calculations of complicated formulas to a practical precision” (Doerfler 2009). A later integration of the derived algorithms into a practical mine planning or scheduling software is conceivable.

Characteristics of the SMnN case study area

The case study area is located in the eastern part of the Clarion-Clipperton Fracture Zone (CCZ) in the equatorial northeast Pacific Ocean (Fig. 1). This area, covering about four million square kilometers, is characterized by the largest contiguous occurrence of SMnN fields in the world oceans (Kuhn et al. 2017). Moreover, this area has been extensively investigated by both academia and industry since the early 1970s. The large knowledge base together with high occurrences of SMnN and high metal contents are main reasons why the ISA has granted exploration licenses in this area since 2001 (a map with all license areas of the CCZ can be retrieved from www.isa.org.jm).

Apart from slight local variations, the chemical composition of the SMnN is relatively constant throughout the whole CCZ, especially when compared to variations in nodule abundance (in kg/m2; (Kuhn et al. 2017); the latter ranges between 0 and ~ 30 kg/m2 (based on wet nodule weight) with an average of 15 kg/m2 in the CCZ (SPC 2013). SMnN fields are not equally distributed on the seafloor within the CCZ but occur in patches. Economically interesting “patches” can cover an area of several thousand square kilometers (ISA 2010).

Water depths in the eastern German license area E1 vary from 1460 to 4680 m, with an average of 4240 m (Rühlemann et al. 2011). The seafloor of E1 is characterized by deep-sea plains interspersed with NNW-SSE-oriented horst and graben structures that are several kilometers wide, tens of kilometers long, and 100–300 m high, and many extinct volcanoes (seamounts) rising a few hundred to almost 3000 m over the surrounding abyssal plains (Rühlemann et al. 2011). Seafloor plains with slope angles less than 7° cover about 75% of the German license area and represent areas of interest with respect to future SMnN mining projects. However, due to environmental constraints, it is suggested that only about 20% of the license area may be mined in the future.

The tool developed in this paper is applied to a selected working area of exploration within E1, which is a commercially interesting area and could be a potential future mine site. This case study area has a size of 30 km (N-S) by 33 km (E-W) and is characterized by NNW-SSE-oriented elevations in the central and eastern part of the area which rise about 100–150 m above the surrounding seafloor, as well as by two small seamounts in the western part (Fig. 2a). About 97% of the area has slope angles less than 7°, whereas the slopes of the seamounts and the NNW-SSE striking elevations can reach angles up to 30° (Fig. 2b). With this bathymetry, the case study area is representative for other potential mining areas identified in E1 (BGR, unpublished data).

Bathymetric map (a) and slope angles (b) of the case study area in the eastern German exploration area E1. Slopes in the range of 0 to 7° are combined in map (c). Map (d) shows the predicted nodule abundance; areas with slopes exceeding 7° are excluded (white). The direction (top right to bottom right) indicates the processing/mapping sequence (see “Development of a valuation technique for SMnN deposits” section)

By nature, SMnN are polymetallic rock concretions which are comprised of several metals of economic value (UNOET 1987). During marine exploration, though different in subsequent mine planning, it is common to sum up the grades of the key metals. The sum of the nickel, copper, and cobalt contents averages 2.73%, the manganese content averages 31.1%, and the nodule abundance ranges from 0 to 22 kg/m2 (dry weight; unpublished BGR data). The nodule abundance distribution map (Fig. 2d) indicates increased values in topographically elevated areas. Grades have not been mapped since they are relatively constant. For instance, the coefficient of variance (CoV) for the combined Co + Cu + Ni grades throughout the entire E1 area is less than 10% compared to the CoV of nodule abundance which is > 30% (Knobloch et al. 2017).

Financial key figures of the case study

The launch of a DSM venture will depend on the forecast of future revenues or the predicted profitability (Martino and Parson 2013; Hoagland 1993). The net profit (NP′) per unit of output is used as a measure of a project profitability. The theoretical background is subject to financial modeling (Blue Mining, unpublished). The projects net profit was defined as the difference between the sales value and the breakeven sales value (in US$) per lifted dry metric ton of SMnN (dmt). In the spatial planning tool (see “Development of a spatial planning tool for SMnN mining” section), the net profit per unit of metal output is used (Formula 3). Different scenarios are considered, which relate to the Blue Mining case study. Assumptions and estimates apply (Table 1), which were evaluated trough a GAP analysis (good, average, poor) as of year-end 2015.

Revenues are generated from the sale of the metals nickel (Ni), cobalt (Co), copper (Cu), and optionally manganese (Mn), which could be sold as ferromanganese (FeMn; 73% Mn). The economic feasibility of SMnN mining will, at least for the foreseeable future, depend on these metals, even though trace metals such as rare earth elements (REE), tellurium (Te), lithium (Li), and gallium (Ga) (Hein et al. 2013) might be of economic interest as well (SPC 2016; Martino and Parson 2013). Their prices are based on time series data sets published by the USGS (2016), which were adjusted for inflation. The good case refers to the upper quartile, the average case to the average value, and the poor case scenario to the lower quartile of constant year 2015-dollar prices (1970 to 2015). The time series data set for manganese ore was scaled up to match with the 2015-price of ferromanganese. It is distinguished between three-metal (Ni, Co, Cu) and four-metal (plus Mn) processing routes (SPC 2016). Recovery rates reported by the ISA (2008) and average metal grades reported by Rühlemann et al. (2011) for E1 were used (Table 1).

The breakeven revenue is the minimum value required to cover all costs, including interest, taxes, and depreciation. Thus, it can be considered as a cost figure. The breakeven calculation is based on a discounted cash flow (DCF) analysis, using the time value of money to appraise long-term projects. SMnN and land-based mining projects share fundamental similarities: high risk and high capital cost. Capital expenditures (CAPEX) were estimated to range between about 2015-$1.2 and 1.5 billion. These costs were depreciated over 20 years using the straight-line method. Operative expenditures (OPEX) were estimated to range between $200 and 340/dmt SMnN (Volkmann and Osterholt 2017). Costs of a pilot mining test are not included. Tax and royalties are similar to rates which would be assumed for land-based mining projects. Discount rates of up to 25% apply, which are commensurate with the level of risk currently associated with the first SMnN mining projects. Production is assumed to range between 1 and 2 Mt/a (dry).

Assumptions and estimates have only been partly published for the Blue Mining project (Volkmann and Osterholt 2017). Most of these figures need yet to be validated through comprehensive studies and tests (Knodt et al. 2016; ECORYS 2014; ISA 2008). This concerns in particular the effective production and costs related to the processing and refining of SMnN. Assumptions and estimates may be compared to figures published in recent studies, e.g., BMWi (2016); SPC (2016).

