Abstract

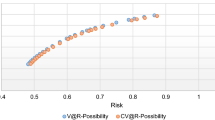

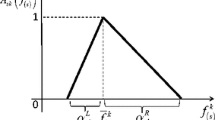

In this paper, views of investor are described in fuzzy sets, and two fuzzy Black-Litterman models are constructed with fuzzy views and fuzzy random views respectively. In the models, expected returns and uncertainty matrix of views are redefined and the views are formulated by fuzzy approaches suitably. Then the models are tested with data from Chinese financial markets. Empirical results show that the fuzzy random views model performs the best, and both the fuzzy models are better than the traditional ones, demonstrating that the fuzzy approaches can contain more information in the views and measure the uncertainty more correctly.

Similar content being viewed by others

References

Markowitz H, Portfolio selection, The Journal of Finance, 1952, 7(1): 77–91.

Kolm P N, Tütüncü R, and Fabozzi F J, 60 Years of portfolio optimization: Practical challenges and current trends, European Journal of Operational Research, 2014, 234(2): 356–371.

Brown D B and Smith J E, Dynamic portfolio optimization with transaction costs: Heuristics and dual bounds, Management Science, 2011, 57(10): 1752–1770.

Borkovec M, Domowitz I, Kiernan B, et al., Portfolio optimization and the cost of trading, The Journal of Investing, 2010, 19(2): 63–76.

Clarke R, De Silva H, and Thorley S, Portfolio constraints and the fundamental law of active management, Financial Analysts Journal, 2002, 58(5): 48–66.

Ceria S, Saxena A, and Stubbs R A, Factor alignment problems and quantitative portfolio management, The Journal of Portfolio Management, 2012, 38(2): 29–43.

Li J, Li M, Wu D, et al., A Bayesian networks-based risk identification approach for software process risk: The context of Chinese trustworthy software, International Journal of Information Technology & Decision Making, 2016, 15(6): 1391–1412.

Yin L and Han L, Risk management for international portfolios with basket options: A multistage stochastic programming approach, Journal of Systems Science and Complexity, 2015, 28(6): 1279–1306.

Ji X and Zhu S, The convergence of set-valued scenario approach for downside risk minimization, Journal of Systems Science and Complexity, 2016, 29(3): 722–735.

Black F and Litterman R, Global portfolio optimization, Financial Analysts Journal, 1992, 48(5): 28–43.

Fabozzi F J, Huang D, and Zhou G, Robust portfolios: Contributions from operations research and finance, Annals of Operations Research, 2010, 176(1): 191–220.

Campbell J Y and Viceira L M, Strategic Asset Allocation: Portfolio Choice for Long-Term Investors, Oxford University Press, USA, 2002.

Zadeh L A, Fuzzy sets, Information and Control, 1965, 8(3): 338–353.

Tang J, Wang D W, Fung R Y K, et al., Understanding of fuzzy optimization: Theories and methods, Journal of Systems Science and Complexity, 2004, 17(1): 117–136.

Fang Y, Lai K K, and Wang S Y, Portfolio rebalancing model with transaction costs based on fuzzy decision theory, European Journal of Operational Research, 2006, 175(2): 879–893.

Vercher E, Bermúdez J D, and Segura J V, Fuzzy portfolio optimization under downside risk measures, Fuzzy Sets and Systems, 2007, 158(7): 769–782.

Chen L H and Huang L, Portfolio optimization of equity mutual funds with fuzzy return rates and risks, Expert Systems with Applications, 2009, 36(2): 3720–3727.

Zhang W G, Liu Y J, and Xu W J, A new fuzzy programming approach for multi-period portfolio optimization with return demand and risk control, Fuzzy Sets and Systems, 2014, 246: 107–126.

He G L and Litterman R, The Intuition Behind Black-Litterman Model Portfolios, Available at SSRN: https://ssrn.com/abstract=334304, 2002.

Idzorek T M, A step-by-step guide to the Black-Litterman model, Forecasting Expected Returns in the Financial Markets, 2002, 17: 1–32.

Giacometti R, Bertocchi M, Rachev S T, et al., Stable distributions in the Black-Litterman approach to asset allocation, Quantitative Finance, 2007, 7(4): 423–433.

Bertsimas D, Gupta V, and Paschalidis I C, Inverse optimization: A new perspective on the Black-Litterman model, Operations Research, 2012, 60(6): 1389–1403.

Chincarini L B and Kim D, Uses and misuses of the Black-Litterman model in portfolio construction, Journal of Mathematical Finance, 2013, 3: 153–164.

Gharakhani M and Sadjadi S, A fuzzy compromise programming approach for the Black-Litterman portfolio selection model, Decision Science Letters, 2013, 2(1): 11–22.

Meucci A, Risk and Asset Allocation, Springer-Verlag, Berlin, 2005.

Carlsson C and Fullér R, On possibilistic mean value and variance of fuzzy numbers, Fuzzy Sets and Systems, 2001, 122(2): 315–326.

Kwakernaak H, Fuzzy random variables-I, definitions and theorems, Information Sciences, 1978, 15(1): 1–29.

Feng Y H, Hu L J, and Shu H S, The variance and covariance of fuzzy random variables and their applications, Fuzzy Sets and Systems, 2001, 120(3): 487–497.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China under Grant Nos. 71271201 and 71631008.

This paper was recommended for publication by Editor ZHANG Xun.

Rights and permissions

About this article

Cite this article

Fang, Y., Bo, L., Zhao, D. et al. Fuzzy Views on Black-Litterman Portfolio Selection Model. J Syst Sci Complex 31, 975–987 (2018). https://doi.org/10.1007/s11424-017-6330-2

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-017-6330-2