Methodology

The case study area has been assessed from a geological and an economic standpoint. A spatial planning tool was developed, bringing together geological, technical, operational, financial, and economic aspects incurred in a mining project. Results of the case studies are used to investigate the techno-economic requirements, e.g., the dimension and potential implications of SMnN mining on resource utilization and land use (Fig. 3).

Development of a valuation technique for SMnN deposits

Although proposals for the identification of the mineable area have been made (Volkmann and Lehnen 2017; UNOET 1979), a standardized reporting code for declaring SMnN reserves does not yet exist. Recent studies consider grade, nodule abundance, and hydro-acoustic backscatter data in conjunction with slope angles to tag prospective SMnN fields (Volkmann and Lehnen 2017; Knobloch et al. 2017; Mucha and Wasilewska-Blaszczyk 2013). Relating thereto, a method for identifying the areas of (potential) commercial interest is proposed here, which—in addition to the existing approaches—takes into account the economic value of SMnN.

Mapping the seafloor’s cash value

To map the seafloor’s cash value, information on grades, nodule abundance, metal prices, and technical parameters such as efficiencies and the climbing ability of the seafloor mining tool (SMT) are required.

The “seafloor’s cash value” (R′′) is the revenue which could be generated by mining a specific area (raster unit, i.e., pixel), in US-dollar ($) per square meter. Simplified, it is the money that can be collected from the seafloor, i.e., revenue is generated by collecting SMnN and by selling the recovered metals. The cash value is the product of the metal content recovered from the area and the nickel price (Formula 1).

Formula 1: The seafloor’s cash value.

where

-

R′′ = The seafloors average cash value [$/m2]

-

M′′ = Average nickel equivalent content (recoverable), see Formula 6 [t/m2]

-

pNi = Selling price of nickel [$/t]

-

NAF = Average nodule abundance in the fields [t/m2, dry]

-

gNiE = Average nickel equivalent grade, see Formula 2 [%]

-

ηC = Constant collecting efficiency [%]

Constant metal grades and metal recovery rates, but variable nodule abundances (in kg/t, dry weight; Fig. 2) and prices of the respective scenarios apply (Table 1). The average metal contents derive from geochemical analyses of more than 700 nodule samples (BGR data).

The “nickel equivalent grade” (gNiE) is defined as the percentage amount (sum) of nickel equivalents determined for Co, Cu, and optionally Mn (sold as FeMn) with Ni as the major metal. To calculate the equivalent grade, all metals (m) are converted to a single metal based upon metal prices (pm), grades (gm), and recovery rates (ηm) (Formula 2).

Formula 2: Nickel equivalent grade including metal recovery.

where

-

gNiE = Average nickel equivalent grade [%]

-

pm = Selling price of product containing metal m [$/t, metal content]

-

pNi = Selling price of nickel [$/t]

-

gm = Average grade of metal m in ore [%]

-

ƞm = Average recovery rate for metal m [%]

-

k = Number of metals recovered (here three or four metals)

-

m = Here: Ni (1), Co (2), Cu (3), and Mn sold as FeMn (4)

The distribution of nodule abundance per square meter in the case study area (Fig. 1) was modeled based on the neural network approach by Knobloch et al. (2017), who used bathymetry and backscatter data of the seafloor and several derived datasets as input data. Based on known nodule abundance at box corer sites, the neural network was trained to find patterns in the input data which correlate with the nodule abundance from box corers. It could be proven that such patterns exist and, thus, it was possible to predict the nodule abundance at all sites where hydro-acoustic data are available (Knobloch et al. 2017). Therefore, nodule abundance values in the study area were available with a resolution of about 100 m, leading to the application of raster data with pixel sizes of about 100 m by 100 m with one nodule abundance value per pixel (Fig. 2) in the present study.

The distribution of cash values for each scenario in the case study area was mapped with ArcGIS™. The seafloor’s cash value was then calculated by using the presented formula (Formula 1). Areas with slope angles above 7° were removed from the analysis (white areas in Fig. 2d) as currently proposed mining equipment may only cope with areas inclined up to 7°—if at all (Agarwal et al. 2012; Kuhn et al. 2011; Atmanand 2011). The potentially mineable area is smaller and patchier (Fig. 2b, c) when slopes should not exceed 3°. Cash values were filtered using a smoothing average filter to remove noisy data. An averaging filter was applied, replacing each pixel value in the image of the case study area with the mean value of its neighbors, including the central pixel of the 3 × 3 matrix.

Theoretical resource utilization

The theoretical resource utilization (RUMax) is defined as the percentage amount of SMnN (contained in the case study area) that could be recovered by assuming an ideal extraction process (Volkmann and Lehnen 2017). The ideal state implies constant extraction costs and an extraction ratio of 100%, i.e., all SMnN are recovered from the areas (pixels) classified as (potentially) mineable. Mining losses are not considered. Field characteristics or other factors which have (under production conditions) an impact on costs are also not considered. Grades are assumed to be constant. The percentage utilization is plotted against the average nodule abundance. In general, the higher the cutoff (threshold) value, the more areas (pixels) are excluded from the case study area and the higher is the average value and vice versa.

Development of a spatial planning tool for SMnN mining

The spatial planning tool proposed here for SMnN mining is called nomogram (see “Definitions” section). A nomogram is created for each of the four GAP scenarios. Assumptions and estimates (Table 1) apply as default parameters. The nomogram is divided into four quadrants and visualizes the mathematical relationships between project economics (quadrant I), mine production (quadrant II), deposit characteristics (quadrant III), and market economics (quadrant IV). A formulaic approach to create a spatial planning tool for SMnN is presented, which is tied to certain objectives and constraints.

In contrast to the nomogram, different units are used in the formulas to avoid the use of conversion factors. All figures refer to annual or annual average values.

Objectives and constraints

The breakeven cash value (\( {{\widehat{R}}_{\mathrm{A}}}^{\prime \prime } \)) and the breakeven price (\( {\widehat{p}}_{\mathrm{Ni}} \)) are sought. The breakeven cash value is used to identify the areas of potential commercial interest (see “Development of a valuation technique for SMnN deposits” section) and to investigate the theoretical resource utilization (RUMax). The breakeven price is required to assess the profitability and the techno-economic requirements of a SMnN mining project.

From a socioeconomic perspective, the case study area’s resource should be utilized in the best possible manner, leaving more equivalent areas unmined for future generations (Volkmann 2014). A theoretical resource utilization of 100% is assumed, i.e., all SMnN is recovered from the entire case study area. However, environmental aspects still need to be effectively integrated. From a financial standpoint (Volkmann 2014), profitability is an absolute prerequisite for a commercial operation, here indicated by the net profit per unit of output (NP′).

The “net profit per nickel equivalent unit” (NP′) is defined as the nickel price (pNi) minus the breakeven price (\( {\widehat{p}}_{\mathrm{Ni}} \)). A mining project can only be accepted for positive values (NP′ > 0) (Formula 3).

Formula 3: Net profit per nickel equivalent unit.

where

-

NP′ = Net profit per ton nickel equivalent [$/t, metal content]

-

pNi = Selling price of nickel price [$/t, metal content]

-

\( {\widehat{p}}_{\mathrm{Ni}} \) = Breakeven nickel (equivalent) price [$/t, metal content]

In addition, techno-operational constraints and assumptions of the Blue Mining case study apply (Volkmann and Lehnen 2017). It is assumed that the maximum production would be limited to 2 Mt per annum. With current mining technology, a maximum mining capacity (MRMax) of 9 m2/s is expected by using one or two seafloor mining tools (SMTs). Furthermore, an operating time of 5000 h per year (TA) and a collecting efficiency of 80% (ηC) are assumed and defined as constants (note that this is a simplification).

Quadrant I: mine project economics

The first quadrant shows breakeven revenue, i.e., cost isolines for production capacities in the range of 0.5 to 2.5 Mt/a. The calculation is based on breakeven sales values (i.e., the costs per dmt; Table 1). Economies of scale, i.e., cost advantages that would arise with increased output, apply. The annual breakeven revenue (\( {\widehat{R}}_{\mathrm{A}} \)) is plotted against the average mining rate (MRA) and the seafloor’s average breakeven cash value (\( {\widehat{R}}_{\mathrm{A}} \)). The latter needs to be determined to identify the areas of potential commercial interest (see “Development of a valuation technique for SMnN deposits” section).

The “seafloor’s breakeven cash value” (\( {{\widehat{R}}_{\mathrm{A}}}^{\prime \prime } \)) is the minimum economic value that the mineable (and mined) area must exhibit on average to ensure profitability. The main objective is to ensure sufficient annual revenues to cover all costs incurred in the project. The breakeven cash value depends on the breakeven revenue (\( {\widehat{R}}_{\mathrm{A}} \)), the annual operating time (TA), and the average mining rate (MRA) (Formula 4). The average mining rate indicates the operational performance (Volkmann and Lehnen 2017).

Formula 4: The seafloor’s breakeven cash value.

where

-

\( {{\widehat{R}}_{\mathrm{A}}}^{\prime \prime } \) = The seafloor’s breakeven cash value (annual average) [$/m2]

-

\( {\widehat{R}}_{\mathrm{A}} \) = Annual breakeven revenue [$/a]

-

MRA = Annual average mining rate [m2/h]

-

TA = Annual (scheduled) operating time [h/a]

Quadrant II: mine production

The second quadrant shows production isolines for rates in the range of 0.5 to 2.5 Mt/a. The annual production rate (PA) is plotted against MRA and the average nodule abundance (NAF). Full capacity utilization is assumed, i.e., production and breakeven isolines match (PA = PA Max). The isolines indicate the dimension (scale) of a SMnN mining system, i.e., the designed capacity.

The “annual production rate” (PA) is defined as the dry mass of SMnN which would be recovered each year (Volkmann and Lehnen 2017). The annual production rate (Formula 5) is the product of the average nodule abundance in the mining fields (NAF), the annual operating time (TA), the average mining rate (MRA), and the collecting efficiency (ηC). The collecting efficiency is the percentage of SMnN picked-up from the seafloor. Further losses (of metals) are expected to occur in subsequent processes of the mine value chain (Melcher 1989), but are neglected in the calculations because the overall efficiency still needs to be assessed.

Formula 5: Annual production rate.

where

-

PA = Annual production rate [t/a, dry]

-

NAF = Average nodule abundance in the fields (annual average) [t/m2]

-

TA = Annual (scheduled) operating time [h/a]

-

MRA = Average mining rate (annual average) [m2/h]

-

ηC = Constant collecting efficiency [%]

Quadrant III: deposit characteristics

The third quadrant shows nickel equivalent grade isolines in the range of 1 to 7%. Although the nickel equivalent grade (gNiE) depends on the market conditions, it is rather unlikely that values are outside of this range with respect to historical metal prices and grades of the case study area. The nickel equivalent grade is plotted against NAF and the recoverable metal content (M′′). The relationship is shown for metal content, which is used in the cash value formula (Formula 1).

The “seafloor’s recoverable metal content” (M′′) is defined as the metal content that would be recovered from the seafloor. To calculate M′′, nodule abundance, the nickel equivalent grade, and the collecting efficiency (ηC) must be determined (Formula 6).

Formula 6: The seafloor’s recoverable metal content.

where

-

M′′ = The seafloor’s recoverable metal content (nickel equivalent) [t/m2]

-

NAF = Average nodule abundance in the fields [t/m2, dry]

-

gNiE = Average nickel equivalent grade [%]

-

ηC = Constant collecting efficiency [%]

The nickel equivalent grade and nodule abundance are results of the economic deposit assessment (see “Development of a valuation technique for SMnN deposits” section) and apply as annual averages. The nodule abundance depends on RUMax or vice versa.

Quadrant IV: market economics

The fourth quadrant shows price isolines in the range of $6000 to 30,000 per metric ton (metal content). In the light of historical metal prices and breakeven cash values, it is rather unlikely that values are outside this range for the case study area. The nickel price (pNi) is plotted against M′′ and the breakeven cash value (\( {{\widehat{R}}_{\mathrm{A}}}^{\prime \prime } \)). The breakeven price (\( {\widehat{p}}_{\mathrm{Ni}} \)) is sought, i.e., required to appraise the project.

The “break-even nickel (equivalent) price” (\( {\widehat{p}}_{\mathrm{Ni}} \)) is the ratio of \( {{\widehat{R}}_{\mathrm{A}}}^{\prime \prime } \) to the metal content, which would be recovered from the seafloor area (M′′; Formula 7). It represents the economic minimum price required to cover all costs incurred in the project to result in a positive investment decision.

Formula 7: Breakeven nickel price.

where

-

\( {\widehat{p}}_{\mathrm{Ni}} \) = Breakeven nickel (equivalent) price [$/t]

-

\( {{\widehat{R}}_{\mathrm{A}}}^{\prime \prime } \) = The seafloor’s breakeven cash value [$/m2]

-

M′′ = The seafloor’s recoverable nickel (equivalent) content [t/m2]

Guidance on using the nomogram

The nomogram is a specific tool for SMP to assess the techno-economic requirements of a mining project. Using the nomogram requires that a comprehensive assessment is conducted to determine breakeven revenues (costs) and constraints, among other model parameters. In combination with the deposit valuation method, the areas of commercial interest can be identified, and the theoretical resource utilization and potential land use can be studied with the generated maps.

To identify the areas of potential commercial interest with the maps generated for the case study area (see “Deposit potential of the SMnN case study area” section), the breakeven cash value (\( {{\widehat{R}}_{\mathrm{A}}}^{\prime } \)) needs to be graphically determined. The different quadrants in a nomogram are connected by joint x-axes (to connect the upper with the lower diagrams) and joint y-axes (to connect the right diagrams with those on the left). The vertical line in quadrant I can be extended into the lower left diagram (quadrant III). A horizontal line can be drawn from the intersection of the production isolines (quadrant I) with the vertical line derived from the 100% utilization (14.8 kg/m2) resulting in a distinct mining rate (Fig. 5(I)). This horizontal line intersects with different breakeven revenues and from this intersection, the breakeven cash value can be read off from the diagrams by drawing a vertical line downwards (to quadrant IV). With this information, the areas of potential commercial interest can be identified on the maps (Fig. 4a). Accordingly, the theoretical resource utilization and land use can be estimated (see “Critical review of the methodology” section).

In order to assess the profitability and/or the techno-economic requirements of the project scenario, the breakeven price (\( {\widehat{p}}_{\mathrm{Ni}} \)) must be determined. Firstly, the grade isoline (quadrant III) needs to be determined (Formula 2). In a next step, a horizontal line is drawn, intersecting with the vertical line within quadrant IV and the respective grade isoline (quadrant III). The breakeven nickel price in question is the isoline where the horizontal and vertical lines intersect. Ultimately, the net profit (NP′) reads off as the difference between the nickel price (of the respective scenario) and the breakeven nickel price (graphically determined). In conformity with the objectives and constraints, the techno-economic requirements can be determined by variation of the model parameters. The theoretical resource utilization curve may be plotted into quadrant I (Fig. 5(I), dashed blue line).

Results

In the following sections, the results of the assessment of the three- and four-metal GAP scenarios (Table 1) are presented, using both seafloor maps and nomograms.

Deposit potential of the SMnN case study area

Maps of the cash value are shown for the different GAP scenarios (Fig. 4). In these areas, slopes do not exceed 7°. Grades were shown to be constant in the study area. Comparing the four-metal good case (Fig. 4a) and four-metal average case scenario (Fig. 4b), the area divides into two contiguous areas. At higher prices in the good case, more areas fall into the class of cash values > $9/m2. These areas exhibit the highest nodule abundance (15–20 kg/m2; Fig. 2d) and are situated in the eastern part of the case study area. For the four-metal poor case scenario (Fig. 4c), the same can be observed, but cash values fall into the next lower classes. In the case of the three-metal average case scenario (Fig. 4d), the study area is more or less one large area with cash values between $3 and 6/m2.

According to the metal prices and recovery rates of the GAP scenarios (Table 1), the average nickel equivalent grade would be about 4.5 wt% in the case of four-metal and around 2 wt% in the case of three-metal recovery.

For the good case scenario (Fig. 5a), and planning with an average mining rate of ~ 7 m2/s or higher (Table 2), the entire model area could be mined from an economic perspective (referring to violet and blue image pixels). The potentially mineable area (referring to the areas of potential commercial interest) would be significantly smaller when cherry-picking only the violet areas (> $9/m2), which, however, would be mandatory at mining rates less than ~ 5 m2/s. The techno-economic requirements are particularly high for the three-metal average and the four-metal poor case scenario, aiming to achieve a positive net profit (NP′; compare to results of “Comprehensive evaluation of the case study” section) and the overall ambition to best utilize the given resource of the case study area.

Comprehensive evaluation of the case study

The nomograms are related to the case study area (Fig. 2) and to the assumptions defined for the four different GAP scenarios (Table 1). Objectives and constraints apply (see “Development of a spatial planning tool for SMnN mining” section).

Four-metal good case scenario

In the case of the four-metal good case scenario (Fig. 5), an average mining rate of about 9.8 m2/s would be required to result in a production of 2 Mt/a, while aiming to best utilize the resource of the case study area. The breakeven price would amount to about $8000/t, in contrast to a selling nickel price of about $16,000/t assumed for the scenario. The average seafloor’s cash value should not be less than ~ $4.5/m2. In this case, the net profit (NP′) is positive and the mining project would be economically viable. However, mining rates exceeding 9 m2/s are not expected to be achievable on average at present.

At a lower mining rate of 8 m2/s, a production of only ~ 1.7 Mt/a can be reached, based on an average nodule abundance of 14.8 kg/m2. However, at a breakeven cash value of ~ $5.7/m2 still a positive, but lower, net profit (NP′) could be achieved (Fig. 5(IV)). In Fig. 4a the cash values per square meter have been mapped, and it becomes apparent that a value of $5.7/m2 is reached in almost the complete case study area. If the mining rate would only be 4 m2/s, ~ 0.8 Mt/a could be mined in the case study area at 100% resource utilization. The breakeven nickel price would amount to about $12,000/t with a breakeven cash value of ~ $6.5/m2. However, almost all areas, i.e., pixels of the case study area are higher than the average minimum cash value (Fig. 4a).

Based on the assumption to mine the entire case study area, the smaller the project’s scale (capacity), the more pixels (Fig. 4) are below the economic minimum average value (Fig. 5(I)). In the light of constant metal prices and grades, profitability is improved by up-scaling the system’s capacity (economies of scale). Higher production rates require higher mining rates. As expected to be not realizable for the good case scenario (~ 9.8 m2/s), uneconomic pixels would have to be excluded from mining to result in a higher average nodule abundance (Fig. 5(III)). Planning with 2 Mt/a, a (lower) mining rate of 7.5 m2/s would result in the same net profit (NP′; Fig. 5(IV)), but would lead to a RUMax of only ~ 5%, relating to an average abundance of ~ 19 kg/m2 (Fig. 5(II)).

Four-metal average case scenario

In the case of the four-metal average scenario (Fig. 6), a mining rate of ~ 7.5 m2/s would be required on average to result in a production of 1.5 Mt/a (RUMax = 100%). The breakeven price would then amount to about $11,000/t, in contrast to a nickel price of $14,000/t assumed for this scenario. The average seafloor’s cash value should not be less than ~ $6.1/m2. This prerequisite is met, since most pixels are higher than this average value (Fig. 4b). Planning to recover 1 Mt per annum would result in a breakeven cash value of ~ $7.8/m2 and the net profit (NP′) would be just sufficient to accept the project. A significant share of areas (pixels) of the case study area is now below the minimum average of $7.8/m2 (Fig. 4b). As in the case of the good case scenario, the mining rate can be reduced by targeting high-abundance areas (pixels). At a production of 1.5 Mt/a and a RUMax of ~ 5% (~ 19 kg/m2), a mining rate of about 5.8 m2/s would be sufficient without compromising profitability (by downsizing the system to a lower capacity).

Three-metal average case scenario

In the case of the three-metal average scenario (Fig. 7), the average mining rate would also be 7.5 m2/s aiming for an optimal utilization. Compared to the four-metal case scenario, the specific breakeven value of ore is lower (due to lower costs of the three-metal processing route), while the breakeven nickel price is significantly higher and amounts to about $20,000/t. This is due to the lower value of ore (Table 1). The nickel equivalent grade amounts to approximately 2% compared to about 4.5% when recovering four metals. The average breakeven cash value would be ~ $5/m2. However, a project with these parameters would not be profitable (negative net profit; NP′). Even when taking larger capacities (larger-scale systems) into account to reach higher production (e.g., 2.0 Mt/a), this would not result in positive net profit (NP′).

Four-metal poor case scenario

The same result can be observed for the four-metal poor scenario (Fig. 8). The breakeven price is about $16,000/t, while a price of $11,000/t would be required to break even at low prices. The average seafloor’s cash value should not be less than ~ $9/m2 at a mining rate of about 5 m2/s. There is no seafloor region in the case study area which has a cash value of $9/m2 or more (Fig. 4d). Therefore, and due to the negative net profit (NP′; Fig. 8), this mining scenario must be declined. Moreover, investing in a 2-Mt/a capacity system, cost savings due to economies of scale do not render the project attractive.

Discussion

The discussion focuses on the methodology and derived results, but not on the background, i.e., assumptions and estimates related to deposit characterization and financial analysis.

Critical review of the methodology

Deposit valuation method

Using the method presented here (see “Development of a valuation technique for SMnN deposits” section), it is not yet possible to identify the (potentially) mineable area. Although technical and economic criteria have been considered (Fig. 2; Fig. 4), additional criteria might need to be considered, such as the size of SMnN, the trafficability of the soil, and areas of environmental interest that require protection, among others. Nevertheless, sound criteria to differentiate between non-mineable and mineable areas need to be investigated and these methods should be further fine-tuned and validated for other areas within the CCZ (ISA 2010). Moreover, none of the known SMnN resources have reached the status of a “reserve,” yet. This is due to the lack of geological confidence, economic technological readiness, and a missing legal framework for the exploitation of SMnN (Volkmann and Lehnen 2017).

The approach to identify the areas of potential commercial interest provides only a rough representation of the reality. The breakeven cash value (Formula 4) and the slope angle are used as criteria, i.e., pixels are excluded from mining which are below the economic minimum value and are not accessible for the SMTs (> 7°). Filters to identify contiguous areas have been developed, which have been inspired by traffic patterns of farming machines (Volkmann and Lehnen 2017). These filters were not applied to the case study area in order to not further increase the complexity of the analysis. However, maps of the seafloor’s cash value (Fig. 4) can be used to visually identify potentially mineable fields—seeking for coherent, large-scale areas, with a simple geometry and only few geological disturbances (obstacles). Surrounding areas and areas within should be included, if accessible and as long the (annual) average value is not less than the minimum cash value.

The breakeven cash value depends on the mining rate achieved in the particular area (Formula 4). The mining rate may depend, inter alia, on the slope angle, soil condition, number of obstacles, and field shape, among other factors. Furthermore, geological and field properties will influence costs, e.g., the steeper the slope, the higher the energy consumption and costs. In contrast, the collecting efficiency, a factor of the cash value formula (Formula 1), may depend on the burial depth and size of SMnN, among other factors. Therefore, these influencing factors should be analyzed for different area- and field-specific “patterns” by conducting pilot mining tests, experiments, or simulations. In the next step, a “preliminary reserve” could be estimated, not considering field design and route planning at this stage. The preliminary reserve, i.e., the mineable area could serve as a basis for further route planning to determine the “in-field reserve” (Volkmann and Lehnen 2017).

Spatial planning tool

The nomogram (see “Development of a spatial planning tool for SMnN mining” section) has several limitations. Because the breakeven calculation (see “Financial key figures of the case study” section) is based on a discounted cash flow (DCF) method, the nomogram is to be seen as a supporting tool for the strategic planning of a commercial mining project. Assuming that the cash flows of the financial model are constant over time is a simplification: from experience, metal prices, costs and production rates, among other model parameters, change during the life time of a mine. This is, however, counterbalanced by considering multiple scenarios with different parameter values (Table 1). Moreover, other methods may apply to determine the economic breakeven value (Wellmer et al. 2008). A further limitation is that the size and location of the case study area is fixed, whereas seafloor consumption is variable. It chiefly depends on the production (target) and average nodule abundance in the mining area (Volkmann and Lehnen 2017). Because equivalent areas have been identified for E1 (BGR unpublished data), it is assumed that the model area would be extensible, i.e., the characteristics of the model area apply to (smaller) sub-areas or fields.

Because the creation and use of the nomogram is relatively time-consuming, especially for larger data sets, computer-aided SMP should be sought. Using computer software, data handling, analysis, and visualization would be easier, faster, and dynamic. The tool could be integrated into GIS-software, e.g., ArcGIS™, which is designed to store, manipulate, analyze, and visualize spatial data. Moreover, the presented tool may also apply for other spatially distributed marine minerals, e.g., phosphate nodules. In precision farming, for instance, soil properties are obtained via close sensing, while remote sensing is commonly used to obtain information on the field, e.g., the yield. The collected data is used to generate application maps providing the user and the agricultural tools with information, e.g., fertilizer suggestions and traffic routes (Mulla 2013). For SMnN mining software, respective tools and methods still need to be developed, which will allow determination of the mineable area, the engineering of mining fields, and route planning. Then, it may be possible to benchmark the economic performance of a mining system, while assessing the environmental and societal implications of SMnN mining.

Validity of the results

The model case study and scenarios are hypothetical and based on assumptions and estimates of the Blue Mining case study. To assess the general techno-economic requirements in view of resource utilization, results of other projects need to be evaluated and compared.

Techno-economic requirements

A prerequisite of any mining project is economic feasibility. Based on the results of the Blue Mining case study (cf. nomograms), at least moderate conditions (Table 1) are necessary to realize economic SMnN mining, while focusing on the metals nickel, cobalt, copper, and manganese. This fits with the general consensus on the profitability of SMnN mining (SPC 2016; Martino and Parson 2013; Johnson and Otto 1986). Especially the high expectations on the internal rate of return (IRR), which are reflected in the breakeven revenue (costs; Table 1), make SMnN mining technologically difficult—although the techno-economic feasibility of SMnN mining has not yet been demonstrated. Currently, an IRR (discount rate) of about 15 to 30% is anticipated to be commensurate with the level of risk associated with SMnN projects (BMWi 2016; Martino and Parson 2013). However, it should be noted that commercial ventures must make a profit, while governments and their agencies may not (Gertsch and Gertsch 2005).

In the past, low profitability forced companies to focus on large scale (> 1 Mt/a) rather than on small-scale projects (≤ 1 Mt/a), with a median of 1.5 Mt/a of dry SMnN (SPC 2016). Also, the lifting system developed by Blue Mining partners is designed for production rates of up to 2 Mt/a. SPC (2016) states “that three-metal plants only become attractive as long as the plants receive 2-3 million dry tonnes of nodule per year as inputs. […] Four metal plants can sustain a much smaller operation at 1.5 million dry tonnes of nodules per year, as long as there is a high manganese recovery rate to make the operation competitive with respect to the additional capital and operating expenditures.” However, boosting profitability by harnessing economies of scale is restricted, because the production from one vessel or platform has shown to be limited to about 1.5 to 2 Mt/a dry SMnN, due mainly to technical, operational, and geological reasons (Volkmann and Lehnen 2017).

In the recent past, recommendations suggest (Martino and Parson 2013) that small-scale projects (Handschuh et al. 2003; Søreide et al. 2001) may be advisable under the dominance of the conventional (land-based) mining industry and low profitability of SMnN mining. Although cost savings due to economies of scale are tempting, an oversupply of metals due to an emerging number of SMnN projects could abruptly stop the rapid spread (Martino and Parson 2013). The conventional mining industry could recognize a reduction of metal prices as an effective barrier or even measure to drive SMnN mines out of the market (Marvasti 1998, 2000). Based on the results (cf. nomograms), small-scale mining would be most profitable under good conditions, while it would be just profitable under conditions assumed for the average case scenario (Table 1). Thus, the development of cost-efficient and high-performance mining concepts as well as adequate prices will be decisive to ensure economic viability.

The nomograms and the generated maps on the areas of potential commercial interest show that mining must be selective to be economically viable. Even in the good case scenario (Fig. 5(II)), the miner would have to “pick the cherries,” i.e., the most economic parts from the model area (> 9 $/m2; Fig. 4a) due to the capacity restriction of the SMT. To achieve average mining rates of 4 to 10 m2/s, mining capacities of 7.5 to 20 m2/s would have to be provided by one or several SMTs, depending on the time efficiency and the operating time (Volkmann and Lehnen 2017). Improving operating and time efficiency by adopting a most simple mining pattern and navigating the SMT(s) through the most nodule-rich areas with favorable field conditions (mostly flat and with only few obstacles) may be reasonable to increase productivity or if technically and/or economically unavoidable. However, an excessive practice would lead to a lower mining efficiency and reserve recovery (extraction ratio) within a mine site, thus, to a poor utilization of resources and land (Volkmann and Lehnen 2017).

Environmental considerations

Beside profitability and land and resource utilization, the affected seafloor area has been advocated to be an important aspect of sustainability (Volkmann 2014). Using the nomograms and maps of the areas of potential commercial interest, it may be possible to ecologically investigate the affected seafloor area (MIDAS 2016b; Thiel and Schriever 1993; Sharma 2013). Mining nodule-rich mine sites in the best possible manner may reduce the areal extent of the impacted area. Thus, “cherry-picking” by targeting the most economic (and abundant) mine sites within a license area seems to be favorable on a large scale, while “equivalent areas” must be protected. Also, it is yet uncertain if “cherry-picking” would be reasonable to preserve the abyssal ecosystem or to foster its recovery on a smaller scale (Vanreusel et al. 2016), i.e., within a mine site or mining field (Volkmann and Lehnen 2017). At the present time, the “impacts and effects of mining surrounding the directly mined area are poorly understood” (MIDAS 2016a). Although it is known that fine particles whirled up by SMTs and released from the MSV can be transported over large distances of several hundreds of kilometers, forming a thin sediment layer on the seafloor which may overlap and suppress the benthic ecosystem (SPC 2013; Sharma et al. 2001), it is not yet possible to define absolute threshold values or to predict the severity of the impact (MIDAS 2016a). Sound criteria need yet to be defined.

Conclusions

The presented tool and deposit valuation method contributes to an early understanding of the relationships between geological, technical, operational, economic, and financial aspects of SMnN mining, and the implications of SMnN mining in terms of resource and land utilization are considered. However, the comprehensive approach needs to be fine-tuned and validated with larger data sets, and possible environmental impacts still need to be considered. To work towards sustainable development, the development of a spatial planning and management strategy needs to be tackled. This requires that sound objectives, indicators, and regulations are formulated. In addition to a mining code, a computer code, i.e., a software for spatial mine planning (SMP), is required. In this context, interdisciplinary research, mining tests, and simulations, accompanied by comprehensive environmental studies, need to be conducted to determine the mineable area and to pre-define proper mining concepts.

Abbreviations

- BGR:

-

Federal Institute for Geosciences and Natural Resources (BGR), Hanover, Germany

- CAPEX:

-

Capital expenditure

- CCZ:

-

Clarion-Clipperton (Fracture) Zone

- Co:

-

Cobalt

- CoV:

-

Coefficient of variance

- Cu:

-

Copper

- DCF:

-

Discounted cash flow

- DSM:

-

Deep-sea mining

- DMT:

-

Dry metric ton (of SMnN)

- E1:

-

Eastern German license area E1

- FeMn:

-

Ferromanganese

- GAP-Analysis:

-

Good, average, poor analysis

- GIS:

-

Geographic information system

- IRR:

-

Internal rate of return

- MSV:

-

Mining support vessel

- Mn:

-

Manganese

- Ni:

-

Nickel

- NiEq:

-

Nickel equivalent

- NPV:

-

Net present value

- NSR:

-

Net smelter/processor return

- OPEX:

-

Operative expenditure

- ROM:

-

Run of mine

- SMnN:

-

Seafloor manganese nodules

- SMT:

-

Seafloor mining tool

- SMP:

-

Spatial mine planning

- MSP:

-

Marine spatial planning

- REE:

-

Rare earth elements

References

Abramowski T (2016) Deep sea mining value chain: organization, technology and development. Interoceanmetal Joint Organization, Szczecin

Agarwal B, Hu P, Placidi M, Santo H, Zhou JJ 2012 Feasibility study on manganese nodules: recovery in the Clarion-Clipperton Zone. https://pdfs.semanticscholar.org/687e/b9658dd10fb5c276aa591bd44f15d012f746.pdf

Ardron J, Gjerde K, Pullen S, Tilot V (2008) Marine spatial planning in the high seas. Mar Policy 32(5):832–839. https://doi.org/10.1016/j.marpol.2008.03.018

Atmanand MA (2011) Status of India’s polymetallic nodule mining Programme. In: Chung JS (ed) Proceedings of the twenty-first (2011) international offshore and polar engineering conference. ISOPE, Cupertino

BMWi 2016 Analysis of the Economic Benefits of Developing Commercial Deep Sea Mining Operations in Regions where Germany has Exploration Licenses of the International Seabed Authority, as well as Compilation and Evaluation of Implementation Options with a Focus on the Perfomance of Pilot Mining Test. With the assistance of Ramboll IMS and HWWI. Hamburg. Federal Ministry for Economic Affairs and Energy Division I C 4, Project No. 59/15

Doerfler R (2009) On jargon-the lost art of nomography. UMAP J 30(4):457

Durden JM, Murphy K, Jaeckel A, van Dover CL, Christiansen S, Gjerde K, Ortega A, Jones DOB (2017) A procedural framework for robust environmental management of deep-sea mining projects using a conceptual model. Mar Policy 84:193–201. https://doi.org/10.1016/j.marpol.2017.07.002

ECORYS 2014 Study to investigate state of knowledge of deep-sea mining: Final Report under FWC MARE/2012/06 - SC E1/2013/04.” Accessed 26 Nov 2016. https://webgate.ec.europa.eu/maritimeforum/en/node/3732

Ehler C (2008) Conclusions: benefits, lessons learned, and future challenges of marine spatial planning. Mar Policy 32(5):840–843. https://doi.org/10.1016/j.marpol.2008.03.014

Ehler C, Douvere F 2009 Marine spatial planning, a step-by-step approach toward ecosystem-based management. IOC Manuals and Guides 53

Foley JA, Defries R, Asner GP, Barford C, Bonan G, Carpenter SR, Chapin FS, Coe MT, Daily GC, Gibbs HK, Helkowski JH, Holloway T, Howard EA, Kucharik CJ, Monfreda C, Patz JA, Prentice IC, Ramankutty N, Snyder PK (2005) Global consequences of land use. Science (New York, NY) 309(5734):570–574. https://doi.org/10.1126/science.1111772.

Gertsch R, Gertsch L 2005 Economic analysis tools for mineral projects in space. Space Resources Roundtable, http://www.mines.edu/research/srr/rgertsch.pdf. Last viewed Sep 21: 3–11

Handschuh R, Schulte E, Grebe H, Schwarz W (2003) Economic simulations for a small scale manganese nodule mining system taking into account new technologies. In: Proceedings of The Fifth Ocean Mining Symposium, edited by The International Society of Offshore and Polar Engineers, 71. International Society of Offshore and Polar Engineers (ISOPE), Tsukuba, 15–19 Sept 2003

Hein JR, Koschinsky A (2014) Deep-ocean ferromanganese crusts and nodules. In: Holland HD, Turekian KK (eds) Treatise on geochemistry, 2nd edn. Elsevier, Amsterdam, pp 273–291. https://doi.org/10.1016/B978-0-08-095975-7.01111-6

Hein JR, Mizell K, Koschinsky A, Conrad TA (2013) Deep-ocean mineral deposits as a source of critical metals for high-and green-technology applications: comparison with land-based resources. Ore Geol Rev 51:1–14. https://doi.org/10.1016/j.oregeorev.2012.12.001

Hoagland P (1993) Manganese nodule price trends. Resour Policy 19(4):287–298. https://doi.org/10.1016/0301-4207(93)90041-K

ISA (ed) 2008 Polymetallic nodule mining technology: current status and challenges ahead. Proceedings of a workshop held by the International Seabed Authority in Chennai, India February 18-22, 2008. http://www.isa.org.jm/files/documents/EN/Pubs/Chennai.pdf

ISA (ed) (2010) A geological model of polymetallic nodule deposits in the Clarion Clipperton fracture zone. Technical study 6. International Seabed Authority, Kingston

ISA 2017a Ongoing development of regulations on exploitation of mineral resources in the area. Accessed 30 Nov 2017. https://www.isa.org.jm/legal-instruments/ongoing-development-regulations-exploitation-mineral-resources-area

ISA 2017b Report of the Chair of the Legal and Technical Commission on the work of the Commission at its session in 2017. ISBA/23/C/13. https://www.isa.org.jm/sites/default/files/files/documents/isba-23c-13_5.pdf

Jaeckel A, Gjerde KM, Ardron JA (2017) Conserving the common heritage of humankind—options for the deep-seabed mining regime. Mar Policy 78:150–157. https://doi.org/10.1016/j.marpol.2017.01.019

Jenisch U (2013) Tiefseebergbau–Lizenzvergabe und Umweltschutz. NuR 35(12):841–854. https://doi.org/10.1007/s10357-013-2554-7

Johnson CJ, Otto JM (1986) Manganese nodule project economics: factors relating to the Pacific region. Resour Policy 12(1):17–28. https://doi.org/10.1016/0301-4207(86)90045-0.

Knobloch A, Kuhn T, Rühlemann C, Hertwig T, Zeissler K-O, Noack S (2017) Predictive mapping of the nodule abundance and mineral resource estimation in the Clarion-Clipperton Zone using artificial neural networks and classical geostatistical methods. In: Sharma R (ed) Deep-Sea Mining. Springer, Cham

Knodt S, Kleinen T, Dornieden C, Lorscheidt J, Bjørneklett B, Mitzlaff A 2016 Development and engineering of offshore mining systems—state of the art and future perspectives. Offshore Technology Conference, Houston

Kuhn T, Rühlemann C, Wiedicke-Hombach M, Rutkowsky J, Wirth HJ, Koenig D, Kleinen T, Mathy T (2011) Tiefseeförderung von Manganknollen. Schiff & Hafen (5):78–83

Kuhn T, Wegorzewski A, Rühlemann C, Vink A 2017 Composition, formation, and occurrence of polymetallic nodules. In: Sharma R (2017) Deep-sea mining: resource potential, technical and environmental considerations. Springer International Publishing, Cham. pp 23–63. https://doi.org/10.1007/978-3-319-52557-0

Lodge M, Johnson D, Le Gurun G, Wengler M, Weaver P, Gunn V (2014) Seabed mining: international seabed authority environmental management plan for the Clarion–Clipperton zone. A partnership approach. Mar Policy 49:66–72. https://doi.org/10.1016/j.marpol.2014.04.006

Martino S, Parson LM (2013) Spillovers between cobalt, copper and nickel prices: implications for deep seabed mining. Miner Econ 25(2–3):107–127. https://doi.org/10.1007/s13563-012-0027-8

Marvasti A (1998) An assessment of the international technology transfer systems and the new law of the sea. Ocean Coast Manag 39(3):197–210. https://doi.org/10.1016/S0964-5691(98)00025-8

Marvasti A (2000) Resource characteristics, extraction costs, and optimal exploitation of mineral resources. Environ Resour Econ 17(4):395–408. https://doi.org/10.1023/A:1026566931709

Melcher PR (1989) Konzeption eines Fördersystems zum Abbau von Manganknollen. Forsch Ingenieurwesen 55(1):16–31. https://doi.org/10.1007/BF02559012

Mengerink KJ, van Dover CL, Ardron J, Baker M, Escobar-Briones E, Gjerde K, Koslow JA et al (2014) A call for deep-ocean stewardship. Science (New York, NY) 344(6185):696–698. https://doi.org/10.1126/science.1251458.

Mero JL (1962) Ocean-floor manganese nodules. Econ Geol 57(5):747–767. https://doi.org/10.2113/gsecongeo.57.5.747

MIDAS 2016a Implications of MIDAS results for policy makers: recommendations for future regulations.” Accessed 13 Dec 2017. http://www.eu-midas.net/sites/default/files/downloads/MIDAS_recommendations_for_policy_lowres.pdf

MIDAS 2016b Managing impacts of deep sea resource exploitation: research highlights. Accessed 13 Dec 2016. http://www.eu-midas.net/sites/default/files/downloads/MIDAS_research_highlights_low_res.pdf

Mucha J, Wasilewska-Blaszczyk M 2013 The Contouring accuracy of polymetallic nodules ore fields in the Interoceanmetal (IOM) Area, East Pacific Ocean. In Proceedings of the Tenth (2013) ISOPE Ocean Mining and Gas Hydrates Symposium: Deep ocean minerals, exploration, mining, gas hydrates and environment, edited by J. S. Chung. Cupertino, Calif

Mulla DJ (2013) Twenty five years of remote sensing in precision agriculture: key advances and remaining knowledge gaps. Biosyst Eng 114(4):358–371. https://doi.org/10.1016/j.biosystemseng.2012.08.009

Petersen S, Krätschell A, Augustin N, Jamieson J, Hein JR, Hannington MD (2016) News from the seabed—geological characteristics and resource potential of deep-sea mineral resources. Mar Policy 70:175–187. https://doi.org/10.1016/j.marpol.2016.03.012

Preuße A, Beckers D, Charlier F, Müller D, PapstM, Preuße L (2016) 16th International Congress for mine surveying, Brisbane, 12–16 Sept 2016

Rühlemann C, Kuhn T, Wiedicke-Hombach M, Kasten S, Mewes K, Picard A 2011 Current status of manganese nodule exploration in the German license area. In Chung, pp 168–73

Sharma R (2013) Deep-sea impact experiments and their future requirements. Mar Georesour Geotechnol 23(4):331–338. https://doi.org/10.1080/10641190500446698

Sharma R, Nath N, Parthiban G, Sankar SJ (2001) Sediment redistribution during simulated benthic disturbance and its implications on deep seabed mining. Deep-Sea Res II 48(16):3363–3380. https://doi.org/10.1016/S0967-0645(01)00046-7

Sieveking GDG, Bush P, Ferguson J, Craddock PT, Hughes MJ, Cowell MR (1972) Prehistoric flint mines and their identification as sources of raw material. Archaeometry 14(2):151–176. https://doi.org/10.1111/j.1475-4754.1972.tb00061.x

Søreide F, Lund T, Markussen JM (2001) Deep ocean mining reconsidered: A study of the manganese nodule deposits in Cook Island. In: The proceedings of the Fourth (2001) ISOPE Ocean Mining Symposium, edited by The International Society of Offshore and Polar Engineers (ISOPE). Cupertino, Calif

SPC (2013) Deep Sea Minerals. In: Baker E, Beaudoin Y (eds) Manganese nodules, a physical, biological, environmental, and technical review, vol 1B. Secretariat of the Pacific Community

SPC (2016) An assessment of the costs and benefits of mining deepsea minerals in the Pacific Island Region: deep-sea mining cost-benefit analysis. Suva, Fiji. SPC Technical Report SPC00035

Stelzenmüller V, Lee J, South A, Jo F, Rogers SI (2013) Practical tools to support marine spatial planning: a review and some prototype tools. Mar Policy 38:214–227. https://doi.org/10.1016/j.marpol.2012.05.038

Thiel H, Schriever G (1993) Environmental consequences of deep-sea mining. Int Chall 13:54–70

UNCLOS 1994 United Nations Convention on the Law of the Sea. Accessed 18 Nov 2016. http://www.un.org/depts/los/convention_agreements/texts/unclos/unclos_e.pdf

UNOET (ed) (1979) Manganese nodules: dimensions and perspectives. Natural resources forum library 2. Reidel, Dordrecht

UNOET (ed) (1987) Delineation of mine sites and potential in different sea areas. Seabed Minerals Series 4, vol. 9. Graham & Trotman, London

USGS 2016 USGS minerals information: commodity statistics and information. Accessed 15 Sept 2017. https://minerals.usgs.gov/minerals/pubs/commodity/

Vanreusel A, Hilario A, Ribeiro PA, Menot L, Arbizu PM (2016) Threatened by mining, polymetallic nodules are required to preserve abyssal epifauna. Sci Rep 6(1):26808. https://doi.org/10.1038/srep26808

Volkmann SE (2014) “Deliverable 3.41: sustainable indicators.” Public report submitted to the EU Commission within the 7th Framework Programme (GA No. 604500). Accessed July 26, 2016. http://www.bluemining.eu/downloads/

Volkmann SE, Lehnen F (2017) Production key figures for planning the mining of manganese nodules. Mar Georesour Geotechnol:1–16. https://doi.org/10.1080/1064119X.2017.1319448

Volkmann SE, Osterholt V 2017 Deliverable 3.42: sustainable economic models and evaluation. Public report submitted to the EU Commission within the 7th Framework Programme (GA No. 604500). http://www.bluemining.eu/downloads/

Wedding LM, Friedlander AM, Kittinger JN, Watling L, Gaines SD, Bennett M, Hardy SM, Smith CR (2013) From principles to practice: a spatial approach to systematic conservation planning in the deep sea. Proc R Soc B Biol Sci 280(1773):20131684. https://doi.org/10.1098/rspb.2013.1684

Wellmer FH, Dalheimer M, Wagner M (2008) Economic evaluations in exploration. Springer, Berlin

Acknowledgements

This work received funding by the EU as part of the 7th Framework Programme (GA No. 604500). Exploration data were kindly provided by the German Federal Institute for Geosciences and Natural Resources (BGR) where we would like to thank Dr. Annemiek Vink for a critical review of our manuscript. Furthermore, we would like to thank Prof. Bernd Lottermoser (RWTH Aachen University) for additional input.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Volkmann, S.E., Kuhn, T. & Lehnen, F. A comprehensive approach for a techno-economic assessment of nodule mining in the deep sea. Miner Econ 31, 319–336 (2018). https://doi.org/10.1007/s13563-018-0143-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-018-0143-1